Texas Instruments Unusual Options Activity

Investors with a lot of money to spend have taken a bullish stance on Texas Instruments TXN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with TXN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 20 uncommon options trades for Texas Instruments.

This isn’t normal.

The overall sentiment of these big-money traders is split between 70% bullish and 15%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $259,790, and 14 are calls, for a total amount of $2,307,755.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $195.0 and $210.0 for Texas Instruments, spanning the last three months.

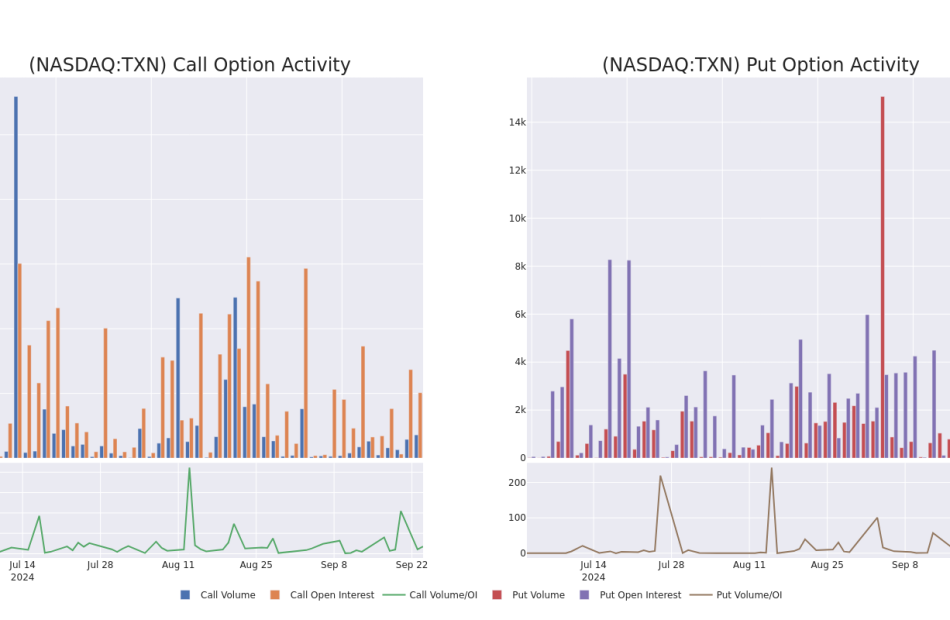

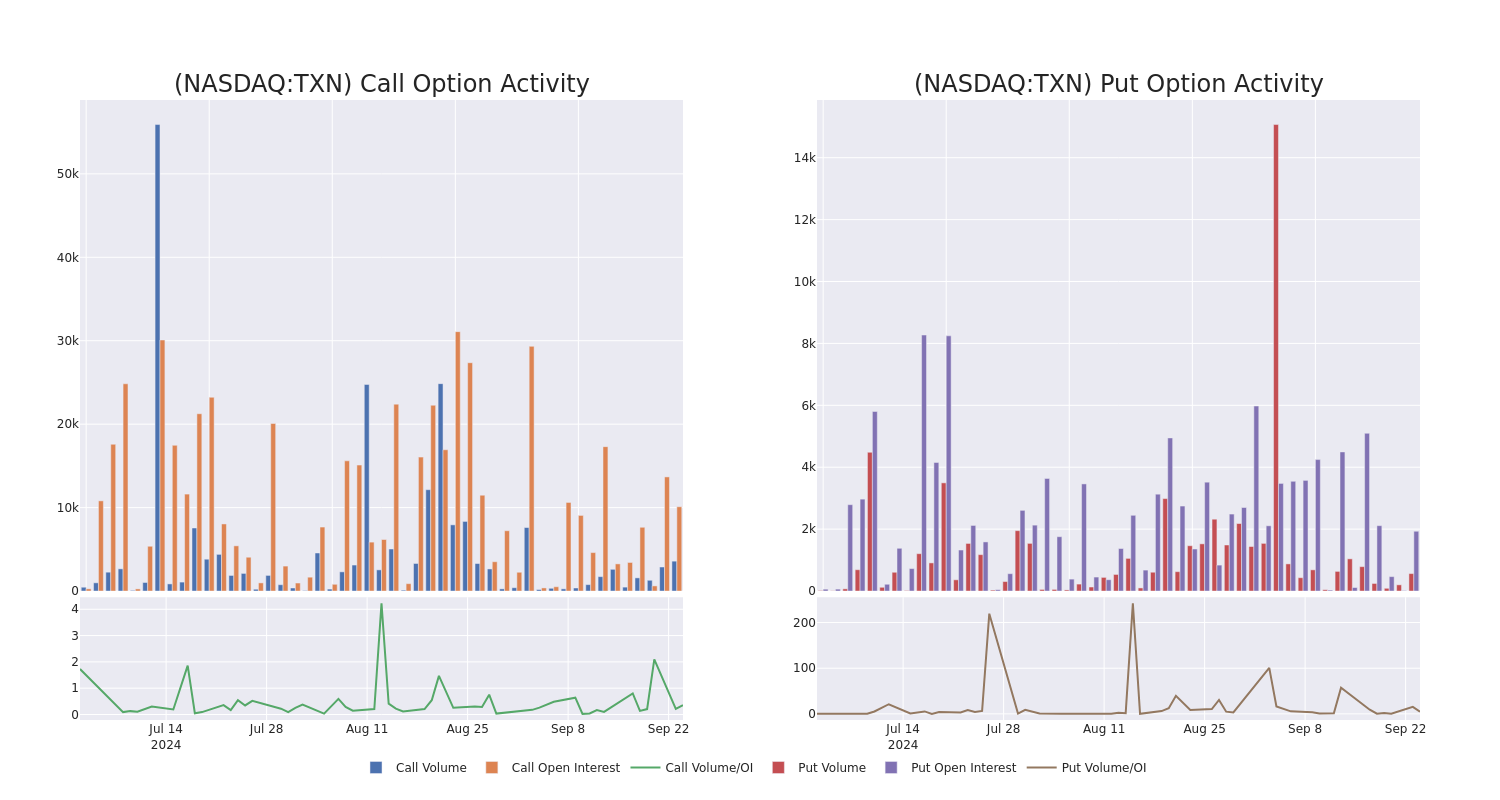

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Texas Instruments’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Texas Instruments’s substantial trades, within a strike price spectrum from $195.0 to $210.0 over the preceding 30 days.

Texas Instruments Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | CALL | TRADE | BULLISH | 09/27/24 | $12.8 | $12.45 | $12.8 | $195.00 | $1.1M | 1.4K | 1.4K |

| TXN | CALL | SWEEP | NEUTRAL | 09/27/24 | $12.8 | $12.3 | $12.8 | $195.00 | $628.5K | 1.4K | 491 |

| TXN | PUT | TRADE | BULLISH | 10/04/24 | $5.25 | $4.9 | $5.03 | $210.00 | $50.3K | 210 | 200 |

| TXN | CALL | TRADE | NEUTRAL | 10/04/24 | $5.8 | $3.75 | $4.85 | $205.00 | $48.4K | 241 | 0 |

| TXN | CALL | TRADE | BULLISH | 01/17/25 | $20.0 | $19.6 | $20.0 | $195.00 | $48.0K | 3.5K | 86 |

About Texas Instruments

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world’s largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

After a thorough review of the options trading surrounding Texas Instruments, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Texas Instruments

- With a volume of 3,961,287, the price of TXN is up 0.47% at $204.8.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 28 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Texas Instruments with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

One stock being targeted by a value-investing legend in a market he says has gotten too top-heavy

-

Value-investing legend Bill Nygren says the S&P 500 lacks the diversification it once had.

-

He likes to invest in inexpensive companies with enough capital on hand to consistently buy back shares.

-

Nygren mentioned Corebridge Financial as a top pick that checks all his boxes.

The S&P 500 isn’t as risk-free as investors might think, says Oakmark Funds’ Bill Nygren, who lamented the S&P 500’s growing lack of diversification.

Rather than buy the mega-cap tech stocks that dominate major indexes, the value-investing legend told CNBC he’s instead focused on inexpensive companies with ample cash on hand to consistently buy back shares.

“It’s become so important to us that we invest with companies that are taking matters into their own hands and using excess capital to repurchase their own stock,” Nygren told the outlet on Monday.

One stock he pinpointed that fits the bill is Corebridge Financial.

While the stock is currently trading around $28 a share, Nygren sees it almost doubling is book value to $50 by the end of 2025, or about four or five times earnings. He also predicts that Corebridge could buy back as much as 20% of its outstanding stock each year, a practice that generally engineers gains by increasing the per-unit value of each remaining share.

“It’s a name not many people know about,” Nygren said of the firm. “They don’t have to depend on other investors to recognize the value. They just keep reducing the float.”

He continued: “I think it just creates a tremendous opportunity for companies that are good businesses, generating a lot of cash flow, and it gives them the opportunity to increase per share value by reinvesting in themselves.”

Read the original article on Business Insider

Assurant or Old Republic: Which Multiline Insurer Has an Edge?

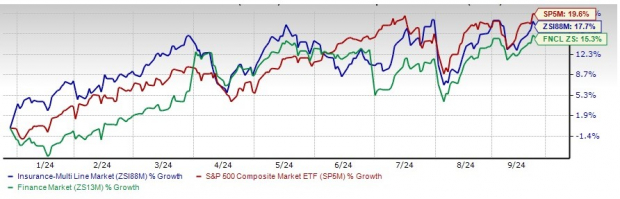

Better pricing, prudent underwriting, increased exposure and faster economic recovery should help Multiline insurers to grow. The industry has returned 17.7% year to date compared with the Finance sector’s growth of 15.3%. The Zacks S&P 500 composite has witnessed an increase of 19.6% in the said time frame. Product diversification helps insurance industry players lower concentration risk and improve retention ratio.

YTD Performance

Image Source: Zacks Investment Research

Accelerated digitalization will help the industry function smoothly. An improving rate environment should drive investment income higher as insurers are beneficiaries of a better rate environment.

Here we focus on two multiline insurers, namely Assurant, Inc. AIZ and Old Republic International Corporation ORI.

Assurant, with a market capitalization of $10.26 billion, provides business services that support, protect and connect consumer purchases in North America, Latin America, Europe and the Asia Pacific. Old Republic International, with a market capitalization of $9.21 billion, through its subsidiaries, engages in the insurance underwriting and related services business primarily in the United States and Canada. AIZ and ORI carry a Zacks Rank #2 (Buy) each at present.

Multiline insurers benefit from a diversified portfolio that lowers concentration risk. While higher demand for protection products benefits sales and premiums of life insurance operations, better pricing and increased exposure to intangibles and cyber threats support premium growth of non-life insurance operations.

Also, per Deloitte Insights, the transition to green energy and related insurance products, as well as exposure to intangible assets, offers growth opportunities. Per a report in Carrier Management, AM Best expects profitable commercial lines and improving personal lines in 2024. Swiss Re estimates high single-digit premium growth in 2024.

Insurers are direct beneficiaries of a rising rate environment. They invest a portion of their premiums. Long-tail insurers tend to gain more from rising rates as they have more time to invest their premiums and earn a higher rate of return. With a lower rate of return, investment income will suffer. In the FOMC meeting, the Federal Reserve announced cutting the interest rate by 50 basis points. This is the first time in four years that the central bank has taken such an action. The interest rate is now 4.75-5%, down from a more than two-decade high of 5.25-5.5%.

Multiline insurers are investing heavily in technology to improve scale and efficiencies. This should help them generate higher margins and improve profitability.

These positives together help insurers build solid policyholders’ surplus that helps the industry absorb losses. The solid capital level of the multiline insurers will fuel merger and acquisition activities to ramp up growth and aid these insurers to engage in shareholder-friendly moves.

Let’s delve deeper into specific parameters to ascertain which multi-line insurer is better-positioned at the moment.

Price Performance

Shares of Old Republic have climbed 21.3% year to date, outperforming the industry’s growth of 17.8% and Assurant’s rise of 17.6%.

Image Source: Zacks Investment Research

Return on Equity (ROE)

Assurant, with a ROE of 19.6%, exceeds Old Republic’s ROE of 12.5% and the industry average of 16%.

Image Source: Zacks Investment Research

Debt-to-Capital

Old Republic’s debt-to-capital ratio of 24.8 is lower than the industry average of 31.8 and Assurant’s reading of 29.3. Therefore, ORI has an advantage over AIZ on this front.

Image Source: Zacks Investment Research

Earnings Surprise History

AIZ outpaced expectations in each of the last seven reported quarters. ORI surpassed estimates in six of the last seven reported quarters.

Dividend Yield

Old Republic’s dividend yield of 2.97% is better than Assurant’s dividend yield of 1.45%. Thus, ORI has an advantage over AIZ on this front.

Image Source: Zacks Investment Research

Valuation

The price-to-book value is the best multiple used for valuing insurers. Compared with Assurant’s P/B ratio of 2.06, Old Republic is cheaper, with a reading of 1.53. The multi-line insurance industry’s P/B ratio is 2.70.

Image Source: Zacks Investment Research

Growth Projection

The Zacks Consensus Estimate for 2024 earnings indicates 7.6% growth from the year-ago reported figure for Old Republic, while the same for Assurant implies an increase of 6.7%.

Earnings Estimates

For 2024, the Zacks Consensus Estimate for AIZ has moved 2.9% north to $16.54 in the past 60 days, while the same for ORI has been revised 4.4% north to $2.83. Therefore, AIZ is in an advantageous position over ORI on this front.

Net Margin

Old Republic’s net margin for the trailing 12 months was 8.59%, higher than Assurant’s reading of 6.9%.

To Conclude

Our comparative analysis shows that Old Republic is better positioned than Assurant with respect to price, valuation, growth projection, dividend yield, leverage and net margin. AIZ outpaces ORI in terms of return on equity, earnings estimates and earnings surprise history. With the scale majorly tilted toward Old Republic, the stock appears to be better poised.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Just Bought $345 Million of His Favorite Stock (Hint: Not Apple)

Warren Buffett is one of the most revered investors on Wall Street. That’s partly because he has amassed a personal fortune of $140 billion, but also because Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) has grown at a phenomenal pace under his leadership.

The company’s Class A stock has returned 20% annually since Buffett took control in 1965. Meanwhile, the S&P 500 (SNPINDEX: ^GSPC) has returned about 10% annually. Berkshire’s outperformance boils down to prudent capital allocation decisions, and Buffett deserves much of the credit.

He has architected dozens of savvy acquisitions, made many prudent investments, and repurchased company stock in a manner that has undoubtedly created shareholder value. But two recent capital allocation decisions are worth exploring. In the June quarter, Buffett sold 389 million shares of Apple (NASDAQ: AAPL) and he bought $345 million worth of his favorite stock.

Here’s what investors should know.

1. Apple

Berkshire first took a stake in Apple during the first quarter of 2016, and it became the biggest position in the company’s portfolio by the fourth quarter of 2017. Many investors were initially surprised because Warren Buffett had famously avoided technology stocks for most of his career. But he has praised Apple CEO Tim Cook for his extraordinary management on several occasions, and Buffett recently said the iPhone “may be the greatest product of all time.”

Apple still ranks as Berkshire’s largest holding, and Buffett does not expect that to change this year. But his decision to sell 49% of the position in the June quarter raises questions, especially because he had already trimmed the position by 13% in the March quarter. Why would Buffett sell so much Apple stock when he clearly admires the company?

Earlier this year, Buffett was asked that question at Berkshire’s annual meeting, and he attributed the decision to a probable increase in the corporate tax rate in the future. The U.S. federal government has run a historic deficit in recent years, and Buffett believes higher taxes will be used to remedy the situation at some point. In that scenario, Berkshire would pay more taxes on its earnings, and GAAP earnings include investment gains.

In other words, Buffett has been selling Apple stock this year so that Berkshire will not have to pay a higher tax rate on the investment gains in the future. That makes sense, but it raises another question: Why focus on Apple? If corporate taxes increase, Berkshire would owe the federal government a large slice of its investment gains on every stock. So, why is Buffett selling Apple so aggressively? The logical answer is valuation.

Apple is a wonderful business with enviable brand authority and a strong presence in many markets, including its position as the largest smartphone manufacturer in the U.S. However, Wall Street expects its earnings to increase at 8.6% annually over the next three years, which makes its current valuation of 34.4 times earnings look expensive. Those figure give a PEG ratio of 4, a substantial premium to the three-year average of 2.7.

2. Berkshire Hathaway

Berkshire Hathaway amended its stock buyback program in 2018, such that Warren Buffett can repurchase shares whenever he believes they are discounted compared to their intrinsic value. Buffett allocated $345 million to stock buybacks in the June quarter, bringing the total to $2.6 billion year to date and nearly $78 billion since 2018.

Consistent share repurchases indicate Berkshire stock has regularly been undervalued in Buffett’s estimation. It also suggests that Berkshire is his favorite stock. As my colleague Sean Williams explains, Buffett could have purchased any of 379 companies in the S&P 500 with $78 billion. Alternatively, he could have bought stock in the other 121 companies. Instead, he spent the money on buybacks.

What sets Berkshire apart is the scope of its insurance businesss, coupled with prudent investment decisions made by Buffett and his understudies, Todd Combs and Ted Weschler. To elaborate, Berkshire is the world leader in insurance float — a terms that refers to premiums collected by the company that have not yet been paid out in claims. Moreover, Berkshire has paid “less than nothing” to accumulate float due to disciplined underwriting, according to Buffett.

He once defined float as “funds that do not belong to us, but are nevertheless ours to deploy, whether in bonds, stocks or cash equivalents such as U.S. Treasury bills.” That’s why Buffett loves the insurance business. With disciplined underwriting, it generates large sums of investable capital, and Buffett has used those funds to create substantial value for shareholders.

Berkshire’s book value per share — a good proxy for changes in intrinsic value — increased 194% during the 10-year period that ended in the June quarter. The S&P 500 returned 179% over the same interval. That tells me Buffett and his understudies have invested Berkshire’s float very effectively.

Wall Street expects Berkshire’s operating earnings (which exclude investment gains and losses) to increase at 17% annually through 2027. That consensus estimate makes the current valuation of 23.3 times operating earnings look reasonable. Patient investors should feel confident in buying a small position in Berkshire today, especially because Buffett is probably repurchasing shares in the current quarter.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Just Bought $345 Million of His Favorite Stock (Hint: Not Apple) was originally published by The Motley Fool

Decoding CarMax's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on CarMax. Our analysis of options history for CarMax KMX revealed 11 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $537,122, and 3 were calls, valued at $127,050.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $75.0 to $85.0 for CarMax over the last 3 months.

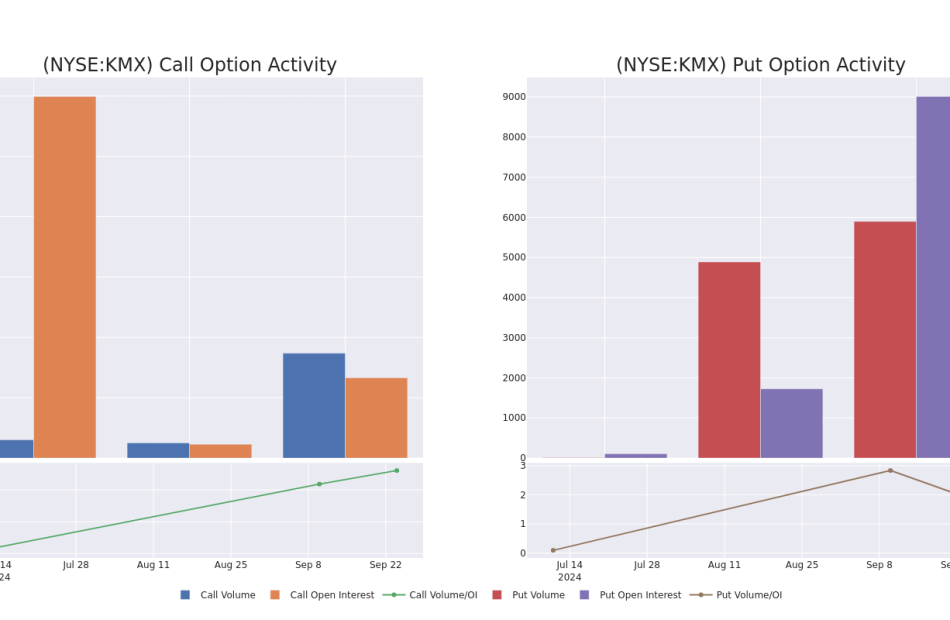

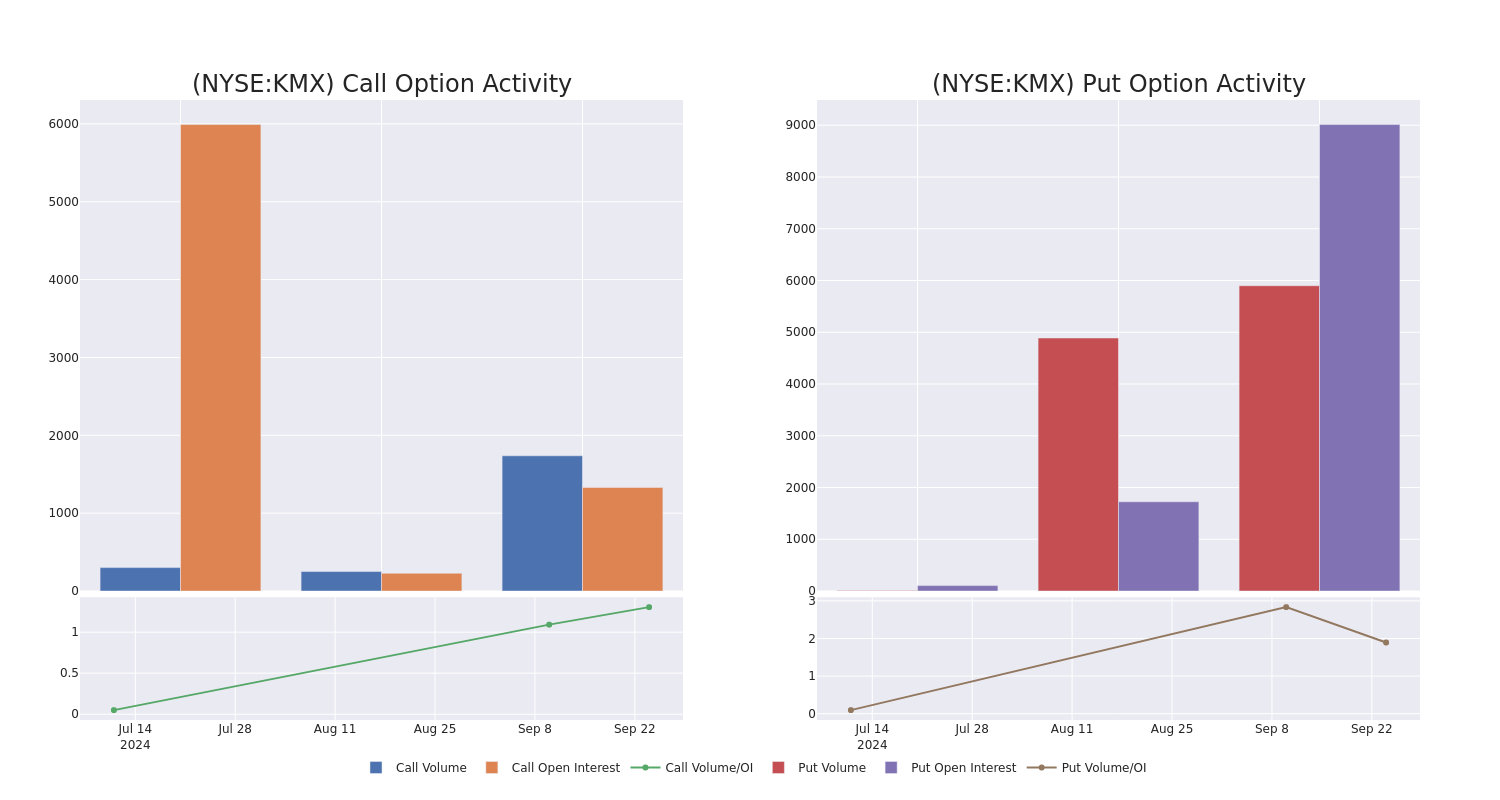

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for CarMax’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CarMax’s whale activity within a strike price range from $75.0 to $85.0 in the last 30 days.

CarMax Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KMX | PUT | SWEEP | NEUTRAL | 10/18/24 | $8.1 | $7.8 | $7.95 | $82.50 | $190.0K | 2.7K | 1.4K |

| KMX | PUT | SWEEP | NEUTRAL | 10/18/24 | $4.9 | $4.6 | $4.75 | $77.50 | $113.5K | 3.4K | 1.7K |

| KMX | CALL | SWEEP | BULLISH | 10/18/24 | $2.6 | $2.55 | $2.55 | $80.00 | $53.5K | 699 | 274 |

| KMX | PUT | SWEEP | BULLISH | 10/18/24 | $4.7 | $4.6 | $4.6 | $77.50 | $46.0K | 3.4K | 114 |

| KMX | PUT | SWEEP | BEARISH | 01/17/25 | $10.4 | $10.2 | $10.4 | $82.50 | $40.5K | 467 | 39 |

About CarMax

CarMax sells, finances, and services used and new cars through a chain of around 250 used retail stores. It was formed in 1993 as a unit of Circuit City and spun off into an independent company in late 2002. Used-vehicle sales typically account for about 83% of revenue (79% in fiscal 2024 due to the chip shortage) and wholesale about 13% (19% in fiscal 2024), with the remaining portion composed of extended service plans and repair. In fiscal 2024, the company retailed and wholesaled 765,572, and 546,331 used vehicles, respectively. CarMax is the largest used-vehicle retailer in the US but still estimates that it had only about 3.7% US market share of vehicles 0-10 years old in 2023. It seeks over 5% share a few years from now. CarMax is based in Richmond, Virginia.

After a thorough review of the options trading surrounding CarMax, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of CarMax

- With a trading volume of 2,442,796, the price of KMX is up by 0.07%, reaching $76.5.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 2 days from now.

What The Experts Say On CarMax

3 market experts have recently issued ratings for this stock, with a consensus target price of $78.33333333333333.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $95.

* An analyst from JP Morgan persists with their Underweight rating on CarMax, maintaining a target price of $65.

* An analyst from Truist Securities persists with their Hold rating on CarMax, maintaining a target price of $75.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for CarMax with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gold Trades Near Record High as US Data Support Deeper Rate Cuts

(Bloomberg) — Gold steadied near an all-time high, as weak US data bolstered the case for deeper interest rate cuts.

Most Read from Bloomberg

Bullion climbed to a record $2,670.57 an ounce earlier on Wednesday, before paring its gains. A report on Tuesday showed US consumer confidence this month fell the most in three years.

Swaps traders increased bets for more than three-quarters of a point of easing by the Federal Reserve this year. Lower rates tend to benefit both gold and silver as they don’t offer interest, while a weaker dollar makes the metals cheaper for many buyers.

Gold has surged 29% this year, while silver has risen 34% — with the rallies gaining momentum after the Fed’s half-point cut last week.

Gold has also been supported by strong central bank purchases and heightened geopolitical tensions driving haven demand. A too-close-to-call US presidential election that could be massively consequential for financial markets is now less than six weeks away.

Gold and silver tend to move largely in tandem as both offer similar macro- and currency-hedging properties. Still, the white metal is more exposed to the economic cycle as it’s also an industrial commodity used in clean-energy technologies, including solar panels.

In a boost for industrial metals, Beijing announced a series of stimulus measures Tuesday to address the nation’s economic malaise and in particular targeting the real estate market.

“The main driver for silver in the last few weeks has been the gold rally — which got another boost yesterday from higher rate-cut expectations following the weak consumer confidence report,” said Zhong Liang Han, an analyst at Standard Chartered Plc. However, the “rally in industrial metals following China’s broad stimulus package was the key driver behind the next leg of the up-move in silver.”

Spot gold was steady at $2,657.73 as of 9:04 a.m. in London. The Bloomberg Dollar Spot Index was little changed following. Silver dipped 0.8% to $31.85 an ounce, retreating from near a four-month high afer gaining 4.6% on Tuesday. Palladium and platinum declined.

Silver is getting attention given the sharp rally in gold, especially as investors look for catch-up buying opportunities, said Joni Teves, a precious metals strategist at UBS Group AG.

“The move in industrial commodities is likely also providing an additional boost,” Teves said. “Our bullish outlook for silver is unchanged; we think it can outperform in this environment of rising gold prices, Fed easing and forecasted silver market deficits.”

Looking ahead, investors are waiting for more US data — including the personal consumption expenditures gauge and jobless claims — due later in the week, for additional indications on the Fed’s likely easing path.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

3 No-Brainer High-Yield Dividend Stocks to Buy With $1,000 Right Now

After much speculation, the Federal Reserve has finally started reducing interest rates. Falling rates should be a boon for the real estate sector. It will lower borrowing costs and should boost property valuations.

This means real estate investment trusts (REITs) look like no-brainer buys right now, especially for those seeking a lucrative income stream. Realty Income (NYSE: O), Mid-America Apartment Communities (NYSE: MAA), and Prologis (NYSE: PLD) all have dividend yields over 3%, more than double the S&P 500’s dividend yield (less than 1.5%). That makes them great REITs to buy for income and upside potential right now.

An acceleration ahead

Realty Income currently yields more than 5%. At that rate, it could turn a $1,000 investment into more than $50 of annual passive dividend income.

The diversified REIT has a terrific track record of paying dividends. It has paid over 650 consecutive monthly dividends, including raising its payout 127 times since coming public in 1994 and for 108 straight quarters. It has grown its dividend at a 4.3% compound annual rate, which helped it deliver a 13.5% compound annual total return since its public listing.

Realty Income is in a strong position to continue increasing its dividend. The REIT’s main growth driver is its ability to acquire income-producing properties. It can raise its adjusted funds from operations (FFO) by around 0.5% per share for every $1 billion of accretive investments it funds externally (issuing new debt and shares). It currently expects to invest about $3 billion into new properties this year, which is down from recent years due to higher interest rates (it also purchased another REIT in a $9.3 billion deal).

With rates expected to fall, Realty Income should be able to ramp up its acquisition volume and grow even faster. That should enhance its ability to increase its dividend.

A reacceleration awaits

Mid-America Apartment Communities (MAA) is a leading apartment REIT focused on Sunbelt markets. The landlord currently offers a dividend yield above 3.5%. It has paid 122 consecutive quarterly dividends and increased its payment for 14 straight years, including by 5% late last year.

The REIT benefits from the strong demand for apartments in its markets. That keeps occupancy levels high and tends to drive above-average rent growth.

A surge in new supply has slowed rent growth to a crawl in recent quarters (0.5% in the second quarter). That headwind should fade over the second half of this year and into 2025 as its markets absorb this new supply. That should drive a reacceleration in rent growth.

Meanwhile, MAA has started ramping up its investment activities to capitalize on the expected resurgence in rent. It recently acquired a newly built multifamily property. It also has seven communities under construction and expects to begin four to six more projects over the next two years. The combination of accelerating rent growth and its investments to expand its portfolio should enable the REIT to continue increasing its dividend.

A speed bump on the path to more growth ahead

Prologis currently yields more than 3%. The leading industrial REIT has a great record of growing its payout. It has grown its dividend at a 13% compound annual rate over the last five years, more than double the S&P 500’s average (5% compound annual dividend growth).

The warehouse owner hit a slight speed bump this year. Higher interest rates have impacted customer demand, which caused the REIT to trim its guidance earlier for 2024. Despite that near-term headwind, it still expects its core FFO to grow by nearly 8% per share this year.

Meanwhile, it sees a reacceleration ahead, driven by the growing demand for warehouse space and limited future supply. It sees its core FFO growing by 9% to 11% per share through 2026. In addition to strong warehouse demand, the REIT is starting to tap into new growth drivers like energy and data centers. These catalysts could enhance its long-term growth rate, potentially allowing it to continue increasing its dividend at a well-above-average annual pace.

A great time to buy these top-notch REITs

Realty Income, MAA, and Prologis pay high-yielding dividends that they’ve historically grown at healthy rates. While they’re all experiencing some near-term growth headwinds from higher rates, that should fade as they begin to fall. Because of that, they look like no-brainer buys right now for those seeking income and upside potential.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Matt DiLallo has positions in Mid-America Apartment Communities, Prologis, and Realty Income. The Motley Fool has positions in and recommends Mid-America Apartment Communities, Prologis, and Realty Income. The Motley Fool recommends the following options: long January 2026 $90 calls on Prologis. The Motley Fool has a disclosure policy.

3 No-Brainer High-Yield Dividend Stocks to Buy With $1,000 Right Now was originally published by The Motley Fool

Did Aping Warren Buffett And Hedge Fund Managers Bring Success To This AI-Powered ETF That Launched Last Week?

It’s a week since the Intelligent Livermore ETF LIVR, an exchange-traded fund that aims to mimic the investment philosophies of prominent investors, debuted, and here’s a look at how the financial asset has fared and the opportunity it presents for investors.

LIVR’s Origin? For the unversed, LIVR is the first instrument launched by investment firm Intelligent Alpha floated by Doug Clinton, co-founder and Managing Partner at Deepwater Asset Management. Intelligent Alpha aims to use artificial intelligence technology to zero in on portfolio assets, tapping specifically into three of the most popular large-language models such as OpenAI’s ChatGPT, Anthropic’s Claude and Alphabet, Inc.’s GOOG GOOGL Gemini.

LIVR has been named after famed 20th-century investor Jesse Livermore who is considered the pioneer of day trading. To start with, the LIVR portfolio will focus on opportunities in AI, Latin American equities, Asian equities, renewables and energy, and defensive stocks as selected by the AI investment committee, the firm said.

“My experience investing in emerging technologies over the last decade makes me believe that large-language AI models will drive a trillion-dollar shift in the asset management industry from traditional passive and active portfolios to AI-powered portfolios,” said Clinton in a statement.

The ETF created a unique investment strategy by drawing upon inputs from financial information, public letters, interviews and statements from finance legends such as Warren Buffett and hedge fund managers such as Stanley Druckenmiller and David Tepper, Clinton reportedly told Fortune.

“They can sort of replicate or pretend to be any investor. That’s one of the superpowers of AI,” he reportedly said. “You could have it be a super aggressive growth investor, or you could have it be a super value conscious Buffett acolyte.”

See Also: Best AI Stocks

LIVR has an expense ratio of 0.69% and it has $13.8 million in assets under management. The top five holdings of the ETF and each of their portfolio weightings are:

- PDD Holdings Inc. PDD: 4.60%

- Meta Platforms, Inc. META: 4.55%

- Nvidia Corp. (NASDAQ: NVDA): 4.51%

- Taiwan Semiconductor Management Co. Ltd. TSM: 4.41%

- Procter & Gamble Co. PG: 2.96%

Performance: LIVR began trading on the Nasdaq on Wednesday, Sept. 18, starting the session at a net asset value of $25.21 before ending down about 0.6% at $25.05. The ETF largely remained rang-bound around the $25 level and ended Tuesday’s session up 2.07% at $26.08. Over the past week, the ETF has gained 4.1%, outperforming the Invesco QQQ Trust QQQ and the SPDR S&P 500 ETF Trust (NYSE SPY), which are up a little over 3% and 2%, respectively.

During the same time, the Global X Artificial Intelligence & Technology ETF AIQ has added a comparable 4.6%.

It’s still in the early days to assess the success of the ETF. That said, the heavy weighting of AI-levered stocks could keep it on track to perform in line with these stocks. Since the AI bubble is seen to last for three to five years, LIVR could make hay while the sun shines. That said, the Federal Reserve’s interest rate cut is widely expected to apply brakes on the tech rally.

On Tuesday, LIVR added 2.07% before ending at $26.08, according to Benzinga Pro data.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Invesco Mortgage Capital Inc. Announces Quarterly Common Dividend

ATLANTA, Sept. 24, 2024 /PRNewswire/ — Invesco Mortgage Capital Inc. (the “Company”) IVR today announced that its Board of Directors declared a cash dividend of $0.40 per share of common stock for the third quarter of 2024. The dividend will be paid on October 25, 2024 to stockholders of record at the close of business on October 7, 2024, with an ex-dividend date of October 7, 2024.

About Invesco Mortgage Capital Inc.

Invesco Mortgage Capital Inc. is a real estate investment trust that primarily focuses on investing in, financing and managing mortgage-backed securities and other mortgage-related assets. Invesco Mortgage Capital Inc. is externally managed and advised by Invesco Advisers, Inc., a subsidiary of Invesco Ltd. IVZ, a leading independent global investment management firm. Additional information is available at www.invescomortgagecapital.com.

Cautionary Notice Regarding Forward-Looking Statements

This press release may include statements and information that constitute “forward-looking statements” within the meaning of the U.S. securities laws as defined in the Private Securities Litigation Reform Act of 1995, as amended, and such statements are intended to be covered by the safe harbor provided by the same. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company’s control. These forward-looking statements include those related to our intention and ability to pay dividends, as well as any other statements other than statements of historical fact. The words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,” or similar expressions and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” and any other statement that necessarily depends on future events, are intended to identify forward-looking statements.

Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect the Company. Except as required by law, the Company is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investor Relations Contact: Greg Seals, 404-439-3323

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/invesco-mortgage-capital-inc-announces-quarterly-common-dividend-302257489.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/invesco-mortgage-capital-inc-announces-quarterly-common-dividend-302257489.html

SOURCE Invesco Mortgage Capital Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Winners And Losers Of Q2: Ford (NYSE:F) Vs The Rest Of The Automobile Manufacturers Stocks

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at automobile manufacturers stocks, starting with Ford (NYSE:F).

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

The 5 automobile manufacturers stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 6.1%.

After much suspense, the Federal Reserve cut its policy rate by 50bps (half a percent) in September 2024. This marks the central bank’s first easing of monetary policy since 2020 and the end of its most pointed inflation-busting campaign since the 1980s. Inflation had begun to run hot in 2021 post-COVID due to a confluence of factors such as supply chain disruptions, labor shortages, and stimulus spending. While CPI (inflation) readings have been supportive lately, employment measures have prompted some concern. Going forward, the markets will debate whether this rate cut (and more potential ones in 2024 and 2025) is perfect timing to support the economy or a bit too late for a macro that has already cooled too much.

Amidst this news, automobile manufacturers stocks have had a rough stretch. On average, share prices are down 15.4% since the latest earnings results.

Ford (NYSE:F)

Established to make automobiles accessible to a broader segment of the population, Ford (NYSE:F) designs, manufactures, and sells a variety of automobiles, trucks, and electric vehicles.

Ford reported revenues of $47.81 billion, up 6.3% year on year. This print exceeded analysts’ expectations by 6.5%. Despite the top-line beat, it was still a slower quarter for the company with a miss of analysts’ earnings estimates.

Unsurprisingly, the stock is down 19.7% since reporting and currently trades at $10.97.

Read our full report on Ford here, it’s free.

Best Q2: General Motors (NYSE:GM)

Founded in 1908 by William C. Durant, General Motors (NYSE:GM) offers a range of vehicles and automobiles through brands such as Chevrolet, Buick, GMC, and Cadillac.

General Motors reported revenues of $47.97 billion, up 7.2% year on year, outperforming analysts’ expectations by 5.9%. The business had a stunning quarter with an impressive beat of analysts’ operating margin estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.4% since reporting. It currently trades at $48.35.

Is now the time to buy General Motors? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Winnebago (NYSE:WGO)

Created to provide high-quality, affordable RVs to the post-war American family, Winnebago (NYSE:WGO) is a manufacturer of recreational vehicles, providing a range of motorhomes, travel trailers, and fifth-wheel products for outdoor and adventure lifestyles.

Winnebago reported revenues of $786 million, down 12.7% year on year, falling short of analysts’ expectations by 1.5%. It was a softer quarter as it posted a miss of analysts’ earnings and operating margin estimates.

Winnebago delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 1.9% since the results and currently trades at $57.75.

Read our full analysis of Winnebago’s results here.

Rivian (NASDAQ:RIVN)

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ:RIVN) designs, manufactures, and sells electric adventure vehicles and commercial delivery vans.

Rivian reported revenues of $1.16 billion, up 3.3% year on year. This print was in line with analysts’ expectations. It was an exceptional quarter as it also put up an impressive beat of analysts’ volume estimates.

The stock is down 18.8% since reporting and currently trades at $12.01.

Read our full, actionable report on Rivian here, it’s free.

Nikola (NASDAQ:NKLA)

Seeking to transform the heavy-duty transportation industry, Nikola (NASDAQ:NKLA) develops and manufactures zero-emission trucks.

Nikola reported revenues of $31.32 million, up 104% year on year. This print topped analysts’ expectations by 19.6%. Overall, it was a very strong quarter as it also produced a decent beat of analysts’ operating margin estimates.

Nikola scored the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 38.1% since reporting and currently trades at $4.83.

Read our full, actionable report on Nikola here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.