P/E Ratio Insights for Sempra

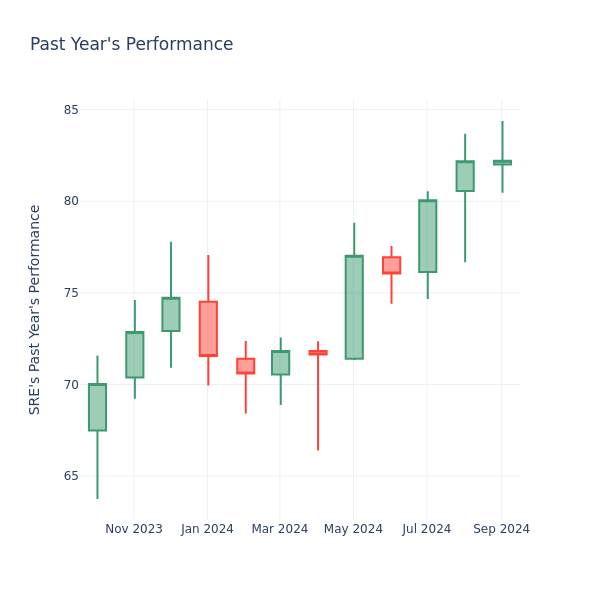

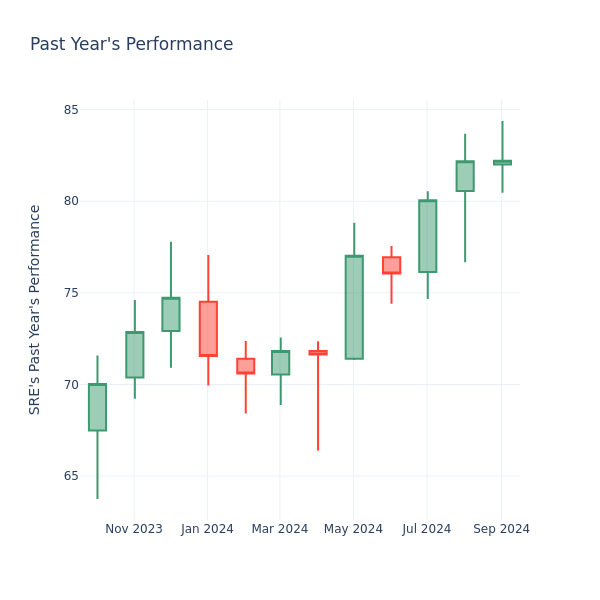

In the current market session, Sempra Inc. SRE stock price is at $82.20, after a 0.22% drop. However, over the past month, the company’s stock increased by 0.72%, and in the past year, by 20.84%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is not performing up to par in the current session.

How Does Sempra P/E Compare to Other Companies?

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Compared to the aggregate P/E ratio of the 19.77 in the Multi-Utilities industry, Sempra Inc. has a lower P/E ratio of 17.74. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Diabetic Neuropathy Market Size Set to Hit USD 8.5 Billion by 2034 with a 5.5% CAGR, Boosted by Biomarker-based Diagnostics and Stem Cell Therapy – Analysis by Transparency Market Research

Wilmington, Delaware, United States, Transparency Market Research, Inc., Sept. 26, 2024 (GLOBE NEWSWIRE) — The diabetic neuropathy market (سوق الاعتلال العصبي السكري) was worth US$ 4.6 billion in 2023. A 5.5% CAGR is estimated from 2024 to 2034, leading to a market value of US$ 8.5 billion by 2034. Blood sugar management should be combined with supplements and complementary treatments for neuropathy. Many medications can be used to treat symptoms, including acupuncture. A healthcare professional should be consulted before beginning any new treatment or supplement.

Diabetic neuropathy can be diagnosed early through the identification of biomarkers. The development of diagnostic tools that allow early detection of neuropathy is ongoing, enabling effective management and intervention as soon as possible. Nerve damage caused by diabetic neuropathy can be repaired with stem cell therapy and regenerative techniques. The possibility of stem cells promoting nerve regeneration and restoring nerve function is being investigated by researchers in clinical trials and research investigations.

Access to healthcare services for people with diabetes and associated complications is improved by improvements in the healthcare infrastructure. The market expands by enhancing access to alternative treatment options, diagnostic centers, and specialty clinics. Government programs to reduce diabetes-related problems and enhance diabetic care may contribute to market expansion. Diabetic neuropathy early detection methods, diabetes prevention programs, and affordable treatments are some of these.

Download Sample PDF Brochure: https://www.transparencymarketresearch.com/diabetic-neuropathy-market.html

Key Findings of the Market Report

- Based on disorder type, peripheral neuropathy is expected to drive growth in the diabetic neuropathy market.

- In terms of treatment type, drugs for diabetic neuropathy are expected to drive growth.

- Hospitals are expected to drive diabetic neuropathy market demand.

- In 2023, the most dominant region for diabetic neuropathy was North America.

Global Diabetic Neuropathy Market: Growth Drivers

- The increasing incidence of diabetes worldwide is the main factor propelling the market for treatments for diabetic neuropathy. The number of patients at risk of diabetic neuropathy is growing along with the number of people who have been diagnosed with diabetes.

- Technological advancements in medicine have made it possible to diagnose and detect diabetes neuropathy earlier. The ability to intervene and handle situations promptly drives the need for medicines to reduce symptoms and halt disease progression.

- The significance of controlling diabetes and its consequences, such as diabetic neuropathy, has been recognized by growing knowledge of early diagnosis and treatment. The expansion of the market is fueled by the fact that patients seek medical attention more frequently for symptoms.

- New therapeutic alternatives are being developed for diabetic neuropathy in the wake of ongoing research and development. Patient and healthcare professional options have been expanded through these advances.

- Pharmaceutical companies increasingly focus on patient-centric drug development, considering patient preferences, needs, and quality of life. With this approach, diabetic neuropathy treatments become more effective and tolerable, enhancing market growth.

Global Diabetic Neuropathy Market: Regional Landscape

- North America is expected to drive demand for the diabetic neuropathy market. The United States, in particular, has a high diabetes prevalence in North America. Diabetes neuropathy is a common disease that afflicts a vast number of people, fueling the need for treatments.

- Diagnostic centers and specialty clinics are available at cutting-edge hospitals throughout North America. Detection and control of diabetic neuropathy will be made easier by early detection and treatment alternatives.

- Several novel medical research centers are located in the area. People with diabetic neuropathy benefit from improvements in medical devices, medications, and diagnostic technologies.

- In North America, patient education and awareness campaigns about diabetes and its complications are highly valued. Early detection and aggressive treatment of diabetic neuropathy increase treatment requirements.

- In North America, strict regulatory systems guarantee the efficacy and safety of treatments for diabetic neuropathy. As a result, patients and healthcare professionals gain trust, increasing the rate at which authorized therapies are used.

- Many North American academic institutions and clinical research centers are involved in diabetic neuropathy treatment trials. Patients can benefit from state-of-the-art treatments by enrolling in these studies, which advance medical science in this field.

Global Diabetic Neuropathy Market: Competitive Landscape

To establish a strong position in the global diabetic neuropathy market, major players are undergoing clinical trials and gaining regulatory approval.

- Johnson & Johnson (Janssen Global Services, LLC)

- Boehringer Ingelheim GmbH

- NeuroMetrix, Inc.

- Eli Lilly and Company

- GlaxoSmithKline plc

- Lupin Limited

- Pfizer Inc.

- Astellas Pharma Inc.

- Glenmark Pharmaceuticals Ltd.

- Arbor Pharmaceuticals, LLC

- Depomed Inc.

Key Developments

- In September 2023, Neuralace Medical reported that enrollment in the study had reached its primary endpoint, paving the way for FDA approval and a potential stroke of luck for Parkinson’s patients. Axon Therapy and conventional medical management (CMM) were randomized to 50 patients in the AT-PDN study, and sham treatments were given to 20 patients.

- In March 2024, NeuroMetrix, Inc. published a large study showing DPNCheck® and standard EKGs combined accurately detect diabetic peripheral neuropathy (DPN). As part of the study, Hayashi and colleagues examined 167 diabetic patients with Type 1 or Type 2 diabetes. Nerve conduction studies were considered the gold standard for DPN.

Purchase the Report for Market-Driven Insights: https://www.transparencymarketresearch.com/checkout.php?rep_id=2199<ype=S

Global Diabetic Neuropathy Market: Segmentation

By Disorder Type

- Peripheral Neuropathy

- Autonomic Neuropathy

- Proximal Neuropathy

- Focal Neuropathy

By Treatment Type

- Amitriptyline

- Imipramine

- Others

- Citalopram

- Paroxetin

- Others

- Gabapentin

- Pregabalin

- Topimarate

- Others

By Distribution Channel

- Hospitals

- Clinics

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Have a Look at More Valuable Insights of Pharmaceutical

- Animal Drug Compounding Market: The animal drug compounding market (سوق مركبات الأدوية الحيوانية) acquired US$ 1.1 billion in 2021. The market is likely to secure a market valuation of US$ 2.4 billion by 2031 and is anticipated to experience a 7.4% CAGR from 2022 to 2031.

- Acute Lymphoblastic Leukemia Market: The acute lymphoblastic leukemia market (سوق سرطان الدم الليمفاوي الحاد) was estimated to have acquired US$ 2.2 billion in 2021. It is anticipated to register a 7.6% CAGR from 2022 to 2031 and by 2031; the market is likely to gain US$ 4.5 billion.

- Natural APIs Market – The global natural APIs market (سوق واجهات برمجة التطبيقات الطبيعية) is expected to grow at a CAGR of 6.1% from 2024 to 2034 and reach US$ 57.5 Billion by the end of 2034.

- Myocarditis Treatment Market – The global myocarditis treatment market (سوق علاج التهاب عضلة القلب) is expected to grow at a CAGR of 5.6% from 2024 to 2034 and reach US$ 2.7 Billion by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Media shares are rebounding from record lows. Here’s why

Shares in Donald Trump’s social media startup surged on Wednesday amid speculation that the former president isn’t selling his stock in the company.

As of press time, there have been no SEC regulatory filings published on its investor relations site that would indicate a change in his ownership in Trump Media and Technology Group (TMTG). As an investor with more than a tenth of the outstanding stock, the company is required by regulators to file a Form 4 informing the market should Trump sell part or all of his 114.75 million shares.

TMTG was last exchanging hands at a price of $13.72, more than 7% higher in the session. It was even up by more than 13% when it reached an intraday high of $14.48 a share.

This rebound likely proves only meager solace however as most have seen the value of their investment dwindle when fears of a Trump sale sent the stock crashing to record lows.

The company did not immediately respond to Fortune with a written statement, and Donald Trump left a request for comment unanswered.

Pressing need to meet potentially hundreds of millions in legal costs

It is generally known that Trump, who owns 59% of the outstanding shares, was subject to a six month lockup from the closing date of the merger on March 25.

But the fine print of the deal meant that Trump could sell earlier so long as the closing stock price did not fall below $12—equivalent to a market cap of about $2.28 billion—during 20 out of 30 trading days in a period 150 days from the closing.

With that requirement having already been met last week, Trump could have sold at the first opportunity by Friday. TMTG would then have had to two business days to report to the market, i.e. by Wednesday.

Since the company hasn’t reported any such transaction, it suggests Trump has at least initially kept his word, when he said earlier this month he would not be liquidating his stock despite his financial predicaments.

Trump badly needs cash to meet heavy fines and fees related to his various ongoing legal cases. One court ruled Trump must cough up some $450 million for losing a civil fraud case, but the fine is still subject to an ongoing legal appeal.

The liquidation of part of his TMTG stock was expected to cover these costs earlier in the year when the value of his stake peaked at some $9 billion in March. But the ongoing declines have instead forced Trump to merchandise everything from digital trading cards and bibles to sneakers and now silver coins to drum up cash.

This story was originally featured on Fortune.com

Insider Selling: Milanes Douglas J Unloads $981K Of Darden Restaurants Stock

Milanes Douglas J, SVP at Darden Restaurants DRI, disclosed an insider sell on September 25, according to a recent SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, J sold 5,705 shares of Darden Restaurants. The total transaction value is $981,495.

Darden Restaurants shares are trading up 0.45% at $168.87 at the time of this writing on Thursday morning.

All You Need to Know About Darden Restaurants

Darden Restaurants is the largest restaurant operator in the us full-service space, with consolidated revenue of $11.4 billion in fiscal 2024 resulting in 3%-4% full-service market share (per NRA data and our calculations). The company maintains a portfolio of 10 restaurant brands: Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Ruth’s Chris, Yard House, The Capital Grille, Seasons 52, Eddie V’s, Bahama Breeze, and The Capital Burger. Darden generates revenue almost exclusively from company-owned restaurants, though a small network of franchised restaurants and consumer-packaged goods sales through the traditional grocery channel contribute modestly. As of the end of its fiscal 2024, the company operated 2,031 restaurants in the us.

Unraveling the Financial Story of Darden Restaurants

Decline in Revenue: Over the 3 months period, Darden Restaurants faced challenges, resulting in a decline of approximately -6.77% in revenue growth as of 31 August, 2024. This signifies a reduction in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Key Profitability Indicators:

-

Gross Margin: The company faces challenges with a low gross margin of 20.41%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 1.75, Darden Restaurants showcases strong earnings per share.

Debt Management: Darden Restaurants’s debt-to-equity ratio is below the industry average. With a ratio of 2.48, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Darden Restaurants’s P/E ratio of 19.39 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.77 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 13.88, Darden Restaurants presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Closer Look at Important Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Darden Restaurants’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fluidized Bed Concentrator (FBC) Market to Reach $4.9 Billion, Globally, by 2032 at 7.9% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 26, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Fluidized Bed Concentrator (FBC) Market by Flow Rate (below 10000 CFM, 10000-50000 CFM and above 50000 CFM), and Application (Paint Finishing, Semiconductor, Printing, Chemical Production and Others): Global Opportunity Analysis and Industry Forecast, 2024-2032″. According to the report, the fluidized bed concentrator (FBC) market was valued at $2.5 billion in 2023, and is estimated to reach $4.9 billion by 2032, growing at a CAGR of 7.9% from 2024 to 2032.

Prime determinants of growth

The fluidized bed concentrator (FBC) market is growing due to stringent environmental regulations globally, driving the effective air pollution control solutions. FBC systems are preferred for their versatility in treating various pollutants, including volatile organic compounds (VOCs) and particulate matter, across industries. In addition, advancements in technology improving system efficiency and reliability, coupled with increasing awareness and adoption of sustainable industrial practices, further drive market expansion. Cost-effectiveness and regulatory compliance are key factors influencing the growth trajectory of the FBC market.

Download PDF Sample Copy: https://www.alliedmarketresearch.com/request-sample/A194820

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2032 |

| Base Year | 2023 |

| Market Size in 2023 | $2.5 billion |

| Market Size in 2032 | $4.9 billion |

| CAGR | 7.9% |

| No. of Pages in Report | 220 |

| Segments Covered | Flow Rate and Application |

| Drivers | Increasing regulations worldwide requiring industries to reduce emissions Continuous improvements in FBC technology Expansion of industrial activities in emerging economies |

| Opportunities | Rapid industrialization in Asia-Pacific and Latin America Increasing emphasis on sustainable practices and environmentally friendly pollution control technologies |

| Restraint | High initial investments Technical complexity |

Buy This Research Report (220 Pages PDF with Insights, Charts, Tables, Figures): https://bit.ly/47FZG0W

The 10, 000 to 50, 000 CFM segment is expected to exhibit fastest growth throughout the forecast period

By flow rate, the 10, 000 to 50, 000 CFM segment is anticipated to experience faster growth in the fluidized bed concentrator market due to medium-sized industrial operations across sectors like manufacturing and chemical production, where stringent environmental regulations drive the adoption of efficient emission control technologies. These systems offer a balanced approach, combining effective pollutant removal with cost efficiency, making them attractive to industries optimizing operational costs while ensuring compliance. Technological advancements further enhance their appeal by improving performance and reliability.

The semiconductor segment is likely to exhibit fastest growth throughout the forecast period

By application, the semiconductor segment is anticipated to experience faster growth for the fluidized bed concentrator market due to stringent regulatory requirements globally, which mandate the reduction of volatile organic compounds (VOCs) and other hazardous emissions. As semiconductor manufacturing expands globally, particularly in Asia-Pacific region, there is increasing demand for efficient air pollution control technologies like FBCs. These systems offer precise VOC capabilities, ensuring compliance with environmental standards while supporting uninterrupted production processes in cleanroom environments critical for semiconductor fabrication.

Inquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A194820

Asia-Pacific is expected to exhibit fastest growth throughout the forecast period

North America accounted for the highest market share in 2023, however, Asia-Pacific is expected to grow with a highest CAGR during the forecast period due to rapid industrialization and urbanization in countries like China, India, and Southeast Asia which are driving stringent environmental regulations. These regulations compel industries to adopt advanced air pollution control technologies such as FBC systems to mitigate emissions effectively. In addition, increasing awareness of environmental sustainability and government initiatives supporting clean technologies further accelerate market growth in the Asia-Pacific region.

Players: –

- DuPont Clean Technologies

- CTP Chemisch Thermische Prozesstechnik GmbH

- Anguil Environmental Systems, Inc.

- Advanced Cyclone Systems

- Gulf Coast Environmental Systems

Similar Reports:

Europe flushing system Market Size, Share, Competitive Landscape and Trend Analysis Report

Tank Liner Market Size, Share, Competitive Landscape and Trend Analysis Report

Semiconductor Etch Equipment Market Size, Share, Competitive Landscape and Trend Analysis Report

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

Wilmington, Delaware

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle, Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oil prices slide on prospect of Saudi Arabia raising output

By Erwin Seba

HOUSTON (Reuters) -Oil prices fell more than 3% on Thursday on a Financial Times report that Saudi Arabia, the world’s top crude exporter, will give up its $100 price target in preparation for raising output, along with OPEC members and allies in December.

Brent crude futures settled down $1.86, or 2.53%, to $71.60 a barrel. U.S. West Texas Intermediate crude finished down $2.02, or 2.90%, at $67.67 per barrel.

Saudi Arabia is preparing to abandon its unofficial price target of $100 a barrel for crude as it gets ready to increase output, the Financial Times reported on Thursday, citing people familiar with the matter.

Meanwhile, two OPEC+ sources told Reuters on Thursday that the producer group is set to go ahead with a December oil output increase because its impact will be small should a plan for some members to make larger cuts to compensate for overproduction be delivered in September and later months.

“They are over-reacting to the story from FT,” said Phil Flynn, senior analyst for Price Futures Group.

Tamas Varga, analyst at PVM, said the report is about a preplanned unwinding of production cuts that will if implemented add 180,000 barrels per day (bpd) of extra crude oil supply each month.

“No doubt, it will loosen the global oil balance but at the same time it will reduce OPEC’s spare production capacity,” Varga said. “It will most probably lead to stock builds in 2025 and keep prices under moderate pressure. What is perhaps more important is whether it is the harbinger of a supply war within and outside the organization. If the answer is yes, a painful plunge to the $40/bbl area cannot be ruled out.”

The Organization of the Petroleum Exporting Countries, along with the group’s allies including Russia, together known as OPEC+, have been cutting oil output to support prices.

However, prices are down nearly 6% so far this year, amid increasing supply from other producers, especially the U.S., as well as weak demand growth in China.

“The prospect of additional supply from Libya and Saudi Arabia has been the main driver behind the latest weakness,” said Ole Hansen, an analyst at Saxo Bank.

A United Nations statement on Wednesday said delegates from Libya’s divided east and west regions agreed on the process of appointing a central bank governor, a step which could help resolve the crisis over control of the country’s oil revenue that has disrupted exports.

Libya’s crude exports have averaged about 400,000 barrels per day (bpd) in September, down from more than 1 million bpd in August, shipping data show.

News of a new Chinese stimulus package, however, limited further losses.

Top government officials in China, the world’s largest crude oil importer, pledged on Thursday to deploy “necessary fiscal spending” to meet this year’s economic growth target of roughly 5%, acknowledging new problems and raising market expectations for fresh stimulus in addition to measures announced this week.

(Additional reporting by Ahmad Ghddar in London, Gabrielle Ng in Singapore and Katya Golubkova in Tokyo; Editing by Christian Schmollinger, Shri Navaratnam, Emelia Sithole-Matarise, Paul Simao and David Gregorio)

CTRI INVESTIGATION NOTICE: Robbins Geller Rudman & Dowd LLP Announces Investigation into Centuri Holdings, Inc. and Encourages Investors with Substantial Losses or Witnesses with Relevant Information to Contact the Firm

SAN DIEGO, Sept. 26, 2024 (GLOBE NEWSWIRE) — The law firm of Robbins Geller Rudman & Dowd LLP is investigating potential violations of U.S. federal securities laws involving Centuri Holdings, Inc. CTRI focused on whether Centuri and certain of its top executives made false and/or misleading statements and/or failed to disclose material information to investors.

If you have information that could assist in the Centuri Investigation or if you are a Centuri investor who suffered a loss and would like to learn more, you can provide your information here:

https://www.rgrdlaw.com/cases-centuri-holdings-inc-investigation-ctri.html

You can also contact attorneys J.C. Sanchez or Jennifer N. Caringal of Robbins Geller by calling 800/449-4900 or via e-mail at info@rgrdlaw.com.

THE COMPANY: Centuri offers gas utility services, including maintenance, repair, installation, and replacement services for natural gas local distribution utility companies. In April 2024, Centuri spun off of natural gas distributor Southwest Gas Holdings in an initial public offering in which Centuri sold over 14 million shares at $21 per share for nearly $300 million in gross offering proceeds (the “IPO”).

THE INVESTIGATION: On July 29, 2024, Centuri missed market expectations when it revealed financial results for Centuri’s second quarter of 2024 – the same quarter during which the IPO was conducted. Specifically, Centuri reported that net income in the second quarter came in at $11.7 million, down from $17.1 million in the prior year period. Following this news, the price of Centuri stock fell to less than $16 per share, approximately 24% below the IPO price set just three month previously.

ABOUT ROBBINS GELLER: Robbins Geller Rudman & Dowd LLP is one of the world’s leading law firms representing investors in securities fraud cases. Our Firm has been #1 in the ISS Securities Class Action Services rankings for six out of the last ten years for securing the most monetary relief for investors. We recovered $6.6 billion for investors in securities-related class action cases – over $2.2 billion more than any other law firm in the last four years. With 200 lawyers in 10 offices, Robbins Geller is one of the largest plaintiffs’ firms in the world and the Firm’s attorneys have obtained many of the largest securities class action recoveries in history, including the largest securities class action recovery ever – $7.2 billion – in In re Enron Corp. Sec. Litig. Please visit the following page for more information:

https://www.rgrdlaw.com/services-litigation-securities-fraud.html

Attorney advertising.

Past results do not guarantee future outcomes.

Services may be performed by attorneys in any of our offices.

Contact:

Robbins Geller Rudman & Dowd LLP

J.C. Sanchez, Jennifer N. Caringal

655 W. Broadway, Suite 1900, San Diego, CA 92101

800-449-4900

info@rgrdlaw.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Adapting to the Future: A New Real Estate Demand from Digital "Slowmads" in Spain

– Cecilia Varela, Luxury Realty Advisor, Addresses the Needs of the Growing Luxury Real Estate Market in Madrid

– Digital Nomads Exceed 35 Million Globally, 49% from the United States

MADRID, Sept. 26, 2024 /PRNewswire/ — Cecilia Varela, a renowned luxury real estate advisor with extensive experience in the high-end real estate market, announces her specialization as a Luxury Realty Advisor, focused on meeting the growing demand of international investors and “Slowmads” with the finest luxury properties in Madrid. This new trend, driven by digital professionals—now over 35,000 in Spain alone, mostly executives and international entrepreneurs from Latin America and the United States—seeks a long-term stay that combines work and family life in one of Europe’s most dynamic cities, Madrid.

The rise of digital nomads, a global trend that has surpassed 35 million people, has made Madrid a key point of attraction. The city was highlighted in the “52 Best Places to Visit” list by The New York Times, establishing itself not only as a tourist destination but also for those looking to settle for months or even longer, known as “Slowmads.”

Recent studies show that the global population of digital nomads has exceeded 35 million, with 49% coming from the United States. Surprisingly, women lead this movement. Although digital nomads are often portrayed as men, surveys reveal that women, particularly working mothers, are increasingly adopting this lifestyle. A city like Madrid, with its rich culture and family-friendly environment, promises to enhance their experience.

Cecilia Varela explains that her clients’ profiles have evolved in recent years. “My clients are no longer just looking for luxury properties but homes that offer a balanced lifestyle where remote work and family life can seamlessly coexist,” says Varela. “Areas like Salamanca, Chamberí, Justicia, Recoletos, and El Viso are highly sought after for their architectural charm and vibrant cultural and social offerings.”

Furthermore, the digital nomad visa launched by the Spanish government in 2023 has facilitated the arrival of these international professionals, allowing many to settle in the city with their families. With attractive tax benefits and the possibility for dependents to live, study, or work in the country, the visa has proven to be a key driver for the influx of “Slowmads.”

A Real Estate Market in Transformation

Madrid is adapting its real estate offerings to meet this new demand, with a growing focus on meticulously designed interiors, high-end furnishings, and exclusive amenities. These elements are essential for luxury clients, particularly those from the United States and Latin America, who value both design and functionality in their new homes.

Walkability, a vibrant international community, and affordability compared to other major European capitals make Madrid an increasingly attractive destination for long-term digital nomads.

Cecilia Varela, as a Luxury Realty Advisor, positions herself as one of the leading real estate advisors for those looking to invest in luxury properties in the Spanish capital. She adapts to the new paradigm that combines work, family, and lifestyle in one place, catering to this growing trend of professionals by offering personalized advice, project management support, financial consulting, benefit maximization, and property acquisition.

Press Contact:

sandra.zuluaga@brayaus.com

+1 (305) 772.9116

![]() View original content:https://www.prnewswire.com/news-releases/adapting-to-the-future-a-new-real-estate-demand-from-digital-slowmads-in-spain-302259335.html

View original content:https://www.prnewswire.com/news-releases/adapting-to-the-future-a-new-real-estate-demand-from-digital-slowmads-in-spain-302259335.html

SOURCE CECILIA VARELA LUXURY REALTY ADVISOR

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Eficode's revenue grew over 51% last financial year, fueled by development tools going to the cloud

AI is now part of software development, integrated into both tools and development culture

HELSINKI, Sept. 26, 2024 /PRNewswire/ — Eficode grew by more than 51% last year, increasing revenue from €189.7 million to €287.2 million. Over the past four years, Eficode’s compound annual growth rate (CAGR) was over 75%.

Profitable, strong international growth

Last fiscal year, Eficode acquired Avoset Oy in Finland and Jodocus GmbH in Germany. Eficode now has over 650 employees for DevOps, Agile, and associated tools and services, continuing its growth towards 1000 employees during the ongoing strategy period.

Eficode’s personnel in the United States doubled, while Eficode was recognized as the best company to work for in the UK. Both countries hit major milestones, including acquiring new customers for the Eficode ROOT Managed DevOps platform, and surpassing key Annual Recurring Revenue targets for the managed services from the customers in the region.

Continental Europe experienced remarkable growth in consulting and managed services. Numerous large automotive, industrial, and financial enterprises continue to collaborate deeply with Eficode.

“Every company will become a software organization and need to solve questions about the software development tools and culture,” said Ilari Nurmi, CEO of Eficode. “Many of them are already expanding into platform engineering and GenAI, yet all of them need to improve their ways of working, the development tools, and the skillset. We take pride in transforming every industry with modern tools and processes.”

Cloud transition boosts the Atlassian ecosystem

Large companies continue to transform their software development. Software development tools play an increasingly important role in this transformation, as tools on the cloud must be integrated for a seamless development pipeline to deliver common development processes. Eficode’s customer base grew with a number of large enterprises, including the following.

- A leading global beverage producer selected Eficode as their partner in their Atlassian Cloud journey and established a long-term agreement for further advisory and solution development

- Qualco, a top credit management software provider adopted Eficode’s entire solutions portfolio, including Eficode ROOT, Atlassian tools, and consulting services

- A significant Swiss insurance institution and a leading European logistics and postal services provider selected Eficode as their partner for Atlassian Cloud migration and consulting services

- A rapidly growing digital banking services business chose Eficode to assess its software development practices and selected Eficode as the Atlassian support and license provider.

GitHub and Microsoft empower AI in software development

Large enterprises explore and adopt GitHub Enterprise and GitHub Copilot for their modern software development practices. With AI capabilities in GitHub Copilot, customers gain faster development time, higher software quality, and a more enjoyable developer experience.

Eficode delivered dozens of GitHub Copilot projects, and provided solutions including GitHub Enterprise, Eficode’s Managed Services, and technology advisory. As a result, revenue from GitHub-related business multiplied year over year.

During the financial year, Daimler Truck joined The DEVOPS Conference and Enterprise Technology Leadership Summit to share their experiences adopting GitHub with Eficode.

DevOps platforms are vital in scaling software development

Software development professionals continue to advocate the benefits of platform engineering and DevOps platforms. Eficode extensively covered these themes in The DEVOPS Conferences in Copenhagen, Stockholm, and London. Also, a reputable industry analyst firm covered Eficode in its report on selecting DevOps Toolchains and Platforms.

Eficode’s employee was honored as a GitLab Champion: an individual whom GitLab recognizes as a member of the GitLab Partner community who champions great customer outcomes based on the DevSecOps platform.

Notable customer agreements include assisting a large European law enforcement authority to shift left using GitLab, a major global IT services provider for their GitLab needs, adoption and implementation projects and training to enterprise customers in the Finance, Healthcare and Automotive sectors. With the AI capabilities, GitLab Duo Enterprise is included in the key platforms that Eficode utilizes to drive DevOps with its customers.

Media Contacts

Lauri Palokangas, Chief Marketing Officer, Eficode. lauri.palokangas@eficode.com, +358 50 486 4918

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/eficodes-revenue-grew-over-51-last-financial-year-fueled-by-development-tools-going-to-the-cloud-302259680.html

View original content:https://www.prnewswire.com/news-releases/eficodes-revenue-grew-over-51-last-financial-year-fueled-by-development-tools-going-to-the-cloud-302259680.html

SOURCE Eficode Oy

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.