US Stocks May Stall After S&P 500 Hits Another Record; Micron Earnings, Meta Connect On Traders' Radar: Why This Strategist Is Optimistic About Q4

After resiliently resisting selling pressure, the market could be in for some weakness on Wednesday as traders position themselves defensively ahead of the key Main Street catalysts for the rest of the week. The index futures are modestly lower early Wednesday. Traders may not have much to look forward to in terms of data as merely the routine weekly mortgage application data and new homes sales report for August are due for the session.

It would be interesting to see if the week mortgage applications volume data will receive a boost from the recent pullback in mortgage rates ahead and amid the Fed rate cut. Micron Technology Inc.’s MU earnings report is in the spotlight as traders strive to gauge artificial intelligence technology-related demand.

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.20% |

| S&P 500 | -0.09% |

| Dow | -0.05% |

| R2K | -0.03% |

In premarket trading on Wednesday, the SPDR S&P 500 ETF Trust SPY fell 0.07% to $570.92 and the Invesco QQQ ETF QQQ moved down 0.19% to $484.46, according to Benzinga Pro data.

Cues From Last Session:

U.S. stocks ended Tuesday’s session higher yet again despite some nervous moments in early trading on the back of the September consumer confidence reading that unexpectedly fell. Following the data, Jamie Cox, Managing Partner at Harris Financial Group, said, “It’s never good to see consumer confidence fall this much.”

The strategist attributed the weak consumer confidence to concerns about the implications of the upcoming election, the increasing conflict around the world, and the stubbornly high cost of food and credit. The 50 basis-point Fed funds rate cut last week seemed more correct in light of these data, he added.

The major indices opened higher but reversed course after the data. After hitting a bottom in late-morning trading, the tech-heavy Nasdaq Composite and the broader S&P 500 Index bounced back in a V-shaped recovery before moving sideways in the afternoon. Nvidia Corp. NVDA ended up nearly 4%, providing a shot in the arm the these two indices, and China’s stimulus measures also kept the risk-on mood intact.

The Nasdaq Composite ended at the 18K+ level for the first time since time since late-July. The S&P 500 hit fresh intraday and closing highs.

Despite seeing volatility throughout the session, the 30-stock Dow Industrials Average also clocked new intraday and closing highs.

| Index | Performance (+/) | Value |

| Nasdaq Composite | +0.56% | 18,074.52 |

| S&P 500 Index | +0.25% | 5,732.93 |

| Dow Industrials | +0.20% | 42,208.22 |

| Russell 2000 | +0.17% | 2,223.99 |

Insights From Analysts:

With Sept. 22, the first day of autumn, now in the rearview mirror, the historically rough month for the market is nearly over, said LPL Financial Chief Technical Strategist Adam Turnquist. With less than five trading sessions remaining before October, stocks are on track to outperform historical averages for September, barring any major market-moving events, he said.

The strategist noted that the S&P 500 is up 1.2% month-to-date, compared to the average decline of 0.7% since 1950. The declines in the past four years are at 4.9%, 9.3%, 4.8%, and 3.9%, respectively.

This bodes well for the fourth quarter, Turnquist said. “Based on historical performance for the S&P 500, strong performance and momentum in the first nine months of the year could signal more gains ahead,” he said. Over the last 75 years, the fourth quarter has generated negative returns only eight times when momentum was strong during the first three quarters, he said.

Even In four of those eight years, returns in October–December were only slightly lower, in the range of 0% and -1.5%, Turnquist said. The largest fourth-quarter decline after positive performance through September came in 1987, which includes the infamous “Black Monday” market crash on October 19, when the S&P 500 famously shed over 20% in one day, he added.

Looking ahead, the analyst sees Fed policy decisions, a much-anticipated Presidential election, and third-quarter earnings as major market catalysts.

See also: Best Futures Trading Software

Upcoming Economic Data:

- The Mortgage Bankers Association is due to announce its weekly mortgage application volume data at 7 a.m. EDT. In the week ended Sept. 13, mortgage applications volume climbed 14.2% week-over-week on a seasonally adjusted basis. The spike came as the 30-year fixed mortgage rate was 6.15%, the lowest since Sept. 2022.

- The Commerce Department is scheduled to release its August new home sales report at 10 a.m. EDT. The consensus estimate calls for a seasonally adjusted annual rate of 700,000, down from the 739,000 rate in July.

- The Energy Information Administration will release its weekly petroleum status report at 10:30 a.m. EDT.

- The Treasury will auction five-year notes at 1 p.m. EDT.

- Federal Reserve Governor Adriana Kugler is scheduled to speak at 4 p.m. EDT.

Stocks In Focus:

- Trump Media & Technology Group Corp. DJT rose about 7% in premarket trading, tacking on to Tuesday’s gains, after the initial public offering lock-up period for insiders expired.

- Meta Platforms, Inc. META shares could be in the spotlight as the two-day Meta Connect technology-focused event gets underway on Wednesday.

- Cintas Corporation CTAS is due to announce its financial results before the market opens, while H.B. Fuller Company FUL, Micron, Jefferies Financial Group Inc. JEF and Worthington Enterprises, Inc. WOR are among those reporting after the close.

Commodities, Bonds And Global Equity Markets:

Crude oil futures moved lower but held above the $71-a-barrel level, while gold futures continued to shine in record territory. Bitcoin BTC/USD was once again flattish around the $63.5K level. The 10-year Treasury note climbed 1.7 points to 3.753%.

The major Asian markets traded on a mixed note, with China, Hong Kong and Taiwan extending their gains amid continued optimism over the stimulus measures announced by the People’s Bank of China this week. Most others settled lower. European stocks weakened in early trading on Wednesday.

Read Next:

Image Via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

France's Orange to exit New York Stock Exchange

(Reuters) -French telecom operator Orange intends to delist its shares from the New York Stock Exchange (NYSE), it said on Wednesday, citing the financial and administrative requirements of the secondary listing.

“The decision to voluntarily delist from the NYSE and to deregister from the SEC was made after careful consideration by the board of directors, taking into account the significant financial and administrative requirements of maintaining the NYSE listing and SEC registration,” the group said in a press release.

This decision “aims primarily to simplify our administrative workload, rather than to achieve significant cost reductions”, an Orange spokesperson told Reuters.

Savings will remain “modest” compared to the group’s expenses, he said, adding that Orange expects a simplification of its reporting requirements, thanks to the unified and standardised Euronext system.

It plans to file an application with the Securities and Exchange Commission in the fourth quarter of this year to start the delisting process. The delisting will be effective 10 days after that filing, it said.

The exit from the NYSE is expected to have no impact on Orange’s U.S. clients or partners or its presence in the U.S. market, the French group said.

Orange said it would also proceed to the deregistration of two sets of debt securities, previously issued on the NYSE.

(Reporting by Alban Kacher; editing by Jason Neely and Emelia Sithole-Matarise)

Ohmyhome Reports Results of 106% Growth in the First Half of 2024

- Revenues achieved S$4.5 million (US$3.3 million), representing a 106% growth compared to the first half of 2023.

- Revenue growth was driven by increased performance across all three primary business units.

- EBITDA loss margin narrowed from -107% to -44%.

- Net income loss reduced to S$2.3 million (US$1.7 million), or US$0.07 per diluted share.

- Cash and Cash Equivalents stood at S$2.4 million (US$1.8 million).

SINGAPORE, Sept. 25, 2024 (GLOBE NEWSWIRE) — Ohmyhome Ltd. OMH “Ohmyhome“, “the Company“))), a one-stop-shop property technology platform providing end-to-end property solutions and services including brokerage, renovation and condominium property management services in Singapore, is pleased to report its financial results for the six months ended June 30, 2024.

Significant Revenue Growth and Margin Improvement

For the first half of 2024 (1H 2024), Ohmyhome reported revenues of S$4.5 million (US$3.3 million), a 106% increase compared to S$2.2 million in the same period of 2023 (1H 2023). This growth was driven by a 13.9% year-over-year (YoY) increase in brokerage services revenue, despite high mortgage interest rates and a slowdown in market transactions compared to 1H 2023.

New revenue contribution from Property Management services reached S$2.0 million (US$1.5 million). Revenue from emerging and other services also grew by 16%, with independent third-party revenue rising by 206%, primarily due to higher demand for renovation services.

Gross profit saw a 108% increase compared to 1H 2023, with margin improvements across all three business units. Brokerage services’ gross margin rose from 46% to 49%, property management services was at 33%, and emerging and other services grew from 23% to 28%.

EBITDA loss improved by 15%, narrowing from S$2.3 million to S$2.0 million, while the EBITDA loss margin decreased from -107% to -44%. These improvements were primarily driven by higher gross margins and optimized operating expenses.

Net loss decreased from S$2.5 million to S$2.3 million (US$1.7 million), with the loss per diluted share improving from US$(0.10) to US$(0.07).

The Company anticipates a further reduction in EBITDA loss for the second half of 2024, supported by higher total contract values signed in Q3 2024 and the continued realization of cost optimization initiatives.

Strengthened Balance Sheet

As of June 30, 2024, cash and cash equivalents stood at S$2.4 million (US$1.8 million), an increase of S$2.2 million as compared to December 31, 2023. Current assets increased by 237% to S$3.3 million (US$2.5 million), while current liabilities were reduced by 22% to S$2.1 million (US$1.6 million).

Total assets grew by 24% to S$12.7 million (US$9.4 million), while total liabilities decreased by 6.9% to S$5.9 million (US$4.3 million) compared to December 31, 2023.

Looking Ahead

In response to the company’s financial performance, Rhonda Wong, CEO and co-founder of Ohmyhome, stated, “We have been focusing on improving the operations and the fundamentals of the Company, and we are proud of the strong growth and improved margins we have achieved in the first half of 2024. Our strategic focus on achieving higher growth and optimizing our operational efficiency is yielding positive results, and we are confident that our efforts will continue to drive better financial outcomes in the second half of the year. The commitment and resilience of our team, alongside the strong demand for our end-to-end property services, have positioned Ohmyhome for sustained growth.”

The Company is excited to share additional updates on its growth trajectory and will provide further details on business growth following the conclusion of the third quarter of 2024.

Appendix for Condensed Version of Unaudited Interim Consolidated Statement of Operations and Comprehensive Loss

| For the six months ended June 30, | |||||||||

| 2023 | 2024 | 2024 | |||||||

| SGD | SGD | USD | |||||||

| Total operating revenues | 2,167,021 | 4,470,089 | 3,298,472 | ||||||

| Gross profit | 803,645 | 1,670,149 | 1,232,400 | ||||||

| Total operating expenses | (3,430,676 | ) | (4,398,845 | ) | (3,245,900 | ) | |||

| Total other income, net | 130,145 | 449,311 | 331,546 | ||||||

| NET LOSS | (2,496,886 | ) | (2,279,385 | ) | (1,681,954 | ) | |||

| LOSS PER BASIC SHARE | (0.13 | ) | (0.11 | ) | (0.07 | ) | |||

| LOSS PER DILUTED SHARE | (0.13 | ) | (0.10 | ) | (0.07 | ) | |||

| Net Loss | (2,496,886 | ) | (2,279,385 | ) | (1,681,954 | ) | |||

| Interest Income (expenses), net | 7,733 | 121,775 | 89,857 | ||||||

| Depreciation and Amortization | (182,531 | ) | (437,287 | ) | (322,673 | ) | |||

| EBITDA | (2,015,204 | ) | (1,963,873 | ) | (1,449,138 | ) | |||

Appendix for Condensed Version of Unaudited Interim Consolidated Balance Sheets

| December 31, | June 30, | June 30, | |||||||

| 2023 | 2024 | 2024 | |||||||

| SGD | SGD | USD | |||||||

| ASSETS | |||||||||

| Current assets | 993,089 | 3,347,892 | 2,470,403 | ||||||

| Property and equipment, net | 78,721 | 87,195 | 64,341 | ||||||

| Non-current assets | 9,230,130 | 9,311,093 | 6,870,642 | ||||||

| Total assets | 10,301,940 | 12,746,180 | 9,405,386 | ||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||

| Current liabilities | 2,721,237 | 2,135,248 | 1,575,598 | ||||||

| Non-current liabilities | 3,578,128 | 3,728,961 | 2,751,594 | ||||||

| Total liabilities | 6,299,365 | 5,864,209 | 4,327,192 | ||||||

| SHAREHOLDERS’ EQUITY | 4,002,575 | 6,881,971 | 5,078,194 | ||||||

Appendix for Condensed Version of Unaudited Interim Consolidated Statements of Cash Flows

| For the six months ended June 30, | |||||||||

| 2023 | 2024 | 2024 | |||||||

| SGD | SGD | USD | |||||||

| Net loss | (2,496,886 | ) | (2,279,385 | ) | (1,681,954 | ) | |||

| Net cash used in operating activities | (2,546,400 | ) | (2,033,164 | ) | (1,500,269 | ) | |||

| Net cash used in investing activities | (287,430 | ) | (643,579 | ) | (474,896 | ) | |||

| Net cash provided by financing activities | 8,848,175 | 4,992,380 | 3,683,869 | ||||||

| Foreign currency effect | 32,408 | (63,098 | ) | (46,559 | ) | ||||

| Net change in cash and cash equivalents | 6,046,753 | 2,252,539 | 1,662,145 | ||||||

| Cash, cash equivalents and restricted cash at beginning of period | 301,433 | 191,807 | 141,534 | ||||||

| Cash, cash equivalents and restricted cash at period end | 6,348,186 | 2,444,346 | 1,803,679 | ||||||

About Ohmyhome

Ohmyhome is a one-stop-shop property technology platform in Singapore that provides end-to-end property solutions and services to buy, sell, rent, and renovate homes, as well as property management services for condominiums in Singapore. Since its launch in 2016, Ohmyhome has transacted over 15,500 properties as of June 30, 2024, and has approximately 7,560 units under management as of June 30, 2024. It is also the highest-rated property transaction platform, with more than 8,000 genuine reviews, and an average rating of 4.9 out of 5 stars.

Ohmyhome is dedicated to bringing speed, ease, and reliability to property-related services and to becoming the most trusted and comprehensive property solution for everyone.

For more information, visit: https://ohmyhome.com/en-sg/

Safe Harbor Statement

This press release contains forward-looking statements. In addition, from time to time, we or our representatives may make forward-looking statements orally or in writing. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “hopes” or the negative of these or similar terms. In evaluating these forward-looking statements, you should consider various factors, including: our ability to change the direction of the Company; our ability to keep pace with new technology and changing market needs; and the competitive environment of our business. These and other factors may cause our actual results to differ materially from any forward-looking statement.

Forward-looking statements are only predictions. The forward-looking events discussed in this press release and other statements made from time to time by us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks, uncertainties, and assumptions about us. We are not obligated to publicly update or revise any forward-looking statement, whether as a result of uncertainties and assumptions, the forward-looking events discussed in this press release and other statements made from time to time by us or our representatives might not occur.

Contact

Investor Relations: ir@ohmyhome.com

Follow Social Media for the Latest Updates from the Company

X: https://twitter.com/ohmyhometweets

Facebook: https://www.facebook.com/ohmyhomesg/

Instagram: https://www.instagram.com/ohmyhomesg/

LinkedIn: https://www.linkedin.com/company/ohmyhome/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should You Buy Super Micro Computer Before or After Its Stock Split? Here's What History Says.

The countdown has begun. The latest tech stock split, from Super Micro Computer (NASDAQ: SMCI), is set to happen in a few days — and the stock will open at its split-adjusted price as of Oct. 1. Supermicro announced a 10-for-1 split during its earnings report last month, joining several other market leaders and big tech players in launching such an operation in recent times. Nvidia, Broadcom, and high flyers in other industries such as Walmart and Chipotle Mexican Grill have split their stock this year.

Companies generally decide on stock splits when their shares have climbed considerably, reaching levels investors may not want to pay, even if valuation remains reasonable. For example, Nvidia and Broadcom shares traded above $1,000 prior to their stock splits, a level that could represent a psychological barrier for some investors.

Now, as the Supermicro operation approaches, you may be wondering if it’s a better idea to get in on the stock right away, prior to the split, or if you should buy once the operation is complete. Let’s take a look at what history has to say.

What a stock split does

First, let’s consider a few more details about stock splits. These operations lower the price of a stock through the issuance of additional shares to current holders. But this doesn’t change the total market value or anything fundamental about the company, so it isn’t a reason to buy or sell a particular stock.

That said, these operations could attract more investors over time because they open the investment opportunity to a broader range of investors. To become a shareholder, instead of paying hundreds or thousands of dollars for one share, you can get in for a much lower price.

Now, let’s look at what recent history shows us about stock performance before and after stock splits. This year, Nvidia soared 27% in the two-week period between its split announcement and the actual operation. Broadcom rose 14% from the time of its split announcement to the completion of the operation about a month later.

Since, the completion of those splits through today, performance has been lackluster, with Nvidia losing 4% and Broadcom little changed.

If we broaden our lens to include companies outside of technology, history shows us that Walmart advanced about 8% from its split announcement to the actual operation and has since soared 32%. Chipotle gained about 2.5% during the few weeks from announcement to split and has since lost about 13%.

All of this shows us investors have usually gained by buying a stock as soon as the company announces a split — but gains may taper off after the operation.

Is history right?

It’s important to remember that history isn’t always right when it comes to predicting the future, and each company’s situation is unique. Supermicro’s stock actually has fallen 25% since the announcement of its stock split — this isn’t due to the upcoming split but to unrelated headwinds. A short report in late August weighed significantly on the stock, and a delay by Supermicro in the filing of its 10-K annual report further hurt appetite for the shares.

And it’s also important to remember that a major gain after the stock split, such as we’ve seen with Walmart this year, isn’t due to the split itself but to a company’s fundamentals. Walmart has reported earnings that have surpassed analysts’ estimates, and the company even raised its forecast for the year.

So history tells us a stock split announcement often is positive for a stock right away, but what sets the long-term trend for a stock is that company’s earnings power and prospects ahead. And this means it really doesn’t matter whether you buy Supermicro stock today or after the split. If you hold on for the long term, a good or bad performance over a period of a few weeks won’t impact your returns by very much.

This is great news for investors because it means you don’t have to rush into an investing decision, timing it around a stock split, and instead have plenty of time to get in on exciting players that could multiply your winnings over time.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Nvidia, and Walmart. The Motley Fool recommends Broadcom and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Should You Buy Super Micro Computer Before or After Its Stock Split? Here’s What History Says. was originally published by The Motley Fool

California REALTORS® commend passage of C.A.R.-sponsored AB 2992 (Nguyen)

LOS ANGELES, Sept. 24, 2024 /PRNewswire/ — The CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) today issued the following statement on the passage of C.A.R.-sponsored bill AB 2992 (Nguyen):

“The California Association of REALTORS® applauds Gov. Newsom for signing C.A.R.-sponsored bill AB 2992 (Nguyen) into law as part of a package of bills that will strengthen protections for California consumers,” said C.A.R. President Melanie Barker, a Yosemite REALTOR®. “By mandating buyer broker representation agreements, consumers will have more choice and more clarity about the services they are getting from the REALTOR® they choose to help them through a complex transaction.

We commend Assemblymember Nguyen for her commitment to safeguarding consumers and upholding the integrity of our industry.”

Leading the way… ® in California real estate for nearly 120 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States, with nearly 200,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/california-realtors-commend-passage-of-car-sponsored-ab-2992-nguyen-302257768.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/california-realtors-commend-passage-of-car-sponsored-ab-2992-nguyen-302257768.html

SOURCE CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.)

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top 5 Tech Stocks That May Rocket Higher This Month

The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

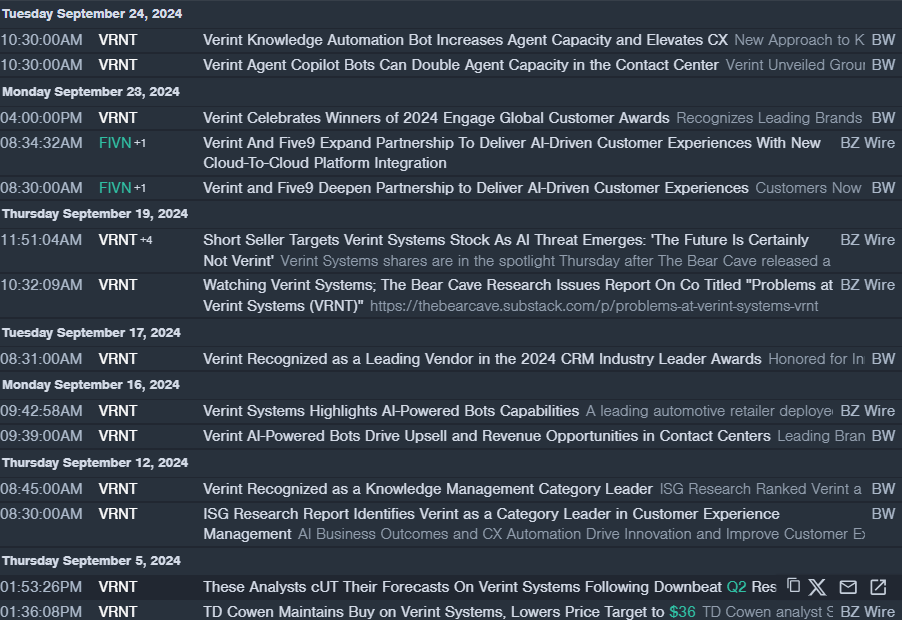

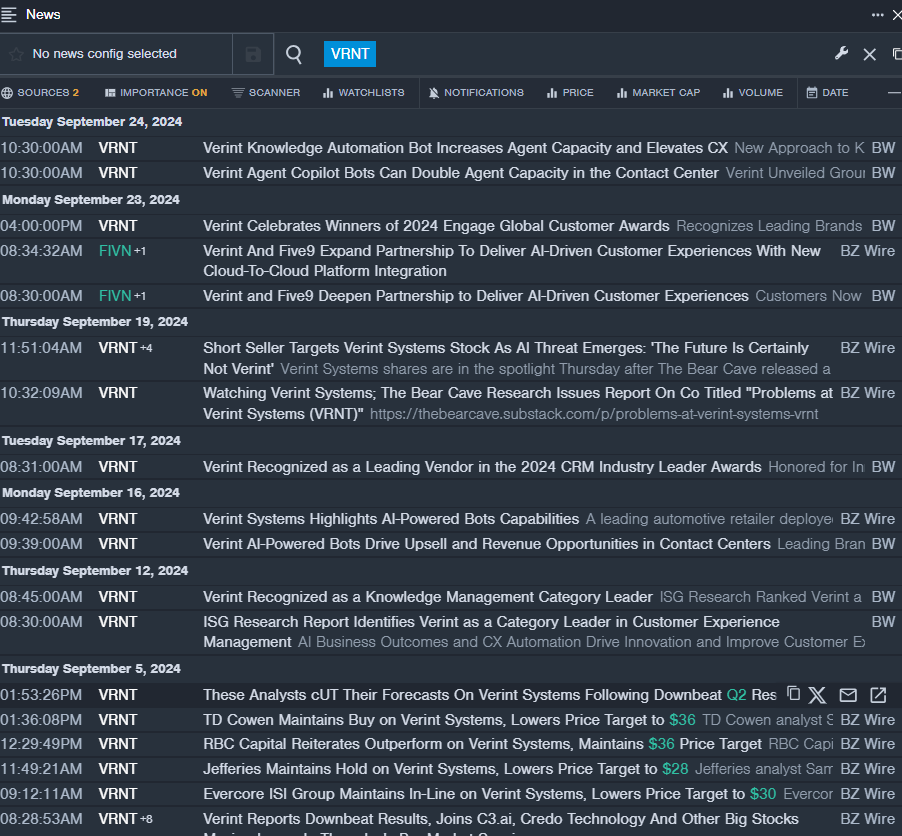

Verint Systems Inc. VRNT

- On Sept. 4, Verint Systems reported worse-than-expected second-quarter financial results and announced a new $200 million stock buyback program. Dan Bodner, Verint CEO commented, “Behind our AI momentum is delivering ‘AI Business Outcomes, Now’™ better than any other vendor in the market. We launched our AI platform a year ago and we now have many customers, including some of the world’s leading brands, reporting strong AI business outcomes achieving significant ROI with Verint’s AI-powered bots. In Q2, we reported strong AI bookings growth and Bundled SaaS revenue growth driven by AI. We believe the AI opportunity in the contact center is very large and still in its early stages and that our ability to demonstrate measurable AI business outcomes positions us well for strong AI bookings growth in the second half of the year and accelerating revenue growth over time.” The company’s stock fell around 24% over the past month and has a 52-week low of $18.41.

- RSI Value: 26.27

- VRNT Price Action: Shares of Verint closed at $24.91 on Tuesday.

- Benzinga Pro’s real-time newsfeed alerted to latest VRNT news.

Braze Inc BRZE

- On Sept. 5, Braze reported quarterly earnings of nine cents per share, which beat the consensus estimate and revenue of $145.5 million which beat the analyst consensus estimate by 2.98%. “We delivered a great second quarter, demonstrating strong top-line growth while driving efficiency in our business, achieving our first quarter of non-GAAP operating income profitability and non-GAAP net income profitability. Our results demonstrate our effective execution and continued demand for the Braze Customer Engagement Platform,” said Bill Magnuson, CEO of Braze. The company’s stock fell around 29% over the past month. It has a 52-week low of $31.80.

- RSI Value: 27.87

- BRZE Price Action: Shares of Braze fell 5.7% to close at $32.64 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in BRZE stock.

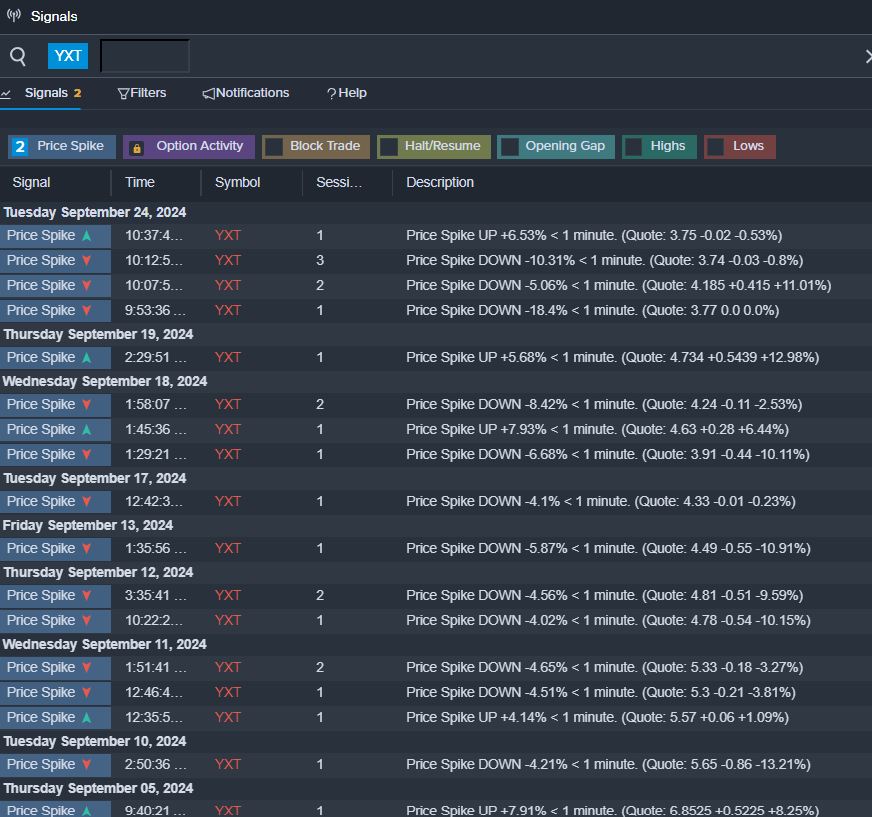

YXT.Com Group Holding Ltd – ADR YXT

- On Aug. 21, YXT.com Group announced the closing of initial public offering. The company’s shares fell around 59% over the past month and has a 52-week low of $3.21.

- RSI Value: 15.60

- YXT Price Action: Shares of YXT.Com Group fell 7.4% to close at $3.49 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in YXT shares.

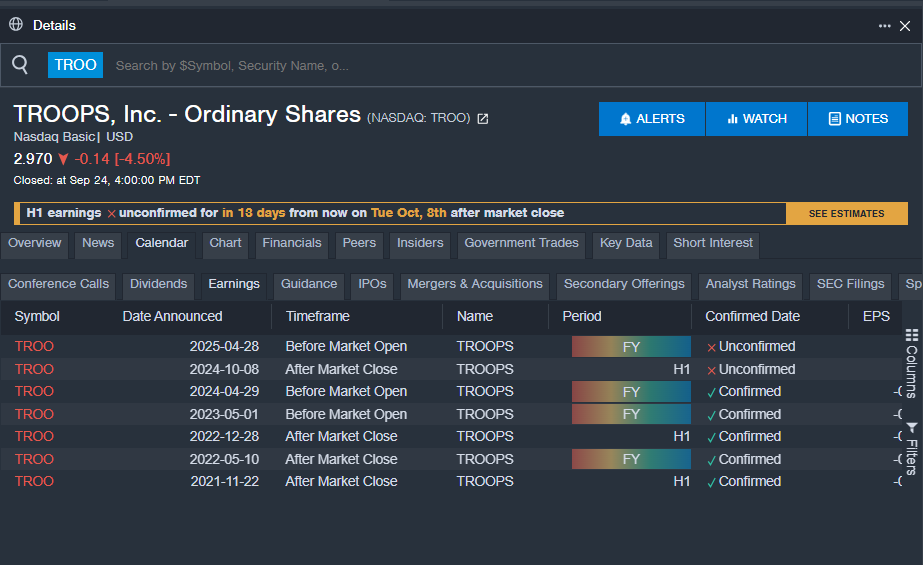

TROOPS Inc TROO

- The company’s shares lost around 18% over the past five days. The company’s 52-week low is $0.73.

- RSI Value: 29.69

- TROO Price Action: Shares of TROOPS fell 4.5% to close at $2.97 on Tuesday.

- Benzinga Pro’s earnings calendar was used to track upcoming TROO earnings reports.

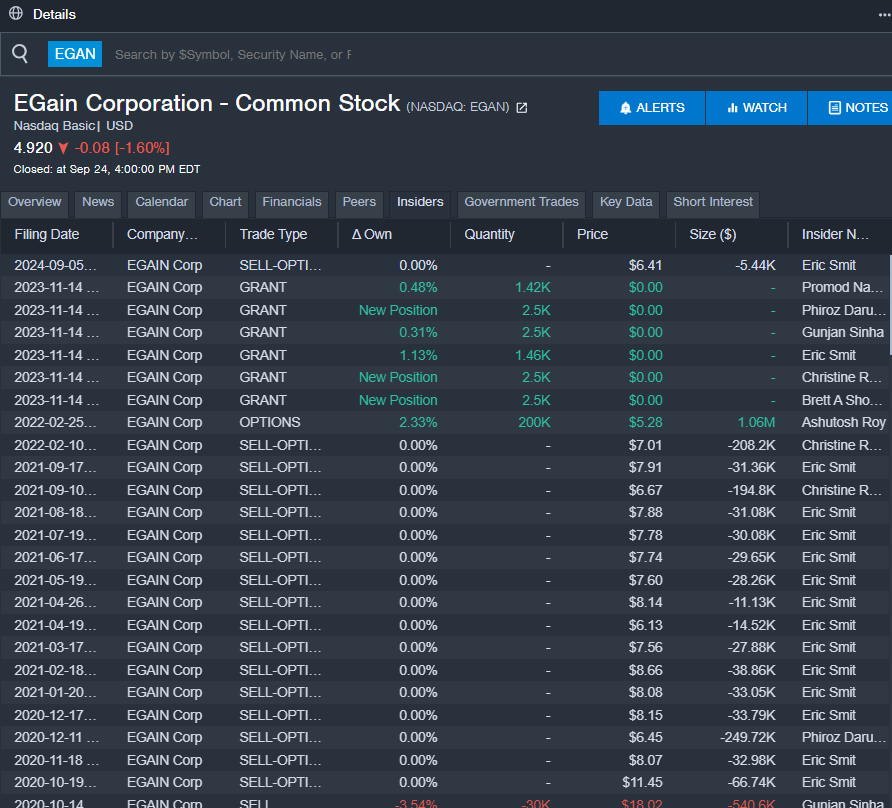

eGain Corp EGAN

- On Sept. 5, eGain reported fourth-quarter financial results and issued FY25 adjusted EPS guidance below estimates. “As businesses invest in Gen AI at scale, our AI Knowledge Hub helps deliver trusted answers for customer service, reducing cost and improving experience,” said Ashu Roy, eGain’s CEO. “As a result, new logo wins and RFPs for AI Knowledge were up 50 percent in fiscal 2024, and we are investing into this growing market opportunity for AI Knowledge.” The company’s shares fell around 35% over the past month. The company has a 52-week low of $4.81.

- RSI Value: 29.12

- EGAN Price Action: Shares of eGain fell 1.6% to close at $4.92 on Tuesday.

- Benzinga Pro’s insiders feature was used to track insider trading in EGAN’s stock.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Target Hospitality Provides Business Update

– Target Hospitality Board Disbands Special Committee –

– Target Hospitality to Reinvigorate Focus on Allocating Capital to High Return Initiatives, Including In-Organic Growth –

– Reaffirms 2024 Outlook Given Strength of Year-to-Date Operating Results –

THE WOODLANDS, Texas, Sept. 25, 2024 /PRNewswire/ — Target Hospitality Corp. (“Target Hospitality,” “Target” or the “Company”) TH, one of North America’s largest providers of vertically integrated modular accommodations and value-added hospitality services, today announced that the Company’s Board of Directors has determined to disband the Special Committee of the Company’s Board of Directors (the “Special Committee”), comprised solely of independent directors, which it had established to consider and evaluate the previously announced unsolicited non-binding offer, received on March 24, 2024, from Arrow Holdings S.à r.l. (“Arrow”), an affiliate of TDR Capital LLP (“TDR”), to acquire all of the outstanding shares of common stock of the Company not owned by Arrow, any investment fund managed by TDR or their respective affiliates (the “Unaffiliated Shares”), for cash consideration of $10.80 per share (the “TDR Offer”) and explore and consider strategic alternatives thereto. In connection with its review of the TDR Offer, the Special Committee launched a formal process to solicit offers for the Company and invited Arrow to participate in such a process. Following the previously announced loss of a contract, no formal offers were received, and Arrow did not reaffirm the TDR Offer or advance any alternative proposal that the Special Committee could conclude, in consultation with its independent financial and legal advisors, would be more attractive to the holders of the Unaffiliated Shares than the Company’s standalone prospects. The Company cannot predict what Arrow, TDR or others will do in the future regarding a potential acquisition of the Company.

The Company will continue to focus on allocating capital to high return initiatives, including in-organic growth. Given the operating results to date, the Company is reaffirming its 2024 guidance outlook.

Brad Archer, President and Chief Executive Officer commented, “Our underlying business fundamentals remain strong, and the Company continues to perform well, capitalizing on healthy demand for our services and our efficient operating platform. Our team remains focused on driving the business forward, supported by a solid balance sheet, strong liquidity profile, good revenue visibility and robust cash generation. The conclusion of the evaluation process of the TDR Offer restores our full flexibility to pursue multiple capital allocation opportunities focused on maximizing value. Based on all these favorable dynamics, we are pleased to reaffirm our 2024 outlook.”

Target will reinvigorate its efforts to maximize value creation while maintaining its strong financial position through disciplined capital deployment. The Company has continued its efforts to build and evaluate a pipeline of strategic growth opportunities in the coming years. These opportunities encompass Target’s existing full-turnkey hospitality solutions, as well as broaden Target’s value chain participation through individual elements of existing core competencies.

About Target Hospitality

Target Hospitality is one of North America’s largest providers of vertically integrated modular accommodations and value-added hospitality services in the United States. Target builds, owns and operates a customized and growing network of communities for a range of end users through a full suite of value-added solutions including premium food service management, concierge, laundry, logistics, security and recreational facilities services.

Cautionary Statement Regarding Forward Looking Statements

Certain statements made in this press release (including the financial outlook) are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside our control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: operational, economic, including inflation, political and regulatory risks; our ability to effectively compete in the specialty rental accommodations and hospitality services industry, including growing the HFS – South and Government segments; effective management of our communities; natural disasters and other business distributions including outbreaks of epidemic or pandemic disease; the duration of any future public health crisis, related economic repercussions and the resulting negative impact to global economic demand; the effect of changes in state building codes on marketing our buildings; changes in demand within a number of key industry end-markets and geographic regions; changes in end-market demand requirements including variable occupancy levels associated with subcontracts in the Government segment; our reliance on third party manufacturers and suppliers; failure to retain key personnel; increases in raw material and labor costs; the effect of impairment charges on our operating results; our future operating results fluctuating, failing to match performance or to meet expectations; our exposure to various possible claims and the potential inadequacy of our insurance; unanticipated changes in our tax obligations; our obligations under various laws and regulations; the effect of litigation, judgments, orders, regulatory or customer bankruptcy proceedings on our business; our ability to successfully acquire and integrate new operations; global or local economic and political movements, including any changes in policy under the Biden administration or any future administration; federal government budgeting and appropriations; our ability to effectively manage our credit risk and collect on our accounts receivable; our ability to fulfill Target Hospitality’s public company obligations; any failure of our management information systems; our ability to refinance debt on favorable terms and meet our debt service requirements and obligations; and risks related to our outstanding obligations in connection with the Senior Notes. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Investor Contact

Mark Schuck

ir@targethospitality.com

(832) 702 – 8009

![]() View original content:https://www.prnewswire.com/news-releases/target-hospitality-provides-business-update-302257842.html

View original content:https://www.prnewswire.com/news-releases/target-hospitality-provides-business-update-302257842.html

SOURCE Target Hospitality

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chinese stocks rally loses momentum as skepticism kicks in

(Bloomberg) — Chinese stocks ended Wednesday higher, though paring from earlier gains as worries linger about whether a host of support measures announced Tuesday would turn around the economy.

Most Read from Bloomberg

The onshore benchmark CSI 300 Index rose 1.5% at close after climbing as much as 3.4% on the day. The gauge remained 0.9% lower for the year. The advance in the Hang Seng China Enterprises Index also was slashed to 0.5% from its earlier ascent to 3.4%.

The weakening momentum underscored investors’ skepticism about Beijing’s capability to revive the market and economy, given the absence of more details on policy implementation. The paring came despite what appears to be enhanced state support, with the turnover in some exchange-traded funds favored by the sovereign fund seeing spikes in inflows.

“The policies don’t really address the root problems facing the real economy,” said Shen Meng, a director at Beijing-based investment bank Chanson & Co. “They at most provided bears with an opportunity to cash in and may create asset bubbles in the longer run.”

With the previous rallies this year fizzling, market watchers sounded caution despite a blitz of stimulus measures announced Tuesday. The benchmark’s recent gains — the CSI 300 index rose for six straight days — may be fleeting if policymakers fail to address the country’s long-standing problems.

Chinese equities have been trapped in a start-stop cycle of gains and losses for most of this year, as the government’s piecemeal approach to reviving the market has resulted only in brief rebounds.

The rally in Hong Kong stocks may have been driven by short cover, according to JPMorgan Chase & Co. strategists including Wendy Liu. The short sales ratio as a percentage of the market turnover dipped to 13.6% on Tuesday, one standard deviation below the average since 2016, indicating many shorts have been covered, they said.

Still, investors largely applauded the comprehensiveness of the stimulus package, which included liquidity support for the stock market and a policy rate cut. The policies also fanned hopes that the government — with the Politburo set to meet ahead of a week-long annual holiday starting Oct. 1 — may be readying ammunition to address deep-rooted issues, such as weak consumer confidence.

The People’s Bank of China said it will set up a swap facility to allow securities firms, funds and insurance companies to tap its funds to purchase equities. The central bank is also weighing plans for a stock stabilization fund. The securities regulator later issued draft guidelines urging listed companies to boost investment returns.

“We believe these coordinated policy announcements could pave the way for further policy support and raise the possibility of an economic upcycle in 2025,” Chaoping Zhu, global market strategist at JP Morgan Asset Management, wrote in a note. “Combined with private sector companies that have improved their profit margin and corporate fundamentals, we do see value opportunities in Chinese equities, and diversification opportunities given the expensive markets around the world.”

–With assistance from Charlotte Yang and Cecile Vannucci.

(Updates with closing prices and quote in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

3 Breakout Growth Stocks You Can Buy and Hold for the Next Decade

For those with many years before retirement, it’s imperative to be invested in growth stocks. While perhaps more volatile than low-priced value stocks, over a long period of time, high-quality growth stocks have the potential to compound wealth by leaps and bounds.

After the post-pandemic downturn in growth stocks, the AI revolution and the prospect of lower interest rates should reignite growth stocks again. Here are three all-star names trading at very reasonable prices today.

Broadcom

Broadcom (NASDAQ: AVGO) hadn’t been given much credit for growth prior to the AI revolution. Up until AI hit big, Broadcom’s strategy was to buy highly profitable and stable semiconductor franchises across communications infrastructure, while adding infrastructure software to the mix in recent years. It was really a private equity strategy designed to buy companies, cut costs, and milk profits.

However, the AI revolution and Broadcom’s recent acquisition of VMware has lit a fire under its growth prospects. AI turbocharged two of Broadcom’s business: One in custom ASICs used by cloud giants for their own in-house accelerators, and another in high-speed ethernet networking chips and optical components. Each of those businesses grew between three and four times over this year relative to 2023, which is stunning growth.

And with its massive VMware acquisition closing late in 2023, management not only managed to cut costs, but also accelerate VMware’s growth at the same time. By innovating a new data center virtualization platform, concentrating on the largest enterprises with the deepest pockets, and charging a premium, management has grown VMware’s quarterly revenue from $2.1 billion to $3.8 billion in a span of just two quarters, even as operating costs went down!

Though AI chips and VMware are bound to decelerate, their growth should still be strong for years to come. Meanwhile, these high-growth businesses will soon combine to exceed 50% of Broadcom’s total revenue. With AI chips and VMware underpinning growth and the appetite for more acquisitions across both hardware and software, Broadcom is still a buy even near its all-time highs.

Sea Limited

Southeast Asian e-commerce, fintech, and video game giant Sea Limited (NYSE: SE) was a darling of the pandemic, but fell on hard times afterwards. Its hit mobile game Free Fire saw declines in users and monetization and a ban in India over geopolitical concerns, while higher interest rates lowered growth in its other businesses.

However, management showed its agility by cutting costs and achieving profitability by early 2023, within a year after interest rates spiked.

Now with profitability stabilized and inflation coming down, Sea is achieving a happy medium between the hypergrowth pandemic era and the slower but more profitable period thereafter.

The most recent quarter showed solid growth across all three businesses. The Shopee e-commerce platform grew revenue 33.7%, digital financial services grew 39.5%, and the digital entertainment segment returned to growth after bottoming last year, with bookings up 21.1%. And despite a return to reinvesting in growth especially in e-commerce, the company remained profitable overall on a GAAP basis.

Sea seems to have solidified a leadership position over rivals in Southeast Asia’s digital economy, which should see strong growth in the years ahead. According to Bain & Co., Southeast Asia’s economy is projected to grow at a 5.1% average rate over the next 10 years, even outpacing China.

With Sea’s stock trading at just 3.5 times sales and still 78% below its 2021 highs, it’s another growth stock ready to break out again.

Aehr Test Systems

Aehr Test Systems (NASDAQ: AEHR) makes test and burn-in equipment mainly used to test automotive chips, especially new silicon carbide chips increasingly used in new electric vehicles. Test and burn-in equipment allows chip manufacturers to subject chips to rugged heat conditions while still on the wafer before they are packaged into a device. Hence, why the technology has generally been used in chips that need to function in challenging conditions, such auto an industrial chips.

Yet while the EV market boomed in recent years, it entered a severe downturn about a year ago. Hence, why Aehr Test Systems is down 78% from its July 2023 highs.

Still, if one thinks the EV market will eventually bounce back, perhaps helped along by lower interest rates, then Aehr could be a bargain buy.

Not only that, but the company recently made a consequential announcement for revenues beyond just EVs. On Sept. 5, the company announced it had received an order of six Sonoma machines to test the AI accelerators of a large cloud infrastructure player. This is the first-ever order of Aehr’s machines for AI accelerators.

Given the increasingly energy-hungry and heat-generative nature of AI chips, it’s quite possible Aehr’s solutions may be adopted not only by this AI company in greater numbers, but other AI players as well. Given AI’s hypergrowth prospects, Aehr may have another great growth segment on its hands, making the recent swoon potentially a terrific buying opportunity.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Billy Duberstein and/or his clients have positions in Aehr Test Systems, Broadcom, and Sea Limited. The Motley Fool has positions in and recommends Sea Limited. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

3 Breakout Growth Stocks You Can Buy and Hold for the Next Decade was originally published by The Motley Fool

Worthington Enterprises Reports First Quarter Fiscal 2025 Results

COLUMBUS, Ohio, Sept. 24, 2024 (GLOBE NEWSWIRE) — Worthington Enterprises, Inc. WOR reported net sales of $257.3 million and net earnings from continuing operations of $24.3 million, or $0.48 per diluted share, for its fiscal 2025 first quarter ended August 31, 2024. This compares to net sales of $311.9 million and net earnings from continuing operations of $26.8 million, or $0.54 per diluted share, in the first quarter of fiscal 2024. On a non-GAAP basis, adjusted net earnings from continuing operations totaled $25.1 million for the first quarter of fiscal 2025, or $0.50 per diluted share, compared to $37.2 million, or $0.75 per diluted share, in the prior year comparable quarter. Reported results reflect the controlling interest portion of continuing operations and were impacted by certain items, as summarized in the table below.

| (U.S. dollars in millions, except per share amounts) | 1Q 2025 | 1Q 2024 | ||||||||||||||

| After-Tax | Per Share | After-Tax | Per Share | |||||||||||||

| Net earnings from continuing operations | $ | 24.3 | $ | 0.48 | $ | 26.8 | $ | 0.54 | ||||||||

| Restructuring charges | 0.8 | 0.02 | – | – | ||||||||||||

| Corporate costs eliminated at Separation (1) | – | – | 7.4 | 0.15 | ||||||||||||

| Separation costs | – | – | 1.8 | 0.04 | ||||||||||||

| Loss on extinguishment of debt | – | – | 1.2 | 0.02 | ||||||||||||

| Adjusted net earnings from continuing operations | $ | 25.1 | $ | 0.50 | $ | 37.2 | $ | 0.75 | ||||||||

(1) References in this release to the “Separation” are to the Company’s separation of its former steel processing business into Worthington Steel, Inc. on December 1, 2023.

Financial highlights, on a continuing operations basis, for the current year and prior year quarters are as follows:

(U.S. dollars in millions, except per share amounts)

| 1Q 2025 | 1Q 2024 | |||||||

| Net sales | $ | 257.3 | $ | 311.9 | ||||

| Operating loss | (4.7 | ) | (7.3 | ) | ||||

| Adjusted operating income (loss) | (3.5 | ) | 4.8 | |||||

| Net earnings from continuing operations | 24.3 | 26.8 | ||||||

| Adjusted EBITDA from continuing operations | 48.4 | 65.9 | ||||||

| EPS from continuing operations – diluted | 0.48 | 0.54 | ||||||

| Adjusted EPS from continuing operations – diluted | $ | 0.50 | $ | 0.75 | ||||

“We had another respectable quarter thanks to our team’s focus on managing costs and serving our customers even as persistent higher interest rates and macroeconomic uncertainty continued to impact demand,” said Worthington Enterprises President and CEO Andy Rose. “Consumer Products had a solid quarter delivering year over year earnings growth despite flat volumes. Building Products earnings were down on weak volumes in our heating and cooking business, combined with lower contributions from ClarkDietrich, which continued to face some margin compression. Our teams are navigating the current environment well with a focus on delivering value-added solutions and products for our customers.”

Consolidated Quarterly Results

Net sales for the first quarter of fiscal 2025 were $257.3 million, a decrease of $54.6 million, or 17.5%, from the prior year quarter, driven by the impact of the deconsolidation of the former Sustainable Energy Solutions (“SES”) segment during the fourth quarter of fiscal 2024 combined with lower volume in the Building Products segment. Net sales in the prior year first quarter included $28.6 million related to SES, which is now an unconsolidated joint venture, with the Company’s share of SES joint venture results for the first quarter of fiscal 2025 reported within equity income on the consolidated statement of earnings.

The operating loss of $4.7 million for the first quarter of fiscal 2025 was favorable by $2.6 million compared to the prior year quarter, which included $2.4 million of non-recurring Separation costs and $9.7 million of SG&A expense that was eliminated post-Separation. Excluding restructuring and the aforementioned effects of the Separation in the prior year quarter, the Company generated an operating loss of $3.5 million compared to operating income of $4.8 million in the first quarter of fiscal 2024. The year-over-year decrease was driven by lower gross margin in Building Products partially offset by the lack of the operating loss generated by the former SES segment in the prior year quarter.

Equity income decreased $9.9 million from the prior year quarter to $35.5 million, driven by lower contributions from ClarkDietrich, which was down $8.0 million from the prior year quarter combined with a $1.8 million loss generated from the newly formed SES joint venture.

Income tax expense was $6.8 million in the first quarter of fiscal 2025 compared to $9.0 million in the prior year quarter. The decrease was driven by lower pre-tax earnings from continuing operations. Tax expense in the first quarter of fiscal 2025 reflects an estimated annual effective rate of 24.5% compared to 25.1% in the prior year quarter.

Balance Sheet

Total debt of $300.0 million at first quarter end was consistent with the balance at May 31, 2024. The Company ended the quarter with cash of $178.5 million, down $65.7 million from May 31, 2024, primarily driven by the purchase of Hexagon Ragasco.

Quarterly Segment Results

Consumer Products generated net sales of $117.6 million during the first quarter of fiscal 2025, up $0.2 million, from the prior year quarter on marginally higher volume. Adjusted EBITDA of $17.8 million, was up $3.5 million from the prior year quarter, driven by improved gross margin.

Building Products generated net sales of $139.7 million during the first quarter of fiscal 2025, down $26.2 million, or 15.8%, from the prior year quarter because of lower volume and an unfavorable shift in product mix, partially offset by contributions from Hexagon Ragasco. Adjusted EBITDA of $39.7 million decreased by $20.0 million from the prior year quarter, driven by the impact of lower volume and unfavorable mix combined with lower contributions of equity income, primarily from ClarkDietrich. Adjusted EBITDA for the first quarter of fiscal 2025 includes $1.9 million of incremental expense related to the Hexagon Ragasco acquisition resulting primarily from the step up of inventory to fair value.

Recent Developments

- On June 3, 2024, the Company acquired Hexagon Ragasco, a leading global manufacturer of composite propane cylinders. The purchase price was approximately $100.3 million, net of cash acquired, with a future earnout of up to approximately $14.0 million.

- During the first quarter of fiscal 2025, the Company repurchased a total of 150,000 of its common shares for $6.8 million, at an average purchase price of $45.35.

- On September 24, 2024, the Company’s Board of Directors declared a quarterly dividend of $0.17 per common share payable on December 27, 2024, to shareholders of record at the close of business on December 13, 2024.

Outlook

“We have a positive long-term outlook especially with the recent recalibration of interest rates. Our market-leading products and brands are well-positioned to take advantage of long-term secular trends and should benefit when near-term headwinds subside and demand normalizes,” Rose said. “We are also equipped with a strong balance sheet and the ability to drive long-term growth and reward shareholders as we leverage the Worthington Business System of transformation, innovation and M&A.”

Upcoming Investor Events

- CJS Securities Investor Briefings (Virtual Non-Deal Roadshow), October 9, 2024

- Baird 2024 Global Industrial Conference, November 12, 2024

Conference Call

The Company will review fiscal 2025 first quarter results during its quarterly conference call on September 25, 2024, at 8:30 a.m., Eastern Time. Details regarding the conference call can be found on the Company website at www.WorthingtonEnterprises.com.

About Worthington Enterprises

Worthington Enterprises WOR is a designer and manufacturer of market-leading brands that help enable people to live safer, healthier and more expressive lives. The Company operates with two primary business segments: Building Products and Consumer Products. The Building Products segment includes cooking, heating, cooling and water solutions, architectural and acoustical grid ceilings and metal framing and accessories. The Consumer Products segment provides solutions for the tools, outdoor living and celebrations categories. Product brands within the Worthington Enterprises portfolio include Balloon Time®, Bernzomatic®, Coleman® (propane cylinders), CoMet®, Garden-Weasel®, General®, HALO™, Hawkeye™, Level5 Tools®, Mag Torch®, NEXI™, Pactool International®, PowerCore™, Well-X-Trol® and XLite™, among others. The Company also serves the growing global hydrogen ecosystem via a joint venture focused on on-board fueling systems and gas containment solutions.

Headquartered in Columbus, Ohio, Worthington Enterprises and its joint ventures employ approximately 6,000 people throughout North America and Europe.

Founded in 1955 as Worthington Industries, Worthington Enterprises follows a people-first Philosophy with earning money for its shareholders as its first corporate goal. Worthington Enterprises achieves this outcome by empowering its employees to innovate, thrive and grow with leading brands in attractive markets that improve everyday life. The Company engages deeply with local communities where it has operations through volunteer efforts and The Worthington Companies Foundation, participates actively in workforce development programs and reports annually on its corporate citizenship and sustainability efforts. For more information, visit worthingtonenterprises.com.

Safe Harbor Statement

Selected statements contained in this release constitute “forward-looking statements,” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). The Company wishes to take advantage of the safe harbor provisions included in the Act. Forward-looking statements reflect the Company’s current expectations, estimates or projections concerning future results or events. These statements are often identified by the use of forward-looking words or phrases such as “believe,” “expect,” “anticipate,” “may,” “could,” “should,” “would,” “intend,” “plan,” “will,” “likely,” “estimate,” “project,” “position,” “strategy,” “target,” “aim,” “seek,” “foresee” and similar words or phrases. These forward-looking statements include, without limitation, statements relating to: future or expected cash positions, liquidity and ability to access financial markets and capital; outlook, strategy or business plans; the anticipated benefits of the separation of the Company’s Steel Processing business (the “Separation”); the expected financial and operational performance of, and future opportunities for, the Company following the Separation; the Company’s performance on a pro forma basis to illustrate the estimated effects of the Separation on historical periods; the tax treatment of the Separation transaction; future or expected growth, growth potential, forward momentum, performance, competitive position, sales, volumes, cash flows, earnings, margins, balance sheet strengths, debt, financial condition or other financial measures; pricing trends for raw materials and finished goods and the impact of pricing changes; the ability to improve or maintain margins; expected demand or demand trends for the Company or its markets; additions to product lines and opportunities to participate in new markets; expected benefits from transformation and innovation efforts; the ability to improve performance and competitive position at the Company’s operations; anticipated working capital needs, capital expenditures and asset sales; anticipated improvements and efficiencies in costs, operations, sales, inventory management, sourcing and the supply chain and the results thereof; projected profitability potential; the ability to make acquisitions and the projected timing, results, benefits, costs, charges and expenditures related to acquisitions, joint ventures, headcount reductions and facility dispositions, shutdowns and consolidations; projected capacity and the alignment of operations with demand; the ability to operate profitably and generate cash in down markets; the ability to capture and maintain market share and to develop or take advantage of future opportunities, customer initiatives, new businesses, new products and new markets; expectations for Company and customer inventories, jobs and orders; expectations for the economy and markets or improvements therein; expectations for generating improving and sustainable earnings, earnings potential, margins or shareholder value; effects of judicial rulings; the ever-changing effects of the novel coronavirus (“COVID-19”) pandemic and the various responses of governmental and nongovernmental authorities thereto on economies and markets, and on our customers, counterparties, employees and third-party service providers; and other non-historical matters.

Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, those that follow: the uncertainty of obtaining regulatory approvals in connection with the Separation, including rulings from the Internal Revenue Service; the Company’s ability to successfully realize the anticipated benefits of the Separation; the risks, uncertainties and impacts related to the COVID-19 pandemic – the duration, extent and severity of which are impossible to predict, including the possibility of future resurgence in the spread of COVID-19 or variants thereof – and the availability, effectiveness and acceptance of vaccines, and other actual or potential public health emergencies and actions taken by governmental authorities or others in connection therewith; the effect of national, regional and global economic conditions generally and within major product markets, including significant economic disruptions from COVID-19, the actions taken in connection therewith and the implementation of related fiscal stimulus packages; the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the impact of tariffs, the adoption of trade restrictions affecting the Company’s products or suppliers, a United States withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing oil prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations (especially in light of the COVID-19 pandemic and Russia’s invasion of Ukraine); effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly-acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts (especially in light of Russia’s invasion of Ukraine), terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability (especially in light of Russia’s invasion of Ukraine), foreign currency exchange rate exposure and the acceptance of the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, which may negatively impact the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; the level of imports and import prices in the Company’s markets; the impact of environmental laws and regulations or the actions of the United States Environmental Protection Agency or similar regulators which increase costs or limit the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability regulations and considerations; the impact of judicial rulings and governmental regulations, both in the United States and abroad, including those adopted by the United States Securities and Exchange Commission and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Plan Act of 2021, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; the effect of healthcare laws in the United States and potential changes for such laws, especially in light of the COVID-19 pandemic, which may increase the Company’s healthcare and other costs and negatively impact the Company’s operations and financial results; the effects of tax laws in the United States and potential changes for such laws, which may increase the Company’s costs and negatively impact the Company’s operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the Company’s filings with the United States Securities and Exchange Commission, including those described in “Part I – Item 1A. – Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2024.

Forward-looking statements should be construed in the light of such risks. The Company notes these factors for investors as contemplated by the Act. It is impossible to predict or identify all potential risk factors. Consequently, readers should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. The Company does not undertake, and hereby disclaims, any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

| WORTHINGTON ENTERPRISES, INC. CONSOLIDATED STATEMENTS OF EARNINGS (In thousands, except per share amounts) |

||||||||

| Three Months Ended | ||||||||

| August 31, | ||||||||

| 2024 | 2023 | |||||||

| Net sales | $ | 257,308 | $ | 311,918 | ||||

| Cost of goods sold | 194,813 | 242,288 | ||||||

| Gross profit | 62,495 | 69,630 | ||||||

| Selling, general and administrative expense | 66,036 | 74,544 | ||||||

| Restructuring and other expense, net | 1,158 | – | ||||||

| Separation costs | – | 2,410 | ||||||

| Operating loss | (4,699 | ) | (7,324 | ) | ||||

| Other income (expense): | ||||||||

| Miscellaneous income, net | 486 | 299 | ||||||

| Loss on extinguishment of debt | – | (1,534 | ) | |||||

| Interest expense, net | (489 | ) | (1,074 | ) | ||||

| Equity in net income of unconsolidated affiliates | 35,492 | 45,424 | ||||||

| Earnings before income taxes | 30,790 | 35,791 | ||||||

| Income tax expense | 6,782 | 8,960 | ||||||

| Net earnings from continuing operations | 24,008 | 26,831 | ||||||

| Net earnings from discontinued operations | – | 72,872 | ||||||

| Net earnings | 24,008 | 99,703 | ||||||

| Net earnings (loss) attributable to noncontrolling interests | (245 | ) | 3,597 | |||||

| Net earnings attributable to controlling interest | $ | 24,253 | $ | 96,106 | ||||

| Amounts attributable to controlling interest: | ||||||||

| Net earnings from continuing operations | $ | 24,253 | $ | 26,831 | ||||

| Net earnings from discontinued operations | – | 69,275 | ||||||

| Net earnings attributable to controlling interest | $ | 24,253 | $ | 96,106 | ||||

| Earnings per share from continuing operations – basic | $ | 0.49 | $ | 0.55 | ||||

| Earnings per share from discontinued operations – basic | – | 1.42 | ||||||

| Net earnings per share attributable to controlling interest – basic | $ | 0.49 | $ | 1.97 | ||||

| Earnings per share from continuing operations – diluted | $ | 0.48 | $ | 0.54 | ||||

| Earnings per share from discontinued operations – diluted | – | 1.39 | ||||||

| Net earnings per share attributable to controlling interest – diluted | $ | 0.48 | $ | 1.93 | ||||

| Weighted average common shares outstanding – basic | 49,487 | 48,842 | ||||||

| Weighted average common shares outstanding – diluted | 50,365 | 49,886 | ||||||

| Cash dividends declared per share | $ | 0.17 | $ | 0.32 | ||||

| CONSOLIDATED BALANCE SHEETS WORTHINGTON ENTERPRISES, INC. (In thousands) |

||||||||

| August 31, | May 31, | |||||||

| 2024 | 2024 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 178,547 | $ | 244,225 | ||||

| Receivables, less allowances of $508 and $343 at August 31, 2024 | ||||||||

| and May 31, 2024, respectively | 168,497 | 199,798 | ||||||

| Inventories | ||||||||

| Raw materials | 77,577 | 66,040 | ||||||

| Work in process | 10,053 | 11,668 | ||||||

| Finished products | 99,669 | 86,907 | ||||||

| Total inventories | 187,299 | 164,615 | ||||||

| Income taxes receivable | 4,711 | 17,319 | ||||||

| Prepaid expenses and other current assets | 37,383 | 47,936 | ||||||

| Total current assets | 576,437 | 673,893 | ||||||

| Investment in unconsolidated affiliates | 140,467 | 144,863 | ||||||

| Operating lease assets | 27,109 | 18,667 | ||||||

| Goodwill | 373,375 | 331,595 | ||||||

| Other intangibles, net of accumulated amortization of | ||||||||

| $87,024 and $83,242 at August 31, 2024 and May 31, 2024, respectively | 250,376 | 221,071 | ||||||

| Other assets | 21,611 | 21,342 | ||||||

| Property, plant and equipment: | ||||||||

| Land | 8,676 | 8,657 | ||||||

| Buildings and improvements | 129,254 | 123,478 | ||||||

| Machinery and equipment | 344,250 | 321,836 | ||||||

| Construction in progress | 33,841 | 24,504 | ||||||

| Total property, plant and equipment | 516,021 | 478,475 | ||||||

| Less: accumulated depreciation | 260,125 | 251,269 | ||||||

| Total property, plant and equipment, net | 255,896 | 227,206 | ||||||

| Total assets | $ | 1,645,271 | $ | 1,638,637 | ||||

| Liabilities and equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 82,768 | $ | 91,605 | ||||

| Accrued compensation, contributions to employee benefit plans and related taxes | 30,536 | 41,974 | ||||||

| Dividends payable | 9,443 | 9,038 | ||||||

| Other accrued items | 34,486 | 29,061 | ||||||

| Current operating lease liabilities | 7,353 | 6,228 | ||||||

| Income taxes payable | 1,652 | 470 | ||||||

| Total current liabilities | 166,238 | 178,376 | ||||||

| Other liabilities | 57,918 | 62,243 | ||||||

| Distributions in excess of investment in unconsolidated affiliate | 110,522 | 111,905 | ||||||

| Long-term debt | 300,009 | 298,133 | ||||||

| Noncurrent operating lease liabilities | 20,166 | 12,818 | ||||||

| Deferred income taxes | 87,177 | 84,150 | ||||||

| Total liabilities | 742,030 | 747,625 | ||||||

| Shareholders’ equity – controlling interest | 901,353 | 888,879 | ||||||

| Noncontrolling interests | 1,888 | 2,133 | ||||||

| Total equity | 903,241 | 891,012 | ||||||

| Total liabilities and equity | $ | 1,645,271 | $ | 1,638,637 | ||||

| WORTHINGTON ENTERPRISES, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) |

||||||||

| Three Months Ended | ||||||||

| August 31, | ||||||||

| 2024 | 2023 | |||||||

| Operating activities: | ||||||||

| Net earnings | $ | 24,008 | $ | 99,703 | ||||

| Adjustments to reconcile net earnings to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 11,830 | 28,325 | ||||||

| Impairment of long-lived assets | – | 1,401 | ||||||

| Benefit from deferred income taxes | (5,537 | ) | (5,453 | ) | ||||

| Loss on extinguishment of debt | – | 1,534 | ||||||

| Bad debt income | (8 | ) | (799 | ) | ||||

| Equity in net income of unconsolidated affiliates, net of distributions | 3,453 | 10,225 | ||||||

| Net loss (gain) on sale of assets | (18 | ) | 105 | |||||

| Stock-based compensation | 3,925 | 4,516 | ||||||

| Changes in assets and liabilities, net of impact of acquisitions: | ||||||||

| Receivables | 28,166 | (8,843 | ) | |||||

| Inventories | (6,406 | ) | (64,327 | ) | ||||

| Accounts payable | (13,093 | ) | 278 | |||||

| Accrued compensation and employee benefits | (11,445 | ) | (12,014 | ) | ||||

| Other operating items, net | 6,271 | 5,045 | ||||||

| Net cash provided by operating activities | 41,146 | 59,696 | ||||||

| Investing activities: | ||||||||

| Investment in property, plant and equipment | (9,629 | ) | (29,298 | ) | ||||

| Acquisitions, net of cash acquired | (88,887 | ) | – | |||||

| Proceeds from sale of assets, net of selling costs | 11,769 | 51 | ||||||

| Investment in non-marketable equity securities | (2,000 | ) | (40 | ) | ||||

| Investment in note receivable | – | (15,000 | ) | |||||

| Net cash used by investing activities | (88,747 | ) | (44,287 | ) | ||||

| Financing activities: | ||||||||

| Dividends paid | (8,116 | ) | (15,725 | ) | ||||

| Repurchase of common shares | (6,803 | ) | – | |||||

| Proceeds from issuance of common shares, net of tax withholdings | (3,158 | ) | (5,130 | ) | ||||

| Net repayments of short-term borrowings | – | (2,813 | ) | |||||

| Principal payments on long-term obligations | – | (243,757 | ) | |||||

| Payments to noncontrolling interests | – | (1,921 | ) | |||||

| Net cash used by financing activities | (18,077 | ) | (269,346 | ) | ||||

| Decrease in cash and cash equivalents | (65,678 | ) | (253,937 | ) | ||||

| Cash and cash equivalents at beginning of period | 244,225 | 454,946 | ||||||

| Cash and cash equivalents at end of period (1) | $ | 178,547 | $ | 201,009 | ||||

(1) The cash flows related to discontinued operations have not been segregated in the periods presented herein. Accordingly, the consolidated statements of cash flows include the results from continuing and discontinued operations.

WORTHINGTON ENTERPRISES, INC.

NON-GAAP FINANCIAL MEASURES

(In thousands, except units and per share amounts

The following provides a reconciliation of non-GAAP financial measures, including adjusted operating income (loss), adjusted earnings before income taxes, adjusted income tax expense (benefit), adjusted net earnings (loss) from continuing operations attributable to controlling interest, adjusted earnings per diluted share from continuing operations attributable to controlling interest and adjusted effective tax rate, from their most comparable GAAP measure for the three months ended August 31, 2024, and August 31, 2023. Refer to the Use of Non-GAAP Measures and Definitions section herein and non-GAAP footnotes below for further information on these measures .

| Three Months Ended August 31, 2024 | ||||||||||||||||||||

| Operating Loss |

Earnings Before Income Taxes |

Income Tax Expense (Benefit) |

Net Earnings from Continuing Operations (1) | Diluted EPS – Continuing Operations | ||||||||||||||||

| GAAP | $ | (4,699 | ) | $ | 30,790 | $ | 6,782 | $ | 24,253 | 0.48 | ||||||||||

| Restructuring and other expense, net | 1,158 | 1,158 | (290 | ) | 868 | 0.02 | ||||||||||||||

| Non-GAAP | $ | (3,541 | ) | $ | 31,948 | $ | 7,072 | $ | 25,121 | $ | 0.50 | |||||||||

| Three Months Ended August 31, 2023 | ||||||||||||||||||||

| Operating Income (Loss) |

Earnings Before Income Taxes |

Income Tax Expense (Benefit) |

Net Earnings from Continuing Operations (1) | Diluted EPS – Continuing Operations | ||||||||||||||||

| GAAP | $ | (7,324 | ) | $ | 35,791 | $ | 8,960 | $ | 26,831 | $ | 0.54 | |||||||||

| Corporate costs eliminated at Separation | 9,672 | 9,672 | (2,271 | ) | 7,401 | 0.15 | ||||||||||||||

| Separation costs | 2,410 | 2,410 | (566 | ) | 1,844 | 0.04 | ||||||||||||||

| Loss on extinguishment of debt | – | 1,534 | (360 | ) | 1,174 | 0.02 | ||||||||||||||

| Non-GAAP | $ | 4,758 | $ | 49,407 | $ | 12,157 | $ | 37,250 | $ | 0.75 | ||||||||||

(1) Excludes the impact of noncontrolling interest.

To further assist in the analysis of segment results for the three months ended August 31, 2024 and 2023 the following supplemental information has been provided. Reconciliations of adjusted EBITDA from continuing operations and adjusted EBITDA margin from continuing operations to the most comparable GAAP measures, earnings before income taxes and earnings before income taxes margin.

| Three Months Ended | ||||||||

| August 31, | ||||||||

| (in thousands) | 2024 | 2023 | ||||||

| Volume | ||||||||

| Consumer Products | 16,171 | 16,032 | ||||||

| Building Products | 3,094 | 3,809 | ||||||

| Total reportable segments | 19,265 | 19,841 | ||||||

| Other | – | 106 | ||||||

| Consolidated | 19,265 | 19,947 | ||||||

| Net sales | ||||||||

| Consumer Products | $ | 117,596 | $ | 117,353 | ||||

| Building Products | 139,712 | 165,928 | ||||||

| Total reportable segments | 257,308 | 283,281 | ||||||

| Other | – | 28,637 | ||||||

| Consolidated | $ | 257,308 | $ | 311,918 | ||||

| Adjusted EBITDA from continuing operations | ||||||||

| Consumer Products | $ | 17,775 | $ | 14,275 | ||||

| Building Products | 39,729 | 59,692 | ||||||

| Total reportable segments | 57,504 | 73,967 | ||||||

| Other | (9,067 | ) | (8,052 | ) | ||||

| Consolidated | $ | 48,437 | $ | 65,915 | ||||

| Adjusted EBITDA margin from continuing operations | ||||||||