BHVN Stock Up as Rare Neurological Disease Study Meets Primary Goal

Shares of Biohaven Ltd. BHVN were up 13.7% on Sept. 23 after the company announced positive top-line data from the pivotal BHV4157-206-RWE study, which evaluated its pipeline candidate, troriluzole, for the treatment of spinocerebellar ataxia (SCA), a rare and debilitating neurodegenerative disease.

Currently, there are no FDA-approved therapy for the given indication.

The study showed the efficacy of troriluzole on the mean change from baseline in the modified functional Scale for the Assessment and Rating of Ataxia (f-SARA) following three years of treatment.

Year to date, shares of Biohaven have gained 7.4% with no change for the industry.

Image Source: Zacks Investment Research

BHVN’s Pivotal BHV4157-206-RWE Study Data

The study met the primary endpoint on the change from baseline in the f-SARA at three years in all study population genotypes following treatment with troriluzole (200 mg) in SCA patients.

Also, treatment with troriluzole led to statistically significant improvements in the f-SARA at years one and two. Data collected from multiple analyses showed a robust and clinically meaningful slowing of disease progression in SCA patients.

Importantly, treatment with troriluzole slowed disease progression by 50% to 70%, representing a 1.5-2.2 years delay in disease progression over three years compared to untreated patients.

Treatment with troriluzole demonstrated statistically significant superiority on nine consecutive, prespecified primary and secondary endpoints of the study.

Per management, troriluzole is the first treatment to show a delay in disease progression for SCA patients.

BHVN’s Upcoming Plans for Troriluzole

Based on the positive data from the BHV4157-206-RWE study, along with previous safety and efficacy data, BHVN plans to submit a new drug application (NDA) for troriluzole in SCA with the FDA in the fourth quarter of 2024.

If approved, the company plans to launch troriluzole in the United States in 2025.

The FDA has granted Fast-Track and orphan drug designation to troriluzole for treating SCA. The European Medicines Agency has also granted orphan drug designation to troriluzole for treating SCA.

As a result of the orphan drug and fast-track designations granted by the FDA, the NDA for troriluzole is eligible for a priority review.

Troriluzole is also being evaluated in two late-stage studies for treating obsessive-compulsive disorder (OCD). Interim analysis of the second phase III OCD study is expected later in 2024, while top-line data from the first phase III OCD study is anticipated in the first half of 2025.

Zacks Rank & Stocks to Consider

Biohaven currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are ANI Pharmaceuticals, Inc. ANIP, Krystal Biotech, Inc. KRYS and Fulcrum Therapeutics, Inc. FULC, each sporting a Zacks Rank #1 (Strong Buy) at present.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have moved up from $4.49 to $4.82. Earnings per share estimates for 2025 have improved from $5.51 to $5.93. Year to date, shares of ANIP have gained 9%.

ANIP’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 31.32%.

In the past 60 days, estimates for Krystal Biotech’s 2024 earnings per share have increased from $2.09 to $2.38. Earnings per share estimates for 2025 have improved from $4.33 to $7.31. Year to date, shares of KRYS have risen 45.3%.

KRYS’ earnings beat estimates in three of the trailing four quarters while missing on the remaining occasion, with the average surprise being 45.95%.

In the past 60 days, estimates for Fulcrum Therapeutics’ 2024 loss per share have narrowed from $1.33 to 28 cents. Loss per share estimates for 2025 have narrowed from $1.71 to $1.14. Year to date, shares of FULC have plunged 52.6%.

FULC’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 393.18%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spotlight on Lockheed Martin: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bullish stance on Lockheed Martin LMT.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with LMT, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 14 options trades for Lockheed Martin.

This isn’t normal.

The overall sentiment of these big-money traders is split between 35% bullish and 35%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $39,000, and 13, calls, for a total amount of $2,204,930.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $520.0 and $600.0 for Lockheed Martin, spanning the last three months.

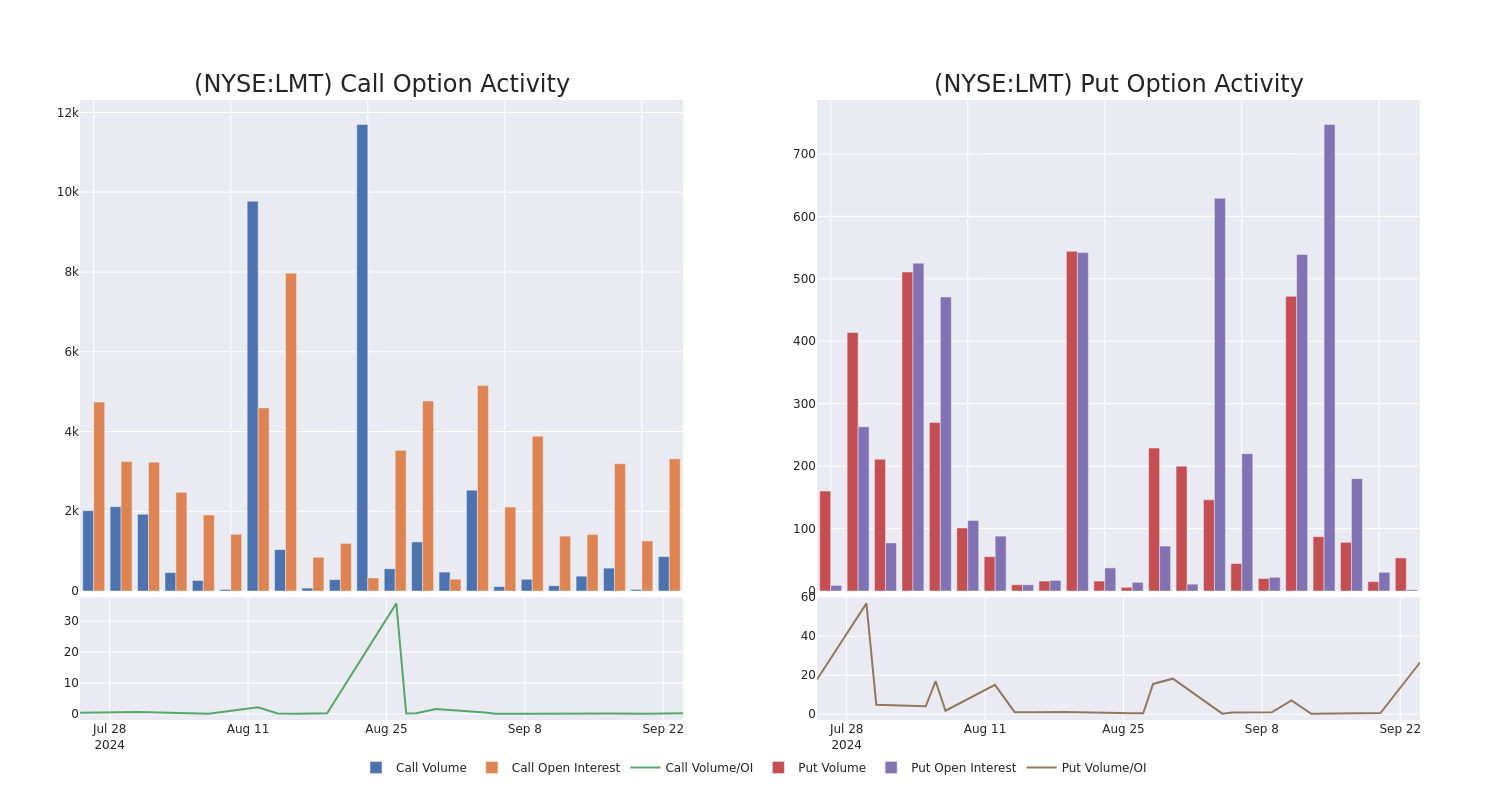

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Lockheed Martin options trades today is 301.27 with a total volume of 916.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lockheed Martin’s big money trades within a strike price range of $520.0 to $600.0 over the last 30 days.

Lockheed Martin Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | CALL | TRADE | BULLISH | 10/18/24 | $57.4 | $54.1 | $56.35 | $525.00 | $1.6M | 1 | 300 |

| LMT | CALL | SWEEP | BEARISH | 01/17/25 | $31.4 | $30.8 | $30.8 | $570.00 | $138.6K | 560 | 100 |

| LMT | CALL | SWEEP | BULLISH | 10/18/24 | $15.2 | $15.0 | $15.2 | $570.00 | $60.8K | 284 | 45 |

| LMT | CALL | SWEEP | BEARISH | 10/18/24 | $10.5 | $10.0 | $10.0 | $577.50 | $50.0K | 6 | 57 |

| LMT | PUT | SWEEP | BULLISH | 10/18/24 | $8.3 | $7.8 | $7.8 | $577.50 | $39.0K | 2 | 53 |

About Lockheed Martin

Lockheed Martin is the world’s largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed’s largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed’s remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

After a thorough review of the options trading surrounding Lockheed Martin, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Lockheed Martin

- Currently trading with a volume of 701,991, the LMT’s price is down by -0.32%, now at $578.63.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 21 days.

What The Experts Say On Lockheed Martin

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $635.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Lockheed Martin, targeting a price of $635.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lockheed Martin with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Moody's Sounds Alarm On Widening Deficits, Diverging Credit Risks: What Trump, Harris Can't Ignore

The next U.S. administration “must grapple with widening budget deficits,” warned Moody’s Ratings in a report published Tuesday.

But no matter who is elected on Nov. 5, whether it’s ex-President Donald Trump or current Vice President Kamala Harris, the situation is dire, Moody’s reported.

What Happened: Recall last November when Moody’s outlook on the U.S. government’s ratings went from stable to negative?

The decision came after Moody’s rival, Fitch Ratings, slashed the U.S. sovereign credit grade from AAA to AA+. Fitch reaffirmed the U.S. credit rating in August.

Both agencies blamed fiscal deterioration, escalating interest rates, political polarization and substantial deficits. And today, Moody’s is just as nervous — perhaps more so — about the U.S.’s ability to manage its finances.

“The incoming administration will face a deteriorating U.S. fiscal outlook, as declining debt affordability will gradually weaken U.S. fiscal strength,” Moody’s analysts, led by Claire Li and William Foster, wrote. “In the absence of policy measures that can curb these trends and help limit fiscal deficits, deteriorating fiscal strength will increasingly weigh on the U.S. sovereign credit profile.”

- If nothing changes, the federal government will run fiscal deficits that average around 7% of GDP per year over the next five years.

- This will rise to nearly 9% by 2034.

- The debt burden will hover at around 130% of GDP by 2034 from 97% in 2023.

- Federal interest payments relative to revenue and GDP will double to around 30% and 5% by 2034, respectively, from 14.8% and 2.4% in 2023.

- The 2017 Tax Cuts and Jobs Act (TCJA) is a significant factor in the worsening fiscal outlook.

- If the Trump-era TCJA extends, federal tax revenue will be around 1% of GDP lower per year from 2026 onward.

- Letting it expire means more revenue and a narrowing of the fiscal deficit projections.

- The 10-year Treasury yield will settle at around 4% from 2025 onward.

See Also: Kamala Harris Promises To Encourage ‘Innovative Technologies’ Like Crypto

Why It Matters: Economists have long insisted that U.S. credit is at risk. A debt crisis would lead to a weaker dollar, higher borrowing costs and market volatility and inflationary pressure, they say.

It could also hurt social programs and damage the U.S.’s international reputation.

Moody’s analysts project that a Harris administration will likely positively affect banks. Trump’s approach would likely lead to looser regulation, creating credit risks for banks and consumer asset-backed securities.

On immigration, both candidates are expected to maintain strict policies, Moody’s explains. But Trump has proposed mass deportations. This could ultimately lead to increased labor costs in agriculture, and construction, negatively affecting those sectors and related industries.

And about those tax cuts. Harris has backed measures like reversing parts of the TCJA, which provided significant tax cuts to high-income earners. Increasing the corporate tax rate to 28% from 21% could help reduce the deficit by generating more government revenue.

That proposal contrasts with Trump’s promise to reduce the corporate tax rate to 15%.

Now Read:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oracle Founder Larry Ellison Just Delivered Fantastic News for Nvidia Stock Investors

Larry Ellison owns 42% of Oracle (NYSE: ORCL), a $465 billion technology giant that is building some of the most powerful data centers for artificial intelligence (AI) development.

Nvidia (NASDAQ: NVDA) supplies Oracle and most other tech companies with data center chips called graphics processing units (GPUs). Nvidia has experienced an eye-popping surge in its revenue over the past year, and GPU demand continues to outstrip supply. However, some investors have begun to question how much longer Oracle and its peers can throw billions of dollars at the chip giant to fuel their AI aspirations.

Worries that the AI train may be starting to lose steam are a key reason Nvidia stock is trading down 14.5% from its all-time high. But the market may have missed comments this month from Ellison at Oracle’s financial analyst meeting that suggest more fantastic news for Nvidia’s investors.

Oracle is nowhere close to meeting its AI infrastructure goals

Oracle’s data centers are unique because they are automated. Each one is operationally identical regardless of its size, and since they don’t require human workers, it allows the company to build them quickly. Plus, Oracle’s RDMA (random direct memory access) GPU networking technology allows data to flow from one point to another more quickly than traditional Ethernet networks.

Since most AI developers pay for computing capacity by the minute, Oracle’s data centers can deliver considerable cost savings compared to competing infrastructure. That’s why demand is soaring from leading AI start-ups like OpenAI, Cohere, and xAI. Oracle had 85 data centers up and running with 77 more under construction as of its fiscal 2025 first quarter (ended Aug. 31), but Ellison thinks it could operate as many as 2,000 in the long term.

Next year, Oracle intends to offer a cluster of 131,072 GPUs, which is a big step up from its largest clusters now, at around 32,000 GPUs. But there’s another difference: The new cluster will use Nvidia’s latest Blackwell chips, which can perform AI inference at 30 times the pace of its flagship H100, which Oracle currently uses. Theoretically, it’s going to allow developers to build the largest AI models in history.

That’s going to benefit Nvidia significantly. It generated $26.3 billion in data center revenue during its fiscal 2025 second quarter (ended July 28) primarily from GPU sales, which was a 154% increase from the year-ago period. That growth rate slowed compared to previous quarters because the numbers have become so large, but Nvidia’s customers are showing no signs of pulling back.

In fact, Oracle spent $6.9 billion on data center infrastructure in fiscal 2024, and it plans to double that figure in fiscal 2025. But it gets better.

Ellison’s latest comments are great news for Nvidia

During the analyst meeting, Ellison told the audience about a dinner he arranged with Tesla CEO (and xAI founder) Elon Musk and Nvidia CEO Jensen Huang at Nobu in Palo Alto. He recalled himself and Musk begging Huang for more GPUs:

Please take our money … take more of it. You’re not taking enough. … We need you to take more of our money. Please.

— Ellison’s and Musk’s comments to Jensen Huang over dinner, according to Ellison.

Oracle Cloud Infrastructure (OCI) generated $2.2 billion in revenue during Q1 (primarily from renting data center capacity to customers), which was a 46% increase from the year-ago period. However, Oracle ended the quarter with a record $99 billion in remaining performance obligations (RPOs), a whopping 53% jump. The company said it signed 42 new deals for GPU capacity worth $3 billion during Q1, which contributed to the backlog.

Oracle can’t serve all of those AI developers — or convert its RPO into revenue — until it brings more data centers online, hence Ellison begging Huang for more GPUs.

Tesla is in a similar position. It’s battling for supremacy in the autonomous self-driving software industry, and it’s trying to bring a cluster of 50,000 GPUs online by the end of this year to further train its AI models. Tesla will spend $10 billion on that infrastructure, but it’s going to need more capacity over time.

Now might be a great time to buy Nvidia stock

Oracle and Tesla aren’t the only companies spending big on data centers. Microsoft spent $55.7 billion on capital expenditures (capex) mostly relating to AI infrastructure during its fiscal 2024 year (ended June 30), and it plans to spend even more in fiscal 2025. Similarly, Amazon‘s capex spending is on track to top $60 billion this calendar year.

Based on Nvidia’s trailing-12-month earnings per share of $2.20, its stock trades at a price-to-earnings (P/E) ratio of 52.7. That’s expensive compared to the 30.9 P/E ratio of the Nasdaq-100 technology index, which hosts many of Nvidia’s big-tech peers.

However, Nvidia’s fiscal 2026 will begin at the end of January 2025, and Wall Street expects the company to deliver $4.02 in earnings per share for the year. That places its stock at a forward P/E ratio of just 28.8. In other words, investors who are willing to hold Nvidia stock for at least the next year and a half could be scooping up a bargain at its current price — assuming Wall Street’s forecast proves accurate.

A slowdown in Nvidia’s business will eventually come because the sheer magnitude of current AI spending will be very difficult to maintain over the long term. Plus, competition is slowly coming online in the GPU space, which could erode some of the company’s market share in the next few years.

However, based on the facts at hand today, Nvidia stock is likely a good buy at the current price. The earmarked AI spending from some of its largest customers suggests a slowdown isn’t on the immediate horizon.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Oracle Founder Larry Ellison Just Delivered Fantastic News for Nvidia Stock Investors was originally published by The Motley Fool

Analyst Report: Crowdstrike Holdings Inc

Analyst Profile

Joseph F. Bonner, CFA

Senior Analyst: Communication Services & Technology

Joe covers the Communication Services sector and selected software technology stocks for Argus. In 2010, he was named #5 Stock Picker for Telecom Services in the Wall Street Journal’s Best on the Street Analyst Survey. In 2008, Joe was named #1 Stock Picker for Media: U.S. by the Financial Times and was second in the Wall Street Journal’s Best on the Street Analyst Survey for Telecommunications: Fixed Line. For more than a decade, Joe worked with Technicolor Inc., where he focused on financial and legal issues. He received his Masters in Business Administration from Fordham University in New York, where he concentrated in Finance. He earned a BA in International Affairs from the George Washington University, and spent three years with the Peace Corps in Talgar, Kazakhstan, developing an English Language resource center and teaching students. Joe is a CFA charterholder.

Why Nvidia Stock Rallied on Tuesday

Shares of Nvidia (NASDAQ: NVDA) surged higher on Tuesday, jumping as much as 4.8%. As of 3:20 p.m. ET, the stock was still up 4%.

The catalyst that sent the chipmaker and artificial intelligence (AI) specialist higher were reports that the company’s chief executive was done selling stock for now.

Sales of more than $700 million

CEO Jensen Huang has sold a large block of Nvidia stock in recent months, a move that caught the attention of investors. In all, he sold roughly 6 million shares worth roughly $713 million as part of a prearranged stock trading plan put in place earlier this year.

The sales were made pursuant to a 10b5-1 plan, which allows insiders to sell stock in the future according to a predetermined schedule without running afoul of insider trading rules. In more than four dozen transactions over the past three months, Huang divested 6 million shares, reaching the limit set up in the prearranged plan, suggesting the chief executive was done selling Nvidia stock — at least for now.

Some investors tend to get nervous when insiders sell stock, particularly in large quantities. Rumors that “they know something we don’t” or “the stock has peaked” tend to make the rounds.

The reality is much more mundane

However, there are plenty of reasons to sell stock, especially if it makes up a large part of an executive’s compensation package. That’s certainly the case with Huang, as 96% of his total pay is stock options tied to Nvidia’s overall stock performance. As a result, and in order to reap the rewards of successfully navigating the stock to new heights, Huang and other executives must sell stock, so there’s nothing concerning or nefarious about these sales.

Furthermore, Huang is still the largest individual holder of Nvidia stock. According to the company’s most recent proxy statement, Huang controlled more than 93 million shares, or more than 3.75% of the outstanding stock. This alone suggests that Huang is still confident in Nvidia’s future prospects.

In short: Nothing to see here, folks. Move it along.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Danny Vena has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Why Nvidia Stock Rallied on Tuesday was originally published by The Motley Fool

What Makes AngloGold Ashanti a New Strong Buy Stock

AngloGold Ashanti AU could be a solid choice for investors given its recent upgrade to a Zacks Rank #1 (Strong Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

The sole determinant of the Zacks rating is a company’s changing earnings picture. The Zacks Consensus Estimate — the consensus of EPS estimates from the sell-side analysts covering the stock — for the current and following years is tracked by the system.

Individual investors often find it hard to make decisions based on rating upgrades by Wall Street analysts, since these are mostly driven by subjective factors that are hard to see and measure in real time. In these situations, the Zacks rating system comes in handy because of the power of a changing earnings picture in determining near-term stock price movements.

As such, the Zacks rating upgrade for AngloGold Ashanti is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, and the near-term price movement of its stock are proven to be strongly correlated. That’s partly because of the influence of institutional investors that use earnings and earnings estimates for calculating the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their transaction of large amounts of shares then leads to price movement for the stock.

For AngloGold Ashanti, rising earnings estimates and the consequent rating upgrade fundamentally mean an improvement in the company’s underlying business. And investors’ appreciation of this improving business trend should push the stock higher.

Harnessing the Power of Earnings Estimate Revisions

As empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, tracking such revisions for making an investment decision could be truly rewarding. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for AngloGold Ashanti

This gold miner is expected to earn $2.58 per share for the fiscal year ending December 2024, which represents a year-over-year change of 2445.5%.

Analysts have been steadily raising their estimates for AngloGold Ashanti. Over the past three months, the Zacks Consensus Estimate for the company has increased 9.1%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of AngloGold Ashanti to a Zacks Rank #1 positions it in the top 5% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood's Ark Invest Buys $4.5M Of PayPal And $3.5M Of Pinterest Shares, Continues Offloading Palantir

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

On Monday, Cathie Wood-led Ark Invest made some significant trades. Notably, the firm bought shares of PayPal Holdings Inc (NASDAQ:PYPL) and Pinterest Inc (NYSE:PINS), while selling its stake in ARK 21Shares Bitcoin ETF (BATS:ARKB).

The PayPal Trade

Ark Invest’s Fintech Innovation ETF (NYSE:ARKF) added 57,824 shares of PayPal, valued at approximately $4.5 million based on the closing price of $77.67. This move comes in the wake of analysts expressing diverse opinions about the company, with an average 12-month price target of $78.62.

Don’t Miss:

PayPal has recently made a strategic shift to penetrate the U.S. point-of-sale (POS) payments market. The company is integrating its debit card with Apple Inc.’s mobile wallet and offering different cashback rewards.

The Pinterest Trade

Ark Invest’s Next Generation Internet ETF (NYSE:ARKW) purchased 115,211 shares of Pinterest, amounting to approximately $3.51 million based on the closing price of $30.46. Pinterest reported solid second-quarter results at the end of July, with revenue slightly surpassing expectations. However, third-quarter guidance came in below analyst projections, raising concerns about sustained growth for the rest of 2024.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

The Bitcoin ETF Trade

ARKW sold 44,609 shares of ARK 21Shares Bitcoin ETF, valued at approximately $2.82 million based on the closing price of $63.25. This sale occurred on the same day that Bitcoin hit a new high of $63,500, causing a significant surge in pre-market activity for several Bitcoin ETFs.

On Monday, Bitcoin steadily declined below $63,000 after a spike to $64,600, following positive comments about cryptocurrency from Democratic presidential candidate Kamala Harris. Total cryptocurrency liquidations surpassed $124 million in the past 24 hours, with bearish bets at $67 million, while Bitcoin’s funding rate remained positive, reflecting bullish trader dominance.

Other Key Trades:

-

ARK Innovation ETF (NYSE:ARKK) sold 7,747 shares of Palantir Technologies Inc. (NYSE:PLTR) in a transaction valued at $293,998, based on Monday’s closing price of $37.95 per share.

-

ARKF sold shares of Adyen NV (ADYEN). ARKG also sold shares of Vertex Pharmaceuticals Inc (VRTX) and bought shares of Pacific Biosciences of California Inc (PACB).

-

ARKK sold shares of Roku Inc (ROKU) and ARKQ bought shares of 3D Systems Corp (DDD).

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Cathie Wood’s Ark Invest Buys $4.5M Of PayPal And $3.5M Of Pinterest Shares, Continues Offloading Palantir originally appeared on Benzinga.com

Chinese Tech Giants Alibaba, JD Boosted By Stimulus Plan; Tencent Breaks Out

China is stepping up efforts to reignite growth in the world’s second largest company – helping send U.S.-listed China tech stocks Alibaba (BABA), JD.com (JD) and Baidu (BIDU) higher. China-based messaging and gaming company Tencent (TCEHY) also got a boost, with its U.S. shares breaking out from a flat base.

↑

X

AI Stocks Are Getting Tired. Is The Dot-Com Bubble A Blueprint Or A Cautionary Tale For Investors?

China’s central bank announced several measures Tuesday that it hopes will bolster the country’s flagging economy. The list includes cutting the benchmark interest rate and lowering the amount of cash banks are required to hold. The central bank will also offer funding for funds, insurers and brokers to buy stocks.

On the stock market today, Alibaba’s U.S.-listed stock rallied 8% to close at 97.19. Rival e-commerce giant JD.com jumped 14% to close at 33.90. And Chinese internet services company Baidu gained 7.4% to close at 94.81. Meanwhile, over-the-counter U.S. shares of Tencent gapped up 7% to 53.64.

Alibaba Stock: Recent Breakout

U.S.-listed Alibaba stock was up about 17% this year, entering trading Tuesday. However, shares of the e-commerce and cloud computing company are still well below highs reached late in 2020.

The slumping economy in China has weighed on sales for its technology companies. Alibaba’s revenue grew 4% for its June-ended quarter, while JD grew 1.2% and Baidu’s sales were flat from a year earlier.

Alibaba stock scored a recent breakout. Shares climbed above an 85.79 cup-with-handle buy point, as identified by MarketSurge, on Sept. 19. The tech giant released new AI models and video-to-text capabilities that day.

Alibaba stock has an improving IBD Composite Rating of 81 out of 99, according to IBD Stock Checkup. The score combines five separate proprietary ratings into one rating. The best growth stocks have a Composite Rating of 90 or better.

Tencent Stock Breaks Out

For Tencent, its gains Tuesday have its U.S. shares breaking out above a 50.89 flat base buy point on its weekly chart, according to MarketSurge. Shares of Tencent, the parent company of the super-app WeChat, are listed in Hong Kong and trade over-the-counter in the U.S.

JD stock, meanwhile, has formed a consolidation pattern with a 35.69 buy point, as identified by MarketSurge pattern recognition. JD.com gained after reporting better-than-expected Q2 results in August but tumbled a week later on news that Walmart sold its near 10% stake in the company.

Overall, U.S.-listed JD stock entered Tuesday up about 3% year-to-date.

U.S.-listed Baidu stock, on other hand, was down more than 25% on the year, entering Tuesday. The company is leaning on its AI offerings to boost growth as advertising sales have slowed. But shares fell 4% following Baidu’s June-quarter earnings results in August. Baidu’s adjusted earnings per share decreasing 7% year-over-year, with revenue was flat.

YOU MAY ALSO LIKE:

IBD Live: Learn And Analyze Growth Stocks With The Pros

Warren Buffett Owns 1 Vanguard ETF That Could Soar 163%, According to a Top Wall Street Analyst

Warren Buffett, CEO of Berkshire Hathaway, oversees a portfolio of 45 publicly traded stocks and securities worth $315 billion, in addition to a $277 billion cash pile and numerous private, wholly owned businesses.

Buffett has a remarkable track record. His investment picks have propelled Berkshire stock to a compound annual return of 19.8% since he took the helm in 1965, crushing the 10.2% average annual gain in the S&P 500 (SNPINDEX: ^GSPC) index over the same period.

Buffett knows average investors would struggle to replicate his returns by picking individual stocks, so he often recommends they buy exchange-traded funds (ETFs) instead. And Berkshire has two in its portfolio: the Vanguard S&P 500 ETF (NYSEMKT: VOO), and the SPDR S&P 500 ETF Trust.

Both are designed to track the performance of the S&P by holding the same stocks and maintaining similar weightings, but the Vanguard ETF is cheaper to own (which I’ll discuss further in a moment), so let’s focus on that one.

If one particular Wall Street analyst is right, it could be poised for 163% upside by 2030!

Why the Vanguard S&P 500 ETF is a great choice for investors

The S&P 500 has strict entry criteria. Companies need to have a market capitalization of at least $18 billion and must be profitable. Even then, admission is at the discretion of a committee, which rebalances the index once every quarter.

As a result, investors can rest assured they are buying exposure to the highest quality companies when they put money into the Vanguard S&P 500 ETF. And it has an expense ratio of 0.03% (the proportion of the fund deducted each year to cover costs), making it far cheaper to own than the SPDR ETF, which has an expense ratio of 0.09%.

The ETF is made up of 11 different sectors. Technology is the largest with a 31.1% weighting, followed by financials at 13.2%, and healthcare at 12.2%. The tech industry is likely to drive the S&P higher for years because it’s home to the world’s most valuable companies, and the index is weighted by market capitalization.

The top five holdings in the Vanguard S&P 500 ETF have a combined market cap of $12.9 trillion, accounting for just over 25% of the total value of its entire portfolio of 500 companies:

|

Stock |

Vanguard ETF Portfolio Weighting |

|---|---|

|

1. Apple |

6.97% |

|

2. Microsoft |

6.54% |

|

3. Nvidia |

6.20% |

|

4. Amazon |

3.45% |

|

5. Meta Platforms |

2.41% |

Data source: Vanguard. Portfolio weightings are accurate as of Aug. 31 and are subject to change.

Apple just launched its new iPhone 16 Pro. It’s fitted with the latest A18 Pro chip, which is designed to process artificial intelligence (AI) workloads on the device, so it’s ready for the launch of the Apple Intelligence software later this year. It was developed in partnership with OpenAI, and it will give users powerful new writing tools and transform the Siri voice assistant with new capabilities powered by ChatGPT.

Microsoft and Amazon have developed their own AI chatbots and virtual assistants. Businesses can also access the latest large language models (LLMs) and the computing power required to develop AI applications through the Microsoft Azure and Amazon Web Services cloud platforms.

None of the above would be possible without Nvidia, which supplies the most powerful data center chips in the world for developing AI. Right now, the company can’t keep up with demand from tech giants including Microsoft, Amazon, Meta, OpenAI, Tesla, Oracle, and others, which are battling for AI supremacy.

The Vanguard ETF could be poised for 163% upside by 2030

Wall Street analysts don’t always get things right, but Fundstrat Global Advisors managing partner Tom Lee has made some very accurate S&P 500 predictions over the last couple of years:

-

He said the S&P would reach 4,750 in 2023, and it closed the year at 4,769.

-

He entered 2024 with a 5,200 target, which was surpassed within the first three months.

-

He then said the index would hit 5,500 in June, and it did.

Lee’s most recent year-end forecast is for 5,700 on the S&P. Considering it closed at 5,702 on Sept. 20, it looks like he will add that to his list of successful calls.

Earlier this year, he also issued a long-term forecast suggesting the index could surpass 15,000 by 2030. That implies an upside of 163% from here, which is the return investors could expect from the Vanguard S&P 500 ETF if he’s right.

Lee says AI will be a key driver behind the move. He estimates the global workforce will be short 80 million workers by the end of this decade, which will drive more investment into AI technologies to automate more jobs.

He also says there is a huge demographic tailwind coming, with millennials and Gen Zers entering the prime period of their lives (between 30 and 50 years of age). That’s when people are earning the most money, and when they are making big life decisions like investing.

Of course, there are risks. A global recession could add years to Lee’s 15,000 target, and if AI fails to live up to the hype, some of the world’s largest stocks I highlighted earlier could suffer a prolonged period of underperformance.

With all of that said, even if the S&P 500 doesn’t reach 15,000 by 2030, history suggests it’s likely to get there eventually, so investors should definitely consider taking Buffett’s advice and buying the Vanguard S&P 500 ETF.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Oracle, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Warren Buffett Owns 1 Vanguard ETF That Could Soar 163%, According to a Top Wall Street Analyst was originally published by The Motley Fool