Looking At Delta Air Lines's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Delta Air Lines.

Looking at options history for Delta Air Lines DAL we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $294,345 and 11, calls, for a total amount of $739,713.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $20.0 and $55.0 for Delta Air Lines, spanning the last three months.

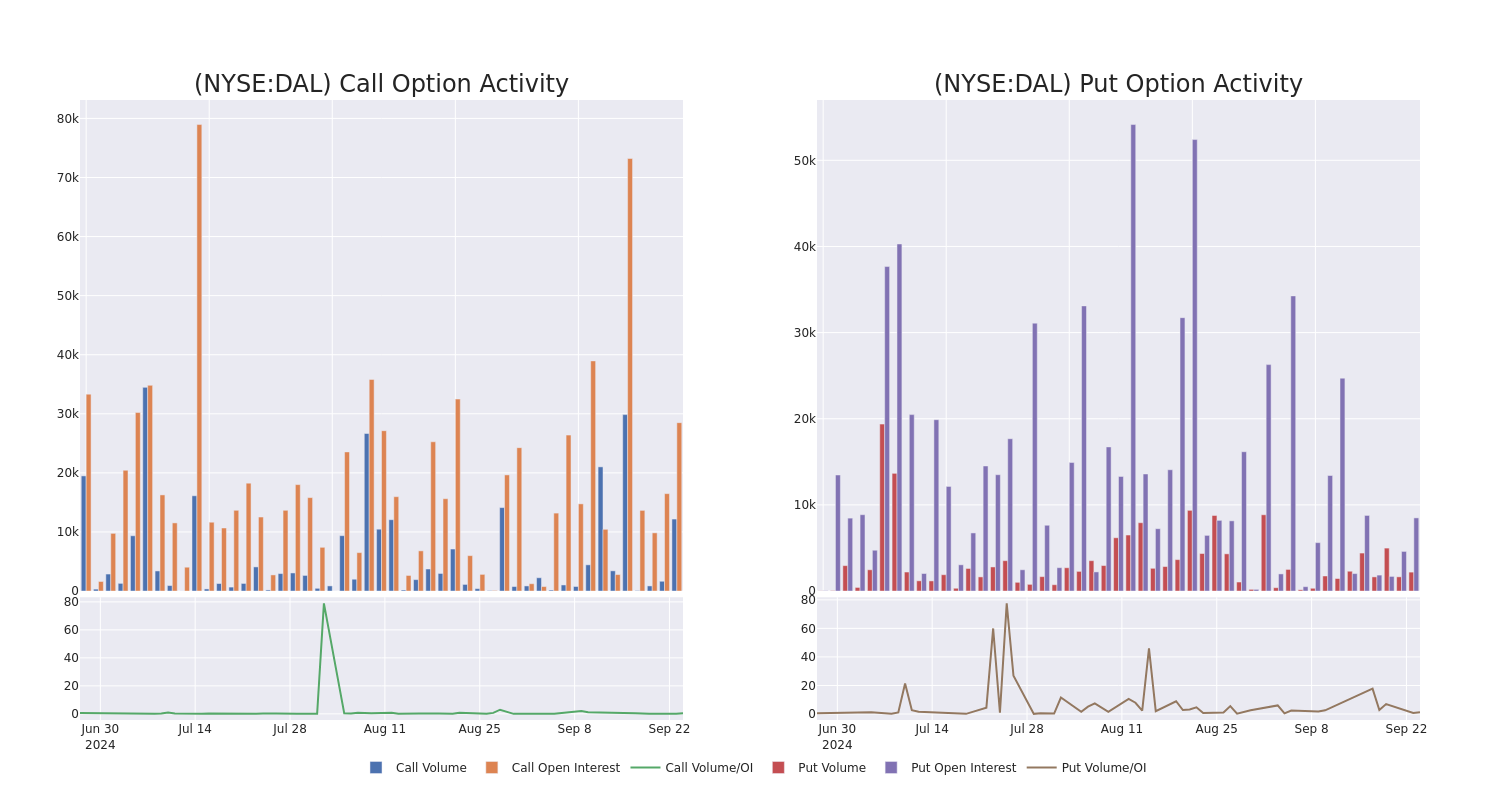

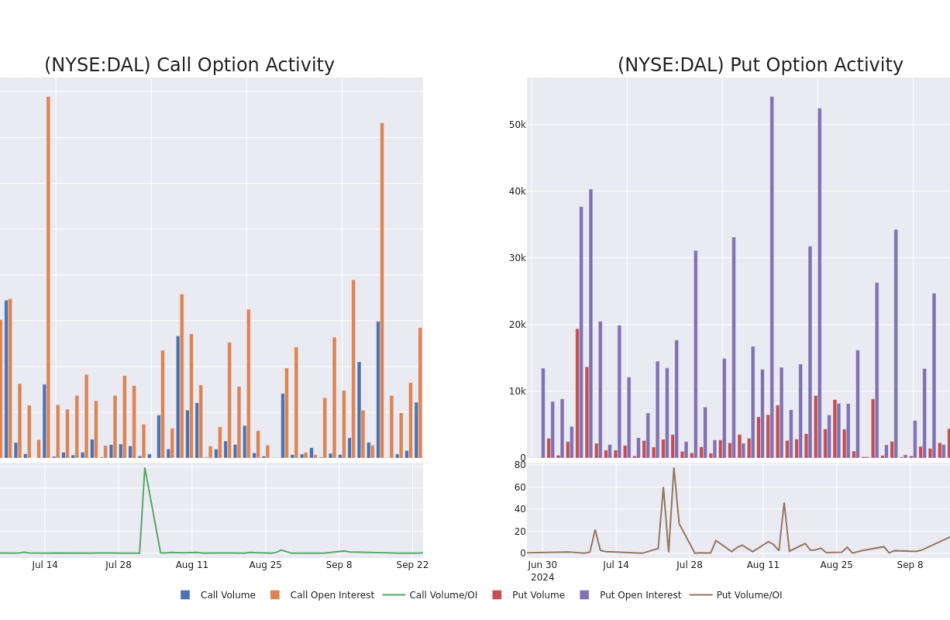

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Delta Air Lines’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Delta Air Lines’s significant trades, within a strike price range of $20.0 to $55.0, over the past month.

Delta Air Lines Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DAL | CALL | SWEEP | BULLISH | 12/20/24 | $0.9 | $0.89 | $0.9 | $55.00 | $212.9K | 4.6K | 2.4K |

| DAL | PUT | SWEEP | BEARISH | 01/16/26 | $5.45 | $5.35 | $5.45 | $45.00 | $110.1K | 2.0K | 204 |

| DAL | CALL | SWEEP | BULLISH | 06/20/25 | $10.15 | $10.05 | $10.15 | $40.00 | $101.5K | 716 | 0 |

| DAL | CALL | SWEEP | BULLISH | 06/20/25 | $10.15 | $10.05 | $10.15 | $40.00 | $93.3K | 716 | 200 |

| DAL | PUT | TRADE | BULLISH | 10/18/24 | $1.3 | $1.18 | $1.2 | $46.00 | $84.0K | 3.8K | 730 |

About Delta Air Lines

Atlanta-based Delta Air Lines is one of the world’s largest airlines, with a network of over 300 destinations in more than 50 countries. Delta operates a hub-and-spoke network, where it gathers and distributes passengers across the globe through its biggest hubs in Atlanta, New York, Salt Lake City, Detroit, Seattle, and Minneapolis-St. Paul. Delta has historically earned the greatest portion of its international revenue and profits from flying passengers over the Atlantic Ocean.

Following our analysis of the options activities associated with Delta Air Lines, we pivot to a closer look at the company’s own performance.

Current Position of Delta Air Lines

- With a trading volume of 3,814,905, the price of DAL is up by 0.94%, reaching $47.6.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 16 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Delta Air Lines options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply