This Ford Analyst Is No Longer Bullish; Here Are Top 5 Downgrades For Wednesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Needham analyst Scott Berg downgraded the rating for Smartsheet Inc. SMAR from Buy to Hold and maintained a price target of $57. Smartsheet shares gained 6.5% to close at $55.46 on Tuesday. See how other analysts view this stock.

- BTIG analyst Andrew Harte downgraded Global Payments Inc. GPN from Buy to Neutral. Global Payments shares fell 6.5% to close at $103.81 on Tuesday. See how other analysts view this stock.

- TD Cowen analyst Kevin Kopelman downgraded the rating for Expedia Group, Inc. EXPE from Buy to Hold and announced a price target of $150. Expedia shares gained 2.7% to close at $147.92 on Tuesday. See how other analysts view this stock.

- Evercore ISI Group analyst Jonathan Chappell downgraded Union Pacific Corporation UNP from Outperform to In-Line and slashed the price target from $254 to $247. Union Pacific shares gained 2% to close at $248.96 on Tuesday. See how other analysts view this stock.

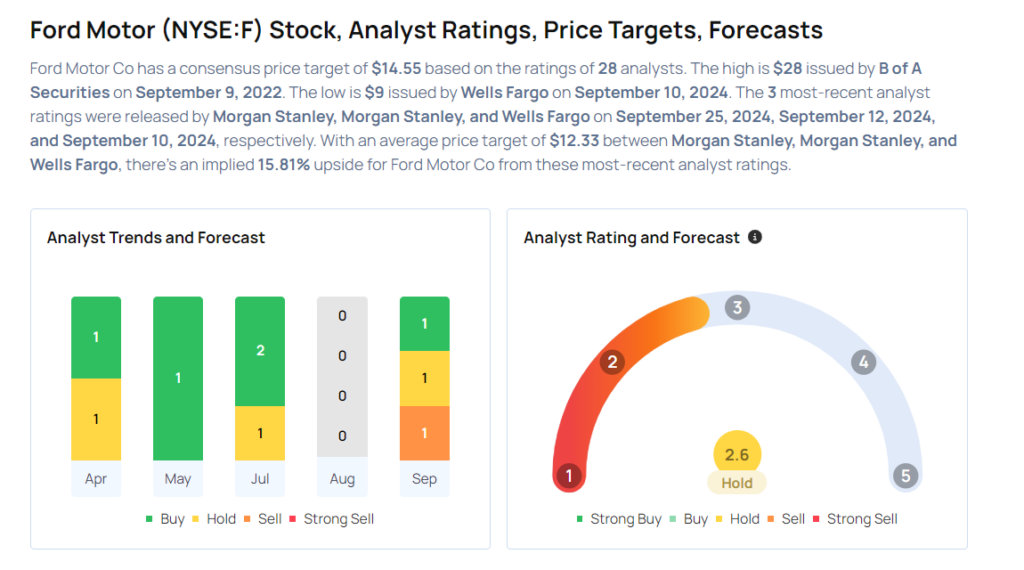

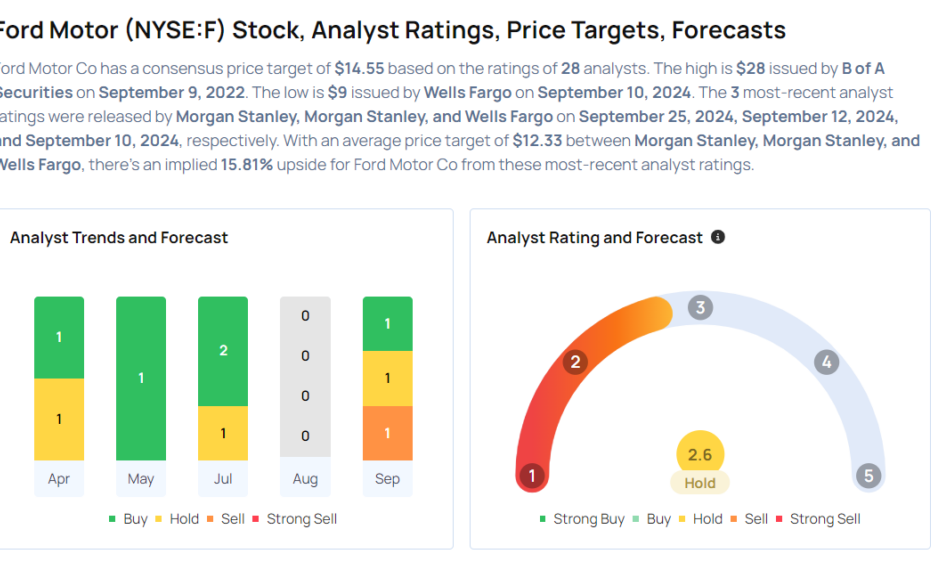

- Morgan Stanley analyst Adam Jonas downgraded Ford Motor Company F from Overweight to Equal-Weight and cut the price target from $16 to $12. Ford shares fell 0.4% to close at $10.87 on Tuesday. See how other analysts view this stock.

Considering buying Ford stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Previous Post

Smart Energy Storage Market Size to Surpass USD 425.8 Billion by 2034, Growing at 9.0% CAGR as Digital Technologies Transform Energy Infrastructure| Analysis by Transparency Market Research Inc.

Next Post

Leave a Reply