Breaking down Intel’s wild week

Intel (INTC) is in the midst of one of the most tumultuous periods in its 56-year history. Declining sales, missed opportunities to compete in the AI space, and a massive turnaround effort by CEO Pat Gelsinger looking to return the company to its former glory are putting significant pressure on the chip giant’s bottom line and share price.

And things for the company are only getting more interesting.

Last Monday, Intel announced that it signed a deal with Amazon (AMZN) to build custom chips for Amazon Web Services, a positive sign for the company’s nascent third-party foundry business.

Then, on Friday, the Wall Street Journal reported that Qualcomm (QCOM) reached out to Intel about a blockbuster takeover deal that would give Qualcomm a larger foothold in the PC and AI spaces. That’s not all. On Sunday, Bloomberg reported that Apollo Global Management (APO) has offered to make a multibillion-dollar investment in Intel to keep Gelsinger’s turnaround moving forward. (Disclosure: Yahoo Finance is owned by Apollo Global Management.)

It’s a lot to follow and even more to make any sense of. Luckily, I’m here to help break it all down for you.

Intel’s slowing sales and AI troubles

Intel is dealing with sliding sales and the unenviable position of having to take on market leader Nvidia in the AI space. For 2023, Intel reported full-year revenue of $54.2 billion, a 14% year-over-year decline from the $63.1 billion the company saw in 2022.

That included an 8% decline in Intel’s Client Computing Group, which sells chips for PCs; a 20% drop in Data Center and AI revenue; and a 31% decrease in Network and Edge sales. Intel did, however, report a 103% increase in its Intel Foundry Services, but that amounted to just $952 million.

Part of Intel’s woes have stemmed from the fact that the explosion in PC sales at the onset of the pandemic pulled Client Computing Group revenue forward several quarters, creating a boom and bust. Consumers bought new computers in droves for work and play, sending chip revenue soaring. But millions of consumers don’t usually buy new PCs at the same time. With so many people holding new computers, there were fewer consumers looking for upgrades, and sales entered an extended slump that sent shipments plummeting for eight consecutive quarters.

Sales are picking up again, though. In July, IDC said the PC market grew 3% in the second quarter, notching a second consecutive quarter of growth. But the industry still has a way to go.

At the same time, Intel is facing a new threat from Qualcomm, which began offering its Snapdragon X Elite and X Plus chips in Windows PCs earlier this year as an alternative to Intel’s processors. Those chips provide improved performance and power versus Intel’s older offerings and are meant to compete with Apple’s (AAPL) exceptional M family of chips that power its MacBooks.

Intel is fighting back, though. Earlier this month, the company showed off its Core Ultra 200V line of processors that it says can outpace Qualcomm’s chips.

Flagging PC sales also impacted graphics giant Nvidia (NVDA), which saw sales of its video game graphics chips deteriorate after the pandemic boom. But the company, unlike Intel, has managed to exploit its early investments in AI to take advantage of the surge in interest caused by the debut of OpenAI’s ChatGPT in November 2022.

That helped catapult Nvidia to the forefront of the semiconductor industry and sent its stock to extraordinary new heights, rising more than 860% over the last two years and 191% in the last 12 months.

Intel is working to try to catch Nvidia with its own Gaudi line of AI accelerators. On Tuesday, the company debuted its latest Gaudi 3 AI accelerator and announced that IBM will use it as part of its IBM Cloud offering.

But with Gartner estimating that Nvidia controls more than 70% of AI chip sales, it’s an uphill battle.

Intel’s foundry services

Intel is also battling for position as a chip manufacturer for third-party clients. The plan is for the company’s foundry business to operate as a subsidiary of Intel that builds processors for customers looking for an alternative to TSMC, which is among the world’s largest chipmakers

But the buildout is costly and Wall Street isn’t completely sold on the idea. Analysts at Citi Research have said Intel should exit the foundry business altogether so that it can improve margins and earnings per share.

In September, however, Intel announced a multibillion-dollar deal to “produce an AI fabric chip for AWS on Intel 18A, the company’s most advanced process node.” The company is also set to build a custom version of its Xeon 6 chip for Amazon.

The news comes after Intel announced that Microsoft signed on as a manufacturing customer in February. Two big-name companies are certainly a start for Intel, but it’s going to need to sign a slew of customers if it hopes to grow its manufacturing segment to match competing chip fabricators.

Qualcomm and Apollo

Intel’s PC and AI woes have left it as a potential takeover target, which is where Qualcomm and Apollo enter the mix. Qualcomm, according to the Wall Street Journal, wants to buy up Intel, though it’s unclear if the company would hold on to all of Intel or sell portions of its business segments. The deal is also sure to generate plenty of antitrust concerns, as the companies are two of the most important chip firms in the US.

Apollo, meanwhile, looks to favor Gelsinger’s plans and could invest up to $5 billion in Intel to follow through with the effort, Bloomberg reports.

Now investors will have to wait and see whether Intel moves forward with either company or continues to try to go it alone.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance.

Micron Technology, Inc. Reports Results for the Fourth Quarter and Full Year of Fiscal 2024

BOISE, Idaho, Sept. 25, 2024 (GLOBE NEWSWIRE) — Micron Technology, Inc. MU today announced results for its fourth quarter and full year of fiscal 2024, which ended August 29, 2024.

Fiscal Q4 2024 highlights

- Revenue of $7.75 billion versus $6.81 billion for the prior quarter and $4.01 billion for the same period last year

- GAAP net income of $887 million, or $0.79 per diluted share

- Non-GAAP net income of $1.34 billion, or $1.18 per diluted share

- Operating cash flow of $3.41 billion versus $2.48 billion for the prior quarter and $249 million for the same period last year

Fiscal 2024 highlights

- Revenue of $25.11 billion versus $15.54 billion for the prior year

- GAAP net income of $778 million, or $0.70 per diluted share

- Non-GAAP net income of $1.47 billion, or $1.30 per diluted share

- Operating cash flow of $8.51 billion versus $1.56 billion for the prior year

“Micron delivered 93% year-over-year revenue growth in fiscal Q4, as robust AI demand drove a strong ramp of our data center DRAM products and our industry-leading high bandwidth memory. Our NAND revenue record was led by data center SSD sales, which exceeded $1 billion in quarterly revenue for the first time,” said Micron Technology President and CEO Sanjay Mehrotra. “We are entering fiscal 2025 with the best competitive positioning in Micron’s history. We forecast record revenue in fiscal Q1 and a substantial revenue record with significantly improved profitability in fiscal 2025.”

| Quarterly Financial Results | |||||||||||||||||||

| (in millions, except per share amounts) | GAAP(1) | Non-GAAP(2) | |||||||||||||||||

| FQ4-24 | FQ3-24 | FQ4-23 | FQ4-24 | FQ3-24 | FQ4-23 | ||||||||||||||

| Revenue | $ | 7,750 | $ | 6,811 | $ | 4,010 | $ | 7,750 | $ | 6,811 | $ | 4,010 | |||||||

| Gross margin | 2,737 | 1,832 | (435 | ) | 2,826 | 1,917 | (366 | ) | |||||||||||

| percent of revenue | 35.3 | % | 26.9 | % | (10.8 | %) | 36.5 | % | 28.1 | % | (9.1 | %) | |||||||

| Operating expenses | 1,215 | 1,113 | 1,037 | 1,081 | 976 | 842 | |||||||||||||

| Operating income (loss) | 1,522 | 719 | (1,472 | ) | 1,745 | 941 | (1,208 | ) | |||||||||||

| percent of revenue | 19.6 | % | 10.6 | % | (36.7 | %) | 22.5 | % | 13.8 | % | (30.1 | %) | |||||||

| Net income (loss) | 887 | 332 | (1,430 | ) | 1,342 | 702 | (1,177 | ) | |||||||||||

| Diluted earnings (loss) per share | 0.79 | 0.30 | (1.31 | ) | 1.18 | 0.62 | (1.07 | ) | |||||||||||

| Annual Financial Results | |||||||||||||

| (in millions, except per share amounts) | GAAP(1) | Non-GAAP(2) | |||||||||||

| FY-24 | FY-23 | FY-24 | FY-23 | ||||||||||

| Revenue | $ | 25,111 | $ | 15,540 | $ | 25,111 | $ | 15,540 | |||||

| Gross margin | 5,613 | (1,416 | ) | 5,943 | (1,196 | ) | |||||||

| percent of revenue | 22.4 | % | (9.1 | %) | 23.7 | % | (7.7 | %) | |||||

| Operating expenses | 4,309 | 4,329 | 4,008 | 3,623 | |||||||||

| Operating income (loss) | 1,304 | (5,745 | ) | 1,935 | (4,819 | ) | |||||||

| percent of revenue | 5.2 | % | (37.0 | %) | 7.7 | % | (31.0 | %) | |||||

| Net income (loss) | 778 | (5,833 | ) | 1,472 | (4,862 | ) | |||||||

| Diluted earnings (loss) per share | 0.70 | (5.34 | ) | 1.30 | (4.45 | ) | |||||||

Investments in capital expenditures, net(2) were $3.08 billion for the fourth quarter of 2024 and $8.12 billion for the full year of 2024, which resulted in adjusted free cash flows(2) of $323 million for the fourth quarter of 2024 and $386 million for the full year of 2024. Micron ended the year with cash, marketable investments, and restricted cash of $9.16 billion. On September 25, 2024, Micron’s Board of Directors declared a quarterly dividend of $0.115 per share, payable in cash on October 23, 2024, to shareholders of record as of the close of business on October 7, 2024.

Business Outlook

The following table presents Micron’s guidance for the first quarter of 2025:

| FQ1-25 | GAAP(1) Outlook | Non-GAAP(2) Outlook |

| Revenue | $8.70 billion ± $200 million | $8.70 billion ± $200 million |

| Gross margin | 38.5% ± 1.0% | 39.5% ± 1.0% |

| Operating expenses | $1.211 billion ± $15 million | $1.085 billion ± $15 million |

| Diluted earnings per share | $1.54 ± $0.08 | $1.74 ± $0.08 |

Further information regarding Micron’s business outlook is included in the prepared remarks and slides, which have been posted at investors.micron.com.

Investor Webcast

Micron will host a conference call on Wednesday, September 25, 2024 at 2:30 p.m. Mountain Time to discuss its fourth quarter financial results and provide forward-looking guidance for its first quarter. A live webcast of the call will be available online at investors.micron.com. A webcast replay will be available for one year after the call. For Investor Relations and other company updates, follow us on X @MicronTech.

About Micron Technology, Inc.

We are an industry leader in innovative memory and storage solutions transforming how the world uses information to enrich life for all. With a relentless focus on our customers, technology leadership, and manufacturing and operational excellence, Micron delivers a rich portfolio of high-performance DRAM, NAND, and NOR memory and storage products through our Micron® and Crucial® brands. Every day, the innovations that our people create fuel the data economy, enabling advances in artificial intelligence (AI) and compute-intensive applications that unleash opportunities — from the data center to the intelligent edge and across the client and mobile user experience. To learn more about Micron Technology, Inc. MU, visit micron.com.

© 2024 Micron Technology, Inc. All rights reserved. Micron, the Micron logo, and all other Micron trademarks are the property of Micron Technology, Inc. All other trademarks are the property of their respective owners.

Forward-Looking Statements

This press release contains forward-looking statements regarding our industry, our strategic position, and our financial and operating results, including our guidance for the first quarter and full year fiscal 2025. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially. Please refer to the documents we file with the Securities and Exchange Commission, including our most recent Form 10-K and Form 10-Q. These documents contain and identify important factors that could cause our actual results to differ materially from those contained in these forward-looking statements. These certain factors can be found at investors.micron.com/risk-factor. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We are under no duty to update any of the forward-looking statements to conform these statements to actual results.

| (1) | GAAP represents U.S. Generally Accepted Accounting Principles. |

| (2) | Non-GAAP represents GAAP excluding the impact of certain activities, which management excludes in analyzing our operating results and understanding trends in our earnings, adjusted free cash flow, and business outlook. Further information regarding Micron’s use of non-GAAP measures and reconciliations between GAAP and non-GAAP measures are included within this press release. |

| MICRON TECHNOLOGY, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share amounts) (Unaudited) |

|||||||||||||||

| 4th Qtr. | 3rd Qtr. | 4th Qtr. | Year Ended | ||||||||||||

| August 29, 2024 |

May 30, 2024 |

August 31, 2023 |

August 29, 2024 |

August 31, 2023 |

|||||||||||

| Revenue | $ | 7,750 | $ | 6,811 | $ | 4,010 | $ | 25,111 | $ | 15,540 | |||||

| Cost of goods sold | 5,013 | 4,979 | 4,445 | 19,498 | 16,956 | ||||||||||

| Gross margin | 2,737 | 1,832 | (435 | ) | 5,613 | (1,416 | ) | ||||||||

| Research and development | 903 | 850 | 719 | 3,430 | 3,114 | ||||||||||

| Selling, general, and administrative | 295 | 291 | 219 | 1,129 | 920 | ||||||||||

| Restructure and asset impairments | 1 | — | 4 | 1 | 171 | ||||||||||

| Other operating (income) expense, net | 16 | (28 | ) | 95 | (251 | ) | 124 | ||||||||

| Operating income (loss) | 1,522 | 719 | (1,472 | ) | 1,304 | (5,745 | ) | ||||||||

| Interest income | 131 | 136 | 134 | 529 | 468 | ||||||||||

| Interest expense | (136 | ) | (150 | ) | (129 | ) | (562 | ) | (388 | ) | |||||

| Other non-operating income (expense), net | (7 | ) | 10 | 9 | (31 | ) | 7 | ||||||||

| 1,510 | 715 | (1,458 | ) | 1,240 | (5,658 | ) | |||||||||

| Income tax (provision) benefit | (623 | ) | (377 | ) | 24 | (451 | ) | (177 | ) | ||||||

| Equity in net income (loss) of equity method investees | — | (6 | ) | 4 | (11 | ) | 2 | ||||||||

| Net income (loss) | $ | 887 | $ | 332 | $ | (1,430 | ) | $ | 778 | $ | (5,833 | ) | |||

| Earnings (loss) per share | |||||||||||||||

| Basic | $ | 0.80 | $ | 0.30 | $ | (1.31 | ) | $ | 0.70 | $ | (5.34 | ) | |||

| Diluted | 0.79 | 0.30 | (1.31 | ) | 0.70 | (5.34 | ) | ||||||||

| Number of shares used in per share calculations | |||||||||||||||

| Basic | 1,108 | 1,107 | 1,095 | 1,105 | 1,093 | ||||||||||

| Diluted | 1,125 | 1,123 | 1,095 | 1,118 | 1,093 | ||||||||||

| MICRON TECHNOLOGY, INC. CONSOLIDATED BALANCE SHEETS (In millions) (Unaudited) |

|||||||||

| As of | August 29, 2024 |

May 30, 2024 |

August 31, 2023 |

||||||

| Assets | |||||||||

| Cash and equivalents | $ | 7,041 | $ | 7,594 | $ | 8,577 | |||

| Short-term investments | 1,065 | 785 | 1,017 | ||||||

| Receivables | 6,615 | 5,131 | 2,443 | ||||||

| Inventories | 8,875 | 8,512 | 8,387 | ||||||

| Other current assets | 776 | 1,297 | 820 | ||||||

| Total current assets | 24,372 | 23,319 | 21,244 | ||||||

| Long-term marketable investments | 1,046 | 775 | 844 | ||||||

| Property, plant, and equipment | 39,749 | 37,926 | 37,928 | ||||||

| Operating lease right-of-use assets | 645 | 660 | 666 | ||||||

| Intangible assets | 416 | 413 | 404 | ||||||

| Deferred tax assets | 520 | 597 | 756 | ||||||

| Goodwill | 1,150 | 1,150 | 1,150 | ||||||

| Other noncurrent assets | 1,518 | 1,415 | 1,262 | ||||||

| Total assets | $ | 69,416 | $ | 66,255 | $ | 64,254 | |||

| Liabilities and equity | |||||||||

| Accounts payable and accrued expenses | $ | 7,299 | $ | 5,145 | $ | 3,958 | |||

| Current debt | 431 | 398 | 278 | ||||||

| Other current liabilities | 1,518 | 1,297 | 529 | ||||||

| Total current liabilities | 9,248 | 6,840 | 4,765 | ||||||

| Long-term debt | 12,966 | 12,860 | 13,052 | ||||||

| Noncurrent operating lease liabilities | 610 | 609 | 603 | ||||||

| Noncurrent unearned government incentives | 550 | 672 | 727 | ||||||

| Other noncurrent liabilities | 911 | 1,049 | 987 | ||||||

| Total liabilities | 24,285 | 22,030 | 20,134 | ||||||

| Commitments and contingencies | |||||||||

| Shareholders’ equity | |||||||||

| Common stock | 125 | 125 | 124 | ||||||

| Additional capital | 12,115 | 11,794 | 11,036 | ||||||

| Retained earnings | 40,877 | 40,169 | 40,824 | ||||||

| Treasury stock | (7,852 | ) | (7,552 | ) | (7,552 | ) | |||

| Accumulated other comprehensive income (loss) | (134 | ) | (311 | ) | (312 | ) | |||

| Total equity | 45,131 | 44,225 | 44,120 | ||||||

| Total liabilities and equity | $ | 69,416 | $ | 66,255 | $ | 64,254 | |||

| MICRON TECHNOLOGY, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) (Unaudited) |

||||||

| For the year ended | August 29, 2024 |

August 31, 2023 |

||||

| Cash flows from operating activities | ||||||

| Net income (loss) | $ | 778 | $ | (5,833 | ) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | ||||||

| Depreciation expense and amortization of intangible assets | 7,780 | 7,756 | ||||

| Stock-based compensation | 833 | 596 | ||||

| Provision to write down inventories to net realizable value | — | 1,831 | ||||

| Goodwill impairment | — | 101 | ||||

| Change in operating assets and liabilities: | ||||||

| Receivables | (3,581 | ) | 2,763 | |||

| Inventories | (488 | ) | (3,555 | ) | ||

| Accounts payable and accrued expenses | 1,915 | (1,302 | ) | |||

| Other current liabilities | 989 | (817 | ) | |||

| Other | 281 | 19 | ||||

| Net cash provided by operating activities | 8,507 | 1,559 | ||||

| Cash flows from investing activities | ||||||

| Expenditures for property, plant, and equipment | (8,386 | ) | (7,676 | ) | ||

| Purchases of available-for-sale securities | (1,999 | ) | (723 | ) | ||

| Proceeds from maturities and sales of available-for-sale securities | 1,794 | 1,591 | ||||

| Proceeds from government incentives | 315 | 710 | ||||

| Other | (33 | ) | (93 | ) | ||

| Net cash provided by (used for) investing activities | (8,309 | ) | (6,191 | ) | ||

| Cash flows from financing activities | ||||||

| Repayments of debt | (1,897 | ) | (761 | ) | ||

| Payments of dividends to shareholders | (513 | ) | (504 | ) | ||

| Repurchases of common stock – repurchase program | (300 | ) | (425 | ) | ||

| Payments on equipment purchase contracts | (149 | ) | (138 | ) | ||

| Proceeds from issuance of debt | 999 | 6,716 | ||||

| Other | 18 | 95 | ||||

| Net cash provided by (used for) financing activities | (1,842 | ) | 4,983 | |||

| Effect of changes in currency exchange rates on cash, cash equivalents, and restricted cash | 40 | (34 | ) | |||

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (1,604 | ) | 317 | |||

| Cash, cash equivalents, and restricted cash at beginning of period | 8,656 | 8,339 | ||||

| Cash, cash equivalents, and restricted cash at end of period | $ | 7,052 | $ | 8,656 | ||

| MICRON TECHNOLOGY, INC. NOTES (Unaudited) |

|||||||||||

| Inventories In 2023, we recorded charges of $1.83 billion to cost of goods sold to write down the carrying value of work in process and finished goods inventories to their estimated net realizable values (“NRV”). The impact of inventory NRV write-downs for each period reflects (1) inventory write-downs in that period, offset by (2) lower costs in that period on the sale of inventory written down in prior periods. The impacts of inventory NRV write-downs are summarized below: |

|||||||||||

| 4th Qtr. | 3rd Qtr. | 4th Qtr. | Year Ended | ||||||||

| August 29, 2024 |

May 30, 2024 |

August 31, 2023 |

August 29, 2024 |

August 31, 2023 |

|||||||

| Provision to write down inventory to NRV | $ | — | $ | — | $ | — | $ | — | $ | (1,831 | ) |

| Lower costs from sale of inventory written down in prior periods | — | — | 563 | 987 | 844 | ||||||

| $ | — | $ | — | $ | 563 | $ | 987 | $ | (987 | ) | |

| MICRON TECHNOLOGY, INC. RECONCILIATION OF GAAP TO NON-GAAP MEASURES (In millions, except per share amounts) |

|||||||||||||||

| 4th Qtr. | 3rd Qtr. | 4th Qtr. | Year Ended | ||||||||||||

| August 29, 2024 |

May 30, 2024 |

August 31, 2023 |

August 29, 2024 |

August 31, 2023 |

|||||||||||

| GAAP gross margin | $ | 2,737 | $ | 1,832 | $ | (435 | ) | $ | 5,613 | $ | (1,416 | ) | |||

| Stock-based compensation | 85 | 80 | 64 | 312 | 201 | ||||||||||

| Other | 4 | 5 | 5 | 18 | 19 | ||||||||||

| Non-GAAP gross margin | $ | 2,826 | $ | 1,917 | $ | (366 | ) | $ | 5,943 | $ | (1,196 | ) | |||

| GAAP operating expenses | $ | 1,215 | $ | 1,113 | $ | 1,037 | $ | 4,309 | $ | 4,329 | |||||

| Stock-based compensation | (128 | ) | (137 | ) | (87 | ) | (509 | ) | (363 | ) | |||||

| Restructure and asset impairments | (1 | ) | — | (4 | ) | (1 | ) | (171 | ) | ||||||

| Patent cross-license agreement gain | — | — | — | 200 | — | ||||||||||

| Goodwill impairment | — | — | (101 | ) | — | (101 | ) | ||||||||

| Litigation settlement | — | — | — | — | (68 | ) | |||||||||

| Other | (5 | ) | — | (3 | ) | 9 | (3 | ) | |||||||

| Non-GAAP operating expenses | $ | 1,081 | $ | 976 | $ | 842 | $ | 4,008 | $ | 3,623 | |||||

| GAAP operating income (loss) | $ | 1,522 | $ | 719 | $ | (1,472 | ) | $ | 1,304 | $ | (5,745 | ) | |||

| Stock-based compensation | 213 | 217 | 151 | 821 | 564 | ||||||||||

| Restructure and asset impairments | 1 | — | 4 | 1 | 171 | ||||||||||

| Patent cross-license agreement gain | — | — | — | (200 | ) | — | |||||||||

| Goodwill impairment | — | — | 101 | — | 101 | ||||||||||

| Litigation settlement | — | — | — | — | 68 | ||||||||||

| Other | 9 | 5 | 8 | 9 | 22 | ||||||||||

| Non-GAAP operating income (loss) | $ | 1,745 | $ | 941 | $ | (1,208 | ) | $ | 1,935 | $ | (4,819 | ) | |||

| GAAP net income (loss) | $ | 887 | $ | 332 | $ | (1,430 | ) | $ | 778 | $ | (5,833 | ) | |||

| Stock-based compensation | 213 | 217 | 151 | 821 | 564 | ||||||||||

| Restructure and asset impairments | 1 | — | 4 | 1 | 171 | ||||||||||

| Patent cross-license agreement gain | — | — | — | (200 | ) | — | |||||||||

| Goodwill impairment | — | — | 101 | — | 101 | ||||||||||

| Litigation settlement | — | — | — | — | 68 | ||||||||||

| Other | 5 | 3 | 7 | — | 32 | ||||||||||

| Estimated tax effects of above and other tax adjustments | 236 | 150 | (10 | ) | 72 | 35 | |||||||||

| Non-GAAP net income (loss) | $ | 1,342 | $ | 702 | $ | (1,177 | ) | $ | 1,472 | $ | (4,862 | ) | |||

| GAAP weighted-average common shares outstanding – Diluted | 1,125 | 1,123 | 1,095 | 1,118 | 1,093 | ||||||||||

| Adjustment for stock-based compensation | 12 | 13 | — | 16 | — | ||||||||||

| Non-GAAP weighted-average common shares outstanding – Diluted | 1,137 | 1,136 | 1,095 | 1,134 | 1,093 | ||||||||||

| GAAP diluted earnings (loss) per share | $ | 0.79 | $ | 0.30 | $ | (1.31 | ) | $ | 0.70 | $ | (5.34 | ) | |||

| Effects of the above adjustments | 0.39 | 0.32 | 0.24 | 0.60 | 0.89 | ||||||||||

| Non-GAAP diluted earnings (loss) per share | $ | 1.18 | $ | 0.62 | $ | (1.07 | ) | $ | 1.30 | $ | (4.45 | ) | |||

| RECONCILIATION OF GAAP TO NON-GAAP MEASURES, Continued | |||||||||||||||

| 4th Qtr. | 3rd Qtr. | 4th Qtr. | Year Ended | ||||||||||||

| August 29, 2024 |

May 30, 2024 |

August 31, 2023 |

August 29, 2024 |

August 31, 2023 |

|||||||||||

| GAAP net cash provided by operating activities | $ | 3,405 | $ | 2,482 | $ | 249 | $ | 8,507 | $ | 1,559 | |||||

| Expenditures for property, plant, and equipment | (3,120 | ) | (2,086 | ) | (1,461 | ) | (8,386 | ) | (7,676 | ) | |||||

| Payments on equipment purchase contracts | (22 | ) | (45 | ) | (26 | ) | (149 | ) | (138 | ) | |||||

| Proceeds from sales of property, plant, and equipment | 12 | 41 | 18 | 99 | 92 | ||||||||||

| Proceeds from government incentives | 48 | 33 | 462 | 315 | 710 | ||||||||||

| Investments in capital expenditures, net | (3,082 | ) | (2,057 | ) | (1,007 | ) | (8,121 | ) | (7,012 | ) | |||||

| Adjusted free cash flow | $ | 323 | $ | 425 | $ | (758 | ) | $ | 386 | $ | (5,453 | ) | |||

The tables above reconcile GAAP to non-GAAP measures of gross margin, operating expenses, operating income (loss), net income (loss), diluted shares, diluted earnings (loss) per share, and adjusted free cash flow. The non-GAAP adjustments above may or may not be infrequent or nonrecurring in nature, but are a result of periodic or non-core operating activities. We believe this non-GAAP information is helpful in understanding trends and in analyzing our operating results and earnings. We are providing this information to investors to assist in performing analysis of our operating results. When evaluating performance and making decisions on how to allocate our resources, management uses this non-GAAP information and believes investors should have access to similar data when making their investment decisions. We believe these non-GAAP financial measures increase transparency by providing investors with useful supplemental information about the financial performance of our business, enabling enhanced comparison of our operating results between periods and with peer companies. The presentation of these adjusted amounts varies from amounts presented in accordance with U.S. GAAP and therefore may not be comparable to amounts reported by other companies. Our management excludes the following items in analyzing our operating results and understanding trends in our earnings:

- Stock-based compensation;

- Gains and losses from settlements;

- Restructure and asset impairments;

- Goodwill impairment; and

- The estimated tax effects of above, non-cash changes in net deferred income taxes, assessments of tax exposures, certain tax matters related to prior fiscal periods, and significant changes in tax law. The divergence between our GAAP and non-GAAP income tax provision relates to the difference in our GAAP and non-GAAP estimated annual effective tax rates, which are computed separately.

Non-GAAP diluted shares are adjusted for the impact of additional shares resulting from the exclusion of stock-based compensation from non-GAAP income (loss).

| MICRON TECHNOLOGY, INC. RECONCILIATION OF GAAP TO NON-GAAP OUTLOOK |

||||||||

| FQ1-25 | GAAP Outlook | Adjustments | Non-GAAP Outlook | |||||

| Revenue | $8.70 billion ± $200 million | — | $8.70 billion ± $200 million | |||||

| Gross margin | 38.5% ± 1.0% | 1.0% | A | 39.5% ± 1.0% | ||||

| Operating expenses | $1.211 billion ± $15 million | $126 million | B | $1.085 billion ± $15 million | ||||

| Diluted earnings per share(1) | $1.54 ± $0.08 | $0.20 | A, B, C | $1.74 ± $0.08 | ||||

| Non-GAAP Adjustments (in millions) |

||||

| A | Stock-based compensation – cost of goods sold | $ | 87 | |

| A | Other – cost of goods sold | 4 | ||

| B | Stock-based compensation – research and development | 76 | ||

| B | Stock-based compensation – sales, general, and administrative | 50 | ||

| C | Tax effects of the above items and other tax adjustments | 3 | ||

| $ | 220 | |||

| (1) | GAAP earnings per share based on approximately 1.12 billion diluted shares and non-GAAP earnings per share based on approximately 1.14 billion diluted shares. | |||

The tables above reconcile our GAAP to non-GAAP guidance based on the current outlook. The guidance does not incorporate the impact of any potential business combinations, divestitures, additional restructuring activities, balance sheet valuation adjustments, strategic investments, financing transactions, and other significant transactions. The timing and impact of such items are dependent on future events that may be uncertain or outside of our control.

Contacts: Satya Kumar Investor Relations satyakumar@micron.com (408) 450-6199 Erica Rodriguez Pompen Media Relations epompen@micron.com (408) 834-1873

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: This 1 Thing Will Help Nvidia Stock Soar in the Fourth Quarter

Nvidia (NASDAQ: NVDA) shares have roared higher over the past several years, thanks to the company’s dominance in the artificial intelligence (AI) chip market — it holds a more than 80% share. But recently, the stock has lost some of its momentum, falling more than 6% over the past month. Some investors have worried about growing competition in the chip market, and others fear that any slowdown in AI spending could hurt the company.

In my opinion, these concerns are overdone and Nvidia still has plenty of fuel in the tank to climb both in the near term and over time. My prediction is that one thing, in particular, will help Nvidia stock soar in the fourth quarter and the recent loss of momentum is only temporary. Let’s dive into this tech story that still has plenty of exciting chapters ahead.

Nvidia’s path from gaming to AI

Just a few years ago, this technology giant’s biggest source of revenue was the gaming industry. Nvidia’s graphics processing units (GPUs) powered all of the action, due to their ability to handle multiple tasks simultaneously. It soon became clear that this profile made the GPU perfect for other uses, including AI.

Nvidia turned its attention to this high-growth field, and its earnings took off, climbing in the triple digits quarter after quarter. Today, Nvidia’s data center business — the one that serves AI customers — represents 87% of the company’s total quarterly revenue. That’s set to continue, considering the massive demand Nvidia’s seeing and the general growth forecasts for the AI market, which is expected to expand from $200 billion today to more than $1 trillion by 2030.

Of course, competitors do exist, but Nvidia is a step ahead when it comes to innovation. It also plans to update its GPUs on an annual basis, which should keep it in this top position. As for AI spending, my colleague Trevor Jennewine recently wrote about how spending on AI may gain more momentum over the coming years, representing great news for Nvidia.

Now let’s move on to my prediction. Yes, Nvidia shares have delivered a lackluster performance in recent weeks, but it’s important to put that into perspective. The stock still has advanced 144% so far this year and has soared 2,700% over the past five years.

“Several billion dollars” of new revenue

My prediction is that this is a pause in the action, and in the fourth quarter, sales of Nvidia’s new Blackwell architecture will help the stock roar higher. Nvidia said during its most recent earnings call that it plans to ramp up production of Blackwell in the fourth quarter and will record “several billion dollars” of revenue from it during that period.

Nvidia won’t report fiscal fourth-quarter earnings until early next year, but any communications from the company about the Blackwell release or talk in the market could happen much earlier — and investors are known to react to any news. All of this may equal strong performance for Nvidia shares in the fourth quarter of this year as investors consider the company’s message during the last earnings call — and look ahead to Blackwell’s contribution to the next fourth-quarter report.

It’s important to remember that Nvidia Chief Executive Officer (CEO) Jensen Huang said demand for Blackwell has surpassed supply, and he expects this to continue into the coming year, so it’s clear that customers are rushing to get in on this new platform. I recently wrote about how two major technology players begged Huang for more GPUs, further illustrating how eager customers are to get Nvidia chips.

All this makes me confident about Nvidia’s long-term revenue potential in the AI market and the potential for its shares to soar over time, as well — whether my near-term prediction is right or not. That means Nvidia still is a great stock to buy and hold for the long haul.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Prediction: This 1 Thing Will Help Nvidia Stock Soar in the Fourth Quarter was originally published by The Motley Fool

Check Out What Whales Are Doing With AUR

Investors with a lot of money to spend have taken a bullish stance on Aurora Innovation AUR.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AUR, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Aurora Innovation.

This isn’t normal.

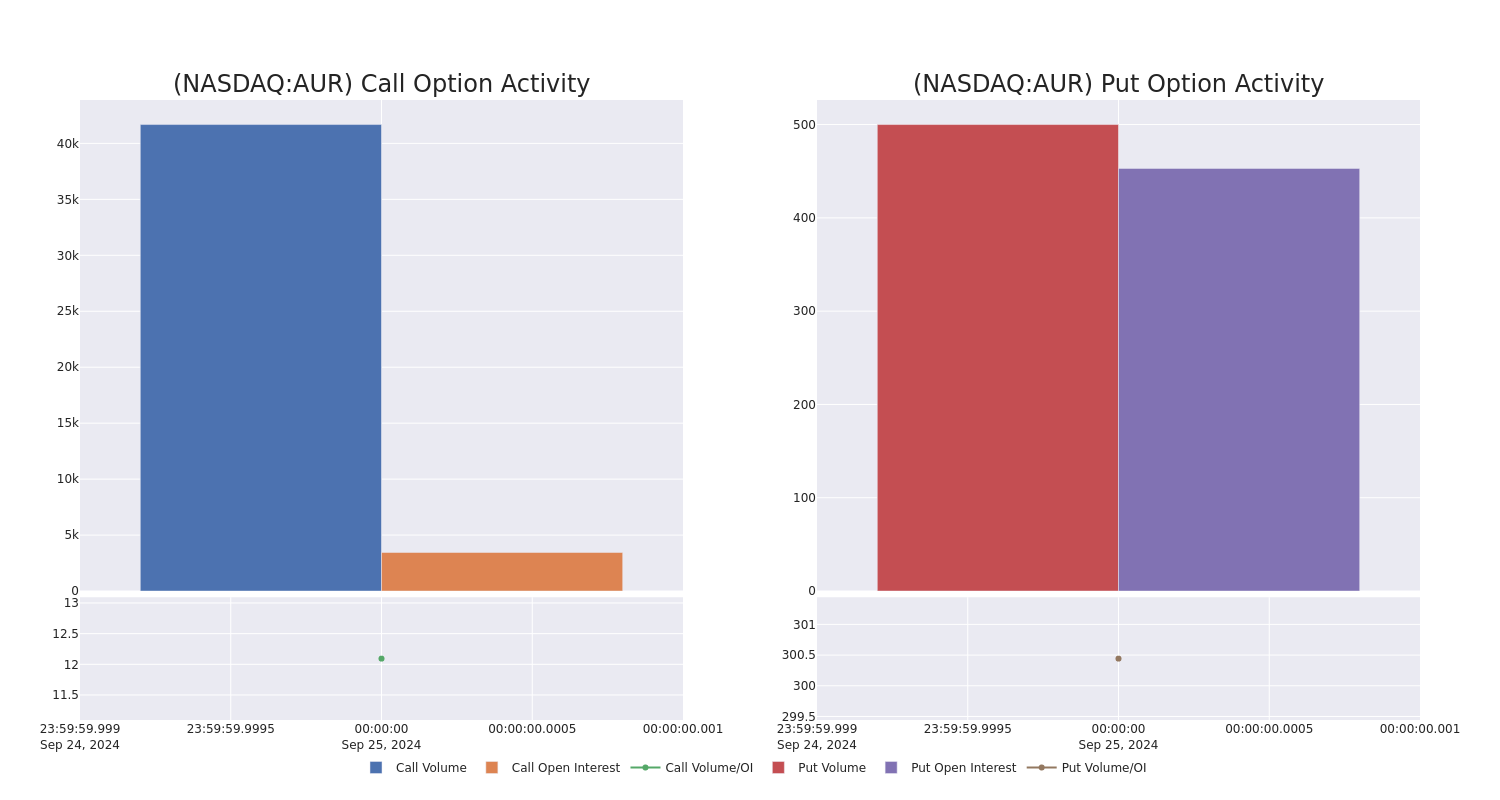

The overall sentiment of these big-money traders is split between 80% bullish and 10%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $76,750, and 8 are calls, for a total amount of $601,410.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $5.5 and $10.0 for Aurora Innovation, spanning the last three months.

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Aurora Innovation stands at 557.14, with a total volume reaching 42,184.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Aurora Innovation, situated within the strike price corridor from $5.5 to $10.0, throughout the last 30 days.

Aurora Innovation Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AUR | CALL | TRADE | BEARISH | 03/21/25 | $1.7 | $1.55 | $1.6 | $6.00 | $160.0K | 288 | 0 |

| AUR | CALL | SWEEP | BULLISH | 10/18/24 | $0.65 | $0.6 | $0.65 | $7.00 | $135.7K | 2.8K | 9.2K |

| AUR | CALL | SWEEP | BULLISH | 10/18/24 | $0.6 | $0.55 | $0.55 | $7.00 | $84.0K | 2.8K | 5.4K |

| AUR | CALL | TRADE | BULLISH | 10/18/24 | $0.75 | $0.7 | $0.74 | $7.00 | $74.0K | 2.8K | 10.4K |

| AUR | CALL | SWEEP | BULLISH | 11/15/24 | $1.75 | $1.4 | $1.73 | $5.50 | $49.3K | 201 | 319 |

About Aurora Innovation

Aurora Innovation Inc is engaged in delivering self-driving technology safely, quickly, and broadly. The Aurora Driver is a self-driving system designed to operate multiple vehicle types, from freight-hauling trucks to ride-hailing passenger vehicles, and underpins Aurora Horizon and Aurora Connect, its driver-as-a-service products for trucking and ride-hailing. The Company is developing the Aurora Driver, an advanced and scalable suite of self-driving hardware, software and data services designed as a platform to adapt and interoperate amongst vehicle types and applications.

Current Position of Aurora Innovation

- With a volume of 18,274,127, the price of AUR is up 2.54% at $6.46.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 35 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Aurora Innovation with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

About 45% of Americans will run out of money in retirement, including those who invested and diversified. Here are the 4 biggest mistakes being made.

-

Nearly half of Americans retiring at 65 risk running out of money, Morningstar finds.

-

Single women face a 55% chance of depleting funds, higher than single men and couples.

-

Experts advise better tax planning and diversified investments to mitigate retirement risks.

If you’re aiming to retire at the standard age of 65, buckle up because you’re going to want to hear this one.

According to a simulated model that factors in things like changes in health, nursing home costs, and demographics, about 45% of Americans who leave the workforce at 65 are likely to run out of money during retirement.

The model, run by Morningstar’s Center for Retirement and Policy Studies, showed that the risk is higher for single women, who had a 55% chance of running out of money versus 40% for single men and 41% for couples.

The group most susceptible to ending up in this situation are those who didn’t save toward a retirement plan, according to Spencer Look, the center’s associate director. Still, retirement advisors say even those who think they’re prepared aren’t.

It’s a big problem, says JoePat Roop, the president of Belmont Capital Advisors, who has been helping clients set up income streams for their retirement years. What might surprise many is that one of the biggest mistakes people make isn’t so much about how much they save but how they plan around what they save.

To be more specific, Roop says what catches retirees off guard is taxes and the lack of planning around them. Many assume they will be in a lower tax bracket once they stop receiving a paycheck. But from his experience, retirees often remain in the same tax bracket or could even end up in a higher one.

“It’s wrong in so many ways,” Roop said. After retiring, most people’s spending habits either remain the same or go up. When you have more leisure time on your hands, more money goes toward entertainment and travel, especially in the first few years of retirement. The outcome is a higher withdrawal rate, which can push you into a higher tax bracket, he noted.

People spend their careers investing in a 401(k) or an IRA because they allow contributions before taxes. It sounds like a great perk when you can cut your taxes and defer them. The downside is that withdrawals will be taxed.

His solution is to add a Roth IRA, an after-tax account that allows gains to grow tax-free. This way, during a year when you need to withdraw a higher amount, you can resort to that account instead, he noted.

Another big mistake people make is moving money around in an inefficient way that leads them to incur more taxes than they should or lose on future returns. This can include choosing to withdraw a high amount of money from an investment account to pay off a mortgage or buy a house.

“There are rules that the IRS has set up for us, and they’re there to pay the government, not you,” Roop said.

A prime example of a big tax mistake one of Roop’s clients (let’s call him Bob) made recently was liquidating part of an IRA to buy a house.

Bob is a man of modest means retiring this year, Roop said. But a sudden breakup with his girlfriend led him to cash out some of his IRA to buy a house. He decided to withhold the tax, which could have been between $30,000 and $40,000.

“When he told us this, my mouth dropped,” Roop said. “I said, Bob, you had the money for the down payment in another account where there would’ve been no tax, and we were going to roll over your IRA and put it in a tax-deferred account.”

In this case, Roop planned to move money from Bob’s IRA to an annuity that would have paid him a bonus of 10%, or $15,000. The mistake might cost Bob between $45,000 and $55,000, between the owed taxes and the missed bonus.

The lesson: don’t be Bob.

The next big mistake is sequence risk, which is when you withdraw from your portfolio when the stock market is down.

“The S&P 500 has averaged close to 10% for the last 50 years,” Roop said. “And so it’s a true assumption that over the next 50 years, it’ll probably make between nine and 11%. But when people retire, we don’t know the sequence of returns.”

Simply put, if you retire next year with an investment portfolio worth a million dollars and the market drops by 15% that year, you now have $850,000. If you need to withdraw during that time, it will be very difficult to get back to breakeven, Roop said.

It means that owning stocks and bonds isn’t enough diversification. He noted that you must also have something that is principal-protected, such as a CD, fixed annuities, or government bond. This way, you can avoid touching your portfolio during a bad time in the market.

Gil Baumgarten, founder and CEO of Segment Wealth Management, says another big reason he sees people run out of money is the lack of appropriate risk-taking they make during their income-earning years.

A low-risk approach is earning interest on cash, a terrible form of compounding because it’s taxed higher as ordinary income with lower returns, he noted. Meanwhile, stocks could see higher returns and aren’t taxed until sold, or aren’t taxed at all if you opt for a Roth IRA.

“People don’t take into account how expensive things get over time, not realizing that they can live another 40 years in retirement. You can’t get rich investing your money at 5%,” Baumgarten said.

As for those who do take risks, it’s often the wrong kind. They chase hype and bet on highly speculative investments. They end up losing money and assume risk is bad, Baumgarten said. The right kind of risk is a higher exposure to stocks through mutual funds or index funds and even buying blue chip stocks, he noted.

Read the original article on Business Insider

Five Reasons to Stay Bullish on Nvidia Stock (NVDA) After Recent Corrections

Nvidia’s (NVDA) ultra-bullish trend in the first half of the year has paused, with the stock failing to reach new peaks over the past few months. Following the highly anticipated Q2 earnings report at the end of August, Nvidia stock experienced a pullback due to elevated investor expectations for hypergrowth, despite the strong results it posted. I believe this price correction offers a compelling opportunity. In this article, I will outline five reasons for my bullish view on Nvidia, focusing on strong revenue growth (despite tough comps), AI dominance, valuation, technical indicators, and Wall Street analyst consensus.

Let’s dive in.

1. Nvidia’s Strong Revenue Growth Despite Tough Comparisons

The first point supporting a prolonged bullish thesis for Nvidia is the solid revenue growth demonstrated in its Q2 results, despite challenging comparisons.

Nvidia posted 122% year-over-year growth in the most recent quarter, reaching revenues of $30 billion—a remarkable achievement given the company’s already substantial revenue base. Although this growth rate is lower than the 200% surge from the previous quarter, the absolute triple-digit top-line growth remains impressive. This underscores Nvidia’s ability to scale its revenue significantly even when set against it’s prior performance.

While the post-Q2 stock pullback can be attributed to expectations being set too high, it’s crucial to note that Nvidia continues to deliver sequential quarterly revenue growth, signaling robust demand for its products, especially in AI and data centers. This level of sustained growth at such a large scale highlights Nvidia’s capacity to capture market share and drive long-term revenue expansion. Nvidia’s Q3 sales guidance of $32.5 billion further reflects the company’s confidence in maintaining its growth trajectory.

2. Nvidia’s Dominance in AI and Data Center Market

The second bullish point is Nvidia’s continued dominance in the data center GPU space, where it holds a 98% market share in this rapidly growing sector, according to HPCwire.

Demand for AI-driven solutions is booming across industries, with Nvidia’s H100 Hopper GPU becoming crucial for enterprise cloud applications that require massive computing power. Beyond hardware, Nvidia dominates AI through its software ecosystem, including CUDA and cuDNN, offering a comprehensive AI solution. As highlighted in Nvidia’s earnings call, the company aims to transform the $1 trillion data center market by shifting from traditional to accelerated computing using advanced data processing libraries.

Looking ahead, Nvidia plans to launch its Blackwell architecture in Q4 of Fiscal 2025, offering greater power and efficiency than Hopper. Designed to meet the demands of hyperscalers and AI developers, Blackwell will provide comprehensive solutions, including chips, systems, networking, and software. This release is a key catalyst that will further solidify Nvidia’s leadership in AI.

3. Nvidia Appears Attractively Priced When Adjusted for Growth

The third point concerns Nvidia’s valuations. At first glance, its P/E ratio of 54.7x and forward P/E of 42.5x may seem high, especially compared to the semiconductor industry average of 23.7x. However, my bullish stance is strengthened by Nvidia’s growth prospects, with the company expected to achieve 106% revenue growth and 119% EPS growth this year.

Furthermore, analysts expect Nvidia’s EPS to grow at a CAGR of 36.6% over the next three to five years. This impressive growth rate, combined with the current forward P/E, results in a reasonable forward price-to-earnings-to-growth (PEG) ratio of 1.16.

Traditionally, undervalued stocks have a PEG ratio below one, yet NVIDIA’s PEG ratio is more favorable than those of all other Magnificent 7 stocks. Among this group, Alphabet (GOOGL) and Meta (META) have the next lowest PEG ratios at 1.28 and 1.48, respectively. While this doesn’t necessarily mean NVIDIA is undervalued compared to its Big Tech peers, it does suggest that, according to this metric, the stock doesn’t appear overly expensive.

4. NVDA’s Moving Averages Suggest a Bullish Trend

The fourth point reinforcing the bullish thesis is closely tied to the sentiment surrounding Nvidia’s stock performance. Despite recent fluctuations, the company’s triple-digit revenue growth indicates that it is still in a hypergrowth phase. However, with a staggering 2,700% stock price surge over the past five years, concerns about a potential bubble remain.

In this context, I believe that focusing on long-term moving averages is essential for gauging momentum. This provides a clearer view of Nvidia’s trend amid daily volatility, especially given the stock’s 48% annualized volatility. NVDA stock’s upward trend is supported by a current trading price above its 200-day moving average of $92.80.

5. Wall Street Remains Overwhelmingly Bullish on NVDA

Finally, the fifth point contributing to my favorable outlook for Nvidia is the overwhelmingly bullish consensus among Wall Street analysts. Of the 42 analysts covering the stock, 39 have issued Buy recommendations, while the remaining three have a Hold rating. Moreover, the average price target among these analysts is $152.44, indicating potential upside of nearly 25%.

A standout is Rosenblatt analyst Hans Mosesmann, who has the highest price target on Wall Street for Nvidia at $200 per share. His optimism persisted after the Q2 results, which he deemed strong, driven by growth in Hopper AI and networking. Although gross margins dipped slightly due to updates on Blackwell chips aimed at improving yields, Mosesmann remains confident. He highlights that despite potential short-term weakness in the share price, the bullish sentiment is supported by a 44x P/E multiple based on Fiscal 2027 EPS.

Conclusion

In this article, I’ve outlined five key points supporting my Buy stance on Nvidia. I believe that the stock’s recent weakness presents an attractive buying opportunity for investors eager to capitalize on its strong growth trajectory.

While some short-term hiccups may persist, Nvidia’s Q2 results suggest that its growth story is set to continue robustly as the company consolidates its market dominance and prepares for the upcoming release of the Blackwell architecture. Given the potential for further growth in the coming years, the current rich valuation can be justified, and Wall Street believes the same.

Dow Tumbles Nearly 300 Points: Investor Optimism Improves Slightly, But Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed some improvement in the overall market sentiment, while the index remained in the “Greed” zone on Wednesday.

U.S. stocks settled mostly lower on Wednesday, with the Dow Jones index falling around 300 points during the session.

Shares of Stitch Fix, Inc. SFIX dipped more than 39% on Wednesday after the company reported worse-than-expected fourth-quarter EPS results.

On the economic data front, U.S. building permits increased by 4.6% to an annual rate of 1.470 million in August. Sales of new single-family houses in the U.S. fell by 4.7% from the prior month to an annualized rate of 716,000 in August of 2024, compared to a revised 10.3% gain in the prior month.

Most sectors on the S&P 500 closed on a negative note, with energy, health care, and financials stocks recording the biggest losses on Wednesday. However, information technology and utilities stocks bucked the overall market trend, closing the session higher.

The Dow Jones closed lower by around 293 points to 41,914.75 on Wednesday. The S&P 500 fell 0.19% to 5,722.26, while the Nasdaq Composite gained 0.04% at 18,082.21 during Wednesday’s session.

Investors are awaiting earnings results from Accenture plc ACN, Jabil Inc. JBL, and Costco Wholesale Corporation COST today.

What is CNN Business Fear & Greed Index?

At a current reading of 67, the index remained in the “Greed” zone on Wednesday, versus a prior reading of 66.5.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lennar Corporation Declares Quarterly Dividends

MIAMI, Sept. 25, 2024 /PRNewswire/ — Lennar Corporation LEN, one of the nation’s leading homebuilders, announced that its Board of Directors has declared a quarterly cash dividend of $0.50 per share for both Class A and Class B common stock payable on October 24, 2024 to holders of record at the close of business on October 9, 2024.

About Lennar

Lennar Corporation, founded in 1954, is one of the nation’s leading builders of quality homes for all generations. Lennar builds affordable, move-up and active adult homes primarily under the Lennar brand name. Lennar’s Financial Services segment provides mortgage financing, title and closing services primarily for buyers of Lennar’s homes and, through LMF Commercial, originates mortgage loans secured primarily by commercial real estate properties throughout the United States. Lennar’s Multifamily segment is a nationwide developer of high-quality multifamily rental properties. LENX drives Lennar’s technology, innovation and strategic investments. For more information about Lennar, please visit www.lennar.com.

Contact:

Ian Frazer

Investor Relations

Lennar Corporation

(305) 485-4129

![]() View original content:https://www.prnewswire.com/news-releases/lennar-corporation-declares-quarterly-dividends-302259130.html

View original content:https://www.prnewswire.com/news-releases/lennar-corporation-declares-quarterly-dividends-302259130.html

SOURCE Lennar Corporation

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Director Of Mission Produce Makes $1.33M Sale

Taylor Family Investments LLC, Director at Mission Produce AVO, reported an insider sell on September 24, according to a new SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Tuesday showed that LLC sold 100,100 shares of Mission Produce. The total transaction amounted to $1,326,328.

At Wednesday morning, Mission Produce shares are down by 0.0%, trading at $12.77.

Discovering Mission Produce: A Closer Look

Mission Produce Inc is engaged in the business of producing and distributing avocados, serving retail, wholesale, and food service customers. Also, the company provides additional services like ripening, bagging, custom packing, and logistical management. The company’s operating segments include Marketing and Distribution and International Farming and Blueberries. It generates maximum revenue from the Marketing and Distribution segment. The Marketing and Distribution segment sources fruit mainly from growers and then distributes fruit through a distribution network.

Understanding the Numbers: Mission Produce’s Finances

Revenue Growth: Mission Produce displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 23.95%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Staples sector.

Insights into Profitability:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 11.42%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Mission Produce’s EPS reflects a decline, falling below the industry average with a current EPS of 0.17.

Debt Management: With a below-average debt-to-equity ratio of 0.45, Mission Produce adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 38.67 is lower than the industry average, implying a discounted valuation for Mission Produce’s stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.8 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 12.48, Mission Produce presents an attractive value opportunity.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Exploring Key Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Mission Produce’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LIFD's 5x Potential: Is This Psychoactive Hemp Stock The Next Big Speculative Buy?

A leading player in psychoactive hemp-derived products (PHDs), LFTD Partners Inc. LIFD is trading at just 0.2x CY24 EV/Sales, offering a steep discount. The stock has plummeted over 90% from its April 2021 peak but remains cash flow positive with a net cash position, leaving the company ripe for expansion through mergers and acquisitions.

Despite regulatory pressures, LIFD’s compliant strategy is expected to drive market share gains. According to a report from Zuanic & Associates, the stock could see a 5x rise by December 2025.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Valuation And Growth Potential

LIFD trades at 0.2x CY24 EV/Sales, below its estimated liquidation value. Zuanic’s report suggests that if LIFD were to reach 0.5x sales on projected estimates, the stock could rise 5x by December 2025.

This makes the stock an attractive, albeit speculative, investment. The analyst assigns only a 10% probability to a scenario of a federal ban on PHDs, providing further support for the stock’s upside potential. However, the future of LIFD is highly binary, driven by regulatory developments.

Regulatory Risks And Opportunities

LIFD’s business has been heavily impacted by regulatory challenges at both the state and federal levels, with 19 states having banned PHDs outright.

However, according to Zuanic, the upcoming Farm Bill is expected to delegate the regulation of PHDs to individual states, potentially allowing LIFD to capitalize on compliant strategies in states with strict regulations rather than outright bans.

This could lead to market share gains and top-line growth.

Zuanic notes that LIFD has the opportunity to benefit from collaboration with THC cannabis companies entering the PHD space, which could validate the compliant PHD market and lead to potential joint lobbying efforts.

The long-term regulatory convergence between PHDs and THC products is another potential upside.

Bull Vs. Bear Case

In the bull case, if the regulatory landscape clarifies and no state bans emerge in key markets, LIFD’s EV/Sales multiple could return to a 0.5-1.0x range.

This would imply a substantial upside. In the bear case, if federal legislation leads to a ban on PHDs or the company’s nutraceutical strategy fails, the stock could face a total loss in value. However, Zuanic assigns just a 10% probability to this worst-case scenario.

Read Next: Gov. Newsom’s Hemp Ban Goes Into Effect: Consequences For Industry, Investors, Patients

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.