Progress Announces Third Quarter 2024 Financial Results

Progress Q3’24 Tops High End of Estimates

Expects to Close ShareFile Acquisition in Fiscal 2024

BURLINGTON, Mass., Sept. 24, 2024 (GLOBE NEWSWIRE) — Progress PRGS, the trusted provider of AI-powered infrastructure software, today announced financial results for its fiscal third quarter ended August 31, 2024.

Third Quarter 2024 Highlights1:

- Revenue and non-GAAP revenue of $179 million increased 2% year-over-year on both an actual and a constant currency basis.

- Annualized Recurring Revenue (“ARR”) of $582 million remained relatively flat year-over-year on a constant currency basis.

- Operating margin was 23% and non-GAAP operating margin was 41%.

- Diluted earnings per share was $0.65 compared to $0.42 in the same quarter last year, an increase of 55%.

- Non-GAAP diluted earnings per share was $1.26 compared to $1.08 in the same quarter last year, an increase of 17%.

Yogesh Gupta, CEO of Progress said: “This is a very exciting time for Progress. Our Q3 results were ahead of our guidance, and I am extremely pleased with our execution during the quarter. What’s more exciting is our proposed acquisition of ShareFile, which we announced two weeks ago. We expect the deal to close before the end of our fiscal year, and we are eager to begin the work of integrating ShareFile’s people and products into the Progress team.”

Additional financial highlights included:

| Three Months Ended | |||||||||||||||||||||

| GAAP | Non-GAAP1 | ||||||||||||||||||||

| (In thousands, except percentages and per share amounts) | August 31, 2024 |

August 31, 2023 |

% Change |

August 31, 2024 |

August 31, 2023 |

% Change |

|||||||||||||||

| Revenue | $ | 178,686 | $ | 174,992 | 2 | % | $ | 178,686 | $ | 175,783 | 2 | % | |||||||||

| Income from operations | $ | 40,349 | $ | 29,371 | 37 | % | $ | 74,123 | $ | 68,390 | 8 | % | |||||||||

| Operating margin | 23 | % | 17 | % | 600 | bps | 41 | % | 39 | % | 200 | bps | |||||||||

| Net income | $ | 28,464 | $ | 19,098 | 49 | % | $ | 55,216 | $ | 48,749 | 13 | % | |||||||||

| Diluted earnings per share | $ | 0.65 | $ | 0.42 | 55 | % | $ | 1.26 | $ | 1.08 | 17 | % | |||||||||

| Cash from operations (GAAP) /Adjusted free cash flow (non-GAAP) | $ | 57,658 | $ | 46,041 | 25 | % | $ | 57,525 | $ | 47,649 | 21 | % | |||||||||

Other fiscal third quarter 2024 metrics and recent results included:

- Cash and cash equivalents were $232.7 million at the end of the quarter.

- Days sales outstanding was 45 days compared to 49 days in the fiscal third quarter of 2023 and 41 days in the fiscal second quarter of 2024.

- On September 9, 2024, we announced a definitive agreement to acquire ShareFile, a business unit of Cloud Software Group, Inc., providing SaaS-native, AI-powered, document-centric collaboration, for $875 million in cash.

- Additionally, on September 9, 2024, we announced that Progress’ Board of Directors has approved the suspension of Progress’ quarterly dividend as of the closing of the ShareFile acquisition and plans to redirect such capital toward the repayment of debt to increase liquidity for future M&A and for share repurchases, both of which are prioritized in our capital allocation policy.

______________________

1 See Important Information Regarding Non-GAAP Financial Information and a reconciliation of non-GAAP adjustments to Progress’ GAAP financial results at the end of this press release.

“We’re very pleased with our third quarter results, which once again came in above the high end of previously issued guidance ranges,” said Anthony Folger, CFO. “Announcing our intent to acquire ShareFile made the end of Q3 particularly exciting and busy, so I want to be sure to highlight the strong performance on the top and bottom lines. Operating margin ended the quarter at over 41%, which reflects solid top line performance and our continued focus on expense control and running the business efficiently. We’re looking forward to closing the ShareFile acquisition before the end of this fiscal year and getting started on the integration.”

2024 Business Outlook

Progress provides the following guidance for the fiscal year ending November 30, 2024 and the fiscal fourth quarter ending November 30, 2024:

| Updated FY 2024 Guidance (September 24, 2024) |

Prior FY 2024 Guidance (June 25, 2024) |

||||||||||

| (In millions, except percentages and per share amounts) | GAAP | Non-GAAP1 | GAAP | Non-GAAP1 | |||||||

| Revenue | $745 – $755 | $745 – $755 | $725 – $735 | $725 – $735 | |||||||

| Diluted earnings per share | $1.69 – $1.81 | $4.75 – $4.85 | $1.98 – $2.10 | $4.70 – $4.80 | |||||||

| Operating margin | 16% – 17% | 39% | 19% | 39% – 40% | |||||||

| Cash from operations (GAAP) / Adjusted free cash flow (non-GAAP) |

$196 – $206 | $195 – $205 | $205 – $215 | $205 – $215 | |||||||

| Effective tax rate | 17 % | 19 % | 20 % | 20 % | |||||||

| Q4 2024 Guidance | |||

| (In millions, except per share amounts) | GAAP | Non-GAAP1 | |

| Revenue | $207 – $217 | $207 – $217 | |

| Diluted earnings per share | $0.17 – $0.27 | $1.15 – $1.25 | |

Our updated guidance for FY 2024 and Q4 2024 assumes one month of contribution from our proposed acquisition of ShareFile.

Based on current exchange rates, the expected positive currency translation impact on Progress’ fiscal year 2024 business outlook compared to 2023 exchange rates is approximately $1.8 million on GAAP and non-GAAP revenue, and approximately $0.02 on GAAP and non-GAAP diluted earnings per share. The expected positive currency translation impact on Progress’ fiscal Q4 2024 business outlook compared to 2023 exchange rates is approximately $1.6 million on GAAP and non-GAAP revenue, and approximately $0.01 on GAAP and non-GAAP diluted Q4 2024 earnings per share. Fluctuations in exchange rates can impact our future performance.

Conference Call

Progress will hold a conference call to review its financial results for the fiscal third quarter of 2024 at 5:00 p.m. ET on Tuesday, September 24, 2024. Participants must register for the conference call here: https://register.vevent.com/register/BIad4e20ba61bf4c42b82b0f756d5a6dee. The webcast can be accessed at: https://edge.media-server.com/mmc/p/y8oedrez/. The conference call will include comments followed by questions and answers. Attendees must register for the webcast and an archived version of the conference call and supporting materials will be available on the Progress website within the investor relations section after the live conference call.

Important Information Regarding Non-GAAP Financial Information

Progress furnishes certain non-GAAP supplemental information to our financial results. We use such non-GAAP financial measures to evaluate our period-over-period operating performance because our management team believes that by excluding the effects of certain GAAP-related items that in their opinion do not reflect the ordinary earnings of our operations, such information helps to illustrate underlying trends in our business and provides us with a more comparable measure of our continuing business, as well as greater understanding of the results from the primary operations of our business. Management also uses such non-GAAP financial measures to establish budgets and operational goals, evaluate performance, and allocate resources. In addition, the compensation of our executives and non-executive employees is based in part on the performance of our business as evaluated by such non-GAAP financial measures. We believe these non-GAAP financial measures enhance investors’ overall understanding of our current financial performance and our prospects for the future by: (i) providing more transparency for certain financial measures, (ii) presenting disclosure that helps investors understand how we plan and measure the performance of our business, (iii) affords a view of our operating results that may be more easily compared to our peer companies, and (iv) enables investors to consider our operating results on both a GAAP and non-GAAP basis (including following the integration period of our prior and proposed acquisitions). However, this non-GAAP information is not in accordance with, or an alternative to, generally accepted accounting principles in the United States (“GAAP”) and should be considered in conjunction with our GAAP results as the items excluded from the non-GAAP information may have a material impact on Progress’ financial results. A reconciliation of non-GAAP adjustments to Progress’ GAAP financial results is included in the tables at the end of this press release.

In the noted fiscal periods, we adjusted for the following items from our GAAP financial results to arrive at our non-GAAP financial measures:

- Acquisition-related revenue – We include acquisition-related revenue, which constitutes revenue reflected as pre-acquisition deferred revenue that would have been recognized prior to our adoption of Accounting Standards Update No. 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers (“ASU 2021-08”) during the fourth quarter of fiscal year 2021. The acquisition-related revenue in our prior period results relates to Chef Software, Inc. which we acquired on October 5, 2020. Since GAAP accounting required the elimination of this revenue prior to the adoption of ASU 2021-08, GAAP results alone do not fully capture all of our economic activities. We believe these adjustments are useful to management and investors as a measure of the ongoing performance of the business because, although we cannot be certain that customers will renew their contracts, we have historically experienced high renewal rates on maintenance and support agreements and other customer contracts. Upon our adoption of ASU 2021-08, this adjustment is no longer applicable to subsequent acquisitions.

- Amortization of acquired intangibles – We exclude amortization of acquired intangibles because those expenses are unrelated to our core operating performance and the intangible assets acquired vary significantly based on the timing and magnitude of our acquisition transactions and the maturities of the businesses acquired.

- Stock-based compensation – We exclude stock-based compensation to be consistent with the way management and, in our view, the overall financial community evaluates our performance and the methods used by analysts to calculate consensus estimates. The expense related to stock-based awards is generally not controllable in the short-term and can vary significantly based on the timing, size and nature of awards granted. As such, we do not include these charges in operating plans.

- Restructuring expenses and other – In all periods presented, we exclude restructuring expenses incurred because those expenses distort trends and are not part of our core operating results.

- Acquisition-related expenses – We exclude acquisition-related expenses in order to provide a more meaningful comparison of the financial results to our historical operations and forward-looking guidance and the financial results of less acquisitive peer companies. We consider these types of costs and adjustments, to a great extent, to be unpredictable and dependent on a significant number of factors that are outside of our control. Furthermore, we do not consider these acquisition-related costs and adjustments to be related to the organic continuing operations of the acquired businesses and are generally not relevant to assessing or estimating the long-term performance of the acquired assets. In addition, the size, complexity and/or volume of past acquisitions, which often drives the magnitude of acquisition-related costs, may not be indicative of the size, complexity and/or volume of future acquisitions.

- Cyber incident and vulnerability response expenses, net

- November 2022 Cyber Incident – We exclude certain expenses resulting from the detection of irregular activity on certain portions of our corporate network, as more thoroughly described in the Form 8-K that we filed on December 19, 2022.

- MOVEit Vulnerability – We exclude certain expenses resulting from the zero-day MOVEit Vulnerability, as more thoroughly described in our filings with the Securities and Exchange Commission since June 5, 2023.

Expenses include costs to investigate and remediate these cyber related matters, as well as legal and other professional services related thereto. Expenses related to such cyber matters are provided net of expected insurance recoveries, although the timing of recognizing insurance recoveries may differ from the timing of recognizing the associated expenses. Costs associated with the enhancement of our cybersecurity program are not included within this adjustment. We expect to continue to incur legal and other professional services expenses in future periods associated with the MOVEit Vulnerability. We do not expect to incur additional costs associated with the November 2022 Cyber Incident as the investigation is closed. Expenses related to such cyber matters are expected to result in operating expenses that would not have otherwise been incurred in the normal course of business operations. We believe that excluding these costs facilitates a more meaningful evaluation of our operating performance and comparisons to our past operating performance.

- Provision for income taxes – We adjust our income tax provision by excluding the tax impact of the non-GAAP adjustments discussed above.

- Constant currency – Revenue from our international operations has historically represented a substantial portion of our total revenue. As a result, our revenue results have been impacted, and we expect will continue to be impacted, by fluctuations in foreign currency exchange rates. As exchange rates are an important factor in understanding period-to-period comparisons, we present revenue growth rates on a constant currency basis, which helps improve the understanding of our revenue results and our performance in comparison to prior periods. The constant currency information presented is calculated by translating current period results using prior period weighted average foreign currency exchange rates. These results should be considered in addition to, not as a substitute for, results reported in accordance with GAAP.

- Annualized Recurring Revenue (“ARR”) – We disclose ARR as a performance metric to help investors better understand and assess the performance of our business because our mix of revenue generated from recurring sources currently represents the substantial majority of our revenues and is expected to continue in the future. We define ARR as the annualized revenue of all active and contractually binding term-based contracts from all customers at a point in time. ARR includes revenue from maintenance, software upgrade rights, public cloud, and on-premises subscription-based transactions and managed services. ARR mitigates fluctuations in revenue due to seasonality, contract term and the sales mix of subscriptions for term-based licenses and SaaS. Management uses ARR to understand customer trends and the overall health of the Company’s business, helping it to formulate strategic business decisions.

We calculate the annualized value of annual and multi-year contracts, and contracts with terms less than one year, by dividing the total contract value of each contract by the number of months in the term and then multiplying by 12. Annualizing contracts with terms less than one-year results in amounts being included in our ARR that are in excess of the total contract value for those contracts at the end of the reporting period. We generally do not sell contracts with a term of less than one year unless a customer is purchasing additional licenses under an existing annual or multi-year contract. The expectation is that at the time of renewal, contracts with a term less than one year will renew with the same term as the existing contracts being renewed, such that both contracts are co-termed. Historically contracts with a term of less than one year renew at rates equal to or better than annual or multi-year contracts.

Revenue from term-based license and on-premises subscription arrangements include a portion of the arrangement consideration that is allocated to the software license that is recognized up-front at the point in time control is transferred under ASC 606 revenue recognition principles. ARR for these arrangements is calculated as described above. The expectation is that the total contract value, inclusive of revenue recognized as software license, will be renewed at the end of the contract term.

The calculation is done at constant currency using the current year budgeted exchange rates for all periods presented.

ARR is not defined in GAAP and is not derived from a GAAP measure. Rather, ARR generally aligns to billings (as opposed to GAAP revenue which aligns to the transfer of control of each performance obligation). ARR does not have any standardized meaning and is therefore unlikely to be comparable to similarly titled measures presented by other companies. ARR should be viewed independently of revenue and deferred revenue and is not intended to be combined with or to replace either of those items. ARR is not a forecast and the active contracts at the end of a reporting period used in calculating ARR may or may not be extended or renewed by our customers.

- Net Retention Rate – We calculate net retention rate as of a period end by starting with the ARR from the cohort of all customers as of 12 months prior to such period end (“Prior Period ARR”). We then calculate the ARR from these same customers as of the current period end (“Current Period ARR”). Current Period ARR includes any expansion and is net of contraction or attrition over the last 12 months but excludes ARR from new customers in the current period. We then divide the total Current Period ARR by the total Prior Period ARR to arrive at the net retention rate. Net retention rate is not calculated in accordance with GAAP.

We also provide guidance on adjusted free cash flow, which is equal to cash flows from operating activities less purchases of property and equipment, plus restructuring payments.

Note Regarding Forward-Looking Statements

This press release contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Progress has identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “should,” “expect,” “intend,” “plan,” “target,” “anticipate” and “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Forward-looking statements in this press release include, but are not limited to, statements regarding Progress’ business outlook (including future acquisition activity) and financial guidance. There are a number of factors that could cause actual results or future events to differ materially from those anticipated by the forward-looking statements, including, without limitation: (i) economic, geopolitical and market conditions can adversely affect our business, results of operations and financial condition, including our revenue growth and profitability, which in turn could adversely affect our stock price; (ii) our international sales and operations subject us to additional risks that can adversely affect our operating results, including risks relating to foreign currency gains and losses; (iii) we may fail to achieve our financial forecasts due to such factors as delays or size reductions in transactions, fewer large transactions in a particular quarter, fluctuations in currency exchange rates, or a decline in our renewal rates for contracts; (iv) if the security measures for our software, services, other offerings or our internal information technology infrastructure are compromised or subject to a successful cyber-attack, or if our software offerings contain significant coding or configuration errors or zero-day vulnerabilities, we may experience reputational harm, legal claims and financial exposure; (v) the results of inquiries, investigations and legal claims regarding the MOVEit Vulnerability remain uncertain and the ultimate resolution of these matters could result in losses that may be material to our financial results for a particular period; and (vi) Progress’ ability to close the proposed acquisition of ShareFile, the expected time of closing or the expected benefits therefore; uncertainties as to the effects of disruption from the proposed acquisition of ShareFile making it more difficult to maintain relationships with employees, licensees, other business partners or governmental entities; transaction costs; actual or contingent liabilities; uncertainties as to whether anticipated synergies will be realized; and uncertainties as to whether ShareFile’s business will be successfully integrated with Progress’ business. For further information regarding risks and uncertainties associated with Progress’ business, please refer to our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended November 30, 2023. Progress undertakes no obligation to update any forward-looking statements, which speak only as of the date of this press release.

About Progress

Progress PRGS empowers organizations to achieve transformational success in the face of disruptive change. Our software enables our customers to develop, deploy and manage responsible, AI-powered applications and experiences with agility and ease. Customers get a trusted provider in Progress, with the products, expertise and vision they need to succeed. Over 4 million developers and technologists at hundreds of thousands of enterprises depend on Progress. Learn more at www.progress.com.

Progress and Progress Software are trademarks or registered trademarks of Progress Software Corporation and/or its subsidiaries or affiliates in the U.S. and other countries. Any other names contained herein may be trademarks of their respective owners.

| Investor Contact: | Press Contact: | |

| Michael Micciche | Erica McShane | |

| Progress Software | Progress Software | |

| +1 781 850 8450 | +1 781 280 4000 | |

| Investor-Relations@progress.com | PR@progress.com |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||

| (In thousands, except per share data) | August 31, 2024 |

August 31, 2023 |

% Change |

August 31, 2024 |

August 31, 2023 |

% Change |

|||||||||||||||

| Revenue: | |||||||||||||||||||||

| Software licenses | $ | 57,850 | $ | 50,544 | 14 | % | $ | 175,929 | $ | 164,519 | 7 | % | |||||||||

| Maintenance and services | 120,836 | 124,448 | (3 | )% | 362,519 | 352,950 | 3 | % | |||||||||||||

| Total revenue | 178,686 | 174,992 | 2 | % | 538,448 | 517,469 | 4 | % | |||||||||||||

| Costs of revenue: | |||||||||||||||||||||

| Cost of software licenses | 2,700 | 2,732 | (1 | )% | 7,928 | 7,998 | (1 | )% | |||||||||||||

| Cost of maintenance and services | 20,057 | 22,192 | (10 | )% | 64,452 | 62,663 | 3 | % | |||||||||||||

| Amortization of acquired intangibles | 6,307 | 7,995 | (21 | )% | 21,564 | 22,253 | (3 | )% | |||||||||||||

| Total costs of revenue | 29,064 | 32,919 | (12 | )% | 93,944 | 92,914 | 1 | % | |||||||||||||

| Gross profit | 149,622 | 142,073 | 5 | % | 444,504 | 424,555 | 5 | % | |||||||||||||

| Operating expenses: | |||||||||||||||||||||

| Sales and marketing | 37,141 | 38,612 | (4 | )% | 114,141 | 112,513 | 1 | % | |||||||||||||

| Product development | 34,720 | 33,138 | 5 | % | 105,143 | 98,396 | 7 | % | |||||||||||||

| General and administrative | 20,503 | 20,791 | (1 | )% | 63,830 | 61,046 | 5 | % | |||||||||||||

| Amortization of acquired intangibles | 13,810 | 17,668 | (22 | )% | 47,515 | 48,825 | (3 | )% | |||||||||||||

| Cyber incident and vulnerability response expenses, net | 927 | 951 | (3 | )% | 4,950 | 5,126 | (3 | )% | |||||||||||||

| Restructuring expenses | 308 | 843 | (63 | )% | 3,308 | 6,230 | (47 | )% | |||||||||||||

| Acquisition-related expenses | 1,864 | 699 | 167 | % | 3,114 | 4,433 | (30 | )% | |||||||||||||

| Total operating expenses | 109,273 | 112,702 | (3 | )% | 342,001 | 336,569 | 2 | % | |||||||||||||

| Income from operations | 40,349 | 29,371 | 37 | % | 102,503 | 87,986 | 16 | % | |||||||||||||

| Other expense, net | (6,070 | ) | (8,419 | ) | (28 | )% | (20,489 | ) | (22,501 | ) | (9 | )% | |||||||||

| Income before income taxes | 34,279 | 20,952 | 64 | % | 82,014 | 65,485 | 25 | % | |||||||||||||

| Provision for income taxes | 5,815 | 1,854 | 214 | % | 14,723 | 10,623 | 39 | % | |||||||||||||

| Net income | $ | 28,464 | $ | 19,098 | 49 | % | $ | 67,291 | $ | 54,862 | 23 | % | |||||||||

| Earnings per share: | |||||||||||||||||||||

| Basic | $ | 0.66 | $ | 0.44 | 50 | % | $ | 1.55 | $ | 1.27 | 22 | % | |||||||||

| Diluted | $ | 0.65 | $ | 0.42 | 55 | % | $ | 1.52 | $ | 1.23 | 24 | % | |||||||||

| Weighted average shares outstanding: | |||||||||||||||||||||

| Basic | 42,872 | 43,452 | (1 | )% | 43,296 | 43,365 | — | % | |||||||||||||

| Diluted | 43,711 | 44,981 | (3 | )% | 44,167 | 44,543 | (1 | )% | |||||||||||||

| Cash dividends declared per common share | $ | 0.175 | $ | 0.175 | — | % | $ | 0.525 | $ | 0.525 | — | % | |||||||||

| Stock-based compensation is included in the condensed consolidated statements of operations, as follows: | |||||||||||||||||

| Cost of revenue | $ | 834 | $ | 797 | 5 | % | $ | 2,732 | $ | 2,146 | 27 | % | |||||

| Sales and marketing | 2,169 | 1,763 | 23 | % | 6,939 | 5,027 | 38 | % | |||||||||

| Product development | 3,199 | 3,065 | 4 | % | 10,255 | 9,112 | 13 | % | |||||||||

| General and administrative | 4,356 | 4,447 | (2 | )% | 15,085 | 13,826 | 9 | % | |||||||||

| Total | $ | 10,558 | $ | 10,072 | 5 | % | $ | 35,011 | $ | 30,111 | 16 | % | |||||

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| (In thousands) | August 31, 2024 | November 30, 2023 | |||

| Assets | |||||

| Current assets: | |||||

| Cash and cash equivalents | $ | 232,713 | $ | 126,958 | |

| Accounts receivable, net | 87,680 | 125,825 | |||

| Unbilled receivables | 35,163 | 29,965 | |||

| Other current assets | 33,001 | 48,040 | |||

| Total current assets | 388,557 | 330,788 | |||

| Property and equipment, net | 12,574 | 15,225 | |||

| Goodwill and intangible assets, net | 1,117,454 | 1,186,379 | |||

| Right-of-use lease assets | 12,853 | 18,711 | |||

| Long-term unbilled receivables | 34,636 | 28,373 | |||

| Other assets | 53,810 | 23,307 | |||

| Total assets | $ | 1,619,884 | $ | 1,602,783 | |

| Liabilities and shareholders’ equity | |||||

| Current liabilities: | |||||

| Accounts payable and other current liabilities | $ | 87,999 | $ | 92,805 | |

| Current portion of long-term debt, net | — | 13,109 | |||

| Short-term operating lease liabilities | 8,873 | 10,114 | |||

| Short-term deferred revenue, net | 218,036 | 236,090 | |||

| Total current liabilities | 314,908 | 352,118 | |||

| Long-term debt, net | — | 356,111 | |||

| Convertible senior notes, net | 795,282 | 354,772 | |||

| Long-term operating lease liabilities | 8,597 | 13,000 | |||

| Long-term deferred revenue, net | 67,348 | 58,946 | |||

| Other long-term liabilities | 8,137 | 8,121 | |||

| Shareholders’ equity: | |||||

| Common stock and additional paid-in capital | 339,023 | 371,017 | |||

| Retained earnings | 86,589 | 88,698 | |||

| Total shareholders’ equity | 425,612 | 459,715 | |||

| Total liabilities and shareholders’ equity | $ | 1,619,884 | $ | 1,602,783 | |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Three Months Ended | Nine Months Ended | ||||||||||||||

| (In thousands) | August 31, 2024 |

August 31, 2023 |

August 31, 2024 |

August 31, 2023 |

|||||||||||

| Cash flows from operating activities: | |||||||||||||||

| Net income | $ | 28,464 | $ | 19,098 | $ | 67,291 | $ | 54,862 | |||||||

| Depreciation and amortization | 23,108 | 27,892 | 78,181 | 77,432 | |||||||||||

| Stock-based compensation | 10,558 | 10,072 | 35,011 | 30,111 | |||||||||||

| Other non-cash adjustments | (6,128 | ) | (4,935 | ) | (5,613 | ) | (11,091 | ) | |||||||

| Changes in operating assets and liabilities | 1,656 | (6,086 | ) | 16,973 | (10,555 | ) | |||||||||

| Net cash flows from operating activities | 57,658 | 46,041 | 191,843 | 140,759 | |||||||||||

| Capital expenditures | (1,064 | ) | (1,212 | ) | (2,328 | ) | (3,181 | ) | |||||||

| Repurchases of common stock, net of issuances | (9,750 | ) | 4,008 | (69,303 | ) | (9,627 | ) | ||||||||

| Dividend payments to shareholders | (7,692 | ) | (7,798 | ) | (23,814 | ) | (23,669 | ) | |||||||

| Payments for acquisitions, net of cash acquired | — | 846 | — | (355,250 | ) | ||||||||||

| Proceeds from the issuance of debt, net of payment of issuance costs | — | — | 431,929 | 195,000 | |||||||||||

| Principal payment on term loan and repayment of revolving line of credit | — | (31,720 | ) | (371,250 | ) | (60,157 | ) | ||||||||

| Purchase of capped calls | — | — | (42,210 | ) | — | ||||||||||

| Other | 3,141 | 2,303 | (9,112 | ) | (2,153 | ) | |||||||||

| Net change in cash and cash equivalents | 42,293 | 12,468 | 105,755 | (118,278 | ) | ||||||||||

| Cash and cash equivalents, beginning of period | 190,420 | 125,531 | 126,958 | 256,277 | |||||||||||

| Cash and cash equivalents, end of period | $ | 232,713 | $ | 137,999 | $ | 232,713 | $ | 137,999 | |||||||

RECONCILIATIONS OF GAAP TO NON-GAAP SELECTED FINANCIAL MEASURES1

(Unaudited)

| Three Months Ended | Nine Months Ended | ||||||||||||||

| (In thousands, except per share data) | August 31, 2024 |

August 31, 2023 |

August 31, 2024 |

August 31, 2023 |

|||||||||||

| Adjusted revenue: | |||||||||||||||

| GAAP revenue | $ | 178,686 | $ | 174,992 | $ | 538,448 | $ | 517,469 | |||||||

| Acquisition-related revenue | — | 791 | — | 3,158 | |||||||||||

| Non-GAAP revenue | $ | 178,686 | $ | 175,783 | $ | 538,448 | $ | 520,627 | |||||||

| Adjusted income from operations: | |||||||||||||||

| GAAP income from operations | $ | 40,349 | $ | 29,371 | $ | 102,503 | $ | 87,986 | |||||||

| Amortization of acquired intangibles | 20,117 | 25,663 | 69,079 | 71,078 | |||||||||||

| Stock-based compensation | 10,558 | 10,072 | 35,011 | 30,111 | |||||||||||

| Restructuring expenses and other | 308 | 843 | 3,308 | 6,230 | |||||||||||

| Acquisition-related revenue and expenses | 1,864 | 1,490 | 3,114 | 7,591 | |||||||||||

| Cyber incident and vulnerability response expenses, net | 927 | 951 | 4,950 | 5,126 | |||||||||||

| Non-GAAP income from operations | $ | 74,123 | $ | 68,390 | $ | 217,965 | $ | 208,122 | |||||||

| Adjusted net income: | |||||||||||||||

| GAAP net income | $ | 28,464 | $ | 19,098 | $ | 67,291 | $ | 54,862 | |||||||

| Amortization of acquired intangibles | 20,117 | 25,663 | 69,079 | 71,078 | |||||||||||

| Stock-based compensation | 10,558 | 10,072 | 35,011 | 30,111 | |||||||||||

| Restructuring expenses and other | 308 | 843 | 3,308 | 6,230 | |||||||||||

| Acquisition-related revenue and expenses | 1,864 | 1,490 | 3,114 | 7,591 | |||||||||||

| Cyber incident and vulnerability response expenses, net | 927 | 951 | 4,950 | 5,126 | |||||||||||

| Provision for income taxes | (7,022 | ) | (9,368 | ) | (23,710 | ) | (26,553 | ) | |||||||

| Non-GAAP net income | $ | 55,216 | $ | 48,749 | $ | 159,043 | $ | 148,445 | |||||||

| Adjusted diluted earnings per share: | |||||||||||||||

| GAAP diluted earnings per share | $ | 0.65 | $ | 0.42 | $ | 1.52 | $ | 1.23 | |||||||

| Amortization of acquired intangibles | 0.46 | 0.57 | 1.56 | 1.60 | |||||||||||

| Stock-based compensation | 0.24 | 0.23 | 0.80 | 0.67 | |||||||||||

| Restructuring expenses and other | 0.01 | 0.02 | 0.07 | 0.14 | |||||||||||

| Acquisition-related revenue and expenses | 0.04 | 0.03 | 0.07 | 0.17 | |||||||||||

| Cyber incident and vulnerability response expenses, net | 0.02 | 0.02 | 0.11 | 0.12 | |||||||||||

| Provision for income taxes | (0.16 | ) | (0.21 | ) | (0.53 | ) | (0.60 | ) | |||||||

| Non-GAAP diluted earnings per share | $ | 1.26 | $ | 1.08 | $ | 3.60 | $ | 3.33 | |||||||

| Non-GAAP weighted avg shares outstanding – diluted | 43,711 | 44,981 | 44,167 | 44,543 | |||||||||||

OTHER NON-GAAP FINANCIAL MEASURES1

(Unaudited)

| Adjusted Free Cash Flow | |||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||

| (In thousands) | August 31, 2024 |

August 31, 2023 |

% Change |

August 31, 2024 |

August 31, 2023 |

% Change |

|||||||||||||||

| Cash flows from operations | $ | 57,658 | $ | 46,041 | 25 | % | $ | 191,843 | $ | 140,759 | 36 | % | |||||||||

| Purchases of property and equipment | (1,064 | ) | (1,212 | ) | (12 | )% | (2,328 | ) | (3,181 | ) | (27 | )% | |||||||||

| Free cash flow | 56,594 | 44,829 | 26 | % | 189,515 | 137,578 | 38 | % | |||||||||||||

| Add back: restructuring payments | 931 | 2,820 | (67 | )% | 4,287 | 4,982 | (14 | )% | |||||||||||||

| Adjusted free cash flow | $ | 57,525 | $ | 47,649 | 21 | % | $ | 193,802 | $ | 142,560 | 36 | % | |||||||||

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES FOR FISCAL YEAR 2024 GUIDANCE1

(Unaudited)

| Fiscal Year 2024 Updated Revenue Guidance | ||||||||||||||

| Fiscal Year Ended | Fiscal Year Ending | |||||||||||||

| November 30, 2023 | November 30, 2024 | |||||||||||||

| (In millions) | Low | % Change | High | % Change | ||||||||||

| GAAP revenue | $ | 694.4 | $ | 745.0 | 7 | % | $ | 755.0 | 9 | % | ||||

| Acquisition-related adjustments – revenue | 3.8 | — | (100 | )% | — | (100 | )% | |||||||

| Non-GAAP revenue | $ | 698.2 | $ | 745.0 | 7 | % | $ | 755.0 | 8 | % | ||||

| Fiscal Year 2024 Updated Non-GAAP Operating Margin Guidance | |||||||

| Fiscal Year Ending November 30, 2024 | |||||||

| (In millions) | Low | High | |||||

| GAAP income from operations | $ | 121.1 | $ | 128.0 | |||

| GAAP operating margins | 16 | % | 17 | % | |||

| Acquisition-related expense | 11.7 | 11.7 | |||||

| Restructuring expense | 9.8 | 9.8 | |||||

| Stock-based compensation | 46.4 | 46.4 | |||||

| Amortization of acquired intangibles | 94.7 | 94.7 | |||||

| Cyber incident and vulnerability response expenses, net | 6.1 | 6.1 | |||||

| Total adjustments | 168.7 | 168.7 | |||||

| Non-GAAP income from operations | $ | 289.8 | $ | 296.7 | |||

| Non-GAAP operating margin | 39 | % | 39 | % | |||

| Fiscal Year 2024 Updated Non-GAAP Earnings per Share and Effective Tax Rate Guidance | |||||||

| Fiscal Year Ending November 30, 2024 | |||||||

| (In millions, except per share data) | Low | High | |||||

| GAAP net income | $ | 74.6 | $ | 80.3 | |||

| Adjustments (from previous table) | 168.7 | 168.7 | |||||

| Income tax adjustment(2) | (33.9 | ) | (34.0 | ) | |||

| Non-GAAP net income | $ | 209.5 | $ | 215.1 | |||

| GAAP diluted earnings per share | $ | 1.69 | $ | 1.81 | |||

| Non-GAAP diluted earnings per share | $ | 4.75 | $ | 4.85 | |||

| Diluted weighted average shares outstanding | 44.1 | 44.3 | |||||

| 2 Tax adjustment is based on a non-GAAP effective tax rate of approximately 19%, calculated as follows: | |||||||

| Fiscal Year Ending November 30, 2024 | |||||||

| Low | High | ||||||

| Non-GAAP income from operations | $ | 289.8 | $ | 296.7 | |||

| Other (expense) income | (31.2 | ) | (31.2 | ) | |||

| Non-GAAP income from continuing operations before income taxes | 258.6 | 265.5 | |||||

| Non-GAAP net income | 209.5 | 215.1 | |||||

| Tax provision | $ | 49.1 | $ | 50.4 | |||

| Non-GAAP tax rate | 19 | % | 19 | % | |||

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES FOR FISCAL YEAR 2024 GUIDANCE1

(Unaudited)

| Fiscal Year 2024 Adjusted Free Cash Flow Guidance | |||||||

| Fiscal Year Ending November 30, 2024 | |||||||

| (In millions) | Low | High | |||||

| Cash flows from operations (GAAP) | $ | 196 | $ | 206 | |||

| Purchases of property and equipment | (6 | ) | (6 | ) | |||

| Add back: restructuring payments | 5 | 5 | |||||

| Adjusted free cash flow (non-GAAP) | $ | 195 | $ | 205 | |||

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES FOR Q4 2024 GUIDANCE1

(Unaudited)

| Q4 2024 Revenue Guidance | ||||||||||||||

| Three Months Ended | Three Months Ending | |||||||||||||

| November 30, 2023 | November 30, 2024 | |||||||||||||

| (In millions) | Low | % Change | High | % Change | ||||||||||

| GAAP revenue | $ | 177.0 | $ | 206.6 | 17 | % | $ | 216.6 | 22 | % | ||||

| Acquisition-related adjustments – revenue | 0.5 | — | (100 | )% | — | (100 | )% | |||||||

| Non-GAAP revenue | $ | 177.5 | $ | 206.6 | 16 | % | $ | 216.6 | 22 | % | ||||

| Q4 2024 Non-GAAP Earnings per Share Guidance | |||||||

| Three Months Ending November 30, 2024 | |||||||

| Low | High | ||||||

| GAAP diluted earnings per share | $ | 0.17 | $ | 0.27 | |||

| Acquisition-related expense | 0.19 | 0.19 | |||||

| Restructure expense | 0.15 | 0.15 | |||||

| Stock-based compensation | 0.26 | 0.26 | |||||

| Amortization of acquired intangibles | 0.58 | 0.58 | |||||

| Cyber incident and vulnerability response expenses, net | 0.03 | 0.03 | |||||

| Total adjustments | 1.21 | 1.21 | |||||

| Income tax adjustment | (0.23 | ) | (0.23 | ) | |||

| Non-GAAP diluted earnings per share | $ | 1.15 | $ | 1.25 | |||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

On Holding's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on On Holding.

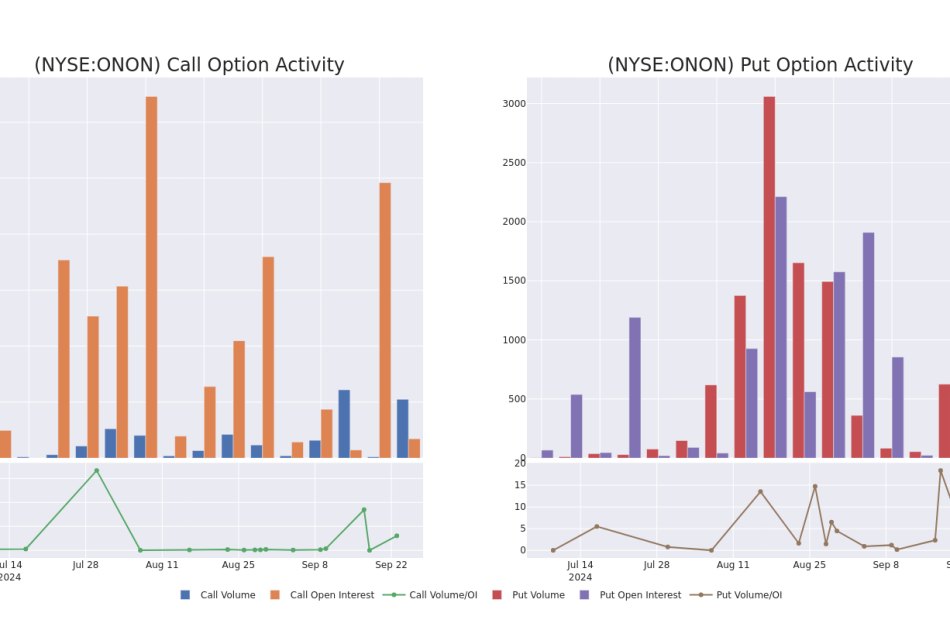

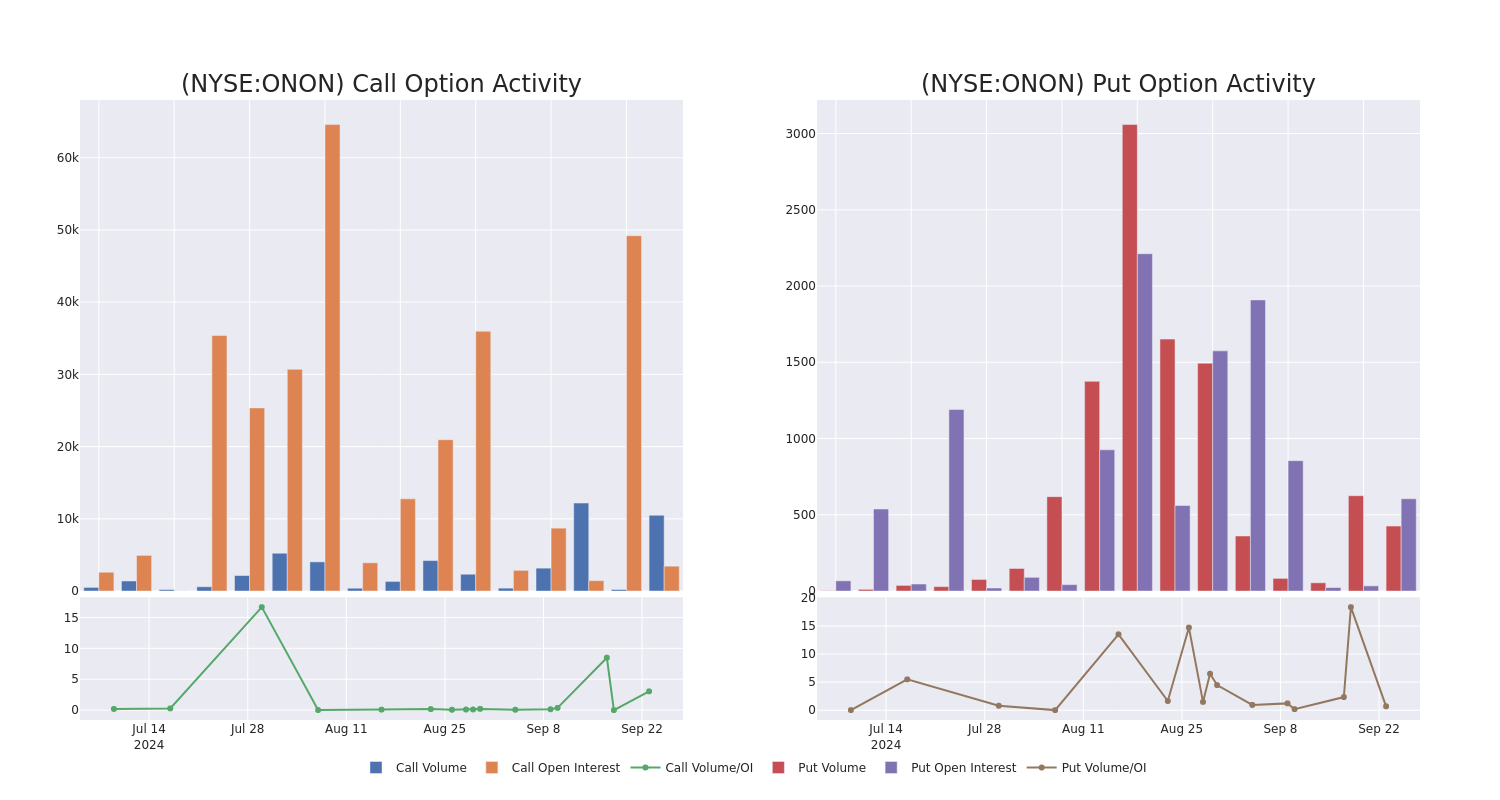

Looking at options history for On Holding ONON we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 20% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $346,736 and 5, calls, for a total amount of $496,565.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $45.0 to $57.5 for On Holding over the recent three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for On Holding’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of On Holding’s whale activity within a strike price range from $45.0 to $57.5 in the last 30 days.

On Holding Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ONON | PUT | SWEEP | NEUTRAL | 01/17/25 | $3.25 | $3.2 | $3.25 | $47.50 | $169.6K | 2.1K | 733 |

| ONON | CALL | TRADE | BULLISH | 12/18/26 | $17.7 | $17.15 | $17.7 | $45.00 | $168.1K | 124 | 95 |

| ONON | CALL | SWEEP | BEARISH | 01/17/25 | $6.75 | $6.65 | $6.65 | $47.50 | $166.2K | 5.4K | 500 |

| ONON | CALL | TRADE | BEARISH | 01/17/25 | $5.5 | $5.4 | $5.43 | $50.00 | $67.8K | 35.3K | 128 |

| ONON | CALL | SWEEP | BULLISH | 01/17/25 | $4.25 | $4.1 | $4.25 | $52.50 | $61.6K | 4.1K | 147 |

About On Holding

On Holding AG is a premium performance sports brand rooted in technology, design, and impact. Its shoes, apparel, and accessories products are designed predominantly for athletic use, casual, or leisure purposes. It does not manufacture the products or the raw materials and relies instead on third-party suppliers and contract manufacturers. Geographically, it derives a majority of its revenue from the Americas and rest from Europe, Middle East and Africa, and Asia-Pacific region.

Present Market Standing of On Holding

- Currently trading with a volume of 2,074,466, the ONON’s price is up by 0.2%, now at $50.51.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 49 days.

Professional Analyst Ratings for On Holding

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $55.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from HSBC downgraded its action to Hold with a price target of $52.

* An analyst from Stifel persists with their Buy rating on On Holding, maintaining a target price of $59.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for On Holding with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alibaba Stock Rips Higher On China Stimulus News, But Is BABA Stock A Buy Now?

Alibaba stock gapped up powerfully Tuesday after China loosened lending standards to stimulate an economy that’s been slow to recover. Headed into Tuesday, Alibaba stock was 5% above an 85.79 entry. But is BABA stock a buy now?

China stock indexes rallied sharply on the news. The Shanghai composite and the Hang Seng soared 4.1% overnight.

↑

X

Indexes Trade In Up-And-Down Session; Onsemi, KBR, Harmony Biosciences In Focus

Alibaba (BABA) scored a technical breakout last week after the company announced a suite of new open-source artificial intelligence (AI) models as well as text-to-video AI technology.

BABA stock also gapped up in late August after Chinese regulators said the company has successfully completed a three-year regulatory “rectification process.” Alibaba (BABA) was fined $2.6 billion in 2021 for monopolistic practices.

It hasn’t been the best of times for Alibaba stock in recent years amid waning fundamentals. Alibaba isn’t the growth engine it once was, but revenue growth should accelerate in coming quarters as China’s consumer continues a slow recovery.

Recent Earnings

In mid-August, Alibaba reported adjusted profit of $2.26 a share. Revenue growth accelerated from the prior quarter, rising 4% to $33.5 billion.

Sellers hit Alibaba stock hard on May 14 despite a slight revenue beat, although buyers pushed the stock well of lows by the close. Buyers were in control for the next three trading sessions, sending shares higher by more than 11%.

On an adjusted basis, Alibaba earned $1.40 a share, down 10% year over year. Revenue edged higher by 1% to $30.7 billion.

Alibaba also announced a two-part dividend. It includes an annual cash dividend of $1 per American depository share and a “one-time extraordinary cash dividend” of 66 cents per ADS. The total dividend will cost $4 billion, the company said.

BABA stock rallied sharply on Feb. 6 after the company reported fiscal Q3 revenue of $36.7 billion, up 2% from the year-ago quarter and slightly above the $36.16 billion consensus. But adjusted profit fell 4% to $2.67 a a share.

Investors also liked the fact that Alibaba added $25 billion to its share buyback program through March 2027.

Three months earlier, Alibaba stock plunged in mid-November despite reporting an 18% rise in quarterly profit and 6% increase in revenue.

Alibaba Stock News

BABA stock surged on Jan. 23 on reports that co-founder Jack Ma and business associate Joe Tsai have been buying shares of BABA stock in recent months.

According to an SEC filing, Tsai purchased $151 million in Alibaba stock in the fourth quarter via his Blue Pool Management family fund. Ma, meanwhile, bought $50 million worth of Alibaba stock. Ma stepped down as the company’s chairman in 2019 and remains a big shareholder.

Stock Market ETF Strategy And How To Invest

Alibaba came under selling pressure on Sept. 11 after outgoing CEO Daniel Zhang unexpectedly stepped down as head of the company’ cloud business.

The company said in June that Zhang was departing as chairman and CEO of the company to focus on Alibaba’s cloud intelligence unit. In May, Alibaba announced plans to spin off its cloud business as a separate, publicly traded company.

In December, the company said that CEO Eddie Wu would take over the company’s struggling e-commerce business.

Alibaba stock soared above its 200-day moving average in July 2023 after Chinese regulators fined Alibaba’s financial arm, Ant Group, just under $1 billion.

Chinese regulators halted Ant Group’s IPO in late 2020 for not meeting listing requirements. In April 2021, regulators hit Alibaba with $2.8 billion fine in an anti-monopoly probe. But after three years of regulatory scrutiny, optimism is building that Beijing is close to ending its crackdown on tech firms.

In March 2023, Alibaba announced plans to separate into six separate units.

The company said each business will have the ability raise outside funding and even pursue an IPO. According to report, the company would likely hold on to its cloud/artificial intelligence business and its giant e-commerce operations.

- Cloud Intelligence

- Taobao Tmall Commerce

- Local Services

- Cainiao Smart Logistics

- Global Digital Commerce

- Digital Media and Entertainment

China/U.S. Relations

Sentiment was weak around Chinese stocks in October after the Biden administration announced new restrictions on China’s access to U.S. semiconductor technology. This included tighter rules on the sale of chip equipment to China as well as restrictions on the exports of some types of chips used in supercomputing and artificial intelligence.

Alibaba stock rallied sharply in late August 2023 on reports that Beijing and U.S. regulators were close to an audit-inspection deal.

Increased regulatory scrutiny has weighed on Alibaba and other Chinese stocks for the past couple of years. Besides a strict regulatory environment, Chinese stocks have also been dealing with a slowing economy.

In April 2020, China regulators fined Alibaba $2.8 billion after an antimonopoly probe. At the time, it looked like BABA stock was ready to break out of a downtrend. But the stock got turned away at its 50-day moving average. It tried to rally above the 50-day line again in late April but sellers knocked the stock lower again.

Alibaba Stock Fundamental Analysis

The company has a five-year annualized earnings growth rate of 3%, hurt by recent earnings declines.

See Which Stocks Are In The Leaderboard Portfolio

Alibaba’s Composite Rating of 81 (on a scale of 1-99 with 99 being the best) has improved quite a bit in recent weeks. Still, the rating is weighed down by soft fundamentals and weak 12-month price performance.

But annual return on equity of 16% helps give Alibaba a top-notch SMR Rating (sales + margins + return on equity) of A from IBD Stock Checkup (on an A-to-E scale with A tops).

The Stock Checkup tool quickly identifies group leaders based on a combination of fundamental and technical factors.

According to Zacks, Alibaba is expected to earn $8.35 a share in its current fiscal year 2025, down 3% compared to fiscal 2024. For fiscal 2026, earnings are expected to rise 13% to $9.39 a share.

Click here to the top-rated stocks in the group.

Alibaba Stock Technical Analysis

Alibaba’s relative strength line has started to point upward again

A stock’s relative strength line, found in daily and weekly charts at Investors.com, compares the stock’s daily price performance to the S&P 500. An upward-sloping RS line means the stock is outperforming the S&P 500. A downward-sloping line means the stock is lagging the S&P 500.

Alibaba’s Accumulation/Distribution Rating is very good at A-. The rating is helped by higher-volume price gains in recent weeks. Higher-volume price declines will weigh on the rating.

BABA Stock: Is It A Buy Now?

Overhead supply issues are still an issue for Alibaba, with the stock more than 5% above the buy zone after gapping above an 85.79 entry. A low-volume pullback closer to the entry would but Alibaba stock in an alternate buy zone.

Some might call Alibaba a turnaround story with revenue growth expected to ramp up in coming quarters.

For the September-ended quarter, revenue is expected to climb 7% to $33.7 billion, with 8% to 10% top-line growth expected over the next three quarters.

Follow Ken Shreve on Twitter at @IBD_KShreve for more market insight and analysis right now.

YOU MIGHT ALSO LIKE:

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Donald Trump Says He'll Cut Your Automobile Insurance In Half. People Push Back And Ask Him If He'll Use Government Price Controls To Do It

Former President Donald Trump recently made a bold promise: if he’s elected president again, he’ll cut your auto insurance rates in half. But not everyone is buying it and many wonder how he plans to make that happen.

Trump’s claim came via a social media post where he said, “Your Automobile Insurance is up 73% – VOTE FOR TRUMP, I’LL CUT THAT NUMBER IN HALF!”

The idea of saving so much money on something as essential as car insurance sounds great, especially with the cost of living increasing. However, many experts are scratching their heads over where this 73% figure came from since it doesn’t match any recent data.

Don’t Miss:

Your Automobile Insurance is up 73% — VOTE FOR TRUMP, I’LL CUT THAT NUMBER IN HALF!

— Donald J. Trump (@realDonaldTrump) September 17, 2024

Economist and insurance specialist Robert Hartwig told Insurance Journal that although rates have gone up, they haven’t increased as much as Trump has claimed. Hartwig claims that while the 73% increase is consistent with September 2016 rates, it does not reflect current trends. In actuality, rates have increased by 16.5% in the last year – a significant increase but nowhere near 73%.

Hartwig and others stress that insurance rates are regulated at the state level, not by the federal government. This means that even if Trump were president, he wouldn’t be able to cut insurance rates in half. Instead, he’d have to get 50 state insurance commissioners to agree to his plan – a tall order.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Insurance industry experts say that capping rates would hurt consumers in the long run, as Trump suggests. If insurers were forced to lower rates drastically, they’d likely stop offering coverage altogether because they couldn’t afford the costs.

On X and other social media websites, many people are skeptical about Trump’s promise to cut auto insurance rates in half, wondering how he could possibly make such a big change happen.

One user mocked the feasibility of Trump’s plan by tweeting, “This is awesome! We can’t wait to see your plan to accomplish this in your first week back on the job!” Others highlighted the irony of his proposal with a comment that read, “Sounds like communism!” given Trump’s past criticism of similar ideas from Democrats.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Trump’s promise has led some to compare his plan to government price controls, which are widely criticized for creating more problems than they solve. When Kamala Harris suggested capping prices in grocery stores, Trump himself bashed her proposals as “socialist” or “communist.”

On the other side, Suze Orman, a well-known financial expert, offered some practical advice recently. She suggested that consumers shop around for better deals, raise their deductibles if they have enough savings or even consider owning fewer cars.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Donald Trump Says He’ll Cut Your Automobile Insurance In Half. People Push Back And Ask Him If He’ll Use Government Price Controls To Do It originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sterling Infrastructure EVP Trades Company's Stock

It was reported on September 23, that Ronald A Ballschmiede, EVP at Sterling Infrastructure STRL executed a significant insider sell, according to an SEC filing.

What Happened: Ballschmiede’s decision to sell 18,700 shares of Sterling Infrastructure was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value of the sale is $2,685,133.

Sterling Infrastructure shares are trading down 0.01% at $148.89 at the time of this writing on Tuesday morning.

Get to Know Sterling Infrastructure Better

Sterling Infrastructure Inc is a construction company that specializes in heavy civil infrastructure construction and infrastructure rehabilitation as well as residential construction projects. The company operates in three reportable segments namely, Transportation Solutions, E-Infrastructure Solutions, and Building Solution. Transportation Solutions include highways, roads, bridges, airfields, ports, light rail, and others. Building Solution projects include concrete foundations for single-family homes. E-Infrastructure Solutions include the services which are provided to large, blue-chip companies in the e-commerce, data center, distribution center, and warehousing, energy, mixed-use, and multi-family sectors. The majority of the revenue is generated from E-Infrastructure Solutions. .

Sterling Infrastructure’s Economic Impact: An Analysis

Revenue Growth: Sterling Infrastructure’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 11.58%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Profitability Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 19.34%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Sterling Infrastructure’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 1.68.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.58.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Sterling Infrastructure’s P/E ratio of 28.69 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 2.26, Sterling Infrastructure’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Sterling Infrastructure’s EV/EBITDA ratio, lower than industry averages at 14.14, indicates attractively priced shares.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Exploring Key Transaction Codes

Digging into the details of stock transactions, investors frequently turn their attention to those taking place in the open market, as outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Sterling Infrastructure’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer Has Dropped 18%. Will It Soar After its Stock Split?

Earlier this year, Super Micro Computer (NASDAQ: SMCI) proved itself as one of the powerhouses in today’s economy. Thanks to demand from artificial intelligence (AI) customers for its equipment, the company delivered triple-digit revenue growth. Stock performance followed, with shares posting a first-half gain of 188%, even beating the gain of market darling Nvidia. And Supermicro scored invitations to join the S&P 500 and the Nasdaq 100, another sign of its earnings strength and market leadership.

All of this sounds fantastic, but in recent weeks Supermicro has faced some headwinds that have translated into declines in the share price. The stock has lost about 18% since a short report in late August that alleged troubles at the company. On top of this, investors worried as Supermicro delayed its 10-K annual report.

Now, moving forward, Supermicro has a big event right around the corner. The company will complete a 10-for-1 stock split at the end of the month, and the shares will start trading at their new split-adjusted price on Oct. 1. Will this once high-flying stock recover from recent woes and soar after the stock split? Let’s find out.

What lies ahead for Supermicro

First, let’s talk about Supermicro’s path so far and what may lie ahead. The company isn’t a new producer of workstations, servers, and other equipment. Supermicro actually has been around for more than 30 years, but growth only started taking off in recent times as the AI boom accelerated. AI customers have flocked to Supermicro for equipment as they build and expand their data centers.

And Supermicro has been ready to serve them — and with all of the latest technology from the AI chip market because this tech powerhouse works hand-in-hand with the biggest chip designers. So when Nvidia, for example, releases a new chip, it’s immediately available in Supermicro’s equipment. This has helped Supermicro grow five times faster than the industry average over the past year.

It’s also helped Supermicro’s earnings take off. In the most recent quarter, revenue soared more than 140%, and profit climbed in the double digits. And this may be just the beginning as Supermicro gears up to address a new growing market: cooling solutions to tackle the heat problem in AI data centers. Supermicro predicts as much as 30% of new data centers will opt for direct liquid cooling within the coming 12 months and says it will dominate this market.

At the same time, Supermicro is readying to open its Malaysia facility, one that will help it make gains in volume and lower costs in the coming years.

As for the short report and Supermicro’s delayed annual report, I don’t see these issues as ones that change the bright long-term story: Supermicro called statements in the short report “false or inaccurate” and regarding its annual report says it doesn’t expect any significant changes to earnings.

The Supermicro stock split

Now, let’s consider the upcoming stock split. These operations lower the price of each individual share, making the stock more accessible for a broader range of investors. But splits don’t change anything fundamental about a company — so valuation and the market value of the company remain the same, for example.

This means a stock split, in and of itself, isn’t a reason to buy a stock — so the shares probably won’t surge when they open at the split-adjusted price. Still, a split generally is a positive move for a company because, as mentioned, it makes it easier for more people to buy a particular stock. In this case, considering the current price of Supermicro and the ratio of the split, you’ll be able to pick up a share for about $45 instead of more than $450. Progressively, this could attract more investors to the stock — but only if they like the company’s earnings track record and long-term prospects.

Now, let’s get back to our question. Will the stock soar after the split? I wouldn’t expect that to happen overnight, since stock splits themselves don’t act as catalysts for performance. But considering Supermicro’s earnings strength so far and its potential to dominate in the DLC market, this top AI player has plenty of room to run over the long term.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Super Micro Computer Has Dropped 18%. Will It Soar After its Stock Split? was originally published by The Motley Fool

Canoo Expands Globally With UK Launch, Establishes Activation Center At Historic Bicester Motion

Canoo Inc. GOEV announced its official entry into the U.K. market by establishing Canoo Technologies UK Limited. This move represents a key milestone in the company’s global expansion strategy.

“Our expansion into the UK is a key milestone in our global growth strategy, enabling us to establish a local presence for our commercial customers to better serve their needs,” said Tony Aquila, Investor, Executive Chairman, and CEO of Canoo.

Canoo has chosen Bicester Motion, a historic automotive campus, for its Activation Center, allowing U.K. customers to experience and test drive right-hand drive commercial electric vans.

The CEO noted that the U.K. activation center at Bicester Motion would enable the company to utilize local expertise and enhance its commercial operations in a promising market, highlighting incentives like the plug-in van grant (PIVG) that support growing demand and align with the government’s zero-emissions goals.

Also Read: Spotify’s AI Playlist Now Available In US, Other Countries: Here’s How It Works

Aquila expressed anticipation for sharing more details soon. The site, formerly a WWII Royal Air Force base, highlights the enduring partnership between the U.S. and the U.K., founded on shared values and economic collaboration, as Canoo advances its mission of providing sustainable mobility solutions worldwide, per a press release.

This initiative marks a crucial milestone in Canoo’s global expansion, paving the way for introducing innovative commercial electric vehicle (EV) solutions in the U.K.

Bicester Motion will function as Canoo’s operational, customer, and activation hub, creating a vibrant base for its commercial activities throughout the U.K. and Europe, with plans to open in October.

Price Action: GOEV shares are trading lower by 0.99% to $0.9707 at last check Tuesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Progress Software Stock Jumps On Q3 Earnings: Revenue Beat, EPS Beat, Raised Guidance And More

Progress Software Corp PRGS shares are trading higher in Tuesday’s after-hours session after the company reported better-than-expected financial results for the third quarter.

- Q3 Revenue: $178.69 million, versus estimates of $175.94 million

- Q3 EPS: $1.26, versus estimates of $1.14

Total revenue was up 2% on a year-over-year basis. Annualized recurring revenue totaled $582 million, “relatively flat” on a constant currency basis. Operating margin was 23%, while adjusted operating margin was 41%.

Progress Software said it ended the quarter with $232.7 million in cash and cash equivalents.

“This is a very exciting time for Progress. Our Q3 results were ahead of our guidance, and I am extremely pleased with our execution during the quarter,” said Yogesh Gupta, CEO of Progress.

“What’s more exciting is our proposed acquisition of ShareFile, which we announced two weeks ago. We expect the deal to close before the end of our fiscal year, and we are eager to begin the work of integrating ShareFile’s people and products into the Progress team.”

See Also: Stitch Fix Stock Falls After Q4 Results: Here’s Why

Outlook: Progress Software expects fourth-quarter adjusted revenue to be between $207 million and $217 million. The company anticipates fourth-quarter adjusted earnings of $1.15 to $1.25 per share.

Progress also raised its full-year guidance. The company now sees full-year adjusted revenue in the range of $745 million to $755 million, up from a prior forecast of $725 million to $735 million. The company also raised its full-year earnings outlook to a range of $4.75 to $4.85 per share, up from a prior outlook of $4.70 to $4.80 per share.

According to Benzinga Pro, analysts are currently anticipating full-year revenue of $730.02 million and full-year earnings of $4.75 per share.

Management will hold a conference call to discuss these results at 5 p.m. ET.

PRGS Price Action: At publication time, Progress Software shares were up 4.29% at $59.60 in after-hours trading, per Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

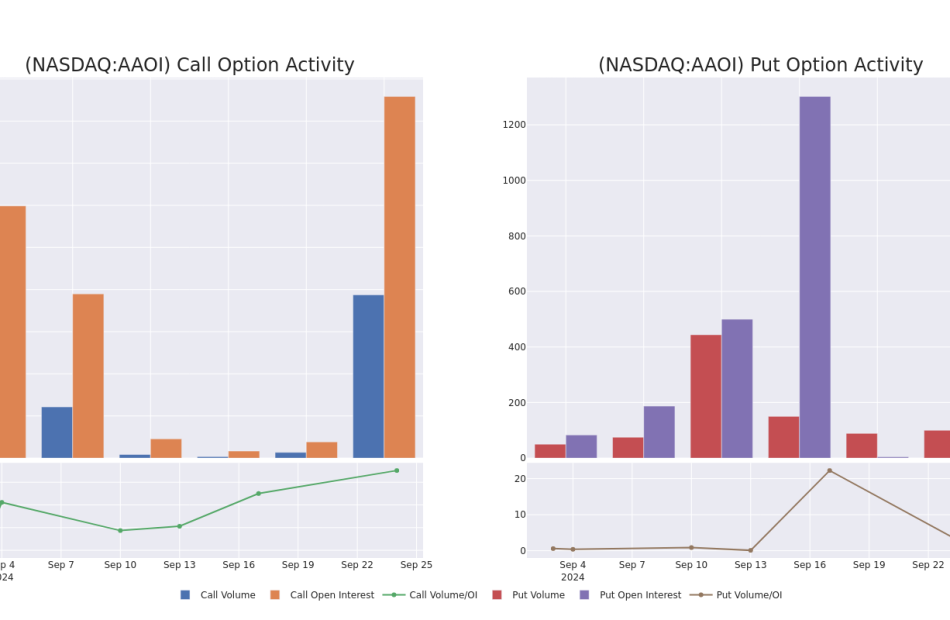

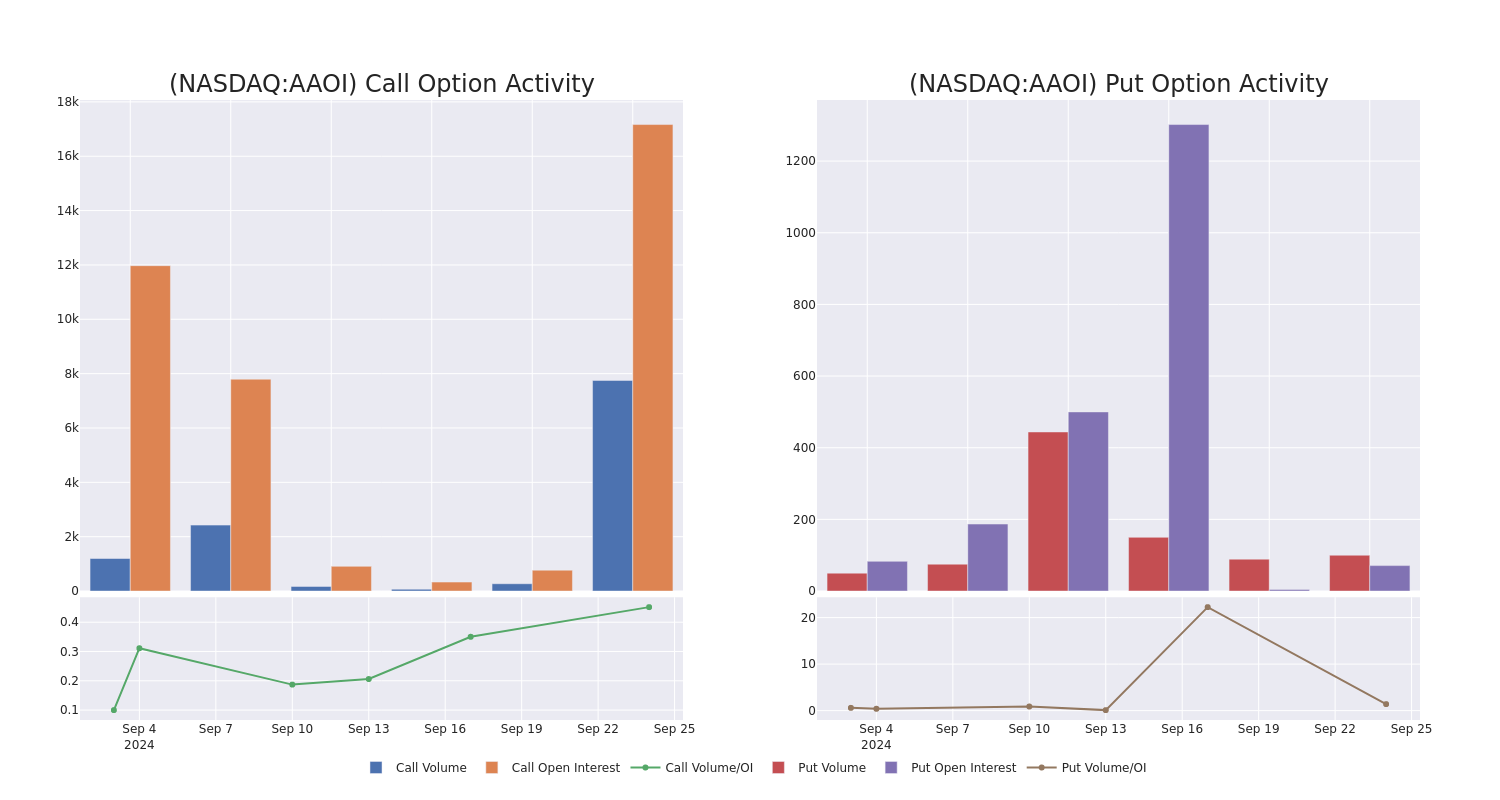

Unpacking the Latest Options Trading Trends in Applied Optoelectronics

Investors with a lot of money to spend have taken a bearish stance on Applied Optoelectronics AAOI.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AAOI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 21 uncommon options trades for Applied Optoelectronics.

This isn’t normal.

The overall sentiment of these big-money traders is split between 38% bullish and 47%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $65,500, and 19 are calls, for a total amount of $1,172,909.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $12.5 and $22.5 for Applied Optoelectronics, spanning the last three months.

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Applied Optoelectronics stands at 2154.62, with a total volume reaching 7,751.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Applied Optoelectronics, situated within the strike price corridor from $12.5 to $22.5, throughout the last 30 days.

Applied Optoelectronics Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAOI | CALL | SWEEP | NEUTRAL | 01/17/25 | $3.3 | $3.1 | $3.2 | $15.00 | $192.0K | 5.8K | 800 |

| AAOI | CALL | SWEEP | BULLISH | 01/17/25 | $3.5 | $3.3 | $3.4 | $15.00 | $98.2K | 5.8K | 912 |

| AAOI | CALL | SWEEP | BEARISH | 01/17/25 | $4.9 | $4.7 | $4.7 | $12.50 | $94.0K | 3.9K | 603 |

| AAOI | CALL | TRADE | BULLISH | 01/17/25 | $4.5 | $4.4 | $4.5 | $12.50 | $90.0K | 3.9K | 402 |

| AAOI | CALL | SWEEP | BEARISH | 01/17/25 | $4.5 | $4.4 | $4.4 | $12.50 | $88.0K | 3.9K | 202 |

About Applied Optoelectronics

Applied Optoelectronics Inc is a provider of fiber-optic networking products for the Internet data center, cable television, telecommunications and fiber-to-the-home end markets. The company focuses on designing and manufacturing a range of optical communication products from components, to subassemblies, and modules to complete turn-key equipment. Demand for Applied Optoelectronics is driven by bandwidth demand in end markets. Through direct sales personnel, and manufacturing teams in the United States, China, and Taiwan, the company coordinates with customers to determine product design, qualifications, and performance. The company derives maximum revenue from Taiwan.

Where Is Applied Optoelectronics Standing Right Now?

- Currently trading with a volume of 5,501,773, the AAOI’s price is up by 13.58%, now at $15.97.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 44 days.

What Analysts Are Saying About Applied Optoelectronics

2 market experts have recently issued ratings for this stock, with a consensus target price of $18.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a positive move, an analyst from Raymond James has upgraded their rating to Outperform and adjusted the price target to $17.

* Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Applied Optoelectronics, targeting a price of $20.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Applied Optoelectronics with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: This Stock Down 94% Will Soar With Lower Interest Rates

The S&P 500 rose last week after the Federal Reserve announced its first interest-rate cut in four years. Lower rates are meant to boost the economy and should result in more money changing hands and higher revenue for many struggling companies and industries.

Opendoor Technologies (NASDAQ: OPEN) is a real estate technology company that wants to change how Americans buy and sell their homes. Residential real estate is one of the largest industries in the country, and the opportunity is enormous.

Its stock is down 94% from its highs. As interest rates decline and the real estate industry rebounds, Opendoor stock could skyrocket.

So far, not so good

Opendoor’s business has been absolutely crushed by rising mortgage interest rates. Homeowners aren’t selling because they don’t want new mortgages at higher rates, so buyers aren’t finding much available. The company’s revenue is down 24% from last year, and that was already down 53% from the year before.

Things have only been getting worse. According to Redfin data, August home sales fell 4.7% year over year, while the median housing price increased 3.1%. That’s even as the national average 30-year fixed-rate mortgage rate fell 0.57 percentage points to 6.5%.

Opendoor stock hasn’t gotten much of a boost from the announcement of lower interest rates. It’s down 54% this year alone.

An uphill climb

That’s the meat and potatoes of what’s been going wrong. But there are actually many things going right — or at least pointing to what could be a highly successful venture in the future.

First is the opportunity. Opendoor services a $1.9 trillion market, of which it has just 1%, and it’s trying to develop a superior alternative to legacy processes. Selling and buying a home the traditional way with a broker is an intensive, multistep process. Opendoor is looking to simplify that process by offering fast and easy digital services.

It gives quick cash offers and handles both sides, so a user can sell their home and find something else through Opendoor’s platform. It provides three ways to use the platform: selling a home directly to Opendoor, which takes out the hassle of bringing in multiple potential buyers to view a home and negotiate; listing a home on Opendoor’s marketplace; or working with Opendoor’s agents to find qualified buyers.

It purchased 4,771 homes in the second quarter, 78% more than last year, bringing total inventory up to 6,399. That puts it in a position to benefit when trends shift in its favor.

Management sees a path to profitability as it rebuilds its inventory with healthier margins. Gross margin widened from 7.5% last year to 8.5% in this year’s second quarter, although the company reported a $92 million net loss.

Opendoor is expected to report a net loss for full-year 2024 and even 2025, so don’t expect anything better soon. However, it beat earnings-per-share (EPS) (or in this case, loss-per-share) projections for the past four quarters. I don’t think that means it will come in positive anytime soon, but a beat says positive things about management’s capabilities and often leads to a jump in the share price, depending on what else is happening with the stock.

Light at the end of the tunnel

Opendoor stock trades at a dirt cheap price-to-sales ratio of 0.3 and just over $2 per share. That shows how much the market thinks of it right now. But there’s a lot in place in terms of the company’s technology, opportunity, and positioning to have confidence in an incredible rebound.

Is this a risky play? Definitely. It’s not for the faint of heart or anyone who needs their investment money in the near future. However, if you have an appetite for risk, some money to put away for a while, and a long-term horizon, even $10 will get you five shares. You might want to take a small position right now at these beaten-down prices.

Should you invest $1,000 in Opendoor Technologies right now?

Before you buy stock in Opendoor Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Opendoor Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.