Investors Charge Up XCHG Stock In Scaled-Back IPO

Key Takeaways:

- Shares of XCHG nearly tripled in their first week of trading after the company raised $20.7 million in its Nasdaq IPO

- The company’s revenue jumped 52% and its profit nearly quadrupled in this year’s first quarter, but it warned of a slowdown in the second quarter

By Edith Terry

Sept. 10 was a special day for Tesla veteran Hou Yifei as he rang the opening bell on the Nasdaq to mark the trading debut for his electric vehicle (EV) charging company XCHG Ltd. XCH, which also uses the XCharge name. An earlier attempt to list in February got a chillier reception, causing Deutsche Bank and Huatai Securities to jump ship as underwriters. That left the smaller U.S. Tiger Securities as sole underwriter of a deal that raised $20.7 million – less than half the previous $50 million target.

Despite the IPO’s smaller scale – or perhaps because of it – XCHG’s shares nearly tripled in their first trading week before settling down somewhat. At Wednesday’s close of $11.56, they were still up by a healthy 86% over the offer price of $6.20, valuing the company at nearly $700 million two weeks after the IPO.

But it’s still early days, and the stock has some distinctively meme-like qualities. Its price to sales (P/S) ratio stands at an eye-popping 16.5, which looks wildly expensive compared to smaller peer NaaS Technology NAASwith a ratio of just 0.67, and ChargePoint CHPT at 1.77. All three companies lost money in 2023, although XCHG moved into the black this year.

The downsizing of XCHG’s IPO came after the U.S. jacked up tariffs on China-made EVs in May, though chargers weren’t part of that move. XCHG is also looking to avoid potential future conflicts with the U.S. by building a 3,500-square-foot factory outside San Marco, Texas, to manufacture chargers in the country.

XCHG currently sources its chargers from China, but most of its business is in Europe. It hopes to someday get significant revenue from software upgrades and maintenance services for the chargers it sells. But for now, at least, the big majority of its revenue comes from product sales, which totaled $38 million, or 98.8% of its total last year.

In 2023, XCHG reported a net loss of $8 million on revenue of $38.5 million, due in part to a $7.5 million expense for share-based compensation. It moved into the black in the first quarter of this year with net income of $733,000 on revenue of $11.1 million, up 51% year-on-year. But it warned that its revenue dropped 19.2% to 33.9% year-on-year to between $8.1 million and $9.9 million in the second quarter, with gross profit down 18.7% to 33.5%. It blamed the declines on a “transition period” caused by falling sales for its older products as customers traded up to newer ones.

Another concern is its reliance on individual customers. In the first quarter of 2024, its largest customer accounted for 47% of its revenue, up from 42% for all of 2023.

Small Player In China

Despite sourcing its products from China, sales from the country still make up a relatively small portion of XCHG’s total. Its China sales totaled just $4.75 million, or 12.2% of its total revenue, last year, and the figure dropped to just 6.7% in this year’s first quarter.

Next Move Strategy Consulting estimates China’s EV charging market was worth nearly $10 billion in 2022, with prospects of reaching $61.4 billion by 2030 as Beijing aggressively promotes the new energy vehicle (NEV) sector. The country had 8.1 million EVs registered in 2023, accounting for more than one-third of the car market, according to the International Energy Agency.

But the market’s huge size means XCHG faces crushing competition there, including from EV manufacturers that supply their own chargers. Europe is XCHG’s largest market and seems less cutthroat, which may possibly explain why investors seem to like the company.

XCHG has two things giving it a modest edge over its competitors. It was a relatively early arrival to the European market in 2018, and Europe accounted for 78% of its revenue in 2023 and grew to an even larger 85% in this year’s first quarter. According to independent research in the company’s prospectus, XCHG was a leading supplier of high-power chargers in Europe in 2023.

The company has a testing laboratory in Madrid, which is a joint venture with Swiss inspection company SGS, and it’s setting up another testing facility and R&D center at its global headquarters in Hamburg, Germany. Javier Lázaro, the company’s European sales head, pointed out the EU’s target of reducing its net greenhouse emissions by at least 55% by 2030 encourages carmakers to shift from internal combustion engine models to EVs.

But the EU hasn’t been completely welcoming to China’s EV industry. In July, like the U.S., the EU imposed punitive duties on Chinese EVs, ranging from 9% for Tesla’s China-made EVs to 37.6% for models from SAIC. While XCHG chargers work for both European and Chinese-made cars, the extra duties may restrict the overall market’s growth.

XCHG’s second selling point is its Net Zero Series, which could open markets beyond charging vehicles. The series consists of integrated lithium battery and direct current (DC) fast chargers that can buy and store power during off-peak hours and sell it back to the grid at higher prices to earn profits during peak hours, in addition to charging EVs. Global sales of such chargers are expected to increase exponentially from 9,000 units in 2024 to approximately 290,000 by 2028, according to third-party data in the prospectus.

According to Grand View Research, the global EV charging infrastructure market was worth $26 billion in 2023 and is projected to grow at an annual rate of 25.4% from 2024 to 2030. The fast charger segment led the market in 2023 with 72.4% of global revenue. But the market for energy storage solutions like XCHG’s Net Zero Series is even more robust, estimated to reach $170 billion by 2028.

XCHG’s European focus could also benefit the company due to the relatively low penetration of chargers outside China. Chargers have been deployed more slowly than EVs, with a ratio of 13 EVs for each charger in Europe and 25 for every charger in the U.S., according to independent research. Such math may be a factor that lured investors to XCHG’s IPO. By comparison, the EV-to-charger ratio in China is less than 10 to one.

Relative to the size of the market, XCHG is still a minnow among whales. In unit terms, it sold 1,688 DC fast chargers in 2023 and another 351 in the first quarter of 2024, with both figures down by more than 10% year-on-year. Revenues still rose over the same periods, with XCHG crediting the sale of higher-priced chargers. That could point to a new higher-growth future if sales for the newer Net Zero Series start to take off with growing popularity for this more versatile new type of product.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Harris Vs Trump: 55% CFOs Believe Vice-President Likely To Win Election, Although Ex-President Is Better For Economy

In a recent survey, a majority of chief financial officers (CFOs) predict that Kamala Harris will win the upcoming presidential election, despite believing that Donald Trump would be better for the economy.

What Happened: The third-quarter CNBC CFO Council Survey conducted between Aug. 19 and Sep. 19 reveals that 55% of CFOs expect Harris to prevail in the election. In contrast, only 31% foresee a Trump victory, with 14% remaining uncertain. This marks a notable shift from the previous quarter when 58% anticipated a Trump win, CNBC reported on Thursday.

Despite the belief in Harris’s likely victory, 55% of CFOs consider Trump better suited to handle inflation and the economy, while only 17% believe Harris has a superior economic plan. Key issues for CFOs include inflation, interest rates, tax policy, and regulation.

The survey also indicates that 74% of CFOs expect a divided government post-election, with 45% predicting Democrats will control the Senate and Republicans the House. Another 29% foresee a flip in control but still expect a divided Capitol Hill.

Both candidates have been actively promoting their economic agendas. Harris has released an 82-page economic blueprint, while Trump has promised new tax incentives for corporations. The survey reflects the ongoing debate about the best approach to economic growth and stability.

Why It Matters: The upcoming 2024 presidential race between Harris and Trump has economists leaning toward Harris’s economic strategies. According to a Wall Street Journal opinion piece by Obama-era economist Jason Furman, Harris’s economic proposals are seen as less risky for the economy compared to Trump’s. This is despite both candidates holding undergraduate degrees in economics.

Harris has moved solidly ahead of Trump in a nationwide poll, while another suggested the two are still running neck-on-neck. A Reuters/Ipsos poll conducted on Sept. 21-23 showed 46.6% support for Harris among registered voters and 40.48% backing for Trump. The vice president has expanded her lead from five points in the previous poll conducted on Sept. 11-12.

Trump has recently ramped up his criticism of President Joe Biden and Harris, claiming inflation has caused severe financial strain for American families.

Read Next:

Image via Wikimedia Commons

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Treasury Bond ETF Under Pressure Ahead Of Key Inflation Data: What Investors Should Know

As the market anticipates the release of the August Personal Consumption Expenditures (PCE) report, the iShares 20+ Year Treasury Bond ETF TLT is sending clear signals for fixed-income investors.

Since the Fed cut interest rates by 50 basis points last week, TLT’s price has fallen by 1.77%. This suggests that investors had already anticipated the rate cut, and their focus has shifted to ongoing concerns about inflation not cooling as much as expected, which may be driving skepticism in the bond market.

How TLT May React To The PCE Report

Analysts are looking for a modest 0.1% increase in month-over-month inflation for August, with an annual figure expected at 2.3%. If the PCE report shows lower inflation than expected, TLT could see a boost in price.

However, if inflation readings come in higher than expected, TLT might face more downward pressure, raising concerns about future inflation.

Read Also: Companies Run To Bond Markets After Last Week’s Fed Rate Cut

Short-Term Vs. Long-Term Bonds

The recent decline in TLT highlights the need for investors to see solid evidence that inflation is under control before committing to longer-term bonds.

Interestingly, the yield curve is steepening, which means investors might want to shift their focus from short-term investments to longer-term bonds.

For the first time in over two years, the yield on 10-year Treasuries has surpassed that of two-year Treasuries, signaling a potential trend shift.

According to Ian Lyngen, a strategist at BMO Capital Markets, this suggests investors are becoming more aware of the risks associated with rising inflation, Barron’s reports.

Why The PCE Report Is Crucial To TLT Investors

For TLT investors, this PCE report is crucial.

Keep an eye on the inflation numbers; lower readings could indicate a buying opportunity, while higher readings may prompt a reevaluation of bond holdings.

As the market adjusts to these dynamics, staying informed and ready to act will be key for maximizing returns in TLT.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kimco Realty Stock Rises 25.9% in Three Months: Here's How

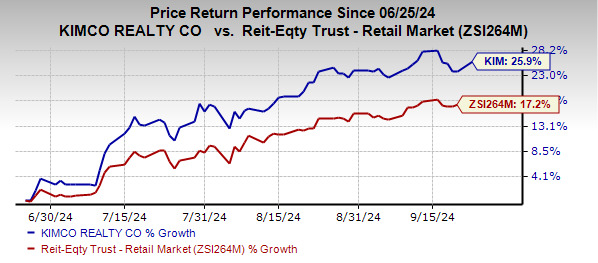

Shares of Kimco Realty KIM have soared 25.9% in the past three months compared with its industry’s rally of 17.2%.

This Jericho, NY-based retail real estate investment trust (REIT) is well-poised to benefit from its portfolio of premium shopping centers, which are predominantly grocery-anchored, in the drivable first-ring suburbs within key major metropolitan Sunbelt and coastal markets. Its focus on developing mixed-use assets and a healthy balance sheet position bode well for long-term growth.

Analysts seem bullish on this Zacks Rank #3 (Hold) company. The Zacks Consensus Estimate for its 2024 FFO per share grew nearly 1% over the past month to $1.62.

Image Source: Zacks Investment Research

Let’s find out the factors behind the surge in the stock price.

Kimco’s properties are located in the drivable first-ring suburbs within key major metropolitan Sunbelt and coastal markets. Particularly, 82% of the annual base rent (“ABR”) comes from its top major metro markets. Given the strategic location of its properties, it is likely to witness healthy demand in the near term, boosting leasing activity.

Kimco enjoys a diverse tenant base, led by a healthy mix of essential, necessity-based tenants and omni-channel retailers. National/regional tenants accounted for 81% of Kimco’s pro rata ABR as of the end of the second quarter of 2024. Given the strength of its retailers with a developed omnichannel presence, the company is likely to be able to generate stable cash flows.

During uncertain times, the grocery component saved the grace of the retail REITs. As of June 30, 2024, RPT’s acquisition has boosted its ABR from grocery-anchored centers to 83% from 81% in 2022. KIM has set a target to reach 85% of its ABR from this segment.

In the second quarter of 2024, Kimco witnessed 54 consecutive quarters of positive leasing spreads, indicating solid pricing power across its high-quality portfolio. Also, retention rates for the grocery portfolio remain higher compared with the non-grocery portfolio. Given the necessity-driven nature of Kimco’s grocery-anchored portfolio, it is likely to continue witnessing healthy leasing activity in the upcoming period and remains well-positioned to tide over challenging times.

Apart from having a focus on grocery and home-improvement tenants, the company emphasizes mixed-use assets clustered in strong economic metropolitan statistical areas. The mixed-use assets category is benefiting from the recovery in both the apartment and retail sectors.

KIM’s Strategic Acquisition & Redevelopment Projects

Kimco has been following an opportunistic investment policy to enhance its overall portfolio quality. This includes divesting its joint venture assets and using the proceeds to fund acquisitions and development and redevelopment projects. In the first half of 2024, the company disposed of 11 operating properties and seven land parcels in separate transactions for an aggregate sales price of $254.1 million.

The acquisition of RPT in January 2024 has benefited the company by increasing scale in high-growth target markets and preserving balance sheet strength. The company remains confident in achieving its 2024 acquisitions range of $300 million to $350 million, which is inclusive of structured investments.

It is actively pursuing redevelopment opportunities within its operating portfolio. The company projects its capital commitment toward these redevelopment projects and re-tenanting efforts for the remainder of 2024 will be within $225-$275 million.

KIM’s Solid Balance Sheet Position

Moreover, Kimco maintains a solid balance sheet position. It exited the second quarter of 2024 with $1.9 billion of immediate liquidity. Its consolidated weighted average debt maturity profile is 8.7 years. It also enjoys investment-grade ratings of BBB+ from S&P and Baa1 from Moody’s, rendering it favorable access to the debt market. With a healthy financial footing, KIM is well-positioned to capitalize on long-term growth opportunities.

Risks Likely to Affect KIM’s Positive Trend

A rise in e-commerce adoption and efforts of online retailers to go deeper into the grocery business are concerns. Kimco faces competition from several real estate companies and developers who compete with the company for leasing space in shopping centers for tenants. This may affect Kimco’s ability to raise rental rates, including renewal rates and fill up vacancies.

Stocks to Consider

Some better-ranked stocks from the retail REIT sector are Tanger Inc. SKT and Brixmor Property Group BRX, each currently carrying a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for SKT’s 2024 FFO per share stands at $2.09, indicating an increase of 6.6% from the year-ago reported figure.

The Zacks Consensus Estimate for BRX’s 2024 FFO per share is pinned at $2.13, suggesting year-over-year growth of 4.4%.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CarMax Q2 Earnings: Mixed Results As Sales Beat Expectations But Loan Losses Weigh On Profits

CarMax, Inc. KMX shares are currently trading higher after the company reported mixed second-quarter earnings results.

The company reported earnings per share of 85 cents, missing the analyst consensus estimate of 86 cents.

CarMax Auto Finance income was $115.6 million, a decline of 14.4% from last year’s second quarter. An increase in the provision for loan losses outweighed growth in CAF’s average managed receivables and a stable net interest margin percentage.

Quarterly sales of $7.01 billion beat the street view of $6.79 billion.

Also Read: What’s Going On With Southwest Airlines Stock After Guidance Update?

Retail used unit sales rose by 5.1%, while comparable store used unit sales increased by 4.3% compared to the second quarter of the previous year; however, wholesale units saw a slight decline of 0.3%.

Gross profit per retail used unit was $2,269, and gross profit per wholesale unit was $975, both consistent with last year. The Extended Protection Plan (EPP) margin increased by $69 per retail unit to $575, while the service margin grew by $84 per retail unit compared to the second quarter of the previous year.

“We grew retail used unit sales, delivered strong margins, continued to manage SG&A, and drove double-digit earnings growth while managing through industry wide auto loan loss pressure,” said Bill Nash, president and chief executive officer.

During the second quarter of fiscal 2025, the company opened two new store locations in El Paso, Texas and Gainesville, Georgia.

In fiscal year 2025, the firm plans to open a total of five new store locations, one stand-alone reconditioning center, and one stand-alone auction facility.

The company exited the quarter with cash and equivalents worth $1.25 billion. Inventories at quarter-end was $3.397 billion.

As of August, the company had $2.15 billion remaining available for repurchase under the outstanding authorization.

Price Action: KMX shares are trading higher by 3.8% to $77.32 at last check Thursday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From Costco Stock Ahead Of Q4 Earnings

When Costco Wholesale Corporation COST releases earnings for the fourth quarter after the closing bell on Thursday, analysts expect the bulk retailer to report quarterly earnings at $5.08 per share.

That’s up from $4.86 per share a year ago. Costco projects to report revenue of $79.97 billion, compared to $78.94 billion a year earlier, according to Benzinga Pro.

On Sept. 24, Truist Securities analyst Scot Ciccarelli downgraded the Issaquah, Washington-based company from Buy to Hold and maintained the price target of $873.

With the recent buzz around Costco, some investors may be eyeing potential gains from the company’s dividends. As of now, Costco has a dividend yield of 0.51%. That’s a quarterly dividend amount of $1.16 a share ($4.64 a year).

To figure out how to earn $500 monthly from Costco, start with a yearly target of $6,000 ($500 x 12 months).

Next, we take this amount and divide it by Costco’s $4.64 dividend: $6,000 / $4.64 = 1,293 shares

An investor would need to own approximately $1,174,587 worth of Costco, or 150,000 shares to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $4.64 = 259 shares, or $235,281 to generate a monthly dividend income of $100.

Note that dividend yield can change on a rolling basis. The dividend payment and the stock price both fluctuate over time.

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

COST Price Action: Shares of Costco gained 0.8% to close at $908.42 on Wednesday.

Read More:

Image: Flickr/Mike Mozart

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

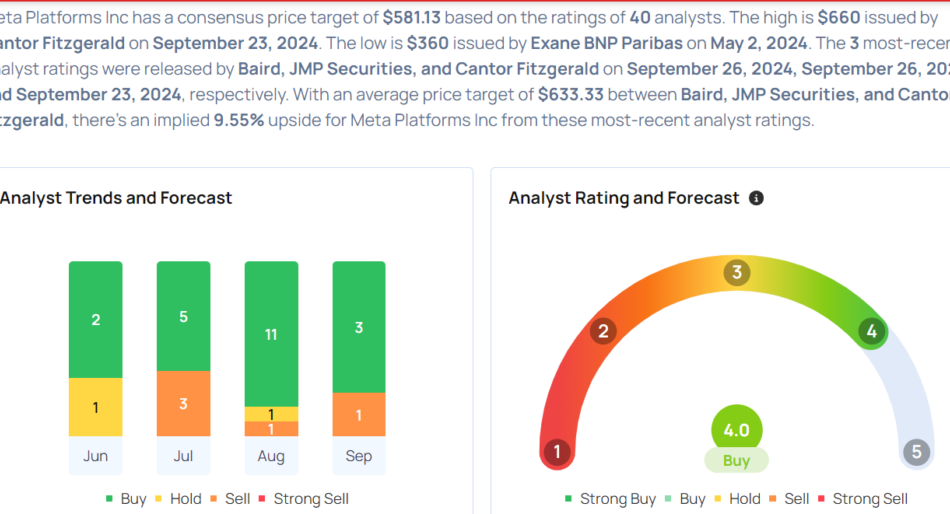

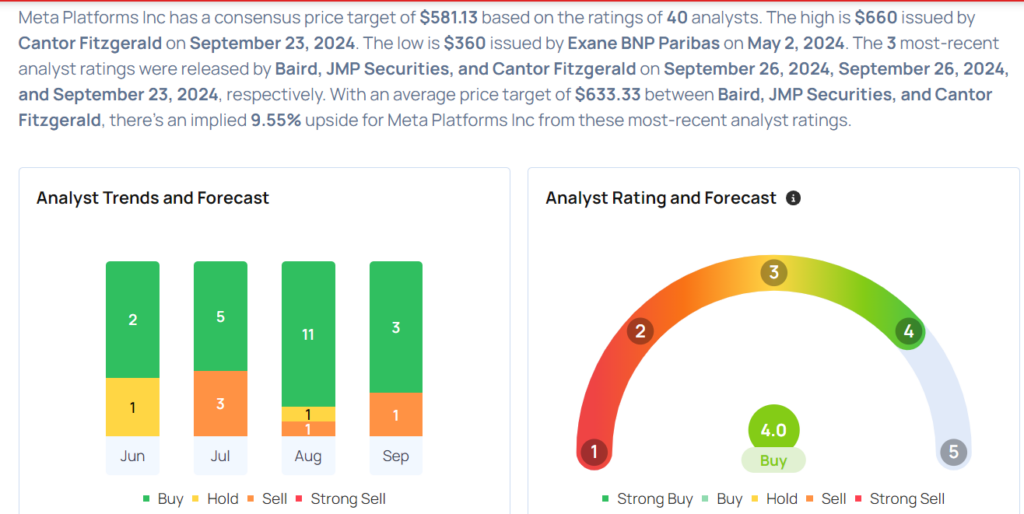

Meta To Rally Around 12%? Here Are 10 Top Analyst Forecasts For Thursday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Bernstein raised the price target for Starbucks Corporation SBUX from $92 to $115. Bernstein analyst Danilo Gargiulo upgraded the stock from Market Perform to Outperform. Starbucks shares rose 1.2% to close at $95.62 on Wednesday. See how other analysts view this stock.

- JMP Securities increased the price target for Meta Platforms, Inc. META from $550 to $635. JMP Securities analyst Andrew Boone maintained a Market Outperform rating. Meta shares gained 0.9% to close at $568.31 on Wednesday. See how other analysts view this stock.

- Keybanc raised Crocs, Inc. CROX price target from $149 to $155. Keybanc analyst Ashley Owens maintained an Overweight rating. Crocs shares fell 1.2% to close at $143.04 on Wednesday. See how other analysts view this stock.

- Baird boosted McDonald’s Corporation MCD price target from $280 to $320. Baird analyst David Tarantino maintained an Outperform rating. McDonald’s shares rose 0.1% to close at $300.47 on Wednesday. See how other analysts view this stock.

- Baird raised Cintas Corporation CTAS price target from $194 to $209. Baird analyst Andrew Wittmann maintained a Neutral rating. Cintas shares gained 1.2% to close at $207.21 on Wednesday. See how other analysts view this stock.

- Keybanc raised the price target for On Holding AG ONON from $47 to $60. Keybanc analyst Ashley Owens maintained an Overweight rating. On Holding fell 0.7% to close at $50.20 on Wednesday. See how other analysts view this stock.

- BMO Capital raised Lightspeed Commerce Inc. LSPD price target from $18 to $20. BMO Capital analyst Thanos Moschopoulos maintained an Outperform rating. Lightspeed Commerce shares jumped 12.9% to close at $15.68 on Wednesday. See how other analysts view this stock.

- Piper Sandler raised the price target for Ecolab Inc. ECL from $270 to $305. Piper Sandler analyst Charles Neivert maintained an Overweight rating. Ecolab shares gained 0.2% to close at $254.82 on Wednesday. See how other analysts view this stock.

- Benchmark raised Flutter Entertainment plc FLUT price target from $255 to $265. Benchmark analyst Mike Hickey maintained a Buy rating. Flutter Entertainment shares gained 5.1% to close at $239.86 on Wednesday. See how other analysts view this stock.

- Goldman Sachs increased State Street Corporation STT price target from $98 to $100. Goldman Sachs analyst Alexander Blostein maintained a Buy rating. State Street shares fell 0.5% to close at $88.50 on Wednesday. See how other analysts view this stock.

Considering buying META stock? Here’s what analysts think:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Space Stocks That Could Be the Next Intuitive Machines

On Feb. 22, 2024, Intuitive Machines (NASDAQ: LUNR) landed its Odysseus uncrewed vehicle on the moon. In some ways, the landing was suboptimal — most notably, Odysseus toppled over after landing, limiting its ability to communicate with Earth.

On the other hand, though, even its less than 100% perfect landing accomplished something for Intuitive Machines that the U.S. hasn’t done in more than 50 years: put a lander on the moon. What’s more, this was the first successful moon landing ever by a private commercial company, arguably giving Intuitive Machines a pole position to win further contracts to put payloads on the moon. Indeed, Intuitive Machines is winning additional contracts, a $117 million contract earlier this month and a gigantic $4.8 billion contract just this past Tuesday!

Now, some other space companies want a piece of this moon action.

Firefly and Blue Ghost

The first company to attempt will be privately owned Firefly Aerospace. In November, the company will use a SpaceX Falcon 9 rocket to launch its Blue Ghost lunar lander, then attempt to land Blue Ghost and its 10 scientific experiment payloads on the moon.

Why isn’t Firefly flying Blue Ghost on its own rocket? Currently, Firefly’s Alpha launch vehicle isn’t big enough to hoist Blue Ghost all the way to the moon. However, a new rocket design dubbed the Medium Launch Vehicle, built in cooperation with Northrop Grumman, will be big enough to carry Blue Ghost once completed.

If it’s successful, the new rocket should give Firefly an economic advantage over Intuitive Machines because it won’t need to pay for rockets from another provider and can keep that money in-house.

ispace and Hakuto

Our next private company contender to duplicate Intuitive Machines’ success is Japan’s ispace (not to be confused with China’s iSpace — although I guarantee there will be confusion). In 2022, ispace attempted to land a Hakuto lander, but software glitches caused the lander to run out of fuel prematurely. Unable to brake effectively, it crash-landed hard on the moon.

Japan’s ispace intends to try again in December when a second Hakuto lander named “Resilience” will piggyback on a SpaceX Falcon 9 rocket en route to Earth’s biggest satellite. Resilience will attempt to put six payloads on the moon, including a small Tenacity rover.

A little more on Intuitive Machines

Making all of the above even more interesting, Intuitive Machines plans to launch its second lunar lander, IM-2, potentially as early as the fourth quarter of 2024. This sets up a race not only for who will be first to match Intuitive Machines’ achievement but also for ispace, Firefly, or both, to potentially fail at the same time as Intuitive Machines scores its second successful landing on the moon!

Be aware that all these launch dates are targets only. Launch schedules often shift in response to delays in development and in getting payloads ready for integration, bad weather delaying rocket takeoff, and so on.

In Reentry, his latest book about SpaceX’s development, space journalist Eric Berger says the timelines posited by space companies are often wishful thinking, describing what might happen if someone tried to drive the 30 miles between SpaceX headquarters in Hawthorne and Malibu, California, hitting nothing but “green lights” all the way. In other words, these launch dates could happen, but it’s probably safer to expect delays.

Still, in a world of nothing but green lights, space investors could theoretically see anywhere from zero to three moon landings over the next three months.

What it means for investors

What does this mean for investors? In an uber-optimistic scenario, let’s say all three landers reach the moon intact. That would be good news for Intuitive Machines (especially if its own lander lands upright this time).

But it would also be bad news, breaking the company’s monopoly on successful moon landings by a commercial company and introducing market competition that could depress prices and postpone profits for the only one of these three companies that is also a publicly traded stock.

For investors and space fans, however, this would introduce the possibility that newly successful lunar landers ispace and Firefly might capitalize on their success by conducting initial public offerings (IPO), creating even more space stocks for us to invest in. (Notably, Firefly has hinted that an IPO might be in its future.)

Of course, a less-happy scenario in which all three landers crash would be bad news for all companies involved. It would probably erase much of the 40% gain Intuitive Machines stock has made this year and postpone IPO prospects for the others. A mixture of successes and failures would yield mixed results.

One thing’s for certain: It’s going to be an interesting three months, and you know I’ll be watching closely.

Should you invest $1,000 in Intuitive Machines right now?

Before you buy stock in Intuitive Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intuitive Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Rich Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2 Space Stocks That Could Be the Next Intuitive Machines was originally published by The Motley Fool

SPAC King Chamath Palihapitiya Forecasts How AI Will Transform Healthcare Sector: 'It's Not All Roses, But Some Areas…Are Just Bananas'

Chamath Palihapitiya, the billionaire investor and former Facebook executive, has shared his insights on the potential of artificial intelligence to revolutionize the healthcare industry.

What Happened: In a podcast interview with Joe Rogan that was posted on Wednesday, Palihapitiya, the founder of Social Capital, discussed the potential of AI.

“It’s not all roses, but some areas if you imagine them, I’ll give you a couple if you want, are just bananas, I think,” he stated.

He then gave the example of cancer surgeries as the most likely scenario, saying that AI could reduce surgery error rates from 30% to 0%. “What’s amazing is that is now working its way through the FDA.”

Palihapitiya noted that the current error rate in cancer surgeries, particularly in breast cancer, is approximately 30% across all U.S. hospitals.

This rate can even increase to 40% in regional hospitals. He attributed this not to the incompetence of doctors, but to the challenge of accurately identifying the boundaries of cancerous tissue.

See Also: Elon Musk Reacts After Mark Cuban Says He Would Buy X ‘In A Heartbeat’

He suggested that AI could be the solution to this problem. “We have models, we have tissue samples of women of all ages, of all races,” he stated.

These could be used to train AI systems to accurately identify cancerous tissue, potentially reducing the error rate to zero.

The SPAC king predicted that within the next two years, AI assistants could be present in operating rooms, assisting surgeons in accurately removing cancerous tissue.

He said that this technology is not limited to breast cancer, but could be applied to lung, pancreatic, stomach, and colon cancer as well.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: Palihapitiya isn’t the only person optimistic about AI’s integration into the healthcare industry. Several other players, including big tech companies, have made progress in the same direction.

For instance, earlier this year, Nvidia Corporation revealed major partnerships with Johnson & Johnson and GE Healthcare to incorporate generative AI into surgical procedures and improve medical imaging.

In June 2024, ChatGPT-parent OpenAI, in collaboration with the startup Color Health, launched a new initiative aimed at leveraging AI to improve cancer screening and treatment strategies.

Meanwhile, during this conversation with Rogan, Palihapitiya also touched on a range of topics, including immigration and the media portrayal of former President Donald Trump. His statement about Trump was also acknowledged by Tesla and SpaceX CEO Elon Musk.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Douglas Elliman's Top Agent With $3B Record Sales Speaks on Fed Cut's Effect On Market Rate As 'People Start Tiptoeing Back Into Financing'

Noble Black, Douglas Elliman’s leading agent with over $3 billion in sales, expects the Federal Reserve’s rate cut to energize the real estate market.

Speaking on CNBC’s Power Lunch last week, Black noted that buyers are already responding to lower interest rates.

“We’re seeing increased activity, particularly in hot markets,” Black said. He pointed to a surge in signed contracts this summer, with Manhattan up 30% and Brooklyn 50% compared to last year.

Don’t Miss:

While cash deals have dominated the market for the past 18 months, Black said he is seeing a gradual shift. “You’re starting to see people start tiptoeing back into financing,” he said, predicting that even those able to pay cash might opt for mortgages as rates decrease.

The 0.50% rate cut the Fed enacted last week raises questions about housing affordability. Black acknowledged that lower rates could initially drive prices up due to increased demand. However, he said there are long-term benefits.

See Also: Will the surge continue or decline on real estate prices? People are finding out about risk-free real estate investing that lets you cash out whenever you want.

“Lower rates are going to mean that more people are going to build houses, more builders get back in and, I mean, we have a housing crisis in the sense that nationally there’s not enough [inventory]. We need people building more houses, we need it to be easier for them to build more houses.”

For potential buyers, Black advised against waiting. “Long term I think this is the right direction, but short term if buyers are sitting waiting, it’s the wrong move,” he said, warning that delaying could lead to higher prices and reduced affordability, even with lower interest rates.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

Black also addressed the broader issue of housing supply. He called for the next Presidential administration to reduce “red tape” (regulations) on builders, describing the current regulatory environment as an “unnecessary layer” that is hindering construction.

“You know I really think the biggest thing is red tape. What [builders] have to go through and the hurdles that they have to go through to build. All of the regulations and the different things you have to satisfy, whether it’s state or national level – there are so many impediments.”

He continued, “They almost add a different layer or an additional unnecessary layer on top of that. They say you want more housing but in some sense they make it very hard for the builders to build.”

Trending: Unlock the hidden potential of commercial real estate — This platform allows individuals to invest in commercial real estate offering a 12% target yield with a bonus 1% return boost today!

If elected in November, Vice President Kamala Harris has promised to build three million housing units over the next four years. Harris has also proposed new tax breaks for first-time buyers.

Meanwhile, while former President Donald Trump hasn’t said much about how he’d handle housing affordability, the GOP says it will reduce mortgage rates by defeating inflation. It also said that it would allow new home construction on some portion of Federal land.

As the market anticipates the Fed’s moves (which include two additional rate cuts before the year ends), Black provides insights to the real estate industry. Potential changes in financing, pricing and construction on the horizon may reshape the landscape for buyers, sellers and builders in the coming months.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.