Market Whales and Their Recent Bets on NVDA Options

Investors with a lot of money to spend have taken a bullish stance on NVIDIA NVDA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with NVDA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 275 uncommon options trades for NVIDIA.

This isn’t normal.

The overall sentiment of these big-money traders is split between 44% bullish and 41%, bearish.

Out of all of the special options we uncovered, 19 are puts, for a total amount of $914,225, and 256 are calls, for a total amount of $15,362,431.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $70.0 and $160.0 for NVIDIA, spanning the last three months.

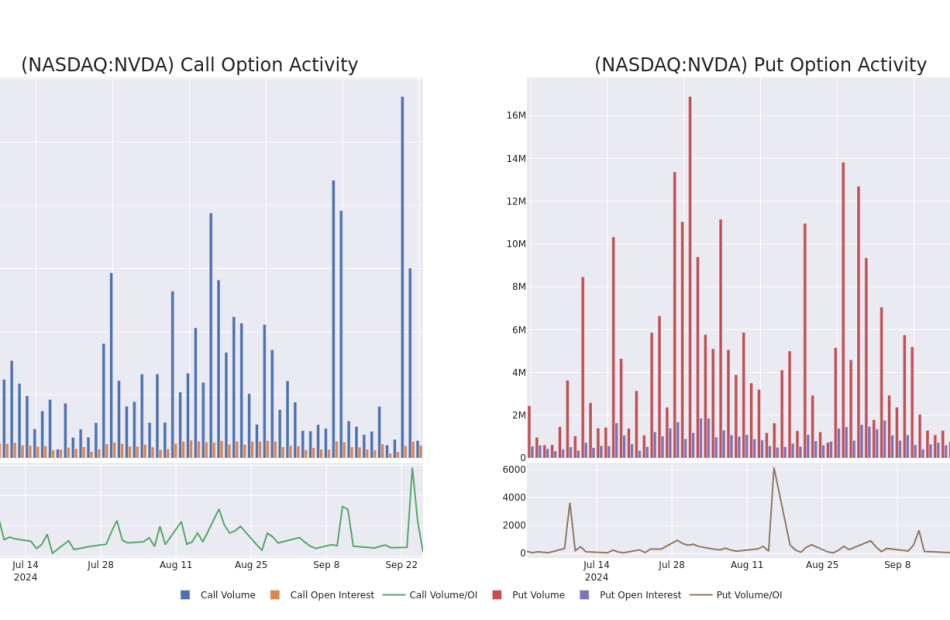

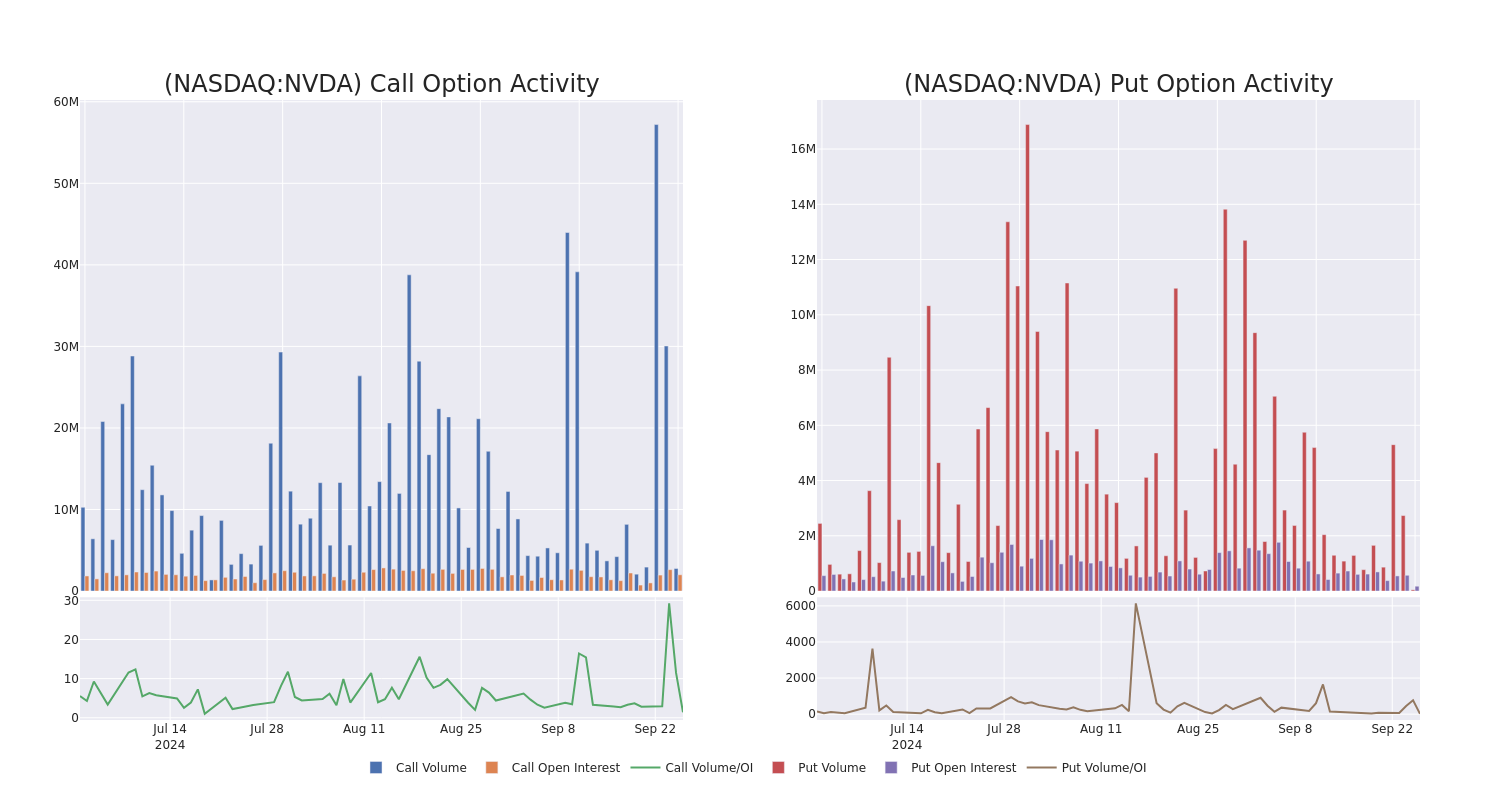

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for NVIDIA’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NVIDIA’s whale activity within a strike price range from $70.0 to $160.0 in the last 30 days.

NVIDIA Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | BULLISH | 11/15/24 | $3.55 | $3.45 | $3.5 | $145.00 | $198.1K | 16.5K | 1.4K |

| NVDA | CALL | SWEEP | BEARISH | 09/27/24 | $2.67 | $2.64 | $2.64 | $125.00 | $131.2K | 104.3K | 31.2K |

| NVDA | CALL | SWEEP | BULLISH | 09/27/24 | $3.5 | $3.45 | $3.45 | $124.00 | $114.1K | 79.7K | 9.5K |

| NVDA | CALL | TRADE | BEARISH | 10/04/24 | $6.05 | $5.95 | $5.99 | $123.00 | $92.8K | 11.9K | 1.7K |

| NVDA | CALL | TRADE | BULLISH | 10/04/24 | $4.6 | $4.5 | $4.57 | $125.00 | $91.4K | 36.6K | 11.7K |

About NVIDIA

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

After a thorough review of the options trading surrounding NVIDIA, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of NVIDIA

- Currently trading with a volume of 20,976,326, the NVDA’s price is up by 2.21%, now at $126.24.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 54 days.

Expert Opinions on NVIDIA

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $162.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Raymond James keeps a Strong Buy rating on NVIDIA with a target price of $140.

* An analyst from Benchmark has revised its rating downward to Buy, adjusting the price target to $170.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for NVIDIA, targeting a price of $155.

* An analyst from Rosenblatt persists with their Buy rating on NVIDIA, maintaining a target price of $200.

* An analyst from Truist Securities persists with their Buy rating on NVIDIA, maintaining a target price of $148.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NVIDIA options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top 3 Materials Stocks You'll Regret Missing This Quarter

The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

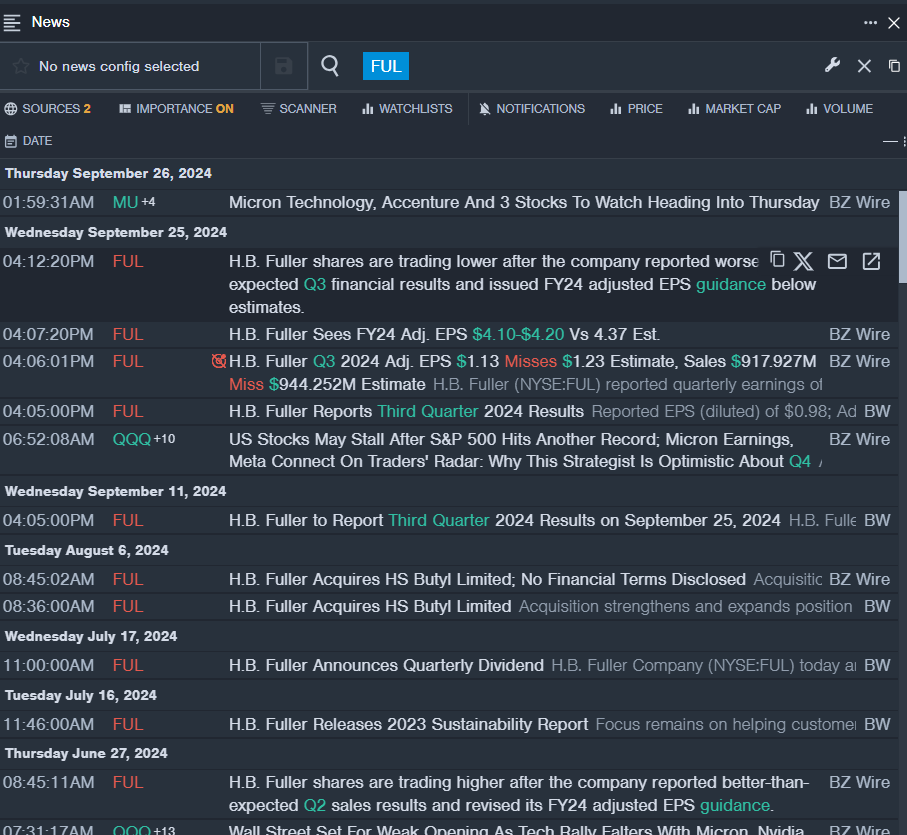

H.B. Fuller Company FUL

- On Sept. 25, H.B. Fuller reported worse-than-expected third-quarter financial results and issued FY24 adjusted EPS guidance below estimates. H.B. Fuller President and CEO Celeste Mastin said, “In the third quarter, we continued to advance our strategy and expand EBITDA margins through volume growth, restructuring actions, and the acquisition of highly profitable, fast-growing businesses.” The company’s stock fell around 3% over the past five days and has a 52-week low of $64.64.

- RSI Value: 28.45

- FUL Price Action: Shares of H.B. Fuller fell 1.8% to close at $80.63 on Wednesday.

- Benzinga Pro’s real-time newsfeed alerted to latest FUL news.

Clearwater Paper Corp CLW

- On Aug. 6, Clearwater Paper reported quarterly losses of $1.55 per share. “We completed the acquisition of the Augusta facility in May and our integration is on track. We are pleased with the quality of the assets and are committed to achieving our targeted synergies by the end of 2026,” said Arsen Kitch, president and chief executive officer. “Our tissue business continues to deliver outstanding performance, and we are expecting a gradual recovery in paperboard market demand in the coming quarters.” The company’s stock fell around 15% over the past month. It has a 52-week low of $27.69.

- RSI Value: 28.90

- CLW Price Action: Shares of Clearwater Paper fell 4.7% to close at $28.40 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in CLW stock.

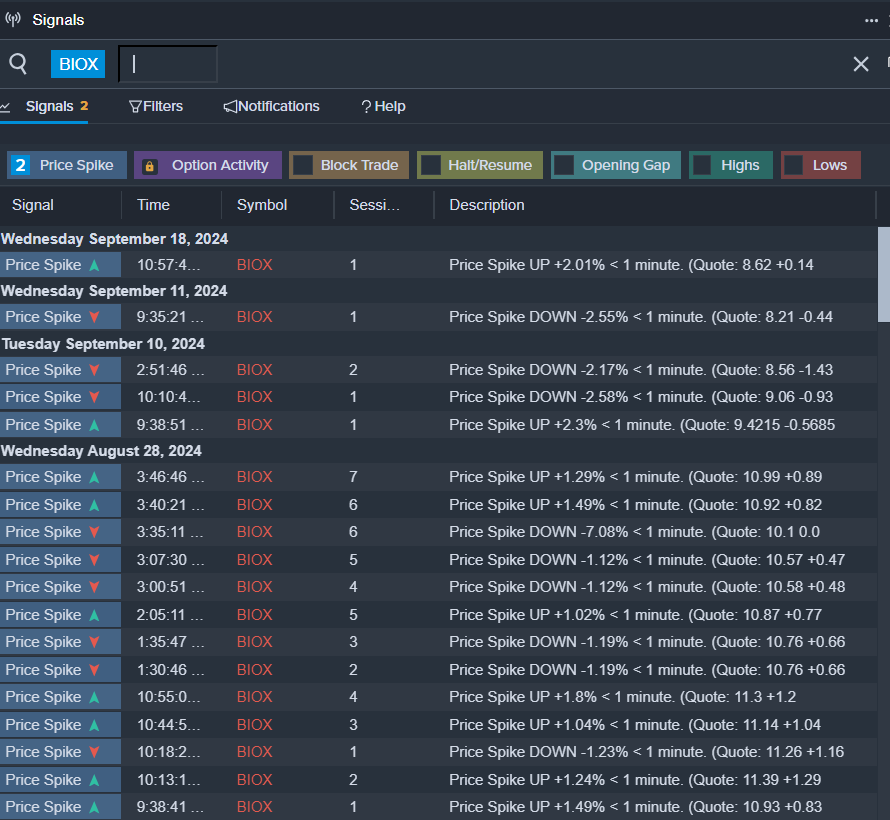

Bioceres Crop Solutions Corp BIOX

- On Sept. 9, Bioceres reported worse-than-expected fourth-quarter sales results. Mr. Federico Trucco, Bioceres´ Chief Executive Officer, commented, “In fiscal year 2024 we consolidated Bioceres’ financial performance at record-high revenue and adjusted EBITDA levels, despite it having been another challenging year for agriculture, with on-farm economics declining in key crops and geographies.” The company’s shares fell around 22% over the past month and has a 52-week low of $7.74

- RSI Value: 21.88

- BIOX Price Action: Shares of Bioceres Crop Solutions fell 3.3% to close at $7.85 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in BIOX shares.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oil Extends Sharp Drop on Prospect for More Saudi, Libyan Supply

(Bloomberg) — Oil slid for the second day as Saudi Arabia was reportedly committed to increasing output in December, while Libya named its new central bank governor, opening the way to reviving some crude production.

Most Read from Bloomberg

West Texas Intermediate dropped about 3% to near $67 a barrel while global benchmark Brent was around $71 a barrel. Saudi Arabia is ready to abandon its unofficial oil price target of $100 a barrel in a bid to regain market share, the Financial Times reported, citing people familiar with the country’s stance.

Representatives from Libya’s rival eastern and western administrations signed an agreement to name Naji Issa as the new governor of Libya’s central bank, a move aimed at ending an impasse over the stewardship of the regulator that had crippled oil exports. Libya’s eastern-based government has also promised to reopen the country’s oil fields shortly, the United Nations’ envoy to the OPEC state, Stephanie Koury, said Thursday in a televised press conference.

The potential revival in Saudi and Libyan production comes after crude earlier this month fell to the lowest since 2021, hurt by the prospect of additional supply from OPEC+ and China’s dour economic outlook. The International Energy Agency has said global oil markets will be oversupplied next year with or without extra OPEC+ supplies because of surging output from outside the group.

“There is no room for more OPEC+ oil on the market if the cartel wants an oil price close to $80 in 2025,” analysts at A/S Global Risk Management said in a report. “We assess that the Saudis are trying to put significant pressure on the quota cheaters.”

Meanwhile, the US, European Union, and major powers in the Middle East have proposed a three-week cease-fire between Israel and Hezbollah in Lebanon, part of a bid to clear the way for negotiations and avert an all-out war in the region. Israel ordered the military to keep bombarding Hezbollah targets in Lebanon and denied interest in a truce.

While oil traders had largely shrugged off China’s earlier monetary stimulus measures, President Xi Jinping on Thursday called for the government to provide more fiscal spending, underscoring the growing anxiety in Beijing over the nation’s slowing growth.

Hurricane Helene is gaining power as the system churns toward Florida, where it’s forecast to make landfall Thursday evening or early Friday. Oil and gas companies had evacuated some offshore workers in the Gulf of Mexico and shut in around 29% of oil production as of Wednesday.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

–With assistance from Julian Lee and Paul Burkhardt.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

'Safety Disaster:' Tesla FSD 'Galaxies Away From Being Anywhere Close To Competition,' Says Bearish Analyst, As He Assigns Zero Valuation To The Tech

With just two weeks to go for Tesla, Inc.’s TSLA Robotaxi unveil event, an analyst painted a bleak picture of the company’s self-driving technology.

What Happened: Tesla’s FSD, which is now promoted as fully-supervised FSD, is a “safety disaster” and “galaxies away from being anywhere close to the competition,” said GLJ Research’s Gordon Johnson in a note. Tesla’s competitors in this arena are Alphabet, Inc.’s GOOGL GOOG Waymo and General Motors Corp.’s GM Cruise.

With Tesla eyeing the rollout of its Fully Supervised FSD in China, the Elon Musk-led company would be up against domestic player Baidu, Inc.’s BIDU Apollo Go.

Johnson referenced reviews by two sources to make his case. Independent lab AMCI Testing, which tried the technology, said the overall performance of Tesla’s camera-enabled autonomous-driving software is “suspect.” In a report released on Tuesday, the firm said its evaluation showed how often human intervention was required for safe operation. “In fact, our drivers had to intervene over 75 times during the evaluation; an average of once every 13 miles,” it said.

While the FSD 12.5.1 was impressive, it is incredibly dangerous for drivers operating with FSD to drive with their hands in their laps or away from the steering wheels, it said. “The most critical moments of FSD miscalculation are split-second events that even professional drivers, operating with a test mindset, must focus on catching,” it added.

Johnson also referred to data from Teslafsdtracker.com, which aggregates TSLA FSD driving experiences/data, in real-time from users, which shows that the latest iteration of FSD has a critical disengagement every 130 miles and every 72 miles when driven in a city.

See Also: How To Buy Tesla (TSLA) Stock

Data reported by competitors to the California Department of Motor Vehicles show that miles to disengagement data for various players are as follows:

- Waymo: 17,311 miles

- Amazon, Inc.’s AMZN Zoox: 177,602 miles

- Pony.Ai (startup): 17,077 miles

- WeRide (startup): 21,191 miles

The metric for Tesla is 13 miles, based on AMCI’s statistics, Johnson said, although Tesla doesn’t yet report data to California DMV, given its FSD tech is only Level 2.

Why It’s Important: Johnson noted that many sell-side analysts assign a valuation of $300 billion to $600 billion for Tesla’s FSD technology. In real-time, the value is close to zero, he said, adding that it could be negative, given the “liability of putting something this dangerous on roads.”

According to Ark’s valuation model, by 2029, robotaxis, which has FSD as its core technology, would account for 63% of Tesla’s revenue and 86% of EBITDA.

Future Fund LLC Managing Partner Gary Black, a Tesla bull, said in a recent post on X that Tesla’s FSD is not yet close to the 99.99% efficacy needed for unsupervised autonomy.

In premarket trading on Thursday, Tesla rose 2.05% to $262.30, according to Benzinga Pro data.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Taiwan Semiconductor, American Tower, Trane Technologies And A Health Care Stock On CNBC's 'Final Trades'

On CNBC’s “Halftime Report Final Trades,” Stephen Weiss of Short Hills Capital Partners said he still finds Taiwan Semiconductor Manufacturing Company Limited TSM cheap.

On Monday, Taiwan Semiconductor Manufacturing bagged the government’s approval for an additional $7.5 billion infusion into Taiwan Semiconductor Arizona unit, the Taipei Times cited the Department of Investment Review statement.

Amy Raskin of Chevy Chase Trust named Regeneron Pharmaceuticals, Inc. REGN.

Chief District Judge Thomas Kleeh denied Regeneron Pharmaceuticals’ effort to prevent the sale of Amgen Inc’s AMGN Eylea biosimilar. Regeneron filed a notice of its appeal to the U.S. Court of Appeals for the Federal Circuit.

Don’t forget to check out our premarket coverage here

Kari Firestone of Aureus Asset Management picked American Tower Corporation AMT as her final trade.

On Sept. 23, JP Morgan analyst Philip Cusick maintained American Tower with an Overweight rating and raised the price target from $240 to $250.

Joseph M. Terranova of Virtus Investment Partners named Trane Technologies plc TT.

On July 31, Trane Technologies reported better-than-expected second-quarter financial results and raised its FY24 guidance. Revenues grew 13% Y/Y to $5.31 billion, surpassing the consensus of $5.13 billion. Bookings increased 19% Y/Y to$5.34 billion in the quarter. Adjusted EPS of $3.30 surpassed the street view of $3.08.

Price Action:

- Taiwan Semiconductor gained 0.2% to close at $182.35 during Wednesday’s session.

- Regeneron Pharmaceuticals shares fell 1.4% to settle at $1,031.15 on Wednesday.

- American Tower fell 0.4% to close at $235.63 during Wednesday’s session.

- Trane Technologies shares gained 1% to close at $387.70 on Wednesday.

Check This Out:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2024 International Youth Forum on Creativity and Heritage along the Silk Road: Young People Can Create Their Own "Digital Age"

CHANGSHA, China, Sept. 26, 2024 (GLOBE NEWSWIRE) — The 2024 International Youth Forum on Creativity and Heritage Along the Silk Road kicked off in Changsha on Monday. The forum is held in Changsha and Nanjing from September 22 to 28.

A Media Snippet accompanying this announcement is available by clicking on this link.

The forum, themed “Reimagining Our Heritage: Stories of Resilience and Change,” discussed the new opportunities and challenges brought by big data, artificial intelligence, metaverse, and other new technologies to the inheritance and protection of cultural heritage in the era of digitalization and globalization.

60 young representatives from 53 countries (including China) along the Silk Road, representatives from UNESCO’s “Creative Cities Network” member cities at home and abroad, gathered to exchange ideas and engage in cross-cultural dialogue.

During the forum, in addition to academic sharing and exchanges, many experiential activities were also held, such as the Sino-foreign Youth Gala Evening, Changsha Intangible Cultural Heritage Experience, and Night Tour of Tianxinge Pavilion, allowing participants to personally experience the unique charm of Changsha as the “World’s Media Arts Capital.” Through communication and exchanges, young people from various countries generated ideas collisions, carried out cooperation and enhanced friendships through experiential interactions, and also provided new ideas and paths for the protection and inheritance of youth creativity and heritage.

Source: Organizing Committee of 2024 International Youth Forum on Creativity and Heritage Along the Silk Road

Contact person: Mr. Zou, Tel: 86-10-63074558

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

HOME OWNERSHIP SLIGHTLY MORE AFFORDABLE ACROSS U.S. IN THIRD QUARTER BUT STILL DIFFICULT FOR AVERAGE WORKERS

Major Home-Ownership Expenses Consume 34 Percent of National Average Wage; Portion Ticks Downward as Home-Price Spike Eases and Mortgage Rates Drop; Historical Affordability Also Inches Up While Remaining Weak

IRVINE, Calif., Sept. 26, 2024 /PRNewswire/ — ATTOM, a leading curator of land, property data, and real estate analytics, today released its third-quarter 2024 U.S. Home Affordability Report showing that median-priced single-family homes and condos remain less affordable in the third quarter of 2024 compared to historical averages in 99 percent of counties around the nation with sufficient data to analyze. The latest trend continues a pattern, dating back to early 2022, of home ownership requiring historically large portions of wages as U.S. home prices keep reaching new highs.

The report also shows that major expenses on median-priced homes currently consume 33.5 percent of the average national wage. That level marks a slight improvement over the second quarter of this year but remains virtually unchanged from a year ago – and still above the common 28 percent lending guideline.

Despite small gains in both the historic and current affordability measures, the third-quarter figures represent ongoing markers of how home ownership remains a financial stretch for average workers around the nation. They come as the national median home price has spiked to $365,000 this quarter and mortgage rates, while declining, remain above 6 percent, helping to keep ownership expenses above what lenders prefer when issuing mortgages.

The portion of average wages nationwide required for typical mortgage payments, property taxes and insurance still sits 12 points above a low point reached early in 2021, right before home-mortgage shot up from the lowest levels in decades.

“Home affordability continues to show signs of easing, which lightens the pressure on house hunters struggling to find a place that fits their budget,” said Rob Barber, CEO for ATTOM. “The cost of owning a home across much of the nation remains a tough go for average workers, exceeding levels preferred by banks and other lenders. But it is at least tracking in the right direction. That’s mainly because of declining interest rates.”

Barber added that last week’s half-point cut in the benchmark interest rate by the Federal Reserve “should brighten the prospects for buyers, as long as it doesn’t spike demand too much and lead to even higher prices amid the ongoing tight supply of homes for sale around the U.S.”

The small shift toward better affordability this quarter comes amid a mix of forces generally, but not completely, working in favor of home buyers.

On the downside for house hunters are home prices and property taxes that continue to rise across the country in 2024, helping to keep affordability at historical lows. At the same time, though, a steady decline in home-mortgage rates in 2024, from more than 7 percent down to close to 6 percent, is acting as a counterweight. In addition, the national median home has increased at a slower pace this quarter versus the prior three-months.

The result over the Summer months has been a 3 percent decrease in the typical cost of major home-ownership expenses at a time when average wages have grown. That combination is pushing affordability back in a better direction for house hunters. While major expenses as a portion of wages is unchanged annually, it has declined for the second straight quarter.

The report determined affordability for average wage earners by calculating the amount of income needed to meet major monthly home ownership expenses — including mortgage payments, property taxes and insurance — on a median-priced single-family home and condo, assuming a 20 percent down payment and a 28 percent maximum “front-end” debt-to-income ratio. That required income was then compared to annualized average weekly wage data from the U.S. Bureau of Labor Statistics (see full methodology below).

Compared to historical levels, median home ownership costs in 575 of the 578 counties analyzed in the third quarter of 2024 are less affordable than in the past. That is mostly unchanged from both the second quarter of 2024 and the third quarter of 2023, when 574 of the same counties were historically unaffordable.

Historic measures remain negative as the portion of average local wages consumed by major home-ownership expenses on typical homes are considered unaffordable during the third quarter of 2024 in about 80 percent of the 578 counties in the report, based on the 28 percent guideline. Counties with the largest populations that are unaffordable in the third quarter are Los Angeles County, CA; Cook County (Chicago), IL; Maricopa County (Phoenix), AZ; San Diego County, CA, and Orange County, CA (outside Los Angeles).

The most populous of the counties with affordable levels of major expenses on median-priced homes during the third quarter of 2024 are Harris County (Houston), TX; Wayne County (Detroit), MI; Philadelphia County, PA; Cuyahoga County (Cleveland), OH, and Allegheny County (Pittsburgh), PA.

View Q3 2024 U.S. Home Affordability Heat Map

National median home price up quarterly and annually in majority of markets

The national median price for single-family homes and condos has risen to $365,000 in the third quarter of 2024. The latest figure represents a 1.4 percent increase over the second quarter of this year and is 6.6 percent above the typical price in the third quarter of 2023, although the pace of increase has slowed compared. (Typical values shot up 7 percent from the first to the second quarter of this year).

At the county level, median home prices have climbed from the second quarter to the third quarter of this year in 363, or 62.8 percent, of the 578 counties included in the report. Annually, they are up in 492, or 85.1 percent of those markets.

Data was analyzed for counties with a population of at least 100,000 with sufficient data and at least 50 single-family home and condo sales in the third quarter of 2024.

Among the 46 counties in the report with a population of at least 1 million, the biggest year-over-year increases in median prices during the third quarter of 2024 are in Wayne County (Detroit), MI (up 12.3 percent annually); Suffolk County (Long Island), NY (up 12.1 percent); Philadelphia County, PA (up 11.8 percent); Cuyahoga County (Cleveland), OH (up 9.6 percent) and Montgomery County, MD (outside Washington, DC) (up 9.4 percent).

Counties with a population of at least 1 million where median prices remain down the most from the third quarter of 2023 to the same period this year are Alameda County (Oakland), CA (down 12.8 percent); Travis County (Austin), TX (down 4.3 percent); Honolulu County, HI (down 3.9 percent); Collin County (Plano), TX (down 1.9 percent) and New York County (Manhattan), NY (down 0.6 percent).

Prices keep improving more than wages around nation

As home values keep rising throughout most of the U.S. this quarter, year-over-year price changes have outpaced changes in weekly annualized wages during the third quarter of 2024 in 411, or 71.1 percent, of the 578 counties analyzed in the report. (Despite that pattern, affordability has improved mainly because of falling mortgage rates).

The latest group of counties where prices have increased more than wages annually include Los Angeles County, CA; Cook County, (Chicago), IL; Harris County (Houston), TX; San Diego County, CA, and Orange County, CA (outside Los Angeles).

On the flip side, year-over-year changes in average annualized wages have bested price movements during the third quarter of 2024 in 167 of the counties analyzed (28.9 percent). The latest group where wages have increased more, or declined less, than median prices include Maricopa County (Phoenix), AZ; New York County (Manhattan), NY; Tarrant County (Fort Worth), TX; Bexar County (San Antonio), TX, and Santa Clara County (San Jose), CA.

Portion of wages needed for home ownership down quarterly but unchanged annually

Amid falling mortgage rates, the portion of average local wages consumed by major expenses on median-priced single-family homes and condos has dropped quarterly in 426, or 73.7 percent, of the 578 counties analyzed.

The typical $2,045 cost of mortgage payments, homeowner insurance, mortgage insurance and property taxes nationwide is down 3.3 percent quarterly from a high point hit in the second quarter of this year. The latest expense level commonly consumes 33.5 percent of the average annual national wage of $73,164. That is down from 34.7 percent the second quarter of 2024 but is unchanged from the third quarter of last year.

Despite the quarterly drop-off, the portion remains far above a recent low point of 21.3 percent hit in the first quarter of 2021.

The expense-to-wage ratio exceeds the 28 percent lending guideline in 453, or 78.4 percent, of the counties analyzed, assuming a 20 percent down payment. That is down slightly from 80.3 percent of the same group of counties in the second quarter of 2024 and 78.7 percent a year ago. But it remains more than twice the level recorded in early 2021.

In about a third of the markets analyzed, major expenses consume at least 43 percent of average local wages, a benchmark considered seriously unaffordable.

The best affordability improvements during the third quarter generally have come in upscale markets concentrated in the West region, where median prices top $450,000. Those counties, however, still among the most unaffordable in the U.S.

Among counties with a population of at least 1 million, the largest quarterly drop-offs in the typical portion of average local wages needed for major ownership expenses are in Orange County, CA (outside Los Angeles) (down from 102.6 percent in the second quarter of 2024 to 95.4 percent in the third quarter of 2024); Travis County (Austin), TX (down from 45.3 percent to 38.5 percent); Contra Costa County, CA (outside Oakland) (down from 69.6 percent to 63.3 percent); Alameda County (Oakland), CA (down from 69.8 percent to 63.6 percent) and Santa Clara County (San Jose), CA (down from 60.9 percent to 55.7 percent).

Home ownership still least affordable along Northeast and West coasts

All but one of the top 30 counties where major ownership costs require the largest percentage of average local wages during the third quarter of 2024 are on the Northeast or West coasts, extending past trends. The leaders are Santa Cruz County, CA (108.5 percent of annualized local wages needed to buy a single-family home); Kings County (Brooklyn), NY (108 percent); Maui County, HI (103.6 percent); Marin County, CA (outside San Francisco) (100.6 percent) and San Luis Obispo County, CA (97.5 percent).

Aside from Kings County, those with a population of at least 1 million where major ownership expenses typically consume more than 28 percent of average local wages in the third quarter of 2024 include Orange County, CA (outside Los Angeles) (95.4 percent required); Queens County, NY (78.9 percent); Los Angeles County, CA (72.6 percent) and San Diego County, CA (71.9 percent).

Counties where the smallest portion of average local wages are required to afford the median-priced home during the third quarter of this year are Cambria County, PA (east of Pittsburgh) (12 percent of annualized weekly wages needed to buy a home); Macon County (Decatur), IL (14 percent); Montgomery County, AL (14.5 percent); Schuylkill County, PA (outside Allentown) (15.8 percent) and St. Lawrence County (Canton), NY (15.9 percent).

Counties with a population of at least 1 million where major ownership expenses typically consume less than 28 percent of average local wages in the third quarter of 2024 include Wayne County (Detroit), MI (17 percent); Philadelphia County, PA (20.7 percent); Cuyahoga County (Cleveland), OH (21.1 percent); Allegheny County (Pittsburgh), PA (22.3 percent) and Harris County (Houston), TX (24.9 percent).

Wages needed to afford typical home is 20 percent more than U.S. average

Major home ownership expenses on typical homes sold in the third quarter of 2024 require an annual income of $87,640 to be affordable, which is 19.8 percent more than the latest average national wage of $73,164.

Annual wages of more than $75,000 are needed to pay for major costs on median-priced homes purchased during the third quarter of 2024 in 324, or 56.1 percent, of the 578 markets in the report. That poses major obstacles as average wages exceed that amount in just 12.8 percent of the counties reviewed.

The 25 largest annual wages required to afford typical homes remain along the east or west coasts, led by San Mateo County, CA ($384,882); New York County (Manhattan), NY ($371,140); Santa Clara County (San Jose), CA ($360,069); Marin County, CA (outside San Francisco) ($328,530) and San Francisco County, CA ($315,157).

The lowest annual wages required to afford a median-priced home in the third quarter of 2024 are in Cambria County, PA (east of Pittsburgh) ($20,775); Schuylkill County, PA (outside Allentown) ($29,959); Montgomery County, AL ($30,746); Bibb County (Macon), GA ($31,289) and Robeson County, NC (outside Fayetteville) ($31,794).

Historical affordability still weak almost everywhere in U.S. but showing signs of improvement

Home ownership is less affordable in the third quarter of 2024 compared to historic averages in 99.5 percent of the 578 counties analyzed. That is about the same as the level in both the second quarter of 2024 and the third quarter of last year – and far higher than the 5.4 percent portion in the first quarter of 2021.

Still, historical indexes improved quarterly in about three-quarters of the counties reviewed, raising the nationwide index from its worst point in 17 years.

Counties with a population of at least 1 million that are less affordable than their historic averages (indexes of less than 100 are considered historically less affordable) include Wayne County (Detroit), MI (index of 60); Mecklenburg County (Charlotte), NC (63); Fulton County (Atlanta), GA (64); Franklin County (Columbus), OH (65) and Oakland County (outside Detroit) (65).

Overall, counties with the worst affordability indexes in the third quarter of 2024 are Montgomery County, PA (outside Philadelphia) (index of 52); Muskegon County, MI (53); Blount County, TN (outside Knoxville) (54); St. Louis County, MO (55) and Beaver County, PA (outside Pittsburgh) (56).

The nationwide index has improved from 73 in the second quarter of 2024 to 75 in the third quarter. Among counties with a population of at least 1 million, those where the index has improved most from the second to the third quarter are Travis County (Austin), TX (index up 18 percent); Palm Beach County (West Palm Beach), FL (up 11 percent); Fulton County (Atlanta), GA (up 10 percent); Contra Costa County, CA (outside Oakland) (up 10 percent) and Alameda County (Oakland), CA (up 10 percent).

Report Methodology

The ATTOM U.S. Home Affordability Index analyzed median home prices derived from publicly recorded sales deed data collected by ATTOM and average wage data from the U.S. Bureau of Labor Statistics in 578 U.S. counties with a combined population of 255.1 million during the third quarter of 2024. Counties in Connecticut were not included in the analysis because the most recent wage data was not available. The affordability index is based on the percentage of average wages needed to pay for major expenses on a median-priced home with a 30-year fixed-rate mortgage and a 20 percent down payment. Those expenses include property taxes, home insurance, mortgage payments and mortgage insurance. Average 30-year fixed interest rates from the Freddie Mac Primary Mortgage Market Survey were used to calculate monthly house payments.

The report determined affordability for average wage earners by calculating the amount of income needed for major home-ownership expenses on median-priced homes, assuming a loan of 80 percent of the purchase price and a 28 percent maximum “front-end” debt-to-income ratio. For example, affording the nationwide median home price of $365,000 in the third quarter of 2024 requires an annual wage of $87,640. That is based on a $73,000 down payment, a $292,000 loan and monthly expenses not exceeding the 28 percent barrier — meaning wage earners would not be spending more than 28 percent of their pay on mortgage payments, property taxes and insurance. That required income is more than the $73,164 average wage nationwide, based on the most recent average weekly wage data available from the Bureau of Labor Statistics, making a median-priced home nationwide unaffordable for average workers.

About ATTOM

ATTOM provides premium property data and analytics that power a myriad of solutions that improve transparency, innovation, digitization and efficiency in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes, and enhances the real estate data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 30TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include ATTOM Cloud, bulk file licenses, property data APIs, real estate market trends, property navigator and more. Also, introducing our newest innovative solution, making property data more readily accessible and optimized for AI applications– AI-Ready Solutions.

Media Contact:

Megan Hunt

megan.hunt@attomdata.com

Data and Report Licensing:

datareports@attomdata.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/home-ownership-slightly-more-affordable-across-us-in-third-quarter-but-still-difficult-for-average-workers-302259197.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/home-ownership-slightly-more-affordable-across-us-in-third-quarter-but-still-difficult-for-average-workers-302259197.html

SOURCE ATTOM

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Western Digital, Nvidia, Other Chip Stocks Are Rising Wednesday: What's Behind The Move?

Several chip stocks are moving higher after the market close on Wednesday alongside Micron Technology Inc MU, which jumped after the company reported strong quarterly results.

What Happened With MU: Micron beat analyst estimates on the top and bottom lines, reporting revenue of $7.75 billion versus estimates of $7.635 billion, and earnings of $1.18 per share versus estimates of $1.13 per share.

Micron said its 93% revenue growth in the quarter was driven by robust AI demand, which was the main driver of chip stock appreciation in recent years.

The memory-chip giant also guided for “significantly improved profitability” in fiscal 2025, which appears to be sparking the surge in shares. Micron stock was up 13.2% at $108.37 at the time of writing, according to Benzinga Pro.

Why It Matters: Micron focuses on making memory chips. Other big players in the semiconductor memory market like Western Digital Corp WDC and Lam Research Corp LRCX are seeing the biggest gains after the bell, with both up more than 4% in after-hours trading at the time of writing, per Benzinga Pro.

Other chipmakers making moves after the bell include NVIDIA Corp NVDA, Advanced Micro Devices Inc AMD, Marvell Technology Inc MRVL, Taiwan Semiconductor Manufacturing Company Ltd TSM and Arm Holdings Plc ARM. Several chip stocks were up roughly 1% after hours at last check.

Read Next:

Photo: Courtesy of Arm Holdings.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Weekly Jobless Claims Lower Than Expected, Suggesting Labor Market Strength: Wall Street Set For Higher Open

The U.S. economy expanded by 3% in the second quarter, according to the third estimate released Thursday, up from the 1.4% growth seen in the first quarter and representing an no change from the government’s second estimate.

This outcome continues to reflect the strength of the U.S. economy, marking the eighth consecutive quarter of growth.

In a separate report released Thursday, initial jobless claims for the week ending Sept. 21 came in slightly below expectations, suggesting some improvement in labor market conditions.

Q2 GDP Report (3rd Estimate) Key Highlights

- The U.S. real gross domestic product (GDP) grew at an annualized rate of 3% in the second quarter, upwardly revised from the initial estimate of 2.8% and matching the second estimate of 3%.

- The Personal Consumption Expenditure (PCE) price index, a key measure of inflation, slowed from 3.4% in the first quarter to 2.5% in the second quarter , staying flat with the prior estimate.

- Excluding food and energy, the core PCE price index eased from 3.7% in the first quarter to 2.8% the second quarter, remaining unchanged from the previous estimate.

- The acceleration in real GDP during the second quarter was primarily driven by an increase in private inventory investment and a pick-up in consumer spending.

Latest Jobless Claims Report

- Initial jobless claims totaled 218,000 for the week ending Sept. 21, down from the upwardly revised 222,000 the previous week and below the figure of 224,000 claims that economists were expecting.

- The four-week moving average of weekly jobless claims, which smooths out weekly volatility, was 1,835,750, a decrease of 6,500 from the previous week’s revised average.

Market Reactions

The U.S. dollar index (DXY) was down 0.05% following the economic data releases.

In Thursday’s premarket trading, futures on major U.S. indices were moving higher. S&P 500 futures were up 0.81%, Nasdaq 100 futures were trading 1.55% higher and Dow Jones Futures were up 0.35%.

Read Now:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Southwest Airlines Stock After Guidance Update?

Southwest Airlines Company LUV shares are trading higher in the premarket session on Thursday.

In an exchange filing, the company said it has authorized a new $2.5 billion share repurchase program.

In connection with the new share repurchase program, the board terminated and replaced the company’s prior share repurchase program, which the board authorized in May 2019.

Southwest highlighted that it is reducing headcount by controlled hiring, and labor cost certainty has been achieved.

For the third quarter, the company sees operating revenue per available seat mile to grow 2% to 3% (prior view: flat to down 2%).

Economic fuel costs per gallon is expected to be $2.50 to $2.60 (prior view: $2.60 to $2.70).

The company expects to deliver approximately $4 billion in cumulative incremental earnings before interest and taxes (EBIT) by 2027, along with an after-tax return on invested capital (ROIC) of 15% or greater, significantly surpassing the weighted average cost of capital (WACC).

The company’s multi-year plan is expected to deliver an estimated $500 million run rate of cost savings in 2027 by minimizing hiring, optimizing scheduling efficiency, capitalizing on supply chain opportunities, and improving corporate efficiency.

Southwest Airlines expects to begin selling assigned seats in the second half of 2025, with its first flights operating with the new model in the first half of 2026.

Southwest Airlines also plans to enhance its boarding process by incorporating seat assignments, while prioritizing operational efficiency and improving the customer experience.

The revamped boarding method will retain Southwest’s distinctive and well-liked approach, utilizing position numbers and signage displayed on stanchions in the gate area.

Price Action: LUV shares are trading higher by 6.45% to $30.22 premarket at last check Thursday.

Image by Around the World Photos via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.