Edgewise Therapeutics Soars 50%: Key Reasons Behind the Surge

Edgewise Therapeutics EWTX is up 50% in a single session and 450% from recent lows for a reason. Its novel, oral, selective treatment for obstructive hypertrophic cardiomyopathy did remarkably well in early trials. The news is important because hypertrophic cardiomyopathy or HCM for short, is the leading cause of sudden cardiac-related death in people under 35.

HCM is a genetic disease causing thickening in the heart muscle, an industry worth more than $1.25 billion today and growing. There are no current treatments of this caliber, with doctors relying heavily on beta-blockers and lifestyle changes. If approved, it will rocket this company from obscurity into the ranks of blockbuster treatments like GLP-1 blockers, which are revolutionizing weight control.

“There continues to be an unmet need for patients with obstructive and non-obstructive HCM, and we are excited to be part of the ongoing CIRRUS-HCM trial evaluating a novel treatment,” commented Anjali T. Owens, M.D., Medical Director, Center for Inherited Cardiac Disease, Associate Professor of Medicine, University of Pennsylvania and CIRRUS-HCM Investigator.

Sell-Side Interest Points to Higher Prices for Edgewise Therapeutics

After years of wallowing, Edgewise Therapeutics’s share price action began to perk up this year as the news stream turned positive and sell-side interest was reinvigorated. The trend of price target reductions ended, and now the revisions are leading the market higher.

The consensus estimate reported by Marketbeat.com assumes at least a 15% upside from the $28 level, but revisions lead to the high-end range. Wedbush is among the few issuing revisions immediately after the news was released, raising its target by 42% to $44 and just shy of the high of $48. That was set by Piper Sandler earlier this year and implies a 70% upside is possible for this healthcare stock within the next twelve months.

Institutional activity is also bullish for this market. The institutional activity is robustly in favor of higher prices, surging to a record in Q2 and sustaining a solid pace in Q3. The takeaway is that institutions, private equity, and venture capital own about 90% of this stock and insiders another 4.5%, showing a high conviction in their support.

Short-Squeeze in Edgewise Therapeutics Means Volatility Ahead

Short interest is a factor in the share price surge. The short interest was nearly 15% in the last report and sufficient for a squeeze. Because EDG-700 is still in early trials and far from approval, the company is far from revenue and profits, and the short-sellers will likely reposition at a higher level and weigh on the market over the next few quarters. The good news is that volatility and short-sellers mean the share price will likely decline to retest for solid support. In that scenario, the stock could retreat to the $22 level or lower, opening a more attractive entry for investors.

Edgewise is Not a One-Trick Pony

Edgewise Therapeutics has an attractive, if small, pipeline of candidates in early stage 1 and stage 2 trials. They target individuals with Duchenne and Becker muscular dystrophy and have shown positive results to date. The next batch of results from these tests is expected in Q4 of this year and may provide another catalyst for the market. Regarding operations, the company reports losses due to its research and lack of revenue, but the losses are manageable, given the balance sheet. The company has over half a billion in cash, sufficient to sustain operations at recent levels for over 15 quarters.

The price chart of EWTX looks good. The market is recovering from its post-IPO blahs and appears to be in a full reversal. The price action is supported by increasingly high volume, so it has a high probability of continuing its advance. However, Investors should expect resistance to cap gains near the all-time highs until further developments are announced.

The article “Edgewise Therapeutics Soars 50%: Key Reasons Behind the Surge” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NamSys Reports Third Quarter Results

TORONTO, Sept. 25, 2024 /CNW/ – NamSys Inc. CTZ, a leading provider of technology for cash processing and transportation, today announced its financial results for the third quarter of fiscal 2024 ended July 31st. All amounts referenced herein are in Canadian dollars.

Third Quarter Highlights (for the three months ended July 31, 2024 compared to July 31, 2023)

- Revenue of $1,741,032, compared to $1,519,831, an improvement of 15%.

- Net income for the quarter was up 61% to $581,481 ($0.02 per share) from $362,049 ($0.01 per share).

- Gross margin of 64% and operating margin of 40%

- The Company purchased and cancelled an additional 128,200 common shares. A total of 405,000 shares were purchased and cancelled as part of the Normal Course Issuer Bid that commenced August 30, 2023 and expired August 30, 2024.

“We remain committed to driving innovation and excellence in this market, leveraging technology and our skilled support and development staff to seize new opportunities,” stated Jason Siemens, President & CEO.

The financial statements and Management’s Discussion and Analysis for the fiscal quarter ended July 31, 2024 are available under the Company’s profile on SEDAR at www.sedarplus.ca.

NamSys Inc. products are designed to bring efficiency to the processing of currency and other value instruments in retailers, financial institutions, and cash-in-transit providers. NamSys’ proprietary systems for this market are sold as software-as-a-service subscriptions and operate in the public cloud service providers.

The TSX Venture Exchange has neither approved nor disapproved of the information contained in this release. This Media Release may contain forward-looking statements, which reflect the Corporation’s current expectations regarding future events. The forward-looking statements involve risks and uncertainties. Actual events could differ from those projected herein and depend on a number of factors including the success of the Corporation’s sales strategies.

SOURCE NamSys Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/September2024/25/c3635.html

View original content: http://www.newswire.ca/en/releases/archive/September2024/25/c3635.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

5 Things To Know In Investing This Week: The We Pivoted Bigly Issue

Years ago, President Trump talked about a change in tax rates that he described as “big league”. It was misinterpreted as “bigly” and a new word entered the lexicon. Last week, the Fed pivoted and cut the fed funds rate. This cut was more than two years after Fed doves and asset gatherers started begging for a return to zero interest rates. The Fed was too late for them and too early for my liking. They went for the 50bp cut, a bigly move. Those who disagree with me about the Fed will find their proof in weaker than expected results from shipper, FedEx FDX. Intel INTC makes the smart move to separate their foundry business and gets a $3B government contract (and a potential buyout). Despite being a free market advocate, I think this was a good move for all involved. We discuss how Bitcoin BTC/USD is a short-term proxy for the NASDAQ and a long-term hedge against inflation. Finally, Learn Wall Street gives the smart advice to do substantial research before investing and we provide two examples of why that’s important.

This week, we’ll address the following topics:

-

The Federal Reserve pivots and cuts the fed funds rate by 50bp. More cuts on the way.

-

Lower rates mean more inflation which means reduced purchasing power for the dollar. Bitcoin rises on expectations for a weaker dollar.

-

Intel restructures and gets a big government contract. After weeks of criticizing Intel, DKI approves.

-

FedEx misses bigly supporting the decision of the Fed to cut.

-

If someone tells you there’s gold underground, how do you know there’s gold?

Alex Petrou and Andrew Brown come through bigly delivering an almost-completed version of this week’s 5 Things by Thursday night. Fantastic work as usual. Next week’s 5 Things will not include the word “bigly”. In order to remain non-partisan, will we include the term “unburdened by what has been”? Probably not, but check in with us just to be certain.

Ready for a new week of big rate cuts and more inflation? Let’s dive in:

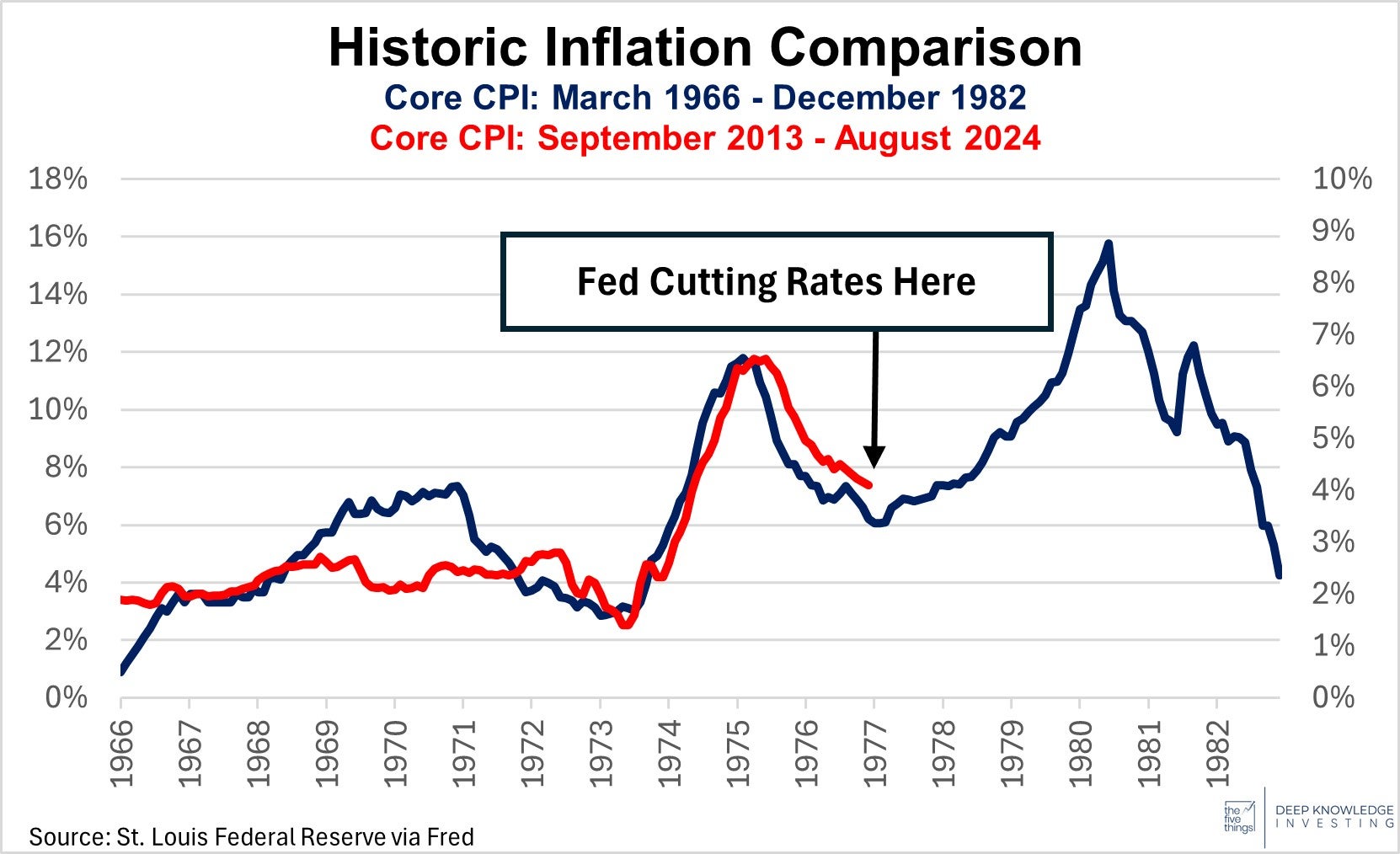

The Federal Reserve completed its September meeting and decided to cut the fed funds rate by 50bp (.50%). The market knew the Fed would pivot and cut at this meeting. There was debate regarding the size of the cut. I had expected 25bp (.25%). The doves in the crowd calling for the larger 50bp cut were correct. The Fed will continue its monthly quantitative tightening and will continue to shrink the size of its balance sheet (for now). Given the weaker employment data and the public comments by Chairman Powell, I’m not surprised the Fed cut (no one is surprised at this point). I’m a bit surprised by the larger 50bp cut because the Fed tries to appear non-partisan and non-political in its actions. Today’s larger cut just 6 weeks before the November elections give the appearance that they’re trying to help Democratic candidates. Public cries for a 75bp cut from prominent Democratic politicians did not help this perception.

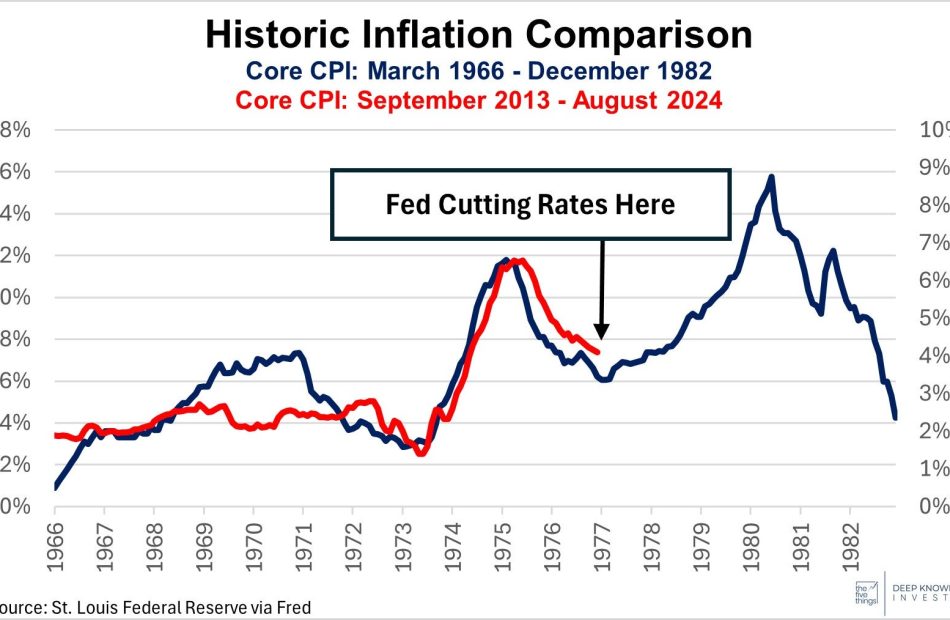

For those of you who were cheering for rate cuts, please look at this chart.

DKI Takeaway: I’m probably in the minority here, but think this cut is unwise. While many claim that the US economy is already in recession, I’m concerned that inflation is still above the 2% target and retail sales remain strong. There are still almost 8MM jobs available which is more than the number of people seeking jobs. Most importantly, Congress is still engaging in trillions of dollars of annual inflation-causing stimulus spending. (For those of you on team red or team blue, I’m sorry to report that overspending is a bipartisan problem.) Check out the graph for this Thing where we compare the inflation of the 1960s and 1970s with the more recent numbers. You can see where former Fed Chairman, Arthur Burns, eased rates prematurely leading to a resurgence of inflation. It looks like the Powell-led Fed just made the same decision. In the end, my opinion of the wisdom of the actions of the Fed is not relevant. We get the market and conditions we get, not the ones we want. As usual, DKI will invest based on the market we have. Our portfolio is well-prepared for higher inflation over the next few years. It’s also important to note that recent DKI stock picks are high potential-return companies that I believe won’t be economically sensitive and can continue to grow revenue at a high level regardless of future Fed actions.

Since hitting its all-time high in March, Bitcoin has been moving sideways (really up and down), but MicroStrategy MSTR is still buying. Recently, they raised $750 million through a convertible debt offering right after purchasing $1.1 billion of Bitcoin (18,300 BTC). The strategy is clear: stack BTC while the opportunity is still there. With the Fed cutting rates, rising inflation, and the dollar losing purchasing power, Bitcoin’s long-term appeal as a hedge against currency debasement is becoming more important than ever. With more money printing on the horizon, Bitcoin should thrive as traditional currencies continue to lose value.

BlackRock was against Bitcoin before figuring out how to make money from it.

DKI Takeaway: In the short term, Bitcoin is still behaving as a high-beta proxy for tech stocks like the Nasdaq’s Invesco QQQ Trust QQQ—rising sharply when tech rallies and crashing hard when sentiment sours. Following the recent Fed meeting, Bitcoin jumped from $59,000 to $63,500, reflecting this tech-driven volatility. Meanwhile, BlackRock released a whitepaper titled “Bitcoin: A Unique Diversifier”, outlining Bitcoin’s growing role as a non-correlated asset and stressing its importance given the looming US debt crisis. With the US debt ballooning and dollar value at risk, Bitcoin is increasingly being seen as a critical asset in a diversified portfolio, unshackled from traditional market forces. DKI has owned and recommended Bitcoin since it was $15k.

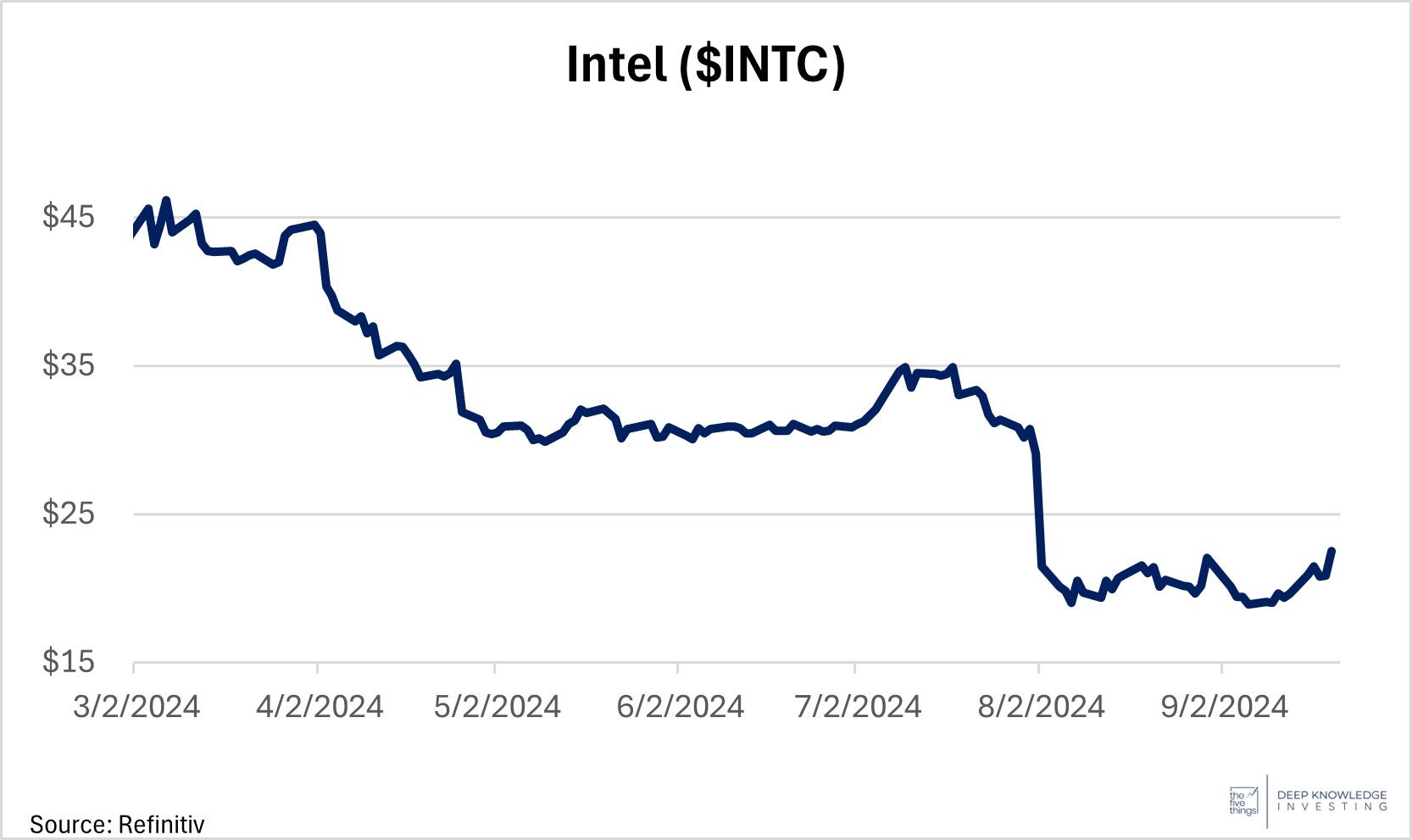

As previously reported by DKI, Intel has faced challenges in recent weeks, struggling with negative headlines related to chip malfunctions. The company is having manufacturing issues and has fallen behind in power efficiency and AI-related GPUs. However, this week brought positive news from CEO Pat Gelsinger. Gelsinger announced that Intel’s Foundry business will be restructured as a subsidiary with its own board, allowing it to raise external capital independently. He also hinted at a potential future spinoff of this division, which serves as a manufacturing partner for tech companies developing new products. In addition, the Foundry unit has entered a partnership with Amazon Web Services (AWS) to produce custom chips. Another significant development is the $3 billion in direct federal funding Intel secured for their Secure Enclave Program.

It’s been a rough year for Intel, but the takeover talk helped the stock price.

DKI Takeaway: Intel has struggled for the past few years. Their decline began in 2020 when Apple AAPL decided to move away from Intel’s chips in favor of its own M series. However, this week’s announcements could signal a turning point. With ongoing layoffs and the separation of their business units, the company is positioning itself for greater efficiency. The $3 billion government order is a significant boost for both the company and national security. In today’s world, chips are essential, and an inability of the U.S. to domestically produce and develop them poses a national security risk. While DKI generally advises against additional government intervention in the economy, this is one of the rare instances where national security considerations outweigh concerns over government spending. As we were finalizing this week’s 5 things, Qualcom QCOM announced they are interested in buying Intel. We’ll probably have more on that next week.

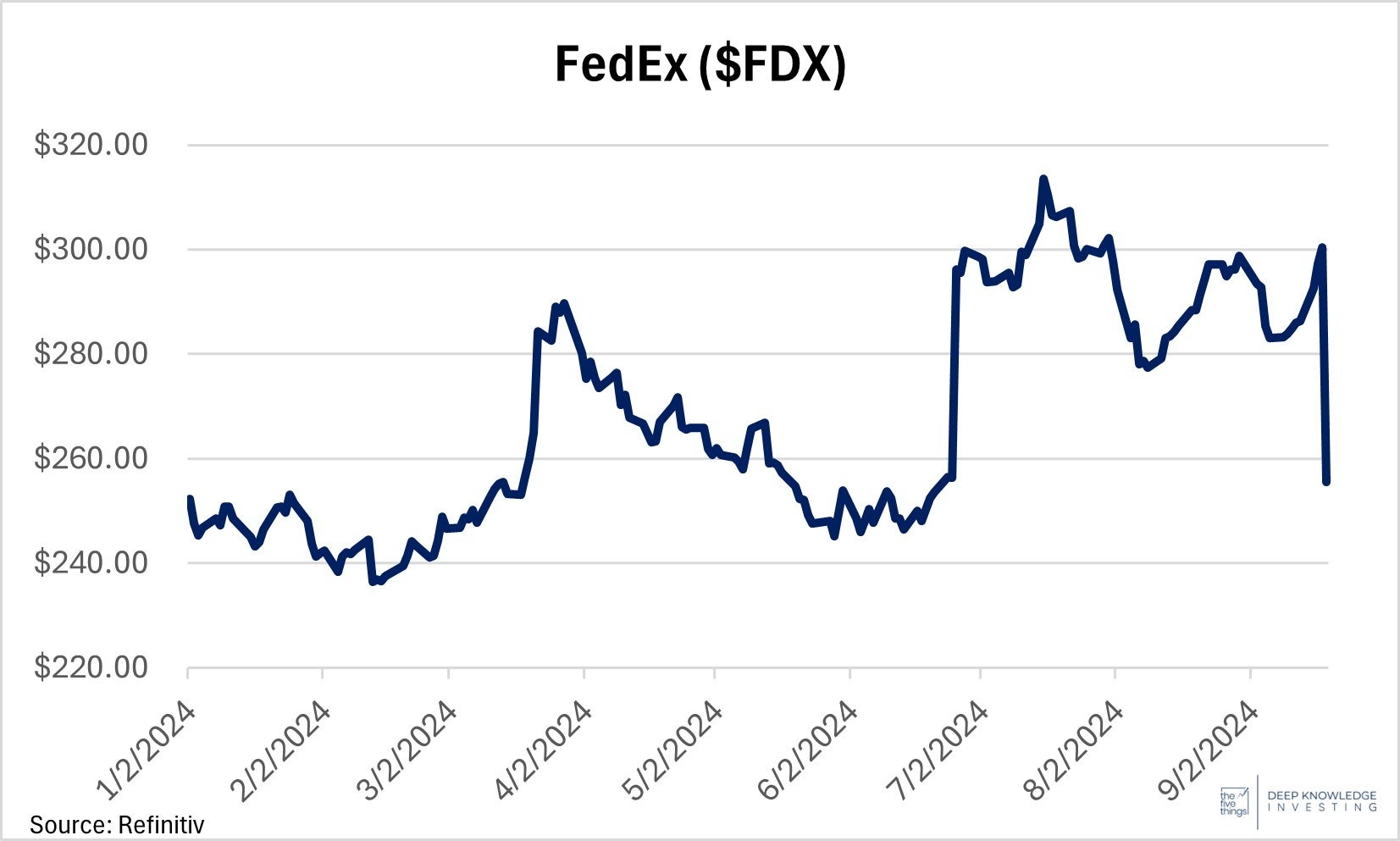

On Thursday, FedEx reported disappointing earnings, with revenue of $21.6 billion falling short of the projected $21.9 billion. The company also posted earnings per share of $3.60, well below the expected $4.77. Management cited a “mix shift” that “reduced demand for priority services,” which constrained yield growth. Additionally, they revised guidance, lowering revenue growth projections from low-to-mid single digits to low single digits and adjusting fiscal 2025 EPS expectations to $20-$21, down from the previous range of $20-$22.

Lack of shipping demand supports the Fed decision to cut.

DKI Takeaway: FedEx’s earnings are closely tied to retail performance, as the company supports major retailers like Walmart, Target, and Home Depot. Recently, FedEx reduced its end-of-year guidance, mirroring similar actions by these retail giants. This signals a slowdown in consumer spending and increasing unemployment, key factors influencing Fed Chair Powell’s decision to adjust policy. The disappointing earnings report led to an 11% drop in FedEx’s stock during after-hours trading, reflecting investor concerns about the broader economic outlook affirming the Fed’s decision to make a larger cut in the fed funds rate. DKI has disagreed with the Fed decision to cut by 50bp. If you disagree with us, weak demand at $FDX is a good place to start.

As usual, our friends at Learn Wall Street make an important point about doing proper research before investing. It might be fun to buy the latest meme stock on its way “to the moon” as a get rich quick and easy scheme, but the market has a way of punishing those who want to avoid doing hard work. Back in the 1990’s, Canadian mining company, Bre-X Minerals, claimed it had found a huge amount of gold in the Indonesian jungle. Bre-X stock rose from $.20 to $280 (Canadian dollars). Skipping ahead, there was no gold. It turns out core samples were “salted” meaning gold from another location was sprinkled into samples to provide the false impression of a big gold find. There was no gold. Investors lost their money. And the chief geologist (or someone who looked like him) exited a helicopter in flight. It was a terrible outcome for everyone involved.

Image Credit: Learn Wall Street

DKI Takeaway: In 2012, I attended an investment conference where a prominent hedge fund manager extoled the virtues of Viacom. At the time, most big hedge funds had huge positions in Viacom, CBS, and Disney which owned ABC and ESPN. After a week of research, I went back to a friend at a multi-billion-dollar fund which owned Viacom. I asked how he got comfortable with the risk of streaming television, YouTube, Hulu, Netflix, piracy, and DVR-powered commercial avoidance. His answer was “I haven’t thought about it.” Raji and I wrote a white paper called TV is Next where we correctly predicted the downfall of the traditional television model due to now-common streaming. The linear television stocks got crushed in the coming years while Netflix grew its stock price and market cap to $300 billion. The tl;dr version: if a company or a smart investor tells you something, it’s worth the time to do your own research and come to your own conclusion.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer or Dell: Mizuho Selects the One Must-Buy AI Stock

Over the past few years, it’s become clear that the technology sector has been a key driver of market growth. Innovations, especially in generative AI, are rapidly enhancing software capabilities, offering the potential for greater productivity and adaptability in digital tools.

Yet, while software plays a vital role, none of this progress could happen without the hardware driving it. This underscores compelling investment opportunities in tech companies that provide the server hardware necessary for running AI applications.

In this context, Vijay Rakesh, a 5-star analyst at Mizuho, has shifted his focus to the AI space, specifically focusing on server hardware.

“Generative AI is igniting growth and disruption across multiple markets, pushing the frontiers of innovation and productivity. AI servers comprise the infrastructure enabling the AI revolution,” Rakesh opined. “The AI server market is projected to be a ~$406B market by 2027E, growing at a ~54% CAGR driven by CSPs (Hyperscale and Tier 2) and Enterprise demand. We see GenAI growing exponentially, supporting secular growth in the AI server market.”

Not all AI stocks are created equal, however, and some present better investment prospects than others. Rakesh highlights two key players in this space, Super Micro Computer (NASDAQ:SMCI) and Dell Technologies (NYSE:DELL), and offers insight into which stands out as a must-buy AI stock. Let’s dive into both, using the latest data from TipRanks alongside insights from Mizuho’s report.

Super Micro Computer

We’ll start with a look at Super Micro Computer, a high-tech firm from Silicon Valley that specializes in developing and producing the hardware behind high-performance computing and high-end server stacks. In addition, Super Micro provides management software and memory storage systems for a wide range of enterprise-scale applications, including AI, cloud computing, data centers, edge computing, and 5G networking.

This company has been in business for more than thirty years and has established itself as a go-to for high-end computing needs. Super Micro has in-house expertise to handle the design and building of complex server stacks and high-performance computers and can install these systems at all scales. The company has product lines available for custom builds, to meet customers’ idiosyncratic needs, or off-the-shelf, and can even handle unique or unusual design requests. Super Micro supports its product offerings with a large-scale manufacturing footprint, capable of producing some 5,000 AI, HPC, and liquid cooling rack solutions every month.

From the customer’s perspective, particularly from those customers in the AI field, the key point here is the ability of Super Micro’s products – the servers, the high-performance computers, the advanced memory storage – to meet the needs of today’s cutting-edge technology.

On the financial side, Super Micro generated $5.3 billion in revenues in its last reported quarter, fiscal 4Q24. This was up an impressive 143% from the prior year period, and beat the forecast by $10 million. The company’s Q4 EPS, $6.25 by non-GAAP measures, missed the estimates, however, by $1.56 per share. The company attributed the miss to a combination of lower gross margins and higher operating expenses in the quarter.

We should note here that SMCI shares are down sharply from their recent peak, hit in March of this year. Since then, not helped by a damning short seller report and a 10-K filing delay, the stock has fallen by 61%, although it still shows a year-to-date gain of approximately 63%. Meanwhile, company management has authorized a stock split, of 10-to-1, to take effect on October 1 this year.

For Mizuho’s Rakesh, the key point here is that the AI hardware segment is growing more crowded, and Super Micro is facing increasing competition with a consequent loss of market share. He writes of the company, “We acknowledge SMCI as a consensus AI leader (AI Server ~70% of revs), but increasing competition, share loss (SMCI market share in AI servers is down from ~80-100% in 2022-23 to 40-50% in 2024E), and continued competition from DELL and other peers is pressuring pricing and margins. We estimate the current 10-K delays a ~10% share headwind, and we don’t foresee a delisting of shares as the delays are tied to internal process controls, we still see share loss and margin pressure as key valuation drivers and justify a 17% discount to its historical average ~12x.”

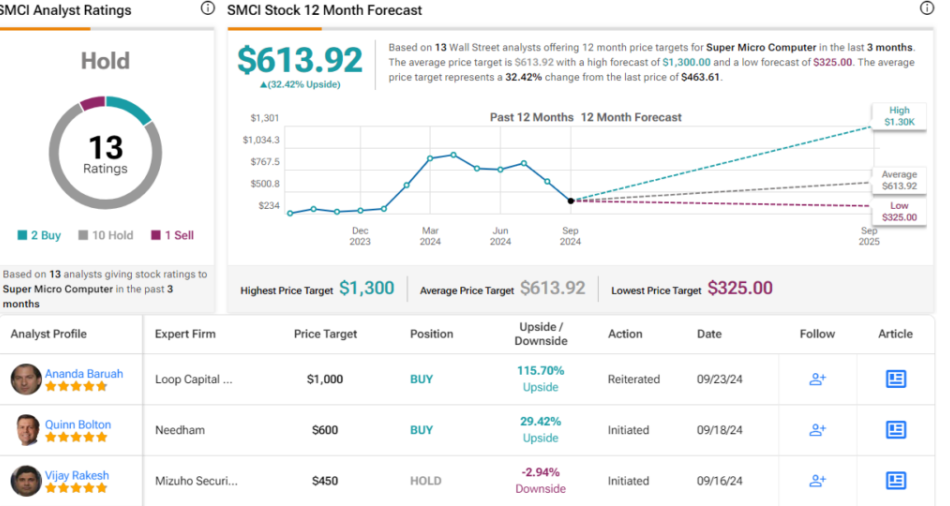

Rakesh follows up those comments with a Neutral (Hold) rating on the stock, along with a $450 price target that suggests the stock will remain relatively flat over the coming year. (To watch Rakesh’s track record, click here)

Overall, SMCI gets a Hold consensus from the Street, based on 13 reviews that include 2 Buys, 10 Holds, and 1 Sell. That said, shares are priced at $463.61, and the $613.92 average target price implies an upside potential of 32.5% in the next 12 months. (See SMCI stock forecast)

Dell Technologies

Next up is Dell Technologies, a well-known name from the personal computing world. Dell built its reputation building PCs and laptops for the direct-to-customer market, and continues to hold a strong position in that market, as a maker and supplier of PCs, laptops, monitors, and gaming peripherals. The company has roots in the 1980s; its modern incarnation dates to 2016, when it acquired the enterprise software and memory storage firm EMC in a transaction valued at approximately $67 billion.

Since then, Dell has expanded its business footprint, and now offers customers a range of hardware products to support networking and AI functions. These include high-end server stacks and advanced memory storage, which are in demand from AI developers, data centers, and other tech businesses that depend on high-performance computing architecture. Dell has taken its expertise at building computer systems – honed through its long experience in the personal computing segment – and applied it to cutting-edge enterprise scale applications.

Looking at the AI world specifically, Dell can offer its customers solutions to fit desktop workstations, data centers, and even cloud-based computing. The company’s computing solutions and hardware can support generative AI applications, including content creation, coding, personal digital assistants, design tools – the list is as long as the imagination of AI developers.

Dell’s last financial report covered fiscal 2Q25, and the company beat the forecasts at both the top and bottom lines. Dell’s quarterly revenue was up more than 9% year-over-year, to reach $25 billion, and beat the forecast by $910 million. The firm’s earnings, reported as a non-GAAP EPS of $1.89, was 18 cents per share better than had been expected.

Prominent among Dell’s revenue drivers were the Infrastructure Solutions Group, which saw a 38% year-over-year increase, to $11.6 billion, and the Networking segment, which was up 80% to $7.7 billion. Both of these figures were segment records for the company.

Checking in again with Vijay Rakesh, we find the analyst upbeat about Dell, noting that the company has built a solid AI hardware business without skimping on its existing retail PC business. Rakesh says of Dell, “We see DELL well positioned in the AI server race with a strong NVDA partnership and aggressively gaining share with pricing, but still diversified with PC, conventional servers, services and storage solutions. We note an Enterprise storage refresh and a potential 2025 Win11 corporate PC refresh cycle is a tailwind, as well as with AI PCs, which could help drive both consumer and corporate upgrades.”

Looking ahead, the analyst outlines plenty of reasons to expect continued strong performance, writing, “We see potential for $9+ EPS for DELL by F26E (~$10+ EPS in F27/C2026) as it continues to take market share in AI servers, maintains a strong position in compute server and see PCs return to growth after F24 saw weaker EPS, mainly due to revenues down ~14% y/ y, offsetting stronger margins.”

In Rakesh’s view, Dell gets an Outperform (Buy) rating, and he complements that with a $135 price target pointing toward a gain of 15% on the one-year horizon.

Dell’s 17 recent analyst reviews include 14 to Buy and 3 to Hold, for a Strong Buy consensus rating. The shares are trading for $117.31 and their average target price of $144.63 suggests an upside of 23% or more by this time next year. (See DELL stock forecast)

Laying out these stocks’ data side by side, it’s clear that for this top analyst, Dell Technologies is the superior AI hardware stock for investors to buy.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

‘Strongly dissatisfied’: Amazon employees plead for reversal of 5-day RTO mandate in anonymous survey

Some Amazon workers are refusing to “disagree and commit,” as one of the company’s famed leadership principles requires of those who aren’t on board with a decision.

Instead, hundreds of the online retailing giant’s employees are complaining that CEO Andy Jassy’s five-days-per-week return-to-office mandate, announced last week, will negatively impact their lives—and productivity at work—and how they hope the company will reverse course.

The feedback is from an anonymous survey created by Amazon employees that was viewed by Fortune on Tuesday. Corporate employees have shared it widely via the messaging app Slack, including in one “remote advocacy” Slack channel with more than 30,000 members that a former employee created when Amazon first announced a three-day return-to-office mandate last year.

As a result, employees who are in favor of remote or hybrid work may have been more likely to respond to the survey and therefore skew the findings.

As of the afternoon of September 24, the average satisfaction rating related to the RTO mandate among survey respondents was 1.4 out of scale up to 5 (with 1 meaning “strongly dissatisfied” and 5 representing “strongly satisfied”). The survey’s creators said in an introduction to their questionnaire that they plan to aggregate and share the results by email with Jassy and other company executives “to provide them with clear insight into the impact of this policy on employees, including the challenges identified and proposed solutions.”

“We are seeking honest, constructive feedback on the recent decision to require a 5-day return to the office schedule,” the survey introduction reads.

An Amazon spokesperson declined to comment.

Amazon has used a hybrid work structure for the past 15 months before Jassy’s recent bombshell announcement that most corporate employees would be required to work a full five-day work week from their local Amazon office starting in January.

“When we look back over the last five years, we continue to believe that the advantages of being together in the office are significant,” Jassy wrote last week. “I’ve previously explained these benefits, but in summary, we’ve observed that it’s easier for our teammates to learn, model, practice, and strengthen our culture; collaborating, brainstorming, and inventing are simpler and more effective; teaching and learning from one another are more seamless; and, teams tend to be better connected to one another.”

Jassy explanation about the new mandate, and a second one announcing a planned thinning of middle management, came across as tacit acknowledgements of a fraying corporate culture inside Amazon in recent years, as Fortune recently detailed.

Fortune has talked to and messaged with several dozen Amazon corporate employees since last week’s announcement, with most opposing Jassy’s decision for reasons including reduced productivity during in-office work days and leadership’s lack of trust in rank-and-file employees and managers, based on the change in RTO policy. They also complained about the impact the policy will have on single parents and a lack of data explaining the decision from a company whose leaders often talk up data-backed decision-making.

Some, however, applauded the move in communications with Fortune and argued that using the length or cost of commutes as excuses to avoid five days in the office weekly would have seemed absurd just a few years ago pre-pandemic.

Still, most respondents opposed the change or cited complications that the new policy will create.

“I work with people across many time zones,” one response read. “With RTO, they no longer have the flexibility to easily shift hours and collaborate. 3 day had an instant impact here, and 5 day will only be worse.”

As for a solution, the employee suggested “more realistic work expectations if we’re eliminating WFH.”

“Amazon got used to people having an extra 5-10 hours a week to work because we weren’t commuting,” the employee said. “RTO means that we no longer have the extra time to commit to Amazon and expectations of employees needs to adjust to reflect that. On a similar note, we need to accept that RTO places hard limits on meeting times. I can’t hop onto an 8am meeting with the folks in HQ2 or the East Coast anymore. When I was at home, I could jump on early or late meetings pretty easily, but I’m physically unable to do that now.”

Several respondents focused on the trust, or distrust factor, and the fear, echoed by many employees, that the move will drive out top talent who can easily find work elsewhere, while other groups with fewer options remain.

“The people that leave first are the strong engineers you want to work with,” one wrote. “Others that can’t find new jobs or can’t leave due to visa are miserable and quiet quit. Anyone left that actually wants to work has to pick up the slack.”

Yet another, echoing others, said they believe that the mandate “ignores the challenge of requiring people to come into an office, but all of their work and every meeting is executed over chime or video conference.”

Most of those who chose “satisfied” or “strongly satisfied” did not leave remarks beyond their rating, or left a negative remark that signaled they may have accidentally selected a positive rating.

The bad news for those dissatisfied with the new return-to-the-office rule is that when a group of Amazon employees sent a six-page memo to leadership last year making the case to reverse the original three-day in-office mandate, it was dismissed. With Jassy and team digging in their RTO heels further, it’s hard to imagine these results producing any significant change.

Are you a current or former Amazon employee with thoughts on this topic or a tip to share? Contact Jason Del Rey at jason.delrey@fortune.com, jasondelrey@protonmail.com, or through secure messaging app Signal at 917-655-4267. You can also message him on LinkedIn or at @delrey on X.

This story was originally featured on Fortune.com

Concentrix Stock Falls After Mixed Q3 Results, iX Hello GenAI Launch Annoucement

Concentrix Corp CNXC reported its third-quarter financial results after Wednesday’s closing bell. Here’s a look at the details from the report.

The Details: Concentrix reported quarterly earnings of $2.87 per share, which missed the analyst consensus estimate of $2.93 by 2.05%. Quarterly revenue came in at $2.387 billion, which beat the analyst consensus estimate of $2.382 billion and represents a 46.2% increase over the same period last year.

The company reported operating income of $153.2 million, a reduction year-on-year primarily due to increased amortization of intangibles and planned integration expenses associated with the company’s combination with Webhelp, which closed in the fourth quarter of 2023.

Read Next: What’s Going On With Snowflake Stock?

Concentrix also announced the launch of iX Hello, a generative AI-powered solution for organizations to boost productivity and engagement within an on-brand, secure environment. iX Hello marks the first product launch in a suite of AI and GenAI technologies which the company has already deployed internally and with pre-launch clients.

“Our third quarter marked another quarter of solid revenue growth and operating results,” said Chris Caldwell, president and CEO of Concentrix.

“We are also delighted to leverage our technology investments to bring our iX Hello product to market with velocity. We believe iX Hello helps augment our existing technology partner strategies, underscores the positive transformation of our business and reflects our strong competitive position as the world’s most trusted provider of intelligent experience solutions.”

Outlook: Concentrix sees fourth-quarter revenue in a range of $2.42 billion to $2.47 billion and adjusted earnings of between $2.90 and $3.16 per share. The company sees fiscal year 2024 revenue in a range of $9.591 billion to $9.641 billion and adjusted earnings of between $11.05 and $11.31 per share.

CNXC Price Action: According to Benzinga Pro, Concentrix shares are down 14.02% after-hours at $54.70 at the time of publication Wednesday.

Read Also:

• What’s Going On With Intel Stock?

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

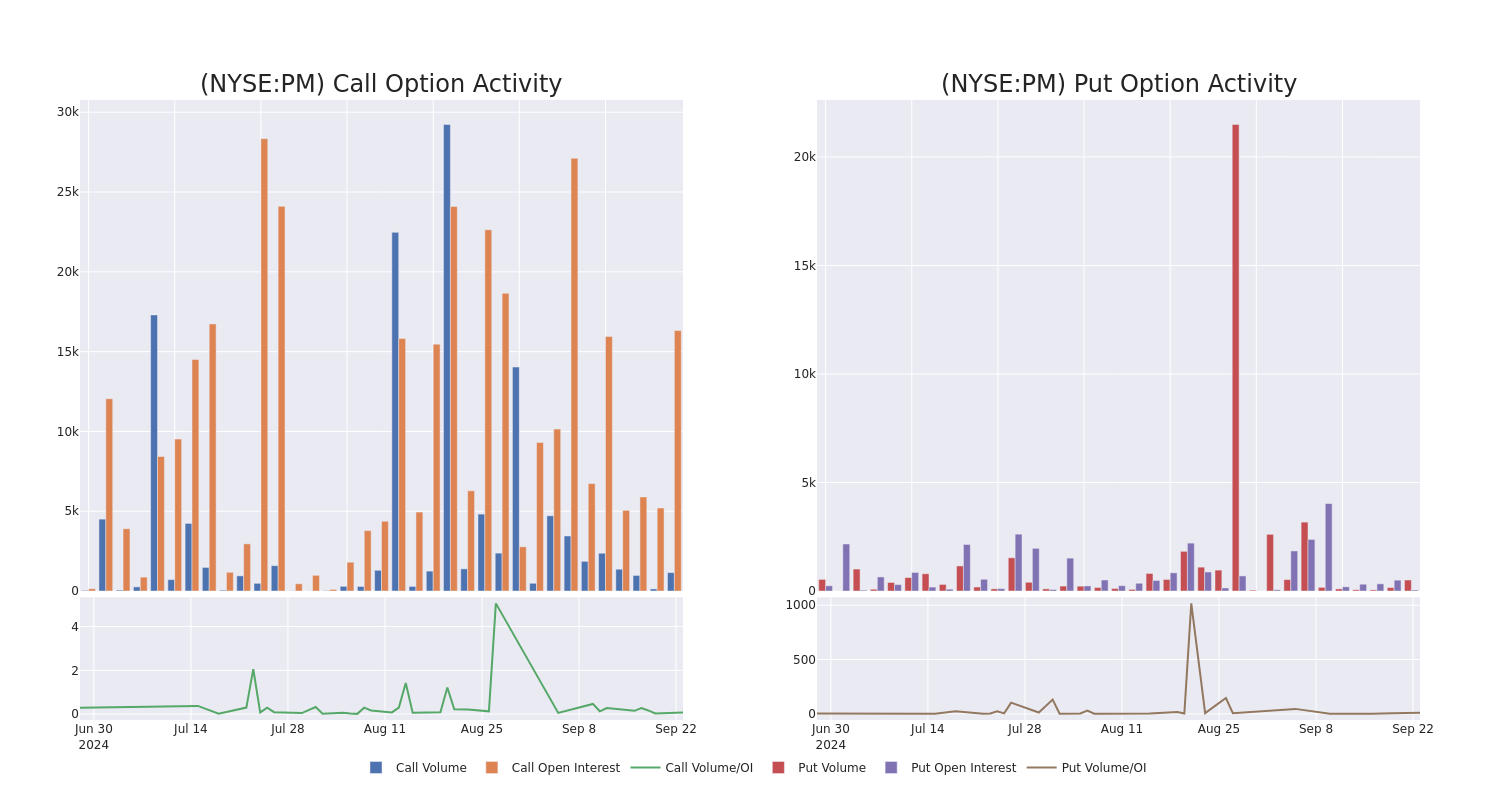

Philip Morris Intl Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Philip Morris Intl.

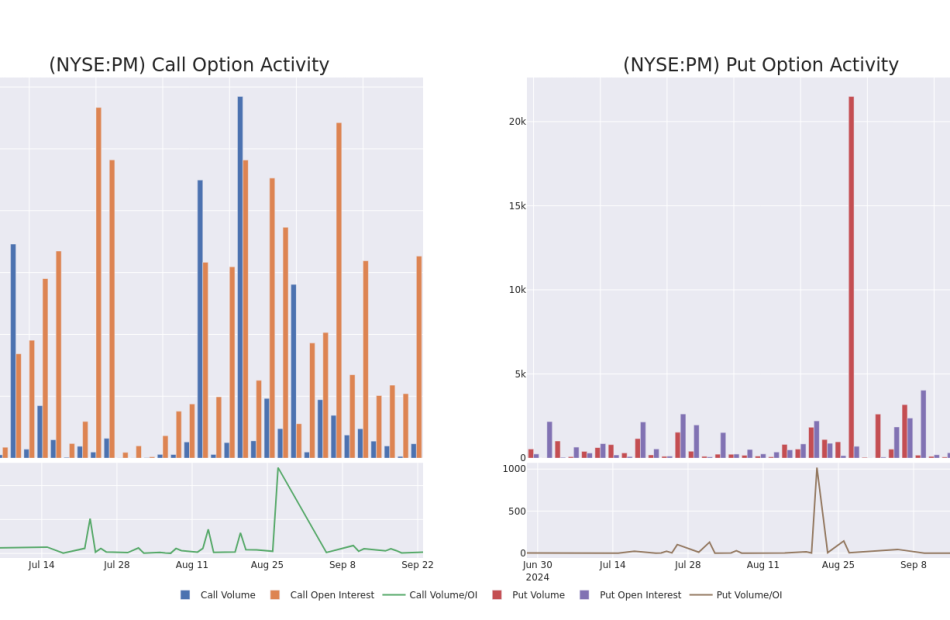

Looking at options history for Philip Morris Intl PM we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 27% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $114,711 and 8, calls, for a total amount of $500,215.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $155.0 for Philip Morris Intl over the last 3 months.

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Philip Morris Intl’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Philip Morris Intl’s whale activity within a strike price range from $70.0 to $155.0 in the last 30 days.

Philip Morris Intl 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PM | CALL | TRADE | BULLISH | 01/17/25 | $41.5 | $40.8 | $41.5 | $80.00 | $141.1K | 275 | 35 |

| PM | CALL | SWEEP | BULLISH | 12/20/24 | $5.5 | $5.2 | $5.4 | $120.00 | $81.0K | 2.7K | 290 |

| PM | CALL | TRADE | BULLISH | 12/20/24 | $21.7 | $21.4 | $21.6 | $100.00 | $75.6K | 725 | 128 |

| PM | CALL | TRADE | BULLISH | 12/20/24 | $5.5 | $5.2 | $5.4 | $120.00 | $53.4K | 2.7K | 139 |

| PM | CALL | SWEEP | BEARISH | 01/16/26 | $54.0 | $51.2 | $51.5 | $70.00 | $46.3K | 72 | 10 |

About Philip Morris Intl

Created from the international operations of Altria in 2008, Philip Morris International sells cigarettes and reduced-risk products, including heatsticks, vapes, and oral nicotine offerings primarily outside of the US. With the 2022 acquisition of Swedish Match, a leading manufacturer of traditional oral tobacco products and nicotine pouches primarily in the US and Scandinavia, PMI has not only diversified away from smokeable products but also gained a toehold into the US to sell its iQOS heatsticks.

After a thorough review of the options trading surrounding Philip Morris Intl, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Philip Morris Intl

- Currently trading with a volume of 4,557,848, the PM’s price is up by 0.61%, now at $121.95.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 27 days.

Expert Opinions on Philip Morris Intl

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $131.75.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Stifel persists with their Buy rating on Philip Morris Intl, maintaining a target price of $138.

* Maintaining their stance, an analyst from UBS continues to hold a Sell rating for Philip Morris Intl, targeting a price of $105.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Philip Morris Intl with a target price of $139.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Philip Morris Intl, targeting a price of $145.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Philip Morris Intl, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Bet $1M He Could Outperform Hedge Funds Over A Decade. He Did It With A Strategy Requiring No Investing Skill

Back in 2007, Warren Buffett made a bold move. The legendary investor bet $1 million that a simple, no-frills S&P 500 index fund could beat a selection of hand-picked hedge funds over 10 years. Experts manage the hedge funds, and for that, they charge a layer of fees. Many see them as the pinnacle of sophisticated investing.

Don’t Miss:

However, Buffett believed that something as straightforward as an index fund, which simply tracks the performance of the top 500 companies in the U.S., would do better in the long run.

What was the result? Buffett comfortably won the wager. Over the decade, the Vanguard S&P 500 Index Fund, which he selected, yielded an astounding 125.8% return, whereas the returns made by the hedge funds varied from 2.8% to 87.7%. However, how could this “ordinary” investment approach surpass some of the most accomplished financial minds?

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

Warren Buffett has argued that low-cost index funds are a wise investment option for most people for many years. An index fund enables investors to own a portion of each company in the index instead of trying to time the market or identify the next big stock.

It’s a detached strategy that merely replicates the market’s overall performance. As Buffett said, “You don’t have to do that, you just have to sit back and let American industry do its job for you.”

This might sound too simple to be effective, especially compared to the complex strategies employed by hedge funds. However, Buffett has always said keeping costs low is key to successful investing. Hedge funds usually charge a lot – around 2% of your money every year, plus 20% of any profits they make. These high fees can cut into your earnings over time.

Trending: Rory McIlroy’s mansion in Florida is worth $22 million today, doubling from 2017 — here’s how to get started investing in real estate with just $100

In contrast, the Vanguard fund Buffett chose had an expense ratio of just 0.04%, meaning almost all of the investment’s growth stayed in the investor’s pocket. “Fees matter in investing, no doubt about it,” said Ted Seides, the hedge fund manager who accepted Buffett’s bet. He later admitted that Buffett was right about the impact of high fees.

Despite the clear advantages of low-cost index funds, many wealthy individuals and large institutions continue to seek out more expensive investment strategies. Buffett explained this phenomenon by saying, “No consultant in the world will tell you just buy an S&P index fund and sit for the next 50 years. You don’t get to be a consultant and certainly don’t get an annual fee that way.”

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Warren Buffett Bet $1M He Could Outperform Hedge Funds Over A Decade. He Did It With A Strategy Requiring No Investing Skill originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

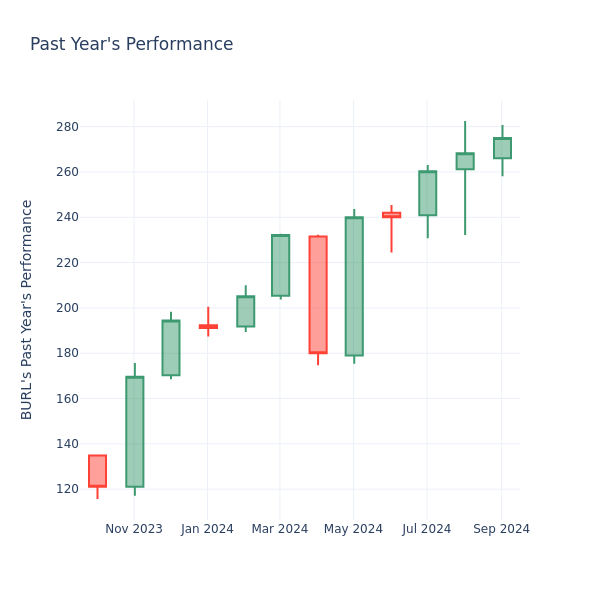

A Look Into Burlington Stores Inc's Price Over Earnings

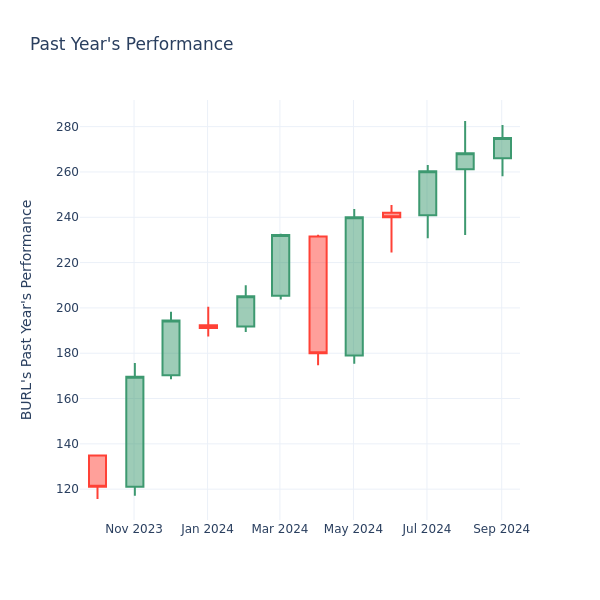

In the current session, the stock is trading at $276.00, after a 1.04% increase. Over the past month, Burlington Stores Inc. BURL stock increased by 0.80%, and in the past year, by 104.89%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Burlington Stores P/E Compared to Competitors

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Burlington Stores has a better P/E ratio of 41.26 than the aggregate P/E ratio of 19.74 of the Specialty Retail industry. Ideally, one might believe that Burlington Stores Inc. might perform better in the future than it’s industry group, but it’s probable that the stock is overvalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

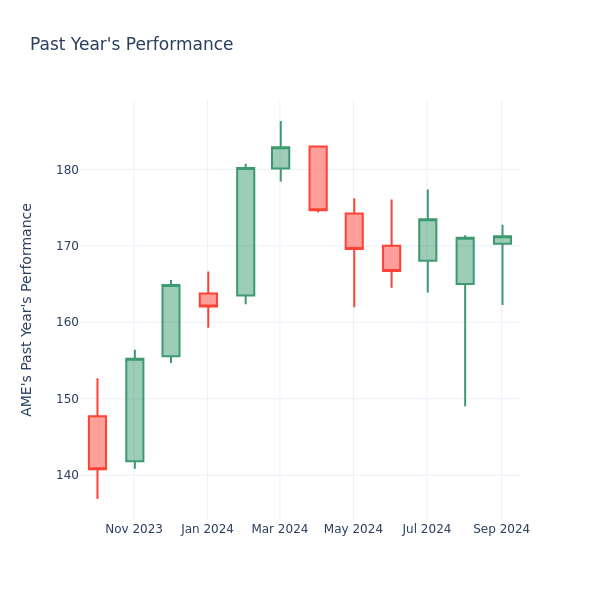

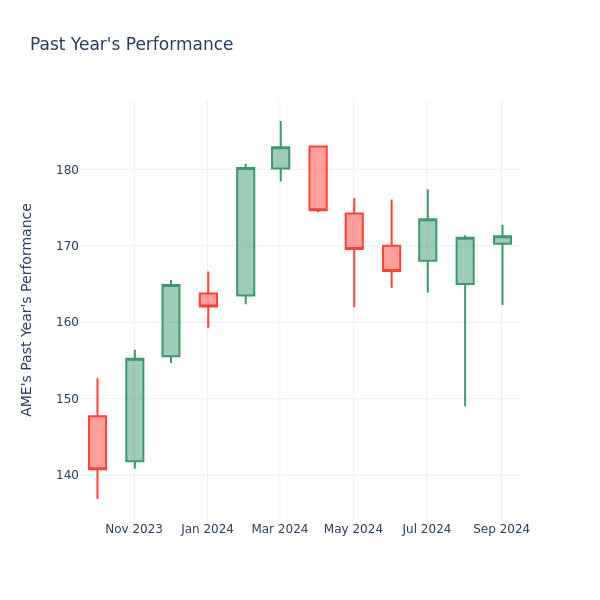

P/E Ratio Insights for AMETEK

In the current session, the stock is trading at $171.16, after a 0.36% increase. Over the past month, AMETEK Inc. AME stock increased by 1.61%, and in the past year, by 15.10%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Comparing AMETEK P/E Against Its Peers

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Compared to the aggregate P/E ratio of the 39.68 in the Electrical Equipment industry, AMETEK Inc. has a lower P/E ratio of 29.71. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.