Huize Holding Limited Reports Second Quarter 2024 Unaudited Financial Results

SHENZHEN, China, Sept. 25, 2024 (GLOBE NEWSWIRE) — Huize Holding Limited, (“Huize”, the “Company” or “we”) HUIZ, a leading insurance technology platform connecting consumers, insurance carriers and distribution partners digitally through data-driven and AI-powered solutions in Asia, today announced its unaudited financial results for the second quarter ended June 30, 2024.

Second Quarter 2024 Financial and Operational Highlights

- Resilient business performance: Gross written premiums (“GWP”) moderated slightly to RMB1,336.9 million in the second quarter of 2024, compared to RMB1,377.7 million in the same period of 2023. Renewal premiums increased by 42.8% year-over-year to RMB685.4 million in the second quarter of 2024, driven by our high-quality customer base and continued robust persistency ratios.

- Sequential improvement in gross profit margin: Gross profit margin was 31.3% in the second quarter of 2024, up by 2.3 percentage points sequentially, mainly driven by our disciplined control on channel expenses and optimization in product mix.

- Cumulative number of insurance clients served increased to 9.8 million as of June 30, 2024. Huize cooperated with 125 insurer partners, including 78 life and health insurance companies and 47 property and casualty insurance companies, as of June 30, 2024.

- As of June 30, 2024, cash and cash equivalents were RMB236.2 million (US$32.5 million).

Mr. Cunjun Ma, Founder and CEO of Huize, said, “Our business demonstrated resilience amidst a challenging economic and operating environment, with total GWP reaching RMB1.34 billion in the second quarter of 2024. These results reflect our strategic vision and core competencies in attracting high-quality customers, innovating customized products, developing sophisticated AI solutions, and diversifying into international markets.”

“Our long-term insurance products maintained a GWP contribution above 90% for the nineteenth consecutive quarter, underscoring our commitment to sustainable growth. The overall quality of our customers continued to improve, as evidenced by our record-high average first year premiums (“FYP”) ticket size of RMB78,000 for savings products and a sustainably high repeat purchase rate for long-term insurance products of 40.5%. Moreover, our high-quality customer base also helped sustain our persistency ratio for long-term life and health insurance products at the industry’s highest levels. As of the end of June 2024, the 13th and 25th-month persistency ratios stood at above 95%.”

“Our expansion into the international market is gaining traction, with revenue contribution from our international business increasing to 11% in the second quarter. We are also pleased to have completed the acquisition of a controlling stake in Global Care, a leading Vietnam-based Insurtech company specializing in digital transformation solutions for the insurance industry through our international arm Poni Insurtech in September. These strategic initiatives will further diversify our revenue streams and solidify our presence globally.”

“Looking ahead, we remain committed to enhancing the customer experience by leveraging cutting-edge technology, further solidifying our position as a leading pan-Asian digital insurance platform. We are focused on diversifying our revenue streams by expanding into high-growth markets in Southeast Asia, reinforcing our strategy for sustainable, long-term growth.”

Second Quarter 2024 Financial Results

GWP and operating revenue

GWP facilitated on our platform was RMB1,336.9 million (US$184.0 million) in the second quarter of 2024, a decrease of 3.0% from RMB1,377.7 million in the same period of 2023. Within GWP facilitated in the second quarter of 2024, FYP accounted for RMB651.5 million (or 48.7% of total GWP), a decrease of 27.4% year-over-year. Renewal premiums accounted for RMB685.4 million (or 51.3% of total GWP), an increase of 42.8% year-over-year.

Operating revenue was RMB283.0 million (US$38.9 million) in the second quarter of 2024, a decrease of 23.2% from RMB368.2 million in the same period of 2023. The decrease was primarily driven by the decrease in FYP facilitated.

Operating costs

Operating costs were RMB194.4 million (US$26.7 million) in the second quarter of 2024, a decrease of 20.2% from RMB243.6 million in the same period of 2023, primarily due to a decrease in channel expenses.

Operating expenses

Selling expenses were RMB46.8 million (US$6.4 million) in the second quarter of 2024, a decrease of 18.3% from RMB57.3 million in the same period of 2023, primarily due to a decrease in salaries and employment benefits related to employees with sales functions.

General and administrative expenses were RMB49.7 million (US$6.8 million) in the second quarter of 2024, an increase of 33.9% from RMB37.1 million in the same period of 2023. This increase was primarily due to an increase in rental and utilities expenses and share-based compensation expenses.

Research and development expenses were RMB18.1 million (US$2.5 million) in the second quarter of 2024, a decrease of 17.7% from RMB22.0 million in the same period of 2023, primarily due to a decrease in salaries and employment benefits for research and development personnel, as well as a decrease in office expenses.

Net profit and Non-GAAP net profit for the period

Net loss was RMB23.3 million (US$3.2 million) in the second quarter of 2024, compared to net profit of RMB14.1 million in the same period of 2023. Non-GAAP net loss was RMB13.0 million (US$1.8 million) in the second quarter of 2024, compared to non-GAAP net profit of RMB19.0 million in the same period of 2023.

Cash and cash equivalents

As of June 30, 2024, the Company’s cash and cash equivalents amounted to RMB236.2 million (US$32.5 million), compared to RMB249.3 million as of December 31, 2023.

Conference Call

The Company’s management team will hold an earnings conference call at 8:00 A.M. Eastern Time on Wednesday, September 25, 2024 (8:00 P.M. Beijing/Hong Kong Time on Wednesday, September 25, 2024). Details for the conference call are as follows:

Event Title: Huize Holding Limited’s Second Quarter 2024 Earnings Conference Call

Registration Link: https://register.vevent.com/register/BId0560560e56046b6aebe3fdd2b12cd48

All participants must use the link provided above to complete the online registration process in advance of the conference call. Upon registration, each participant will receive a confirmation email containing dial-in numbers and a unique access PIN, which will be used to join the conference call.

Additionally, a live and archived webcast of the conference call will also be available on the Company’s investor relations website at http://ir.huize.com.

About Huize Holding Limited

Huize Holding Limited is a leading insurance technology platform connecting consumers, insurance carriers and distribution partners digitally through data-driven and AI-powered solutions in Asia. Targeting mass affluent consumers, Huize is dedicated to serving consumers for their life-long insurance needs. Its online-to-offline integrated insurance ecosystem covers the entire insurance life cycle and offers consumers a wide spectrum of insurance products, one-stop services, and a streamlined transaction experience across all scenarios. By leveraging AI, data analytics, and digital capabilities, Huize empowers the insurance service chain with proprietary technology-enabled solutions for insurance consultation, user engagement, marketing, risk management, and claims service.

For more information, please visit http://ir.huize.com.

Use of Non-GAAP Financial Measure Statement

In evaluating our business, we consider and use non-GAAP net profit/(loss) attributable to common shareholders as a supplemental measure to review and assess our operating performance. The presentation of the non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. We define non-GAAP net profit/(loss) attributable to common shareholders as net profit/(loss) attributable to common shareholders excluding share-based compensation expenses. Such adjustments have no impact on income tax because either the non-GAAP adjustments were recorded at entities located in tax free jurisdictions, such as the Cayman Islands or because the non-GAAP adjustments were recorded at operating entities located in the PRC for which the non-GAAP adjustments were not deductible for tax purposes.

We present the non-GAAP financial measure because it is used by our management to evaluate our operating performance and formulate business plans. Non-GAAP net profit/(loss) attributable to common shareholders enables our management to assess our operating results without considering the impact of share-based compensation expenses and the interest on convertible bond. We also believe that the use of this non-GAAP financial measure facilitates investors’ assessment of our operating performance.

This non-GAAP financial measure is not defined under U.S. GAAP and is not presented in accordance with U.S. GAAP. The non-GAAP financial measure has limitations as an analytical tool. One of the key limitations of using adjusted net profit/(loss) attributable to common shareholders is that it does not reflect all items of income and expense that affect our operations. Further, the non-GAAP financial measure may differ from the non-GAAP financial information used by other companies, including peer companies, and therefore their comparability may be limited.

The non-GAAP financial measure should not be considered in isolation or construed as an alternative to net profit/(loss) attributable to common shareholders or any other measure of performance or as an indicator of our operating performance. Investors are encouraged to review the historical non-GAAP financial measure in light of the most directly comparable GAAP measure, as shown below. The non-GAAP financial measure presented here may not be comparable to similarly titled measure presented by other companies. Other companies may calculate similarly titled measures differently, limiting the usefulness of such measures when analyzing our data comparatively. We encourage investors and others to review our financial information in its entirety and not rely on a single financial measure.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars and from U.S. dollars to RMB are made at a rate of RMB7.2672 to US$1.00, the exchange rate on June 28, 2024, set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or U.S. dollars amounts referred could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about Huize’s beliefs and expectations, are forward-looking statements. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. Among other things, business outlook and quotations from management in this announcement, contain forward-looking statements. Huize may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Huize’s goal and strategies; Huize’s expansion plans; Huize’s future business development, financial condition and results of operations; Huize’s expectation regarding the demand for, and market acceptance of, its online insurance products; Huize’s expectations regarding its relationship with insurer partners and insurance clients and other parties it collaborates with; general economic and business conditions; and assumptions underlying or related to any of the foregoing.

Further information regarding these and other risks is included in Huize’s filings with the SEC. All information provided in this press release is as of the date of this press release, and Huize does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

Investor Relations

investor@huize.com

Media Relations

mediacenter@huize.com

Christensen Advisory

In China

Ms. Dee Wang

Phone: +86-10-5900-1548

Email: dee.wang@christensencomms.com

In U.S.

Ms. Linda Bergkamp

Phone: +1-480-614-3004

Email: linda.bergkamp@christensencomms.com

| Huize Holding Limited Unaudited Condensed Consolidated Balance Sheets (all amounts in thousands, except for share and per share data) |

|||||||||||

| As of December 31 | As of June 30 |

||||||||||

| 2023 | 2024 | ||||||||||

| RMB | RMB | USD | |||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | 249,258 | 236,161 | 32,497 | ||||||||

| Restricted cash | 42,307 | 46,419 | 6,387 | ||||||||

| Short-term investments | 8,879 | 5,221 | 718 | ||||||||

| Contract assets, net of allowance for doubtful accounts | 41,481 | 65,010 | 8,946 | ||||||||

| Accounts receivables, net of allowance for impairment | 178,294 | 145,906 | 20,077 | ||||||||

| Insurance premium receivables | 927 | 1,646 | 226 | ||||||||

| Amounts due from related parties | 383 | 2,450 | 337 | ||||||||

| Deferred costs | 6,147 | – | – | ||||||||

| Prepaid expense and other receivables | 78,784 | 80,407 | 11,064 | ||||||||

| Total current assets | 606,460 | 583,220 | 80,252 | ||||||||

| Non-current assets | |||||||||||

| Restricted cash | 29,687 | 29,887 | 4,113 | ||||||||

| Contract assets, net of allowance for doubtful accounts | 12,495 | 23,931 | 3,293 | ||||||||

| Property, plant and equipment, net | 54,107 | 50,788 | 6,989 | ||||||||

| Intangible assets, net | 50,743 | 50,436 | 6,940 | ||||||||

| Long-term investments | 76,688 | 70,710 | 9,730 | ||||||||

| Operating lease right-of-use assets | 115,946 | 114,750 | 15,790 | ||||||||

| Other receivables | – | 7,267 | 1,000 | ||||||||

| Goodwill | 461 | 461 | 63 | ||||||||

| Other assets | 419 | 485 | 67 | ||||||||

| Total non-current assets | 340,546 | 348,715 | 47,985 | ||||||||

| Total assets | 947,006 | 931,935 | 128,237 | ||||||||

| Liabilities and Shareholders’ Equity | |||||||||||

| Current liabilities | |||||||||||

| Short-term borrowings | 30,000 | 30,000 | 4,128 | ||||||||

| Accounts payable | 211,905 | 232,854 | 32,042 | ||||||||

| Insurance premium payables | 37,514 | 42,330 | 5,825 | ||||||||

| Contract liabilities | 2,728 | 993 | 137 | ||||||||

| Other payables and accrued expenses | 34,850 | 29,015 | 3,990 | ||||||||

| Payroll and welfare payable | 56,207 | 35,340 | 4,863 | ||||||||

| Income taxes payable | 2,440 | 2,440 | 336 | ||||||||

| Operating lease liabilities | 16,949 | 20,047 | 2,759 | ||||||||

| Amount due to related parties | 2,451 | 1,593 | 219 | ||||||||

| Total current liabilities | 395,044 | 394,612 | 54,299 | ||||||||

| Non-current liabilities | |||||||||||

| Deferred tax liabilities | 12,048 | 12,048 | 1,658 | ||||||||

| Operating lease liabilities | 129,299 | 126,636 | 17,426 | ||||||||

| Payroll and welfare payable | 200 | 1,507 | 207 | ||||||||

| Total non-current liabilities | 141,547 | 140,191 | 19,291 | ||||||||

| Total liabilities | 536,591 | 534,803 | 73,590 | ||||||||

| Shareholders’ equity | |||||||||||

| Class A common shares | 62 | 62 | 9 | ||||||||

| Class B common shares | 10 | 10 | 1 | ||||||||

| Treasury stock | (28,580 | ) | (29,512 | ) | (4,061 | ) | |||||

| Additional paid-in capital | 905,958 | 905,958 | 124,664 | ||||||||

| Accumulated other comprehensive loss | (14,060 | ) | (12,039 | ) | (1,657 | ) | |||||

| Accumulated deficits | (458,237 | ) | (474,678 | ) | (65,318 | ) | |||||

| Total shareholders’ equity attributable to Huize Holding Limited shareholders | 405,153 | 389,801 | 53,638 | ||||||||

| Non-controlling interests | 5,262 | 7,331 | 1,009 | ||||||||

| Total shareholders’ equity | 410,415 | 397,132 | 54,647 | ||||||||

| Total liabilities and shareholders’ equity | 947,006 | 931,935 | 128,237 | ||||||||

| Huize Holding Limited Unaudited Condensed Consolidated Statements of Comprehensive Income/(Loss) (all amounts in thousands, except for share and per share data) |

||||||||||||||||||

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||||

| 2023 | 2024 | 2023 | 2024 | |||||||||||||||

| RMB | RMB | USD | RMB | RMB | USD | |||||||||||||

| Operating revenue | ||||||||||||||||||

| Brokerage income | 355,563 | 271,790 | 37,400 | 643,919 | 573,672 | 78,940 | ||||||||||||

| Other income | 12,628 | 11,161 | 1,536 | 23,182 | 19,591 | 2,696 | ||||||||||||

| Total operating revenue | 368,191 | 282,951 | 38,936 | 667,101 | 593,263 | 81,636 | ||||||||||||

| Operating costs and expenses | ||||||||||||||||||

| Cost of revenue | (238,512 | ) | (187,469 | ) | (25,796 | ) | (412,588 | ) | (405,361 | ) | (55,780 | ) | ||||||

| Other cost | (5,051 | ) | (6,885 | ) | (948 | ) | (10,822 | ) | (9,188 | ) | (1,264 | ) | ||||||

| Total operating costs | (243,563 | ) | (194,354 | ) | (26,744 | ) | (423,410 | ) | (414,549 | ) | (57,044 | ) | ||||||

| Selling expenses | (57,343 | ) | (46,825 | ) | (6,443 | ) | (113,622 | ) | (91,030 | ) | (12,526 | ) | ||||||

| General and administrative expenses | (37,081 | ) | (49,669 | ) | (6,835 | ) | (70,610 | ) | (72,301 | ) | (9,949 | ) | ||||||

| Research and development expenses | (22,003 | ) | (18,099 | ) | (2,491 | ) | (40,315 | ) | (32,479 | ) | (4,469 | ) | ||||||

| Total operating costs and expenses | (359,990 | ) | (308,947 | ) | (42,513 | ) | (647,957 | ) | (610,359 | ) | (83,988 | ) | ||||||

| Operating profit/(loss) | 8,201 | (25,996 | ) | (3,577 | ) | 19,144 | (17,096 | ) | (2,352 | ) | ||||||||

| Other income/(expenses) | ||||||||||||||||||

| Interest income, net | 1,011 | 1,096 | 151 | 807 | 2,320 | 319 | ||||||||||||

| Unrealized exchange (loss)/income | (79 | ) | 49 | 7 | (208 | ) | (244 | ) | (34 | ) | ||||||||

| Investment loss | (774 | ) | (1,511 | ) | (208 | ) | (315 | ) | (3,836 | ) | (528 | ) | ||||||

| Others, net | 5,691 | 2,954 | 406 | 13,012 | 4,904 | 675 | ||||||||||||

| Profit/(Loss) before income tax expense, and share of (loss)/income of equity method investee | 14,050 | (23,408 | ) | (3,221 | ) | 32,440 | (13,952 | ) | (1,920 | ) | ||||||||

| Share of (loss)/income of equity method investee | (7 | ) | 345 | 47 | (994 | ) | (422 | ) | (58 | ) | ||||||||

| Income tax expense | – | – | – | – | – | – | ||||||||||||

| Net profit/(loss) | 14,043 | (23,063 | ) | (3,174 | ) | 31,446 | (14,374 | ) | (1,978 | ) | ||||||||

| Net (loss)/profit attributable to non-controlling interests | (79 | ) | 286 | 39 | (586 | ) | 2,067 | 284 | ||||||||||

| Net profit/(loss) attributable to common shareholders | 14,122 | (23,349 | ) | (3,213 | ) | 32,032 | (16,441 | ) | (2,262 | ) | ||||||||

| Net profit/(loss) | 14,043 | (23,063 | ) | (3,174 | ) | 31,446 | (14,374 | ) | (1,978 | ) | ||||||||

| Foreign currency translation adjustment, net of tax | 5,764 | (2,623 | ) | (361 | ) | 5,252 | (1,124 | ) | (155 | ) | ||||||||

| Comprehensive income/(loss) | 19,807 | (25,686 | ) | (3,535 | ) | 36,698 | (15,498 | ) | (2,133 | ) | ||||||||

| Comprehensive (loss)/income attributable to non-controlling interests | (79 | ) | 286 | 39 | (586 | ) | 2,067 | 284 | ||||||||||

| Comprehensive income/(loss) attributable to Huize Holding Limited | 19,886 | (25,972 | ) | (3,574 | ) | 37,284 | (17,565 | ) | (2,417 | ) | ||||||||

| Weighted average number of common shares used in computing net profit/(loss) per share | ||||||||||||||||||

| Basic and diluted | 1,004,586,294 | 991,124,813 | 991,124,813 | 1,008,291,649 | 991,969,450 | 991,969,450 | ||||||||||||

| Net profit/(loss) per share attributable to common shareholders | ||||||||||||||||||

| Basic and diluted | 0.01 | (0.02 | ) | (0.00 | ) | 0.03 | (0.02 | ) | (0.00 | ) | ||||||||

| Huize Holding Limited Unaudited Reconciliations of GAAP and Non-GAAP Results (all amounts in thousands) |

||||||||||||||||

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||

| 2023 | 2024 | 2023 | 2024 | |||||||||||||

| RMB | RMB | USD | RMB | RMB | USD | |||||||||||

| Net profit/(loss) attributable to common shareholders | 14,122 | (23,349 | ) | (3,213 | ) | 32,032 | (16,441 | ) | (2,262 | ) | ||||||

| Share-based compensation expenses | 4,889 | 10,355 | 1,425 | 5,393 | 7,797 | 1,073 | ||||||||||

| Non-GAAP net profit/(loss) attributable to common shareholders | 19,011 | (12,994 | ) | (1,788 | ) | 37,425 | (8,644 | ) | (1,189 | ) | ||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

General Motors To $42? Here Are 10 Top Analyst Forecasts For Wednesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Morgan Stanley cut the price target for General Motors Company GM from $47 to $42. Morgan Stanley analyst Adam Jonas downgraded the stock from Equal-Weight to Underweight. General Motors shares rose 0.1% to close at $48.07 on Tuesday. See how other analysts view this stock.

- Loop Capital increased the price target for monday.com Ltd. MNDY from $285 to $310. Loop Capital analyst Mark Schappel maintained a Buy rating. monday.com shares gained 1.3% to close at $281.64 on Tuesday. See how other analysts view this stock.

- Northland Capital Markets raised Gorilla Technology Group Inc. GRRR price target from $7 to $9. Northland Capital Markets analyst Michael Latimore maintained an Outperform rating. Gorilla Technology shares fell 2.7% to close at $4.38 on Tuesday. See how other analysts view this stock.

- TD Cowen cut Textron Inc. TXT price target from $103 to $95. TD Cowen analyst Cai Rumohr downgraded the stock from Buy to Hold. Textron shares fell 0.2% to close at $86.68 on Tuesday. See how other analysts view this stock.

- HC Wainwright & Co raised Wave Life Sciences Ltd. WVE price target from $15 to $22. HC Wainwright & Co. analyst Andrew Fein maintained a Buy rating. Wave Life Sciences shares gained 53.4% to close at $8.19 on Tuesday. See how other analysts view this stock.

- Baird cut the price target for Foot Locker, Inc. FL from $35 to $27. Baird analyst Jonathan Komp maintained a Neutral rating. Foot Locker gained 0.6% to close at $27.48 on Tuesday. See how other analysts view this stock.

- Needham raised Duolingo, Inc. DUOL price target from $245 to $310. Needham analyst Ryan MacDonald maintained a Buy rating. Duolingo shares fell 0.2% to close at $269.79 on Tuesday. See how other analysts view this stock.

- Evercore ISI Group cut the price target for Union Pacific Corporation UNP from $254 to $247. Evercore ISI Group analyst Jonathan Chappell downgraded the stock from Outperform to In-Line. Union Pacific shares gained 2% to close at $248.96 on Tuesday. See how other analysts view this stock.

- JMP Securities raised Lennar Corporation LEN price target from $170 to $210. JMP Securities analyst Aaron Hecht maintained a Market Outperform rating. Lennar shares fell 0.8% to close at $184.23 on Tuesday. See how other analysts view this stock.

- Keybanc slashed Global Payments Inc. GPN price target from $145 to $135. Keybanc analyst Alex Markgraff maintained an Overweight rating. Global Payments shares fell 6.5% to close at $103.81 on Tuesday. See how other analysts view this stock.

Considering buying GM stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lingerfelt Announces 163,853 Square-Foot Lease at Northlake Distribution Center

RICHMOND, Va., Sept. 24, 2024 /PRNewswire/ — Lingerfelt is pleased to announce the recent signing of a 163,853 square-foot lease expansion with NEFCO Construction Supply, LLC (“NEFCO”) at Northlake Distribution Center – Building C, located at 11800 N Lakeridge Pkwy, Ashland, VA 23005. Jason Hetherington, Brad Lowry, Doug Tice (Richmond, VA) and Mike Puzzo (Hartford, CT) of CBRE represented NEFCO, while Matt Anderson and Harrison McVey of Range Commercial Partners represented Lingerfelt in the transaction.

NEFCO is a family owned and operated construction supply company providing a broad range of products and services to a large variety of professional contractors. With 41 locations throughout the United States, NEFCO provides localized, contractor-centric services including extensive industry expertise, large local inventories, fast dependable job site delivery, turnkey engineering services, and specialty fabrication and assembly of construction materials.

Northlake Distribution Center is a 293,187 square-foot, Class-A industrial warehouse-distribution facility located in the Lakeridge industrial node of Hanover County, with immediate access to I-95 and direct connectivity to the Greater Richmond region’s major distribution arteries. Lingerfelt acquired the building as part of a greater portfolio in March of 2023, immediately executing a capital improvement program that included full roof replacements, asphalt replacements, building painting, and LED retrofits, among other enhancements.

Ron Cipriano, Executive Vice President & COO at NEFCO said, “Since opening our 2nd Distribution Center in Ashland, VA in 2021, we have experienced tremendous organic growth in the Virginia, Maryland and North Carolina construction markets. In order to properly support our partnerships with our dedicated customer base, we were looking to double the size of our Ashland distribution center to stock a deeper and more extensive inventory of SHARP®, TOOLS+ and Safety Products. Lingerfelt provided us the perfect opportunity to grow into the adjacent spaces at the Northlake facility and we look forward to working with them for years to come.”

Rob Valentine, Principal at Lingerfelt said, “It is a pleasure to be able to expand our relationship with NEFCO at our Northlake facility as a result of the company’s impressive organic growth. We are honored to be in a position to assist NEFCO with their expansion in the Mid-Atlantic and to further extend our relationship.”

About Lingerfelt

Lingerfelt is a results-driven, vertically integrated real estate investment management firm serving the Mid-Atlantic and Southeast United States. Since the 1950’s, Lingerfelt has been a dependable name in real estate and continues to build upon a stellar reputation by sourcing and investing in unique real estate opportunities that provide outsized returns for investors and partners. Lingerfelt, along with its partners, has successfully constructed, acquired, and managed a portfolio of over 25 million square feet of commercial real estate valued at over $3 billion and growing each day. To learn more, visit www.lingerfelt.co.

About NEFCO

NEFCO is a family owned and operated construction supply company providing a broad range of products and services to a large variety of professional contractors. With 41 locations throughout the United States, NEFCO provides localized, contractor-centric services including extensive industry expertise, large local inventories, fast dependable jobsite delivery, turnkey engineering services, and specialty fabrication and assembly of construction materials.

For media inquiries, please contact: Rob Valentine, Principal, Lingerfelt | RValentine@Lingerfelt.co

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lingerfelt-announces-163-853-square-foot-lease-at-northlake-distribution-center-302257466.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lingerfelt-announces-163-853-square-foot-lease-at-northlake-distribution-center-302257466.html

SOURCE Lingerfelt

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

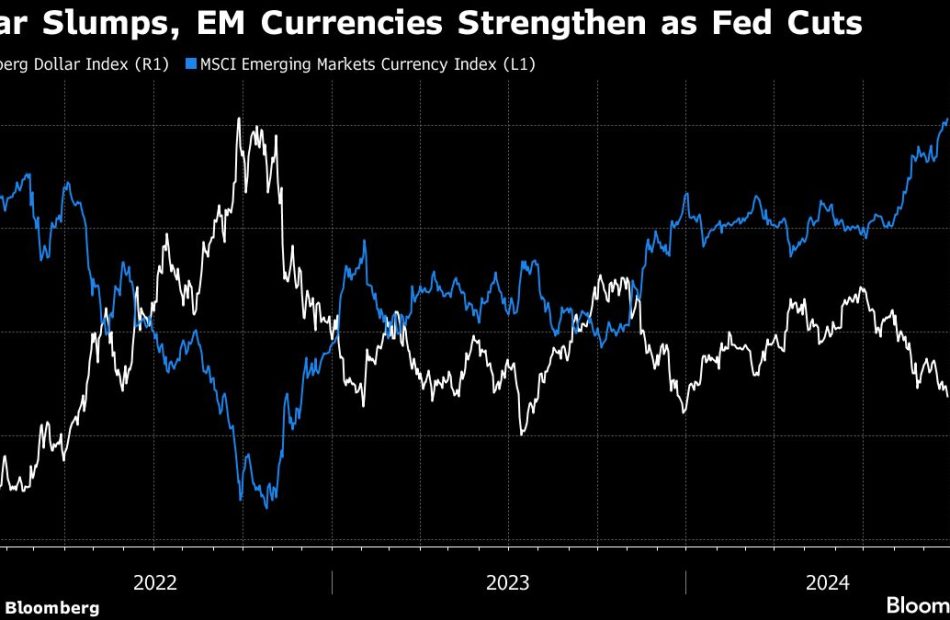

US Futures Drop After S&P 500 Record; SAP Tumbles: Markets Wrap

(Bloomberg) — US stocks declined as investors weigh the Fed’s path of rate cuts and await Micron Technology Inc.’s earnings for details on artificial intelligence demand.

Most Read from Bloomberg

The S&P 500 dropped after struggling for direction earlier. The Nasdaq 100 fluctuated. The 10-year US Treasury yield is around 3.77%. The Bloomberg Dollar Spot Index rose after a 0.5% drop on Tuesday.

Data on Wednesday showed sales of new homes in the US fell last month. A separate set of data show mortgage rates have dropped for eight consecutive weeks, spurring demand for purchasing a home. Investors are parsing this information for clues on the economy and housing market.

“One of the things we’re watching is buyers catching up to the idea that mortgage rates are lower and that the break we’ve recently gotten in mortgage rates might be a lot of what we are expecting to get,” Skylar Olsen, chief economist at Zillow, said on Bloomberg Television. “Mortgage rates are not expected to go too much lower from here because they moved early with that anticipation.”

Traders are still seeking fresh catalysts after last week’s half-point rate cut by the Federal Reserve and as growth concerns linger. Earnings could be that catalyst for some investors — with Micron expected to report after the market close. Financials are also in focus, with earnings from early reporter Jefferies due later.

After China’s latest stimulus failed to ripple beyond Asian markets, investors are also looking to a speech by Fed Chair Jerome Powell and price data at the end of the week.

“Equity investors have been cheered by the Fed’s commitment to supporting economic growth, along with reassurances from Powell that the risk of a US recession remains low at present,” said UBS Group AG’s Solita Marcelli. “But the Fed’s level of success in guiding the US to a soft landing will be important in determining the outlook for other asset classes.”

Gargi Chaudhuri, chief investment and portfolio strategist for the Americas at BlackRock, says the base case is for US growth to gradually slow but stay positive.

“However, a cooling economy is more vulnerable to exogenous shocks, and we look ahead to potential volatility-inducing events, including the US election,” she said.

Earlier, China’s stocks rallied for a sixth day after the central bank lowered the interest rate charged on its one-year policy loans by the most on record. That followed a wide-ranging stimulus package announced the day before.

Iron ore climbed. Gold flirted with another record Wednesday. UBS’s Marcelli sees the precious metal gaining further ground as the Fed eases while the dollar will remain under pressure.

ECB Wagers

In Europe, the region’s darkening economic outlook has fueled bets the European Central Bank will reduce rates again next month, while economists at HSBC Holdings Plc predict policy makers will start cutting interest rates at every meeting between October and April.

“The worry has been that all the economic data is looking quite shaky,” said Anwiti Bahuguna, global asset allocation CIO at Northern Trust Asset Management, where the region’s stocks have been cut to market weight from overweight.

“At the beginning of the year we did think we would see a nice uptick, but it started to slow down way more than any of us anticipated,” she told Bloomberg TV.

Meanwhile, the Czech Republic cut interest rates to the lowest level in nearly three years as inflationary risks in the European Union nation fade and the outlook for economic growth worsens.

Key events this week:

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, durable goods, revised GDP, Thursday

-

Fed Chair Jerome Powell gives pre-recorded remarks to the 10th annual US Treasury Market Conference, Thursday

-

China industrial profits, Friday

-

Eurozone consumer confidence, Friday

-

US PCE, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.2% as of 1 p.m. New York time

-

The Nasdaq 100 was little changed

-

The Dow Jones Industrial Average fell 0.6%

-

The MSCI World Index fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.5%

-

The euro fell 0.4% to $1.1134

-

The British pound fell 0.6% to $1.3332

-

The Japanese yen fell 0.9% to 144.53 per dollar

Cryptocurrencies

-

Bitcoin fell 1.1% to $63,501.69

-

Ether fell 1.9% to $2,600.6

Bonds

-

The yield on 10-year Treasuries advanced four basis points to 3.77%

-

Germany’s 10-year yield advanced three basis points to 2.18%

-

Britain’s 10-year yield advanced five basis points to 3.99%

Commodities

-

West Texas Intermediate crude fell 2.6% to $69.71 a barrel

-

Spot gold fell 0.1% to $2,653.79 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu, Sujata Rao, John Viljoen, Margaryta Kirakosian, Alex Nicholson and Cristin Flanagan.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Experts Slam Trump's 200% Tariff Threat To John Deere: 'You'll Find No Serious, Respected Trade Economists Thinking That This Is A Good Idea'

Ahead of the 2024 presidential election, former President Donald Trump has made headlines with his latest trade policy proposal, promising a hefty tariff on John Deere DE for moving production to Mexico.

What Happened: Several trade economists have criticized this move by the former President, Business Insider reported on Wednesday.

Jonathan W. Coppess, director of the agriculture policy program at the University of Illinois Urbana-Champaign, said that John Deere is a significant manufacturer, and relocating jobs has serious consequences. However, Coppess believes Trump’s solution may not be effective.

Ian Sheldon, a professor at Ohio State University, stated, “You’ll find no serious, respected trade economists thinking that this is a good idea.”

He described the tariff as “huge” and potentially prohibitive, suggesting it could severely restrict imports of John Deere products.

Gary Hufbauer, a senior fellow at the Peterson Institute for International Economics, shared similar concerns about the proposed tariff’s impact.

Why It Matters: Billionaire entrepreneur Mark Cuban criticized Trump’s threat to impose a 200% tariff on John Deere, calling it a “good way to destroy a legendary American company.” Cuban’s remarks came in response to Trump’s comments made at a policy roundtable in Smithton, Pennsylvania. Trump warned John Deere of a 200% tariff if they proceed with plans to shift some production to Mexico.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amesite Reports Its NurseMagic App Is Ramping Up Users As Social Media Attention Goes Viral, Company Inks More Health Professional Business Deals

Many nurses and caregivers are stressed out and overworked, leading to high turnover and big shortages. This is of particular concern in the home healthcare arena, where more than 1 in 4 nurses plan to leave the profession by 2027. The ones who stay need more support, and thousands are finding it with Amesite’s AMST NurseMagic™, a proprietary AI app designed for nurses.

Image source: Amesite

The app is capable of quickly creating nursing notes, a requirement for professionals ranging from CNAs and LPNs to APRN-CNPs and NPs and a daily shift task which Amesite says takes up 40% of nurses’ time. Caregivers can also use the app to explain medical procedures in easy-to-understand language, create work emails, give guidance on patient and family communication, provide coaching on taking wellness breaks during the day, provide key information about medications and more.

Fast Growing Usership And Five-Star Reviews

NurseMagic | AI Tools for Nurses leverages Amesite’s cloud infrastructure and expertise in AI integrations and AI-powered features. Amesite entered the market with its Amesite Engage platform and reports that it has accelerated customer acquisition after streamlining its infrastructure to deliver systems at very low incremental cost. Now Amesite reports that it is signing with community colleges across the country that are tapping Amesite to train the workers of tomorrow. The company reports being encouraged by its no-setup-fee model, which was followed by the signing seven new community college deals across the U.S.

With that experience, it was only natural that Amesite would pivot into healthcare. After all, there are more than five million nurses and an additional 3.9 million home health workers in the country, and surveys support the strong need for more support among nurses and healthcare professionals.

Within eight weeks of its beta stage debut, NurseMagic witnessed triple-digit monthly growth driven in part by its presence on social media. Amesite has engaged with prominent influencers including Paige Slayton, Nurse Cynesse, Nurse Tara and Nurse Hailey. Combined, that gives Amesite access to over three million followers. The engagement with Nurse Hailey alone was responsible for a 27% increase in users. From June to July the app has seen 830% growth in registered users.

NurseMagic also recently debuted in the Apple App Store, charting at #33 in the medical category after only four weeks in the store and garnering five-star reviews. The app is now being used by nurses and healthcare professionals in all 50 states and six countries.

“The 27% increase in users following the most recent social post demonstrates both the incredible impact of influencers voicing the capabilities of NurseMagic and the power of the app itself,” said Madison Bush, Corporate Operations and Marketing Manager at Amesite. “Charting for the first time after only a few weeks in the App Store is incredibly exciting and validates the utility of NurseMagic as a mobile tool for a wide variety of healthcare professionals.”

Amesite says a big driver of user engagement is the accuracy and speed of the app. The company reports that it relies on qualified data sources that have proven to be accurate and reliable. It uses this data to train its more than 20 proprietary AI models to ensure performance – and adds an average of five new features per week. At last check, Amesite indicated it has integrated more than 100 APIs into its company tech stack, including connections to government databases, authentication services, payment gateways and AI-powered tools. The app’s models have also demonstrated 93% accuracy when tested against NCLEX test questions. The NCLEX exam is a standardized exam developed by the National Council of State Boards of Nursing (NCSBN) that nursing graduates must pass to obtain their nursing licenses in the United States and Canada. Amesite reports feedback from customers has “been extremely positive.”

15X ROI For Enterprise NurseMagic Customers

It’s not just individual nurses that are interested in NurseMagic. A variety of healthcare professionals are using NurseMagic, with Amesite recently announcing the launch of pilot programs in five home health agencies and skilled nursing facilities across the United States. Amesite said that collectively, these companies and their franchisees have over 30,000 employees providing skilled nursing, hospice care and home healthcare. The latter is a large and growing sector in need of support. Home healthcare is valued at $100 billion today and is projected to grow to $176 billion by 2032. It’s also an area that is seeing job growth of about 21% per year through 2032, presenting a lucrative opportunity for Amesite.

The company estimates that its customers will achieve a whopping 15X ROI with its product, based on the expected increase in efficiency of workers using the app and expected pricing. “We anticipate very significant quarter-to-quarter revenue increases with NurseMagic,” said Amesite founder and CEO Dr. Ann Marie Sastry. “For less than 2% of the cost of wages, our technology can make this entire workforce at least 30% more productive, while simultaneously improving the quality of patient care. Because of the efficiency of our systems, we believe that we can do so at highly attractive margins that enable sustained growth.” As of May 10, 2024, the company reported it had $3 million of cash in hand and 10 months of burn on hand, even assuming no new revenue, reflecting its liquidity position.

The company is bullish on building revenue through its B2B and B2C NurseMagic products, while simultaneously continuing to offer its higher education platform at low incremental cost. The company reported a reduction in SG&A of nearly 50% YOY from FY22 to FY24 and expects to continue finding efficiencies.

Nurses are in demand as acute turnover continues to concern the industry, and many of them are in need of some support – and NurseMagic offers that support. It seeks to tap an unmet need and help meet it with an assist from AI. To learn more about the app and Amesite, click here.

Featured photo by PeopleImages.com – Yuri A on Shutterstock.

This post contains sponsored content. This content is for informational purposes only and not intended to be investing advice.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AGF Management Limited Reports Third Quarter 2024 Financial Results

TORONTO, Sept. 25, 2024 (GLOBE NEWSWIRE) —

- Reported quarterly adjusted diluted earnings per share of $0.37

- Total assets under management and fee-earning assets of $49.7 billion

- Declared quarterly dividend per share of 11.5 cents

AGF Management Limited (AGF or the Company) AGF today announced financial results for the third quarter ended August 31, 2024.

AGF reported total assets under management and fee-earning assets1 of $49.7 billion compared to $47.8 billion as at May 31, 2024 and $42.3 billion as at August 31, 2023.

“Amid an uncertain economic backdrop and significant market volatility, we are pleased to see early signs of improvement with positive retail net flows complementing our solid investment performance,” said Kevin McCreadie, Chief Executive Officer and Chief Investment Officer, AGF. “This improvement can be attributed to our long-term strategic plan which diversifies our business across asset classes and client channels ensuring we thrive through changing market cycles.”

AGF’s mutual fund gross sales were $1,012 million for the quarter compared to $934 million in the previous quarter and $633 million in the prior year quarter. Mutual fund net sales were $14 million compared to net redemptions of $112 million in the previous quarter and net redemptions of $151 million in the prior year quarter.

“Given the current market environment and industry trends, we are pleased with the trajectory of our sales strategy,” said Judy Goldring, President and Head of Global Distribution, AGF. “Heading into the final months of 2024, we remain focused on diversifying our capabilities and offerings through a vehicle agnostic approach that meets the evolving needs of our clients.”

_________________

1 Fee-earning assets represents assets in which AGF has carried interest ownership and earns recurring fees but does not have ownership interest in the managers

Key Business and Financial Highlights:

- AGF International Advisors Company Limited, a subsidiary of AGF, was once again accepted as a signatory to the UK Stewardship Code, a best-practice benchmark in investment stewardship.

- AGF Management Limited partnered with Archer Holdco, LLC – a leading technology-enabled service provider to the investment management industry – to help further grow its Separately Managed Accounts (SMA) model business through additional product offerings and investment strategies.

- AGF SAF Private Credit LP was named a Top Contender for a 2024 Canadian Hedge Fund Award Fund.

- Adjusted EBITDA2 for the three months ended August 31, 2024, was $40.2 million, compared to $37.0 million for the three months ended May 31, 2024 and $33.7 million in the prior year comparative period.

- Net management, advisory and administration fees2 were $78.7 million for the three months ended August 31, 2024, compared to $81.2 million for the three months ended May 31, 2024 and $73.8 million for the comparative prior year period.

- Adjusted revenue from AGF Capital Partners for the three months ended August 31, 2024, was $18.5 million, compared to $12.0 million for the three months ended May 31, 2024 and $7.3 million for the comparative prior year period. The increase quarter over quarter and year over year were driven by higher fair value adjustments and distribution income and the consolidation of a full quarter of KCPL financial results. Revenue from AGF Capital Partners can be variable quarter to quarter and can be impacted by fair value adjustments, timing of monetizations and cash distributions as well as performance fees and carried interest.

- Adjusted selling, general and administrative costs2 were $59.6 million for the three months ended August 31, 2024, compared to $60.0 million for the three months ended May 31, 2024 and $50.3 million for the comparative prior year period.

- Adjusted net income attributable to equity owners was $24.5 million ($0.37 adjusted diluted EPS) for the three months ended August 31, 2024, compared to $23.6 million ($0.35 adjusted diluted EPS) for the three months ended May 31, 2024 and $22.9 million ($0.34 adjusted diluted EPS) for the comparative prior year period.

| Three months ended | Nine months ended | |||||||||||||||

| August 31, | May 31, | August 31, | August 31, | August 31, | ||||||||||||

| (in millions of Canadian dollars, except per share data) | 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||

| Revenues | ||||||||||||||||

| Management, advisory and administration fees | $ | 114.4 | $ | 116.4 | $ | 107.4 | $ | 339.4 | $ | 324.0 | ||||||

| Trailing commissions and investment advisory fees | (35.7 | ) | (35.2 | ) | (33.6 | ) | (104.6 | ) | (101.5 | ) | ||||||

| Net management, advisory and administration fees2 | $ | 78.7 | $ | 81.2 | $ | 73.8 | $ | 234.8 | $ | 222.5 | ||||||

| Deferred sales charges | 1.4 | 1.9 | 1.8 | 5.3 | 5.7 | |||||||||||

| Adjusted revenue from AGF Capital Partners2 | 18.5 | 12.0 | 7.3 | 54.7 | 29.4 | |||||||||||

| Other revenue2 | 1.2 | 1.9 | 1.1 | 5.1 | 2.4 | |||||||||||

| Total adjusted net revenue2 | 99.8 | 97.0 | 84.0 | 299.9 | 260.0 | |||||||||||

| Selling, general and administrative | 66.3 | 68.2 | 50.2 | 192.3 | 156.2 | |||||||||||

| Adjusted selling, general and administrative2 | 59.6 | 60.0 | 50.3 | 173.1 | 155.0 | |||||||||||

| EBITDA2 | 33.0 | 26.6 | 33.8 | 104.8 | 103.8 | |||||||||||

| Adjusted EBITDA2 | 40.2 | 37.0 | 33.7 | 126.8 | 105.0 | |||||||||||

| Net income – equity owners of the Company | 20.3 | 18.1 | 23.0 | 68.9 | 70.9 | |||||||||||

| Adjusted net income – equity owners of the Company | 24.5 | 23.6 | 22.9 | 81.8 | 71.9 | |||||||||||

| Diluted earnings per share | 0.30 | 0.27 | 0.34 | 1.03 | 1.05 | |||||||||||

| Adjusted diluted earnings per share | 0.37 | 0.35 | 0.34 | 1.23 | 1.07 | |||||||||||

| Free cash flow2 | 29.1 | 23.7 | 22.9 | 73.9 | 62.8 | |||||||||||

| Dividends per share | 0.115 | 0.115 | 0.110 | 0.340 | 0.320 | |||||||||||

| (end of period) | Three months ended | |||||||||||||||

| Aug. 31, | May 31, | Feb. 28, | Nov. 30, | Aug. 31, | ||||||||||||

| (in millions of Canadian dollars) | 2024 | 2024 | 2024 | 2023 | 2023 | |||||||||||

| Mutual fund assets under management (AUM)3 | $ | 28,104 | $ | 26,961 | $ | 26,186 | $ | 24,459 | $ | 24,377 | ||||||

| ETFs and SMA AUM | 2,128 | 1,800 | 1,676 | 1,465 | 1,332 | |||||||||||

| Segregated accounts and sub-advisory AUM | 6,430 | 6,313 | 7,162 | 6,774 | 7,058 | |||||||||||

| Total AGF Investments AUM | 36,662 | 35,074 | 35,024 | 32,698 | 32,767 | |||||||||||

| AGF Private Wealth AUM | 8,186 | 8,026 | 7,836 | 7,341 | 7,360 | |||||||||||

| AGF Capital Partners AUM | 2,774 | 2,663 | 48 | 46 | 42 | |||||||||||

| Total AUM | $ | 47,622 | $ | 45,763 | $ | 42,908 | $ | 40,085 | $ | 40,169 | ||||||

| AGF Capital Partners fee-earning assets4 | 2,080 | 2,081 | 2,104 | 2,095 | 2,090 | |||||||||||

| Total AUM and fee-earning assets4 | $ | 49,702 | $ | 47,844 | $ | 45,012 | $ | 42,180 | $ | 42,259 | ||||||

| Net mutual fund sales (redemptions)3 | 14 | (112 | ) | (125 | ) | (224 | ) | (151 | ) | |||||||

| Average daily mutual fund AUM3 | 27,542 | 26,604 | 25,197 | 23,840 | 24,168 | |||||||||||

2 Net management, advisory and administration fees, adjusted revenue from AGF Capital Partners, total net revenue, adjusted selling, general and administrative, EBITDA, adjusted EBITDA, and free cash flow are not standardized measures prescribed by IFRS. The Company utilizes non-IFRS measures to assess our overall performance and facilitate a comparison of quarterly and full-year results from period to period. They allow us to assess our investment management business without the impact of non-operational items. These non-IFRS measures may not be comparable with similar measures presented by other companies. These non-IFRS measures and reconciliations to IFRS, where necessary, are included in the Management’s Discussion and Analysis available at www.agf.com.

3 Mutual fund AUM includes retail AUM and institutional client AUM invested in customized series offered within mutual funds.

4 Fee-earning assets represents assets in which AGF has carried interest ownership and earns recurring fees but does not have ownership interest in the managers.

For further information and detailed financial statements for the third quarter ended August 31, 2024, including Management’s Discussion and Analysis, which contains discussions of non-IFRS measures, please refer to AGF’s website at www.agf.com under ‘About AGF’ and ‘Investor Relations’ and at www.sedarplus.com.

Conference Call

AGF will host a conference call to review its earnings results today at 11 a.m. ET.

The live audio webcast with supporting materials will be available in the Investor Relations section of AGF’s website at www.agf.com or at https://edge.media-server.com/mmc/p/fwjgan3c/. Alternatively, the call can be accessed over the phone by registering here or in the Investor Relations section of AGF’s website at www.agf.com, to receive the dial-in numbers and unique PIN.

A complete archive of this discussion along with supporting materials will be available at the same webcast address within 24 hours of the end of the conference call.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. With nearly $50 billion in total assets under management and fee-earning assets, AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

AGF Management Limited shareholders, analysts and media, please contact:

Ken Tsang

Chief Financial Officer

416-865-4338, InvestorRelations@agf.com

Caution Regarding Forward-Looking Statements

This press release includes forward-looking statements about the Company, including its business operations, strategy and expected financial performance and condition. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as ‘expects,’ ‘estimates,’ ‘anticipates,’ ‘intends,’ ‘plans,’ ‘believes’ or negative versions thereof and similar expressions, or future or conditional verbs such as ‘may,’ ‘will,’ ‘should,’ ‘would’ and ‘could.’ In addition, any statement that may be made concerning future financial performance (including income, revenues, earnings or growth rates), ongoing business strategies or prospects, fund performance, and possible future action on our part, is also a forward-looking statement. Forward-looking statements are based on certain factors and assumptions, including expected growth, results of operations, business prospects, business performance and opportunities. While we consider these factors and assumptions to be reasonable based on information currently available, they may prove to be incorrect. Forward-looking statements are based on current expectations and projections about future events and are inherently subject to, among other things, risks, uncertainties and assumptions about our operations, economic factors and the financial services industry generally. They are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied by forward-looking statements made by us due to, but not limited to, important risk factors such as level of assets under our management, volume of sales and redemptions of our investment products, performance of our investment funds and of our investment managers and advisors, client-driven asset allocation decisions, pipeline, competitive fee levels for investment management products and administration, and competitive dealer compensation levels and cost efficiency in our investment management operations, as well as general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition, taxation, changes in government regulations, unexpected judicial or regulatory proceedings, technological changes, cybersecurity, the possible effects of war or terrorist activities, outbreaks of disease or illness that affect local, national or international economies, natural disasters and disruptions to public infrastructure, such as transportation, communications, power or water supply or other catastrophic events, and our ability to complete strategic transactions and integrate acquisitions, and attract and retain key personnel. We caution that the foregoing list is not exhaustive. The reader is cautioned to consider these and other factors carefully and not place undue reliance on forward-looking statements. Other than specifically required by applicable laws, we are under no obligation (and expressly disclaim any such obligation) to update or alter the forward-looking statements, whether as a result of new information, future events or otherwise. For a more complete discussion of the risk factors that may impact actual results, please refer to the ‘Risk Factors and Management of Risk’ section of the 2023 Annual MD&A.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Starbucks Is Serving Classy Afternoon Tea In Tokyo And Its Not A Cheap Affair

In a move to attract tea enthusiasts, Starbucks Corp SBUX has unveiled a new afternoon tea set at its Reserve Roastery in Tokyo.

What Happened: The new offering, known as the Roastery Pasticcini Flight, will be available from Oct. 1-31. It includes three new autumn-themed pastries and a variety of teas. Priced at 6,050 yen ($41.94), the set is served in 90-minute slots at 1, 3, and 5 p.m. daily.

The pastries featured in the set are Mele, Rum Raisin Fromage, and Vignolata, each providing distinct flavors and textures. Tea options include Kagabo Hojicha, Spice Apple Cider, Citrus Lavender Sage, and Rwandan Black Tea.

Due to the high demand for Starbucks’ previous afternoon tea set in 2021, which sold out quickly, advance reservations are recommended.

See Also: Warren Buffett Moves: Berkshire Hathaway Reduces Bank Of America Holdings By $863M

Why It Matters: This new offering comes at a time when Starbucks is undergoing significant changes in its leadership and strategy. Recently, Michael Conway, the North American CEO, resigned after just six months in the role. His departure marks the end of his 11-year tenure at the company.

Additionally, Brian Niccol, the new CEO, has outlined a vision to reconnect Starbucks with its community coffeehouse roots. He aims to enhance the in-store experience by emphasizing comfortable seating and distinguishing between “to-go” and “for-here” services.

However, Niccol’s tenure has not been without controversy. His decision to commute between his California home and the Seattle headquarters using a company jet has sparked environmental concerns.

Moreover, Starbucks’ operator in Malaysia, Berjaya Food Bhd., recently reported a significant loss due to anti-Israel boycotts, highlighting the various challenges the company faces globally.

Read Next:

Image Via Pixabay

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Synchrony to Announce Third Quarter 2024 Financial Results on October 16, 2024

STAMFORD, Conn., Sept. 25, 2024 /PRNewswire/ — Synchrony SYF plans to report its third quarter 2024 results on Wednesday, October 16, 2024. The earnings release and presentation materials are scheduled to be released and posted to the Investor Relations section of the Company’s website, www.investors.synchrony.com, at approximately 6:00 a.m. Eastern Time. A conference call to discuss Synchrony’s results will be held at 8:00 a.m. Eastern Time on that day; the live audio webcast and replay can be accessed through the same website under Events and Presentations.

About Synchrony

Synchrony SYF is a premier consumer financial services company delivering one of the industry’s most complete digitally-enabled product suites. Our experience, expertise and scale encompass a broad spectrum of industries including digital, health and wellness, retail, telecommunications, home, auto, outdoor, pet and more. We have an established and diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which we refer to as our “partners.” We connect our partners and consumers through our dynamic financial ecosystem and provide them with a diverse set of financing solutions and innovative digital capabilities to address their specific needs and deliver seamless, omnichannel experiences. We offer the right financing products to the right customers in their channel of choice. For more information, visit www.synchrony.com

Contacts

Investor Relations:

Kathryn Miller

(203) 585-6291

kathryn.miller@syf.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/synchrony-to-announce-third-quarter-2024-financial-results-on-october-16-2024-302257844.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/synchrony-to-announce-third-quarter-2024-financial-results-on-october-16-2024-302257844.html

SOURCE Synchrony

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Uber Teams With WeRide For UAE Robotaxi Rollout: Details

Uber Technologies, Inc. UBER shares are trading marginally higher on Wednesday in the premarket session.

Today, the company has finalized a partnership with WeRide, an autonomous driving technology firm, to integrate WeRide’s self-driving vehicles into the Uber platform, starting in the United Arab Emirates.

The partnership is gearing up for an exciting launch in Abu Dhabi later this year, featuring a fleet of WeRide’s autonomous vehicles ready to roll through the Uber app. WeRide currently operates the largest robotaxi fleet in the UAE, where residents can access its robotaxi services through the TXAI app.

However, this bold venture won’t be expanding to the U.S. or China.

Additionally, in July 2023, WeRide received the UAE’s first and only national license for self-driving vehicles, which permits the testing and operation of its autonomous vehicles on public roads throughout the country.

Earlier this month, Uber inked a multi-year delivery partnership with Darden Restaurants, Inc., set to begin with Olive Garden in late 2024.

The agreement will enable restaurant guests to order on-demand delivery via Darden restaurant channels, with delivery handled by Uber Direct, through Uber’s national delivery network.

According to Benzinga Pro, UBER stock has gained over 72% in the past year. Investors can gain exposure to the stock via iShares Trust iShares U.S. Transportation ETF IYT and Franklin Disruptive Commerce ETF BUYZ.

Price Action: UBER shares are trading higher by 0.59% to $77.90 premarket at last check Wednesday.

Photo by Daniel Fung on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.