With More Megaprojects on the Horizon, Owners Must Double Down on Proactive Planning

Increased risks with big-dollar, broad scale projects can be mitigated with early focus on procurement, virtual design & construction, according to DPR Construction

REDWOOD CITY, Calif., Sept. 24, 2024 /PRNewswire/ — Fueled by legislation and technology trends, DPR Construction is tracking more upcoming megaprojects – projects over $1 billion – in the advanced manufacturing, life sciences and advanced technology sectors. In DPR’s latest Market Conditions Report, the company recommends project owners sharpen their focus in the planning phases to account for the increased risks these projects present.

“The complexity, pace, risk and demand of megaprojects require a higher level of attention to planning best practices,” said Philip Bartkowski, DPR’s preconstruction corporate service leader. “What might seem like a small issue on a smaller job can quickly scale to business-impacting cost and schedule ramifications on a megaproject. Disciplined planning that recognizes the greater risks to all project partners can lower risks and set large projects on track for success.”

Owners planning large projects in the months ahead should focus on:

- Design and procurement – Procurement of materials and key equipment must help shape designs and, at the same time, designs should meet the needs of procurement. Without the right integration between these two aspects, projects may increase their outsized risks from delays and budget impacts.

- Robust Virtual Design & Construction – Proper applications of VDC allow issues to surface on a screen first so they can be built safely and at top quality once in the field. Re-work on a large project can be extremely costly for budget and schedule.

- Accounting for financial risks – Money fuels every project. Scaled to megaproject level, having aligned cash flow expectations is crucial to ensure every project partner can move at the right pace.

- Building the right team – Megaprojects demand a dedicated team that is often large. Identifying the right group of leaders that can look out for the owner, align with the design team and keep the work moving forward is paramount.

DPR’s latest report also provides updates on emerging supply chain pressures and considerations for owners to take in light of them. Previous quarterly reports and related interactive market conditions dashboard can be found here.

About DPR Construction

DPR Construction is a forward-thinking, self-performing general contractor and construction manager specializing in technically complex and sustainable projects for the advanced technology, life sciences, healthcare, higher education and commercial markets. DPR’s portfolio of work ranges from large-scale new construction to small tenant improvements and special projects. Founded in 1990, DPR is a great story of entrepreneurial success as a private, employee-owned company that has grown to a multi-billion-dollar organization with offices around the world. The company is strategically focused on delivering more predictable outcomes through applications of virtual design & construction, prefabrication, its team of self-perform craft, and leveraging data to learn and improve from. DPR consistently ranks among the top building contractors and employs approximately 11,000 professionals across its family of companies. For more information, visit http://www.dpr.com.

For more information, please contact:

DPR Construction

Email: pr@dpr.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/with-more-megaprojects-on-the-horizon-owners-must-double-down-on-proactive-planning-302254607.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/with-more-megaprojects-on-the-horizon-owners-must-double-down-on-proactive-planning-302254607.html

SOURCE DPR Construction

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Victor Ciardelli and Rate Companies Increase Conforming Loan Limit to $792,000 Ahead of Official FHFA Announcement

CHICAGO, Sept. 24, 2024 /PRNewswire/ — Rate, a leading financial services provider in the mortgage industry, today announced an increase in its conforming loan limit to $792,000 for select loan products across the contiguous 48 states. This move comes ahead of the Federal Housing Finance Agency’s (FHFA) official 2025 announcement, making Rate one of the first lenders to implement this change. The maximum loan limit for properties in Alaska and Hawaii has also been increased to $1,185,000.

This adjustment reflects growing demand in the housing market. It aims to provide more flexibility for borrowers, allowing them to benefit from conforming products with lower interest rates and less rigorous requirements than high-balance and jumbo loans. This change is especially beneficial for competitive housing markets where home prices steadily increase.

“We’re proud to lead the field in raising conforming loan limits, giving more homebuyers access to competitive rates and overall better loan options,” said Jeremy Collett, EVP, Head of Capital Markets at Rate. “By acting ahead of the FHFA’s announcement, we continue our commitment to supporting homebuyers during this crucial period.”

Key Updates:

- Max Loan Amount for the contiguous 48 states: $792,000 (previously $766,550)

- Max Loan Amount for Alaska and Hawaii: $1,185,000 (previously $1,149,825)

This annual adjustment to conforming loan limits typically follows the FHFA’s evaluation of changes in the national average purchase price for conventionally financed single-family homes. By implementing this increase early, Rate Companies positions itself as a forward-thinking leader in the mortgage space, ensuring borrowers can take advantage of the new limits and better financing terms.

“We are committed to staying ahead of market trends and delivering the best possible solutions for our customers,” said Victor Ciardelli, CEO of Rate. “By increasing our conforming loan limits ahead of the official FHFA announcement, we’re giving more borrowers access to the affordable financing they need in today’s competitive housing market. This early adoption demonstrates our commitment to supporting homeownership, ensuring our clients always have every possible advantage in securing the home of their dreams.”

About Rate

Rate Companies is a leader in mortgage lending and digital financial services. Headquartered in Chicago, Rate is the #2 retail mortgage lender in the U.S., with over 850 branches across all 50 states and Washington D.C. Since its launch in 2000, Rate has helped more than 2 million homeowners with home purchase loans and refinances. The company has cemented itself as an industry leader by introducing innovative technology, offering low rates, and delivering unparalleled customer service. Honors and awards include Best Mortgage Lender for First-Time Homebuyers by NerdWallet for 2023; HousingWire’s Tech100 award for the company’s industry-leading FlashClose℠ digital mortgage platform in 2020, MyAccount in 2022, and Language Access Program in 2023; No. 2 ranking in Scotsman Guide’s 2022 list of Top Retail Mortgage Lenders; the most Scotsman Guide Top Originators for 11 consecutive years; Chicago Agent Magazine’s Lender of the Year for seven consecutive years; and Chicago Tribune’s Top Workplaces list for seven straight years. Visit https://www.rate.com for more information.

Housing Equal Housing Lender | ©️ 2024 Guaranteed Rate, Inc. D/B/A Rate | NMLS ID 2611 | NMLS Consumer Access | Licensing Information

Applicant subject to credit and underwriting approval. Restrictions apply.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/victor-ciardelli-and-rate-companies-increase-conforming-loan-limit-to-792-000-ahead-of-official-fhfa-announcement-302257420.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/victor-ciardelli-and-rate-companies-increase-conforming-loan-limit-to-792-000-ahead-of-official-fhfa-announcement-302257420.html

SOURCE Rate

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EVP At Intuit Exercises Options Worth $9.45M

Highlighted on September 24, it was unveiled in an SEC filing that FENNELL, EVP at Intuit INTU, executed a significant transaction involving the exercise of company stock options.

What Happened: FENNELL, EVP at Intuit, exercised stock options for 26,700 shares of INTU stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The exercise price of the options was $281.6 per share.

During Wednesday’s morning session, Intuit shares down by 0.43%, currently priced at $635.47. Considering the current price, FENNELL’s 26,700 shares have a total value of $9,448,329.

Delving into Intuit’s Background

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of US market share for small-business accounting and do-it-yourself tax-filing software.

Intuit: Financial Performance Dissected

Revenue Growth: Intuit’s revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 17.4%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Holistic Profitability Examination:

-

Gross Margin: The company shows a low gross margin of 75.41%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Intuit exhibits below-average bottom-line performance with a current EPS of -0.07.

Debt Management: Intuit’s debt-to-equity ratio is below the industry average at 0.36, reflecting a lower dependency on debt financing and a more conservative financial approach.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 61.19 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 11.13, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 39.52, Intuit’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Navigating the World of Insider Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Intuit’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Micron Q4 Earnings: Revenue, EPS Beat On 'Robust AI Demand,' Company Sees 'Significantly Improved' Profitability Ahead, Shares Surge

Micron Technology Inc MU reported fourth-quarter financial results after the market close on Wednesday. Here’s a look at the key metrics from the quarter.

Q4 Earnings: Micron reported fourth-quarter revenue of $7.75 billion, beating the consensus estimate of $7.635 billion. The company reported fourth-quarter adjusted earnings of $1.18 per share, beating analyst estimates of $1.13 per share, according to Benzinga Pro.

Operating cash flow came in at $3.41 billion versus $2.48 billion in the prior quarter and $249 million in the comparable quarter last year. Adjusted free cash flow was $323 million in the quarter. The company ended the quarter with $9.16 billion in cash, marketable investments and restricted cash.

“Micron delivered 93% year-over-year revenue growth in fiscal Q4, as robust AI demand drove a strong ramp of our data center DRAM products and our industry-leading high bandwidth memory. Our NAND revenue record was led by data center SSD sales, which exceeded $1 billion in quarterly revenue for the first time,” said Sanjay Mehrotra, president and CEO of Micron.

“We are entering fiscal 2025 with the best competitive positioning in Micron’s history. We forecast record revenue in fiscal Q1 and a substantial revenue record with significantly improved profitability in fiscal 2025.”

Micron noted that its board declared a quarterly cash dividend of $0.115 per share, payable on Oct. 23 to shareholders of record as of Oct. 7.

What’s Next: Micron sees first-quarter revenue of $8.7 billion, plus or minus $200 million. The company expects first-quarter adjusted earnings of $1.74 per share, plus or minus eight cents per share.

Micron management will hold a conference call to discuss these quarterly results at 4:30 p.m. ET.

MU Price Action: Micron shares were up 11.74% after hours, trading at $107.03 at the time of publication Wednesday, according to Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jump on Intel Now: Qualcomm's Bid Could Ignite a Rally

After experiencing a declining trend since its highs in 2021, Intel Co. INTC stock is now trading at a mere 43% of its 52-week high today. While this price action could have caused most to avoid such underperformance, there are others who can spot and appreciate the deep value aspect of this steep discount, one that can be taken advantage of today.

For reasons that investors will clear up in a bit, Intel and not peers like Micron Technology Inc. MU got the benefit of the doubt from the United States government in a recent grant to further build out the semiconductor supply chain domestically. The technology sector has seen major swings since COVID-19, though these two chip makers fell behind by a significant rate.

This could change for Intel stock soon; however, last week alone, it rallied by nearly 10% to end the period on a new announcement. But, before investors know which event drove the stock higher to the end of the week, they should know that the semiconductor industry could be about to shift into its sales cycle as supply tightens and margins improve for Intel.

Qualcomm’s $100 Billion Starting Takeover Bid for Intel: How High Could It Go?

Considering that Intel rose to a near $100 billion market capitalization, investors could safely assume that Qualcomm Inc. QCOM has to make the starting takeover bid at this price. The fact is, however, that Intel shareholders will likely command a premium price on their holdings, especially after recent events.

So, how high can the bid go? Investors can look to Wall Street analysts for some guidance, particularly their earnings per share (EPS) growth forecasts. At $0.02 a share, analysts expect Intel to earn up to $0.23 EPS in the next 12 months.

Now that Wall Street expects Intel to see a tenfold increase in profits, analysts at Northland Securities decided to keep their “Outperform” rating on Intel stock and boosted their valuations to $42 a share. To prove these valuations right, Intel stock would need to rally by as much as 92.6% from where it trades today.

Despite the stock’s underperformance over the past three years, Intel has managed to accumulate enough bullish trends to shake off a few bears. In the past month, Intel stock’s short interest declined by 9.6%, showing signs of bearish capitulation, leaving room for bulls to take their place instead.

Some of the bulls that came in to lead the way include Legal & General Group, which boosted their holdings in Intel sock by 1.3% as of August 2024. This may seem like little on a percentage basis. Still, the addition netted the Group’s investment in Intel stock at a $1.2 billion level today.

However, this is only a small percentage of the $13.6 billion in institutional capital that entered the company over the past 12 months, one factor that investors should watch out for in the coming months as these takeover talks take place.

Intel Stock Gains Another Major Backer as Markets Spot a Massive Discount

Recently, the government announced another round of grants for the semiconductor industry, and this time, Intel stock earned its place in the funding list with $3.5 billion in grants. It is important for investors to keep this in mind for the following reasons.

It wasn’t NVIDIA Co. that received these grants, and it wasn’t Micron Technology that received a takeover bid from Qualcomm despite having a similar market capitalization ($100.8 billion) to Intel. This confidence from investors and the government directly adds value to the company’s brand.

This news also created interest in the sock, another important gauge for investors to consider when evaluating this potential value play. Intel stock has an average volume of 57.6 million, and recently, the volume spiked to 260.4 million shares.

The combination of good news and Intel’s discount caused this much volume to come into the company, showing interest from new buyers. Here’s how steep of a discount Intel offers investors today, the same discount that Qualcomm probably considered when reviewing its takeover bid.

Comparing price-to-book (P/B) ratios between Intel and the computer sector would show this divergence. Intel stock now trades at a low of 0.8x P/E, a discount not only to its own book value but also to the industry’s average valuation of 7.0x P/B.

The article “Jump on Intel Now: Qualcomm’s Bid Could Ignite a Rally” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rivian Automotive Unusual Options Activity For September 25

Deep-pocketed investors have adopted a bearish approach towards Rivian Automotive RIVN, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RIVN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 14 extraordinary options activities for Rivian Automotive. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 21% leaning bullish and 71% bearish. Among these notable options, 8 are puts, totaling $798,541, and 6 are calls, amounting to $401,726.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $14.0 for Rivian Automotive during the past quarter.

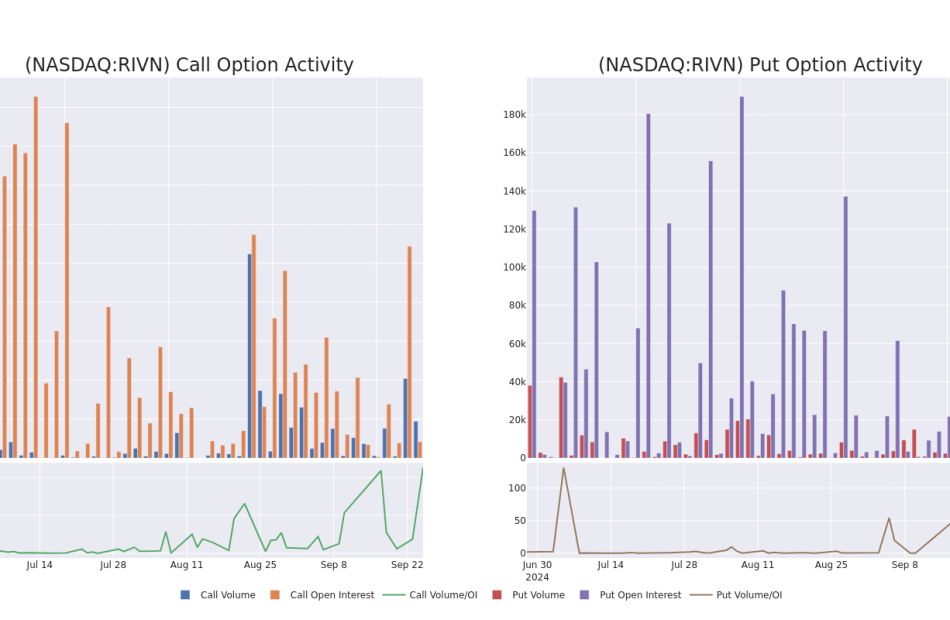

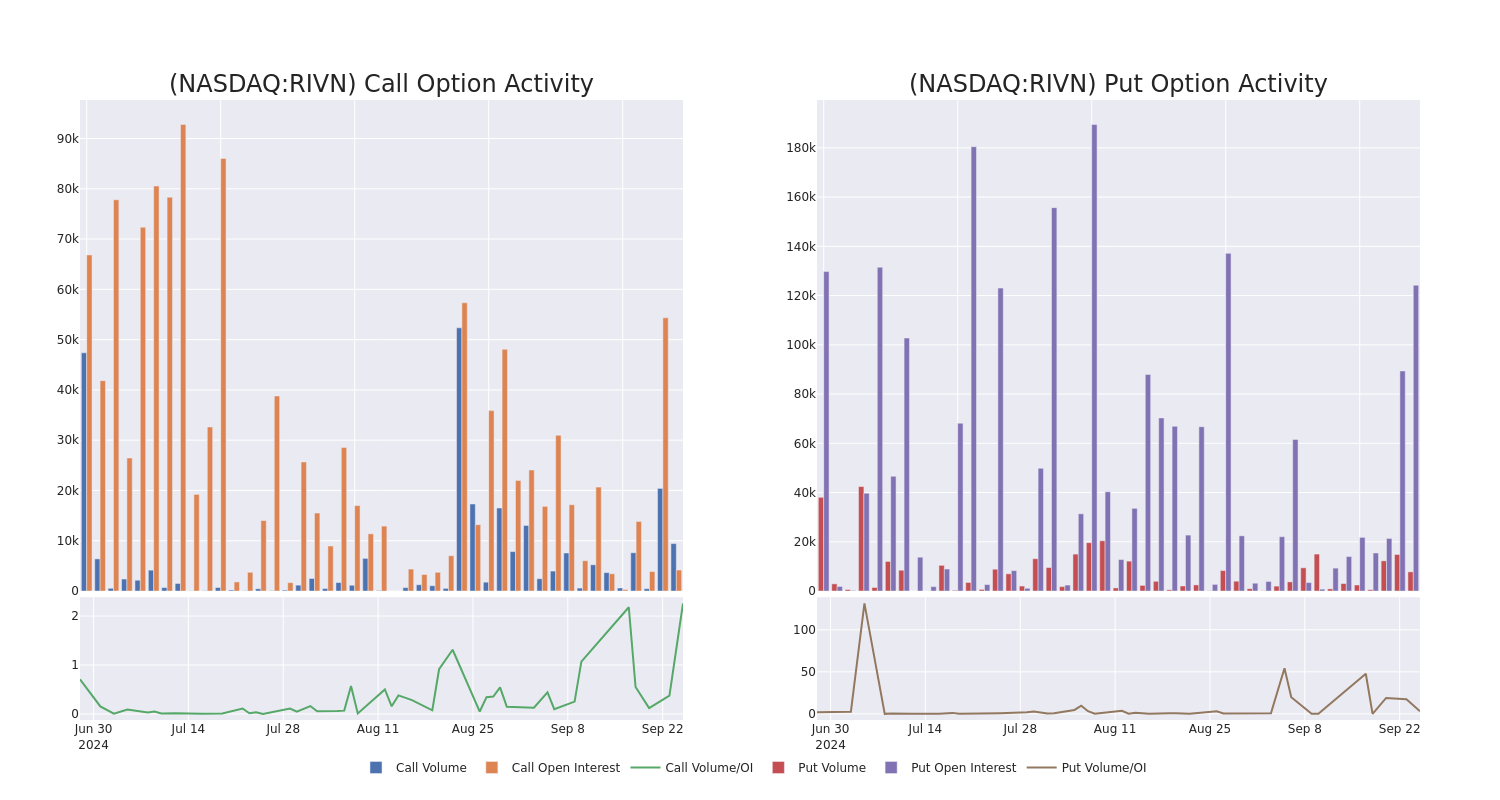

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Rivian Automotive’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Rivian Automotive’s whale activity within a strike price range from $5.0 to $14.0 in the last 30 days.

Rivian Automotive 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIVN | PUT | TRADE | NEUTRAL | 01/17/25 | $1.2 | $1.18 | $1.19 | $10.00 | $476.0K | 53.2K | 4.8K |

| RIVN | CALL | SWEEP | BULLISH | 11/15/24 | $0.54 | $0.53 | $0.53 | $14.00 | $179.2K | 1.1K | 5.7K |

| RIVN | PUT | SWEEP | BEARISH | 09/27/24 | $0.4 | $0.39 | $0.4 | $11.50 | $100.8K | 5.0K | 515 |

| RIVN | CALL | SWEEP | BEARISH | 01/15/27 | $7.35 | $7.3 | $7.3 | $5.00 | $73.0K | 242 | 108 |

| RIVN | PUT | SWEEP | BULLISH | 01/17/25 | $1.22 | $1.19 | $1.19 | $10.00 | $71.4K | 53.2K | 696 |

About Rivian Automotive

Rivian Automotive Inc designs, develops, and manufactures category-defining electric vehicles and accessories. In the consumer market, the company launched the R1 platform with the first generation of consumer vehicles: the R1T, a two-row, five-passenger pickup truck, and the R1S, a three-row, seven-passenger sport utility vehicle (SUV).

Having examined the options trading patterns of Rivian Automotive, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Rivian Automotive

- With a volume of 50,692,485, the price of RIVN is down -6.76% at $11.04.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 41 days.

Expert Opinions on Rivian Automotive

In the last month, 5 experts released ratings on this stock with an average target price of $17.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $19.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $19.

* An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $19.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $19.

* An analyst from Morgan Stanley downgraded its action to Equal-Weight with a price target of $13.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Rivian Automotive with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Methanol Market Size to Exceed USD 32.9 Billion by 2034 at 3.4% CAGR, Fueling the Future of Hydrogen Transportation- According to Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 25, 2024 (GLOBE NEWSWIRE) — According to TMR, methanol (الميثانول) was worth US$22.0 billion in 2023. A CAGR of 3.4% is expected from 2024 to 2034, generating US$ 32.9 billion by 2034. Methanol is regarded as a cleaner-burning fuel than conventional fossil fuels.

In response to environmental restrictions aimed at reducing greenhouse gas emissions and air pollution, methanol is becoming more popular as an alternative fuel. With a low emissions profile, methanol is a great option for meeting environmental goals.

Since methanol is easier to store and move than free hydrogen, it can potentially operate as a hydrogen transporter, which makes it particularly helpful in synthetic organic chemistry. As a result, the established method creates a new direction for bulk and fine chemical synthesis and industrial applications.

A novel method of creating hydrogen from methanol via a catalytic reaction under ambient circumstances provides an environmentally friendly and sustainable way to produce vital clean fuel.

Through SERB, a DST-affiliated institution, scientists at the Indian Institute of Science Education and Research (IISER), Tirupati, have developed a method for generating molecular hydrogen from basic feedstock chemicals like methanol. This method has been successfully applied to chemicals and pharmaceuticals with high value-added.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/methanol-market.html

Key Findings of Market Report

- A large share of 2023’s revenue came from the natural gas segment

- As greenhouse gas emissions are reduced and carbon neutrality goals are pursued, green energy solutions like methanol are becoming increasingly prevalent.

- Composite wood panels, such as particleboard, can be produced using formaldehyde-based resins from wood waste otherwise destined for landfills.

- By 2023, Asia Pacific was the leading producer of methanol worldwide.

Global Methanol Market: Growth Drivers

- Methanol is utilized as a fuel and additive, especially in biodiesel mixing and as a feedstock for fuel cells. Increasing energy demand and initiatives to reduce fossil fuel dependency pushed methanol into the spotlight as an alternative fuel source.

- Methanol is crucial in synthesizing many compounds, including acetic acid, formaldehyde, olefins, and polymers. Chemical sector expansion, particularly in emerging economies, significantly impacts methanol demand.

- The production of methanol can be achieved using recycled carbon dioxide and biomass. Renewable methanol as a clean energy source is growing as carbon emissions and sustainability become more important.

- The methanol industry can be greatly impacted by environmental laws and policies designed to lower greenhouse gas emissions and promote renewable energy sources. Regulatory incentives and incentives regarding renewable chemicals and biofuels could lead to growth in the methanol market from sustainable sources.

- Technological developments in methanol production, including gasification, catalytic conversion, and carbon capture and utilization (CCU), can potentially enhance methanol production’s economic viability and efficiency.

- These technological advancements significantly impact how competitive and rapidly the methanol market is expanding. Infrastructure investments in methanol production, distribution, and storage support expansion by opening new markets and guaranteeing dependable supply chains.

Global Methanol Market: Regional Landscape

- Demand for methanol is expected to increase in Asia Pacific. Automobile, construction, electronics, and textile industries are big consumers of methanol for various applications in Asia Pacific.

- The situation is especially severe in nations such as China, India, and South Korea. Consumption of methanol in the region is strongly influenced by rapid urbanization and industrialization, along with a high demand for consumer goods, building materials, and cars.

- China holds a substantial market share and is the foremost producer and user of methanol in the Asia Pacific. The country’s rising industrialization, expanding infrastructure, and increasing demand from diverse industries all contribute to its high methanol use.

- Government laws and policies significantly shape the methanol market in Asia Pacific. The market for methanol and its derivatives may be impacted by laws, requirements, and incentives that support the manufacture of sustainable chemicals, cleaner fuels, and renewable energy.

Global Methanol Market: Competitive Landscape

The top methanol producers in the world are pursuing the organic expansion mode to expand their customer base by opening new facilities in new geographical locations.

Key Players Profiled

- SABIC

- Mitsubishi Chemical Holdings Corporation

- Mitsui Chemicals, Inc.

- Methanex Corporation

- BASF SE

- Celanese Corporation

- Johnson Matthey PLC

- Perstorp Holding AB

- LyondellBasell Industries NV

- Sasol Limited

Key Developments

- In July 2023, Mitsui & Co. Ltd. acquired 49% of Kasso MidCo ApS (“MidCo”), a subsidiary of European Energy A/S. Through its wholly-owned subsidiary Solar Park Kasso ApS (“Kasso”), MidCo generates solar power and produces e-methanol. By capturing carbon dioxide (CO2) from biomass and converting renewable electricity to hydrogen, Kasso produces a low-carbon methanol. Next-generation fuels and chemicals will be increasingly demanded for their environmental friendliness.

- In February 2024, BASF and Envision Energy signed an agreement to convert green hydrogen and CO2 to e-methanol. By developing an advanced, dynamic process design, the collaboration will convert green hydrogen and CO2 into e-methanol.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=1249<ype=S

Global Methanol Market: Segmentation

Feedstock Type

End Use

- Formaldehyde

- Acetic Acid

- MTBE

- MMA

- Gasoline Blending

- Biodiesel

- Dimethyl Ether

- MTO/MTP

- Others

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

More Trending Reports by Transparency Market Research –

- Lubricant Additives Market – The global lubricant additives market (سوق إضافات التشحيم) is estimated to sluggishly surge at a CAGR of 2.8% from 2022 to 2031. Transparency Market Research projects that the overall sales revenue for lubricant additives is estimated to reach US$ 22.7 billion by the end of 2031.

- Polyisobutylene Market – The global polyisobutylene market (سوق البولي إيزوبوتيلين) is expected to grow at a compound annual growth rate (CAGR) of 5.6% during the forecast period between 2022 and 2031.

- Firefighting Foam Market – The global firefighting foam market (سوق رغوة مكافحة الحرائق) is estimated to grow at a CAGR of 3.8% from 2024 to 2034 and reach US$ 1.2 Bn by the end of 2034.

- Fatty Acid Methyl Ester (FAME) Market – The global fatty acid methyl ester (FAME) market (نطاق سوق إستر ميثيل الأحماض الدهنية (FAME)) is estimated to grow at a CAGR of 5.7% from 2024 to 2034 and reach US$ 32.4 Bn by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Decoding Bank of America's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bullish stance on Bank of America BAC.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with BAC, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Bank of America.

This isn’t normal.

The overall sentiment of these big-money traders is split between 80% bullish and 20%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $122,070, and 8 are calls, for a total amount of $463,848.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $30.0 to $45.0 for Bank of America during the past quarter.

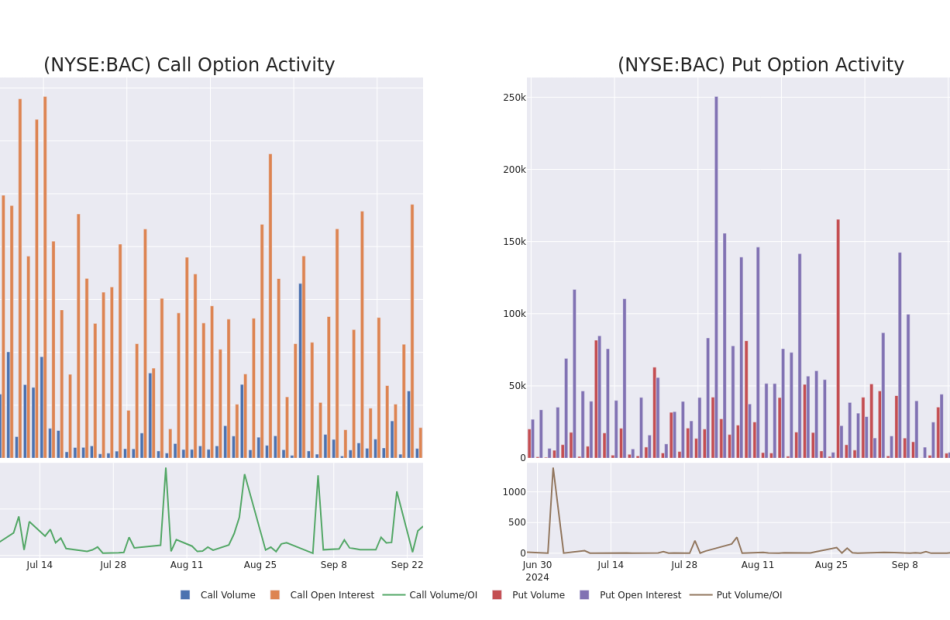

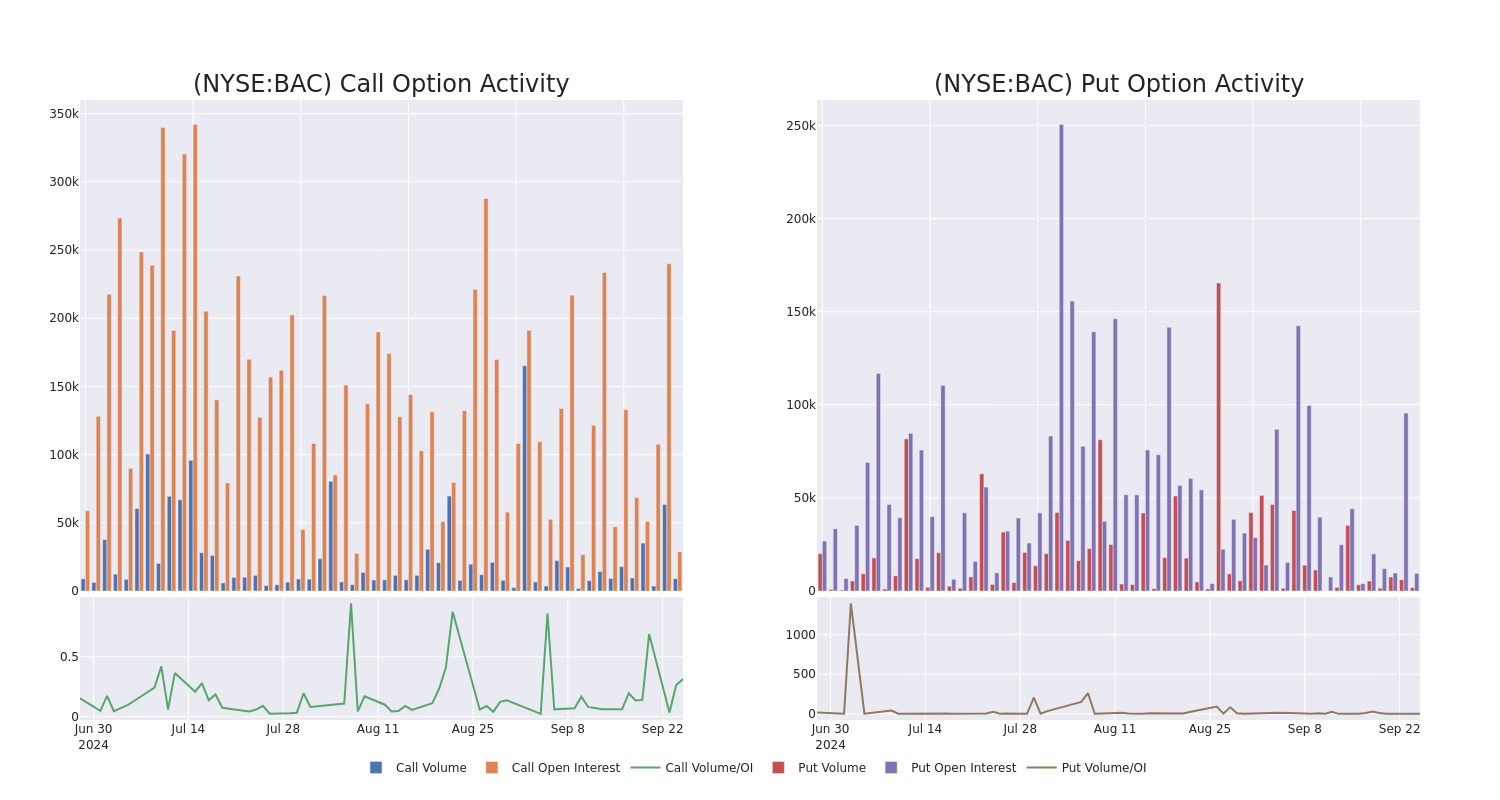

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Bank of America options trades today is 4249.89 with a total volume of 10,871.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Bank of America’s big money trades within a strike price range of $30.0 to $45.0 over the last 30 days.

Bank of America Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BAC | CALL | SWEEP | BULLISH | 09/19/25 | $10.45 | $10.3 | $10.45 | $30.00 | $169.3K | 448 | 162 |

| BAC | CALL | TRADE | BULLISH | 09/27/24 | $0.23 | $0.22 | $0.23 | $39.50 | $69.0K | 5.3K | 7.5K |

| BAC | PUT | SWEEP | BEARISH | 10/04/24 | $0.53 | $0.52 | $0.53 | $39.00 | $68.2K | 741 | 1.7K |

| BAC | PUT | TRADE | BULLISH | 01/17/25 | $2.5 | $2.49 | $2.49 | $40.00 | $53.7K | 8.7K | 75 |

| BAC | CALL | TRADE | BULLISH | 01/15/27 | $3.9 | $3.65 | $3.85 | $45.00 | $46.2K | 107 | 120 |

About Bank of America

Bank of America is one of the largest financial institutions in the United States, with more than $3.0 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America’s consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company’s Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily US-focused.

Following our analysis of the options activities associated with Bank of America, we pivot to a closer look at the company’s own performance.

Present Market Standing of Bank of America

- With a trading volume of 28,579,270, the price of BAC is down by -0.53%, reaching $39.24.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 20 days from now.

What Analysts Are Saying About Bank of America

1 market experts have recently issued ratings for this stock, with a consensus target price of $45.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Showing optimism, an analyst from Deutsche Bank upgrades its rating to Buy with a revised price target of $45.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Bank of America options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.