Super Micro Computer stock plunges on report of DOJ probe

AI server maker Super Micro Computer (SMCI) stock tumbled 15% Thursday after the Wall Street Journal reported that the company is being probed by the US Department of Justice.

The Journal, citing unnamed sources, said the DOJ is investigating the company for potential accounting violations. The issue was first brought to light by the short-selling firm Hindenburg Research in August in a report that accused Super Micro Computer of “glaring accounting red flags,” as well as “undisclosed related party transactions” and “sanctions and export control failures.”

Super Micro declined to comment on the matter.

Super Micro makes AI server equipment that uses Nvidia’s GPUs, and Wall Street analysts believe it is a major supplier of hardware to Meta. Its business flourished at the start of 2024 as the tech industry has created a slew of AI software with increasing power demands — and hence, demand for products like Supermicro’s. It’s one of the AI-driven stocks that has surged to record levels, and even with its decline Thursday, shares are still up 57% from last year.

Its gains earned the company a spot in the S&P 500 at the beginning of the year. But the stock has fallen from highs above $1,200 in mid-March before joining the index. Shares dropped in early August when the company missed Wall Street’s high expectations in its fiscal fourth quarter earnings report and again later in the month when the company delayed filing its annual 10-K report to the SEC.

In reference to both the scathing Hindenburg report and Super Micro’s delayed filing, CEO Charles Liang wrote in a letter to customers on Sept. 3, “Neither of these events affects our products or our ability and capacity to deliver the innovative IT solutions that you rely on every day. Our production capabilities are unaffected and continue operating at pace to meet customer demand.”

The company in August reported earnings per share of $6.25 for the fourth quarter, lower than the $8.25 analysts had expected. Its revenue of $5.3 billion came in just below Wall Street’s estimate of about $5.32 billion, but more than doubled from the prior year.

Liang said in his letter, “[W]e don’t anticipate any material changes in our fourth quarter or fiscal year 2024 financial results.” Still, JPMorgan analyst Samik Chatterjee recently downgraded the stock to Neutral from Overweight, nearly halving his price target from $950 to $500. Shares fell as low as $373 Thursday before recovering in the afternoon to around $400.

Nearly 37% of Wall Street analysts still recommend buying the stock as of Thursday afternoon, according to Bloomberg consensus estimates. Analysts see shares rising to $685 over the next 12 months.

Laura Bratton is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Energy Management Systems Market Size Projected to Grow $84.34 Billion by 2029 | MarketsandMarkets™

Delray Beach, FL, Sept. 26, 2024 (GLOBE NEWSWIRE) — The global Energy Management Systems Market size is expected to grow from USD 44.19 billion in 2024 to USD 84.34 billion by 2029, at a CAGR of 13.8% according to a new report by MarketsandMarkets™. The global EMS market is mainly pushed through the increasing emphasis on power efficiency and the growing need to reduce operational prices across diverse industries. As energy expenses keep to differ and regulatory pressures accentuate, organizations are in search of advanced solutions to optimize strength intake, improve productivity, and reduce carbon emissions. EMS solutions offer actual-time monitoring, predictive analytics, and automation abilities that permit organizations to manipulate their energy utilization more efficiently, main to big cost financial savings and more advantageous sustainability. This demand for electricity efficiency is specially robust in strength-in depth sectors which includes manufacturing, utilities, and industrial actual property, wherein the implementation of EMS can result in sizeable financial and environmental advantages.

Another key driving force is the worldwide push in the direction of sustainability and the transition to renewable energy assets. Governments and regulatory bodies global are enforcing stringent strength efficiency standards and carbon reduction goals, compelling corporations to adopt EMS to conform with these mandates. EMS answers play a crucial position in handling the combination of renewable energy sources, such as solar and wind, into current electricity systems, ensuring that electricity consumption is optimized and emissions are minimized. This alignment with worldwide sustainability desires is accelerating the adoption of EMS throughout various areas, further driving market growth. Technological improvements are also extensively contributing to the enlargement of the EMS market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1189

Energy Management Systems Market Scope:

| Report Coverage | Details |

| Market Size | USD 84.34 billion by 2029 |

| Growth Rate | 13.8% of CAGR |

| Largest Market | North America |

| Market Dynamics | Drivers, Restraints, Opportunities & Challenges |

| Forecast Period | 2024- 2029 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Energy Management Systems Market by component, deployment, type, end-use, and region. |

| Geographies Covered | North America, Asia Pacific, Europe, Middle East & Africa, South America. |

| Report Highlights | Updated financial information / product portfolio of players |

| Key Market Opportunities | Fiscal Incentives and Tax Policies for Carbon Reduction and Energy Efficiency |

| Key Market Drivers | Rising Energy cost and Shift to Renewable Energy |

Power & Energy industry is expected to be the fifth-largest segment in the energy management systems market

The Power & Energy segment holds the fifth-largest market share in the global energy management systems (ems) market due to its critical role in optimizing energy production, distribution, and consumption across a highly regulated and infrastructure-heavy industry. While the sector is fundamental to the broader energy ecosystem, its market share within the EMS market is comparatively lower because of the slower pace of technology adoption and the complexities involved in integrating advanced EMS solutions into existing power grids and generation facilities. However, the rising emphasis on grid modernization, the integration of renewable energy sources, and the need for improved efficiency in power generation and transmission are driving the gradual adoption of EMS in this segment. As utilities and energy providers face increasing pressure to reduce operational costs and comply with stringent environmental regulations, the demand for EMS solutions is expected to grow, albeit at a more measured pace compared to other industries.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=1189

Energy Management Systems Market Dynamics:

Drivers:

- Rise in energy costs and shift to renewable energy

- Increase in adoption of smart grid technologies and smart meters

- Government regulations and incentives driving EMS adoption

Restraints:

- High initial costs and capital investment

- Data privacy and security concerns

Opportunities:

- Emerging markets and rapid industrialization

- Fiscal incentives and tax policies for carbon reduction and energy efficiency

Challenges:

- Awareness deficit among SMEs

- Diverse industry needs

North America is expected to be the largest region in the energy management systems Industry

North America holds the largest market share in the global energy management systems market as its advanced energy systems, high technology, strong regulatory framework that promotes energy efficiency and sustainability, encourage Investments in infrastructure, integration of renewable energy, further modernization of aging energy systems contribute to increased use of EMS. Leading EMS providers and well-established markets applications in the energy sector reinforce North America’s leadership position in the global EMS market. Also, the regulatory compliance is another factor for driving demand of EMS systems in this region.

Key Market Players:

Some of the major players in the Energy Management Systems Companies are Schneider Electric (France), Siemens (Germany), Honeywell International Inc. (US), Johnson Controls, Inc (US), ABB (Switzerland), General Electric (US), Eaton (Ireland), Emerson Electric Co. (US), Mitsubishi Electric Corporation (Japan), and Hitachi, Ltd. (Japan).

Browse Adjacent Markets: Energy and Power Market Research Reports & Consulting

Browse Related Reports:

Distributed Energy Resource Management System Market – Global Forecast to 2026

Residential Energy Management Market – Global Forecast to 2025

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

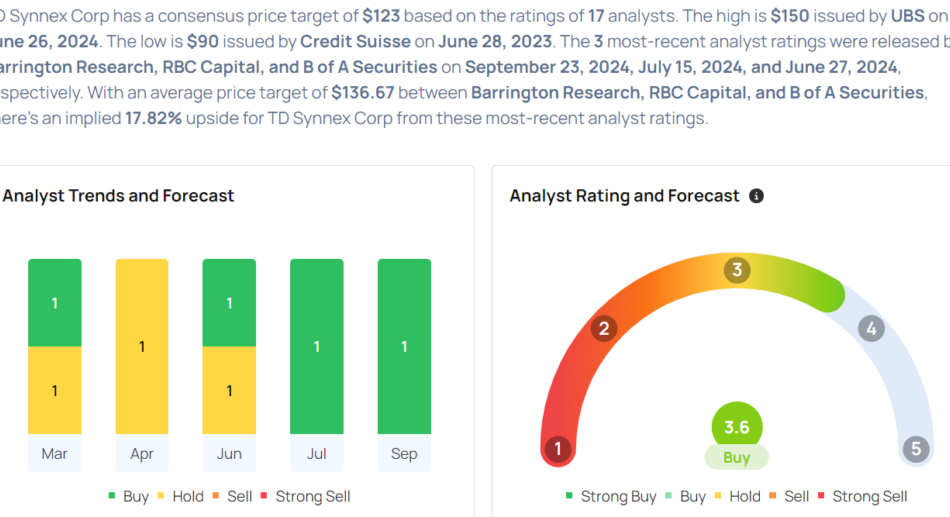

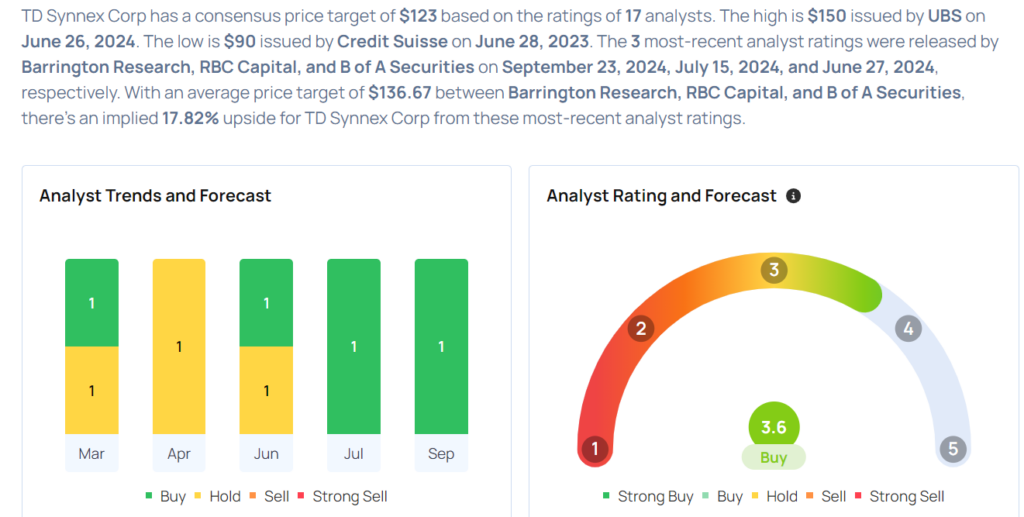

TD SYNNEX Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

TD SYNNEX Corporation SNX will release earnings results for its third quarter, before the opening bell on Thursday, Sept. 26.

Analysts expect the Fremont, California-based company to report quarterly earnings at $2.80 per share, up from $2.78 per share in the year-ago period. TD SYNNEX projects to report revenue of $14.11 billion for the quarter, according to data from Benzinga Pro.

On Sept. 12, TD SYNNEX announced an agreement to acquire IPsense Cloud Migration business in Brazil to create a new cloud competence center for its resellers.

TD SYNNEX shares fell 1.3% to close at $117.29 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Barrington Research analyst Vincent Colicchio maintained an Outperform rating with a price target of $138 on Sept. 23. This analyst has an accuracy rate of 63%.

- RBC Capital analyst Ashish Sabadra upgraded the stock from Sector Perform to Outperform rating and boosted the price target from $135 to $140 on July 15. This analyst has an accuracy rate of 74%.

- UBS analyst David Vogt maintained a Buy rating and raised the price target from $145 to $150 on June 26. This analyst has an accuracy rate of 74%.

- JP Morgan analyst Joseph Cardoso maintained a Neutral rating and cut the price target from $126 to $123 on June 26. This analyst has an accuracy rate of 64%.

- Barclays analyst Tim Long maintained an Equal-Weight rating and raised the price target from $111 to $118 on March 27. This analyst has an accuracy rate of 74%.

Considering buying SNX stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: AECOM

Analyst Profile

John D. Staszak, CFA

Securities Analyst: Consumer Discretionary & Consumer Staples

John’s specialty at Argus includes the gaming, lodging and restaurant groups within the Consumer Discretionary sector. John earned an MBA from the University of Texas and a BA in Economics from the University of Pennsylvania. In the financial services industry, he has worked as an analyst and consultant for firms including Standard & Poor’s, the Bank of New York, Harris Nesbitt Gerard and Merrill Lynch. John is a CFA charterholder. Forbes magazine named John as the second-best stock picker among restaurant analysts in 2006. He was also ranked the second-best analyst covering the restaurant sector by the Wall Street Journal in 2007, a year in which a Financial Times/StarMine survey also ranked John that same way. In 2008, the Journal again listed John as an award winner, with a third-best designation among hotel industry analysts and a fifth-best designation among restaurant analysts.

Darden Restaurants Director Sold $201K In Company Stock

MENSAH NANA, Director at Darden Restaurants DRI, executed a substantial insider sell on September 25, according to an SEC filing.

What Happened: NANA’s decision to sell 1,171 shares of Darden Restaurants was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $201,292.

In the Thursday’s morning session, Darden Restaurants‘s shares are currently trading at $168.87, experiencing a up of 0.45%.

All You Need to Know About Darden Restaurants

Darden Restaurants is the largest restaurant operator in the us full-service space, with consolidated revenue of $11.4 billion in fiscal 2024 resulting in 3%-4% full-service market share (per NRA data and our calculations). The company maintains a portfolio of 10 restaurant brands: Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Ruth’s Chris, Yard House, The Capital Grille, Seasons 52, Eddie V’s, Bahama Breeze, and The Capital Burger. Darden generates revenue almost exclusively from company-owned restaurants, though a small network of franchised restaurants and consumer-packaged goods sales through the traditional grocery channel contribute modestly. As of the end of its fiscal 2024, the company operated 2,031 restaurants in the us.

A Deep Dive into Darden Restaurants’s Financials

Decline in Revenue: Over the 3 months period, Darden Restaurants faced challenges, resulting in a decline of approximately -6.77% in revenue growth as of 31 August, 2024. This signifies a reduction in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Holistic Profitability Examination:

-

Gross Margin: With a low gross margin of 20.41%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Darden Restaurants’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 1.75.

Debt Management: Darden Restaurants’s debt-to-equity ratio is below the industry average at 2.48, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 19.39 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 1.77, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 13.88, Darden Restaurants presents an attractive value opportunity.

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Darden Restaurants’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Warren Buffett Stocks to Buy Hand Over Fist and 1 To Avoid

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) is well known for its massive stock portfolio, which has dozens of common stock positions, many of which were hand-selected by legendary investor Warren Buffett himself.

To be sure, there’s a solid investment case to be made for virtually all of them. Buffett tends to invest in stocks that have durable competitive advantage, attractive valuations, and other clearly identifiable reasons why they’re attractive investments. However, some are far more appealing than others right now. Here are two stocks in particular from Berkshire’s portfolio that are worth a closer look, and one that I’m staying away from even though it’s a Warren Buffett favorite.

A highly profitable bank with interesting potential

Capital One Financial (NYSE: COF) is an interesting bank stock right now and is one of the few large banks trading for less than its book value right now.

While it’s best-known for its credit card business, Capital One is a full-service bank with an extensive branch network in the Washington, D.C. metro area. Because of the high-interest nature of the credit card business, Capital One has a net interest margin of 6.7% — more than double what most other large banks produce. Plus, as one of the few branch-based banks that offers high-yield savings accounts and CDs, the company has grown its customer deposits by 7% year over year. There is certainly some recession risk in the credit card business, but Capital One’s default rate is reasonable, and the bank has plenty in reserves to cover potential losses.

Perhaps most significantly, Capital One is planning to acquire Discover Financial Services (NYSE: DFS) in an all-stock deal. Not only will this make Capital One’s credit card business far larger, but it will give Capital One its own payment network, which will ultimately make the bank far less reliant on Visa and Mastercard. Management expects $2.7 billion in synergies from the deal by 2027, and much of that is from network savings.

A leader with a superior cost structure

Ally Financial (NYSE: ALLY) is a leading auto lender that has a rapidly growing online banking operation. Berkshire owns 9.5% of Ally, and there are plenty of reasons Buffett might be a fan.

For one thing, Ally has several competitive advantages, such as relationships with more than 22,000 vehicle dealerships, a high level of automation, and the superior cost structure that comes with online banking versus branch-based banking. It’s also a high-margin business, as the average retail auto loan it originates has a 10.6% interest rate. With a deposit cost of about 4% and a net charge-off rate of less than 2%, it’s easy to see why this can be such a profitable business.

Ally is also a rather cheap bank stock, with shares trading 25% below its 52-week high and for a forward P/E multiple of just 8.8.

This Buffett favorite isn’t for me

It’s clear that Buffett is a fan of Occidental Petroleum (NYSE: OXY), as he has bought the stock frequently in recent years, and Berkshire now owns more than 27% of the oil company. But it’s one stock I’m happy watching from the sidelines.

For one thing, the company is highly sensitive to the price of oil, even relative to other major oil and has companies, as its main focus is extracting oil from the ground. This is why Occidental has underperformed peers recently, as crude oil has dropped by more than 15% since midyear.

Debt is also an issue that makes me nervous, and although management is doing a good job of debt reduction, this could eat into cash flow for the foreseeable future.

Another Buffett stock could be the better option for you

As a final thought, if you can’t decide which “Buffett stocks” are best for you, there’s nothing wrong with buying Berkshire Hathaway itself and getting exposure to all of them. In fact, another reason I have no real desire to invest in Occidental is that Berkshire is one of my largest stock investments and therefore I have significant indirect exposure to the oil company already.

Should you invest $1,000 in Capital One Financial right now?

Before you buy stock in Capital One Financial, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Capital One Financial wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Ally is an advertising partner of The Ascent, a Motley Fool company. Discover Financial Services is an advertising partner of The Ascent, a Motley Fool company. Matt Frankel has positions in Ally Financial and Berkshire Hathaway. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Discover Financial Services and Occidental Petroleum. The Motley Fool has a disclosure policy.

2 Warren Buffett Stocks to Buy Hand Over Fist and 1 To Avoid was originally published by The Motley Fool

LuxUrban Hotels Inc. Reports Second Quarter 2024 Financial Results

MIAMI, Sept. 25, 2024 (GLOBE NEWSWIRE) — LuxUrban Hotels Inc. LUXH, a hospitality company that leases entire hotels on a long-term basis, manages these hotels, and rents out rooms to guests in the properties it leases, today announced its financial results for the second quarter ended June 30, 2024 (“Q2 2024”). The Company has also submitted its quarterly report on Form 10-Q to the U.S. Securities and Exchange Commission.

Q2 2024 Financial Overview:

- Net Rental Revenue: $18.2 million, compared to $31.9 million in Q2 2023.

- Gross (Loss) Profit: $(22.2) million, compared to a profit of $10.2 million in Q2 2023, impacted by increased rent expenses, surrender of deposits from exiting properties, and other increased operational costs. We have streamlined our hotel portfolio to exclude underperforming properties and now manage 9 hotels with a total of 1,056 rooms.

- Total Operating Expenses: $4.2 million, compared to $5.4 million in Q2 2023, reflecting efforts to realign cost structures.

- Net Loss: $(26.8) million, compared to a net loss of $(26.8) million in Q2 2023.

Rob Arigo, Lux Urban Hotels CEO, commented: “In 2024, we launched a comprehensive initiative to enhance our company’s management and operations, which we refer to as LuxUrban 2.0. Our strategy was focused on the strategic elimination of non-performing hotel properties, and targeted efforts to reduce operating overhead. As part of our recent Lux 2.0 transition, we strengthened our management and operations teams through recruiting talented directors and officers with significant experience in the hospitality and financial sectors. While significant work remains as we navigate the end of 2023, and legacy operations will continue to present exposure and challenges, we are implementing transformative changes within LuxUrban that will enhance our financial stability and provide a solid foundation for future growth.”

Operational Highlights:

Key initiatives include revenue optimization, expense reduction, re-branding, and a focus on long-term Master Lease Agreements, eliminating traditional fees.

Refinement of Hotel Portfolio:

LuxUrban Hotels has refined its portfolio and focused its geographic operations around New York City. The company is now operating 9 properties with a total of 1,025 units available.

Cost Management Initiatives:

In Q2 2024, the Company took actions to reduce its operational expenses, including renegotiating certain lease agreements and surrendering non-core properties, resulting in non-cash charges.

Strengthening the Company with Industry Expertise:

The Company added over 100 years of relevant industry and public company experience at both executive and Board levels. This includes the appointment of Non-Executive Chairman Elan Blutinger, independent board members Kim Schaefer and Alex Lombardo, and Mike James as Chief Financial Officer. Additionally, LuxUrban has hired experienced professionals in revenue management and property operations.

Outlook for the 2H 2024

Looking ahead, LuxUrban Hotels plans to focus on optimizing revenue management, improving its cash flow profile, and enhancing its balance sheet through strategic initiatives aimed at strengthening liquidity. The Company is optimistic about growth prospects in the second half of 2024 as it moves into peak travel seasons and continues to benefit from the recovery in the hospitality sector and the modified portfolio intended to eliminate nonperforming hotels.

Conference Call & Webcast Information:

- Time & Date: September 25, 2024, at 5:00PM ET

- PARTICIPANT DIAL IN (TOLL FREE): 1-877-317-6789

- PARTICIPANT INTERNATIONAL DIAL IN: 1-412-317-6789

- Webcast Link: HERE

The simultaneous webcast will be available in the Investor Relations section of the Company’s website at www.luxurbanhotels.com.

For access to all applicable financial statements, please see the company’s quarterly report on 10Q at the following link: ttps://www.sec.gov/ix?doc=/Archives/edgar/data/0001893311/000182912624006460/luxurbanhotels_10q.htm

LuxUrban Hotels Inc.

LuxUrban Hotels Inc. secures long-term operating rights for entire hotels through Master Lease Agreements (MLA) and rents out, on a short-term basis, hotel rooms to business and vacation travelers. The Company is strategically building a portfolio of hotel properties in destination cities by capitalizing on the dislocation in commercial real estate markets and the large amount of debt maturity obligations on those assets coming due with a lack of available options for owners of those assets. LuxUrban’s MLA allows owners to hold onto their assets and retain their equity value while LuxUrban operates and owns the cash flows of the operating business for the life of the MLA.

Forward Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended). The statements contained in this release that are not purely historical are forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Generally, the words “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this release may include, for example, statements with respect to the Company’s ability to successfully de-platform its properties from its former franchise partner and operate independently, its ability to improve its working capital and cash flow profiles, enhance its balance sheet and deliver organic revenue growth, scheduled property openings, expected closing of noted lease transactions, the Company’s ability to continue closing on additional leases for properties in the Company’s pipeline, as well the Company’s anticipated ability to commercialize efficiently and profitably the properties it leases and will lease in the future. The forward-looking statements contained in this release are based on current expectations and belief concerning future developments and their potential effect on the Company. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements are subject to a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results of performance to be materially different from those expressed or implied by these forward-looking statements, including those set forth under the caption “Risk Factors” in our public filings with the SEC, including in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on April 15, 2024, and any updates to those factors as set forth in subsequent Quarterly Reports on Form 10-Q or other public filings with the SEC, the base prospectus comprising part of the Registration Statement and when filed, the prospectus supplement filed with respect thereto. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws.

For more information, contact:

Investor Relations:

Jeff Ramson, PCG Advisory

Email: Jramson@pcgadvisory.com

Corporate:

Robert Arigo, CEO

Email: rob@luxurbanhotels.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amid Nippon-US Steel Debacle, Kamala Harris Stresses Importance Of US Steel Production, Even If It Means Job Losses: 'Critically Important, Not Only In Terms Of Our Economy, But Also In The Context Of National Security'

Democratic presidential candidate Kamala Harris emphasized the importance of maintaining domestic control over steel production, even if it results in job losses.

What Happened: Harris stated during an interview with MSNBC, that keeping American manufacturing of steel by American workers is crucial.

“It’s most important that we maintain America’s ability to have American manufacturing of steel by American workers,” Harris said.

“An American company manufacturing that steel for those new industries is going to be critically important, not only in terms of our economy, but also in the context of national security,” Harris continued.

This comes in response to a proposed $14.1 billion deal for Nippon Steel Corp. NISTF to acquire United States Steel Corp. X. Harris highlighted her economic policy, which includes investing in sectors like bio-manufacturing, aerospace, AI, blockchain, and nuclear energy, all requiring domestic steel production.

U.S. Steel CEO David Burritt previously told the Wall Street Journal that the company might have to shut down plants and relocate its headquarters from Pittsburgh if the deal does not go through. However, Harris argued that American-made steel is vital for the economy and national security.

Harris’ comments are among the most detailed explanations from the Biden administration regarding their stance on the acquisition. She met with steel workers in Pittsburgh, whose union opposes the deal. An arbitration panel recently sided with U.S. Steel in a labor dispute related to the deal, but other hurdles remain, including a review by the Committee on Foreign Investment in the United States.

Why It Matters: The arbitration panel’s decision in favor of Nippon Steel Corp. was a significant development in the $14.9 billion acquisition of United States Steel Corp. The panel, selected by both the company and the United Steelworkers (USW) union, determined that U.S. Steel had met all conditions of the successorship clause in its labor agreement with the USW. Despite this ruling, the union remains opposed to the acquisition.

Earlier this month, Dave McCall, President of the United Steelworkers, expressed strong opposition to the deal. In a memo to the White House, he criticized US Steel executives for attempting to divide union members and retirees to gain personal financial benefits from the acquisition.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Polyester Staple Fiber Market Size/Share Worth USD 58.6 Billion by 2033 at a 7.7% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Sept. 26, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Polyester Staple Fiber Market Size, Trends and Insights By Type (Solid, Hollow), By Origin (Virgin, Recycled, Blend of Virgin & Recycled), By End-user (Apparel, Automotive, Home Furnishing, Filtration, Construction, Personal Care & Hygiene, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

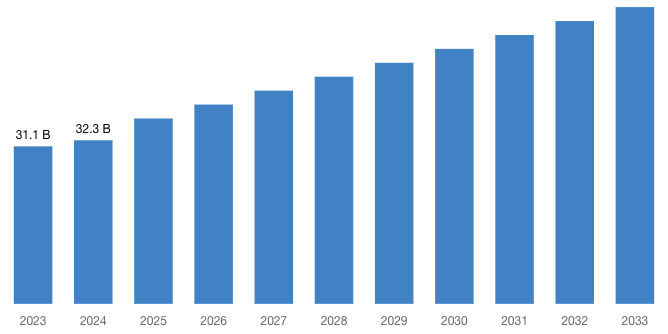

“According to the latest research study, the demand of global Polyester Staple Fiber Market size & share was valued at approximately USD 31.1 Billion in 2023 and is expected to reach USD 32.3 Billion in 2024 and is expected to reach a value of around USD 58.6 Billion by 2033, at a compound annual growth rate (CAGR) of about 7.7% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Polyester Staple Fiber Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52337

Polyester Staple Fiber Market: Overview

Polyester staple fiber (PSF) is a synthetic fiber made from polyester polymer. It is produced through a process called melt spinning, where polyester chips are melted and extruded through spinnerets to form long continuous fibers. These fibers are then cut into shorter lengths to create staple fibers, which typically range from a few millimeters to several centimeters in length.

PSF is valued for its versatility, durability, and affordability, making it a popular choice in various industries. In the textile and apparel sector, PSF is widely used in the production of clothing, home textiles, and industrial textiles. It can be blended with natural fibers like cotton or wool to enhance properties such as strength, wrinkle resistance, and color retention.

PSF is also utilized in non-woven fabrics for applications such as hygiene products, automotive interiors, and filtration materials. In addition to textiles, PSF finds applications in other industries such as automotive, construction, and packaging.

In the automotive sector, PSF is used in interior components like seat upholstery, carpets, and insulation materials due to its durability and resistance to abrasion. In construction, PSF is employed in products like geotextiles, roofing materials, and thermal insulation. PSF is also used in packaging materials such as polyester staple fiberfill for pillows, cushions, and mattresses.

Moreover, PSF can be recycled and used to produce recycled polyester staple fiber, offering a sustainable alternative to virgin polyester. With increasing awareness of environmental issues and demand for eco-friendly products, recycled PSF is gaining traction in various industries, contributing to the circular economy.

Request a Customized Copy of the Polyester Staple Fiber Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52337

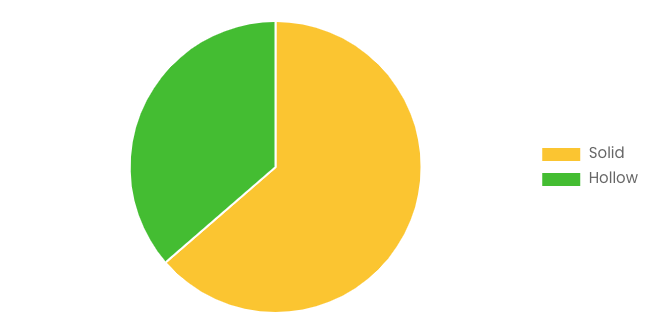

By type, Solid Polyester Staple Fiber segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Solid polyester staple fiber (PSF) refers to a type of synthetic fiber made from polyester polymer that has a uniform and consistent composition throughout its structure.

By application, the Apparel segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Apparel refers to clothing items or garments worn by individuals for practical, social, cultural, or aesthetic reasons. It encompasses a wide range of items, including shirts, pants, dresses, skirts, jackets, suits, and accessories such as hats, scarves, and gloves.

North America is one of the wealthiest regions globally, with a highly developed industrial and service-based economy. The United States, in particular, boasts the world’s largest economy, driven by sectors such as technology, finance, manufacturing, and agriculture.

Bombay Dyeing & Manufacturing Company Limited is an Indian textile company headquartered in Mumbai, India. It operates as a subsidiary of the Wadia Group and is one of India’s largest producers of textiles.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 32.3 Billion |

| Projected Market Size in 2033 | USD 58.6 Billion |

| Market Size in 2023 | USD 31.1 Billion |

| CAGR Growth Rate | 7.7% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Polyester Staple Fiber report is available upon request; please contact us for more information.)

Request a Customized Copy of the Polyester Staple Fiber Market Report @ https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Polyester Staple Fiber report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Polyester Staple Fiber Market Report @ https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

CMI has comprehensively analyzed the Global Polyester Staple Fiber market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict depth scenarios of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Polyester Staple Fiber industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Polyester Staple Fiber market and what is its expected growth rate?

- What are the primary driving factors that push the Polyester Staple Fiber market forward?

- What are the Polyester Staple Fiber Industry’s top companies?

- What are the different categories that the Polyester Staple Fiber Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Polyester Staple Fiber market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Polyester Staple Fiber Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

Polyester Staple Fiber Market: Regional Analysis

By region, Polyester Staple Fiber market is segmented into North America, Europe, Asia-Pacific, Latin America, the Middle East & Africa. North America dominated the global Polyester Staple Fiber market in 2023 with a market share of 40.5% and is expected to keep its dominance during the forecast period 2024-2033.

North America propels the polyester staple fiber market through a combination of factors that capitalize on its robust industrial infrastructure, innovative technologies, and consumer demand.

The region’s textile and apparel industry, particularly in the United States and Mexico, serves as a significant driver for polyester staple fiber consumption. Polyester staple fiber, known for its versatility, durability, and affordability, is widely used in the production of clothing, home textiles, and industrial applications.

Moreover, North America’s dominance in the automotive and construction sectors further fuels demand for polyester staple fiber, which finds applications in interior upholstery, carpets, insulation, and non-woven fabrics.

Additionally, technological advancements and research investments in materials science enhance the quality and performance of polyester staple fiber, catering to evolving consumer preferences for sustainable and eco-friendly products.

The region’s strategic geographical location facilitates trade and logistics, enabling efficient supply chain management and market penetration both domestically and internationally. Furthermore, initiatives promoting recycling and circular economy principles drive the adoption of recycled polyester staple fiber, aligning with growing environmental consciousness among consumers and businesses.

Request a Customized Copy of the Polyester Staple Fiber Market Report @ https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Polyester Staple Fiber Market Size, Trends and Insights By Type (Solid, Hollow), By Origin (Virgin, Recycled, Blend of Virgin & Recycled), By End-user (Apparel, Automotive, Home Furnishing, Filtration, Construction, Personal Care & Hygiene, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

List of the prominent players in the Polyester Staple Fiber Market:

- Alpek S.A.B.

- Bombay Dyeing

- China Petroleum Corporation (Sinopec Group)

- Diyou Fibre

- Far Eastern New Century Corporation

- Huvis Corporation

- Indorama Corporation

- Reliance Industries Limited

- Shubhalakshmi Polyester Ltd

- Toray Industries Inc.

- XINDA Corp

- Others

Click Here to Access a Free Sample Report of the Global Polyester Staple Fiber Market @ https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Aerosol Disinfectants Market: Aerosol Disinfectants Market Size, Trends and Insights By Product Category (Plain, Scented), By Sale Channels (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, Others), By Application (Residential, Commercial, Industrial), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Timber Plants Market: Timber Plants Market Size, Trends and Insights By Type (Soft, Semi-hard, Hardwoods), By Grade (CLT, Glulam), By Application (Furniture making, Construction Activities, Flooring material., Crafting veneers and plywood., Boat building, Wood carvings and sculptures., Paper and pulp products manufacturing, Others), By End User Industry (Residential, Commercial, Institutional, Industrial, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Lead Smelting and Refining Market: Lead Smelting and Refining Market Size, Trends and Insights By Technology (Pyrometallurgical Methods, Hydrometallurgical Methods, Electrometallurgical Methods), By Environmental Compliance (Standard Compliance, Advanced Compliance), By Distribution Channel (Direct Sales, Distributors, Online Sales), By Application (Lead Acid Batteries, Radiation Shielding, Cable Sheathing, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Titanium Dioxide Market: Titanium Dioxide Market Size, Trends and Insights By Grade (Rutile, Anatase), By Application (Paints & Coatings, Plastics, Paper, Cosmetics, Inks, Textiles, Food Additives, Others), By Production Process (Sulfate Process, Chloride Process), By End-Use Industry (Automotive, Construction, Packaging, Consumer Goods, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Synthetic Organic Alcohol Market: Synthetic Organic Alcohol Market Size, Trends and Insights By Types of Alcohols (Methanol, Ethanol, Isopropanol, Butanol, Others), By Application (Solvents, Disinfectants, Antifreeze, Fuel Additives, Others), By End Users (Pharmaceuticals, Cosmetics, Automotive, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

AdBlue Carrefour Market: AdBlue Carrefour Market Size, Trends and Insights By Type (Passenger Vehicles, Commercial Vehicles), By Application (Original Equipment Manufacturer (OEM), Aftermarket), By Manufacturing Process (Solution Polymerization, Emulsion Polymerization), By Raw Material (Natural Latex, Synthetic Latex), By Distribution Channel (Online, Offline), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Cycloalkanes Market: Cycloalkanes Market Size, Trends and Insights By Function (Blowing Agent & Refrigerant, Solvent & Reagent, Others), By Application (Refrigeration, Construction, Electrical & Electronics, Chemical, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Household Insecticides Market: Household Insecticides Market Size, Trends and Insights By Type Insights (Synthetic, Natural), By Purpose Insights (Mosquitoes and Flies Control, Rat and Rodent Control, Termite control, Bedbugs and Beetle Control, Others), By Packaging Insights (Small (50-200 ml), Medium (200-500 ml), Large (500 ml and above)), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Polyester Staple Fiber Market is segmented as follows:

By Type

- Solid

- Semi-dull Optical White

- Bright Optical White

- Black Dope Dyed

- Colored Dope Dyed

- Others

- Hollow

By Origin

- Virgin

- Recycled

- Blend of Virgin & Recycled

By End-user

- Apparel

- Automotive

- Home Furnishing

- Filtration

- Construction

- Personal Care & Hygiene

- Others

Click Here to Get a Free Sample Report of the Global Polyester Staple Fiber Market @ https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Polyester Staple Fiber Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Polyester Staple Fiber Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Polyester Staple Fiber Market? What Was the Capacity, Production Value, Cost and PROFIT of the Polyester Staple Fiber Market?

- What Is the Current Market Status of the Polyester Staple Fiber Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Polyester Staple Fiber Market by Considering Applications and Types?

- What Are Projections of the Global Polyester Staple Fiber Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Polyester Staple Fiber Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Polyester Staple Fiber Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Polyester Staple Fiber Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Polyester Staple Fiber Industry?

Click Here to Access a Free Sample Report of the Global Polyester Staple Fiber Market @ https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

Reasons to Purchase Polyester Staple Fiber Market Report

- Polyester Staple Fiber Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Polyester Staple Fiber Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Polyester Staple Fiber Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Polyester Staple Fiber Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Polyester Staple Fiber market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Polyester Staple Fiber Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Polyester Staple Fiber market analysis.

- The competitive environment of current and potential participants in the Polyester Staple Fiber market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Polyester Staple Fiber market should find this report useful. The research will be useful to all market participants in the Polyester Staple Fiber industry.

- Managers in the Polyester Staple Fiber sector are interested in publishing up-to-date and projected data about the worldwide Polyester Staple Fiber market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Polyester Staple Fiber products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Polyester Staple Fiber Market Report @ https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Polyester Staple Fiber Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/polyester-staple-fiber-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.