1 No-Brainer Oil Stock to Buy Right Now for Less Than $500

Warren Buffett knows a thing or two about oil stocks. And while his track record hasn’t been perfect, betting alongside one of the best investors of all time is a wise strategy for making money over the long term.

Lately, Buffett has been loading up on one oil stock in particular. Last quarter, he increased his position in it by more than 7 million shares. So if you’re on the hunt for oil stocks with attractive long-term upside, this one is worth considering.

Why does Buffett love this oil company?

As of its most recent filings, Berkshire Hathaway, the conglomerate Buffett runs, owns roughly $16 billion worth of Occidental Petroleum (NYSE: OXY) stock. It’s the sixth-largest position in Berkshire’s equity portfolio.

Buffett first opened a position in Occidental back in 2022, and since then, he has steadily added to it. And while he has denied any interest in buying out the company outright, Berkshire Hathaway did receive regulatory permission to acquire up to 50% of its shares. Its current stake hovers just below 30%, though it holds warrants that could boost that stake.

What does Buffett like so much about Occidental? We don’t have to wonder. After he first bought shares of the company, Buffett revealed in an interview what he found so attractive about the business. After reading the company’s annual report, he was hooked.

“I read every word, and said this is exactly what I would be doing,” he said during a CNBC interview, adding that Occidental Chief Executive Officer Vicki Hollub appears to be “running the company the right way.”

None of this should be surprising. Buffett has long espoused the importance of good management. Especially in resource extraction, where capital allocation and efficiency are paramount, a skilled leadership team that takes a long-term approach goes a long way. Occidental, for instance, has an average breakeven production point for oil of less than $60 per barrel. That compares favorably to prevailing oil prices of about $70 per barrel. It also benefits from chemicals and midstream businesses that generate free cash flows under a variety of market conditions.

As a result, Occidental has the flexibility to allocate capital to wherever it is most productive. In recent years, it has made multibillion-dollar acquisitions, repurchased billions of dollars worth of its stock, and distributed a healthy dividend that at current share prices yields about 1.7%.

But there’s another reason Buffett is likely drawn to this business — the upside it can enjoy if oil prices rise.

Don’t invest in Occidental if you’re not bullish on oil

At the end of the day, no matter how well Occidental is run, the company’s results will still depend heavily on what happens to oil prices over the long term. The company recently raised $9.1 billion in new debt to acquire oil and natural gas producer CrownRock, a deal that greatly expanded Occidental’s production profile, but also added properties with production decline rates of 30% or more. For the acquisition to make sense, oil prices will need to stay at or above their current levels. If oil prices decline, the value of the acquisition — as well as the rest of Occidental’s portfolio — will suffer.

The good news, however, is that investors are likely to profit if oil prices improve. For every $1 per barrel that crude oil prices rise, for instance, Occidental management predicts that its annualized cash flow would increase by as much as $260 million. That means a $4 per barrel increase in oil prices could result in more than $1 billion in additional cash flow — an impressive feat considering that its free cash flow during the past 12 months totaled just $6 billion.

Buffett can talk about management, strategy, and capital allocation all he wants, but there’s likely only one reason he’s invested in Occidental stock: He’s bullish on the long-term direction of oil prices, and Occidental has the operating leverage necessary to benefit in that environment while maintaining a balance sheet that can survive weaker conditions, at least for a time. If you’re an oil bull, $500 will get you almost 10 shares and you’ll be alongside Buffett in betting on Occidental.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

1 No-Brainer Oil Stock to Buy Right Now for Less Than $500 was originally published by The Motley Fool

Huawei, Riding High On Trifold Success, Launches Revolutionary Laptop Powered By Homegrown Chips, Software — China Ready To Break Free From US Tech Dependence?

The Qingyun L540 laptop, a product of Huawei Technologies, is a testament to China’s progress towards technological self-sufficiency, featuring a self-designed processor and a Chinese-made operating system.

What Happened: The Qingyun L540 laptop is a prime example of China’s push for tech independence. The laptop, which is being widely adopted by government and state groups, is a part of China’s localization campaign, Xinchuang, reported Financial Times.

China’s quest for a domestic tech supply chain has been a long-standing goal, with a particular focus on semiconductors. The embargoes on high-tech goods by Washington have further motivated Beijing to intensify its efforts.

Since March, central agencies have transitioned from exclusively purchasing laptops running on Intel and AMD processors to acquiring three-quarters of their devices with chips from Chinese companies.

This includes companies like Huawei, Shanghai Zhaoxin, and Phytium, the report noted.

The Qingyun L540 laptop also runs on the Chinese-made Unity Operating System, based on Linux, and all of its applications are made in China.

However, the laptop still relies on some foreign technology, indicating the challenges that lie ahead for China’s tech independence campaign.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: The push for tech autonomy in China has been a response to the U.S. restrictions on semiconductor exports to China.

In May this year, the Chinese government announced a $47.5 billion public fund aimed at fueling the country’s self-reliance in manufacturing advanced chips.

Earlier, Chinese President Xi Jinping also urged for increased R&D in semiconductors, machine tools, and foundational software, stating that they form the “technological backbone for independent, secure and controllable supply chains.”

Earlier this month, an analysis of China’s semiconductor technology shows it is just three years behind Taiwan Semiconductor Mfg. Co. Ltd.

In the first half of 2024, China invested $25 billion in chipmaking equipment, surpassing the combined spending of South Korea, Taiwan, and the U.S.

Meanwhile, Huawei has received much praise for launching the world’s first tri-fold smartphone, the Mate XT.

Although the smartphone is expensive at the price range of $2,800 to $3,371, it has been giving tough competition to Apple in China.

Image via Shutterstock

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street's Most Accurate Analysts Give Their Take On 3 Materials Stocks With Over 4% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the materials sector.

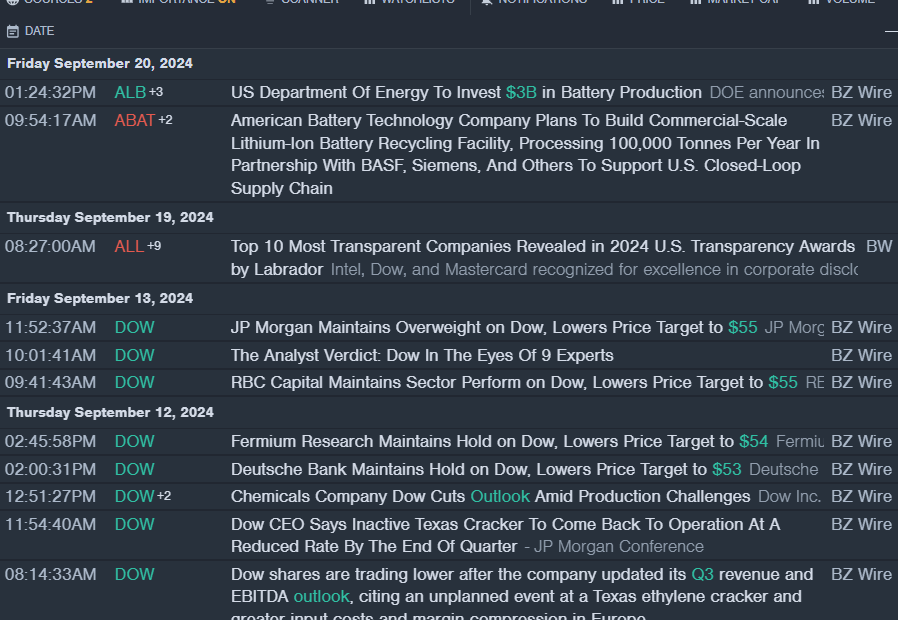

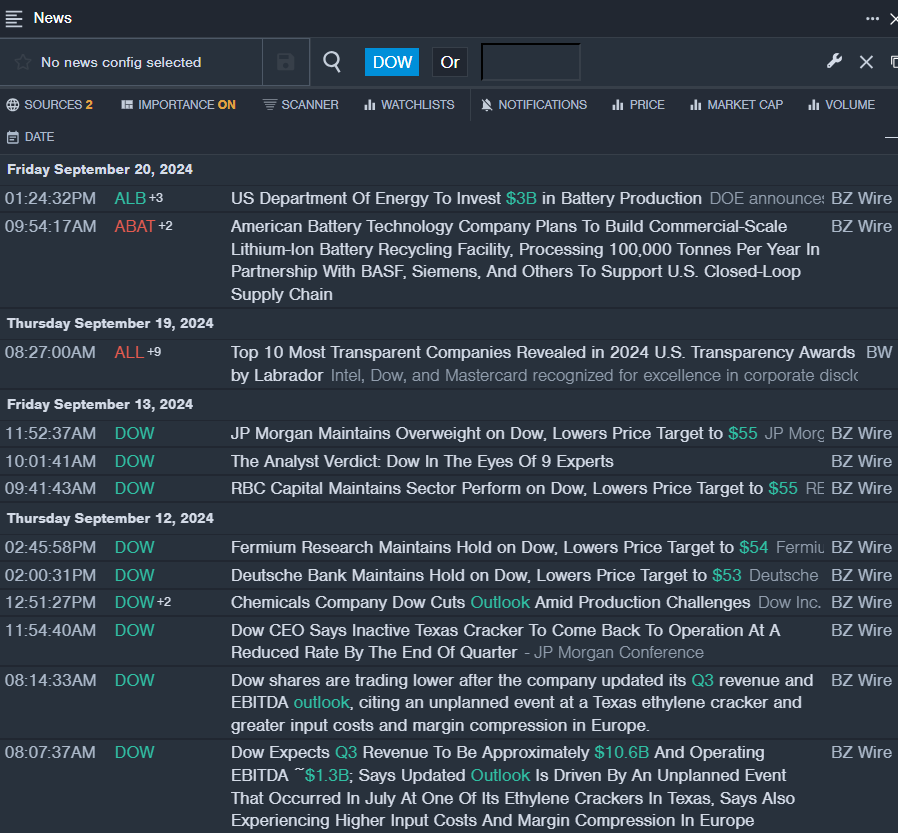

Dow Inc. DOW

- Dividend Yield: 5.24%

- JP Morgan analyst Jeffrey Zekauskas maintained an Overweight rating and cut the price target from $60 to $55 on Sept. 13. This analyst has an accuracy rate of 70%.

- Fermium Research analyst Frank Mitsch maintained a Hold rating and lowered the price target from $60 to $54 on Sept. 12. This analyst has an accuracy rate of 70%.

- Recent News: On Sept. 12, Dow updated its third-quarter revenue and EBITDA outlook, citing an unplanned event at a Texas ethylene cracker and greater input costs and margin compression in Europe..

- Benzinga Pro’s real-time newsfeed alerted to latest Dow news.

The Chemours Company CC

- Dividend Yield: 5.12%

- JP Morgan analyst Jeffrey Zekauskas maintained a Neutral rating and lowered the price target from $25 to $18 on Aug. 6. This analyst has an accuracy rate of 70%.

- Mizuho analyst John Roberts initiated coverage on the stock with a Neutral rating and a price target of $25 on June 7. This analyst has an accuracy rate of 79%.

- Recent News: On Aug. 1, Chemours reported mixed second-quarter financial results and issued weak third-quarter net sales guidance.

- Benzinga Pro’s charting tool helped identify the trend in CC stock.

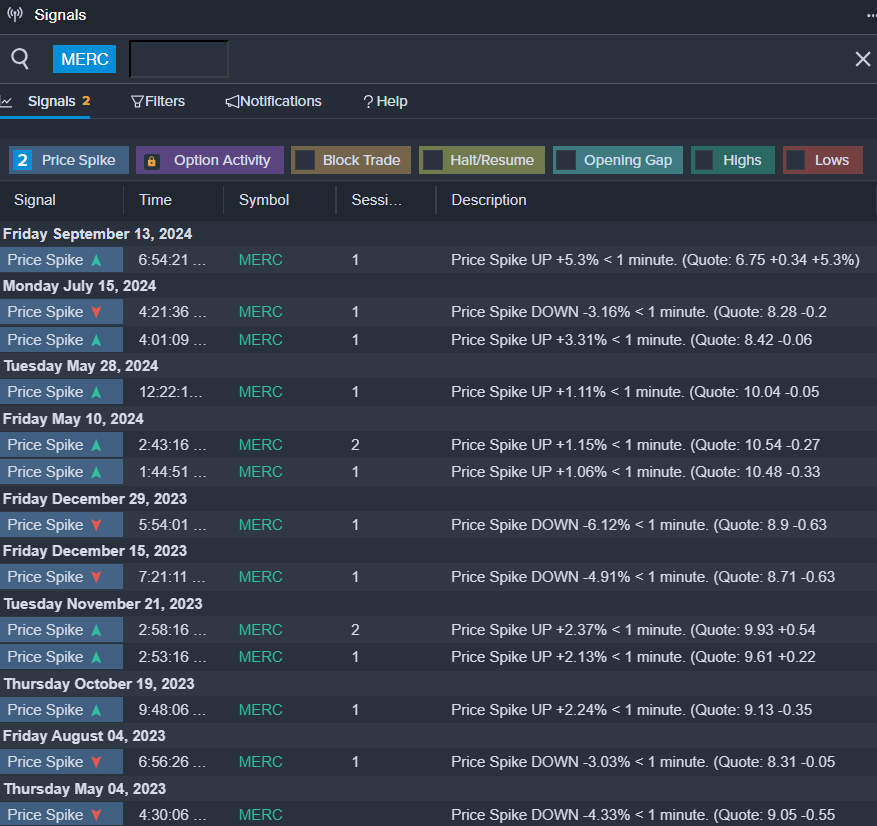

Mercer International Inc. MERC

- Dividend Yield: 4.68%

- CIBC analyst Hamir Patel maintained a Neutral rating and cut the price target from $10 to $8.5 on Aug. 13. This analyst has an accuracy rate of 60%.

- RBC Capital analyst Matthew McKellar maintained a Sector Perform rating and lowered the price target from $10 to $8 on Aug. 12. This analyst has an accuracy rate of 72%.

- Recent News: On Aug. 8, Mercer Intl posted upbeat quarterly sales.

- Benzinga Pro’s signals feature notified of a potential breakout in MERC shares.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top 5 Industrials Stocks That May Collapse In Q3

As of Sept. 25, 2024, five stocks in the industrials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

Nuscale Power Corp SMR

- On Sept. 13, CLSA initiated coverage on the stock with an Outperform rating and announced an $11 price target. The company’s stock gained around 32% over the past five days and has a 52-week high of $16.91.

- RSI Value: 72.59

- SMR Price Action: Shares of Nuscale Power gained 9.7% to close at $11.95 on Tuesday.

Babcock & Wilcox Enterprises Inc BW

- On Sept. 5, Babcock & Wilcox secured a contract for waste-to-energy plant in Alberta, focusing on carbon capture. The company’s stock gained around 27% over the past five days and has a 52-week high of $4.56.

- RSI Value: 77.56

- BW Price Action: Shares of Babcock & Wilcox Enterprises rose 8% to close at $1.63 on Tuesday.

LYFT Inc LYFT

- On Sept. 24, Raymond James analyst Josh Beck reinstated Lyft with a Market Perform rating. The company’s stock gained around 13% over the past month and has a 52-week high of $20.82.

- RSI Value: 71.57

- LYFT Price Action: Shares of LYFT rose 4.8% to close at $13.33 on Tuesday.

ZIM Integrated Shipping Services Ltd ZIM

- On Aug. 19, ZIM Integrated Shipping Services reported better-than-expected second-quarter financial results and raised its FY24 guidance. The company’s stock jumped around 22% over the past five days and has a 52-week high is $23.88.

- RSI Value: 74.31

- ZIM Price Action: Shares of ZIM Integrated gained 6% to close at $23.66 on Tuesday.

Caterpillar Inc. CAT

- On Sept. 24, Caterpillar moved higher following the company’s announcement regarding its exhibit at the MINExpo 2024. Jim Umpleby, Chairman and CEO of Caterpillar, talked about the importance of their latest exhibit, which highlights the Cat Dynamic Energy Transfer system, the 798 AC mining truck, R1700 XE load-haul-dump loader, the Cat R1700 XE load-haul-dump, the Cat R2900 XE LHD and the PGS 1260 HD Energy Storage System.. The company’s stock jumped around 9% over the past five days and has a 52-week high of $389.43.

- RSI Value: 78.92

- CAT Price Action: Shares of Caterpillar climbed 4% to close at $385.93 on Tuesday.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

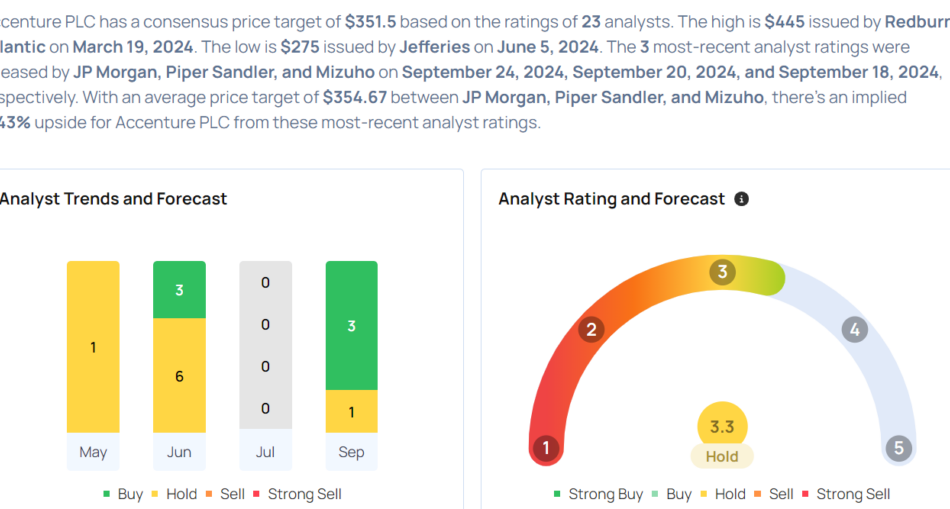

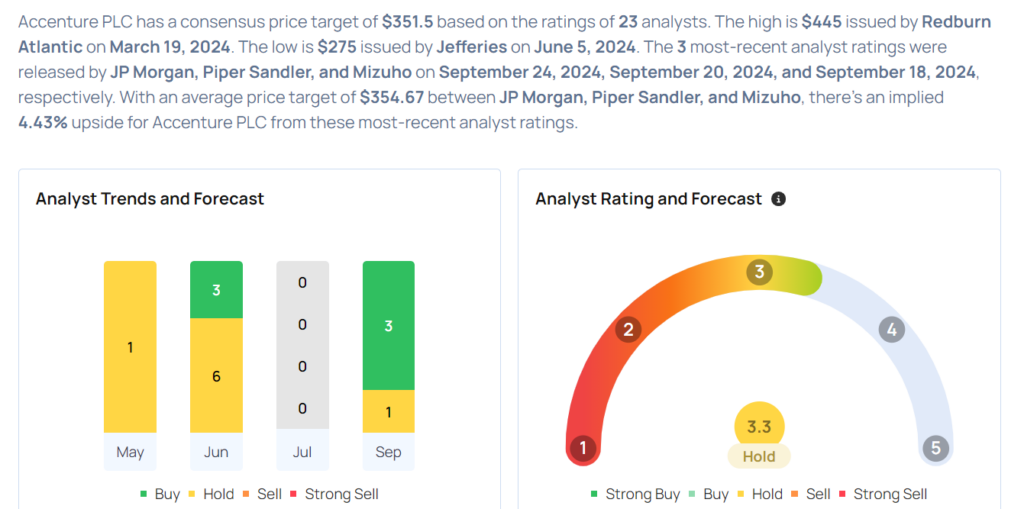

Accenture Gears Up For Q4 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Accenture plc ACN will release earnings results for its fourth quarter, before the opening bell on Thursday, Sept. 26.

Analysts expect the Dublin, Ireland-based company to report quarterly earnings at $2.78 per share, up from $2.71 per share in the year-ago period. Accenture projects to report revenue of $16.38 billion for the quarter, compared to $15.99 billion a year earlier, according to data from Benzinga Pro.

On Sept. 16, Accenture Federal Services won a $190M million U.S. Department of State Data and Systems Engineering contract.

Accenture shares gained 0.1% to close at $339.62 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Tien-Tsin Huang maintained an Overweight rating and cut the price target from $376 to $370 on Sept. 24. This analyst has an accuracy rate of 61%.

- Mizuho analyst Dan Doelev maintained an Outperform rating and boosted the price target from $352 to $365 on Sept. 18. This analyst has an accuracy rate of 63%.

- Citigroup analyst Ashwin Shirvaikar maintained a Buy rating and raised the price target from $350 to $405 on Sept. 17. This analyst has an accuracy rate of 72%.

- TD Cowen analyst Bryan Bergin maintained a Hold rating and raised the price target from $293 to $321 on Sept. 12. This analyst has an accuracy rate of 62%.

- Morgan Stanley analyst James Faucette downgraded the stock from Overweight to Equal-Weight rating and slashed the price target from $382 to $300 on June 26. This analyst has an accuracy rate of 65%.

Considering buying ACN stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chinese Stocks Jump As Central Bank Unveils Major Stimulus To Spur Economy: 'A Step In The Right Direction'

Chinese stocks soared on Tuesday following an unexpected and substantial monetary stimulus from the People’s Bank of China (PBoC).

The central bank announced cuts to the reserve requirement ratio (RRR) for banks and the seven-day repo rate, just a day after lowering the 14-day reverse repo rate.

People’s Bank of China Implements Aggressive Monetary Easing

The PBoC Governor, Pan Gongsheng, revealed a 50-basis-point cut to the bank’s reserve requirement ratio, reducing it from 10.0% to 9.5% for commercial banks.

This cut is set to inject approximately 1 trillion yuan ($140 billion) of liquidity into the banking system, allowing banks more capital to lend.

In addition to the RRR cut, Pan also announced a 0.5 percentage point reduction in existing mortgage rates, offering relief to the struggling property market.

The seven-day repo rate was slashed by 20 basis points to 1.5%, while the 14-day reverse repo rate, already lowered on Monday, saw a 10-basis-point reduction to 1.85%. These moves are seen as a clear signal that Chinese policymakers are increasingly focused on addressing the economic slowdown.

Analysts Praise PBoC’s Moves

“The rare simultaneous cut of policy rates and the RRR, the relatively large magnitude of cuts, and unusual guidance on another 25-50 basis point RRR cut by the end of this year, indicated policymakers’ growing concerns over downside risks to domestic economic activity,” wrote Xinquan Chen, an economist at Goldman Sachs, in a note.

While these monetary measures point to a more proactive stance from the Chinese government, Chen warned that more fiscal stimulus will be required to bolster domestic demand.

Goldman Sachs expects another 25-basis-point RRR cut in the fourth quarter of 2024, along with further reductions in 2025. The bank forecasts two additional 25-basis-point RRR cuts in the first and third quarters of 2025, as well as two 10-basis-point policy rate cuts in the second and fourth quarters.

ING Group commented that markets had initially anticipated smaller 10-basis-point cuts, making the 20-basis-point reduction more aggressive than expected. However, they cautioned that the long-term impact would depend on whether the PBoC continues with more cuts or adopts a “wait-and-see” approach following the current measures.

“We feel today’s measures are a step in the right direction, especially as multiple policies were announced together rather than spaced out piecemeal. We continue to believe that there is room for further easing in the months ahead, as most global central banks are now on a rate-cut trajectory,” ING’s China chief economist Lynn Song said.

Market Reactions: Chinese Stocks, ETFs Rally

The Hang Seng Index jumped 4.13% on Tuesday, closing at 19,000.56 — the highest level since May.

U.S.-listed ETFs investing in Chinese equities also rallied strongly in premarket trading. The iShares MSCI Hong Kong Index Fund EWH was up 2%.

The Chinese yuan appreciated 0.3%, reaching its strongest levels since May.

Major U.S.-listed ETFs focused on China also surged ahead of the market open. The KraneShares CSI China Internet ETF KWEB jumped 5.6%, the iShares China Large-Cap ETF FXI climbed 5.4%, and the iShares MSCI China ETF MCHI rose 5.3%.

Chinese companies listed on U.S. exchanges also saw significant premarket gains.

Chinese EV-maker Li Auto Inc. LI surged 8%, while NIO Inc. NIO gained 7%. JD.com Inc. JD rose 7.1%, and Alibaba Group Holdings Ltd BABA, China’s largest publicly traded company with a market capitalization of $209 billion, climbed 5.4%.

Read now:

Photo: Shan_shan/Shutterstock.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stitch Fix Reports Weak Earnings, Joins KB Home And Other Big Stocks Moving Lower In Wednesday's Pre-Market Session

U.S. stock futures were mixed this morning, with the Dow futures gaining around 0.1% on Wednesday.

Shares of Stitch Fix, Inc. SFIX fell sharply in today’s pre-market trading after the company reported worse-than-expected fourth-quarter EPS results.

Stitch Fix reported quarterly losses of 29 cents per share, which missed the analyst consensus estimate for losses of 19 cents. Quarterly revenue of $319.6 million beat the analyst consensus estimate of $318.5 million and is a 12.4% decrease year-over-year.

Stitch Fix shares dipped 25.6% to $2.79 in pre-market trading.

Here are some big stocks recording losses in today’s pre-market trading session.

- Target Hospitality Corp. TH shares dipped 17.9% to $7.75 in pre-market trading. Target Hospitality Announced that its board of directors has decided to disband the special committee, which was formed solely of independent directors.

- GDS Holdings Limited GDS declined 7.5% to $19.91 in pre-market trading after gaining 5% on Tuesday.

- KB Home KBH shares fell 7.1% to $81.19 in pre-market trading following third-quarter financial results.

- Zai Lab Ltd – ADR ZLAB shares declined 5.2% to $20.45 in pre-market trading.

- Bilibili Inc. BILI shares fell 4.8% to $17.73 in pre-market trading after surging 17% on Tuesday.

- Wave Life Sciences Ltd. WVE shares slipped 4.8% to $7.80 in pre-market trading after the company announced a $175 million proposed public offering of ordinary shares and pre-funded warrants.

- XPeng Inc. XPEV shares declined 4.6% to $10.21 in pre-market trading after jumping 12% on Tuesday.

- JD.com, Inc. JD shares fell 4% to $32.55 in pre-market trading after gaining 14% on Tuesday.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yelloh, formerly known as Schwan's Home Delivery, permanently closing frozen food deliveries

Frozen meal delivery service Yelloh, formerly known as Schwan’s, will be permanently parking its yellow trucks this fall, the company announced Monday.

The frozen food brand, which has been in business for 72 years, will cease all operations in November, citing “insurmountable” business challenges and changes in consumer lifestyle.

Board Member Michael Ziebell said in a press statement that the company had been fighting against the nationwide staffing issues and food supply chain issues caused by the pandemic.

“These challenges, combined with changing consumer lifestyles and competitive pressures that have been building for over 20 years, made success very difficult,” Ziebell said. “Digital shopping has replaced the personal, at-the-door customer interaction that was the hallmark of the company.”

Schwan’s Home Delivery rebranded to Yelloh in 2022

The Minnesota-based company began as Schwan’s Home Delivery in 1952, eventually growing to regularly provide frozen meals to thousands of households across almost every U.S. state from a fleet of iconic yellow trucks.

The company rebranded to Yelloh in 2022 but stuck to its tagline of being the “original frozen food company.” Yelloh currently employs about 1,100 employees nationwide.

“Our concern is now for our employees and caring for them,” Ziebell said in a statement. The last day products may be purchased via Yelloh trucks will be Friday, Nov. 8.

“It’s with heavy hearts that we made the difficult decision to cease operations of Yelloh,” CEO Bernardo Santana said in a press statement. “We are thankful to our many loyal customers and hard-working employees for everything they have done to support us.”

This article originally appeared on USA TODAY: Yelloh, formerly Schwan’s, closing down frozen food delivery company

Got $1,000? 2 Stocks to Buy Now While They're On Sale

The market’s racing higher, but some stocks are still on the outside looking in. Shares of Celsius Holdings (NASDAQ: CELH) and Dave & Buster’s (NASDAQ: PLAY) are trading for less than the all-time highs they hit earlier this year.

These aren’t perfect companies. Some of the downticks have been earned. However, it seems as if pessimism has overshot reality. I think both stocks could be bargains at current levels. Let’s take a closer look at these two stocks that could be compelling bargains for the next $1,000 you put to work in the market.

1. Celsius Holdings

This specialty beverage giant has gone from feast to famine pretty quickly, with the shares down 67% from hitting their all-time high back in March. Celsius grew so fast a year ago that it declared a 3-for-1 stock split in November. Now, it has executed a 3-for-1 stock split without issuing any new shares.

Growth has slammed on the brakes for the company behind the functional fruit-flavored sparkling beverages that help trigger thermogenesis to boost one’s metabolism. The same company that more than doubled sales in each of the last three years has slammed on the brakes. Revenue growth slowed to 29% in the first half of this year, and now it’s shifting into reverse. Analysts are bracing for a 20% year-over-year decline in revenue for the quarter that ends next week.

This is an understandably scary scenario for an investment that was once one of the market’s hottest stocks. The latest step down came earlier this month at an analyst presentation. Celsius revealed that orders from PepsiCo (NASDAQ: PEP) — a minority shareholder in Celsius and its primary distributor — would decline by as much as $120 million in the third quarter. Celsius did point out that retail scanner data shows its product sales rose 10% this summer, but PepsiCo is paring back its inventory.

Can Celsius bounce back? Even PepsiCo noted a few months ago that thirsty consumers are switching to more traditional forms of hydration this hotter-than-usual summer. Sales should recover in the fall, but it is problematic that PepsiCo is still scaling back its Celsius orders.

Analysts have been slashing their top- and bottom-line targets, but they do see sales recovering to 13% growth in the fourth quarter and 17% in 2025. The out-of-favor beverage stock may not seem cheap at 32 times forward earnings, but a shift in momentum can send the bottom line higher and the earnings multiple lower. Keep an eye on international sales that still aren’t moving the needle but are growing faster than domestic revenue.

2. Dave & Buster’s

It’s all fun and games until your stock plummets 54% from a springtime all-time high. The chain of supersized entertainment centers featuring arcade games, casual dining, and event spaces has also seen its business slow to a crawl. Trailing revenue over the last four quarters has risen a mere 1% on contracting profit margins.

A 6% decline in same-unit sales for its latest quarter is a buzzkill, but Dave & Buster’s did trounce earnings expectations after back-to-back misses. With margins starting to recover, the next goal is to get folks back to its indoor havens of food, fun, and revelry. The chain has revamped its menu and is remodeling its appearance to make it more appealing.

Wall Street pros see revenue accelerating in the next fiscal year. The stock is selling for less than 9 times next year’s projected earnings. The turnaround plan could fall apart, and Dave & Buster’s leveraged balance sheet limits the number of times it can hit the “continue” option in this real-life arcade game.

However, if lower rates can keep the economy humming, it’s easy to see traffic start to pick up at your local Dave & Buster’s location. This isn’t half the company it was back in April. It’s on sale, and you can’t say that about too many stocks these days.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Rick Munarriz has positions in Celsius. The Motley Fool has positions in and recommends Celsius. The Motley Fool recommends Dave & Buster’s Entertainment. The Motley Fool has a disclosure policy.

Got $1,000? 2 Stocks to Buy Now While They’re On Sale was originally published by The Motley Fool

Post Holdings Affirms Fiscal Year 2024 Adjusted EBITDA Outlook

ST. LOUIS, Sept. 25, 2024 /PRNewswire/ — Post Holdings, Inc. POST, a consumer packaged goods holding company, today affirmed its non-GAAP Adjusted EBITDA guidance for fiscal year 2024.

Fiscal Year 2024 Outlook

Post management affirmed its outlook for fiscal year 2024 Adjusted EBITDA of $1,370–$1,390 million.

Post provides Adjusted EBITDA guidance only on a non-GAAP basis and does not provide a reconciliation of its forward-looking Adjusted EBITDA non-GAAP guidance measure to the most directly comparable GAAP measure due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for income/expense on swaps, net, gain/loss of extinguishment of debt, net, integration and transaction costs, mark-to-market adjustments on commodity and foreign exchange hedges and equity securities, equity method investment adjustment and other charges reflected in Post’s reconciliations of historical numbers, the amounts of which, based on historical experience, could be significant. For additional information regarding Post’s non-GAAP measure, see the related explanation presented under “Post’s Use of Non-GAAP Measure.”

Post’s Use of Non-GAAP Measure

Post uses Adjusted EBITDA, a non-GAAP measure, to supplement the financial measures prepared in accordance with United States (“U.S.”) generally accepted accounting principles (“GAAP”). Adjusted EBITDA is not prepared in accordance with U.S. GAAP, as it excludes certain items, and may not be comparable to similarly-titled measures of other companies. Management uses Adjusted EBITDA as a key metric in the evaluation of underlying company and segment performance, in making financial, operating and planning decisions and, in part, in the determination of bonuses for its executive officers and employees. Additionally, Post is required to comply with certain covenants and limitations that are based on variations of EBITDA in its financing documents. Management believes the use of this non-GAAP measure provides increased transparency and assists investors in understanding the underlying operating performance of Post and its segments and in the analysis of ongoing operating trends.

Prospective Financial Information

Prospective financial information is necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the prospective financial information described above will not materialize or will vary significantly from actual results. For further discussion of some of the factors that may cause actual results to vary materially from the prospective financial information provided above, see “Forward-Looking Statements” below. Accordingly, the prospective financial information provided above is only an estimate of what Post’s management believes is realizable as of the date of this press release. It also should be recognized that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecasted. In light of the foregoing, the information should be viewed in context and undue reliance should not be placed upon it.

Forward-Looking Statements

Certain matters discussed in this press release are forward-looking statements. These forward-looking statements are made based on known events and circumstances at the time of release, and as such, are subject to uncertainty and changes in circumstances. These forward-looking statements include Post’s Adjusted EBITDA outlook for fiscal year 2024. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made herein. These risks and uncertainties are described in Post’s filings with the Securities and Exchange Commission. These forward-looking statements represent Post’s judgment as of the date of this press release. Post disclaims, however, any intent or obligation to update these forward-looking statements. All forward-looking statements in this press release are qualified in their entirety by this cautionary statement.

About Post Holdings, Inc.

Post Holdings, Inc., headquartered in St. Louis, Missouri, is a consumer packaged goods holding company with businesses operating in the center-of-the-store, refrigerated, foodservice and food ingredient categories. Its businesses include Post Consumer Brands, Weetabix, Michael Foods and Bob Evans Farms. Post Consumer Brands is a leader in the North American ready-to-eat cereal and pet food categories and also markets Peter Pan® peanut butter. Weetabix is home to the United Kingdom’s number one selling ready-to-eat cereal brand, Weetabix®. Michael Foods and Bob Evans Farms are leaders in refrigerated foods, delivering innovative, value-added egg and refrigerated potato side dish products to the foodservice and retail channels. Post participates in the private brand food category through its ownership interest in 8th Avenue Food & Provisions, Inc. For more information, visit www.postholdings.com.

Contact:

Investor Relations

Daniel O’Rourke

daniel.orourke@postholdings.com

(314) 806-3959

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/post-holdings-affirms-fiscal-year-2024-adjusted-ebitda-outlook-302258557.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/post-holdings-affirms-fiscal-year-2024-adjusted-ebitda-outlook-302258557.html

SOURCE Post Holdings, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.