What China's biggest stimulus since the pandemic means for US investors: Morning Brief

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

China just announced its biggest economic stimulus since the pandemic, which is reverberating in stocks and commodities worldwide.

After the details of the monetary stimulus and support for the stock market were announced Tuesday by the People’s Bank of China (PBOC), the nation’s benchmark index, the CSI 300 (000300.SS), surged 4.3% — its largest jump since July 2020.

The country’s currency, the renminbi (CNH=X), dropped 0.6% — the most since the Japanese yen imploded in early August.

In the US, stocks rose, but the biggest effect was felt in commodities. Silver futures (SI=F) skyrocketed over 4.5% to a decade-plus high. Copper futures (HG=F) — already on a nine-day tear — notched a 10th straight win as it surged to a two-month high.

The stimulus, China’s latest attempt to pull its economy out of a slump caused by a shaky property market and deflationary pressures, includes over $325 billion in measures, mostly via monetary — as opposed to fiscal — channels.

For banks, the PBOC cut the amount of money required to set aside for loans — the reserve requirement ratio — by half a percentage point, freeing up about $142 billion in short-term liquidity.

The plan also lowers short- to medium-term interest rates and makes mortgage relief a top priority.

According to PBOC governor Pan Gongsheng, these moves will benefit around 50 million households, saving them $21.3 billion annually in interest expenses.

For China’s ailing stock market (the CSI is down 40% from its 2021 peak), a $71 billion stock market stabilization program was introduced to allow securities firms, funds, and insurers to access funding for stock purchases through a swap facility.

But before investors start celebrating, it’s helpful to know that China’s track record with these big stimulus pushes has been mixed to poor.

In 2008, the country’s massive infrastructure spending led to unsustainable debt. Fast-forward to 2015, and a stock market crash wiped out gains despite similar interventions. And during the pandemic, the Chinese property sector collapsed after another stimulus effort fueled a bubble.

The question on everyone’s mind: Will China add fiscal stimulus to that record?

If Beijing starts throwing more government money at the problem, particularly for infrastructure, that could have global ripple effects.

Commodities would likely see another big push, impacting everything from US manufacturing to energy sectors. There could be major shifts in supply chains and pricing for raw materials (yes, again).

As Bloomberg’s chief Asia economist Chang Shu put it, “Delivering all these measures at once is highly unusual,” going on to say that it “speaks to the urgency felt in Beijing to head off deflationary risks and get growth on track for this year’s 5% [national growth] target.”

And that urgency is why many are speculating that fiscal policy could be the next lever Beijing pulls.

So, what does this all mean for US investors?

Inflated commodity costs don’t necessarily make it to the consumer level of inflation. However, pernicious swings in inflation could be on the horizon, as China’s measures could push commodity prices higher — especially if Beijing keeps pulling levers. For US businesses, this means higher input costs, unpredictable consumer demand, and planning headaches, especially for smaller firms.

In the words of Macro Compass founder Alfonso Peccatiello in a note to clients, “We are not risking a second inflation wave. We are rather looking at more inflation volatility over the next decade.”

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

The price of gold keeps climbing to unprecedented heights. Here's why

NEW YORK (AP) — The rush for gold just keeps coming.

Gold hit another all time high this week. Recent gains for the precious metal are largely credited to ongoing economic uncertainty, geopolitical tensions and strong demand from central banks around the world.

If trends continue, analysts have bullish outlooks on the price of gold for the months ahead. But the future is never promised. Here’s what you need to know.

Where does the price of gold stand today?

The New York spot price of gold closed Tuesday at just over $2,657 per Troy ounce — the standard for measuring precious metals, which is equivalent to 31 grams — the highest recorded to date, per FactSet. That would make a gold bar or brick weighing 400 Troy ounces worth more than $1.06 million today.

This week’s record high means that the price of gold has climbed hundreds of dollars per Troy ounce over the last year. Tuesday’s price is up nearly $145 from a month ago and more than $740 from this time in 2023.

The price of gold is up nearly 30% year to date, analysts note — outpacing the benchmark S&P 500’s roughly 20% gain since the start of 2024.

Why is the price of gold going up?

There are a few factors behind the recent gains.

Interest in buying gold often comes at times of uncertainty — with potential concerns around inflation and the strength of the U.S. dollar, for example, causing some to look for alternative places to park their money. Gold also surged in the early days of the COVID-19 pandemic.

Among sources of uncertainty today are geopolitical tensions — which escalated over recent days with Israel’s deadly strikes in Lebanon. And the ongoing wars in Gaza and Ukraine have continued to fuel fears about the future worldwide.

In markets like the U.S., there’s also particular concern about the health of the job market. Last week’s larger-than-usual half-point cut by the Federal Reserve signals a new focus on slowing employment numbers, and more rate cuts are expected before the end of the year. And such action arrives in the midst of a tumultuous election year — which could prove crucial to economic policy in the road ahead, too.

In the near future, people are considering “any case of turbulence in the economy,” FxPro senior market analyst Michel Saliby explained. “This is why they’re keeping a decent portion of gold in their portfolio as a ‘safe haven.’”

Analysts also point to strong demand from central banks around the world. Joe Cavatoni, senior market strategist at the World Gold Council, noted last month that central bank demand was well-above the five year average — reflecting “heightened concern with inflation and economic stability.”

Recent stimulus measures in China aimed at boosting consumer spending are also expected to up retail investments, Saliby added, further boosting gold’s performance.

Is gold worth the investment?

Advocates of investing in gold call it a “safe haven,” arguing the commodity can serve to diversify and balance your investment portfolio, as well as mitigate possible risks down the road. Some also take comfort in buying something tangible that has the potential to increase in value over time.

Experts caution against putting all your eggs in one basket.

Both retail and institutional investors shouldn’t be influenced by the “FOMO effect,” or fear of missing out, Saliby notes — explaining that people should not risk all their money just because they are seeing others rake in gains. He advises investors to watch the market and always have a clear risk management strategy for their position.

If geopolitical tensions cool, Saliby expects the price of gold to correct slightly, perhaps falling around $50 to $80. But he remains bullish overall for the near future — expecting gold’s spot price to soon surpass the $2,700 mark previously predicted for 2025, and perhaps reach as high as $2,800 or $2,900 if trends continue.

Still, future gains are never promised and not everyone agrees gold is a good investment. Critics say gold isn’t always the inflation hedge many say it is — and that there are more efficient ways to protect against potential loss of capital, such as through derivative-based investments.

The Commodity Futures Trade Commission has also previously warned people to be wary of investing in gold. Precious metals can be highly volatile, the commission said, and prices rise as demand goes up — meaning “when economic anxiety or instability is high, the people who typically profit from precious metals are the sellers.”

If you do choose to invest in gold, the commission adds, it’s important to educate yourself on safe trading practices and be cautious of potential scams and counterfeits on the market.

China gives markets another reason to cheer

A look at the day ahead in European and global markets from Rae Wee

Asian markets rallied on Thursday, defying weakness overnight on Wall Street as optimism over China’s latest stimulus measures got a fresh boost from news of a possible capital injection into its top banks.

Authorities are considering a $142 billion infusion to help big lenders, Bloomberg News reported, just two days after policymakers announced a series of measures intended to pull the country out of its deflationary funk.

While the latest moves point to a sense of urgency among the authorities as Beijing’s 5% economic growth target for the year starts to slip out of sight, investors saw reason to cheer.

After months of seemingly futile waiting by the markets, Chinese authorities finally appear to be waking up to the idea that a lot more needs to be done to get the world’s second-largest economy back on track.

China’s blue-chip index reversed early losses to trade higher after the latest news report, while Hong Kong’s Hang Seng Index rose about 2%.

MSCI’s broadest index of Asia-Pacific shares outside Japan scaled a more than two-year peak.

That set the tone for a strong opening in Europe, with futures posting solid gains during the Asian session.

China aside, the day was already shaping up to be a busy one for global markets with a rate decision by the Swiss National Bank (SNB) due alongside a series of speeches by Federal Reserve and European Central Bank officials.

The SNB is expected to ease rates by 25 basis points, marking its third straight meeting of cuts.

Needless to say, the focus will be on policymakers’ guidance on their respective rate outlooks, with those at the ECB likely to maintain a less hawkish posture on rate cuts compared with their U.S. counterparts.

Key developments that could influence markets on Thursday:

– Swiss National Bank rate decision

– Speeches by Fed, ECB policymakers

– U.S. weekly jobless claims

(By Rae Wee; Editing by Edmund Klamann)

Russia expands Baltic ports as it eyes new grain markets

By Olga Popova and Gleb Stolyarov

MOSCOW (Reuters) – Russia, the world’s leading wheat exporter, is expanding its Baltic Sea ports as it aims to boost agricultural exports by 50% by 2030 while reducing dependence on traditional Black Sea routes, officials and executives said.

The country, which exported at least 72 million metric tons of grain in the 2023/24 season, is looking at new markets in Latin America and Africa to diversify from its traditional grain markets in North Africa and the Middle East.

It has relied on its Black Sea ports to handle booming agricultural exports for the past decades but the conflict with Ukraine has made the area risky for shipping with both sides regularly striking each other’s facilities and infrastructure.

“Last year with its record harvest showed that with the pace of loadings for exports, we do not have enough capacity,” Ksenia Bolomatova, deputy head of state-controlled agricultural conglomerate OZK, which owns several Black Sea terminals, told an industry gathering in Sochi in southern Russia.

In the last 18 months, Russia has launched two major ports, Vysotsky and Lugaport, in the Gulf of Finland, not far from St. Petersburg, President Vladimir Putin’s hometown.

Vysotsky shipped its first grain in April 2023, while Lugaport began operations in June this year and capacity is expected to reach 7 million tons by early 2025, according to its owner Novaport.

Dmitry Rylko from the IKAR agricultural consultancy said the two ports will be able to handle up to 15 million tons of agricultural exports, including grain, per year.

That would account for a quarter of Russia’s 60 million tons of grain exports forecast for the 2024/25 season.

Private firm Primorsky UPK is also planning a grain terminal at Primorsky port with capacity of up to 5 million tons.

EXPORT CONSTRAINTS

Putin set out a goal to increase agricultural exports by 50% by 2030 as part of a strategy to cement the country’s position as an agriculture superpower along with Brazil, the United States and China.

Russia has become the world’s biggest exporter of wheat, corn, barley, and peas in the last decade, but further growth could be constrained by shipping capacity bottlenecks.

Many Russian ports announced plans to boost capacity after record harvests in the last two years. The Baltic Sea terminals are expected to expand at a faster rate.

“The expansion of the Baltic Sea terminals’ capacity is a question of economic and transport security and sovereignty,” Novotrans said in an emailed comment.

Russian trade flows and shipments have so far seen no major disruptions in the Baltic, where 96% of the coastline belongs to NATO members, including Finland and Sweden.

By contrast, disruptions are rising in the Black sea and could reduce global grain supplies, according to a report by the World Bank. Two weeks ago, a Ukrainian vessel carrying grain to Egypt was hit by a missile.

In August, Russian local authorities said Ukraine sank a ferry carrying fuel tanks in Port Kavkaz, which is also used for transshipment of grain.

ECONOMIC APPEAL

Russian exported 62 million tons of grain by sea in the 2023/24 season with 90% of supplies going via the Black Sea, mostly to markets in the Middle East and North Africa. This share is set to fall as Baltic Sea infrastructure grows.

Baltic Sea ports loaded 1.5 million tons of grain last season, a three-fold increase from the previous season but still just 2.4% of overall Russian exports, according to Reuters calculations based on publicly available data.

“Logistically, the Baltic has many advantages for grains exports,” said Darya Snitko, vice president for Gazprombank, one of Russia’s largest banks and one of the biggest lenders to farmers.

She said the ability of Baltic terminals to handle bigger ships should help reduce overall costs.

“Supplies from the Baltic Sea beat (economics of) shipments from the Azov-Black Sea area when trading with countries in Africa outside the Mediterranean as well as Asia,” she added.

Vysotsky has been sending grain to Algeria, Brazil, Cuba, Mali, Mexico, Morocco, Nigeria and Tunisia, according to data from logistics company Rusagrotrans.

(Reporting by Olga Popova and Gleb Stolyarov; Writing by Gleb Bryanski; Editing by Emelia Sithole-Matarise)

Palantir Just Won Another Large Contract. Is It Enough to Make the Stock a Buy?

Palantir Technologies (NYSE: PLTR) continues to rack up new contracts. The latest is a deal with the U.S. government to bring artificial intelligence (AI) capabilities to the various military branches through its Maven Smart System. The contract will pay Palantir up to $99.8 million over the next five years.

With the company announcing several new contract wins, many investors are wondering if these contract awards will be enough to fuel the growth needed to justify the company’s high valuation. Let’s see if an answer presents itself.

Valuation versus growth

Palantir established itself as a top data analytics and AI tech company that helps the government in some of its most important mission-critical tasks. Its services have been used to fight terrorism and track COVID-19 cases during the pandemic. More recently, it has seen a lot of growth in the private sector as customers adopt its Artificial Intelligence Platform (AIP) to address their various use cases.

Palantir’s success in the private sector extends across industries. Its recent contracts include work for the health system Nebraska Medicine and energy giant BP. The company is getting a lot of traction with commercial customers for its AI platform, with its commercial segment seeing 33% year-over-year revenue growth in the second quarter to $307 million.

Its overall government segment had shown signs of slowing in the past, growing only 14% in 2023. But it is picking up this year, with 16% growth in Q1 accelerating to 23% year-over-year growth in Q2 to reach $371 million for the quarter. Its U.S. government segment growth, meanwhile, went from just 12% year over year in Q1 to 24% in Q2. Overall, Palantir reports solid growth that is accelerating, with Q2’s overall revenue growth hitting 27% to $678 million.

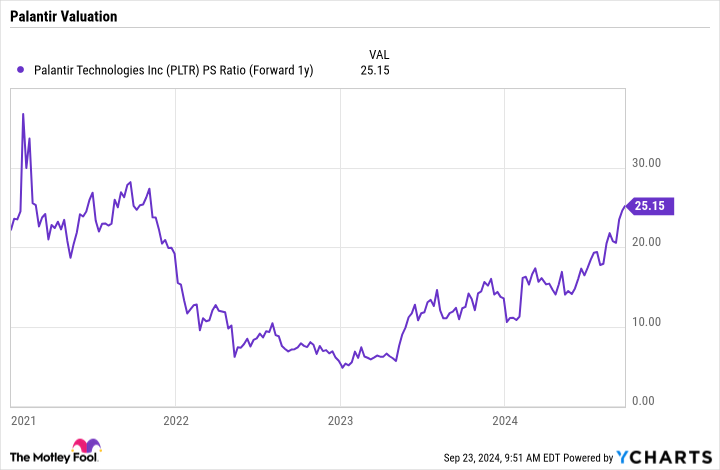

When it comes to the stock, the company’s revenue growth still doesn’t quite justify its current valuation. Its forward price-to-sales (P/S) ratio sits at 25 times analysts’ 2025 consensus revenue estimates.

That is the type of valuation that is typically reserved for hyper-growth stocks that expect 50% or more revenue growth over the next few years. Palantir needs to see its growth continue to accelerate if it wants to justify the stock’s current valuation.

A deal like the one it just signed with the military for its Maven Smart System will add about $20 million a year in revenue. The company has forecast revenue of between $2.742 billion and $2.750 billion this year, so $20 million isn’t moving the needle too much, adding about 0.7 percentage points of growth.

This is a large deal, but the company will need a lot more big U.S. government contracts to really help accelerate growth. One way it could do this is by teaming up with Microsoft, as it will now be able to deploy its offerings through Microsoft’s government cloud, including Microsoft Azure Government, Azure Government Secret, and Azure Top Secret cloud. The government isn’t known to make the quickest decisions, and Palantir is hoping this partnership will help it speed up deployments with the U.S. government, especially with AIP.

On the commercial side, the company will continue to look to grow its customer base through its use of boot camps, which show customers how AIP can be applied to potential use cases while providing onboarding and training. The company has been winning many customers for prototype work with this go-to-market strategy, which it then has been moving to production.

This transition from prototype to production is where Palantir sees its biggest opportunity, and the company has been doing a great job of growing business with existing commercial customers as a result.

Valuation still matters

The problem, though, still comes down to valuation. If Palantir were able to grow revenue by 30% in each of the next three years (a rate higher than its current revenue growth), it would result in $6 billion in revenue in 2027. That revenue total would result in a forward P/S multiple of about 14 using the current stock price.

With 30% revenue growth, that 14 P/S could be justified and would be similar to a company like CrowdStrike. However, it would also mean that Palantir’s stock traded flat over the next two years. It is also asking a lot to see the company generate 30%-a-year revenue growth over the next three years when it generated 24% revenue growth in 2022, 17% revenue growth in 2023, and 24% through the first six months of this year.

While Palantir has the makings of being a great company, valuation does still matter, and Palantir’s valuation is just too high to justify buying right now.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends BP, CrowdStrike, Microsoft, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Palantir Just Won Another Large Contract. Is It Enough to Make the Stock a Buy? was originally published by The Motley Fool

Toll Brothers at Painted Prairie Luxury Home Community Coming Soon to Aurora, Colorado

DENVER, Sept. 25, 2024 (GLOBE NEWSWIRE) — Toll Brothers, Inc. TOL, the nation’s leading builder of luxury homes, today announced its newest community, Toll Brothers at Painted Prairie, is coming soon to the intersection of 63rd Avenue and Killarney Street in Aurora, Colorado. Construction of the Sales Center and model homes is currently underway, and sales will begin in early 2025.

Toll Brothers at Painted Prairie will include 177 luxury townhomes in three exquisite collections. The community will offer the only three-story townhomes within the Painted Prairie Town Center master plan. Home buyers will be able to choose from home designs ranging in size from 1,368 to 2,598+ square feet and an array of on-site personalization options. Homes are priced from the low $400,000s.

“We are excited to debut our stunning collection of new home designs with unrivaled personalization options in one of Aurora’s most desirable and vibrant communities,” said Reggie Carveth, Division President of Toll Brothers in Colorado.

Home buyers will enjoy proximity to nearby shopping, dining, arts and entertainment, and recreational destinations, including 22-acre High Prairie Park, future Town Center, The Shops at Northfield, Gaylord Hotel and Convention Center, and more. Children will attend school in the Adams-Arapahoe 28J School District with a brand-new school opening in the 2024-2025 school year to serve pre-school through eighth grade students.

Major highways including Interstate 70, E-470, and Pena Boulevard are easily accessible from Toll Brothers at Painted Prairie, offering homeowners convenient access to Denver and the Denver International Airport.

Additional Toll Brothers new home communities in Denver and Northern Colorado include North Hill, The Ridge at Ward Station, Downtown Superior, Erie Town Center, Toll Brothers at Heron Lakes, Riano Ridge, and Toll Brothers at Timnath Lakes.

For more information, call (877) 431-2870 or visit TollBrothers.com/Colorado.

About Toll Brothers

Toll Brothers, Inc., a Fortune 500 Company, is the nation’s leading builder of luxury homes. The Company was founded 57 years ago in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol “TOL.” The Company serves first-time, move-up, empty-nester, active-adult, and second-home buyers, as well as urban and suburban renters. Toll Brothers builds in over 60 markets in 24 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, and Washington, as well as in the District of Columbia. The Company operates its own architectural, engineering, mortgage, title, land development, smart home technology, and landscape subsidiaries. The Company also develops master-planned and golf course communities as well as operates its own lumber distribution, house component assembly, and manufacturing operations.

In 2024, Toll Brothers marked 10 years in a row being named to the Fortune World’s Most Admired Companies™ list and the Company’s Chairman and CEO Douglas C. Yearley, Jr. was named one of 25 Top CEOs by Barron’s magazine. Toll Brothers has also been named Builder of the Year by Builder magazine and is the first two-time recipient of Builder of the Year from Professional Builder magazine. For more information visit TollBrothers.com.

From Fortune, ©2024 Fortune Media IP Limited. All rights reserved. Used under license.

Contact: Andrea Meck | Toll Brothers, Director, Public Relations & Social Media | 215-938-8169 | ameck@tollbrothers.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ac4e7708-2e11-403c-a43e-8af9d3fe3fab

https://www.globenewswire.com/NewsRoom/AttachmentNg/e538d140-9840-4f77-bec2-b80a4a927a81

Sent by Toll Brothers via Regional Globe Newswire (TOLL-REG)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tod E Carpenter At Donaldson Executes Options Exercise, Realizing $2.03M

On September 24, it was revealed in an SEC filing that Tod E Carpenter, Chairman at Donaldson DCI executed a significant exercise of company stock options.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday revealed that Carpenter, Chairman at Donaldson in the Industrials sector, exercised stock options for 55,000 shares of DCI stock. The exercise price of the options was $36.57 per share.

The Wednesday morning update indicates Donaldson shares up by 0.04%, currently priced at $73.5. At this value, Carpenter’s 55,000 shares are worth $2,031,012.

Unveiling the Story Behind Donaldson

Donaldson is a leading manufacturer of filtration systems and replacement parts (including air filtration systems, liquid filtration systems, and dust, fume, and mist collectors). The company serves a diverse range of end markets, including construction, mining, agriculture, truck, and industrial. Its business is organized into three segments: mobile solutions, industrial solutions, and life sciences. Donaldson generated approximately $3.6 billion in revenue and $544 million in operating income in its fiscal 2024.

Unraveling the Financial Story of Donaldson

Revenue Growth: Over the 3 months period, Donaldson showcased positive performance, achieving a revenue growth rate of 0.81% as of 31 July, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Holistic Profitability Examination:

-

Gross Margin: With a low gross margin of 35.79%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Donaldson exhibits below-average bottom-line performance with a current EPS of 0.91.

Debt Management: With a below-average debt-to-equity ratio of 0.36, Donaldson adopts a prudent financial strategy, indicating a balanced approach to debt management.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 21.74 is lower than the industry average, implying a discounted valuation for Donaldson’s stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 2.51 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 13.97, Donaldson presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Understanding Crucial Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Donaldson’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Rally With Asia as China Pledges Fiscal Aid: Markets Wrap

(Bloomberg) — Global stocks rallied after China pledged fiscal stimulus and traders raised their bets on interest-rate cuts by major central banks.

Most Read from Bloomberg

Futures on the S&P 500 climbed 0.8% as US-listed China stocks advanced and Micron Technology Inc. surged in premarket trading. Contracts on the Nasdaq 100 jumped 1.5% and the Stoxx 600 index in Europe headed for a record close. Treasury yields and the dollar edged lower.

The promises by China’s Politburo, alongside growing expectations that the Federal Reserve and European Central Bank will push ahead with easing, buoyed markets on Thursday. Traders are waiting for a pre-recorded address by Federal Reserve Chair Jerome Powell and jobs data later Thursday.

“The message, over the last 10 days or so, from monetary and fiscal policymakers across the globe, has been clear and undeniable — the policy ‘put’ is well and truly back,” said Michael Brown, a strategist at Pepperstone Group Ltd. “The path of least resistance is likely to continue to lead to the upside, over both the short- and medium-term.”

Money markets have flipped to favor a half-point cut by the Fed in November, with traders now pricing almost 39 basis points of reductions after lackluster US consumer data earlier in the week.

The US central bank’s preferred price metric and a snapshot of consumer demand will give more clues on the economy’s health on Friday.

“The Federal Reserve is more concerned about growth than they let on,” said Vanguard Chief Economist Joe Davis on Bloomberg TV. “Our view is they are going to be more aggressive in the near term.”

China Doubts

The bid to revive growth by China’s top leaders on Thursday added to a slew of measures from Beijing this week that have supercharged local assets. The CSI 300 Index is headed for its biggest weekly gain in almost a decade.

But questions remain over the long-term impact of the measures.

“I wouldn’t be surprised if tomorrow we are going to see a bit of a pullback,” Helen Jewell, chief investment officer at BlackRock Fundamental Equities EMEA, told Bloomberg TV. “This is what is happening in the markets right now — you end up risk on one day, risk off the next day. The Chinese economy is still very fragile.”

Swiss Cut

Elsewhere, the Swiss National Bank made a 25 basis-point interest rate cut in an effort to contain the strength of the Swiss franc, which has had the strongest rally in nearly a decade.

In commodities, oil fell for a second day as Saudi Arabia was reported to be weighing increasing output, and factions in Libya reached a deal that opens the way to the return of some crude production.

Israel ordered the military to maintain its bombardment of Hezbollah targets in Lebanon and denied interest in a truce deal, complicating efforts by the US and allies to avoid full-blown war.

Key events this week:

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, durable goods, revised GDP, Thursday

-

Fed Chair Jerome Powell gives pre-recorded remarks to the 10th annual US Treasury Market Conference, Thursday

-

China industrial profits, Friday

-

Eurozone consumer confidence, Friday

-

US PCE, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.8% as of 7:48 a.m. New York time

-

Nasdaq 100 futures rose 1.5%

-

Futures on the Dow Jones Industrial Average rose 0.4%

-

The Stoxx Europe 600 rose 1.1%

-

The MSCI World Index rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.4%

-

The euro rose 0.2% to $1.1155

-

The British pound rose 0.4% to $1.3376

-

The Japanese yen rose 0.4% to 144.21 per dollar

Cryptocurrencies

-

Bitcoin rose 1.4% to $64,371.46

-

Ether rose 1.9% to $2,628.45

Bonds

-

The yield on 10-year Treasuries declined two basis points to 3.77%

-

Germany’s 10-year yield declined four basis points to 2.14%

-

Britain’s 10-year yield was little changed at 3.98%

Commodities

-

West Texas Intermediate crude fell 2.8% to $67.72 a barrel

-

Spot gold rose 1% to $2,683.96 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu, Divya Patil, Richard Henderson, Ben Priechenfried and James Hirai.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

FBI Report Over 200,000 People Were Arrested For Cannabis-Related Violations In 2023: How Is That Possible?

The FBI reported that 217,150 arrests for marijuana violations were made in 2023, slightly down from 2022 when the figure stood at 227,108, according to data published in the Bureau’s Crime Data Explorer.

Of those arrested in 2023, a staggering 84%—a bit over 200,000 people—were charged with possession alone, highlighting the ongoing focus on low-level cannabis offenses. It’s important to note that the FBI’s arrest data reflects the number of arrests, not the number of individuals arrested, as a person may be arrested multiple times in a year.

The 2023 figures are based on reports from local agencies covering 90 percent of the U.S. population, meaning the true number of marijuana arrests is likely higher.

While this represents a long-term decline from the peak of 870,000 marijuana-related arrests in 2007, deputy director of the National Organization for the Reform of Marijuana Laws (NORML), Paul Armentano expressed concern.

“At a time when voters and their elected officials nationwide are re-evaluating state and federal marijuana policies, it is inconceivable that government agencies are unable to produce more explicit data on the estimated costs and scope of marijuana prohibition in America,”

Armentano said.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Marijuana Possession Dominates Arrest Rates

Despite state legalization efforts, marijuana-related prosecutions remain a major driver of the U.S. drug war.

Marijuana arrests are part of a larger trend of drug possession offenses, which ranked second for arrest offense rates in the United States in 2023. Police recorded 3,801,505 cases of drug possession, following only the category of “All Other Offenses.”

Drug possession was followed by arrests for simple assault (3,584,195 cases), driving under the influence (2,863,542 cases), and larceny (2,372,550 cases). Data follows a trend that’s been present in every other report in the past.

Aggravated assault was further down the list, underscoring how low-level drug offenses still dominate the U.S. criminal justice system.

Read Also: Legal Weed = Less Crime: FBI Data Shows Surprising Benefits Of Cannabis Legalization

2023 FBI Data Overview

The FBI 2023 Crime in the Nation statistics, details over 14 million criminal offenses reported by more than 16,000 law enforcement agencies.

This data seeks to represent 94.3% of the U.S. population. One main outcome is that in 2023, national violent crime decreased by 3.0%, with notable reductions in murder, rape, aggravated assault and robbery. The agency also tracked a slight 0.6% decline in hate crime incidents, signaling progress in multiple areas of law enforcement, even as marijuana arrests continue to contribute significantly to the numbers.

Cover: FBI Media website

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Has Purchased $78 Billion of His Favorite Stock — but Another Time-Tested Company Has Been His Top Buy Over the Past Year

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is one of Wall Street’s most-followed investors, and it has everything to do with his stunning outperformance of the benchmark S&P 500.

Since becoming CEO nearly six decades ago, the Oracle of Omaha has overseen a cumulative gain of more than 5,500,000% in his company’s Class A shares (BRK.A). Comparatively, the S&P 500 has delivered a very respectable, but Buffett-trailing, total return, including dividends, of less than 38,000% over the same stretch.

Even though Buffett is fallible — he took quite the bath on his company’s stake in legacy media stock Paramount Global — investors often wait on the edge of their seat for Berkshire Hathaway’s Form 13F filings. These are required filings for institutional investors with at least $100 million in assets under management that provide a snapshot of which stocks were purchased and sold in the latest quarter.

The funny thing about 13Fs is they don’t always tell the full story — especially when it comes to Warren Buffett and Berkshire Hathaway.

Warren Buffett has spent roughly $78 billion buying his favorite stock since mid-2018

Although 13Fs have shown Buffett to be a decisive net-seller of stocks in each of the last seven quarters to the aggregate tune of almost $132 billion, there have been selective stocks that have piqued the interest of Berkshire’s chief.

For instance, Buffett has overseen the purchase of more than 255 million shares of integrated oil and gas giant Occidental Petroleum since the start of 2022.

But when it comes to the cumulative amount of Berkshire’s cash Buffett has put to work, nothing tops his favorite stock over the last six years… Berkshire Hathaway. Share repurchases are found in Berkshire’s quarterly operating results but aren’t listed in the company’s 13Fs.

Share buybacks haven’t always been a given for Buffett or his late right-hand man Charlie Munger, who passed away at age 99 in November. Prior to July 2018, share repurchases were only allowed if Berkshire’s share price fell to or below 120% of book value, as of the most recent quarter. This is a line-in-the-sand threshold that Berkshire Hathaway’s stock never dipped below, which meant Buffett and Munger weren’t allowed to spend a cent on buybacks.

On July 17, 2018, Berkshire’s board amended the rules governing buybacks to allow its most important players to get off the bench. The new rules set no ceiling or end date to share repurchases as long as:

-

Berkshire Hathaway has at least $30 billion in cash, cash equivalents, and U.S. Treasuries on its balance sheet; and

-

Warren Buffett believes his company’s share are intrinsically cheap.

With the second criterion up for interpretation, this policy change gave Buffett free reign to (finally) undertake a share repurchase program. He’s purchased shares of Berkshire Hathaway for 24 consecutive quarters, including $345 million in the June-ended quarter, and put close to $78 billion to work in the company nearest and dearest to his heart over the last six years.

Buybacks are an easy way for Buffett to incent a long-term mindset from his company’s shareholders, as well as improve Berkshire’s earnings per share (EPS) over the long run as its outstanding share count decreases.

While Berkshire Hathaway is, without question, Warren Buffett’s favorite stock, there’s actually another company he’s spent more of Berkshire’s cash purchasing shares of over the last year.

Move over Berkshire Hathaway — this is Buffett’s top buy over the last year

Over the previous four quarters, Buffett has green-lit the repurchase of a little over $6.1 billion worth of his company’s stock. But since the midpoint of 2023, average cost basis estimates from 13F aggregator WhaleWisdom.com imply the Oracle of Omaha has spent around $6.5 billion buying shares of property and casualty insurer Chubb (NYSE: CB).

For those of you who closely monitor Berkshire’s 13F filings, Chubb wasn’t always listed as a holding. Between July 2023 and May 2024, Buffett asked for and was granted “confidential treatment” for one of his positions by regulators. This confidential stock was revealed to be Chubb in mid-May 2024.

The “confidential treatment” tool is something Buffett occasionally relies on when he wants to build up a stake in a company without revealing his cards to everyday investors. Since investors have a tendency to pile into the stocks he and his investment lieutenants (Todd Combs and Ted Weschler) are buying, keeping Berkshire’s purchase activity in a larger holding “confidential” allows him to, in theory, build a stake without much of a share price premium.

So, what’s compelled the Oracle of Omaha to spend more of his company’s capital on Chubb than his favorite stock over the last year?

To start with, the insurance industry tends to be boring, highly predictable, and very profitable. Even though catastrophe losses are an eventual given for all insurers, they possess exceptional premium pricing power in pretty much all climates. Loss events offer a reason to raise premiums, while the inevitability of future loss events allow insurers to increase premiums even during periods of below-average payouts.

Insurers like Chubb are also benefiting from a period of above-average interest rates. Insurers invest their float (the premium they collect that isn’t paid out in claims) in extremely safe, short-term, interest-bearing assets. Despite the Federal Reserve kicking off a rate-easing cycle last week, insurers are generating more on their float than they have in a long time.

Furthermore, Chubb’s homeowner insurance segment predominantly caters to high-value homes. Just as longtime Berkshire holding American Express thrives by catering to high earners, Chubb has found a very profitable niche by targeting high-end home and content insurance. High earners are usually less susceptible to minor downturns and inflationary pressures, when compared to average earners.

Whether Chubb is still a good value remains to be seen. As of the closing bell on Sept. 20, shares of the company were trading at a 92% premium to book value, which is a level not consistently observed in more than two decades. Even though Chubb is a steady grower and caters to higher-end clients, a 92% premium to book value is a tough pill to swallow.

In other words, don’t be surprised if Buffett’s stake in Chubb has reached its peak.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett Has Purchased $78 Billion of His Favorite Stock — but Another Time-Tested Company Has Been His Top Buy Over the Past Year was originally published by The Motley Fool