Rocket Lab USA's Options: A Look at What the Big Money is Thinking

Financial giants have made a conspicuous bearish move on Rocket Lab USA. Our analysis of options history for Rocket Lab USA RKLB revealed 25 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 56% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $367,295, and 19 were calls, valued at $995,434.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $5.0 to $15.0 for Rocket Lab USA over the last 3 months.

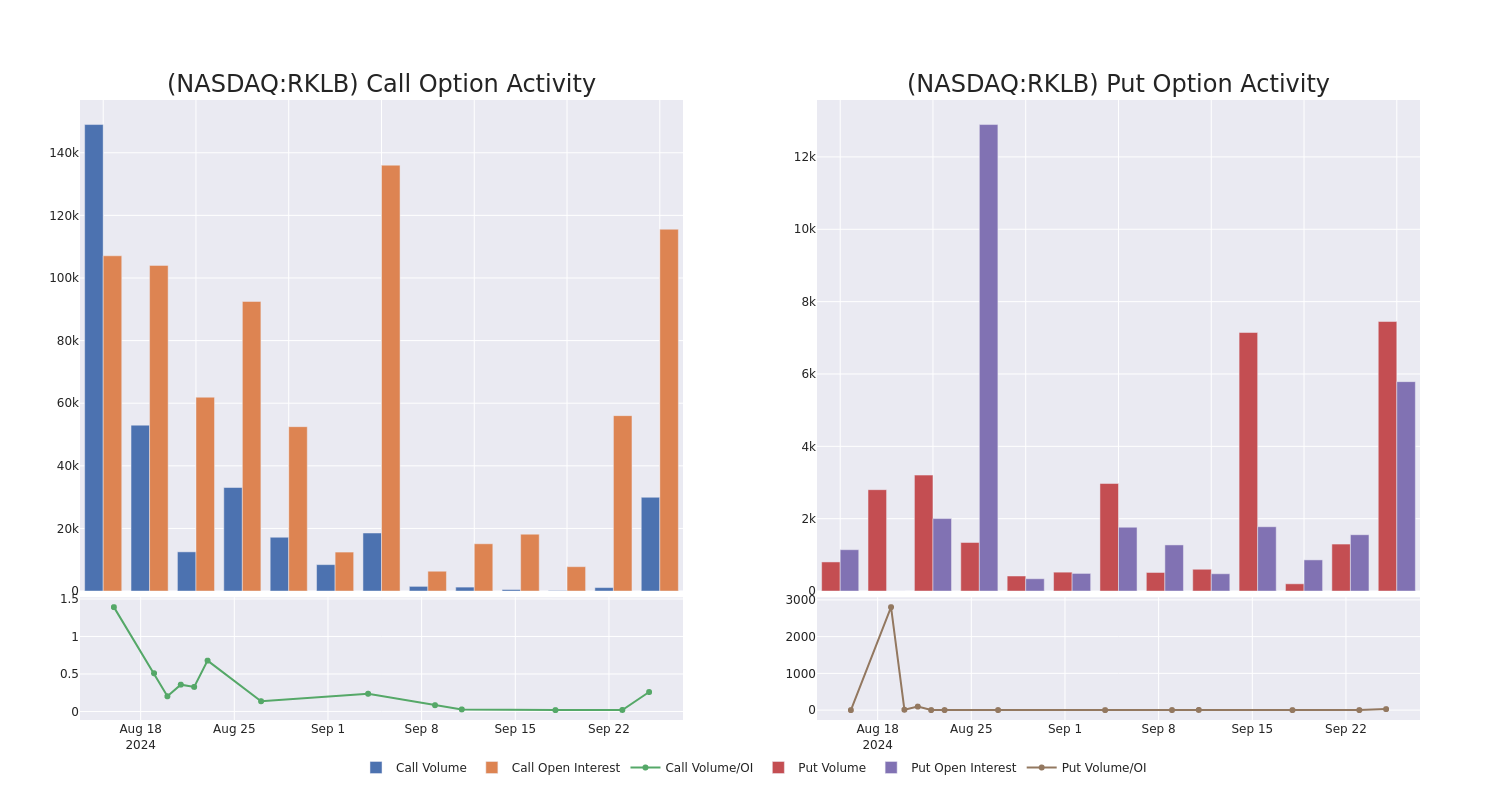

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Rocket Lab USA’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Rocket Lab USA’s whale trades within a strike price range from $5.0 to $15.0 in the last 30 days.

Rocket Lab USA Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RKLB | CALL | SWEEP | BEARISH | 01/15/27 | $4.0 | $3.7 | $3.7 | $10.00 | $240.5K | 146 | 946 |

| RKLB | PUT | SWEEP | BULLISH | 01/17/25 | $0.75 | $0.7 | $0.7 | $7.00 | $140.0K | 3.6K | 2.2K |

| RKLB | CALL | SWEEP | BULLISH | 10/18/24 | $0.5 | $0.45 | $0.5 | $9.00 | $100.9K | 3.2K | 2.4K |

| RKLB | PUT | TRADE | BULLISH | 12/18/26 | $4.6 | $4.3 | $4.4 | $10.00 | $88.0K | 149 | 0 |

| RKLB | CALL | SWEEP | BEARISH | 01/16/26 | $2.15 | $2.1 | $2.1 | $12.00 | $66.9K | 5.7K | 402 |

About Rocket Lab USA

Rocket Lab USA Inc is engaged in space, building rockets, and spacecraft. It provides end-to-end mission services that provide frequent and reliable access to space for civil, defense, and commercial markets. It designs and manufactures the Electron and Neutron launch vehicles and Photon satellite platform. Rocket Lab’s Electron launch vehicle has delivered multiple satellites to orbit for private and public sector organizations, enabling operations in national security, scientific research, space debris mitigation, Earth observation, climate monitoring, and communications. The business operates in two segments being Launch Services and Space systems. Geographically it serves Japan, Germany, rest of the world and earns key revenue from the United States.

After a thorough review of the options trading surrounding Rocket Lab USA, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Rocket Lab USA’s Current Market Status

- Currently trading with a volume of 29,021,043, the RKLB’s price is up by 13.57%, now at $8.62.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 42 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Rocket Lab USA, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply