Dental Market to Reach $87.1 Billion, Globally, by 2033 at 5.8% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 25, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Dental Market by Product Type (Dental Consumables and Dental Equipment), and End User (Hospitals and Clinics, Academic Institute and Research Centers and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the dental market was valued at $49.5 billion in 2023, and is estimated to reach $87.1 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033.

Prime determinants of growth

Rise in prevalence of oral diseases, increase in awareness of oral health, and growth in demand for aesthetic dentistry are the major factors that drive the growth of the dental market growth. However, the shortage of skilled dental professionals and high cost of dental procedures restrict the market growth. Moreover, advancements in dental technology and growth opportunities in emerging markets offer remunerative opportunities for the expansion of the global dental market.

Request Sample of the Report on Dental Market Forecast 2033 – https://www.alliedmarketresearch.com/request-sample/A324404

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $49.5 billion |

| Market Size in 2033 | $87.1 billion |

| CAGR | 5.8% |

| No. of Pages in Report | 250 |

| Segments Covered | Product Type, End User, and Region. |

| Drivers |

|

| Opportunities |

|

| Restraints |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A324404

Segment Highlights

Expansion of dental consumables in dental market

By product type, the dental consumables segment is driven by the increasing demand for routine dental procedures and preventive care. Rising awareness of oral hygiene and preventive measures fuels the need for products such as dental hygiene items, fillings, and sealants. In addition, technological advancements in dental materials, such as high-quality composites and bonding agents, further enhance the appeal of consumables. Furthermore, the emphasis on affordable and accessible dental care supports the demand for disposable and cost-effective consumables.

Rise in adoption of dental products in hospital and dental clinics

By end user, the hospital and dental clinics segment held a substantial portion of the dental market share, primarily driven by their central role in delivering comprehensive dental care. Hospitals and clinics serve as primary providers of a wide range of dental services, from routine check-ups to complex procedures. The increasing number of dental clinics and the expansion of hospital dental departments contribute to the growth of this segment. In addition, the rising prevalence of dental diseases and the emphasis on preventive care further drive the demand for dental products provided in these settings.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A324404

Regional Outlook

Region wise, North America is expected to maintain its leadership in the dental market owing to an advanced healthcare infrastructure and a high standard of dental care, which drives demand for innovative dental solutions. Significant investments in dental technology and research enhance treatment options and attract patients. Additionally, a strong focus on preventive care and oral health awareness contributes to sustained market growth. High disposable incomes and access to cutting-edge dental services further solidify North America’s dominant position.

Key Players

- OSSTEM IMPLANT CO., LTD.

- Koninklijke Philips N.V.,

- Align Technology, Inc.

The report provides a detailed analysis of these key players in the global dental market. These players have adopted different strategies such as agreement, expansion, product launch, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Get Customized Reports with your Requirements – https://www.alliedmarketresearch.com/request-for-customization/A324404

Recent Developments in Dental Industry

- In September 2023, Dentsply Sirona, the world’s largest manufacturer of professional dental products and technologies, and 3Shape, a leading innovator of digital solutions for dental patient care, opened the next chapter in their workflow integrations. The harmonization of DS Core, Primemill and Primeprint, with the 3Shape TRIOS intraoral scanner powered by 3Shape Unite, creates more integrated workflows for digital dentistry.

- In April 2022, Envista Holdings Corporation announced the completion of the acquisition of Carestream Dental’s Intraoral Scanner business. As previously announced, this business will be rebranded as DEXIS and will operate as part of the Envista equipment and consumables segment.

Trending Reports in Healthcare Industry:

Downstream Processing Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Psoriatic Arthritis Treatment Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Cell Therapy Processing Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Automated Microscopy Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Mortgage Rates Fall Again, Triggering Big Wave of Refinancing

(Bloomberg) — Applications to refinance mortgages surged for a second week as more Americans capitalized on the cheapest borrowing costs in two years.

Most Read from Bloomberg

The Mortgage Bankers Association’s refinancing index jumped 20.3% in the week ended Sept. 20 to the highest level since April 2022, the group said Wednesday. The contract rate on a 30-year fixed mortgage eased 2 basis points to 6.13%, the eighth straight weekly drop and the longest stretch of declines since 2018-2019.

That helped boost the group’s home-purchase applications index by 1.4% last week to the highest level since early February. The fifth straight weekly advance in the measure points to burgeoning demand in a housing market that’s gradually finding some footing.

At the same time, home financing costs may start to stabilize. Yields on the 10-year Treasury note have edged higher in the last week as traders debate the magnitude of Federal Reserve’s expected interest-rate cut in November as well as the path for reductions.

The average contract rate on a 15-year mortgage and the five-year adjustable-rate mortgage ticked up last week after sharp declines in the prior two weeks.

The MBA survey, which has been conducted weekly since 1990, uses responses from mortgage bankers, commercial banks and thrifts. The data cover more than 75% of all retail residential mortgage applications in the US.

(Adds graphic.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Deferasirox Market to Reach $4.6 Billion, Globally, by 2033 at 4.7% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 25, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Deferasirox Market by Product Type (90 mg, 125 mg, 250 mg, 360 mg and Others), Application (Transfusional Iron Overload and NTDT Caused Iron Overload), and Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Providers): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the deferasirox market was valued at $2.9 billion in 2023, and is estimated to reach $4.6 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033.

Prime determinants of growth

Increase in prevalence of iron overload disorders, increase in research and development activities, and rise in awareness and screening programs are the major factors that drive the deferasirox market growth. However, the side effects associated with drug may restricts the market growth. Moreover, growth avenues in emerging markets offer remunerative opportunities for the expansion of the global deferasirox market.

Request Sample of the Report on Deferasirox Market Forecast 2033 – https://www.alliedmarketresearch.com/request-sample/A324400

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $2.9 billion |

| Market Size in 2033 | $4.6 billion |

| CAGR | 4.7% |

| No. of Pages in Report | 230 |

| Segments Covered | Product Type, Application, Distribution Channel, and Region. |

| Drivers |

|

| Opportunity |

|

| Restraint |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A324400

Segment Highlights

Rise in demand for diverse deferasirox dosages

By product type, the others segment is driven by the rise in demand for deferasirox dosages due to its efficacy in treating chronic iron overload in patients with transfusion-dependent anemias. In addition, advancements in pharmaceutical formulations have enhanced patient compliance and therapeutic outcomes. Furthermore, increased awareness and diagnosis of iron overload disorders, along with expanded healthcare access in emerging markets contributes towards the segment growth.

Rise in demand for deferasirox technology in transfusional iron overload

By application, the transfusional iron overload segment is driven by the growing prevalence of chronic conditions such as thalassemia and sickle cell anemia, which require frequent transfusions and thus pose a risk of iron overload. Additionally, advancements in treatment protocols and increasing awareness among healthcare providers contribute to segment growth. The transfusional iron overload segment is expected to see substantial market expansion owing to rise in incidence of transfusion-dependent anemias.

Rise in adoption of deferasirox in retail pharmacies

By distribution channel, the retail pharmacies segment held a substantial portion of the deferasirox market share, primarily driven by their accessibility and convenience for patients. Retail pharmacies offer direct, over-the-counter access to deferasirox, facilitating prompt treatment for chronic iron overload conditions. Their widespread presence ensures that patients can easily obtain their prescriptions without extensive wait times. The segment’s growth is further supported by increasing patient preference for convenient access to medications and the expanding network of retail pharmacies globally. This makes retail pharmacies a key distribution channel in the deferasirox market.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A324400

Regional Outlook

North America Dominance by 2033

North America is expected to maintain its leadership in the deferasirox market owing to a well-established healthcare infrastructure and advanced medical research capabilities, which facilitate the development and distribution of deferasirox. In addition, rise in prevalence of conditions requiring iron chelation therapy is driving the demand for deferasirox. Furthermore, the presence of major pharmaceutical companies and increased awareness and better diagnostic capabilities contribute to higher rates of diagnosis and treatment, which thereby drives the market growth in this region.

Key Players

- Dr. Reddy’s Laboratories, Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Glenmark Pharmaceuticals Inc.

- Taj Pharmaceuticals Limited

The report provides a detailed analysis of these key players in the global deferasirox market. These players have adopted different strategies such as agreement, product appeoval, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Get Customized Reports with your Requirements – https://www.alliedmarketresearch.com/request-for-customization/A324400

Recent Developments in Deferasirox Industry

- In June 2020, Zydus Cadila received the final approval from the U.S. FDA to market Deferasirox Tablets in the strengths of 90 mg, 180 mg and 360 mg.

Trending Reports in Healthcare Industry:

Point of Care Diagnostics Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Contraceptives Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Electrophysiology Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Orphan Drugs Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

It's My First Year on Social Security – How Can I Stop Taxes from Eating It Up?

As your first year of retirement progresses, it’s important to evaluate whether the financial plan you laid out to ensure your sustainable well-being is going according to plan. An appropriate plan should include tax calculations to understand how much of your income will truly be at your disposal for needs and wants.

Some people may think that because you pay for Social Security benefits throughout your lifetime via payroll taxes, it’s a tax-free benefit. However, this is often not the case. Both the amount of your Social Security benefits subject to taxes and the tax rate itself will depend on a handful of factors personal to your situation.

To build your own retirement income plan and tax strategy, talk to a fiduciary financial advisor today.

How Your Social Security Benefits Are Taxed

In short, you might pay taxes on 0%, 50% or 85% of your Social Security retirement benefits. This is depending on your provisional income, though:

Provisional income = Taxable income + Tax-exempt interest + ½ of annual Social Security benefits

You then would compare your provisional income to that year’s income threshold to determine what portion of your Social Security benefits will be taxed. Your tax rate will be your marginal rate. For a single filer, the thresholds are as follows for the 2023 tax year:

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

For example, if you had $25,000 in 401(k) withdrawals, $5,000 in tax-exempt bond interest and $29,000 in annual Social Security benefits, your provisional income would be:

$25,000 + $5,000 + (½ x $29,000) = $44,500

Because this is beyond the $34,000 income threshold, 85% of your Social Security income will be taxed.

So, nearly $25,000 of your Social Security benefits ($29,000 x 0.85 = $24,650) for the year would be taxable in this case. Again, that’s only the amount of money you’ll be charged taxes on – not what you’re actually paying in taxes. The other roughly $4,000 would be tax-free.

Talk to a financial advisor about building a strategy to minimize taxes in retirement.

Delaying 401(k) and IRA Distributions

In some cases, it may make sense to reduce your other income streams to prevent additional taxation of your Social Security benefits. While some advisors may recommend their client delays taking Social Security as long as possible to get increased benefits, it might be helpful to reduce the tax liability on Social Security income by delaying other income streams instead. For instance, you could push back distributions from a 401(k) or traditional IRA.

This is because any 401(k) or IRA distributions you take in a year will count toward your provisional income, putting you at risk of increased taxes on your Social Security benefits. However, in some cases this tradeoff may be well worth it, such as if you converted your 401(k) or IRA to a Roth IRA to save on taxes in the future. A financial advisor can help you do the calculations to see which strategy could be more beneficial.

Dealing With and Managing Your RMDs

If you’re in your 70s, you may be already taking or preparing to take required minimum distributions (RMDs) from your retirement accounts. RMDs will necessarily increase your provisional income in a lot of cases, but there may be ways to keep this income out of your provisional income to keep your tax rate on your Social Security benefits low.

For example, you can preempt the taxes by converting your 401(k) or traditional IRA to a Roth IRA. While this will trigger a tax bill up front, it may save even more than just taxes on your Social Security benefits in the long run, since Roth IRA distributions are tax-free. Note that you often cannot make penalty-free withdrawals from a Roth IRA within five years of opening an account, however.

Another alternative is to take an RMD as a qualified charitable distribution, or QCD, if you don’t need the money. QCDs are excluded from your taxable income and wouldn’t push you into a higher threshold of provisional income.

Consider speaking with a financial advisor about ways to navigate RMDs within your retirement income plan.

Bottom Line

It’s important to plan for Social Security taxes in your overall retirement budget. Note that the portion of your benefits that are subject to taxes may change each year depending on your other income streams. In turn, you’ll want to plan ahead each year for these considerations.

Retirement Planning Tips

-

As you plan for your golden years, it’s important to get an accurate estimate of how much money you’ll have saved up by the time you retire. Luckily, SmartAsset’s retirement calculator can help you project how much money you may need to retire and whether you’re on track to hit this target.

-

A financial advisor can help you navigate the sometimes complex world of retirement planning. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/FG Trade

The post This Is My First Year Taking Social Security. How Do I Reduce My Taxes on It? appeared first on SmartReads by SmartAsset.

1 Ultra-High-Yield Healthcare Stock to Buy Hand Over Fist and 1 to Avoid

Companies with high dividend yields can seem attractive, but there is far more to income stocks than above-average yields. Any corporation’s payouts are in danger without a robust business backing it up. That’s why choosing the right dividend stock requires looking beyond the yield and into the company’s fundamentals.

Let’s illustrate that with two examples: Pfizer (NYSE: PFE), and Medical Properties Trust (NYSE: MPW). While both have attractive yields, the former is a worthy investment, but the latter, not so much. Here’s why.

The high-yield stock to buy: Pfizer

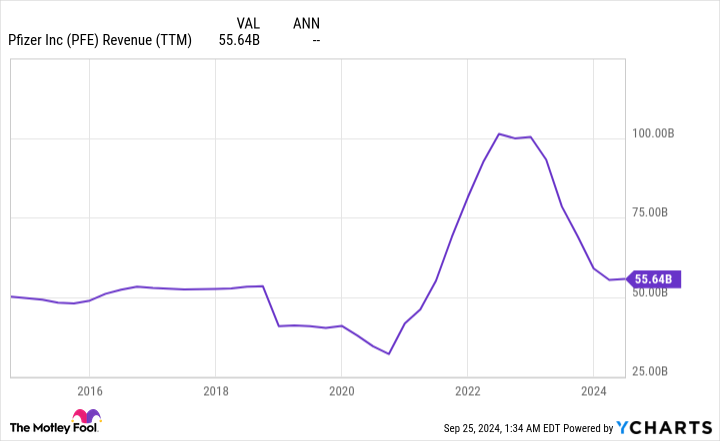

The drugmaker’s stock isn’t popular on the market right now, with shares significantly lagging the market over the past two years. In the meantime, the stock’s dividend yield rose, and as of this writing, it stands at 5.7%. Despite Pfizer’s issues, the company can maintain its dividend program.

To be fair, Pfizer’s financial results are relatively poor compared to what it delivered in 2021 and 2022 — two years during which its sales skyrocketed thanks to its work in the coronavirus area. Yet, its top line inflected well above pre-pandemic levels, a very encouraging sign that points to secular growth in the business.

Pfizer’s COVID-19 drugs will eventually stop affecting its results as much. Moreover, there’s no letup in the company’s research & development expenses (which are far higher than pre-pandemic levels) that saw operating and net income drop below pre-COVID levels.

And so there is a strong possibility that a whole lot of products are in the pipeline, which should help the company return to profitable growth. Currently, Pfizer’s pipeline has over 100 programs. But two areas where the company is focusing its research efforts, and worth a special mention, are in the weight loss space and oncology.

The lucrative GLP-1 weight loss field is growing rapidly. Pfizer’s candidate, oral danuglipron, recently performed well in a phase 2 study.

Then, there are the company’s efforts in oncology. Pfizer acquired Seagen, an oncology specialist, for $43 billion. CEO Albert Bourla said of the acquisition: “We are not buying the golden eggs. We are acquiring the goose that is laying the golden eggs.” Seagen had several approved cancer drugs and a deep pipeline, but it was a much smaller company than Pfizer, with less funding and smaller footprints in the industry. Now that they are a single entity, Pfizer should become a much more prominent player in oncology.

So, despite a poorer showing over the last year or so, the company’s underlying business boasts excellent prospects. Pfizer’s dividend should be safe. It has increased its payouts by 17% in the past five years. Pfizer is a reliable, high-yield dividend stock to buy and hold.

The high-yield stock to avoid: Medical Properties Trust

Medical Properties Trust (MPT), a healthcare-focused real estate investment trust (REIT), has been bruised and battered since early 2023. The company’s revenue, earnings, and share price have all moved in the wrong direction.

Unlike in Pfizer’s case, this isn’t because MPT was falling from incredible heights. Here’s the reason. Steward Healthcare, one of its important tenants, had trouble keeping up with rent payments. Steward officially filed for bankruptcy in May.

As a result of this issue, MPT had no choice but to slash its dividends. It has done it twice since mid-2023. MPT’s yield remains impressive at 5.56%. Still, dividend seekers loathe payout cuts, so MPT might not be the best option right now.

Some will object that the company looks on the verge of putting its Steward-related problems in the rearview mirror. True enough. MPT recently reached agreements to put new tenants in 15 of the 23 hospitals previously operated by Steward Healthcare. The average term of the lease is about 18 years.

But as per the agreement, these new tenants won’t start paying rent until the first quarter of 2025, and even then, they will only pay half of the contractual agreement by the end of next year. They will gradually ramp things up until they reach the total amount in fourth-quarter 2026.

This is a win for MPT: It gets rid of its troubled tenant and replaces it with four new ones (more diversification), which (unless financial problems also arise with them) will pay regular and predictable amounts until at least 2042 on average. However, MPT still has work to do in fixing its business. It has yet to find solutions for some of Steward’s former facilities, including some hospitals under construction.

Even if it had, given the issues it has faced lately, I’d recommend staying away from the stock, at least for now. Yes, MPT is improving its business, but it’s best to watch how things unfold from the sidelines until it can prove that it is officially back by delivering consistently good results.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

1 Ultra-High-Yield Healthcare Stock to Buy Hand Over Fist and 1 to Avoid was originally published by The Motley Fool

Cisco, PayPal, Citizens Financial And More On CNBC's 'Final Trades'

On CNBC’s “Halftime Report Final Trades,” Josh Brown of Ritholtz Wealth Management said PayPal Holdings, Inc. PYPL continues to make new highs. “I am rolling up my stop-loss, but staying with the trade,” he added.

On Sept. 23, Deutsche Bank analyst Bryan Keane maintained PayPal with a Buy and raised the price target from $74 to $94.

Brian Belski of BMO Capital Markets said Citizens Financial Group, Inc. CFG has a 4% dividend yield and 18% free cash flow yield.

On Sept. 20, Citizens Financial Group announced the appointment of Claude E. Wade to the company’s board of directors, effective March 1, 2025. The company also said Wendy Watson will retire from the board after her current term expires at the annual meeting of shareholders in April 2025.

Don’t forget to check out our premarket coverage here

Jim Lebenthal of Cerity Partners said Cisco Systems, Inc. CSCO will quietly hit a fresh high for the year.

On Aug. 16, HSBC analyst Stephen Bersey upgraded Cisco from Hold to Buy and raised the price target from $46 to $58.

Shannon Saccocia of NB Private Wealth named iShares U.S. Real Estate ETF IYR as her final trade.

Price Action:

- PayPal gained 0.1% to close at $78.40 during Tuesday’s session.

- Citizens Financial shares fell 0.7% to settle at $40.76 on Tuesday.

- iShares U.S. Real Estate ETF rose slightly by 0.03% during Tuesday’s session.

- Cisco shares gained 0.6% to close at $52.52 on Tuesday.

Check This Out:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 Hits All-Time Highs, Nasdaq 100 Tops 20K Ahead Of Key Economic Data: What's Driving Markets Wednesday?

The S&P 500 reached record highs during Wednesday morning trading in New York, while the tech-heavy Nasdaq 100 climbed past the 20,000-point mark, a level last seen on July 17.

Semiconductor stocks outperformed, driven by anticipation of Micron Technology Inc.’s MU earnings report, due after the market close on Wednesday.

Yet, Wall Street showed sideways performance across major indices as investors cautiously digested positive stimulus news from China, which boosted market sentiment on Tuesday, and looked ahead to upcoming economic data.

On Thursday, investors will turn their attention to the final second-quarter gross domestic product report. The second estimate already showed the U.S. economy growing at a robust 3% pace for the quarter ending in June.

Weekly jobless claims will also be closely monitored, especially after the latest Conference Board Consumer Confidence Index revealed growing labor market concerns among U.S. households.

Friday brings the release of the personal consumption expenditures price index for August, the Federal Reserve’s preferred inflation gauge. This data could provide critical clues about the expectations for the November rate cut.

The U.S. dollar index edged higher Wednesday, supported by a slight rise in Treasury yields. Oil prices dipped by 1% but pared heavier losses after a larger-than-expected draw in crude oil inventories suggested continued strong demand.

In the crypto space, Bitcoin BTC/USD fell 0.8%, retreating from an intraday high of $64,800 – its highest level since late July.

Wednesday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| Nasdaq 100 | 20,003.52 | 0.3% |

| S&P 500 | 5,732.42 | 0.0% |

| Russell 2000 | 2,214.40 | -0.4% |

| Dow Jones | 41,986.73 | -0.5% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY flattened at $570.76.

- The SPDR Dow Jones Industrial Average DIA flattened at $420.90.

- The tech-heavy Invesco QQQ Trust Series QQQ rose 0.2% to $486.27.

- The iShares Russell 2000 ETF IWM fell to $219.22.

- The Technology Select Sector SPDR Fund XLK outperformed, up 0.4%. The Energy Select Sector SPDR Fund XLE lagged, down 0.9%.

Wednesday’s Stock Movers

- Duolingo Inc. DUOL rallied 6% after Evercore ISI raised the price target from $270 to $335.

- Fortrea Holdings Inc. FTRE tumbled nearly 10% after Jefferies downgraded the stock from Buy to Hold.

- Vistra Corp. VST rallied nearly 5% after Jefferies raised the price target from $99 to $137.

- Ford Motor Co. and General Motors Co. fell 4.4% and 5%, respectively, after receiving a downgrade from Morgan Stanley.

- Hewlett Packard Enterprise Company HPE rallied 4.9% after Barclays upgraded the stock from Equalweight to Overweight, raising the price target from $20 to $24.

- Companies reporting earnings after the close include Micron Technology Inc and Jefferies Financial Group Inc. JEF.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Will Growing Traction in Security Industry Propel MSI's Stock Growth?

Motorola Solutions, Inc. MSI is showcasing the most advanced solutions from its comprehensive security portfolio at the GSX 2024 event in Orlando. MSI’s latest and enhanced technologies include Pelco Sarix Enhanced Duo, a camera powered by two sensors that offer effective coverage of large open spaces. The product brings a major advantage for security officials operating in locations with multiple entrances and exits needing multi-directional video surveillance.

Avigilon Security Suite brings license plate recognition systems with L6A enterprise license plate camera and Avigilon Alta Video analytics. The solution expands appearance search capabilities and detects and verifies potential threats by analyzing license plates. In addition, Avigilon Alta Access with Mercury Security intelligent controllers deliver several cloud native security features to end users. The company is also demonstrating SentryERS, a panic button to alert first responders in any emergency situation and initiate lockdown protocols. During such situations, the solution also delivers live video, voice, text and GPS location data to first responders and reduces the response times.

Apart from this, MSI also boasts smart sensors, access control and body cameras powered by AI that can be deployed in a wide range of environments such as schools, hospitals, businesses, retailers, manufacturers and venues. High adaptability and a flexible integration process of the products are key advantages.

The Greater Dayton School in Ohio has recently deployed MSI solutions to bolster the physical security ecosystem on the premises. Avigilon video security cameras have been installed across campus, an access control system is implemented for all the doors and staff are equipped with an advanced radio communication network. Moreover, HALO smart sensors are deployed to detect vape and keywords such as help or emergency.

Will These Developments Drive MSI’s Share Performance?

Demonstration of its product suite at a major event such as GSX enhances brand visibility and will boost its commercial prospects. The security device market is expected to grow at a substantial rate as enterprises, schools and hospitals worldwide increasingly prioritize their internal security infrastructure. Motorola is steadily advancing its portfolio to capitalize on this emerging market trend.

MSI’s Stock Price Performance

The stock has gained 60.6% over the past year compared with the industry’s growth of 50.3%.

Image Source: Zacks Investment Research

MSI’s Zacks Rank & Stocks to Consider

Motorola currently carries a Zacks Rank #3 (Hold).

Arista Networks, Inc. carries a Zacks Rank #2 (Buy) at present. In the last reported quarter, it delivered an earnings surprise of 8.25%.

ANET is engaged in providing cloud networking solutions for data centers and cloud computing environments. The company offers 10/25/40/50/100 Gigabit Ethernet switches and routers optimized for next-generation data center networks.

Ubiquiti Inc. sports a Zacks Rank #1 at present. The company offers a comprehensive portfolio of networking products and solutions for service providers and enterprises.

UI’s excellent global business model, which is flexible and adaptable to evolving changes in markets, helps it to beat challenges and maximize growth. The company’s effective management of its strong global network of more than 100 distributors and master resellers improved its visibility for future demand and inventory management techniques.

Zillow Group, Inc. ZG carries a Zacks Rank #2 at present. In the last reported quarter, it delivered an earnings surprise of 25.81%.

ZG delivered an earnings surprise of 37.41%, on average, in the trailing four quarters. The company is witnessing solid momentum in rental revenues, driven by growth in both multi and single-family listings, which is a positive factor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Premia new ETF debuts on HKEX providing cost-efficient tool for Asia investment grade USD bonds

HONG KONG, Sept. 25, 2024 /PRNewswire/ — Premia Partners, the leading homegrown ETF provider from Hong Kong, announces listing of Premia J.P. Morgan Asia Credit Investment Grade USD Bond ETF (the ETF) on HKEX today.

The physically replicated ETF covers a diversified basket of USD bonds from investment grade sovereign, quasi-sovereign and corporate issuers across Asia ex-Japan markets, and has a total expense ratio of 0.23% p.a.

- Premia J.P. Morgan Asia Credit Investment Grade USD Bond ETF [Tickers: 3411 (HKD) / 9411 (USD)] tracks the J.P. Morgan Asia Credit Index – Investment Grade (the index).

- The ETF takes a market value weighted approach, covers only investment grade issues rated by S&P, Moody’s or Fitch, and excludes loss absorbing instruments such as Additional Tier 1 bonds (AT1s) and Contingent convertibles (CoCos).

- Listed on HKEX, the ETF trades in Asia time zone in alignment with the underlying bonds, enjoys waiver for Hong Kong stamp duties, and HKEX trading and settlement fee.

- The ETF is designed for portfolio completion, income and diversification, and allows investors to conveniently access a diversified basket of high-quality investment grade USD bonds with a simple, one ticker trade.

“We are delighted to expand our fixed income suite with this new ETF for Asia ex-Japan USD investment grade bonds,” said Rebecca Chua, Managing Partner of Premia Partners. “Similar to other Premia ETFs, this ETF is designed specifically as a cost-efficient allocation tool, and is a very timely strategy well placed to capture the tailwind opportunities in the current interest rate environment.”

For enquiry

+852 2950 5777

enquiries@premia-partners.com

About Premia Partners

Founded in 2016, Premia Partners is one of the leading ETF managers from Hong Kong, dedicated to building low-cost, efficient, best practice ETFs for Asia. As of Sep 25th 2024, Premia Partners manages 10 equity and fixed income ETFs designed as low-cost, efficient allocation tools for Asia. For more information on Premia or Premia ETFs covering China, Emerging ASEAN, Asia Innovative Technology/ Metaverse, Vietnam, China high yield bonds, China government bonds, Asia investment grade USD bonds and US Treasury, please visit www.premia-partners.com.

![]() View original content:https://www.prnewswire.com/news-releases/premia-new-etf-debuts-on-hkex-providing-cost-efficient-tool-for-asia-investment-grade-usd-bonds-302257356.html

View original content:https://www.prnewswire.com/news-releases/premia-new-etf-debuts-on-hkex-providing-cost-efficient-tool-for-asia-investment-grade-usd-bonds-302257356.html

SOURCE Premia Partners

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

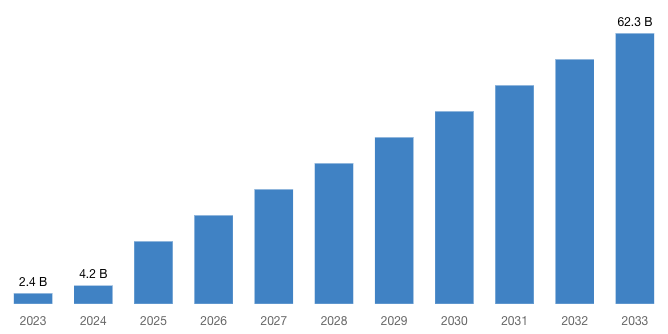

[Latest] Global Augmented Reality in Retail Market Size/Share Worth USD 62.3 Billion by 2033 at a 41.7% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

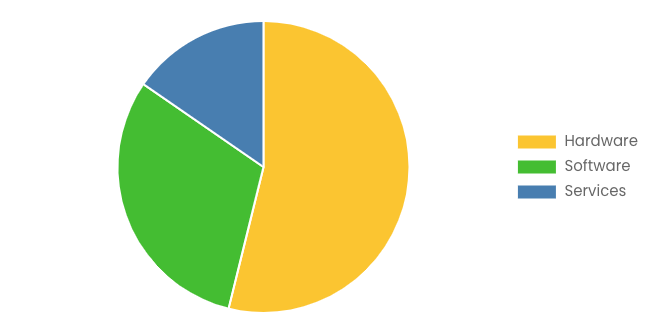

Austin, TX, USA, Sept. 25, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Augmented Reality in Retail Market Size, Trends and Insights By Component (Hardware, Software, Services), By Device Type (Head Mounted Display, Smart AR Mirror, Handheld Device), By Application (Information Systems, Advertising and Marketing, Try on Solutions, Planning and Designing), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Augmented Reality in Retail Market size & share was valued at approximately USD 2.4 Billion in 2023 and is expected to reach USD 4.2 Billion in 2024 and is expected to reach a value of around USD 62.3 Billion by 2033, at a compound annual growth rate (CAGR) of about 41.7% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Augmented Reality in Retail Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52046

Augmented Reality in Retail Market: Overview

Augmented reality (AR) continues to reshape the retail landscape, with several key trends driving innovation and consumer engagement.

Personalized shopping experiences are gaining momentum, as AR enables retailers to tailor product recommendations and virtual try-on experiences based on individual preferences and past behavior. This customization enhances customer satisfaction and increases conversion rates.

Secondly, AR-powered virtual try-on solutions are becoming increasingly sophisticated, allowing consumers to visualize products such as clothing, cosmetics, and furniture in real time, thereby reducing the need for physical store visits and minimizing returns.

Thirdly, the integration of AR into marketing campaigns and product launches is on the rise, as retailers leverage immersive storytelling and interactive experiences to captivate audiences and drive brand engagement. Fourthly, advancements in AR technology, including wearable devices and spatial computing, are expanding the possibilities for immersive retail experiences both in-store and online.

Finally, the COVID-19 pandemic has accelerated the adoption of AR-driven contactless shopping solutions, such as virtual tours and remote assistance, further cementing AR as a crucial tool for enhancing safety and convenience in retail environments.

Request a Customized Copy of the Augmented Reality in Retail Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52046

By Component, the Software segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Software is a subset of artificial intelligence that enables computers to learn from data and improve performance on specific tasks without being explicitly programmed.

By Device Type, Head Mounted Display segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. A Head-Mounted Display (HMD) is a wearable device that presents virtual reality (VR) or augmented reality (AR) content directly in front of the user’s eyes.

By Application, the Information systems segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Information systems (IS) encompass the combination of hardware, software, data, procedures, and people that are used to collect, process, store, and distribute information within an organization.

North America leads in augmented reality retail, with companies like Apple, Google, and Microsoft driving innovation, enhancing shopping experiences, and reshaping consumer engagement through immersive technologies.

Blippar Group Limited uses the camera on your smartphone or tablet to recognize images and real-world objects and show digital content right on top. When you scan something, we use artificial intelligence to find relevant content.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 4.2 Billion |

| Projected Market Size in 2033 | USD 62.3 Billion |

| Market Size in 2023 | USD 2.4 Billion |

| CAGR Growth Rate | 41.7% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Component, Device Type, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Augmented Reality in Retail report is available upon request; please contact us for more information.)

Request a Customized Copy of the Augmented Reality in Retail Market Report @ https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Augmented Reality in Retail report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Augmented Reality in Retail Market Report @ https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

CMI has comprehensively analyzed Global Augmented Reality in Retail market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict the in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Augmented Reality in the Retail industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Augmented Reality in Retail market and what is its expected growth rate?

- What are the primary driving factors that push the Augmented Reality in Retail market forward?

- What are the Augmented Reality in Retail Industry’s top companies?

- What are the different categories that the Augmented Reality in Retail Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Augmented Reality in Retail market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Augmented Reality in Retail Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

Augmented Reality in Retail Market: Regional Analysis

By region, Augmented Reality in Retail market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. North America dominated the global Augmented Reality in Retail market in 2023 with a market share of 42.5% and is expected to keep its dominance during the forecast period 2024-2033.

North America is at the forefront of driving augmented reality (AR) in the retail market due to its technological innovation and consumer readiness. Leading tech companies, such as Apple and Google, are based in the region and continuously develop sophisticated AR platforms and tools that retailers can integrate into their marketing and sales strategies.

Retail giants like Walmart and IKEA have adopted AR to enhance the shopping experience, allowing customers to visualize products in their homes before purchasing. This trend is fuelled by high smartphone penetration and advanced internet infrastructure, facilitating seamless AR experiences.

North America’s strong emphasis on e-commerce and digital transformation, combined with a tech-savvy population, provides fertile ground for AR innovations. Furthermore, investment in AR startups and collaborations between tech firms and retail businesses contribute to the dynamic growth of AR applications in the retail sector.

Request a Customized Copy of the Augmented Reality in Retail Market Report @ https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Augmented Reality in Retail Market Size, Trends and Insights By Component (Hardware, Software, Services), By Device Type (Head Mounted Display, Smart AR Mirror, Handheld Device), By Application (Information Systems, Advertising and Marketing, Try on Solutions, Planning and Designing), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

List of the prominent players in the Augmented Reality in Retail Market:

- PTC Blippar Group Limited

- Holition Ltd.

- INDE

- Imaginate Technologies

- ViewAR GmbH

- Inter IKEA Systems B.V

- Wikitude

- Marxent Labs

- Kudan

- Sephora USA Inc.

- Apple Inc.

- Amazon com Inc.

- Augment

- Microsoft Corporation

- Zugara Inc.

- Vuforia

- Maxst

- Inglobe Technologies

- Others

Click Here to Access a Free Sample Report of the Global Augmented Reality in Retail Market @ https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Core HR Software Market: Core HR Software Market Size, Trends and Insights By Software (Benefits and Claims Management, Payroll and Compensation Management, Personnel Management, Learning Management, Pension Management, Compliance Management, Succession Planning, Others), By Deployment Type (On-Premises, Cloud, Others), By End User Industries (Government, Manufacturing, Energy and Utilities, Consumer Goods and Retail, Healthcare, Transportation and Logistics, Telecom and Information Technology (IT), Banking, Financial Services, and Insurance (BFSI), Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Computer Reservation Systems Market: Computer Reservation Systems Market Size, Trends and Insights By Type (On-Premise, Web-Based), By Application (Air travel, Hotels, Car rental, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Data Center Physical Security Market: Data Center Physical Security Market Size, Trends and Insights By Component (Hardware, Software, Services), By Security Type (Video surveillance, Monitoring solutions, Access control solutions, Others), By Data Center Type (Small data center, Medium data center, Large data center), By End User (BFSI, Healthcare, Retail & E-commerce, Media & entertainment, IT & telecommunication, Government & defense, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

In-Flight Entertainment and Connectivity Market: In-Flight Entertainment and Connectivity Market Size, Trends and Insights By Component (Hardware, Non-portable, Portable, Connectivity, Wired, Wireless, Content, Stored, Streamed), By Aircraft Type (Narrow-Body Aircraft (NBA), Wide-Body Aircraft (WBA), Very Large Aircraft (VLA)), By Offering (In-flight Entertainment (IFE), In-flight Connectivity (IFC)), By End-user (Airlines, Aircraft OEMs), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Composite AI Market: Composite AI Market Size, Trends and Insights By Component (Software, Hardware, Services), By Technique (Product Design and Development, Customer Service, Fraud Detection, Risk Management, Supply Chain Management), By Application (Banking and financial services, Healthcare, Retail, Manufacturing, Transportation and logistics, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Radiometric Dating Machine Market: Radiometric Dating Machine Market Size, Trends and Insights By Type (Alpha Counting, Beta Counting, Gamma Counting, Mass Spectrometry), By Method (Radiocarbon Dating, Potassium-Argon Dating, Uranium-Lead System), By End User (Archaeologists, Geologists, Environmental Scientists, Palaeontologists, Nuclear Scientists, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Cloud Endpoint Protection Market: Cloud Endpoint Protection Market Size, Trends and Insights By Component (Solutions, Services), By Organization Size (SMEs, Large Enterprises), By End User (BFSI, Telecom & IT, Retail, Healthcare, Media & Entertainment, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Blockchain Gaming Market: Blockchain Gaming Market Size, Trends and Insights By Game Type (Role Playing Games, Open World Games, Collectible Games), By Platform (ETH, BNB Chain, Polygon, Others), By Device (Android, Web, IOS, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Augmented Reality in Retail Market is segmented as follows:

By Component

By Device Type

- Head Mounted Display

- Smart AR Mirror

- Handheld Device

By Application

- Information Systems

- Advertising and Marketing

- Try on Solutions

- Planning and Designing

Click Here to Get a Free Sample Report of the Global Augmented Reality in Retail Market @ https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Augmented Reality in Retail Market Research/Analysis Report Contains Answers to the following Questions.

- What Developments Are Going On in That Technology? Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Augmented Reality in Retail Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Augmented Reality in Retail Market? What Was the Capacity, Production Value, Cost and PROFIT of the Augmented Reality in Retail Market?

- What Is the Current Market Status of the Augmented Reality in Retail Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Augmented Reality in Retail Market by Considering Applications and Types?

- What Are Projections of the Global Augmented Reality in Retail Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Augmented Reality in Retail Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Augmented Reality in Retail Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Augmented Reality in Retail Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Augmented Reality in Retail Industry?

Click Here to Access a Free Sample Report of the Global Augmented Reality in Retail Market @ https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

Reasons to Purchase Augmented Reality in Retail Market Report

- Augmented Reality in Retail Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Augmented Reality in Retail Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Augmented Reality in Retail Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Augmented Reality in Retail Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Augmented Reality in Retail market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Augmented Reality in Retail Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Augmented Reality in Retail market analysis.

- The competitive environment of current and potential participants in the Augmented Reality in Retail market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Augmented Reality in Retail market should find this report useful. The research will be useful to all market participants in the Augmented Reality in Retail industry.

- Managers in the Augmented Reality in Retail sector are interested in publishing up-to-date and projected data about the worldwide Augmented Reality in Retail market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Augmented Reality in Retail products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Augmented Reality in Retail Market Report @ https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Augmented Reality in Retail Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/augmented-reality-in-retail-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.