US Futures Drop After S&P 500 Record; SAP Tumbles: Markets Wrap

(Bloomberg) — US stocks declined as investors weigh the Fed’s path of rate cuts and await Micron Technology Inc.’s earnings for details on artificial intelligence demand.

Most Read from Bloomberg

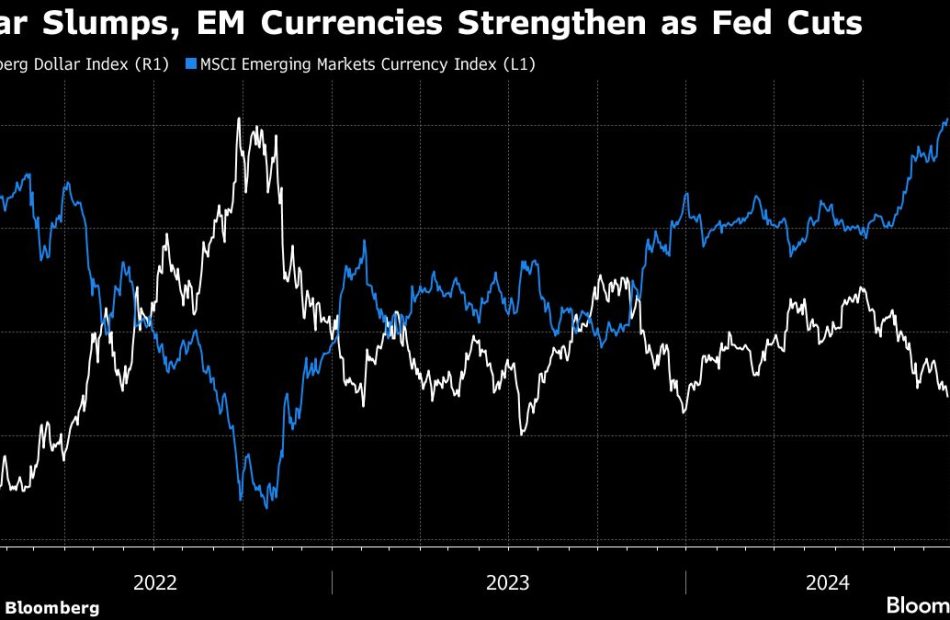

The S&P 500 dropped after struggling for direction earlier. The Nasdaq 100 fluctuated. The 10-year US Treasury yield is around 3.77%. The Bloomberg Dollar Spot Index rose after a 0.5% drop on Tuesday.

Data on Wednesday showed sales of new homes in the US fell last month. A separate set of data show mortgage rates have dropped for eight consecutive weeks, spurring demand for purchasing a home. Investors are parsing this information for clues on the economy and housing market.

“One of the things we’re watching is buyers catching up to the idea that mortgage rates are lower and that the break we’ve recently gotten in mortgage rates might be a lot of what we are expecting to get,” Skylar Olsen, chief economist at Zillow, said on Bloomberg Television. “Mortgage rates are not expected to go too much lower from here because they moved early with that anticipation.”

Traders are still seeking fresh catalysts after last week’s half-point rate cut by the Federal Reserve and as growth concerns linger. Earnings could be that catalyst for some investors — with Micron expected to report after the market close. Financials are also in focus, with earnings from early reporter Jefferies due later.

After China’s latest stimulus failed to ripple beyond Asian markets, investors are also looking to a speech by Fed Chair Jerome Powell and price data at the end of the week.

“Equity investors have been cheered by the Fed’s commitment to supporting economic growth, along with reassurances from Powell that the risk of a US recession remains low at present,” said UBS Group AG’s Solita Marcelli. “But the Fed’s level of success in guiding the US to a soft landing will be important in determining the outlook for other asset classes.”

Gargi Chaudhuri, chief investment and portfolio strategist for the Americas at BlackRock, says the base case is for US growth to gradually slow but stay positive.

“However, a cooling economy is more vulnerable to exogenous shocks, and we look ahead to potential volatility-inducing events, including the US election,” she said.

Earlier, China’s stocks rallied for a sixth day after the central bank lowered the interest rate charged on its one-year policy loans by the most on record. That followed a wide-ranging stimulus package announced the day before.

Iron ore climbed. Gold flirted with another record Wednesday. UBS’s Marcelli sees the precious metal gaining further ground as the Fed eases while the dollar will remain under pressure.

ECB Wagers

In Europe, the region’s darkening economic outlook has fueled bets the European Central Bank will reduce rates again next month, while economists at HSBC Holdings Plc predict policy makers will start cutting interest rates at every meeting between October and April.

“The worry has been that all the economic data is looking quite shaky,” said Anwiti Bahuguna, global asset allocation CIO at Northern Trust Asset Management, where the region’s stocks have been cut to market weight from overweight.

“At the beginning of the year we did think we would see a nice uptick, but it started to slow down way more than any of us anticipated,” she told Bloomberg TV.

Meanwhile, the Czech Republic cut interest rates to the lowest level in nearly three years as inflationary risks in the European Union nation fade and the outlook for economic growth worsens.

Key events this week:

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, durable goods, revised GDP, Thursday

-

Fed Chair Jerome Powell gives pre-recorded remarks to the 10th annual US Treasury Market Conference, Thursday

-

China industrial profits, Friday

-

Eurozone consumer confidence, Friday

-

US PCE, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.2% as of 1 p.m. New York time

-

The Nasdaq 100 was little changed

-

The Dow Jones Industrial Average fell 0.6%

-

The MSCI World Index fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.5%

-

The euro fell 0.4% to $1.1134

-

The British pound fell 0.6% to $1.3332

-

The Japanese yen fell 0.9% to 144.53 per dollar

Cryptocurrencies

-

Bitcoin fell 1.1% to $63,501.69

-

Ether fell 1.9% to $2,600.6

Bonds

-

The yield on 10-year Treasuries advanced four basis points to 3.77%

-

Germany’s 10-year yield advanced three basis points to 2.18%

-

Britain’s 10-year yield advanced five basis points to 3.99%

Commodities

-

West Texas Intermediate crude fell 2.6% to $69.71 a barrel

-

Spot gold fell 0.1% to $2,653.79 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu, Sujata Rao, John Viljoen, Margaryta Kirakosian, Alex Nicholson and Cristin Flanagan.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Leave a Reply