Top 5 Tech Stocks That May Rocket Higher This Month

The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

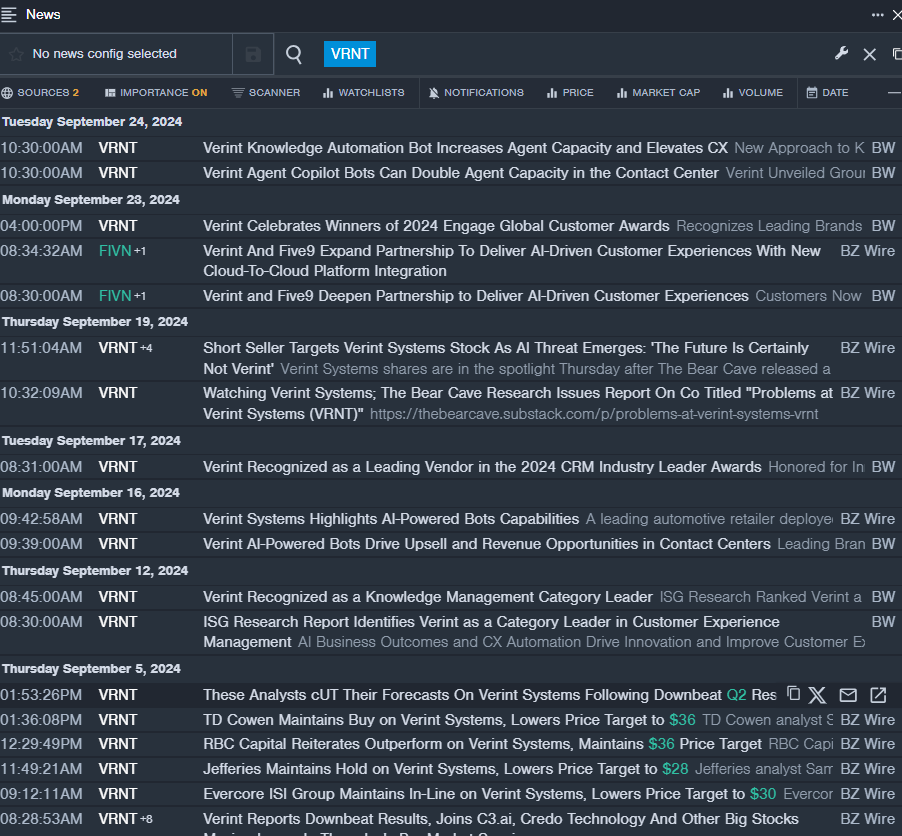

Verint Systems Inc. VRNT

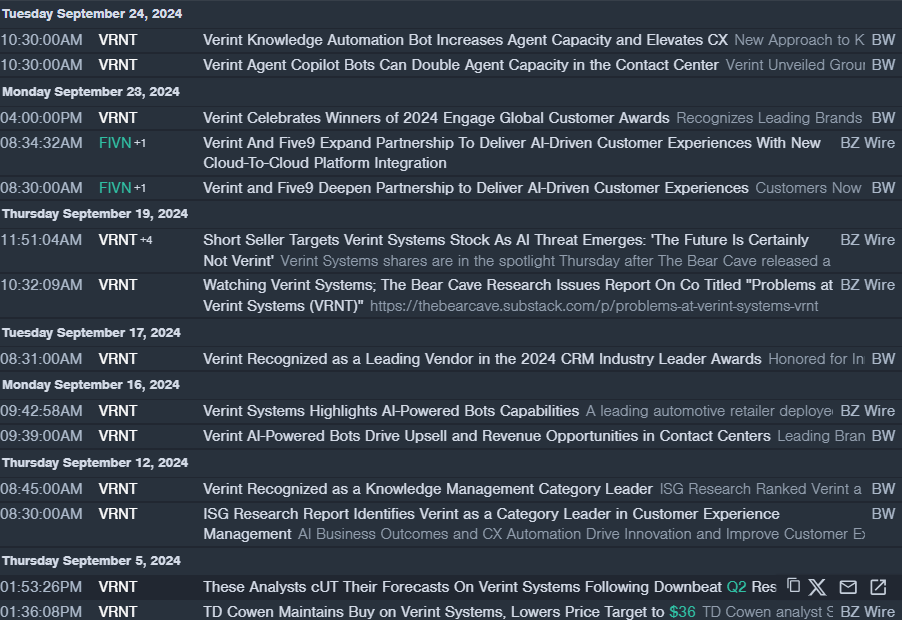

- On Sept. 4, Verint Systems reported worse-than-expected second-quarter financial results and announced a new $200 million stock buyback program. Dan Bodner, Verint CEO commented, “Behind our AI momentum is delivering ‘AI Business Outcomes, Now’™ better than any other vendor in the market. We launched our AI platform a year ago and we now have many customers, including some of the world’s leading brands, reporting strong AI business outcomes achieving significant ROI with Verint’s AI-powered bots. In Q2, we reported strong AI bookings growth and Bundled SaaS revenue growth driven by AI. We believe the AI opportunity in the contact center is very large and still in its early stages and that our ability to demonstrate measurable AI business outcomes positions us well for strong AI bookings growth in the second half of the year and accelerating revenue growth over time.” The company’s stock fell around 24% over the past month and has a 52-week low of $18.41.

- RSI Value: 26.27

- VRNT Price Action: Shares of Verint closed at $24.91 on Tuesday.

- Benzinga Pro’s real-time newsfeed alerted to latest VRNT news.

Braze Inc BRZE

- On Sept. 5, Braze reported quarterly earnings of nine cents per share, which beat the consensus estimate and revenue of $145.5 million which beat the analyst consensus estimate by 2.98%. “We delivered a great second quarter, demonstrating strong top-line growth while driving efficiency in our business, achieving our first quarter of non-GAAP operating income profitability and non-GAAP net income profitability. Our results demonstrate our effective execution and continued demand for the Braze Customer Engagement Platform,” said Bill Magnuson, CEO of Braze. The company’s stock fell around 29% over the past month. It has a 52-week low of $31.80.

- RSI Value: 27.87

- BRZE Price Action: Shares of Braze fell 5.7% to close at $32.64 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in BRZE stock.

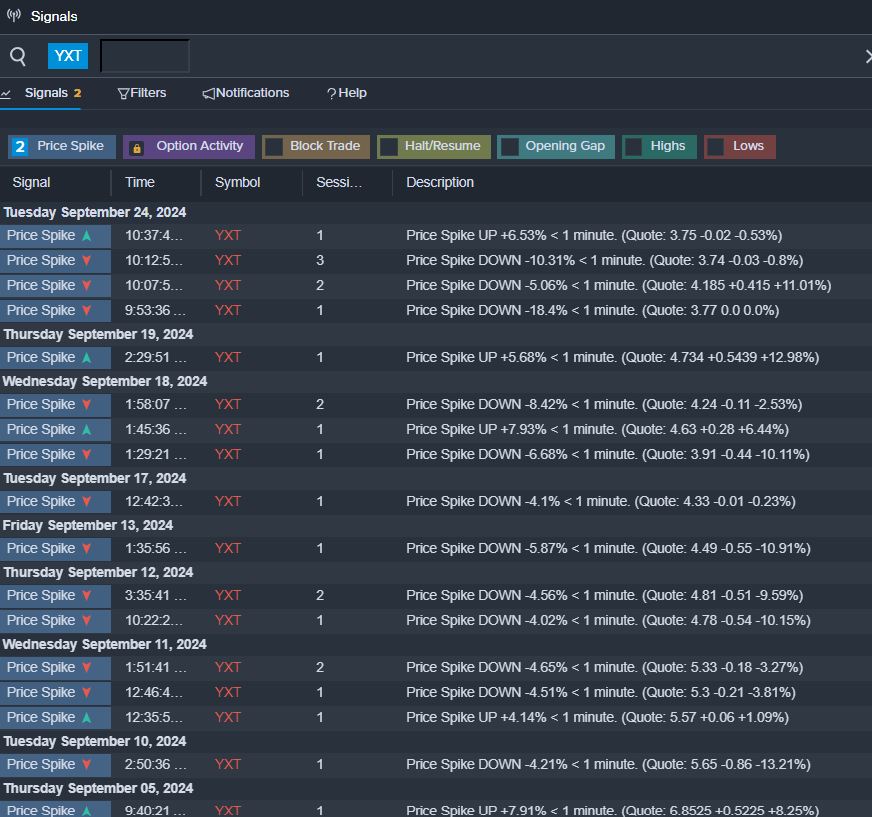

YXT.Com Group Holding Ltd – ADR YXT

- On Aug. 21, YXT.com Group announced the closing of initial public offering. The company’s shares fell around 59% over the past month and has a 52-week low of $3.21.

- RSI Value: 15.60

- YXT Price Action: Shares of YXT.Com Group fell 7.4% to close at $3.49 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in YXT shares.

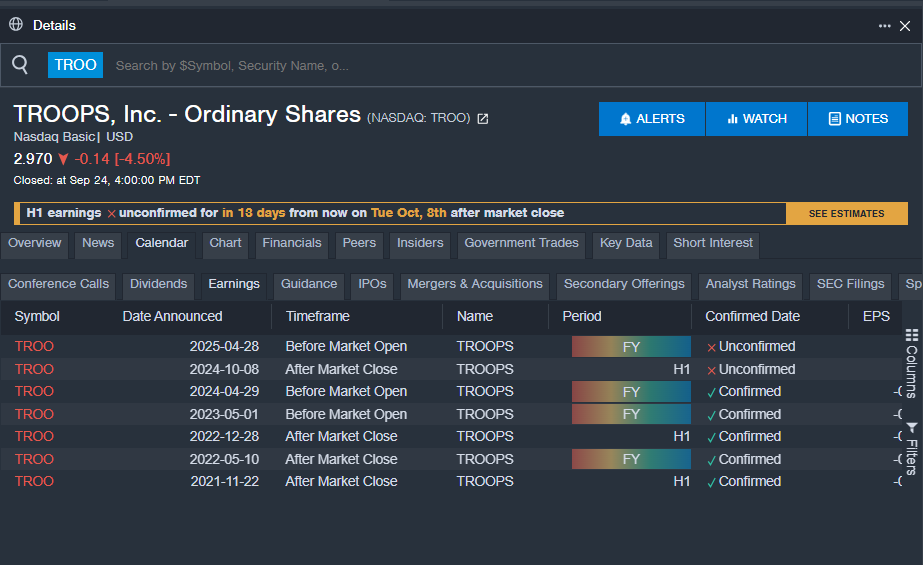

TROOPS Inc TROO

- The company’s shares lost around 18% over the past five days. The company’s 52-week low is $0.73.

- RSI Value: 29.69

- TROO Price Action: Shares of TROOPS fell 4.5% to close at $2.97 on Tuesday.

- Benzinga Pro’s earnings calendar was used to track upcoming TROO earnings reports.

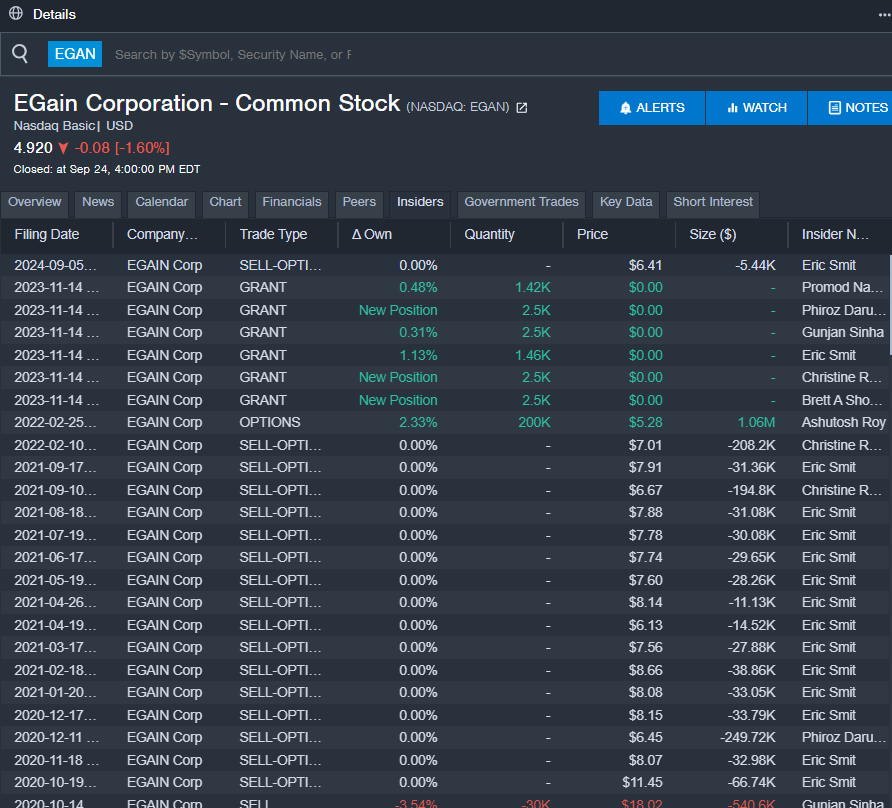

eGain Corp EGAN

- On Sept. 5, eGain reported fourth-quarter financial results and issued FY25 adjusted EPS guidance below estimates. “As businesses invest in Gen AI at scale, our AI Knowledge Hub helps deliver trusted answers for customer service, reducing cost and improving experience,” said Ashu Roy, eGain’s CEO. “As a result, new logo wins and RFPs for AI Knowledge were up 50 percent in fiscal 2024, and we are investing into this growing market opportunity for AI Knowledge.” The company’s shares fell around 35% over the past month. The company has a 52-week low of $4.81.

- RSI Value: 29.12

- EGAN Price Action: Shares of eGain fell 1.6% to close at $4.92 on Tuesday.

- Benzinga Pro’s insiders feature was used to track insider trading in EGAN’s stock.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Previous Post

Target Hospitality Provides Business Update

Next Post

Leave a Reply