Trump Media shares crash to record low despite better polling

Donald Trump’s political fortunes are beginning to diverge from his financial ones.

Shares in the former president’s social media group plumbed fresh all-time lows on Monday, even as the latest polls suggest he’s gaining ground in a few key battleground states in the nation’s sunbelt.

Until recently, the price of his Truth Social parent company was widely viewed as a barometer of his chances in November.

On Monday, a poll published by The New York Times and Siena College showed him holding onto his lead in Georgia while pulling ahead of Harris in Arizona and North Carolina following their contentious debate this month that saw Trump go viral for claiming immigrants are eating pets.

It also marked the sixth straight day of heavy selling in Trump Media and Technology Group (TMTG), the parent of Twitter clone Truth Social, after a very brief respite when Trump told reporters he had no intention of selling his nearly 115 million shares of stock.

It closed down 10% on the session to finish at $12.15, its lowest level since it first announced three years ago plans to go public via a reverse merger with a blank check investment vehicle known as a SPAC.

That means the value of Trump’s 59% stake in the company, which was until this week subject to a six-month lockup period following the SPAC merger, has dwindled to just $1.4 billion from its peak in March of more than $9 billion.

Assuming Trump doesn’t sell his stake as he claims, the selling pressure will not necessarily let up, either.

Hello everyone! I have something incredible to share today, as we are introducing the launch of our Official Trump Coins! The ONLY OFFICIAL coin designed by me—and proudly minted here in the U.S.A. The President Donald J. Trump First Edition Silver Medallion will be available… pic.twitter.com/9SP1PaLOTh

— Donald J. Trump (@realDonaldTrump) September 21, 2024

Billion-dollar valuation, million-dollar sales

With its meme stock image and refusal to reveal anything about the underlying metrics driving its business, the stock is shunned by financial analysts.

There’s not one estimate on Yahoo Finance for this year’s revenue, let alone earnings or, in TMTG’s case, losses.

Applying the same 7.5x price-to-sales multiple for next year’s revenue that Reddit currently trades to TMTG stock would give it a market cap of around $25 million.

That’s a fraction of the $2.4 billion that TMTG, on track for annual sales well below $4 million (with an ‘m’), is currently worth.

Excluding the $344 million raised from the SPAC deal—cash for which investors typically do not assign a multiple beyond their stated value—the amount of total assets on its books that can potentially generate profits for shareholders amounted to just $12.5 million at the end of June.

Fortune could not reach TMTG officials for comment. When contacted via TMTG’s Truth Social, Trump did not respond to a request for a statement.

‘Directional bet on the value of his brand’

Given Trump’s need to drum up cash to meet legal fines in the hundreds of millions of dollars and the lack of unencumbered assets he can easily liquidate, investors seem unwilling to take the former White House resident’s words at face value.

Last week, he announced his latest merchandising plan: selling one-ounce silver coins embossed with his face for $100 each—more than three times their current intrinsic value.

Chamath Palihapitiya, an early Facebook investor best known for promoting SPACs during their pandemic-era boom, ironically predicted TMTG was “a directional bet on the value of his brand” and something akin to the Official Trump Coin just unveiled.

Speaking on the All-In podcast shortly after TMTG began trading in March, he said the stock is “effectively a trading coin, a baseball card if you will—a trading card via a stock” that banks on the former president’s name recognition and likeness.

Trump may have inadvertently hurt his own investment story by declaring on Sunday he wouldn’t run again for the presidency should he lose in November. By taking him out of any future races, he stands to lose his influence on shaping the Republican party.

This story was originally featured on Fortune.com

KB Home Q3 Earnings: Revenue Beat, EPS Beat, Net Orders Flat — 'Variability In Demand Across The Quarter'

KB Home KBH reported third-quarter financial results after the market close on Tuesday. Here’s a look at the key metrics from the quarter.

Q3 Earnings: KB Home reported third-quarter revenue of $1.75 billion, beating analyst estimates of $1.728 billion. The U.S. homebuilder reported third-quarter earnings of $2.04 per share, beating analyst estimates of $2.02 per share.

KB Home has topped analyst estimates for revenue and earnings in seven consecutive quarters, according to Benzinga Pro.

Total revenue was up 10% year-over-year, while earnings grew 13%. KB Home delivered 3,631 homes in the quarter, up 8% year-over-year. Average selling price was $480,900, up 3%, but net orders were flat year-over-year and inventories jumped 10% to $5.65 billion.

“We experienced variability in demand across the quarter, with softening in late June through July, as buyers continued to evaluate elevated mortgage interest rates, and general economic concerns were rising. As rates moderated in August, our net orders improved,” said Jeffrey Mezger, chairman and CEO of KB Home.

“We are encouraged by this strengthening in demand for our affordably priced personalized homes, and the ongoing positive trend we are experiencing so far in our 2024 fourth quarter.”

KB Home noted it repurchased $150 million worth of its common stock during the quarter. The company had $800 million remaining under its buyback program as of Aug. 31.

See Also: Five Emerging Tech Cities Where Home Values Are Surging Alongside Innovation

Outlook: KB Home expects full-year 2024 housing revenues in the range of $6.85 billion to $6.95 billion. Average selling prices for the full year are expected to be approximately $490,000.

Management will hold a conference call to discuss these results at 5 p.m. ET. The company noted that it will provide guidance for the fourth quarter on the call.

KBH Price Action: KB Home shares were up nearly 40% year-to-date heading into the print. The homebuilder stock was down 6.10% in after-hours trading at $82.10 at the time of publication Tueday, according to Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: 1 Stock That Will Be Worth More Than Apple 10 Years From Now

Apple (NASDAQ: AAPL) is the most valuable company in the world right now with a market cap of $3.4 trillion. But a closer look at the company’s recent financial performance indicates that it is finding it difficult to put its growth into a higher gear.

For instance, in the third quarter of fiscal 2024 (which ended on June 29), Apple’s revenue increased just 5% year over year to $85.8 billion. Analysts are expecting this “Magnificent Seven” stock to finish the year with a 9% increase in revenue to $390 billion. Additionally, its revenue is expected to increase by just 8% in the next fiscal year.

This lukewarm growth at Apple can be attributed to the company’s already massive revenue base. Moreover, Apple’s bread-and-butter end market of smartphones is already quite huge, and its growth has stagnated. Market research firm IDC estimates that the global smartphone market could reach an annual growth rate of just 2.3% through 2028.

Considering that Apple is reliant on the iPhone for 52% of its revenue, it is not surprising to see that it’s not expected to grow at a blistering pace anymore. This is precisely the reason Apple could lose its crown as the world’s most valuable company to Nvidia (NASDAQ: NVDA), a company that is sitting on lucrative and fast-growing end markets that could help it deliver impressive growth over the next decade.

Let’s look at the reasons why Nvidia could be worth more than Apple after a decade.

Nvidia is set to benefit from massive growth opportunities in multiple end markets

Nvidia is currently the third-most valuable company in the world with a market cap of $2.85 trillion, which means that it is not very far from catching Apple. The terrific pace at which Nvidia has been growing tells us that it can indeed catch the iPhone maker over the next decade.

The company, which is known for its graphics processing units (GPUs), reported phenomenal revenue growth of 122% in the second quarter of fiscal 2025 to $30 billion. Nvidia has been riding the artificial intelligence (AI) wave, with its chips being deployed for training popular AI models such as ChatGPT. And now, Nvidia is diversifying into areas beyond AI training so that it can sustain its handsome growth for a long time to come.

For instance, on its August earnings conference call, Nvidia management pointed out that AI inference applications have accounted for more than 40% of its data center revenue. This is an important trend to note as inference is the process of using a trained AI model to generate results from a fresh set of data. So, Nvidia has moved beyond AI training and is now getting a nice chunk of revenue from the AI inferencing space as well.

That’s good news for the company’s long-term prospects as its presence in both these markets should allow it to remain a dominant force in AI chips. Investors should note that the market for AI chips is expected to generate $300 billion in revenue in 2034, growing at an annual rate of 22% over the next decade.

Nvidia reportedly controls 70% to 95% of the AI chip market, according various estimates, leaving very little for rivals such as Advanced Micro Devices and Intel. It won’t be surprising to see that trend continue over the next decade as well, as a result of which Nvidia could sustain its elevated levels of growth for a long time to come.

Additionally, Nvidia is diversifying into lucrative markets such as AI enterprise software, where it has started witnessing impressive growth. This could unlock another lucrative growth opportunity for the company as the AI software market is expected to generate a whopping $1 trillion in revenue by 2032, according to Precedence Research.

Then again, Nvidia has other solid growth drivers in the form of the nascent but potentially massive cloud gaming space where it has already established a solid position for itself. All this explains why the company is forecast to grow at a much faster pace than Apple.

Faster growth could help the chipmaker overtake Apple’s market cap

Analysts are expecting Apple’s earnings to increase at a compound annual growth rate (CAGR) of 11% over the next five years. There is a chance that the iPhone maker’s earnings growth could accelerate in the long run thanks to the growing contribution of the company’s high-margin services business, but it is likely to be hamstrung by the slow pace of growth in smartphone sales over the next decade.

Precedence Research estimates that the global smartphone market could see 7% annual growth through 2034. While that’s rosier than IDC’s forecast, Precedence believes that the adoption of technologies such as augmented reality and virtual reality are likely to help the smartphone market achieve faster growth. But it is worth noting that these technologies have been around for some time and they haven’t been enough to inject life into the smartphone market.

On the other hand, the advent of AI turned out to be a massive catalyst for Nvidia. Analysts are forecasting the company’s earnings to increase at a CAGR of 52% over the next five years, a much faster pace than what Apple is expected to report. Moreover, Nvidia’s end markets are set to grow at a much faster pace than Apple’s, and the good part is that the company is the dominant player in most of those markets.

So, there is a good chance that Nvidia could outperform Apple’s growth by a big margin over the next decade, and the market could reward the former with more upside as a result and help it become a more valuable company.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, and Nvidia. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Prediction: 1 Stock That Will Be Worth More Than Apple 10 Years From Now was originally published by The Motley Fool

Unpacking the Latest Options Trading Trends in Chevron

Investors with a lot of money to spend have taken a bearish stance on Chevron CVX.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CVX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 12 uncommon options trades for Chevron.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 41%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $190,690, and 8 are calls, for a total amount of $575,763.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $90.0 to $165.0 for Chevron during the past quarter.

Volume & Open Interest Trends

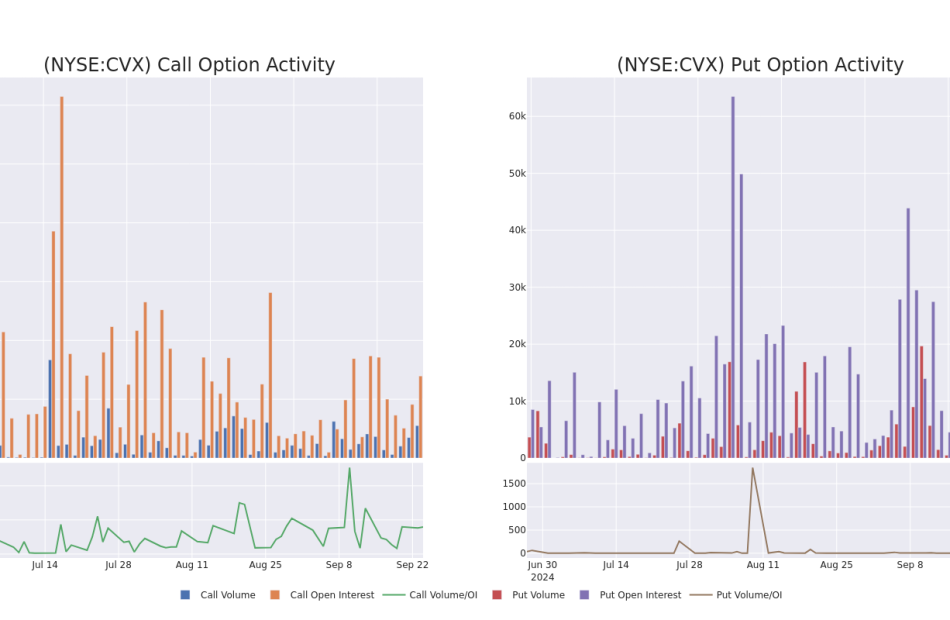

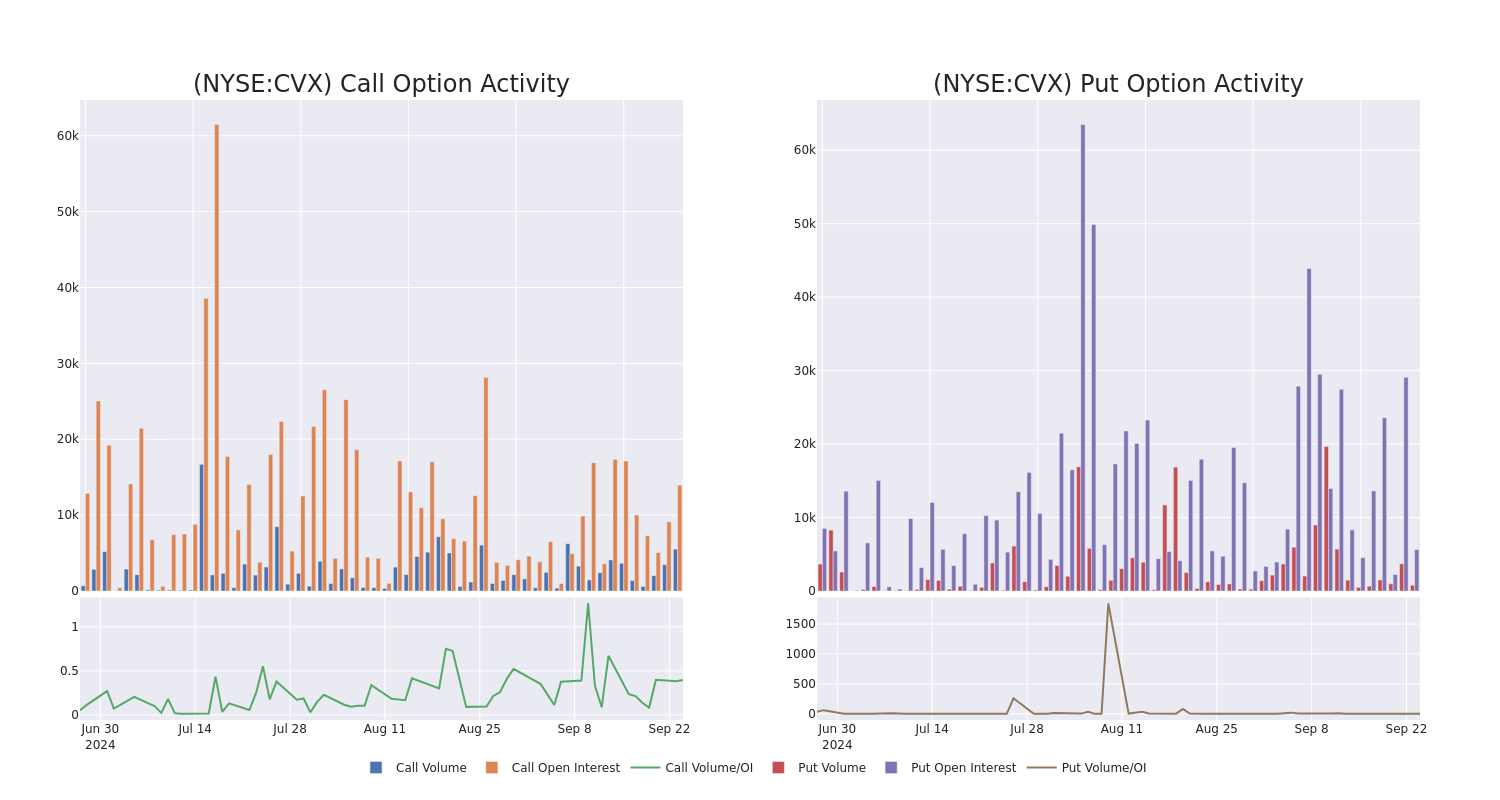

In today’s trading context, the average open interest for options of Chevron stands at 1632.0, with a total volume reaching 6,310.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Chevron, situated within the strike price corridor from $90.0 to $165.0, throughout the last 30 days.

Chevron Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | CALL | TRADE | BEARISH | 12/20/24 | $1.84 | $1.77 | $1.77 | $160.00 | $283.2K | 5.5K | 1.8K |

| CVX | CALL | SWEEP | BULLISH | 11/15/24 | $4.4 | $4.35 | $4.4 | $150.00 | $123.2K | 2.2K | 406 |

| CVX | PUT | SWEEP | BEARISH | 03/21/25 | $2.88 | $2.86 | $2.88 | $130.00 | $85.8K | 2.5K | 305 |

| CVX | PUT | SWEEP | BULLISH | 01/16/26 | $4.2 | $4.05 | $4.05 | $115.00 | $40.5K | 815 | 100 |

| CVX | PUT | TRADE | BEARISH | 10/18/24 | $1.78 | $1.71 | $1.78 | $145.00 | $39.1K | 2.1K | 297 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

In light of the recent options history for Chevron, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Chevron Standing Right Now?

- Trading volume stands at 4,234,428, with CVX’s price up by 0.21%, positioned at $147.85.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 31 days.

What The Experts Say On Chevron

2 market experts have recently issued ratings for this stock, with a consensus target price of $189.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Mizuho persists with their Outperform rating on Chevron, maintaining a target price of $189.

* An analyst from UBS has decided to maintain their Buy rating on Chevron, which currently sits at a price target of $189.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Chevron, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market Whales and Their Recent Bets on Coca-Cola Options

Investors with a lot of money to spend have taken a bearish stance on Coca-Cola KO.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with KO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 15 uncommon options trades for Coca-Cola.

This isn’t normal.

The overall sentiment of these big-money traders is split between 40% bullish and 53%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $235,245, and 12 are calls, for a total amount of $851,005.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $77.5 for Coca-Cola during the past quarter.

Volume & Open Interest Development

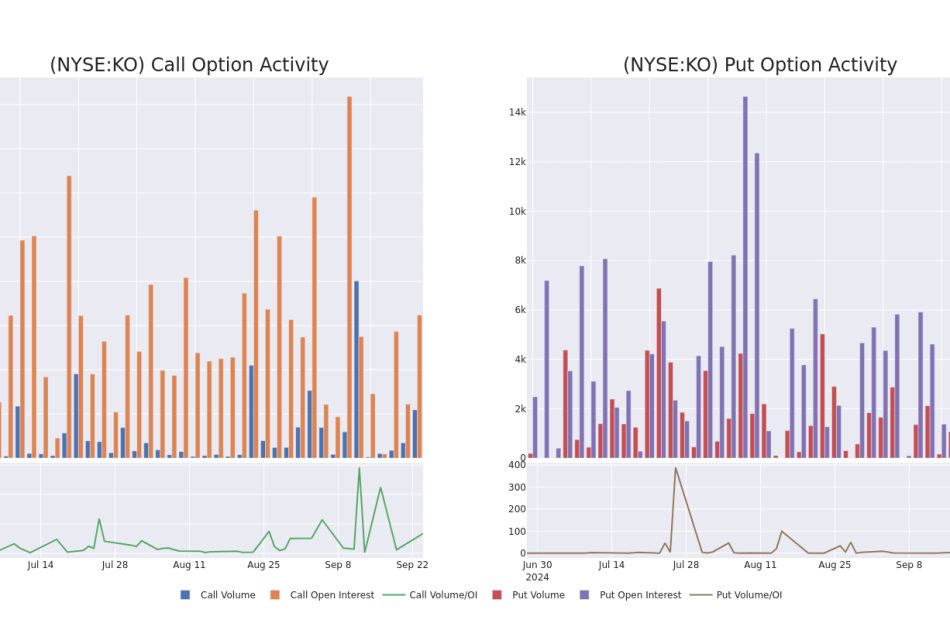

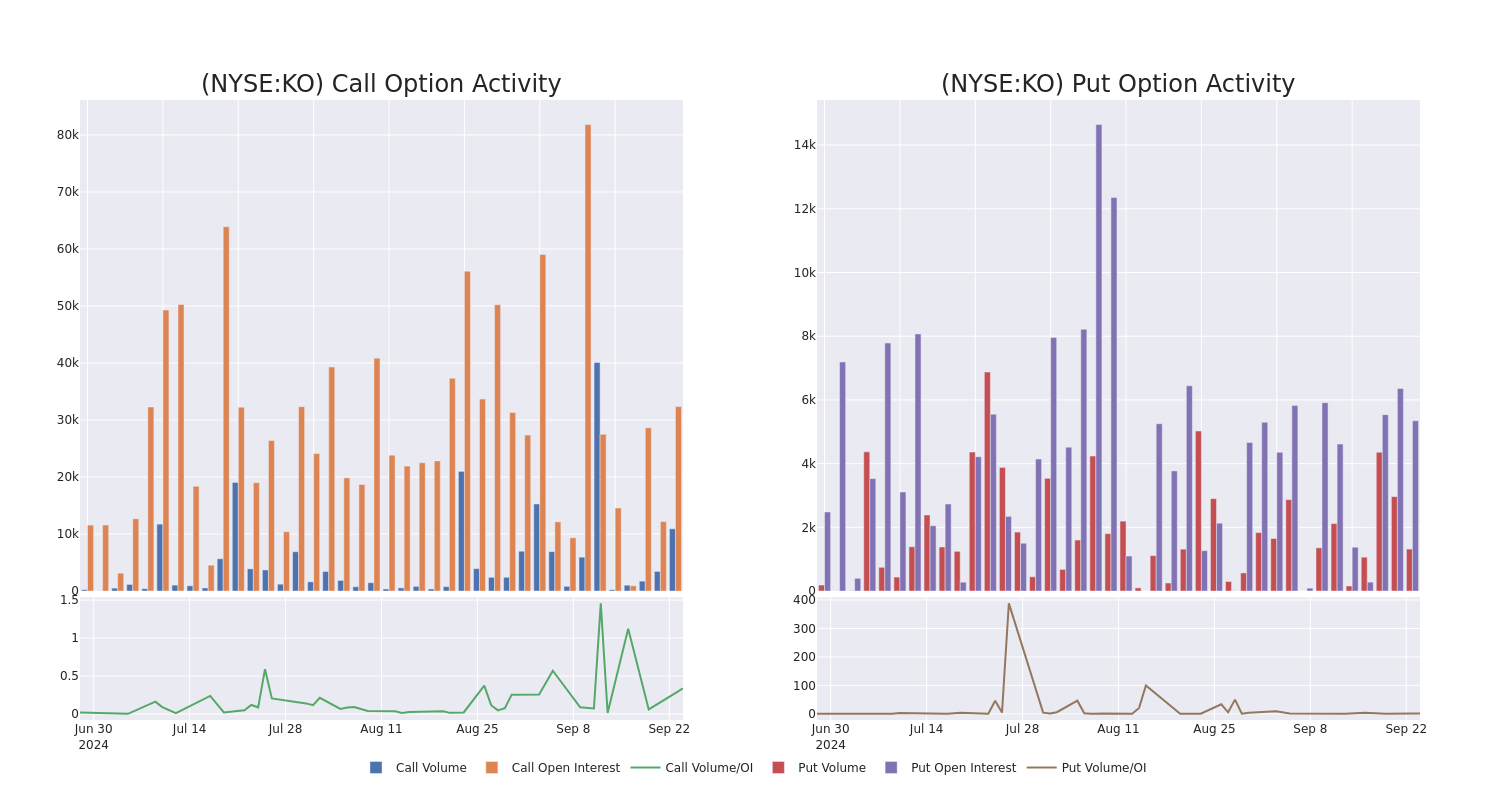

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Coca-Cola’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Coca-Cola’s substantial trades, within a strike price spectrum from $55.0 to $77.5 over the preceding 30 days.

Coca-Cola Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | CALL | TRADE | BULLISH | 01/17/25 | $5.45 | $5.3 | $5.4 | $67.50 | $232.2K | 14.7K | 431 |

| KO | CALL | TRADE | BEARISH | 12/20/24 | $0.77 | $0.75 | $0.74 | $75.00 | $222.0K | 4.1K | 3.9K |

| KO | PUT | SWEEP | BEARISH | 02/21/25 | $6.45 | $6.35 | $6.45 | $77.50 | $167.0K | 461 | 259 |

| KO | CALL | SWEEP | BEARISH | 12/20/24 | $0.75 | $0.74 | $0.75 | $75.00 | $67.4K | 4.1K | 958 |

| KO | CALL | SWEEP | BEARISH | 10/11/24 | $16.5 | $16.4 | $16.4 | $55.00 | $49.1K | 0 | 43 |

About Coca-Cola

Founded in 1886, Atlanta-headquartered Coca-Cola is the world’s largest nonalcoholic beverage company, with a strong portfolio of 200 brands covering key categories including carbonated soft drinks, water, sports, energy, juice, and coffee. Together with bottlers and distribution partners, the company sells finished beverage products bearing Coca-Cola and licensed brands through retailers and food-service locations in more than 200 countries and regions globally. Coca-Cola generates around two thirds of its total revenue overseas, with a significant portion from emerging economies in Latin America and Asia-Pacific.

Having examined the options trading patterns of Coca-Cola, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Coca-Cola

- Trading volume stands at 12,677,698, with KO’s price down by -0.56%, positioned at $71.33.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 28 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Coca-Cola options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's Plan To Cut Social Security Taxes Is A Hit With Voters – But What's The Catch?

Donald Trump has promised a $1.5 trillion tax cut to eliminate income taxes on Social Security benefits. While popular among voters, the proposal raised concerns about its impact on the already strained Social Security system and the broader federal budget.

The former President’s plan taps into a long-simmering frustration among retirees who are often surprised to find their Social Security benefits subject to taxation. According to Social Security Administration data cited by the Wall Street Journal, half of all recipients paid taxes on their benefits in 2023, an increase from just 10% when the tax was introduced in 1983.

Don’t Miss:

Trump’s proposal appeal was evident in a WSJ poll which found that 83% of respondents favored eliminating taxes on Social Security benefits. Even when informed that the change could increase the national debt, a majority still supported the idea.

The proposal comes at an important time for Social Security. The program is projected to face a shortfall within the next decade, potentially triggering automatic benefit cuts if Congress fails to act.

See Also: How do billionaires pay less in income tax than you? Tax deferring is their number one strategy.

The WSJ said the income tax on benefits currently accounts for about 4% of Social Security’s revenue and its repeal would accelerate the program’s fiscal challenges.

Democrats have countered with their proposal spearheaded by Connecticut Rep. John Larson. Their bill would reduce, but not eliminate, the tax on benefits while expanding the program. To offset the costs, it proposes new taxes on high earners, applying Social Security taxes to wages and investment income above $400,000.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

“We do something [Trump] doesn’t,” Rep. Larson told the WSJ. “We pay for it.”

Nancy Altman, who worked on the 1983 reform and now leads the advocacy group Social Security Works, noted the tax’s enduring unpopularity. “From the beginning, it’s not been well understood and been very unpopular,” Altman said.

The current system creates a compounded tax situation for many retirees. Benefits become taxable when a recipient’s total income, including half of their Social Security benefits, exceeds certain thresholds. The structure can result in surprisingly high marginal tax rates for working retirees, potentially discouraging them from seeking employment.

Some economists suggest that eliminating the tax could have mixed effects on the labor market. While it might encourage some seniors to work longer or return to the workforce, it could also lead others to retire earlier, knowing they’ll keep more of their benefits.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Policy experts have proposed different approaches that could achieve similar goals without the price tag of Trump’s plan. Kyle Pomerleau of the American Enterprise Institute suggested including benefits in income from the first dollar while raising the standard deduction. This could prevent high marginal tax rates without “hemorrhaging $1.5 trillion,” Pomerleau argued.

Eric Beckman, a voter and 71-year-old retiree in Pennsylvania, sees potential benefits for middle-income retirees like himself, though he shared concerns about the impact on government finances.

The Tax Policy Center estimates that the tax cut would benefit 16% of all households, giving an average increase of $3,400.

With Social Security’s financial health already in question, any major changes to its revenue structure will likely face scrutiny in the months ahead.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Trump’s Plan To Cut Social Security Taxes Is A Hit With Voters – But What’s The Catch? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are You Looking for a Top Momentum Pick? Why Packaging Corp. is a Great Choice

Momentum investing revolves around the idea of following a stock’s recent trend in either direction. In the ‘long’ context, investors will be essentially be “buying high, but hoping to sell even higher.” With this methodology, taking advantage of trends in a stock’s price is key; once a stock establishes a course, it is more than likely to continue moving that way. The goal is that once a stock heads down a fixed path, it will lead to timely and profitable trades.

Even though momentum is a popular stock characteristic, it can be tough to define. Debate surrounding which are the best and worst metrics to focus on is lengthy, but the Zacks Momentum Style Score helps address this issue for us.

Below, we take a look at Packaging Corp. PKG, a company that currently holds a Momentum Style Score of B. We also talk about price change and earnings estimate revisions, two of the main aspects of the Momentum Style Score.

It’s also important to note that Style Scores work as a complement to the Zacks Rank, our stock rating system that has an impressive track record of outperformance. Packaging Corp. Currently has a Zacks Rank of #2 (Buy). Our research shows that stocks rated Zacks Rank #1 (Strong Buy) and #2 (Buy) and Style Scores of A or B outperform the market over the following one-month period.

Set to Beat the Market?

In order to see if PKG is a promising momentum pick, let’s examine some Momentum Style elements to see if this maker of containerboard and corrugated packaging products holds up.

Looking at a stock’s short-term price activity is a great way to gauge if it has momentum, since this can reflect both the current interest in a stock and if buyers or sellers have the upper hand at the moment. It’s also helpful to compare a security to its industry; this can show investors the best companies in a particular area.

For PKG, shares are up 1.25% over the past week while the Zacks Containers – Paper and Packaging industry is up 2.38% over the same time period. Shares are looking quite well from a longer time frame too, as the monthly price change of 4.46% compares favorably with the industry’s 1.77% performance as well.

While any stock can see its price increase, it takes a real winner to consistently beat the market. That is why looking at longer term price metrics — such as performance over the past three months or year — can be useful as well. Shares of Packaging Corp. Have increased 16.62% over the past quarter, and have gained 42.83% in the last year. On the other hand, the S&P 500 has only moved 4.57% and 31.09%, respectively.

Investors should also pay attention to PKG’s average 20-day trading volume. Volume is a useful item in many ways, and the 20-day average establishes a good price-to-volume baseline; a rising stock with above average volume is generally a bullish sign, whereas a declining stock on above average volume is typically bearish. PKG is currently averaging 512,829 shares for the last 20 days.

Earnings Outlook

The Zacks Momentum Style Score encompasses many things, including estimate revisions and a stock’s price movement. Investors should note that earnings estimates are also significant to the Zacks Rank, and a nice path here can be promising. We have recently been noticing this with PKG.

Over the past two months, 5 earnings estimates moved higher compared to none lower for the full year. These revisions helped boost PKG’s consensus estimate, increasing from $8.50 to $8.72 in the past 60 days. Looking at the next fiscal year, 5 estimates have moved upwards while there have been no downward revisions in the same time period.

Bottom Line

Taking into account all of these elements, it should come as no surprise that PKG is a #2 (Buy) stock with a Momentum Score of B. If you’ve been searching for a fresh pick that’s set to rise in the near-term, make sure to keep Packaging Corp. On your short list.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Americans running out of unemployment benefits and part-time jobs at record levels point to a recession coming, economist says

-

The job market is flashing signs the US is still headed for a hard-landing, Danielle DiMartino Booth says.

-

The forecaster pointed to workers rolling off unemployment benefits, while part-time jobs have soared.

-

Consumers could eventually pull back on spending, causing the US to tip into a downturn, she said.

Developments in the labor market show that the US economy isn’t on solid footing, according to Danielle DiMartino Booth.

The veteran forecaster and QI Research founder pointed to continued signs of weakness in the US job market, zooming in on a few key areas that are flashing signs of trouble.

Booth said that more workers who once qualified for unemployment insurance are now rolling off of their benefits. Workers in most states have 26 weeks of paid unemployment benefits, but according to the Bureau of Labor Statistics, 21% of workers are now taking more than 27 weeks to find a new job, up 3% from last year.

The average unemployment duration in the US climbed to 21 weeks in September, government data shows.

The second factor is the number of part-time workers in the US, which has climbed to an all-time high and suggests that the hiring picture isn’t as strong as may appear. The number of employees that usually work part-time climbed to 28.2 million in August, the highest number since the government began recording the data in the 1960s, BLS data shows.

“We’re not seeing these people pour into the unemployment claims pool,” Booth said in a recent interview with CNBC, attributing many of the part-time jobs to the gig economy, as out-of-work Americans may turn to platforms like Uber or other services in order to keep money coming in.

“Much different economy than we saw in 2007, 2008, because the gig economy has exploded in that period,” she added.

Weakness in the job market could later translate into consumer weakness, one of the economy’s chief concerns, Booth predicted. Fed economists already have their eye on weaker consumer spending, with consumption falling or remaining flat in most Fed Districts, according to the central bank’s latest Beige Book.

Lower consumption already appears to be having an effect on key industries. The manufacturing sector contracted for 21 out of the last 22 months, according to the Institute of Supply Management, while inventory grew. The housing market, where activity has been suppressed over the last two years, also saw existing home sales drop another 2.5% in August, per the National Association of Realtors.

Investors could see more signs of economic weakening with next quarter’s GDP figures, Booth said, which are set to roll out at the end of the week.

The economy is expected to have grown nearly 3% last quarter, matching the pace in the second quarter of 2024, according to the latest Atlanta Fed GDPNow reading. But GDP figures could be later revised down, Booth noted, pointing to a recent revision that showed the economy added nearly a million fewer jobs than expected in the year leading up to March 2024.

Booth has been warning of a recession for months despite most of Wall Street warming up to the prospect of a soft landing. Previously, she made the case that the US economy was already in a recession despite continuing to grow in 2023 and 2024, pointing to continued weakness in the job market.

Read the original article on Business Insider

Global Structured Cabling Market Size, is Projected to Reach USD 20.38 billion by 2030 | Exactitude Consultancy

Luton, Bedfordshire, United Kingdom, Sept. 24, 2024 (GLOBE NEWSWIRE) — Exactitude Consultancy, the market research and consulting wing of Ameliorate Digital Consultancy Private Limited has completed and published the final copy of the detailed research report on the Global Structured Cabling Market

The global structured cabling market is experiencing significant growth as the world becomes more digitally connected. According to market analysis, the market size, valued at USD 12.26 billion in 2023, is projected to reach USD 20.38 billion by 2030, at a compound annual growth rate (CAGR) of 7.53%. Key players like ABB Ltd, Belden Inc., and CommScope Holding Company are driving innovation in the space, providing scalable cabling infrastructure to meet evolving demands in IT, telecommunications, and other industries. This article delves into key trends, market drivers, technological advancements, and the competitive landscape shaping the future of structured cabling.

Click here for more information- https://exactitudeconsultancy.com/reports/33527/structured-cabling-market/

Structured Cabling Market Players

Key players include ABB Ltd, Belden Inc., Commscope Holding Company, Inc., Corning Incorporated, Furukawa Electric Co., Ltd., Legrand Sa, Nexans, Schneider Electric, Siemens Ag, Cisco Systems Inc., Datwyler Holding Inc., Hubnetix Corp., Molex Incorporated, Tyco Electronics Corporation, L-Com Global Connectivity, Anixter International Inc., General Cable Corporation, Sumitomo Electric Industries, Ltd., Nera Networks As, Hubbell Incorporated., and others

Industry Development:

On September 19, 2024, iemon, a global leader in network infrastructure solutions, announced that it is offering its full range of optical patching solutions to work specifically with NVIDIA AI infrastructure for generative AI networks. Large complex GPU clusters can benefit from using structured cabling patch panels versus point-to-point cabling. Siemon acts as a trusted advisor to customers by providing expert advice and best practice recommendations for design and deployment of NVIDIA AI infrastructure.

On September 16, 2024, CommScope, a global leader in network connectivity, earned three Gold awards for its VisiPORT™, GigaREACH™ XL and GigaSPEED XL5™ solutions in the 2024 Cabling Innovators Awards from Cabling Installation & Maintenance magazine. Recognizing cabling and communications technology products, programs, and applications within the structured cabling industry, the Innovators Awards are determined by a panel of senior third-party judges based on outstanding innovation, value, sustainability, collaboration and impact.

On February 22, 2024- Michigan-based IT solutions provider, Centaris, has acquired Network Connections, Inc. (NCI). Financial terms of the deal were not disclosed. This is technology M&A deal number 47 that ChannelE2E and MSSP Alert have covered so far in 2024. Centaris formed in 2021 through a merger between the Center for Computer Resources (CCR) and Business Communication Systems (BCS). The company is headquartered in Sterling Heights, Michigan, and has 110 employees listed on LinkedIn. Centaris’ areas of expertise include managed services for Microsoft Office 365 and Teams, as well as computer systems sales and service, structured cabling, varied voice/phone solutions, telephony, cloud VoIP solutions and internet/voice carrier services.

On 07 July 2023, MegaFlex DPA (Decentralized Parallel Architecture) UPS solutions were introduced for the Indian market by ABB India’s Electrification business. The first sustainable UPS of its kind that complies with the ABB circularity framework and is a member of the ABB EcoSolutionsTM portfolio. It boasts the best efficiency rating and the smallest footprint as it was developed for high density computing environments.

On 09 March 2023, Connect Box, an open and user-friendly Internet of Things solution created to manage small to medium-sized buildings, has been released by Siemens Smart Infrastructure. Users of Connect Box can complete crucial daily building management chores from a single location using a cloud-based interface without the need for an additional gateway or piece of software.

On August 4 2021, R&M has developed a complete Single Pair Ethernet (SPE) cabling system with connectors, connection modules, and patch cords for use in building automation networks.

Market Overview

Structured cabling provides a standardized system for data transmission across various sectors such as IT & telecommunications, residential & commercial, government & education, and manufacturing & automation. The growing adoption of 5G, Internet of Things (IoT), and cloud-based services is a major catalyst for this growth, particularly in industries like telecommunications and data centers that demand high bandwidth.

The fiber cabling segment is expected to witness rapid expansion due to its ability to handle faster and more reliable data transmission, while copper cabling remains essential in smaller networks, particularly for residential and commercial applications. Companies like CommScope Holding Inc., Corning Incorporated, and Schneider Electric are leaders in providing innovative cabling solutions to meet the evolving needs of businesses.

Regionally, North America leads the structured cabling market, owing to its established IT infrastructure and high concentration of data centers. However, Asia-Pacific is projected to experience the fastest growth due to increasing investments in digital infrastructure, particularly in countries like China and India.

As industries continue to digitize, the demand for robust, scalable, and sustainable cabling solutions will push the structured cabling market toward further expansion, making it a crucial backbone for modern global connectivity

Click here for more information- https://exactitudeconsultancy.com/reports/33527/structured-cabling-market/

Key Drivers of Market Growth

The structured cabling market is driven by several key factors contributing to its robust growth. One of the primary drivers is the increasing demand for high-speed internet and seamless connectivity, fueled by the rise of data centers, cloud computing, and the deployment of 5G networks. The expanding use of structured cabling in industries such as IT, telecommunications, and smart cities also plays a pivotal role in supporting modern digital infrastructure. Additionally, the growing adoption of the Internet of Things (IoT) and the demand for better bandwidth to support connected devices have accelerated the need for advanced cabling systems. Fiber optic cabling, which enables faster data transmission over long distances, is experiencing significant growth due to its superior performance over traditional copper cables.

Moreover, automation and artificial intelligence (AI) integration into cabling management systems have further enhanced efficiency, reducing downtime and increasing productivity. Companies across sectors are investing in scalable and future-proof cabling solutions to meet rising connectivity demands, especially in regions undergoing rapid digital transformation, such as Asia-Pacific. Sustainability trends, such as energy-efficient and eco-friendly cabling materials, are also contributing to market expansion. As industries continue to digitize and expand their network capacities, structured cabling will remain a critical component of the global technological ecosystem.

Challenges and Restraints

The structured cabling market faces several challenges and restraints that hinder its rapid growth. One of the primary challenges is the high cost of installation and maintenance, which often deters smaller businesses from adopting advanced cabling systems. Structured cabling, particularly fiber optic cabling, requires significant upfront investment, which can be a financial burden for some organizations. Additionally, transmission losses in fiber optic systems pose another limitation, especially when compared to traditional copper cabling solutions.

Another key restraint is the complexity of upgrading and maintaining structured cabling systems, which require specialized knowledge and expertise. This complexity leads to higher operational costs, particularly in environments like large data centers that need constant monitoring and scaling. Furthermore, supply chain disruptions and fluctuations in the cost of raw materials, such as copper and fiber, have added financial pressure on manufacturers and end-users alike. Lastly, as technology continues to evolve rapidly, companies may struggle to keep their cabling infrastructure future-proof. The emergence of new standards and technologies, such as 5G and the Internet of Things (IoT), requires frequent updates to existing systems, which can be both costly and time-consuming. Despite these challenges, the market continues to grow, but the high initial costs, maintenance complexity, and technological advancements remain ongoing concern.

Click here for more information- https://exactitudeconsultancy.com/reports/33527/structured-cabling-market/

Market Segmentation

- Structured Cabling Market by Type, 2023-2030 (USD Billion)

- Fiber Cabling

- Cabling Infrastructure

- Copper Cabling

- Structured Cabling Market by Offering, 2023-2030 (USD Billion)

- Products

- Cables

- Communication Outlets

- Patch Panels & Cross Connects

- Patch Cords & Cable Assemblies

- Racks & Cabinets

- Services

- Installation & Consultation

- Managed Services

- Maintenance & Support

- Software

- Structured Cabling Market by Industry Vertical, 2023-2030 (USD Billion)

- IT & Telecommunications

- Residential & Commercial

- Government & education

- Manufacturing & automation

- Military & Defense

- Energy

- Oil & Gas

- Others

- Structured Cabling Market by Region, 2023-2030 (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Players

- ABB Ltd

- Belden Inc.

- Commscope Holding Company, Inc.

- Corning Incorporated

- Furukawa Electric Co., Ltd.

- Legrand Sa

- Nexans

- Schneider Electric

- Siemens Ag

- Cisco Systems Inc.

- Datwyler Holding Inc.

- Hubnetix Corp.

- Molex Incorporated

- Tyco Electronics Corporation

- L-Com Global Connectivity

- Anixter International Inc.

- General Cable Corporation

- Sumitomo Electric Industries, Ltd.

- Nera Networks As

- Hubbell Incorporated

Regional Analysis

The Asia Pacific region is projected to grow the fastest, with a CAGR of 12.5% during the same period. Key factors driving the growth of structured cabling market include government initiatives to enhance infrastructure, the push for digitization, the rapid adoption of smart devices, a growing population, and investments in cloud and IoT technologies. China and Japan are the front-runners in this region, and the increase in internet usage is leading to more broadcast activities, which is expected to further boost the local market.

North America is the largest market for structured cabling, holding a 34% share of the global market. This growth can be linked to its busy manufacturing and telecommunications sectors, which rely heavily on structured cabling networks. The region has seen significant advancements due to the early adoption of new technologies across various industries, including government, residential, commercial, and transportation. Additionally, the increasing use of fiber optic cables and digital services is driving the market forward. Major investments in 5G, broadband, and communication infrastructure are expected to keep North America in the lead during the forecast period. For instance, the USDA planned to invest about USD 635 million through the ReConnect Program in 2021 to develop data center infrastructure across the country.

Click here for more information- https://exactitudeconsultancy.com/reports/33527/structured-cabling-market/

Competitive Landscape

The global structured cabling market is competitive, featuring a mix of established players and emerging companies. Key players include Siemon Company, known for high-quality solutions; Panduit Corp., which offers a broad range of products; and CommScope, recognized for its comprehensive cabling systems. Other notable companies are Nexans, Belden, and Legrand, all focusing on innovative and sustainable practices. The market is driven by technological advancements, with firms investing in research and development to create high-speed cabling solutions. Additionally, there is a growing emphasis on sustainability, as companies seek eco-friendly materials. Strategic partnerships are also becoming common, allowing firms to enhance their product offerings and expand into new markets, especially in Asia Pacific and Latin America. However, the industry faces challenges such as intense price competition and the need to keep up with rapid technological changes. Overall, companies that adapt to these dynamics are more likely to succeed in this evolving landscape.

Key stakeholders

- IT and Networking Companies

- Data Centers and Hosting Providers

- Telecommunication Companies

- Enterprises and Businesses

- Government and Public Sector

- Cloud Service Providers

- System Integrators and Installers

- Healthcare Institutions

- Educational Institutions

- Retail and E-commerce Companies

- Others

Future Outlook

The structured cabling market is poised for robust growth, driven by the accelerating pace of digital transformation across industries. With a projected market size of USD 20.38 billion by 2030, key players are well-positioned to take advantage of opportunities in cloud computing, 5G, and IoT. Technological advancements and a focus on sustainability will continue to shape the future of structured cabling, making it a vital component of the global digital infrastructure.

The global demand for structured cabling will only continue to grow as industries rely on faster, more efficient data communication systems. Companies that stay ahead of the curve in technology and sustainability are set to lead the market in the forecasted period.

Related Links

Optical Ground Wire Cable Market

Local Area Network (LAN) Cable Market

Wire Compound And Cable Compound Market

Electrical Insulation Materials Market

Global Cables and Connectors Market

More Research Sites:

https://bulletin.exactitudeconsultancy.com/

https://www.analytica.global/

https://www.marketintelligencedata.com/

h 17.778

w 1992.917

17.778

1992.917

14

14

Irfan Tamboli (Head of Sales) – Exactitude Consultancy Phone: + 1704 266 3234 sales@exactitudeconsultancy.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Little Known Perks of a Costco Executive Membership

Costco offers two kinds of personal memberships: Gold Star and Executive. The cost difference between them is $65 ($65 for Gold Star and $130 for Executive). But an Executive membership lets you earn 2% back on all qualifying Costco purchases up to a maximum of $1,250 per year. Members who choose the Executive membership are usually those who can spend enough in a 12-month period ($6,500) to cover the cost of their entire membership fee.

If that information has you yawning, then you’re probably (a) already an Executive member or (b) aren’t one but have done a little research. Regardless of which category you fall into, there are certainly some little-known Executive perks that deserve some more attention — like these three.

1. Extra perks on insurance

Members can already save big on insurance through Costco’s partnership with CONNECT, an arm of American Family Insurance. According to Costco, members save roughly $600 on auto insurance in the first year they switch to CONNECT.

Executive members, however, get extra perks. Executive members who buy car insurance will also get roadside assistance, which covers up to $75 for minor problems like flat tires and dead batteries.

They also get lifetime renewability. This means CONNECT won’t drop you after you get into an accident or file a claim. There are some exclusions to this policy (for example, CONNECT could drop you if you don’t pay your premiums), so check the benefits page for more information.

CONNECT home insurance also offers extra benefits to Executive members. Home glass repair reimbursement, for instance, will cover up to $1,000 per occurrence with a maximum of two occurrences per year. Meanwhile, home lockout assistance will cover up to $100 per occurrence with a maximum of two occurrences per year.

2. Cash back on travel plans

As mentioned above, Executive members can earn 2% back on qualifying Costco purchases. And, yes, that includes Costco Travel bookings.

This 2% back on travel can make an Executive membership worth buying for a single trip alone. Say, for instance, that you book a five-day trip to Mexico for you and your partner for $5,000. If you can then spend $1,500 at Costco on your regular shopping, you would have earned enough cash back to cover your membership dues.

Better yet, you can double-dip rewards. That is, you can earn 2% back on your Costco membership and rewards on a travel credit card. This could mean getting a fair chunk of change returned to you in the form of cash back, reward points, or miles.

3. Costco Connection magazine

Okay, this one is definitely not as cool as the former two. But if you’re a magazine kind of person, an Executive membership will entitle you to a monthly copy of Costco Connection. Each edition includes health tips, business advice, recipes, member stories, and some book reviews.

Even if you’re not an Executive member, you can view the magazine for free online. But only Executive members can have a paper copy of it delivered to their door.

An Executive membership entitles you to the perks mentioned above. Of course, for many people, its main draw is the 2% back on qualifying Costco purchases. Combine this with a good credit card to use at Costco and you could reduce your out-of-pocket spending at your favorite wholesale club.

Top credit card to use at Costco (and everywhere else!)

We love versatile credit cards that offer huge rewards everywhere, including Costco! This card is a standout among America’s favorite credit cards because it offers perhaps the easiest $200 cash bonus you could ever earn and an unlimited 2% cash rewards on purchases, even when you shop at Costco.

Add on the competitive 0% interest period and it’s no wonder we awarded this card Best No Annual Fee Credit Card.

Click here to read our full review for free and apply before the $200 welcome bonus offer ends!

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

3 Little Known Perks of a Costco Executive Membership was originally published by The Motley Fool