S&P 500 Hits Fresh Record High Amid Surge In Nvidia Shares: Investor Sentiment Improves Further, Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed some improvement in the overall market sentiment, but the index remained in the “Greed” zone on Tuesday.

U.S. stocks settled higher on Tuesday, with the S&P 500 jumping to a new high following a sharp increase in NVIDIA Corporation NVDA shares.

Thor Industries, Inc. THO reported better-than-expected earnings for its fourth quarter on Tuesday. AutoZone, Inc. AZO reported weaker-than-expected earnings for its fourth quarter.

On the economic data front, the S&P CoreLogic Case-Shiller home price index in increased by 5.9% year-over-year in July compared to a 6.5% rise in the previous month. The FHFA house price index rose 0.1% in July, compared to market estimates of a 0.2% increase. Consumer confidence recorded its biggest one-month drop in more than three years, falling to 98.7 in September.

Most sectors on the S&P 500 closed on a positive note, with materials, information technology, and consumer discretionary stocks recording the biggest gains on Tuesday. However, financials and utilities stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 84 points to 42,208.22 on Tuesday. The S&P 500 rose 0.25% to 5,732.93, while the Nasdaq Composite gained 0.56% at 18,074.52 during Tuesday’s session.

Investors are awaiting earnings results from Cintas Corporation CTAS, Jefferies Financial Group Inc. JEF and Micron Technology, Inc. MU today.

What is CNN Business Fear & Greed Index?

At a current reading of 65.6, the index remained in the “Greed” zone on Tuesday, versus a prior reading of 65.1.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BlackRock Upgraded to Buy: Here's What You Should Know

BlackRock BLK could be a solid addition to your portfolio given its recent upgrade to a Zacks Rank #2 (Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

The sole determinant of the Zacks rating is a company’s changing earnings picture. The Zacks Consensus Estimate — the consensus of EPS estimates from the sell-side analysts covering the stock — for the current and following years is tracked by the system.

Since a changing earnings picture is a powerful factor influencing near-term stock price movements, the Zacks rating system is very useful for individual investors. They may find it difficult to make decisions based on rating upgrades by Wall Street analysts, as these are mostly driven by subjective factors that are hard to see and measure in real time.

Therefore, the Zacks rating upgrade for BlackRock basically reflects positivity about its earnings outlook that could translate into buying pressure and an increase in its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. That’s partly because of the influence of institutional investors that use earnings and earnings estimates for calculating the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their transaction of large amounts of shares then leads to price movement for the stock.

For BlackRock, rising earnings estimates and the consequent rating upgrade fundamentally mean an improvement in the company’s underlying business. And investors’ appreciation of this improving business trend should push the stock higher.

Harnessing the Power of Earnings Estimate Revisions

As empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, tracking such revisions for making an investment decision could be truly rewarding. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for BlackRock

For the fiscal year ending December 2024, this investment firm is expected to earn $41.37 per share, which is a change of 9.5% from the year-ago reported number.

Analysts have been steadily raising their estimates for BlackRock. Over the past three months, the Zacks Consensus Estimate for the company has increased 0.3%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of BlackRock to a Zacks Rank #2 positions it in the top 20% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Energy Servs of America Board Member Trades Company's Stock

Making a noteworthy insider sell on September 23, Jack Reynolds, Board Member at Energy Servs of America ESOA, is reported in the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Monday showed that Reynolds sold 50,000 shares of Energy Servs of America. The total transaction amounted to $517,500.

The latest update on Tuesday morning shows Energy Servs of America shares down by 0.1%, trading at $10.07.

All You Need to Know About Energy Servs of America

Energy Services of America Corporation is engaged in providing contracting services for energy-related companies. The company is predominantly engaged in the construction, replacement, and repair of natural gas pipelines and storage facilities for utility companies and private natural gas companies. It services the gas, petroleum, power, chemical, and automotive industries and does incidental work such as water and sewer projects. Energy Service’s other services include liquid pipeline construction, pump station construction, production facility construction, water and sewer pipeline installations, various maintenance and repair services, and other services related to pipeline construction.

Energy Servs of America: A Financial Overview

Revenue Growth: Energy Servs of America’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 0.46%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Energy sector.

Key Profitability Indicators:

-

Gross Margin: With a low gross margin of 17.82%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Energy Servs of America’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 1.06.

Debt Management: Energy Servs of America’s debt-to-equity ratio surpasses industry norms, standing at 0.66. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 6.95 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.48 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 4.22, Energy Servs of America presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Important Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Energy Servs of America’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At Delta Air Lines's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Delta Air Lines.

Looking at options history for Delta Air Lines DAL we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $294,345 and 11, calls, for a total amount of $739,713.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $20.0 and $55.0 for Delta Air Lines, spanning the last three months.

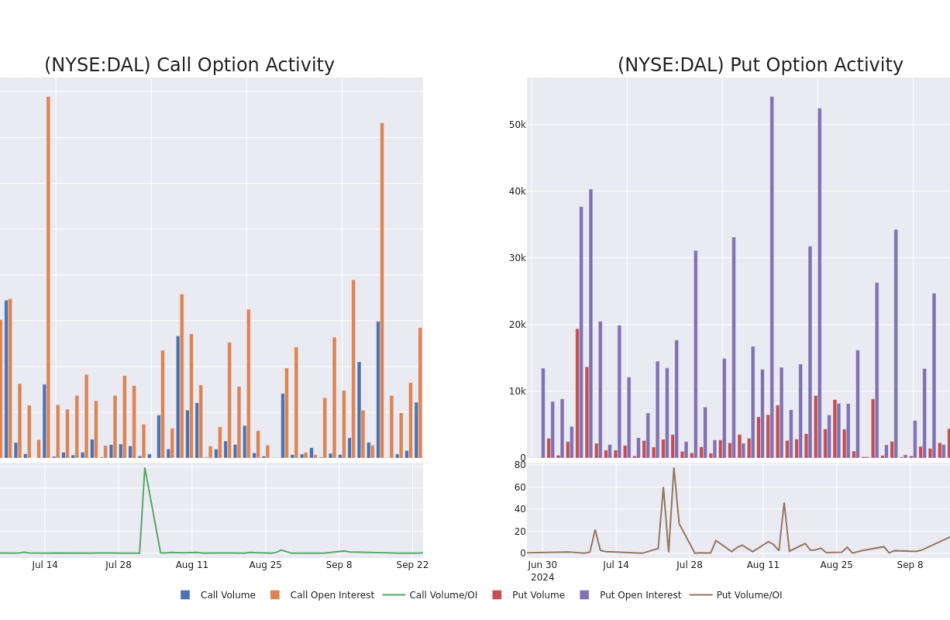

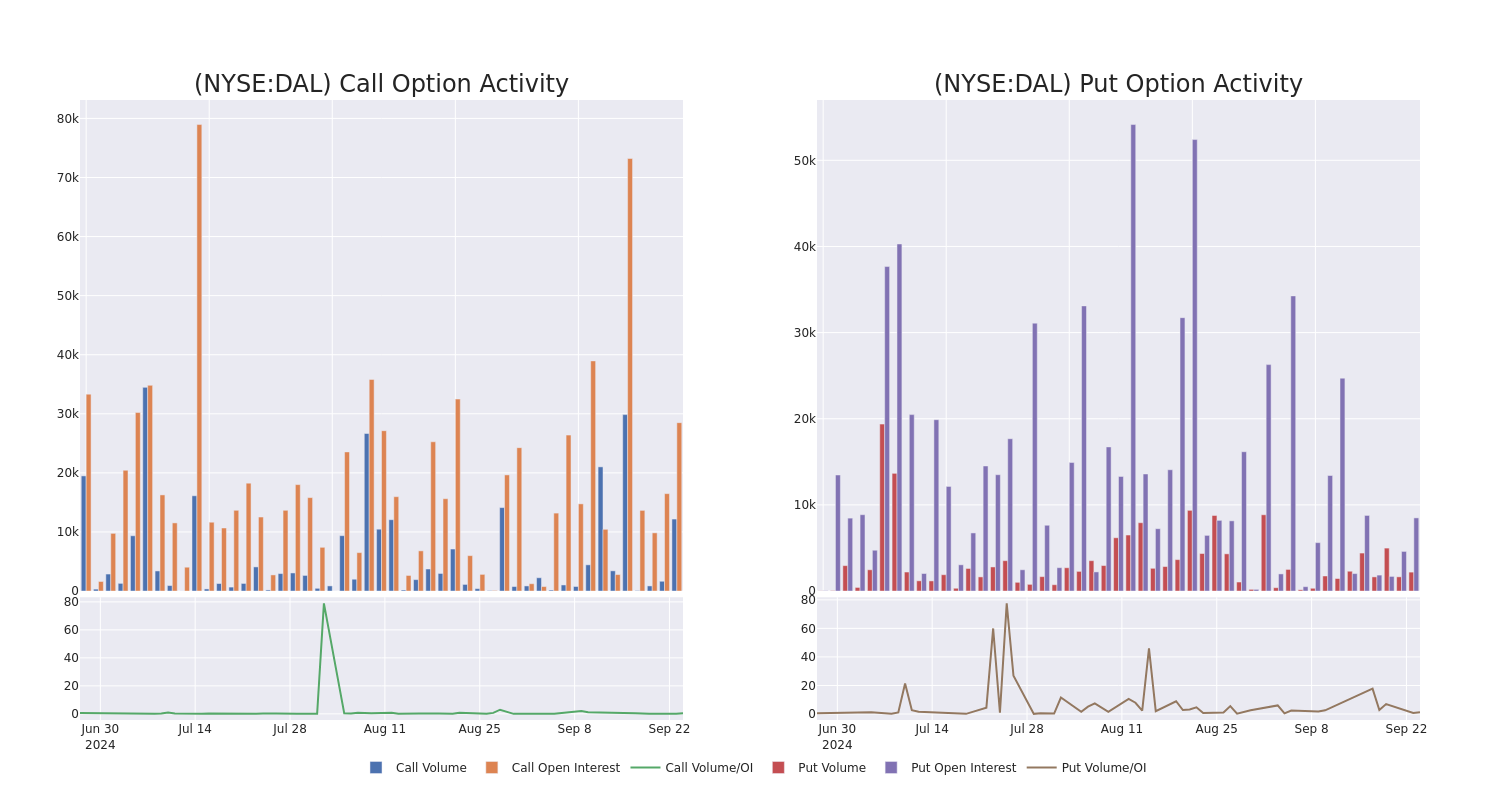

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Delta Air Lines’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Delta Air Lines’s significant trades, within a strike price range of $20.0 to $55.0, over the past month.

Delta Air Lines Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DAL | CALL | SWEEP | BULLISH | 12/20/24 | $0.9 | $0.89 | $0.9 | $55.00 | $212.9K | 4.6K | 2.4K |

| DAL | PUT | SWEEP | BEARISH | 01/16/26 | $5.45 | $5.35 | $5.45 | $45.00 | $110.1K | 2.0K | 204 |

| DAL | CALL | SWEEP | BULLISH | 06/20/25 | $10.15 | $10.05 | $10.15 | $40.00 | $101.5K | 716 | 0 |

| DAL | CALL | SWEEP | BULLISH | 06/20/25 | $10.15 | $10.05 | $10.15 | $40.00 | $93.3K | 716 | 200 |

| DAL | PUT | TRADE | BULLISH | 10/18/24 | $1.3 | $1.18 | $1.2 | $46.00 | $84.0K | 3.8K | 730 |

About Delta Air Lines

Atlanta-based Delta Air Lines is one of the world’s largest airlines, with a network of over 300 destinations in more than 50 countries. Delta operates a hub-and-spoke network, where it gathers and distributes passengers across the globe through its biggest hubs in Atlanta, New York, Salt Lake City, Detroit, Seattle, and Minneapolis-St. Paul. Delta has historically earned the greatest portion of its international revenue and profits from flying passengers over the Atlantic Ocean.

Following our analysis of the options activities associated with Delta Air Lines, we pivot to a closer look at the company’s own performance.

Current Position of Delta Air Lines

- With a trading volume of 3,814,905, the price of DAL is up by 0.94%, reaching $47.6.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 16 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Delta Air Lines options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stock Gainers And Losers From September 24, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

35-Year-Old Who Went from $0 to $200K in 10 Years Shares His Stock Picks – 'There's Really Nothing Super Special To It.'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

About 10 months ago, someone shared their investing journey on Reddit’s r/investing community (with over 2.7 million members), telling how they started from nothing and reached about $200,000 in 10 years.

The Redditor said that after graduating from college, he decided to set up automatic contributions from his bank account to his newly created stock investing account on eTrade in 2013. At first, these contributions were as little as $100. On Dec. 1, 2020, the combined value of the investor’s Roth and traditional brokerage accounts was just over $100,000.

Don’t Miss:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Commercial real estate has historically outperformed the stock market. This platform allows accredited investors to invest in commercial real estate, invest today for a 1% boost.

But here is the most interesting part of the story: it took this investor about seven years to go from $0 to $100,000 and just three years to reach $200,000.

“You read about the power of compound gains all the time, but to go from $100k to $200k in three years when the first $100k took seven years is a testament to that fact. My goal is $1 mil by 47 and eventually to hit $2.5 mil before I retire,” the Redditor added.

“Don’t Rush the Process”

The investor said the secret to a successful investing journey is patience and holding on to quality investments.

“For all you youngins out there, stick with it! But also, don’t rush the process and try to hit home runs every day. For the most part, I am a buy and hold investor after a year or two of trying my hand at day trading with options and futures. When you chase the money, you won’t make it. But if you’re patient with a decent risk tolerance, anything is possible.”

The investor said he’s still sticking with his goals, contributing about $1,000 monthly in stock investments. He said he tried day trading for some time, but it often resulted in “nasty losses.”

“Stick to Profitable Companies”

The investor said he found success by buying individual stocks based on technical and fundamental factors.

“I try to stick to profitable companies with a stock price that has a history of moving in the right direction, however, I also like to buy at a discount price. I keep my eyes on charts and when there are opportunities to buy at historically undervalued prices, I jump on it. There’s really nothing super special to it.”

While this investor did not share the exact details of his latest portfolio, he mentioned a few stocks he currently owns or has owned in the past.

Apple

Apple Inc. (NASDAQ:AAP) was one of the stocks in the portfolio of the Redditor who increased his wealth from $0 to $200,000 in about 10 years. Over the past five years, Apple shares have gained about 327%.

Wall Street analysts have voiced concerns about an expected lackluster demand for the new iPhone. However, T-Mobile’s Chief Executive Officer Mike Sievert recently said that the new model’s sales are higher than last year’s and further activity is expected when the company launches Apple Intelligence.

Meta Platforms

Meta Platforms Inc. (NASDAQ:META) was one of the key stocks in the portfolio of the 35-year-old Redditor who saw his wealth rise over 10 years. Over the past five years, Meta Platforms Inc. (NASDAQ:META) has gained about 196%.

D.A. Davidson recently started covering Meta Platforms with a Buy rating, saying the company can become a leader in the open source world thanks to its AI Foundation Compute and Spatial Compute.

Costco

Costco Wholesale Corporation (NASDAQ:COST) is a defensive stock popular among investors looking to build an all-season portfolio. Costco Wholesale Corporation (NASDAQ:COST) shares are up 216% over the past five years. The company has increased its dividends for nearly two decades.

However, Redburn Atlantic earlier this month downgraded the stock to Neutral from Buy on valuation concerns.

Home Depot

Home Depot Inc. (NYSE:HD) is another solid dividend growth stock in the portfolio of the Redditor whose wealth rose from nothing to $200,000 in a decade. The home improvement equipment company increased its dividend for 15 straight years and its shares rose about 74% over the last five years.

Keep Reading:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Investing in private credit could potentially unlock APY up to 20%, with benefits like shorter term durations and diversified returns – Find out more if you’re an accredited investor.

McDonald’s Corp

McDonald’s Corp (NYSE:MCD) has raised its dividend for 49 years while its share price has gained about 41% over the past five years. McDonald’s Corp (NYSE:MCD) is ramping up promotional efforts and extending its cheaper meals to woo customers who remained on the sidelines amid rising inflation. Evercore said in the latest note that the company’s foot traffic rebounded in the back half of August because of these efforts.

Draft Kings

DraftKings Inc. (NASDAQ:DKNG) is another interesting stock that helped the 35-year-old Redditor achieve wealth growth over 10 years. The gaming company’s shares are up about 300% over the past five years.

Advanced Micro Devices

Advanced Micro Devices Inc. (NASDAQ:AMD) was one of the multi-baggers in the portfolio of the Redditor who saw his wealth grow in 10 years as the chipmaker’s shares rose a whopping 418% over the past five years. Thanks to its AI-focused chips like MI300 and EPYC, Advanced Micro Devices Inc. (NASDAQ:AMD) is seen as the second-biggest beneficiary of the AI boom after Nvidia.

Bank of America

With a dividend yield of about 2.5%, Bank of America Corp (NYSE:BAC) is a notable dividend stock in the portfolio of the Redditor who increased his wealth from scratch to $200,000. Bank of America Corp (NYSE:BAC) has increased its dividend yearly since 2009.

Interest Rates Are Falling, But These Yields Aren’t Going Anywhere

Lower interest rates mean some investments won’t yield what they did in months past, but you don’t have to lose those gains. Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

Arrived Homes, the Jeff Bezos-backed investment platform, offers a Private Credit Fund. This fund provides access to a pool of short-term loans backed by residential real estate with a target of 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

This article 35-Year-Old Who Went from $0 to $200K in 10 Years Shares His Stock Picks – ‘There’s Really Nothing Super Special To It.’ originally appeared on Benzinga.com

Warren Buffett Moves: Berkshire Hathaway Reduces Bank Of America Holdings By $863M

Warren Buffett’s Berkshire Hathaway Inc BRK BRK sold an additional $863 million of Bank of America Corp BAC stock, reducing its stake closer to a 10% regulatory threshold, according to the company’s regulatory filing with U.S. Securities and Exchange Commission.

What Happened: Berkshire now owns close to 10% of the second-largest U.S. bank after the latest disposals over three trading days through Tuesday.

Buffett, 94, began trimming the massive investment in mid-July. Despite months of sales, Berkshire’s remaining stake in Bank of America is valued at $32.1 billion, based on Tuesday’s closing price, maintaining its position as the largest shareholder.

Why It Matters: Bank of America CEO Brian Moynihan recently commented on Buffett’s sales, stating he has not inquired about the reasons behind the reduction. Moynihan praised Buffett’s investment history with the bank but admitted, “I don’t know what exactly he is doing because frankly we can’t ask.” This statement was made during an investor conference in New York.

Meanwhile, Bank of America is actively expanding its retail banking presence. The bank announced plans to open over 165 new financial centers across 63 U.S. markets by the end of 2026. This expansion includes nearly 40 centers set to open this year alone, with the first center in Louisville, Kentucky, opening recently.

Additionally, Ajit Jain, a top executive at Berkshire Hathaway, sold more than half of his shares in the Buffett-led company for approximately $139 million amid speculation on stock valuation and potential tax policies.

Price Action: Bank of America stock closed at $39.45 on Tuesday, down 1.05% for the day. In after-hours trading, the stock dropped 0.051%. Year to date, the stock has gained 16.37%, accroding to data from Benzinga Pro.

Read Next:

Image via Gates Foundation

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Toll Brothers Announces Move-In Ready Homes are Available at Regency at Tracy Lakes 55+ Resort-Style Community in Tracy, California

TRACY, Calif., Sept. 24, 2024 (GLOBE NEWSWIRE) — Toll Brothers, Inc. TOL, the nation’s leading builder of luxury homes, today announced a select number of move-in ready and quick move-in homes are now available in its Regency at Tracy Lakes 55+ community in Tracy, California. The gated, amenity-rich master-planned community for active adults aged 55 and over features luxury homes nestled in the expansive valleys of Tracy, California. These recently completed, brand new homes include designer-appointed features and are available for homeowners who are ready to move in immediately.

Planned by a team of award-winning architects, landscape architects, and interior designers, Regency at Tracy Lakes showcases impressive single-story homes ranging in size from 1,560 to 2,775+ square feet with 2 to 3 bedrooms, 2 to 3 baths, and 2- or 3-car garages. Regency at Tracy Lakes offers a variety of home designs within four collections, featuring modern floor plans with open and spacious living areas, home offices, select lakeside views, an abundance of windows to maximize natural light, and expansive backyard space. Homes are priced from the mid-$600,000s to $1.6 million.

Designed with active lifestyles in mind, the centerpiece of the community is The Lake House, a stunning 11,000 square-foot resort-style clubhouse. There, residents enjoy a host of recreational amenities including six pickleball courts, two bocce courts, a fitness center and studio, indoor and outdoor pools, an event lawn, and much more. A dedicated onsite Lifestyle Director plans year-round programs, events and social gatherings. Current homeowners and home buyers are already enjoying regularly hosted events and outings coordinated by the Lifestyle Director while building friendships with their future neighbors. This summer, the community hosted a popular Concert Series, with a final concert taking place this Saturday, September 28.

“Whether you are retired, nearing retirement, or still working, the exceptional Regency active adult lifestyle is unmatched,” said Todd Callahan, Regional President of Toll Brothers in Northern California. “We love seeing our home buyers enjoying the many activities planned by our Lifestyle Director, including meeting their neighbors at the community garden, bringing family to the summer concert series, or playing a game of pickleball or bocce with friends. With a limited number of move-in ready homes available at this community, buyers have a unique opportunity to start enjoying that lifestyle as soon as possible.”

For built-to-order homes, home buyers will experience one-stop shopping at the Toll Brothers Design Studio. The state-of-the-art Design Studio allows home buyers to choose from a wide array of selections to personalize their dream home with the assistance of Toll Brothers professional Design Consultants. Home buyers who purchase a built-to-order home can also start enjoying the incredible lifestyle Regency at Tracy Lakes offers right away, even while their home is built.

Regency at Tracy Lakes will afford community members time and freedom to enjoy their friends and family, as well as the tranquility of the area. This master plan is located near contemporary restaurants and shopping centers, as well as acclaimed wineries and historical landmarks. The community is just a short drive from outdoor recreation including Yosemite National Park and Lake Tahoe, and its proximity to several Interstate routes offers convenience for commuters or those who want to explore the many wonders of Northern California.

Toll Brothers Regency active-adult communities across the United States are planned with the active lifestyles of their residents in mind. Each community offers exquisitely designed homes with an array of luxury resort-style amenities, activities, and social events available for residents 55 years of age or older.

The Toll Brothers Sales Center and nine brand-new professionally designed model homes are open for tours at 1650 Aloha Court in Tracy. For more information on Regency at Tracy Lakes and Toll Brothers communities throughout California, call 844-790-5263 or visit TollBrothers.com/CA.

About Toll Brothers

Toll Brothers, Inc., a Fortune 500 Company, is the nation’s leading builder of luxury homes. The Company was founded 57 years ago in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol “TOL.” The Company serves first-time, move-up, empty-nester, active-adult, and second-home buyers, as well as urban and suburban renters. Toll Brothers builds in over 60 markets in 24 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, and Washington, as well as in the District of Columbia. The Company operates its own architectural, engineering, mortgage, title, land development, smart home technology, and landscape subsidiaries. The Company also develops master-planned and golf course communities as well as operates its own lumber distribution, house component assembly, and manufacturing operations.

In 2024, Toll Brothers marked 10 years in a row being named to the Fortune World’s Most Admired Companies™ list and the Company’s Chairman and CEO Douglas C. Yearley, Jr. was named one of 25 Top CEOs by Barron’s magazine. Toll Brothers has also been named Builder of the Year by Builder magazine and is the first two-time recipient of Builder of the Year from Professional Builder magazine. For more information visit TollBrothers.com.

From Fortune, ©2024 Fortune Media IP Limited. All rights reserved. Used under license.

CONTACT: Andrea Meck | Toll Brothers, Director, Public Relations & Social Media | 215-938-8169, ameck@tollbrothers.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/cf614799-a848-42d8-ae01-b6bcc1720168

https://www.globenewswire.com/NewsRoom/AttachmentNg/4dee86c3-657e-4ea5-bc1d-8232d79a35d0

Sent by Toll Brothers via Regional Globe Newswire (TOLL-REG)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

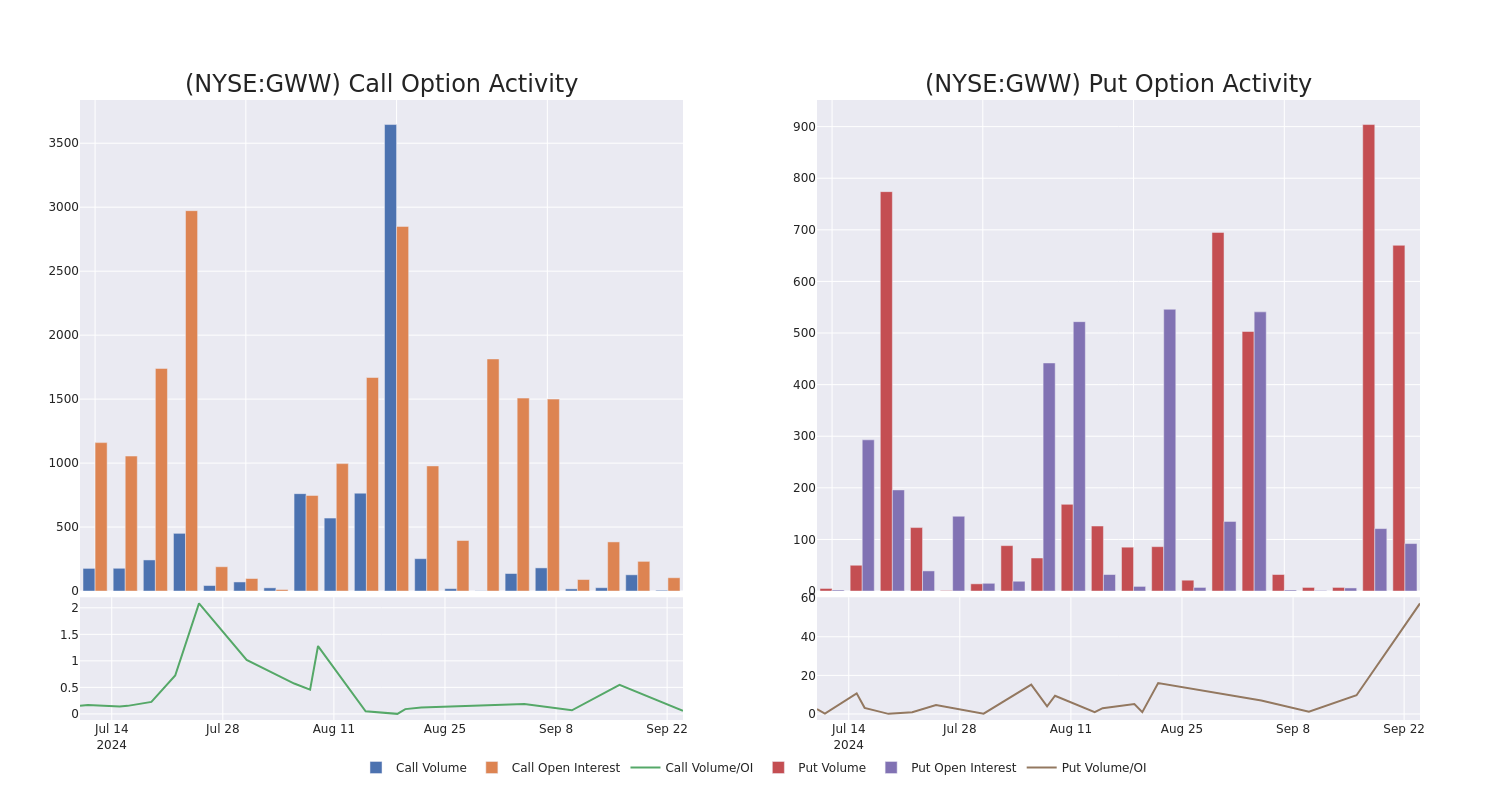

Spotlight on W.W. Grainger: Analyzing the Surge in Options Activity

Deep-pocketed investors have adopted a bullish approach towards W.W. Grainger GWW, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GWW usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for W.W. Grainger. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 62% leaning bullish and 25% bearish. Among these notable options, 5 are puts, totaling $259,160, and 3 are calls, amounting to $88,680.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $720.0 and $1000.0 for W.W. Grainger, spanning the last three months.

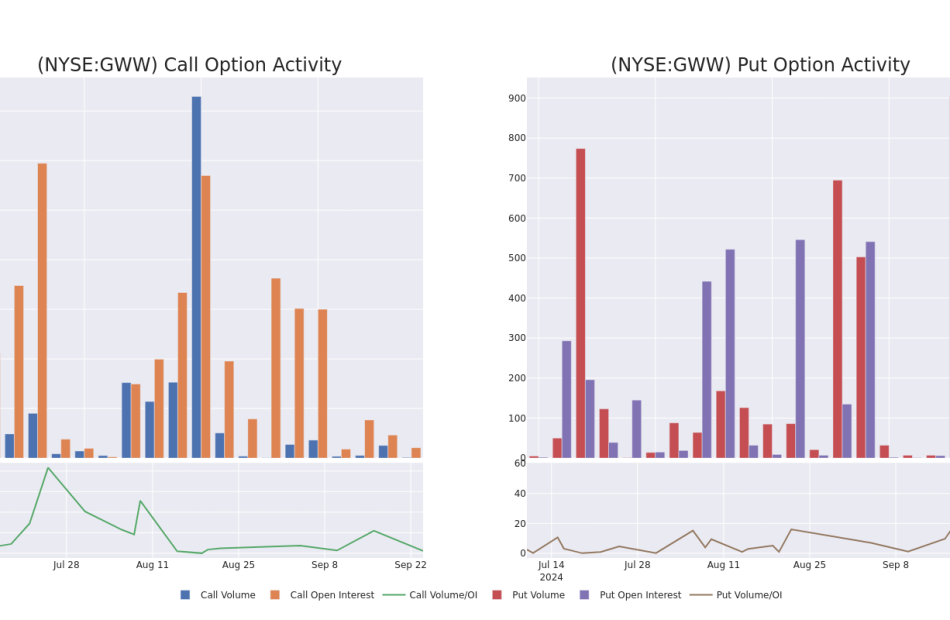

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for W.W. Grainger’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of W.W. Grainger’s whale activity within a strike price range from $720.0 to $1000.0 in the last 30 days.

W.W. Grainger Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GWW | PUT | TRADE | BEARISH | 04/17/25 | $21.6 | $18.9 | $21.6 | $920.00 | $82.0K | 2 | 70 |

| GWW | PUT | TRADE | BEARISH | 04/17/25 | $21.7 | $18.9 | $21.7 | $920.00 | $69.4K | 2 | 32 |

| GWW | PUT | TRADE | BULLISH | 11/15/24 | $5.6 | $5.3 | $5.3 | $920.00 | $40.2K | 90 | 192 |

| GWW | PUT | TRADE | BULLISH | 11/15/24 | $5.6 | $5.2 | $5.3 | $920.00 | $36.0K | 90 | 260 |

| GWW | CALL | TRADE | BULLISH | 04/17/25 | $333.6 | $328.0 | $333.6 | $720.00 | $33.3K | 0 | 1 |

About W.W. Grainger

W.W. Grainger distributes maintenance, repair, and operating products that are sourced from over 5,000 suppliers. The company serves more than 4.5 million customers through its online and electronic purchasing platforms, vending machines, catalog distribution, and network of over 300 global branches.

Present Market Standing of W.W. Grainger

- With a volume of 216,003, the price of GWW is down -0.13% at $1040.71.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 37 days.

What The Experts Say On W.W. Grainger

1 market experts have recently issued ratings for this stock, with a consensus target price of $990.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Morgan Stanley downgraded its action to Equal-Weight with a price target of $990.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest W.W. Grainger options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Can Rithm Capital's 8.5% Yield Continue to Dance to the Dividend Tune?

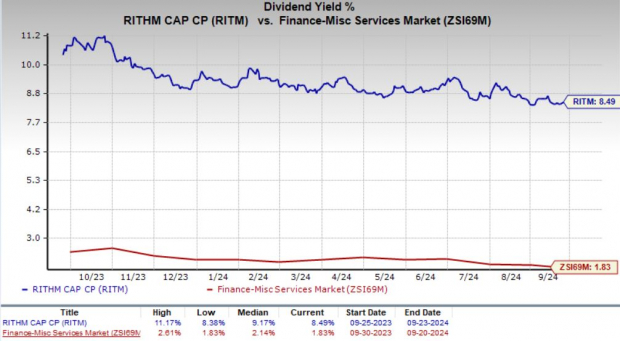

Rithm Capital Corp. RITM recently announced its board’s approval for third-quarter 2024 dividends for both common and preferred stockholders. The common stock dividend remains steady at 25 cents per share, the same as the previous quarter. It will be paid on Nov. 1, 2024, to stockholders of record as of Oct. 1.

The company continues to maintain a higher-than-industry dividend yield. Based on the closing price of $11.78 per share on Sept. 23, the stock has a dividend yield of 8.5%, which is higher than the industry average of 1.8%.

Image Source: Zacks Investment Research

In the second quarter, the company distributed $122.4 million in common dividends. For the third quarter, RITM’s Board also declared Series A, Series B, Series C and Series D dividends per share of 69.9 cents, 68.9 cents, 39.8 cents and 43.8 cents, respectively. The dividends will be paid on Nov. 15, 2024, to preferred stockholders.

Now, the question comes if its dividend yield is sustainable and what to expect in the future.

Total assets of $42.02 billion at second quarter-end rose from $39.72 billion at 2023-end. Total equity of $7.4 billion at the June quarter-end was up from $7.1 billion at 2023-end. It exited the second quarter with cash and cash equivalents of $1.24 billion. However, its long-term debt to capital of 60.1% is higher than the industry average of 43.7%.

Net cash used in operations was at $1.2 billion in the first half of 2024 against net cash from operations of $1.2 billion a year ago. In the past five years, it generated positive net operating cash flow four times and negative cash from operations (cash used in operating activities) once.

RITM reported second-quarter 2024 adjusted earnings of 47 cents per share, which outpaced the Zacks Consensus Estimate by 11.9%. The quarterly results were supported by an improving performance in its Mortgage Loans Receivable business and solid Asset Management unit.

The company’s growing strength in the Newrez business and strategic actions will likely increase the market share of its origination platform in the coming days, which can provide investors with massive growth opportunities. However, rising expenses can hamper its growth path.

Rithm Capital is shielded from the volatility of the mortgage market due to its diversified business model. Its residential mortgage origination business is expected to improve in the coming days. Also, positive impacts from the asset management business acquisition will likely benefit its cash flows and support dividend payouts. The company’s efforts to further improve margins from this Sculptor (asset management) business will likely help sustain its strong yield.

Price Performance

RITM shares have gained 22.4% in the past year compared with the industry average of 28.6%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Rithm Capital currently has a Zacks Rank #3 (Hold).

Investors interested in the broader Finance space may look at some better-ranked players like Jackson Financial Inc. JXN, WisdomTree, Inc. WT and HIVE Digital Technologies Ltd. HIVE, each carrying a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for Jackson Financial’s current-year earnings is pegged at $18.49 per share, which indicates 44% year-over-year growth. It witnessed two upward estimate revisions in the past 60 days against no downward movement. The consensus mark for JXN’s current year revenues suggests a 116.7% surge from a year ago.

The Zacks Consensus Estimate for WisdomTree’s 2024 earnings indicates 67.6% year-over-year growth. During the past two months, WT has witnessed three upward estimate revisions against none in the opposite direction. It beat earnings estimates twice in the past four quarters and met on the other occasions, with an average surprise of 5.9%.

The Zacks Consensus Estimate for HIVE Digital’s current-year earnings suggests a 63.6% year-over-year improvement. During the past month, HIVE has witnessed one upward estimate revision against none in the opposite direction. The consensus mark for current-year revenues is pegged at $125.2 million, indicating a 9.4% increase from a year ago.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.