Factbox-What we know about Kamala Harris' economic plans on taxes, housing, manufacturing

(Reuters) -U.S. Vice President Kamala Harris has announced a basket of economic proposals aimed at lowering living costs for middle- and lower-class Americans and boosting the economy overall by using tax incentives and other tax shifts.

Some of her ideas build on unfinished business in President Joe Biden’s economic agenda but expand their scope and size.

Here’s what we know so far:

INDUSTRIAL INCENTIVES

Harris on Wednesday pledged new tax credits to spur more domestic manufacturing and to invest in sectors that will “define the next century,” including biomanufacturing, aerospace, artificial intelligence, quantum computing and blockchain, advanced nuclear power, and batteries.

She also said she would offer tax incentives for expanding “good union jobs” in long-standing iron, steel, coal and other traditional industrial communities. Details on the size and scope of the incentives and investments were not announced.

Harris announced new investments in U.S. basic technology research, through the National Science Foundation, the Department of Energy’s National Laboratories and other institutions.

She also announced plans to cut red tape to speed the construction of new infrastructure and industrial projects and to use the Defense Production Act and other tools to boost U.S. capacity to process critical minerals and reduce reliance on supplies from China.

TAX ON THE WEALTHY

Harris has echoed Biden’s promise not to raise taxes on households that earn less than $400,000 a year.

She has quietly endorsed most of the nearly $5 trillion in tax hikes over a decade in Biden’s fiscal 2025 budget proposal, which would boost the top income tax rate to 39.6% from 37%.

These include a new 25% minimum tax on people with fortunes exceeding $100 million, including on unrealized capital gains. For those earning more than $1 million annually, Harris has proposed raising the long-term capital gains tax rate paid after selling assets like stocks to 28% from 20%, an increase far smaller than the 39.6% full top income tax rate proposed by Biden.

TAX ON BUSINESSES

Harris has proposed increasing the corporate tax rate to 28%, partially reversing former President and Republican rival Donald Trump’s 2017 tax law, which cut company tax rates to 21% from 35%. The step would raise $1 trillion for the federal government over a decade, budget experts estimate, but cut into company profits, Wall Street says.

Big U.S. companies pay a far lower effective tax rate than their foreign competitors at an average of 16%, a Reuters analysis showed. Any broad corporate tax changes would need to be passed by Congress.

CHILD TAX CREDIT

Harris has kept Biden’s proposal to permanently restore a one-year, COVID-19-era increase in the Child Tax Credit to as much as $3,600 per child from $2,000 currently, which is scheduled to drop to $1,000 after 2025. She also has proposed a $6,000 bonus onetime credit for families with newborns.

Trump’s vice presidential running mate, JD Vance, has floated raising the annual Child Tax Credit to $5,000, but the idea has not been adopted as an official Trump policy proposal.

AFFORDABLE HOUSING

Harris has detailed plans to spur new construction and reduce costs for renters and homebuyers, largely through tax incentives. They include tax credits for builders of homes for first-time buyers and affordable rental units, along with a $25,000 tax credit to help first-time buyers with down payments for the next four years.

Harris is also proposing a $40 billion “innovation fund” to encourage local governments to build more affordable homes, doubling a Biden budget proposal that would make competitive grants to local governments that show they can get results.

U.S. home prices have risen 50% in the last five years and rents have risen 35%, according to real estate firm Zillow, largely due to a housing shortage. Harris has set a goal to increase U.S. housing construction by 3 million units over the next four years.

SMALL BUSINESS TAX CREDIT

Harris also has deviated from Biden’s economic plan by proposing to increase the tax deduction to up to $50,000 for new small business start-up costs from $5,000 currently to support entrepreneurs. The 33 million U.S. small businesses were responsible for 70% of net new jobs created since 2019, according to Small Business Administration data.

CHILD CARE

“My plan is that no family, no working family, should pay more than 7% of their household income in child care,” Harris told the National Association of Black Journalists in September. U.S. parents are currently paying as much as 19.3% of median family income per child for care, Department of Labor figures show.

The 7% figure echoes the Child Care and Development Block Grant, a program Harris has touted that currently supports about 1 million children in low-income families.

Harris’ campaign has not detailed how the child care plan would work.

HIGH GROCERY PRICES

Harris has vowed to enact the “first-ever federal ban on price gouging on food and groceries” that aims to stop big corporations from unfairly exploiting consumers while generating excessive profits. Defining such excessive price hikes is not clear, but some proposals in the U.S. Senate show a potential path to enactment.

(Reporting by Heather Timmons and David Lawder; Editing by Jamie Freed and Jonathan Oatis)

1 Incredible Growth Stock That Has Doubled in 2024 to Buy Hand Over Fist Before It Jumps at Least 48%

Palantir Technologies (NYSE: PLTR) has been one of the top-performing stocks on the market in 2024, jumping 115% as of this writing thanks to its accelerating growth, which is being driven by the fast-growing demand for the company’s software platforms by both federal customers and commercial clients.

Artificial intelligence (AI) has started playing a key role in the acceleration of Palantir’s growth of late. The good part is that Palantir is reportedly the top player in the AI software-platforms market as per market research company Forrester. This puts the company in a terrific position to ensure that its growth rate continues to pick up and hits stronger levels in the long run.

More importantly, a look at Palantir’s recent customer wins indicates that the company’s offerings continue to remain in hot demand, and that could pave the way for more stock upside in the future. In this article, I will take a closer look at how Palantir is capturing the lucrative AI software-platform market and check why that’s likely to lead to outstanding earnings growth in the long run.

Palantir’s AI juggernaut isn’t showing any signs of stopping

Palantir released its second-quarter 2024 results on Aug. 5. Its revenue shot up 27% year over year to $678 million, which was a big improvement over the 13% year-over-year increase in revenue it reported in the same quarter last year. Meanwhile, the company’s non-GAAP earnings shot up 80% from the year-ago quarter to $0.09 per share.

This impressive increase in Palantir’s top and bottom lines was a result of the robust growth in its customer base, an expansion in customer spending, as well as strong unit economics which is allowing it to generate more profit from each customer. For example, Palantir’s count of commercial customers in the U.S. increased by 83% year over year, but the total contract value from U.S. commercial customers increased at a much faster pace of 152%.

On the other hand, the company’s adjusted-operating margin increased to 37% in Q2 from 25% in the same quarter last year. This remarkable increase in Palantir’s margins explains why its bottom line shot up big time last quarter. The good news for Palantir investors is that it has been winning more contracts since reporting its results last month.

For example, Palantir’s Artificial Intelligence Platform (AIP) is set to be deployed by Wendy’s Quality Supply Chain Co-op (QSCC). Palantir points out that QSCC is the second-biggest purchasing cooperative in the quick-service restaurant industry and serves more than 6,400 Wendy’s locations in the U.S. and Canada. The cooperative will deploy AIP to “improve the scale and speed of decision-making” initially before using the platform for supply chain management and waste prevention.

Earlier this month, Palantir announced that British oil and gas giant BP “will extend their strategic relationship and introduce new artificial intelligence capabilities with Palantir’s AIP software.” But this isn’t where Palantir’s recent customer announcements end as Nebraska Medicine, an academic health system, has struck a multimillion-dollar deal to deploy AIP.

And just recently, Palantir said that it has been awarded a $100 million contract by the Army Research Laboratory for using the former’s Maven Smart System, a platform that delivers AI capabilities to the Department of Defense.

The above developments indicate that Palantir’s AI juggernaut continues to roll, and it is unlikely to stop any time soon. That’s because market research company IDC expects the global AI platform-software market to grow at an annual pace of close to 41% through 2028, generating $153 billion in annual revenue at the end of the forecast period.

IDC adds that Palantir is among the top-five AI platform software providers, which means that the company is at the beginning of a massive growth curve considering that the AI platform-software market was worth just under $28 billion last year.

Outstanding earnings growth could translate into more stock-price upside

Palantir’s huge addressable market, its leading position in the AI software market, and strong unit economics that are translating into healthy margin gains explain why analysts are expecting the company’s earnings to grow at a phenomenal annual rate of 85% for the next five years. Even though such an aggressive earnings-growth rate seems ambitious, it won’t be surprising to see Palantir actually delivering the outstanding earnings growth that the market is expecting from it because of the points discussed above.

But even if the company clocks a relatively slower annual earnings-growth rate of 50% for the next five years, its bottom line could jump to $1.90 per share after five years (using its 2023 earnings of $0.25 per share as the base). The stock is currently trading at 87 times trailing earnings. Assuming it trades at a discounted 29 times forward earnings after five years (in line with the tech-laden Nasdaq-100 index being used as a proxy for tech stocks), its stock price could jump to $55.

That would be a 48% increase from current levels. But if Palantir manages to clock faster earnings growth and the market decides to reward it with a richer earnings multiple because of its outstanding growth, it could deliver much stronger gains. That’s why investors looking to add a hot growth stock to their portfolios would do well to buy Palantir before it soars higher following the tremendous gains that it has already delivered this year.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends BP and Palantir Technologies. The Motley Fool has a disclosure policy.

1 Incredible Growth Stock That Has Doubled in 2024 to Buy Hand Over Fist Before It Jumps at Least 48% was originally published by The Motley Fool

Tesla Begins Cybertruck Deliveries In Mexico Before Canada: First Country To Get The Stainless Steel Truck Outside US

EV giant Tesla Inc TSLA commenced deliveries of its Cybertruck in Mexico on Wednesday, making it the first country outside the U.S. where the stainless steel truck is delivered.

What Happened: Tesla took to social media platform X to share pictures from the first Cybertruck deliveries in the U.S.-neighbouring country.

“Hola, estoy aquí,” Tesla wrote in Spanish from its official X account dedicated to Cybertruck updates.

Tesla started delivering the Cybertruck— its latest offering— in November in the U.S.

Why It Matters: The Foundation series Cybertruck starts at 2,199,900 Mexican pesos (US$112,258.19) for the base version and at 2,599,900 Mexican pesos for the more premium Cyberbeast version in Mexico. The foundation series refers to a limited and pricier edition of the Cybertruck with laser-etched foundation series badges and premium accessories.

The Cybertruck is currently among the more costly EVs with its high price point. However, Tesla intends to make it a common sight on roads.

Tesla CEO Elon Musk has previously said that the company intends to make about 250,000 units of the truck a year starting in 2025.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read More:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Freddie Mac Issues Monthly Volume Summary for August 2024

MCLEAN, Va., Sept. 25, 2024 (GLOBE NEWSWIRE) — Freddie Mac FMCC today posted to its website its Monthly Volume Summary for August 2024, which provides information on Freddie Mac’s mortgage-related portfolios, securities issuance, risk management, delinquencies, debt activities and other investments.

Freddie Mac’s mission is to make home possible for families across the nation. We promote liquidity, stability, affordability and equity in the housing market throughout all economic cycles. Since 1970, we have helped tens of millions of families buy, rent or keep their home. Learn More: Website | Consumers | LinkedIn | Facebook| X | Instagram | YouTube

MEDIA CONTACT: Fred Solomon

703-903-3861

Frederick_Solomon@FreddieMac.com

INVESTOR CONTACT: Mahesh Lal

571-382-3630

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Concentrix Reports Third Quarter 2024 Results

- Delivers revenue above the midpoint of guidance and profit within guidance range

- Returns $60 million to shareholders in the quarter through share repurchases and dividends and raises quarterly dividend by 10%

- Introduces iX Hello™, the Company’s first commercial product launch, reflecting the Company’s accelerated AI investments

NEWARK, Calif., Sept. 25, 2024 (GLOBE NEWSWIRE) — Concentrix Corporation CNXC, a global technology and services leader, today announced financial results for the fiscal third quarter ended August 31, 2024.

| Three Months Ended | ||||||||||

| August 31, 2024 | August 31, 2023 | Change | ||||||||

| Revenue ($M) | $ | 2,387.4 | $ | 1,632.8 | 46.2 | % | ||||

| Operating income ($M) | $ | 153.2 | $ | 162.3 | (5.6 | )% | ||||

| Non-GAAP operating income ($M) (1) | $ | 331.0 | $ | 231.0 | 43.3 | % | ||||

| Operating margin | 6.4 | % | 9.9 | % | -350 bps | |||||

| Non-GAAP operating margin (1) | 13.9 | % | 14.1 | % | -20 bps | |||||

| Net income ($M) | $ | 16.6 | $ | 77.6 | (78.6 | )% | ||||

| Non-GAAP net income ($M) (1), (2) | $ | 192.2 | $ | 143.7 | 33.8 | % | ||||

| Adjusted EBITDA ($M) (1) | $ | 388.1 | $ | 269.3 | 44.1 | % | ||||

| Adjusted EBITDA margin (1) | 16.3 | % | 16.5 | % | -20 bps | |||||

| Diluted earnings per common share | $ | 0.25 | $ | 1.49 | (83.2 | )% | ||||

| Non-GAAP diluted earnings per common share (1), (2) | $ | 2.87 | $ | 2.76 | 4.0 | % | ||||

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) As described in the non-GAAP reconciliations included in the accompanying financial tables, the reported amounts for non-GAAP net income and non-GAAP EPS for all periods include adjustments to exclude foreign currency losses (gains), net, which were not adjusted in similar non-GAAP measures previously reported for the prior period.

Third Quarter Fiscal 2024 Highlights:

- Revenue of $2,387.4 million, an increase of 46.2% year-on-year compared to revenue of $1,632.8 million in the prior year third quarter. The Company grew revenue 2.6% year-on-year on a pro forma constant currency basis.

- Operating income of $153.2 million, or 6.4% of revenue, compared to $162.3 million, or 9.9% of revenue, in the prior year third quarter, a reduction year-on-year primarily due to increased amortization of intangibles and planned integration expenses associated with the Company’s combination with Webhelp, which closed in the fourth quarter of 2023.

- Non-GAAP operating income of $331.0 million, or 13.9% of revenue, compared to $231.0 million, or 14.1% of revenue in the prior year third quarter.

- Adjusted EBITDA of $388.1 million, or 16.3% of revenue, compared with $269.3 million, or 16.5% of revenue in the prior year third quarter.

- Cash flow from operations was $191.6 million in the quarter. Adjusted free cash flow was $135.3 million in the quarter.

- Diluted earnings per common share (“EPS”) was $0.25 compared to $1.49 in the prior year third quarter. The decrease was primarily due to increased amortization of intangibles and planned integration expenses associated with the Company’s combination with Webhelp, which closed in the fourth quarter of 2023.

- Non-GAAP diluted EPS was $2.87 compared to $2.76 in the prior year third quarter.

The Company also announced today the launch of iX Hello, a Generative AI-powered solution for organizations to boost productivity and engagement within an on-brand, secure environment. iX Hello marks the first product launch in a suite of AI and GenAI technologies which the Company has already successfully deployed internally and with pre-launch clients. Further details of the product launch can be found in today’s separate press release.

“Our third quarter marked another quarter of solid revenue growth and operating results,” said Chris Caldwell, President and CEO of Concentrix. “We are also delighted to leverage our technology investments to bring our iX Hello product to market with velocity. We believe iX Hello helps augment our existing technology partner strategies, underscores the positive transformation of our business and reflects our strong competitive position as the world’s most trusted provider of intelligent experience solutions.”

Quarterly Dividend and Share Repurchase Program:

- The Company paid a $0.3025 per share quarterly dividend on August 6, 2024. The Company’s Board of Directors has declared a quarterly dividend of $0.33275 per share payable on November 5, 2024, to shareholders of record at the close of business on October 25, 2024.

- The Company repurchased 0.6 million shares in the third quarter at a cost of $39.1 million under its previously announced share repurchase program at an average cost of $64.89 per share. At August 31, 2024, the Company’s remaining share repurchase authorization was $188.0 million.

Business Outlook

The following statements are based on the Company’s current expectations for the fourth quarter of fiscal 2024 and the full year fiscal 2024. Non-GAAP financial measures exclude the impact of acquisition-related and integration expenses, amortization of intangible assets, depreciation, share-based compensation, and the related tax effects thereon. The non-GAAP EPS guidance assumes no impact from changes in acquisition contingent consideration and foreign currency losses (gains), net included in other expense (income), net. These statements are forward-looking and actual results may differ materially.

Fourth Quarter Fiscal 2024 Expectations:

- Fourth quarter reported revenue of $2.420 billion to $2.470 billion. Based on current exchange rates, these expectations assume an approximately 60-basis point positive impact of foreign exchange rates compared with the prior year period. The guidance implies pro forma constant currency revenue for the quarter ranging from a decrease of 0.5% to growth of 1.5%.

- Operating income of $160 million to $166 million and non-GAAP operating income of $335 million to $355 million.

- Non-GAAP EPS of $2.90 to $3.16, assuming approximately 64.5 million diluted common shares outstanding and approximately 3.7% of net income attributable to participating securities.

- The effective tax rate is expected to be approximately 24% to 25%.

Full Year Fiscal 2024 Expectations:

- Full year reported revenue of $9.591 billion to $9.641 billion. Based on current exchange rates, the expectations assume an approximately 110-basis point negative impact of foreign exchange rates compared with the prior year. The guidance implies pro forma constant currency revenue growth for the full year of 2.2% to 2.7%.

- Operating income of $611 million to $617 million and non-GAAP operating income of $1,306 million to $1,326 million.

- Non-GAAP EPS of $11.05 to $11.31, assuming approximately 65.1 million diluted common shares outstanding and approximately 3.6% of net income attributable to participating securities.

- The effective tax rate is expected to be approximately 24.4% to 24.7%.

The Company said it expects adjusted free cash flow of $625 million to $650 million for fiscal 2024. The Company expects to repurchase approximately $30 million of its common stock over the final quarter of the year for total share repurchases of more than $130 million for fiscal 2024, an increase from the Company’s previous commitment.

The Company believes that a quantitative reconciliation of the non-GAAP EPS outlook to the most directly comparable GAAP measures cannot be provided without unreasonable efforts due to (a) the inability to forecast future changes in acquisition contingent consideration, which is based, in part, on the future trading price of the Company’s common stock, and (b) the inability to forecast future foreign currency losses (gains), net included in other expense (income), net. For the same reason, the Company is unable to address the probable significance of the unavailable information, which may have a material impact on the Company’s GAAP results.

The Company believes that a quantitative reconciliation of the adjusted free cash flow outlook to the most directly comparable GAAP measure cannot be provided without unreasonable efforts due to uncertainty related to the future changes in the Company’s factoring program and related timing of those changes. For the same reason, the Company is unable to address the probable significance of the unavailable information, which may have a material impact on the Company’s GAAP results.

Conference Call and Webcast

The Company will host a conference call for investors to review its third quarter fiscal 2024 results today at 5:00 p.m. (ET)/2:00 p.m. (PT).

The live conference call webcast will be available in listen-only mode in the Investor Relations section of the Company’s website under “Events and Presentations” at https://ir.concentrix.com/events-and-presentations. A replay will also be available on the website following the conference call.

About us: Experience the power of Concentrix

Concentrix Corporation CNXC, a Fortune 500® company, is the global technology and services leader that powers the world’s best brands, today and into the future. We’re human-centered, tech-powered, intelligence-fueled. Every day, we design, build, and run fully integrated, end-to-end solutions at speed and scale across the entire enterprise, helping over 2,000 clients solve their toughest business challenges. Whether it’s designing game-changing brand experiences, building and scaling secure AI technologies, or running digital operations that deliver global consistency with a local touch, we have it covered. At the heart of everything we do lies a commitment to transforming the way companies connect, interact, and grow. We’re here to redefine what success means, delivering outcomes unimagined across every major vertical in 70+ markets. Virtually everywhere. Visit concentrix.com to learn more.

Use of Non-GAAP Information

In addition to disclosing financial results that are determined in accordance with GAAP, we also disclose certain non-GAAP financial information, including:

- Constant currency revenue growth, which is revenue growth adjusted for the translation effect of foreign currencies so that certain financial results can be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of our business performance. Constant currency revenue growth is calculated by translating the revenue of each fiscal year in the billing currency to U.S. dollars using the comparable prior year’s currency conversion rate in comparison to prior year’s revenue. Generally, when the U.S. dollar either strengthens or weakens against other currencies, revenue growth at constant currency rates or adjusting for currency will be higher or lower than revenue growth reported at actual exchange rates.

- Pro forma constant currency revenue growth, which is constant currency revenue growth measured against the Company’s combined pro forma results of operations as if the combination with Webhelp had occurred on December 1, 2022.

- Non-GAAP operating income, which is operating income, adjusted to exclude acquisition-related and integration expenses, including related restructuring costs, step-up depreciation, amortization of intangible assets, and share-based compensation.

- Non-GAAP operating margin, which is non-GAAP operating income, as defined above, divided by revenue.

- Adjusted earnings before interest, taxes, depreciation, and amortization, or adjusted EBITDA, which is non-GAAP operating income, as defined above, plus depreciation (exclusive of step-up depreciation).

- Adjusted EBITDA margin, which is adjusted EBITDA, as defined above, divided by revenue.

- Non-GAAP net income, which is net income excluding the tax-effected impact of acquisition-related and integration expenses, including related restructuring costs, step-up depreciation, amortization of intangible assets, share-based compensation, imputed interest related to the sellers’ note issued in connection with the combination with Webhelp (the “sellers’ note”), change in acquisition contingent consideration and foreign currency losses (gains), net. Non-GAAP net income also excludes the income tax effect of certain legal entity restructuring activity.

- Free cash flow, which is cash flows from operating activities less capital expenditures, and adjusted free cash flow, which is free cash flow excluding the effect of changes in the outstanding factoring balance. We believe that free cash flow is a meaningful measure of cash flows since capital expenditures are a necessary component of ongoing operations. We believe that adjusted free cash flow is a meaningful measure of cash flows because it removes the effect of factoring which changes the timing of the receipt of cash for certain receivables. However, free cash flow and adjusted free cash flow have limitations because they do not represent the residual cash flow available for discretionary expenditures. For example, free cash flow and adjusted free cash flow do not incorporate payments for business acquisitions.

- Non-GAAP diluted EPS, which is diluted EPS excluding the per share, tax-effected impact of acquisition-related and integration expenses, including related restructuring costs, step-up depreciation, amortization of intangible assets, share-based compensation, imputed interest related to the sellers’ note, change in acquisition contingent consideration and foreign currency losses (gains), net. Non-GAAP EPS also excludes the per share income tax effect of certain legal entity restructuring activity. Non-GAAP EPS excludes net income attributable to participating securities and the related per share, tax-effected impact of adjustments to net income described above reflect only those amounts that are attributable to common shareholders.

We believe that providing this additional information is useful to the reader to better assess and understand our base operating performance, especially when comparing results with previous periods and for planning and forecasting in future periods, primarily because management typically monitors the business adjusted for these items in addition to GAAP results. Management also uses these non-GAAP measures to establish operational goals and, in some cases, for measuring performance for compensation purposes. These non-GAAP financial measures exclude amortization of intangible assets. Although intangible assets contribute to our revenue generation, the amortization of intangible assets does not directly relate to the services performed for our clients. Additionally, intangible asset amortization expense typically fluctuates based on the size and timing of our acquisition activity. Accordingly, we believe excluding the amortization of intangible assets, along with the other non-GAAP adjustments, which neither relate to the ordinary course of our business nor reflect our underlying business performance, enhances our and our investors’ ability to compare our past financial performance with its current performance and to analyze underlying business performance and trends. These non-GAAP financial measures also exclude share-based compensation expense. Given the subjective assumptions and the variety of award types that companies can use when calculating share-based compensation expense, management believes this additional information allows investors to make additional comparisons between our operating results and those of our peers. As these non-GAAP financial measures are not calculated in accordance with GAAP, they may not necessarily be comparable to similarly titled measures employed by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for the comparable GAAP measures and should be used as a complement to, and in conjunction with, data presented in accordance with GAAP.

Safe Harbor Statement

This news release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, but are not limited to, statements regarding the Company’s expected future financial condition and growth, results of operations, including revenue and operating income, cash flows, and effective tax rate, future growth and success of the Company’s capabilities and products portfolio, the potential benefits associated with use of the Company’s generative artificial intelligence and other products, including productivity and engagement gains, investments, share repurchase and dividend activity, capital allocation, debt repayment, business strategy, product launches, foreign currency exchange rate fluctuations, sales pipeline, and statements that include words such as believe, expect, may, will, provide, could, should and other similar expressions. These forward-looking statements are inherently uncertain and involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Risks and uncertainties include, among other things: risks related to the Company’s ability to realize estimated cost savings, synergies or other anticipated benefits of the combination with Webhelp, or that such benefits may take longer to realize than expected; risks related to general economic conditions, including consumer demand, interest rates, inflation, supply chains and the effects of the conflicts in Ukraine and Gaza; cyberattacks on the Company’s or its clients’ networks and information technology systems; uncertainty around, and disruption from, new and emerging technologies, including the adoption and utilization of generative artificial intelligence; the failure of the Company’s staff and contractors to adhere to the Company’s and its clients’ controls and processes; the inability to protect personal and proprietary information; the effects of communicable diseases or other public health crises, natural disasters and adverse weather conditions; geopolitical, economic and climate- or weather-related risks in regions with a significant concentration of the Company’s operations; the inability to execute on the Company’s strategy; the timing and success of product launches; competitive conditions in the Company’s industry and consolidation of its competitors; variability in demand by the Company’s clients or the early termination of the Company’s client contracts; the level of business activity of the Company’s clients and the market acceptance and performance of their products and services; the demand for CX solutions and technology; damage to the Company’s reputation through the actions or inactions of third parties; changes in law, regulations or regulatory guidance; the operability of the Company’s communication services and information technology systems and networks; the loss of key personnel or the inability to attract and retain staff with the skills and expertise needed for the Company’s business; increases in the cost of labor; the inability to successfully identify, complete, and integrate strategic acquisitions or investments; higher than expected tax liabilities; currency exchange rate fluctuations; investigative or legal actions; and other factors contained in the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2023 filed with the Securities and Exchange Commission and subsequent SEC filings. The Company does not undertake a duty to update forward-looking statements, which speak only as of the date on which they are made.

Copyright 2024 Concentrix Corporation. All rights reserved. Concentrix, the Concentrix logo, and all other Concentrix company, product and services names and slogans are trademarks or registered trademarks of Concentrix Corporation and its subsidiaries.

From Fortune ©2024 Fortune Media IP Limited. All rights reserved. Used under license. Fortune and Fortune 500 are registered trademarks of Fortune Media IP Limited and are used under license. Fortune and Fortune Media IP Limited are not affiliated with, and do not endorse the products or services of Concentrix.

Investor Contact:

Sara Buda

Investor Relations

Concentrix Corporation

sara.buda@concentrix.com

(617) 331-0955

| CONCENTRIX CORPORATION CONSOLIDATED BALANCE SHEETS (currency and share amounts in thousands, except par value) |

|||||||

| August 31, 2024 | November 30, 2023 | ||||||

| (unaudited) | |||||||

| ASSETS | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 246,241 | $ | 295,336 | |||

| Accounts receivable, net | 1,935,566 | 1,888,890 | |||||

| Other current assets | 668,433 | 674,423 | |||||

| Total current assets | 2,850,240 | 2,858,649 | |||||

| Property and equipment, net | 732,663 | 748,691 | |||||

| Goodwill | 5,084,029 | 5,078,668 | |||||

| Intangible assets, net | 2,482,968 | 2,804,965 | |||||

| Deferred tax assets | 114,820 | 72,333 | |||||

| Other assets | 942,878 | 928,521 | |||||

| Total assets | $ | 12,207,598 | $ | 12,491,827 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 211,348 | $ | 243,565 | |||

| Current portion of long-term debt | 2,857 | 2,313 | |||||

| Accrued compensation and benefits | 634,629 | 731,172 | |||||

| Other accrued liabilities | 932,653 | 1,016,406 | |||||

| Income taxes payable | 30,517 | 80,583 | |||||

| Total current liabilities | 1,812,004 | 2,074,039 | |||||

| Long-term debt, net | 4,908,866 | 4,939,712 | |||||

| Other long-term liabilities | 940,301 | 920,536 | |||||

| Deferred tax liabilities | 377,661 | 414,246 | |||||

| Total liabilities | 8,038,832 | 8,348,533 | |||||

| Stockholders’ equity: | |||||||

| Preferred stock, $0.0001 par value, 10,000 shares authorized and no shares issued and outstanding as of August 31, 2024 and November 30, 2023, respectively | — | — | |||||

| Common stock, $0.0001 par value, 250,000 shares authorized; 68,077 and 67,883 shares issued as of August 31, 2024 and November 30, 2023, respectively, and 64,394 and 65,734 shares outstanding as of August 31, 2024 and November 30, 2023, respectively | 7 | 7 | |||||

| Additional paid-in capital | 3,653,735 | 3,582,521 | |||||

| Treasury stock, 3,683 and 2,149 shares as of August 31, 2024 and November 30, 2023, respectively | (375,941 | ) | (271,968 | ) | |||

| Retained earnings | 1,098,855 | 1,024,461 | |||||

| Accumulated other comprehensive loss | (207,890 | ) | (191,727 | ) | |||

| Total stockholders’ equity | 4,168,766 | 4,143,294 | |||||

| Total liabilities and stockholders’ equity | $ | 12,207,598 | $ | 12,491,827 | |||

| CONCENTRIX CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (currency and share amounts in thousands, except per share amounts) (unaudited) |

|||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| August 31, 2024 | August 31, 2023 | % Change | August 31, 2024 | August 31, 2023 | % Change | ||||||||||||||||||

| Revenue | |||||||||||||||||||||||

| Technology and consumer electronics | $ | 664,829 | $ | 528,281 | 26 | % | $ | 1,988,199 | $ | 1,549,093 | 28 | % | |||||||||||

| Retail, travel and ecommerce | 593,736 | 322,394 | 84 | % | 1,745,529 | 935,850 | 87 | % | |||||||||||||||

| Communications and media | 380,508 | 252,497 | 51 | % | 1,141,926 | 767,278 | 49 | % | |||||||||||||||

| Banking, financial services and insurance | 352,471 | 246,771 | 43 | % | 1,095,616 | 768,388 | 43 | % | |||||||||||||||

| Healthcare | 172,400 | 167,428 | 3 | % | 540,162 | 509,960 | 6 | % | |||||||||||||||

| Other | 223,468 | 115,463 | 94 | % | 659,444 | 353,375 | 87 | % | |||||||||||||||

| Total revenue | $ | 2,387,412 | $ | 1,632,834 | 46 | % | $ | 7,170,876 | $ | 4,883,944 | 47 | % | |||||||||||

| Cost of revenue | 1,523,220 | 1,039,142 | 47 | % | 4,592,586 | 3,128,866 | 47 | % | |||||||||||||||

| Gross profit | 864,192 | 593,692 | 46 | % | 2,578,290 | 1,755,078 | 47 | % | |||||||||||||||

| Selling, general and administrative expenses | 710,950 | 431,425 | 65 | % | 2,126,439 | 1,274,198 | 67 | % | |||||||||||||||

| Operating income | 153,242 | 162,267 | (6 | )% | 451,851 | 480,880 | (6 | )% | |||||||||||||||

| Interest expense and finance charges, net | 80,815 | 49,293 | 64 | % | 245,711 | 130,496 | 88 | % | |||||||||||||||

| Other expense (income), net | 46,011 | 6,169 | 646 | % | 19,772 | 19,266 | 3 | % | |||||||||||||||

| Income before income taxes | 26,416 | 106,805 | (75 | )% | 186,368 | 331,118 | (44 | )% | |||||||||||||||

| Provision for income taxes | 9,785 | 29,170 | (66 | )% | 50,801 | 86,763 | (41 | )% | |||||||||||||||

| Net income | $ | 16,631 | $ | 77,635 | (79 | )% | $ | 135,567 | $ | 244,355 | (45 | )% | |||||||||||

| Earnings per common share: | |||||||||||||||||||||||

| Basic | $ | 0.25 | $ | 1.50 | $ | 2.00 | $ | 4.70 | |||||||||||||||

| Diluted | $ | 0.25 | $ | 1.49 | $ | 2.00 | $ | 4.67 | |||||||||||||||

| Weighted-average common shares outstanding: | |||||||||||||||||||||||

| Basic | 64,660 | 51,059 | 65,196 | 51,130 | |||||||||||||||||||

| Diluted | 64,749 | 51,209 | 65,311 | 51,384 | |||||||||||||||||||

| CONCENTRIX CORPORATION RECONCILIATION OF GAAP TO NON-GAAP MEASURES (currency and share amounts in thousands, except per share amounts) (unaudited) |

|||||||

| Three Months Ended | Nine Months Ended | ||||||

| August 31, 2024 | August 31, 2024 | ||||||

| Revenue | $ | 2,387,412 | $ | 7,170,876 | |||

| Pro forma revenue growth | 0.9 | % | 1.5 | % | |||

| Foreign exchange impact | 1.7 | % | 1.6 | % | |||

| Pro forma constant currency revenue growth | 2.6 | % | 3.1 | % | |||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| August 31, 2024 | August 31, 2023 | August 31, 2024 | August 31, 2023 | ||||||||||||

| Operating income | $ | 153,242 | $ | 162,267 | $ | 451,851 | $ | 480,880 | |||||||

| Acquisition-related and integration expenses | 36,055 | 18,494 | 97,134 | 31,470 | |||||||||||

| Step-up depreciation | 2,449 | — | 7,432 | — | |||||||||||

| Amortization of intangibles | 116,556 | 39,510 | 348,827 | 118,196 | |||||||||||

| Share-based compensation | 22,663 | 10,740 | 65,927 | 38,683 | |||||||||||

| Non-GAAP operating income | $ | 330,965 | $ | 231,011 | $ | 971,171 | $ | 669,229 | |||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| August 31, 2024 | August 31, 2023 | August 31, 2024 | August 31, 2023 | ||||||||||||

| Net income | $ | 16,631 | $ | 77,635 | $ | 135,567 | $ | 244,355 | |||||||

| Interest expense and finance charges, net | 80,815 | 49,293 | 245,711 | 130,496 | |||||||||||

| Provision for income taxes | 9,785 | 29,170 | 50,801 | 86,763 | |||||||||||

| Other expense (income), net | 46,011 | 6,169 | 19,772 | 19,266 | |||||||||||

| Acquisition-related and integration expenses | 36,055 | 18,494 | 97,134 | 31,470 | |||||||||||

| Step-up depreciation | 2,449 | — | 7,432 | — | |||||||||||

| Amortization of intangibles | 116,556 | 39,510 | 348,827 | 118,196 | |||||||||||

| Share-based compensation | 22,663 | 10,740 | 65,927 | 38,683 | |||||||||||

| Depreciation (exclusive of step-up depreciation) | 57,115 | 38,246 | 180,864 | 114,632 | |||||||||||

| Adjusted EBITDA | $ | 388,080 | $ | 269,257 | $ | 1,152,035 | $ | 783,861 | |||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| August 31, 2024 | August 31, 2023 | August 31, 2024 | August 31, 2023 | ||||||||||||

| Operating margin | 6.4 | % | 9.9 | % | 6.3 | % | 9.8 | % | |||||||

| Non-GAAP operating margin | 13.9 | % | 14.1 | % | 13.5 | % | 13.7 | % | |||||||

| Adjusted EBITDA margin | 16.3 | % | 16.5 | % | 16.1 | % | 16.0 | % | |||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| August 31, 2024 | August 31, 2023 | August 31, 2024 | August 31, 2023 | ||||||||||||

| Net income | $ | 16,631 | $ | 77,635 | $ | 135,567 | $ | 244,355 | |||||||

| Acquisition-related and integration expenses | 36,055 | 18,494 | 97,134 | 31,470 | |||||||||||

| Step-up depreciation | 2,449 | — | 7,432 | — | |||||||||||

| Acquisition-related expenses included in interest expense and finance charges, net (1) | — | 13,716 | — | 25,556 | |||||||||||

| Acquisition-related expenses included in other expense (income), net (1) | — | 2,064 | — | 14,493 | |||||||||||

| Imputed interest related to sellers’ note included in interest expense and finance charges, net | 4,259 | — | 12,616 | — | |||||||||||

| Change in acquisition contingent consideration included in other expense (income), net | 10,500 | — | (11,086 | ) | — | ||||||||||

| Foreign currency losses (gains), net (4) | 33,435 | 3,557 | 25,636 | 2,105 | |||||||||||

| Amortization of intangibles | 116,556 | 39,510 | 348,827 | 118,196 | |||||||||||

| Share-based compensation | 22,663 | 10,740 | 65,927 | 38,683 | |||||||||||

| Income taxes related to the above (2) | (55,753 | ) | (22,020 | ) | (134,448 | ) | (57,626 | ) | |||||||

| Income tax effect of legal entity restructuring (5) | 5,363 | — | 5,363 | — | |||||||||||

| Non-GAAP net income | $ | 192,158 | $ | 143,696 | $ | 552,968 | $ | 417,232 | |||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| August 31, 2024 | August 31, 2023 | August 31, 2024 | August 31, 2023 | ||||||||||||

| Net income | $ | 16,631 | $ | 77,635 | $ | 135,567 | $ | 244,355 | |||||||

| Less: net income allocated to participating securities | (558 | ) | (1,282 | ) | (4,865 | ) | (4,178 | ) | |||||||

| Net income attributable to common stockholders | 16,073 | 76,353 | 130,702 | 240,177 | |||||||||||

| Acquisition-related and integration expenses allocated to common stockholders | 34,845 | 18,189 | 93,648 | 30,932 | |||||||||||

| Step-up depreciation allocated to common stockholders | 2,367 | — | 7,165 | — | |||||||||||

| Acquisition-related expenses included in interest expense and finance charges, net allocated to common stockholders (1) | — | 13,490 | — | 25,119 | |||||||||||

| Acquisition-related expenses included in other expense (income), net allocated to common stockholders (1) | — | 2,030 | — | 14,245 | |||||||||||

| Imputed interest related to sellers’ note included in interest expense and finance charges, net allocated to common stockholders | 4,116 | — | 12,163 | — | |||||||||||

| Change in acquisition contingent consideration included in other expense (income), net allocated to common stockholders | 10,148 | — | (10,688 | ) | — | ||||||||||

| Foreign currency losses (gains), net allocated to common stockholders (4) | 32,313 | 3,498 | 24,716 | 2,069 | |||||||||||

| Amortization of intangibles allocated to common stockholders | 112,645 | 38,858 | 336,309 | 116,175 | |||||||||||

| Share-based compensation allocated to common stockholders | 21,903 | 10,563 | 63,561 | 38,022 | |||||||||||

| Income taxes related to the above allocated to common stockholders (2) | (53,882 | ) | (21,656 | ) | (129,623 | ) | (56,641 | ) | |||||||

| Income tax effect of legal entity restructuring allocated to common stockholders (5) | 5,183 | — | 5,171 | — | |||||||||||

| Non-GAAP net income attributable to common stockholders | $ | 185,711 | $ | 141,325 | $ | 533,124 | $ | 410,098 | |||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| August 31, 2024 | August 31, 2023 | August 31, 2024 | August 31, 2023 | ||||||||||||

| Diluted earnings per common share (“EPS”) (3) | $ | 0.25 | $ | 1.49 | $ | 2.00 | $ | 4.67 | |||||||

| Acquisition-related and integration expenses | 0.54 | 0.36 | 1.43 | 0.60 | |||||||||||

| Step-up depreciation | 0.04 | — | 0.11 | — | |||||||||||

| Acquisition-related expenses included in interest expense and finance charges, net (1) | — | 0.26 | — | 0.49 | |||||||||||

| Acquisition-related expenses included in other expense (income), net (1) | — | 0.04 | — | 0.28 | |||||||||||

| Imputed interest related to sellers’ note included in interest expense and finance charges, net | 0.06 | — | 0.19 | — | |||||||||||

| Change in acquisition contingent consideration included in other expense (income), net | 0.16 | — | (0.16 | ) | — | ||||||||||

| Foreign currency losses (gains), net (4) | 0.50 | 0.07 | 0.38 | 0.04 | |||||||||||

| Amortization of intangibles | 1.74 | 0.76 | 5.15 | 2.26 | |||||||||||

| Share-based compensation | 0.34 | 0.21 | 0.97 | 0.74 | |||||||||||

| Income taxes related to the above (2) | (0.84 | ) | (0.43 | ) | (1.99 | ) | (1.10 | ) | |||||||

| Income tax effect of legal entity restructuring (5) | 0.08 | — | 0.08 | — | |||||||||||

| Non-GAAP diluted EPS | $ | 2.87 | $ | 2.76 | $ | 8.16 | $ | 7.98 | |||||||

| Weighted-average number of common shares – diluted | 64,749 | 51,209 | 65,311 | 51,384 | |||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| August 31, 2024 | August 31, 2023 | August 31, 2024 | August 31, 2023 | ||||||||||||

| Net cash provided by operating activities | $ | 191,622 | $ | 211,416 | $ | 383,091 | $ | 448,744 | |||||||

| Purchases of property and equipment | (62,746 | ) | (43,936 | ) | (178,891 | ) | (115,717 | ) | |||||||

| Free cash flow | 128,876 | 167,480 | 204,200 | 333,027 | |||||||||||

| Change in outstanding factoring balances | 6,374 | — | 51,632 | — | |||||||||||

| Adjusted free cash flow | $ | 135,250 | $ | 167,480 | $ | 255,832 | $ | 333,027 | |||||||

| Forecast | |||||||||||||||

| Three Months Ending November 30, 2024 |

Fiscal Year Ending November 30, 2024 |

||||||||||||||

| Low | High | Low | High | ||||||||||||

| Revenue | $ | 2,420,000 | $ | 2,470,000 | $ | 9,591,000 | $ | 9,641,000 | |||||||

| Pro forma revenue growth (6) | 0.1 | % | 2.1 | % | 1.1 | % | 1.6 | % | |||||||

| Foreign exchange impact | (0.6 | )% | (0.6 | )% | 1.1 | % | 1.1 | % | |||||||

| Pro forma constant currency revenue growth | (0.5 | )% | 1.5 | % | 2.2 | % | 2.7 | % | |||||||

| Forecast | |||||||||||||||

| Three Months Ending November 30, 2024 |

Fiscal Year Ending November 30, 2024 |

||||||||||||||

| Low | High | Low | High | ||||||||||||

| Operating income | $ | 159,600 | $ | 165,500 | $ | 611,200 | $ | 617,100 | |||||||

| Amortization of intangibles | 114,000 | 116,000 | 463,000 | 465,000 | |||||||||||

| Share-based compensation | 29,000 | 31,000 | 95,000 | 97,000 | |||||||||||

| Acquisition-related and integration expenses | 30,000 | 40,000 | 127,000 | 137,000 | |||||||||||

| Step-up depreciation | 2,400 | 2,500 | 9,800 | 9,900 | |||||||||||

| Non-GAAP operating income | $ | 335,000 | $ | 355,000 | $ | 1,306,000 | $ | 1,326,000 | |||||||

(1) Included in these amounts are a) bridge financing fees expensed and interest expenses associated with the senior notes, net of interest earnings on invested proceeds incurred in advance of the Webhelp Combination and b) expenses associated with non-designated call option contracts put in place to hedge foreign exchange movements in connection with the Webhelp Combination that are included within interest expense and finance charges, net and other expense (income), net, respectively, in the consolidated statement of operations.

(2) The tax effect of taxable and deductible non-GAAP adjustments was calculated using the tax-deductible portion of the expenses and applying the entity-specific, statutory tax rates applicable to each item during the respective periods presented.

(3) Diluted EPS is calculated using the two-class method. The two-class method is an earnings allocation proportional to the respective ownership among holders of common stock and participating securities. Restricted stock awards, and effective in the fourth quarter of fiscal year 2023, certain restricted stock units granted to employees are considered participating securities. For the purposes of calculating diluted EPS, net income attributable to participating securities was approximately 3.4% and 1.7% of net income, respectively, for the three months ended August 31, 2024 and 2023 and 3.6% and 1.7% of net income, respectively, for the nine months ended August 31, 2024 and 2023, and was excluded from total net income to calculate net income attributable to common stockholders. In addition, the non-GAAP adjustments allocated to common stockholders were calculated based on the percentage of net income attributable to common stockholders.

(4) Foreign currency losses (gains), net are included in other expense (income), net and primarily consist of gains and losses recognized on the revaluation and settlement of foreign currency transactions and realized and unrealized gains and losses on derivative contracts that do not qualify for hedge accounting. The reported amounts for non-GAAP net income and non-GAAP EPS for the three- and nine- months ended August 31, 2024 include adjustments to exclude these foreign currency losses (gains), net, which were not adjusted in similar non-GAAP measures previously reported for the corresponding period in fiscal year 2023. In order to enhance comparability, similar adjustments were made for non-GAAP net income and non-GAAP EPS for the three- and nine-months ended August 31, 2023.

(5) Represents the income tax impact related to certain legal entity restructuring activity.

(6) The supplemental pro forma revenue presented below is for illustrative purposes only, does not include the pro forma adjustments that would be required under Regulation S-X for pro forma financial information, is not necessarily indicative of the financial position or results of operations that would have been realized if the combination with Webhelp had been completed on December 1, 2022, does not reflect synergies that might have been achieved, nor is it indicative of future operating results or financial position. The pro forma adjustments are based upon currently available information and certain assumptions that the Company believes are reasonable under the circumstances.

The supplemental pro forma financial information reflects pro forma adjustments to present the combined pro forma results of operations as if the combination with Webhelp had occurred on December 1, 2022. The supplemental pro forma financial information for the quarter and the fiscal year ended November 30, 2023 is as follows:

| Three Months Ended | Fiscal Year Ended | ||||||

| November 30, 2023 | November 30, 2023 | ||||||

| Revenue | $ | 2,417,417 | $ | 9,485,600 | |||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If there’s a nuclear renaissance, here are the stocks to watch, says UBS

It’s a great morning for everything connected to China — not just Chinese stocks but also commodities, luxury-goods makers and the like — after a new monetary stimulus plan was announced in Beijing. More on that later.

There’s genuine excitement in the air around nuclear power, heightened by Constellation Energy CEG announcing it was restarting a nuclear reactor at Three Mile Island under a power-purchase agreement with Microsoft Corp. MSFT, and Monday’s announcement from 14 institutions to finance a tripling of nuclear energy capacity by 2050.

Most Read from MarketWatch

Right on cue comes a report from UBS — interestingly, not one of the 14 institutions — arguing a faster nuclear rollout is possible. They say that not because of the tripling goal but because of simple demand, particularly for datacenters to support the growth of artificial intelligence.

It’ll take some work — nuclear’s share of global power generation slumped to 10% in 2021 from 17% in 1990, and much of that dwindling share is powered through aging reactors. Accidents, waste disposal concerns and, perhaps most importantly, costs, have all hampered nuclear output.

Construction times for new reactors also are an issue — a new reactor in Finland took 16 years to complete. But sentiment is changing. “The conversation around nuclear energy has, in a relatively (very) short space of time, completely reversed. We find it difficult to overstate the magnitude of the shift,” says a new 81-page report from the Swiss bank, written by 44 analysts across multiple continents.

The UBS report says it’s not just technology sector demand but also the backstopping from governments that can push nuclear forward. “We have long argued that complicated sustainability issues cannot be solved by the private or public sector in isolation; a coordinated approach is required. Is this a given? No, but neither are we inclined to rule it out completely,” the report says. In China, where the government has given nuclear a push, nuclear’s levelized cost of electricity is almost on par with other technologies.

UBS says its analysis is that nuclear capacity can grow at a 2.1% to 3% annual growth rate between now and 2030. That would require 1.8 times current uranium production levels by 2030, and 2.9 times by 2050.

That’s music to the ears of uranium investors, and the UBS team also identifies companies in the supply chain. In North America, that list includes Emerson EMR, Flowserve FLS, Fluor FLR, NuScale SMR, Constellation Energy, Vistra VST, PSEG PEG and Crane CR.

By company exposure to nuclear power, that list is topped by CGN Power HK:1816, China National Nuclear Power CN:601985, NuScale and Constellation Energy with 50% to 100% exposure to nuclear, and a 10% to 50% exposure grouping features Kepco KR:052690, Centrica UK:CNA, CEZ CZ:CEZ, Fortum FI:FORTUM, Public Service Enterprise and Vistra.

Besides costs and safety, another factor that could hamper nuclear would be the emergence of nuclear fusion. Companies investing in that potentially breakthrough technology include Eni IT:ENI, Equinor NO:EQNR and Shell UK:SHEL. “If and when it becomes commercially available, many current technologies, including existing nuclear reactors, could potentially become obsolete,” they say.

The market

U.S. stock index futures ES00 NQ00 rose early Tuesday. Oil futures CL00 surged on the China stimulus announcement.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5718.57 |

1.49% |

1.65% |

19.89% |

33.81% |

|

Nasdaq Composite |

17,974.27 |

2.17% |

1.40% |

19.74% |

35.44% |

|

10-year Treasury |

3.795 |

13.60 |

-3.60 |

-8.59 |

-74.47 |

|

Gold |

2653.6 |

1.67% |

3.92% |

28.08% |

37.14% |

|

Oil |

72.14 |

2.33% |

-6.51% |

1.14% |

-19.74% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

China announced a package that includes interest-rate cuts, reduced reserve requirements and measures to boost the stock market, sending Chinese stocks higher and also boosting companies that sell to the second-largest economy including Tesla TSLA and LVMH FR:MC.

The latest U.S. house price measure from S&P/Case-Shiller showed prices in 20 key cities up 5.9% year-over-year through July. Consumer confidence data is due at 10 a.m.

Starbucks SBUX was downgraded to underperform at Jefferies, as it says fiscal 2025 estimates from Wall Street are too high.

Liberty Broadband LBRDK proposed a merger deal with Charter Communications CHTR.

AutoZone AZO missed expectations for its fiscal fourth quarter.

Snowflake SNOW announced a $2 billion convertible bond offering, while Hawaiian Electric Industries HE stock tumbled on an equity offering to help settle wildfire litigation.

Visa V is reportedly facing a U.S. Justice Department antitrust case on debit cards, according to Bloomberg News.

Best of the web

Investors clinging to cash face these two risks as the Fed cuts interest rates.

Wall Street’s future? Goldman’s old headquarters have been converted into apartments.

Top economist in China vanishes after private WeChat comments.

The chart

This chart, from the blog Calculated Risk, shows that inbound container traffic at the key ports of Los Angeles and Long Beach, Calif. are booming — while outbound traffic is stagnant. “In general, it appears port traffic is returning to the pre-pandemic patterns – although this was a very strong August for imports as retailers prepare for holiday shopping – and possibly to beat any increase in tariffs,” says the blog.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

NIO |

Nio |

|

DJT |

Trump Media & Technology |

|

PLTR |

Palantir Technologies |

|

AAPL |

Apple |

|

HOLO |

MicroCloud Hologram |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

BABA |

Alibaba |

Random reads

A zoo admits its pandas are actually painted dogs.

A hive with more than 40,000 bees grew within the walls of a farmhouse in Maine.

Coldplay’s Chris Martin debuted a new song at a Las Vegas karaoke bar, in disguise.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching — and how that’s affecting the economy and your wallet.

Most Read from MarketWatch

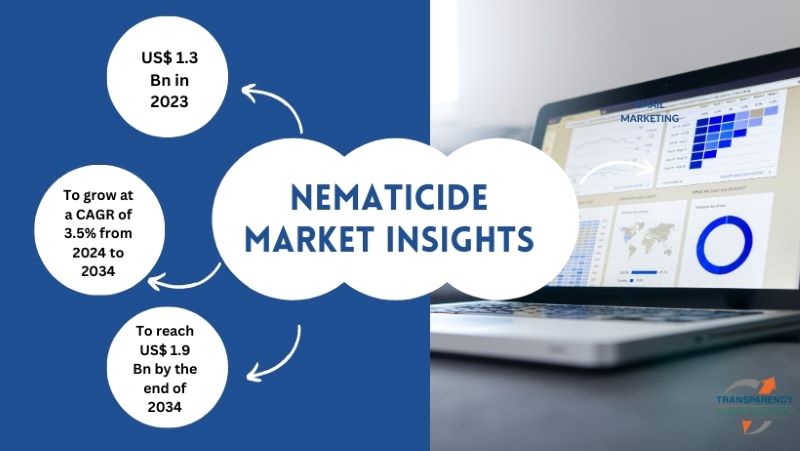

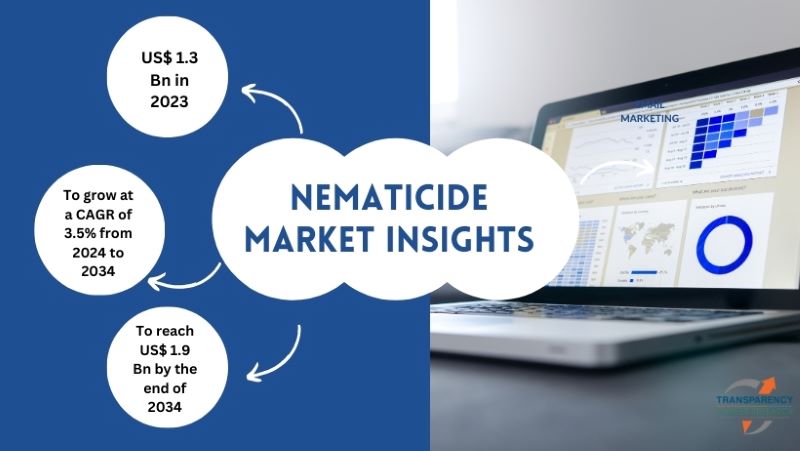

Nematicide Market Size to Grow to USD 1.9 Billion at 3.5% CAGR by 2034, Strengthening Global Food Security-States Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc., Sept. 25, 2024 (GLOBE NEWSWIRE) — The global nematicide industry was worth US$ 1.3 billion in 2023. A CAGR of 3.5% is expected from 2024 to 2034, resulting in US$ 1.9 billion by 2034. The variety of chemical categories utilized in this class of pesticides has been expanded with the introduction or development of various new nematicides.

The future success of novel nematicides will depend on how well they work in the field, how well they can continuously decrease nematode damage, and how they affect crop vigor and productivity.

Due to the drawbacks and safety issues with conventional agrochemicals, innovative, highly efficient biocontrol agents that abide by biosafety standards have been developed. Bionematicides, which use both bacterial and fungal nematicides, are becoming increasingly popular due to the demand for sustainable farming methods, regulatory support, and research findings.

The IRAC Nematode Working Group was formed to examine the potential for resistance in novel nematicides and create a categorization system for their mechanism of action comparable to that of insect and acaricides. Nematicides can be more effectively managed and used with this classification scheme.

Download Sample Copy of the Report: https://www.transparencymarketresearch.com/nematicides-market.html

Global Nematicide Market: Competitive Landscape

The global nematicide industry is adopting organic and inorganic expansion methods to survive fierce competition. This field is largely driven by the development of sustainable pesticides against nematodes.

In addition to targeting parasitic worms, they are developing ingredients that reduce greenhouse gas emissions while protecting the soil. TMR has profiled the following nematicide manufacturers in its extensive report:

- DuPont

- Bayer AG

- Syngenta Group (NI) B.V.

- FMC Corporation

- Nufarm

- PI Industries

- Adama Agricultural Solutions

- Ishihara Sangyo Kaisha, Ltd.

- Valent U.S.A. LLC

Key Developments

- In September 2023, Bayer’s Crop Science division announced the registration of Emesto Complete, a combination fungicide and insecticide for seed-piece treatments, and Velum Rise, a combination fungicide and nematicide. Providing Canadian potato growers with leading crop protection products through Emesto Complete and Velum Rise has been a priority for Bayer for years.

- In December 2023, Syngenta launched CERTANO, a microbiological bionematicide developed and tested in sugarcane fields across Brazil. With this new technology, the company unveils its first biological specifically targeted at sugarcane cultivation, offering consistent control with immediate and prolonged effects by being a biofungicide, bionematicide, and a growth promoter.

Key Findings of the Market Report

- The carbamate market is expected to be a major driver of nematicide demand in the coming years.

- Based on crop, nematicides are expected to be in high demand in oilseeds and pulses.

- The Asia-Pacific region held the largest market share in 2023 for nematicides.

- The nematicide market is experiencing growth due to the adoption of bio-nematicides.

Global Nematicide Market: Growth Drivers

- As the world’s population rises, agricultural production must increase to maintain food security. Since nematodes can drastically lower crop yields, using effective nematicides is crucial to preserving agricultural output.

- Nematode populations frequently rise with agricultural expansion into new areas or intensification within existing ones because of monocropping and other agricultural practices. Therefore, Effective nematicides are required to safeguard crops due to this growth.

- Sustainable agriculture techniques are in demand and becoming increasingly popular. Eco-friendly pest control methods are implemented in addition to reducing chemical inputs. Nematicides with lower environmental impact and less effect on non-target creatures are in greater demand.

- Due to ongoing research and technical developments, eco-friendlier and effective nematicide formulations are being developed. This covers the application of innovative active components, precise application methods, and biological control agents.

Global Nematicide Market: Regional Landscape

- The nematicide market is expected to be driven by demand from Asia-Pacific. As cities expand across Asia Pacific, urbanization puts agricultural land under stress. Agricultural production and intensification increase when nematodes are effective at preserving crop yields.

- Agricultural activities frequently spread into marginal regions that may have larger nematode populations as arable land becomes more limited as a result of urbanization and industrialization. To maintain sustainable agricultural production in these locations, nematode infestations must be controlled with the help of nematodes.

- Government laws and rules pertaining to the use of pesticides have a big impact on the Asia-Pacific nematicide industry. Concerns about food safety, human health, and environmental degradation are causing people throughout Asia-Pacific to become more conscious of the significance of sustainable agriculture.

- Rapid developments in agricultural technology and innovation, such as the creation of novel nematicide formulations, precise application methods, and biological control agents, are being observed throughout the Asia-Pacific region.

- These developments aim to improve the region’s nematicide use’s sustainability and efficacy. Asia-Pacific nations are significant participants in the world’s agricultural trade, acting as importers and exporters of agricultural goods.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=2728<ype=S

Global Nematicide Market: Segmentation

By Product

- Fumigant

- Carbamate

- Organophosphate

By Crop

- Oilseeds & Pulses

- Cereals & Grains

- Fruits & Grains

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Explore More Trending Report by Transparency Market Research:

- Chloromethane Market – The global chloromethane market is Set to Surge at 4.4% CAGR, to Reach USD 5.4 billion by 2031.

- Calcium Chloride Market – The global calcium chloride market is Expected to Achieve USD 4.6 billion by 2031 with a 4.5% CAGR from 2023-2034.

- Acetic Anhydride Market – The global acetic anhydride market is estimated to grow at a CAGR of 4.3% from 2024 to 2034 and reach US$ 3.8 Billion by the end of 2034.

- Friction Materials Market – The global Friction Materials Market is estimated to grow at a CAGR of 4.4% from 2024 to 2034 and reach US$ 8.9 Billion by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Accuses Zelenskyy Of Making 'Nasty Little Dispersions' After Canceled Meeting: 'We Continue To Give Billions Of Dollars To A Man Who Refuses To Make A Deal'

Former President Donald Trump slammed Ukrainian President Volodymyr Zelenskyy after the latter canceled a scheduled meeting. Trump accused Zelenskyy of refusing to negotiate peace and wasting U.S. funds.

What Happened: Trump expressed frustration during a speech in Mint Hill, North Carolina, saying, “We continue to give billions of dollars to a man who refuses to make a deal.”

Trump accused Zelenskyy of insulting him, claiming the Ukrainian president was “making nasty little dispersions toward” him. He also emphasized that he got along “very well” with Russian President Vladimir Putin.

The meeting was supposed to occur at Trump Tower on Thursday, but a campaign official confirmed it was called off, CNBC reported on Thursday.

In a recent New Yorker interview, Zelenskyy criticized Trump’s running mate, Sen. JD Vance (R-Ohio), labeling him “too radical.” This comment reportedly influenced the decision to cancel the meeting.

House Oversight Chair James Comer announced an investigation into Zelenskyy’s visit to an ammunition factory in Pennsylvania, alleging it was politically motivated to support Vice President Kamala Harris‘ presidential campaign.

During his U.S. visit, Zelenskyy attended the UN General Assembly in New York and met with President Joe Biden and Harris. He also visited the Scranton factory, which manufactures crucial artillery shells for Ukraine’s war efforts.

Why It Matters: This incident adds another layer to the complex relationship between Trump and Zelenskyy. Recently, Trump claimed that Zelenskyy supports the Democrats in the upcoming 2024 U.S. election, stating that the Ukrainian leader is “the greatest salesman in history.” Trump’s allies, however, argue that Ukraine would prefer Trump’s return, believing he can negotiate peace with Russian President Vladimir Putin.

Meanwhile, Zelenskyy has been vocal about the need for Western nations to take decisive action against Russia. During a recent address at the United Nations Security Council, he emphasized that the conflict with Russia cannot be resolved through dialogue alone and urged for more forceful measures.

Did You Know?

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fathom Realty Earns Top Ranking for Agent Satisfaction Among Nation's Largest Real Estate Companies

CARY, N.C., Sept. 25, 2024 /PRNewswire/ — Fathom Realty, a subsidiary of Fathom Holdings Inc. FTHM (“Fathom” or the “Company”), a national, technology-driven, end-to-end real estate services platform integrating residential brokerage, mortgage, title, and SaaS offerings for brokerages and agents, was named the top real estate company for agent satisfaction among the nation’s 40 largest real estate companies. The recognition, awarded by Career.io, underscores Fathom’s unwavering commitment to fostering a supportive and empowering environment for agents and employees.

Career.io’s study, which analyzed data from over 755,000 job reviews across various professions, identified real estate agents as one of the most satisfied job groups. Among the companies evaluated, Fathom Realty stood out with an exceptional Glassdoor rating, earning it the highest agent satisfaction score in the industry. This honor was recently highlighted in an RISMedia article titled “Being a REALTOR® Breeds High Job Satisfaction,” further cementing Fathom Realty’s leadership in creating a thriving agent community.

“This recognition is the result of years of hard work by Fathom Realty COO Samantha Giuggio and her team, who have continually put the needs of agents and employees first,” said Fathom Holdings’ CEO Fregenal. “When our agents thrive, Fathom thrives. This ranking reflects our commitment to service, collaboration, and innovation—ensuring our agents are empowered to succeed.”

Giuggio added: “At Fathom, our focus has always been on fostering an environment where our agents and staff feel heard, appreciated, and empowered. This recognition reflects the dedication of our entire team and all the local leaders who work tirelessly to support our agents. Knowing that our agents feel this level of support reaffirms that our approach to leadership, culture, and innovation is making a tangible impact on their success and well-being.”

Key factors driving Fathom Realty’s top agent satisfaction ranking include:

- Agent-Centric Business Model: Fathom’s innovative compensation plans, including Fathom Max and Fathom Share, provide agents with flexibility in how they manage and grow their businesses. These plans feature revenue-sharing opportunities, allowing agents to maximize their earnings while maintaining a sustainable work-life balance.

- Training and Leadership Support: Fathom Realty offers comprehensive training, mentorship, and leadership support, ensuring agents have access to the resources and knowledge they need to succeed. This emphasis on continuous learning keeps Fathom agents competitive in an ever-evolving industry.

- Technological Advancements: By equipping agents with cutting-edge technology, Fathom streamlines operations and enhances client engagement, allowing agents to focus on delivering exceptional service to their clients.

- Collaborative Culture: Fathom Realty prioritizes teamwork and servant leadership, creating a culture of collaboration where agents support one another and grow together. This positive environment promotes personal and professional growth, benefiting agents and their clients.

Fathom Realty’s top ranking in agent satisfaction marks both a proud milestone and a springboard for future innovation and growth. The company remains dedicated to enhancing the agent experience through ongoing investments in technology, leadership, and culture. By prioritizing its agents, Fathom Realty ensures long-term success for both its professionals and the organization as a whole.

For more information about Fathom Realty, visit www.fathomrealty.com.

About Fathom Holdings Inc.

Fathom Holdings Inc. is a national, technology-driven, real estate services platform integrating residential brokerage, mortgage, title, and SaaS offerings to brokerages and agents by leveraging its proprietary cloud-based software, intelliAgent. The Company’s brands include Fathom Realty, Encompass Lending, intelliAgent, LiveBy, Real Results, and Verus Title. For more information, visit www.FathomInc.com.

Investor Contact:

Matt Glover and Clay Liolios

Gateway Group, Inc.

949-574-3860

FTHM@gateway-grp.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fathom-realty-earns-top-ranking-for-agent-satisfaction-among-nations-largest-real-estate-companies-302259102.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fathom-realty-earns-top-ranking-for-agent-satisfaction-among-nations-largest-real-estate-companies-302259102.html

SOURCE Fathom Holdings Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Stock rally loses steam as S&P 500, Dow slip from records

US stocks lost steam on Wednesday after markets hit all-time highs, with the three major gauges closing mixed as investors debated the health of the economy and the chances of another jumbo rate cut.

The Dow Jones Industrial Average (^DJI) reversed earlier gains to close down about 0.7%, while the S&P 500 (^GSPC) also slipped into negative territory, declining around 0.2% on the heels of record closes for both indexes. The tech-heavy Nasdaq Composite (^IXIC) finished the day just above the flat line.

The question now becomes whether or not the US economy could find itself in a recession, with concerns fanned by a surprisingly weak reading on consumer confidence. The debate centers on whether the Federal Reserve lowered rates by a bigger-than-usual 0.5% in response to a slowing economy and what further malaise means for another hoped-for deep cut.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

On the data front, new home sales declined in August following a sharp increase the month prior as ultra-high mortgage rates and lofty prices kept buyers mostly on the sidelines.

Mortgage applications, however, jumped to the highest level since 2022, according to MBA data released before the bell. The growth was driven by homeowners seeking to refinance loans as rates drop.

But the spotlight is firmly on Thursday’s second quarter GDP print and Friday’s crucial reading on the PCE index — the inflation gauge favored by the Fed.

LIVE COVERAGE IS OVER11 updates