Why Rivian Stock Slumped on Wednesday

Rivian Automotive (NASDAQ: RIVN) stock was trading down by 4.8% as of 1:20 p.m. ET Wednesday after Morgan Stanley analyst Adam Jonas downgraded the stock one notch from overweight (i.e., buy) to equal weight (i.e., hold).

Jonas’ note on Wednesday regarding Rivian was only one facet in his broader downgrade of the entire U.S. automotive industry: He also downgraded Ford (NYSE: F) to equal weight and reclassified General Motors (NYSE: GM) to underweight (i.e., sell). But Jonas has specific concerns about Rivian.

What Rivian needs to do

Broadly speaking, Jonas observed that inflation has driven new car prices higher, reducing people’s ability to buy them, with the result that inventories are swelling as sales stagnate. Adding to the problems of U.S. automakers, many Chinese automakers are selling their electric vehicles at ever-greater losses due to a price war. Further, China is producing 9 million more cars a year than it can sell locally. Those excess cars are getting exported, cutting into potential sales for Ford, GM, and Rivian, among others.

Regarding Rivian in particular, though, the analyst notes that its future will depend to a great extent on its partnership with Volkswagen, and on its ability to contribute “electrical architecture expertise” for use in Volkswagen’s vehicles. The problem, asserts Jonas, is that delivering on that promise will require Rivian to lay out an extra $200 million to $300 million in annual capital spending — or more — starting in about 2026.

Is Rivian stock a buy?

Rivian already spends $1 billion a year on capital expenses, so with those additional outlays, you might think its capex would now be expected to reach $1.3 billion, at most, in 2026. But Rivian was already forecasting capex of $1.2 billion in 2024, and $1.5 billion in 2025. Assuming these numbers are accurate, this suggests that its capex could actually surge as high as $1.8 billion in 2026 — as much as Rivian spent annually back in 2021, before it started getting its spending under control.

Long story short, Rivian’s cost-cutting program now seems to have shifted into reverse. Even with financial assistance from Volkswagen, Jonas worries that this level of “capital intensity” might be too much for Rivian to bear.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Rich Smith has no position in any of the stocks mentioned. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Why Rivian Stock Slumped on Wednesday was originally published by The Motley Fool

2 Sectors Investors Should Buy Now That Rate Cuts Are In

Every time the Federal Reserve (the Fed) cuts interest rates, investors tend to flock to the sectors they believe will outperform the most due to historical reactions and fundamental reasoning. However, this rate cut is a bit different than the ones experienced in the recent past, as the United States economy is more globalized and a bit slower than before.

This will be a different case study, one in which rising credit card delinquency rates and spiking car repossessions will place a headwind in the consumer discretionary sector despite interest rate cuts, one that will slow down easier financing rates to boost the energy sector now that the 22-month contraction in the manufacturing PMI index drove business activity down, and one in which the dollar is as strong as it was during the COVID-19 pandemic.

Mixing these factors together, investors should focus on the effect of interest rates on company fundamentals rather than consumer or economic impacts since those may be a bit blurred in today’s environment. By company fundamentals, the balance sheet is kept in the first place, especially the way lower interest expenses can affect utility stocks like Dominion Energy Inc. D and dividend real estate investment trusts (REITs) like Brookfield Infrastructure Partners BIP.

Why Utility Stocks Thrive in a Low Interest Rate Environment

Typically, utility stocks carry more debt on their balance sheet than the average industry and, as a result, will have a higher interest expense on their income statement. For this reason, lower interest rates open up more room in their financials due to lower interest expenses, directly pushing earnings per share (EPS) higher.

Since stock prices are driven by their underlying earnings, investors can see how a domino effect can benefit the utility sector if the underlying stocks and their individual balance sheets carry enough debt to make this factor a reality. One such example can be made out of Dominion Energy.

This utility stock carries up to 61% debt on its balance sheet, so it is safe to assume that lower rates will significantly impact its earning power. Now that the stock trades at 98% of its 52-week high, investors can note how the market has recently rewarded this name with better price action than even the S&P 500.

More than that, this stock offers shareholders up to 4.6% as an annual dividend yield today, beating the Fed’s target inflation rate by twice as much. Since utility stocks also have a subscription-based business model, investors can see how cash flows are safer and more predictable here to cushion any potential market volatility.

This is why Wall Street analysts forecast up to $0.75 in EPS for the next 12 months in Dominion Energy stock, a significant jump from today’s 0.65 a share or a 15.3% jump.

Leaning on these projections, Jefferies Financial decided to initiate coverage on the stock at a $58 a share valuation, which is roughly where it trades today, though that might change soon.

Facing this fundamentally bullish trend, bears decided to move out of the stock during the past month, as Dominion’s short interest declined over the past quarter to show signs of bearish capitulation today. Low interest rates can help utility stocks improve their earning power and dividend strength, and other sectors like real estate benefit as well.

Low Interest Rates Boost Rental Income Potential in Dividend Real Estate Stocks

Here is how lower rates push the income potential for property stocks, especially REITs in agnostic asset classes like infrastructure. This is where Brookfield Infrastructure Partners stock comes into play.

As financing rates and liquidity become available, acquisitions and additions to the company’s real estate portfolio automatically generate more income from tenants and create higher upside potential through the ensuing appreciation of these new properties.

This REIT’s balance sheet shows 64.3% debt, so the same effect in the utility sector is true here: lower interest expenses lead to better earning potential.

These fundamental truths led Wall Street analysts to forecast up to $0.84 in EPS for the next 12 months, up from today’s net loss of $0.10 a share.

Driven by this potential profit growth in the next 12 months, management feels comfortable paying investors up to 4.8% in a dividend yield, which could see further strength as lower interest rates enable the company to expand its property income.

More than that, analysts have also landed on a consensus price target of $37.6 a share, calling for up to 11.1% upside from the stock’s current level. Considering that it already trades at its 52-week high, analysts are directly calling for the stock to reach a new high in cadence with bullish price action and sentiment toward the stock and the sector.

The article “2 Sectors Investors Should Buy Now That Rate Cuts Are In” first appeared on MarketBeat.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

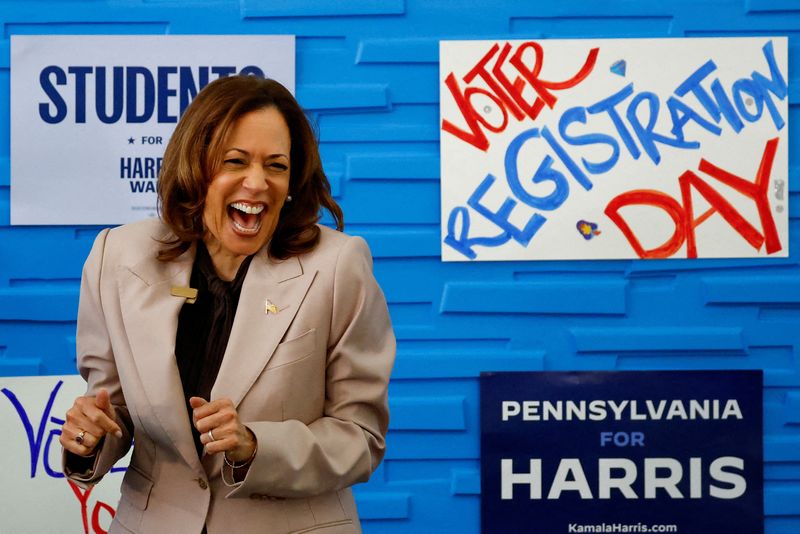

What we know about Kamala Harris' economic plans on taxes, childcare, housing

(Reuters) -U.S. Vice President Kamala Harris has announced a basket of economic proposals aimed at lowering living costs for middle- and lower-class Americans and boosting the economy overall by using tax incentives and other tax shifts.

Some of her ideas build on unfinished business in President Joe Biden’s economic agenda but expand their scope and size.

Here’s what we know so far:

INDUSTRIAL INCENTIVES

Harris on Wednesday pledged new tax credits to spur more domestic manufacturing and to invest in sectors that will “define the next century,” including biomanufacturing, aerospace, artificial intelligence, quantum computing and blockchain, advanced nuclear power, and batteries.

She also said she would offer tax incentives for expanding “good union jobs” in long-standing iron, steel, coal and other traditional industrial communities. Details on the size and scope of the incentives and investments were not announced.

Harris announced new investments in U.S. basic technology research, through the National Science Foundation, the Department of Energy’s National Laboratories and other institutions.

She also announced plans to cut red tape to speed the construction of new infrastructure and industrial projects and to use the Defense Production Act and other tools to boost U.S. capacity to process critical minerals and reduce reliance on supplies from China.

TAX ON THE WEALTHY

Harris has echoed Biden’s promise not to raise taxes on households that earn less than $400,000 a year.

She has quietly endorsed most of the nearly $5 trillion in tax hikes over a decade in Biden’s fiscal 2025 budget proposal, which would boost the top income tax rate to 39.6% from 37%.

These include a new 25% minimum tax on people with fortunes exceeding $100 million, including on unrealized capital gains. For those earning more than $1 million annually, Harris has proposed raising the long-term capital gains tax rate paid after selling assets like stocks to 28% from 20%, an increase far smaller than the 39.6% full top income tax rate proposed by Biden.

TAX ON BUSINESSES

Harris has proposed increasing the corporate tax rate to 28%, partially reversing former President and Republican rival Donald Trump’s 2017 tax law, which cut company tax rates to 21% from 35%. The step would raise $1 trillion for the federal government over a decade, budget experts estimate, but cut into company profits, Wall Street says.

Big U.S. companies pay a far lower effective tax rate than their foreign competitors at an average of 16%, a Reuters analysis showed. Any broad corporate tax changes would need to be passed by Congress.

CHILD TAX CREDIT

Harris has kept Biden’s proposal to permanently restore a one-year, COVID-19-era increase in the Child Tax Credit to as much as $3,600 per child from $2,000 currently, which is scheduled to drop to $1,000 after 2025. She also has proposed a $6,000 bonus onetime credit for families with newborns.

Trump’s vice presidential running mate, JD Vance, has floated raising the annual Child Tax Credit to $5,000, but the idea has not been adopted as an official Trump policy proposal.

AFFORDABLE HOUSING

Harris has detailed plans to spur new construction and reduce costs for renters and homebuyers, largely through tax incentives. They include tax credits for builders of homes for first-time buyers and affordable rental units, along with a $25,000 tax credit to help first-time buyers with down payments for the next four years.

Harris is also proposing a $40 billion “innovation fund” to encourage local governments to build more affordable homes, doubling a Biden budget proposal that would make competitive grants to local governments that show they can get results.

U.S. home prices have risen 50% in the last five years and rents have risen 35%, according to real estate firm Zillow, largely due to a housing shortage. Harris has set a goal to increase U.S. housing construction by 3 million units over the next four years.

SMALL BUSINESS TAX CREDIT

Harris also has deviated from Biden’s economic plan by proposing to increase the tax deduction to up to $50,000 for new small business start-up costs from $5,000 currently to support entrepreneurs. The 33 million U.S. small businesses were responsible for 70% of net new jobs created since 2019, according to Small Business Administration data.

CHILD CARE

“My plan is that no family, no working family, should pay more than 7% of their household income in child care,” Harris told the National Association of Black Journalists in September. U.S. parents are currently paying as much as 19.3% of median family income per child for care, Department of Labor figures show.

The 7% figure echoes the Child Care and Development Block Grant, a program Harris has touted that currently supports about 1 million children in low-income families.

Harris’ campaign has not detailed how the child care plan would work.

HIGH GROCERY PRICES

Harris has vowed to enact the “first-ever federal ban on price gouging on food and groceries” that aims to stop big corporations from unfairly exploiting consumers while generating excessive profits. Defining such excessive price hikes is not clear, but some proposals in the U.S. Senate show a potential path to enactment.

(Reporting by Heather Timmons and David Lawder; Editing by Jamie Freed and Jonathan Oatis)

Chronic Migraines And Cannabis: How One Mom Found Relief After A Lifetime Of Pain

Toria Lyttle, a 43-year-old mother from Newtownards, in Northern Ireland, turned to medical marijuana to manage her severe migraines, which have plagued her since childhood.

With monthly prescription costs reaching up to 350 pounds sterling ($366), Toria’s case underscores the ongoing challenges of accessing alternative treatments for chronic pain in the UK, reported Fox 54 News.

See Also: Can Marijuana Help With Migraines? MS-Related Chronic Pain? New Clinical Guidelines Are Here

Living With Chronic Migraines

Toria has battled migraines since she was nine. The situation became worse when doctors diagnosed her with a benign brain tumor three years ago.

Despite the diagnosis, her migraines persisted, leading to years of disrupted sleep, pain and an inability to live her life fully. “I’ve lived with these awful migraines my whole life, but no one could ever tell me why I suffered with them,” Toria said.

Before turning to medical cannabis, she had been prescribed various painkillers, none of which eased her symptoms, often making her feel worse. Desperate for a solution, Toria approached her doctor in September 2023 about trying medical marijuana.

Turning To Medical Cannabis

After consulting with a specialist at the private medical cannabis clinic Alternaleaf, Toria received a prescription for 30 grams of THC-containing cannabis each month. She now vapes two to four doses daily, depending on the severity of her symptoms. She says the change has been transformative.

“Medicinal cannabis has allowed me to live again,” she said. “It has lightened my world because I don’t feel terrified about the next migraine anymore and it’s much fairer for the people around me, too, because my temper is so much better.”

Though the cannabis has not eliminated her pain entirely, it has significantly improved her condition, allowing her to sleep through the night and function during the day.

“It hasn’t taken the pain away completely, but I can manage it now,” she added.

Cannabis Study Confirms Efficacy For Migraine Sufferers

Meanwhile, research presented at the 2023 American Headache Society Annual Meeting validates the effectiveness of cannabis for migraines, echoing the life-changing relief experienced by Lyttle.

The study, led by Dr. Nathaniel Schuster, found that a combination of THC and CBD significantly reduced migraine symptoms within two hours of use.

Patients were randomly assigned to either tetrahydrocannabinol (THC) 6%, a mix of THC and cannabinoid (CBD) 11%, CBD 11% and placebo cannabis.

“The doses that we used are probably lower than what a lot of people out there are using on their own, and higher doses do not necessarily mean more effective,” Schuster said. “The highness patients were having in the study was not very high, probably somewhere between a 2-4 out of 10 on subjective highness.”

Migraines affect 47 million Americans, 75% of whom are women. Although a splitting headache is one symptom, migraine attacks can include visual disturbances, nausea, extreme light and sound sensitivity, brain fog and debilitating pain.

Read Next:

Cover image made with AI.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Pfizer Stock A Buy Or A Sell On Its New Weight-Gain Approach?

Pfizer (PFE) stock is toeing its 50-day moving average in late September following enthusiasm for its new approach to helping cancer patients gain weight.

↑

X

How Novo Nordisk, Wegovy And Ozempic Are Changing The Weight-Loss Game For Patients And Investors

The Big Pharma titan is testing a drug called ponsegromab in patients with cancer cachexia. In this condition, patients with cancer lose a significant amount of muscle and fat mass. The highest dose of ponsegromab helped patients gain an average 5.6% body weight over 12 weeks.

Patients also saw improvements in appetite, cachexia symptoms, physical activity and muscle mass.

The effort is vastly different than Pfizer’s other weight-focused drug, danuglipron. Pfizer is testing that drug, which mimics the GLP-1 hormone, as an obesity treatment. The company is planning to send ponsegromab into registration-enabling studies in 2025. It’s also currently working to find the right dose for danuglipron in weight loss.

On Sept. 9, Pfizer stock surged above its 50-day line. But the stock fell below that line on Sept. 25.

There are still challenges ahead. Pfizer and BioNTech (BNTX) are considering whether they need to reconfigure their Covid and flu combination vaccine. The shot generated a low number of antibodies capable of handling influenza B strains. Moderna (MRNA), on the other hand, is planning to file for approval of its combo shot later this year.

Is Pfizer stock a buy or a sell today?

Pfizer Stock Fundamentals

In the June quarter, Pfizer earned an adjusted 60 cents per share on $13.3 billion in sales. Both beat expectations. Earnings declined 11% while sales rose 3% operationally. It was the first quarter since December 2022 that sales increased year over year.

Sales of heart disease treatment Vyndaqel surged 71% to $1.32 billion and easily topped forecasts. Padcev, a cancer drug Pfizer acquired with Seagen, brought in $394 million in sales, coming in above projections for $352.6 million.

Revenue from the Covid vaccine Comirnaty plummeted and missed expectations. But Covid treatment Padcev topped the Street’s call and soared 79%.

For the third quarter, analysts project 59 cents earnings per share and $14.98 billion in sales. Profit would reverse from a year-earlier loss and sales would climb more than 13%.

This year, Pfizer expects adjusted earnings of $2.45 to $2.65 a share and $59.5 billion to $62.5 billion in sales. At the midpoints, earnings would surge 39% as sales pop more than 4%.

Obesity Treatments In Focus

Investors have zeroed in on Pfizer’s efforts in obesity treatment. The company says it plans to send danuglipron into additional testing. Danuglipron is a daily pill, compared to leading shots from Eli Lilly (LLY) and Novo Nordisk (NVO).

But Leerink Partners analyst David Risinger doesn’t expect Pfizer to have effectiveness and safety test results until 2026. Danuglipron is one of three obesity treatment candidates Pfizer has in testing. The company has a similar drug that mimics GLP-1 — a hormone tied to satiety and stomach emptying — and a third with an undisclosed mechanism.

The field for oral weight-loss drugs is becoming increasingly crowded. Roche (RHHBY), Viking Therapeutics (VKTX), Structure Therapeutics (GPCR), AstraZeneca (AZN) and others are all in this space.

Pfizer Stock And Recent News

Outside of obesity treatment, Pfizer recently launched PfizerForAll, a digital platform to help people connect with health care providers for migraine, Covid or flu. It also connects people with vaccines for Covid, flu, respiratory syncytial virus and pneumonia.

The Food and Drug Administration also signed off on updated Covid vaccines from Pfizer and Moderna. These shots aim to block against the KP.2 strain and are recommended for people age 6 months and older.

Technical Analysis: PFE Stock Tops 50-Day Line

Pfizer stock dipped below its 50-day moving average on Sept. 25, and remains above its 200-day line. Shares are forming a new flat base with a buy point at 31.54, MarketSurge shows.

(Related: Keep tabs on chart patterns by visiting IBD’s MarketSurge.)

Pfizer stock has an IBD Digital Composite Rating of 47 out of a best-possible 99. The CR is a measure of a stock’s fundamental and technical measures. Shares also have a Relative Strength Rating of 38, a measure of 12-month performance.

Is PFE Stock A Buy Or A Sell?

Based on savvy rules of investing, Pfizer stock isn’t a sell. But it also isn’t currently a buy. Shares are still forming a flat base and have yet to break out. Bearishly, shares have fallen below their 50-day moving average.

Pfizer stock still has to prove its fundamental and technical merit.

The company is trying to shore up its pipeline to return to the growth it saw at the height of the pandemic. The RSV vaccine and a potential approval in obesity treatment could be key.

To find the best stocks to buy and watch, check out IBD Stock Lists. Make sure to also keep tabs on stocks to buy or sell.

Follow Allison Gatlin on Twitter at @IBD_AGatlin.

YOU MAY ALSO LIKE:

Biotech Stocks To Watch And Pharma Industry News

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader

IBD Stock Of The Day: See How To Find, Track And Buy The Best Stocks

Watch IBD’s Investing Strategies Show For Actionable Market Insights

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

Seelos Therapeutics Announces 1-for-16 Reverse Stock Split

NEW YORK, Sept. 25, 2024 /PRNewswire/ — Seelos Therapeutics, Inc. (Nasdaq: SEEL) (“Seelos” or the “Company”), a clinical-stage biopharmaceutical company focused on the development of therapies for central nervous system disorders and rare diseases, today announced that its Board of Directors approved a 1-for-16 reverse stock split of its outstanding shares of common stock, to be effective as of 12:01 a.m. Eastern Time on Friday, September 27, 2024.

The Company’s common stock, par value $0.001, will begin trading on a reverse stock split-adjusted basis at the opening of the market on Friday, September 27, 2024. Following the reverse stock split, the Company’s common stock will continue to trade on the Nasdaq Capital Market under the symbol “SEEL” with the new CUSIP number, 81577F 406. The reverse stock split is intended for the Company to regain compliance with the minimum bid price requirement of $1.00 per share of common stock for continued listing on the Nasdaq Capital Market. The reverse stock split was approved by the Company’s Board of Directors pursuant to Section 78.207 of the Nevada Revised Statutes and was effectuated by the filing of a Certificate of Change with office of the Nevada Secretary of State.

At the effective time of the reverse split, every sixteen (16) issued and outstanding shares of the Company’s common stock will be combined automatically into one (1) share of the Company’s common stock without any change in the par value per share. No fractional shares will be issued in connection with the reverse stock split, and any fractional shares resulting from the reverse stock split will be rounded up to the nearest whole share. The reverse stock split will reduce the number of authorized shares of the Company’s common stock from 50,000,000 shares to 3,125,000 shares and the ownership percentage of each stockholder will remain unchanged other than as a result of the rounding of fractional shares. In addition, the reverse stock split will apply to the Company’s common stock issuable upon the exercise of the Company’s outstanding warrants and stock options, with proportionate adjustments to be made to the exercise prices thereof and under the Company’s equity incentive plans, as applicable.

The reverse stock split will reduce the number of issued and outstanding shares of the Company’s common stock from approximately 9.2 million to approximately 581 thousand.

About Seelos Therapeutics:

Seelos Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on the development and advancement of novel therapeutics to address unmet medical needs for the benefit of patients with central nervous system (CNS) disorders and other rare diseases. The Company’s robust portfolio includes several late-stage clinical assets targeting indications including Acute Suicidal Ideation and Behavior (ASIB) in Major Depressive Disorder (MDD), amyotrophic lateral sclerosis (ALS) and spinocerebellar ataxia (SCA), as well as early-stage programs in Huntington’s disease, Alzheimer’s disease, and Parkinson’s disease.

Forward-Looking Statements:

Statements made in this press release, which are not historical in nature, constitute forward-looking statements for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. These statements include, among others, those regarding the reverse stock split and the timing thereof, the potential impact of the reverse split on the bid price of the Company’s common stock, the potential for the Company to regain compliance with the minimum bid price requirement of $1.00 per share of common stock for continued listing on the Nasdaq Capital Market and the expected number of shares of common stock to be outstanding following the reverse stock split. These statements are based on our current expectations and beliefs and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The risks and uncertainties involved include those associated with general economic and market conditions, as well as other risk factors and matters set forth in our periodic filings with the SEC, including our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available by us on our website or otherwise. We do not undertake any obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Contact Information

Anthony Marciano

Chief Communications Officer

Seelos Therapeutics, Inc. (Nasdaq: SEEL)

300 Park Avenue, 2nd Floor

New York, NY 10022

(646) 293-2136

anthony.marciano@seelostx.com

Mike Moyer

Managing Director

LifeSci Advisors, LLC

250 West 55th St., Suite 3401

New York, NY 10019

(617) 308-4306

mmoyer@lifesciadvisors.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/seelos-therapeutics-announces-1-for-16-reverse-stock-split-302257773.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/seelos-therapeutics-announces-1-for-16-reverse-stock-split-302257773.html

SOURCE Seelos Therapeutics, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dividend Investor Earning $13,000 Per Year With $330,000 Invested Shares His Portfolio: 14 Stocks You Should Not Miss

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Dividend stocks are in focus as investors look to funnel capital into a euphoric market after the first rate cut. Plenty of successful dividend investing stories show that picking dividend-paying stocks prudently can help you generate a reliable income stream.

About three years ago, a dividend investor on r/Dividends shared his detailed income report, saying he earned $13,000 per year. The Redditor’s initial investment was around $330,000, which reached nearly $474,000 in about seven years of his investing journey.

Don’t Miss:

Asked whether he uses DRIP investing strategies, the investor said:

“I don’t drip – I prefer to earn dividends and reinvest when I see a good opportunity. Same with rebalancing. If a stock is very overvalued and I spot a good cheap one, I might divert funds.”

There were 73 stocks in this portfolio. To give you a taste of what kind of stocks generated the most income for this investor, we chose 14 high-yield dividend stocks with the biggest contributions to the overall annual income of the investor, based on the portfolio screenshots he shared publicly in his Reddit post.

AbbVie

With a current dividend yield of 3.2%, AbbVie Inc. (NYSE:ABBV) was one of the important dividend stocks in the portfolio of the Redditor who makes $13,000 per year. The screenshots shared by the investor showed the portfolio had 80 shares of the company. Over the past year, AbbVie shares have gained about 25%.

Franklin Resources

Financial services company Franklin Resources Inc. (NYSE:BEN) was among the highest-yielding dividend stocks in the $13,000 income portfolio. The stock yields about 5.9% and the company has raised its payouts without a break for over four decades. The Redditor owned 180 shares of the company. However, over the past five years, BEN shares have been down about 27%.

Cardinal Health

With more than 35 consecutive years of dividend increases, Cardinal Health Inc. (NYSE:CAH) is among the safest dividend stocks. The Redditor owned about 95 shares of the company.

Caterpillar

The Redditor earning about $13,000 in annual dividend income owned 30 shares of Caterpillar Inc. (NYSE:CAT) about three years ago when he shared his portfolio details. Caterpillar has increased its payouts for 28 consecutive years.

IBM

With a contribution of more than $1,000 in dividend income, IBM Common Stock (NYSE:IBM) was a prominent stock in the $13,000 dividend income portfolio of the Redditor shared three years ago. The investor owned 50 shares of the company.

Coca-Cola

Coca-Cola Co (NYSE:KO) is another strong dividend growth stock in the portfolio of the Redditor, who earns $13,000 per year. The investor owns 150 shares of the company. As of today, Coca-Cola Co (NYSE:KO) has raised its dividend by over six decades and yields 2.7%.

See More:

General Mills

Consumer foods company General Mills Inc. (NYSE:GIS) has a dividend yield of over 3.2% and the stock is up 14% in the past year. The Redditor at the time of sharing his portfolio had 110 shares of General Mills Inc. (NYSE:GIS).

Lazard

Financial advisory and asset management company Lazard Inc. (NYSE:LAZ) was an interesting name in the portfolio of the Redditor. The stock earns $13,000 in dividends per year and has a dividend yield of about 3.96%. The investor reported owning 150 shares of the company.

3M

Industrial conglomerate 3M Co (NYSE:MMM) is a strong dividend-paying stock in the portfolio of the Redditor generating $13,000 in income per year. The company has raised its dividends for 64 consecutive years. 3M Co (NYSE:MMM) is up 64% so far this year. The investor at the time said 3M was his biggest position.

Realty Income

Realty Income Corp. (NYSE:O) has become synonymous with monthly dividend income, thanks to its juicy yield (over 5%) and almost guaranteed dividend hikes. The company has upped its payouts for three decades in a row now. The Redditor had 100 shares of the REIT in his portfolio.

Altria Group

When he shared his income report three years ago, the Redditor had 140 shares of Altria Group Inc. (NYSE:MO) in his portfolio. As of today, the tobacco products company has raised its payouts for 59 straight years. Altria Group Inc. (NYSE:MO) is swiftly transitioning to smoke-free products amid a decline in traditional smoking worldwide. The stock is up 22% so far this year.

AT&T

With a dividend yield of about 5.2%, AT&T Inc. (NYSE:T) is an important dividend stock. The Redditor’s portfolio included the telecom company, which earned $13,000 per year in dividends. The investor owned about 190 shares of the telecom company.

T Rowe Price Group

The Redditor had owned 60 shares of the investment management and financial services company T Rowe Price Group Inc. (NASDAQ:TROW), which has a dividend yield of about 4.6% today.

ExxonMobil

Oil giant Exxon Mobil Corp. (NYSE:XOM) was one of the biggest contributors to the Redditor’s portfolio of dividend income. The investor had 161 XOM shares in his portfolio. Exxon Mobil Corp. (NYSE:XOM) currently yields about 3.2%.

Interest Rates Are Falling, But These Yields Aren’t Going Anywhere

Lower interest rates mean some investments won’t yield what they did in months past, but you don’t have to lose those gains. Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

Arrived Homes, the Jeff Bezos-backed investment platform, offers a Private Credit Fund. This fund provides access to a pool of short-term loans backed by residential real estate with a target of 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

This article Dividend Investor Earning $13,000 Per Year With $330,000 Invested Shares His Portfolio: 14 Stocks You Should Not Miss originally appeared on Benzinga.com

Lockheed Martin's Unit Secures Contract for CH-53K Gearbox Assemblies

Lockheed Martin Corporation‘s LMT unit, Sikorsky Aircraft, recently secured an $84.3 million contract to supply eight gearbox assemblies for the CH-53K helicopters. The work will be carried out in Stratford, CT, and is set to be completed by December 2028.

The contract will serve the U.S. Navy and Israel military. The award has been provided by the Naval Supply Systems Command Weapon Systems Support, Philadelphia, PA.

What’s Favoring LMT Stock?

With countries worldwide enhancing their defense capabilities, spending on advanced military arms and ammunition has been rapidly increasing. This also includes growing investments in military helicopters, which are crucial for air warfare missions. Lockheed, as a prominent manufacturer of combat helicopters, has been witnessing a steady flow of orders from the Pentagon and other U.S. allies. The latest contract win is an example of that.

LMT’s CH-53K King Stallion is designed for modern combat and shipboard operations, being intelligent, reliable, low-maintenance and highly survivable in harsh environments. With more than 1,200 test flight hours, the helicopter achieved several milestones in 2018, including operating at high altitudes, extreme temperatures and low visibility.

These capabilities are likely to have driven this rotorcraft’s demand in recent times and are expected to lead to more contract awards for Lockheed Martin in the days ahead. Such order flows, including the latest one, are expected to boost the company’s revenues, thereby solidifying its position as a leading defense contractor in military aviation.

Growth Prospects for LMT Stock

Rising military conflicts, terrorism and border disputes, along with rapid technological advancements in military helicopters, have led nations to increase their defense spending, with combat-proven helicopters constituting an integral part of a nation’s defense structure.

This is likely to have prompted Mordor Intelligence to forecast a compound annual growth rate of more than 2.9% for the military helicopter market during the 2024-2030 time period.

Such solid market prospects offer growth opportunities for Lockheed Martin. Notably, its portfolio includes well-established helicopters like the Black Hawk, MH-60R Seahawk and CH-148 Cyclone, in addition to the CH-53K King Stallion.

Opportunities for LMT’s Peers

Some other defense companies that are expected to enjoy the perks of the expanding military helicopter market have been discussed below.

The Boeing Company: Its military rotorcraft serves the U.S. Army, Navy, Marines and Air Force and allied defense forces in more than 20 countries across the globe. Boeing’s Defense, Space & Security segment produces rotorcraft and rotary-wing programs, such as H-47 Chinook, AH-64 Apache, AH-6 Little Bird and V-22 Osprey.

The company has a long-term (three to five years) earnings growth rate of 21.3%. The Zacks Consensus Estimate for BA’s 2025 sales indicates year-over-year growth of 21.7%.

Northrop Grumman Corporation NOC: Its Fire Scout is a combat-proven, autonomous helicopter system providing real-time intelligence, surveillance, reconnaissance and target-acquisition, laser designation and battle management to tactical users without relying on manned aircraft or space-based assets. NOC also provides avionics systems, mission equipment and support for military helicopters, including upgrades and modifications.

The company’s long-term earnings growth rate is 8.7%. The Zacks Consensus Estimate for NOC’s 2024 sales indicates year-over-year growth of 5.4%.

Textron TXT: Its Bell business segment supplies advanced military helicopters and provides parts and support services to the U.S. Government and military customers outside the United States. Its primary combat helicopters include H-1, Bell 412, Bell AH-1Z, Bell 407 and a few more rotorcraft.

TXT boasts a long-term earnings growth rate of 10.1%. The consensus estimate for TXT’s 2024 sales indicates year-over-year growth of 5.5%.

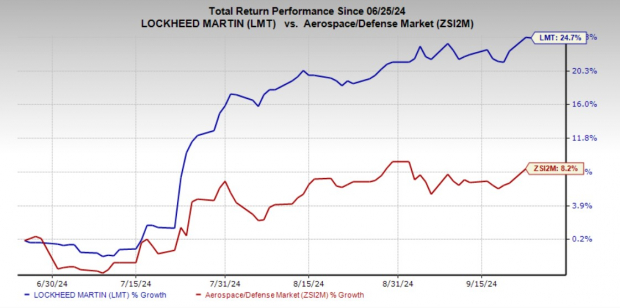

LMT Stock’s Price Movement

Shares of LMT have gained 24.7% in the past three months compared with the industry’s 8.2% growth.

Image Source: Zacks Investment Research

LMT’s Zacks Rank

LMT currently carries a Zacks Rank #2 (Buy).

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Occidental Petroleum

Investors with a lot of money to spend have taken a bearish stance on Occidental Petroleum OXY.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with OXY, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 28 uncommon options trades for Occidental Petroleum.

This isn’t normal.

The overall sentiment of these big-money traders is split between 32% bullish and 57%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $207,995, and 25 are calls, for a total amount of $1,088,878.

Predicted Price Range

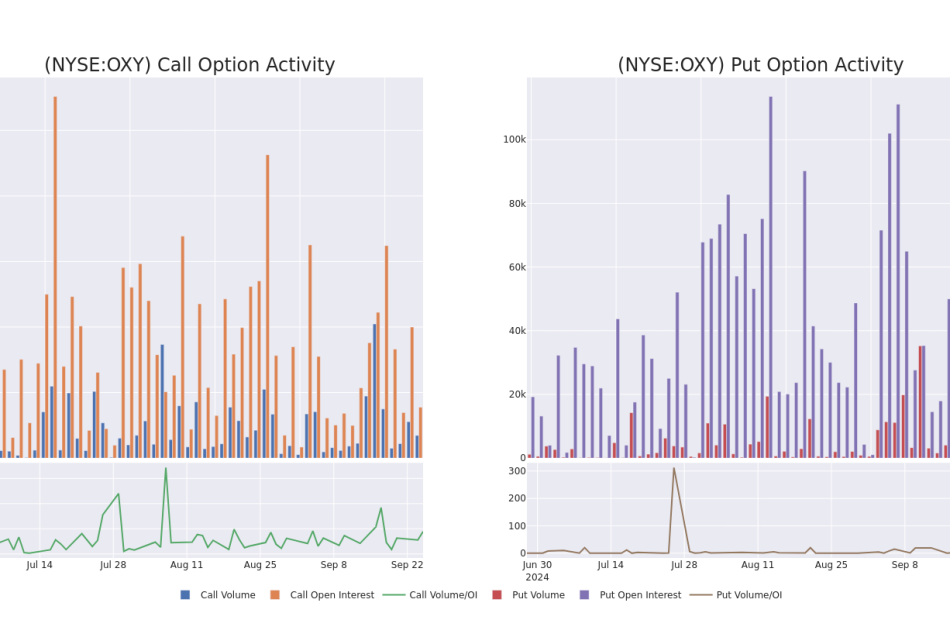

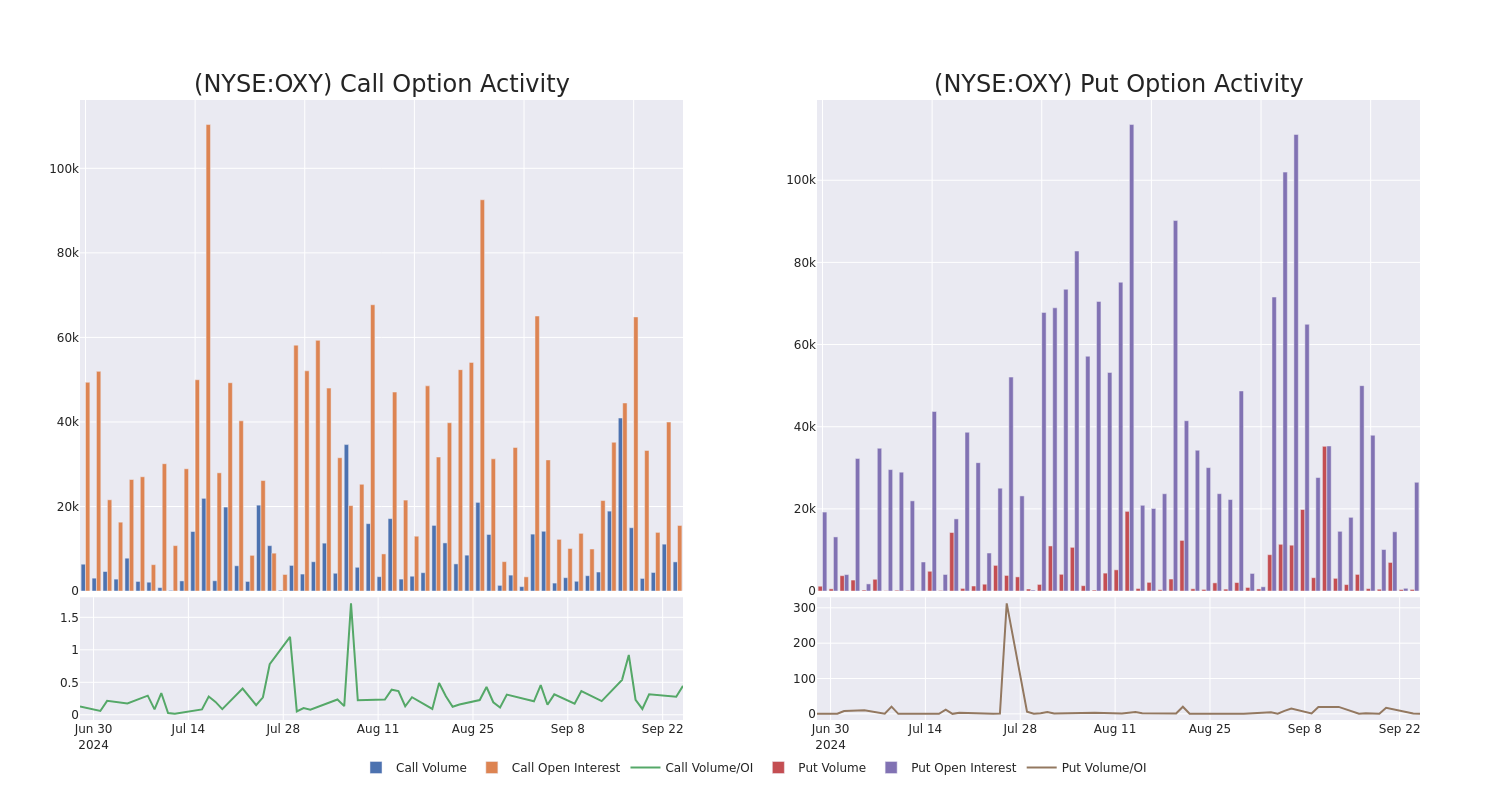

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $35.0 and $70.0 for Occidental Petroleum, spanning the last three months.

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Occidental Petroleum’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Occidental Petroleum’s significant trades, within a strike price range of $35.0 to $70.0, over the past month.

Occidental Petroleum 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | PUT | SWEEP | BULLISH | 01/17/25 | $4.5 | $4.4 | $4.41 | $55.00 | $132.3K | 21.9K | 300 |

| OXY | CALL | TRADE | BEARISH | 01/15/27 | $9.35 | $8.5 | $8.5 | $55.00 | $119.0K | 91 | 145 |

| OXY | CALL | SWEEP | BULLISH | 12/20/24 | $2.76 | $2.72 | $2.76 | $52.50 | $78.1K | 1.5K | 320 |

| OXY | CALL | TRADE | BEARISH | 01/17/25 | $2.92 | $2.9 | $2.9 | $52.50 | $72.2K | 4.8K | 1.1K |

| OXY | CALL | TRADE | BEARISH | 01/17/25 | $3.35 | $3.25 | $3.29 | $52.50 | $65.8K | 4.8K | 6 |

About Occidental Petroleum

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

Having examined the options trading patterns of Occidental Petroleum, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Occidental Petroleum

- Currently trading with a volume of 11,038,290, the OXY’s price is down by -2.37%, now at $51.16.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 41 days.

What The Experts Say On Occidental Petroleum

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $69.66666666666667.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Occidental Petroleum, targeting a price of $78.

* Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Occidental Petroleum with a target price of $59.

* Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Occidental Petroleum, targeting a price of $72.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Occidental Petroleum options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stock Movers For September 25, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.