Micron Gains Most in Six Months as AI Demand Bolsters Forecast

(Bloomberg) — Micron Technology Inc., the largest US maker of computer memory chips, is on track to gain the most in six months after giving surprisingly strong sales and profit forecasts, helped by demand for artificial intelligence gear.

Most Read from Bloomberg

Fiscal first-quarter revenue will be about $8.7 billion, the company said in a statement Wednesday. That compares with an average analyst estimate of $8.32 billion. Profit will be about $1.74 a share, minus certain items, versus a projection of $1.52.

The rosy outlook is the latest sign that Micron is benefiting from a boom in AI spending. Orders for a type of product called high-bandwidth memory have added a lucrative new revenue stream for the company and other chipmakers. The technology helps develop AI systems by providing more rapid access to massive pools of information.

Demand has been outpacing supply, letting Micron boost prices and secure long-term guaranteed contracts. It’s already sold out of the product for 2024 and 2025, the company said Wednesday.

The shares rose about 15% to $110.60 in premarket trading on Thursday. If the gains hold, it will be the biggest intraday increase since March 21.

Results from Micron’s fiscal fourth quarter also handily beat estimates. Revenue increased 93% to $7.75 billion in the period, which ended Aug. 29. Excluding certain items, profit was $1.18 per share. On average, analyst had estimated a profit of $1.12 a share and revenue of $7.66 billion.

Micron has an edge because it’s the first chipmaker to reliably offer more advanced memory in high volumes, Executive Vice President of Operations Manish Bhatia said in an interview. With companies racing to beef up their AI software and hardware — and using more memory in the process — Micron is in a good position, he said.

The chipmaker also is emerging from a slowdown in demand for personal computers and smartphones, two of the biggest markets for memory. Device shipments are now growing again, Micron said. Those devices will increasingly feature AI functionality that requires more memory chips to work properly, adding a further benefit, Bhatia said.

Micron makes dynamic random access memory, or DRAM, a type of chip that temporarily holds information and works alongside processors from companies such as Nvidia Corp. and Intel Corp. It also make Nand flash memory — semiconductors that store information in everything ranging from data-center computers to smartphones.

“Robust AI demand drove a strong ramp of our data center DRAM products,” Chief Executive Officer Sanjay Mehrotra said in the statement. “We are entering fiscal 2025 with the best competitive positioning in Micron’s history.”

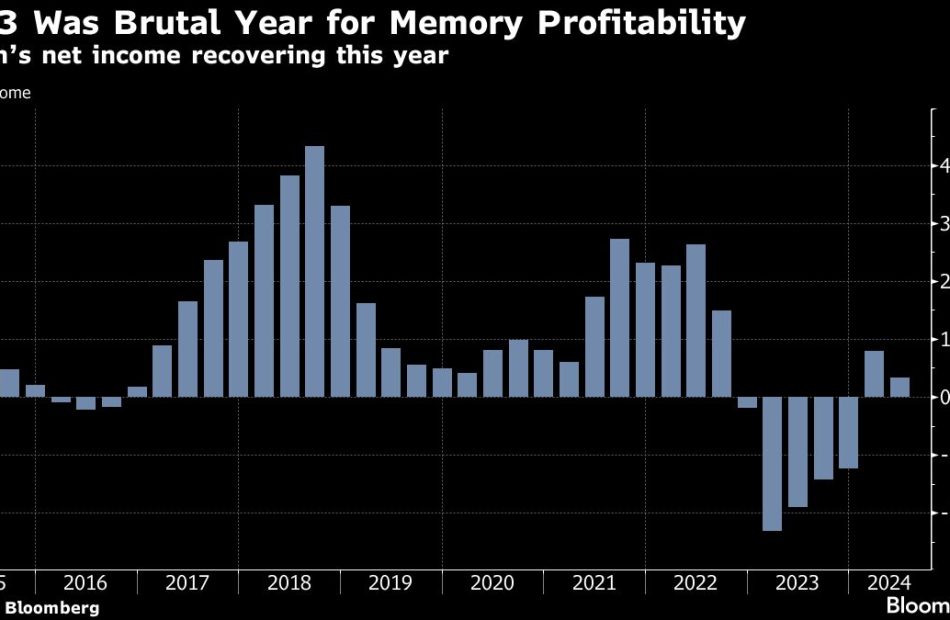

The company is one of only a handful that have survived the industry’s brutal boom-and-bust cycles over the devices. Those swings in demand have made it difficult maintain consistent profits, but the company has been emerging from the latest downturn. The chipmaker competes with South Korea’s Samsung Electronics Co. and SK Hynix Inc. in the memory market.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Micron stock jumps as Q1 revenue forecast tops analyst estimates

Micron (MU) stock surged 16% before the bell on Thursday after the chipmaker forecast higher-than-expected revenue for the upcoming quarter.

Micron projected first quarter revenues of $8.5 billion to $8.9 billion, above the $8.3 billion analysts anticipated.

Company executives attributed the raised guidance to a more favorable pricing environment as well as robust demand for Micron’s memory chips used in data centers to power artificial intelligence.

“With the advent of AI, we are in the most exciting period that I have seen for memory and storage in my career,” CEO Sanjay Mehrotra said during a call with investors Wednesday afternoon. Mehrotra said the company is entering fiscal year 2025 with “the best competitive positioning in Micron’s history.”

Micron is the first chipmaker to report quarterly results this earnings season. Its report provides an initial look at how the semiconductor sector is faring amid high expectations from Wall Street.

The company reported revenue of $7.75 billion in its fiscal fourth quarter ended Aug. 29 — 93% higher than last year and surpassing the $7.66 billion expected by analysts, who had recently softened their expectations. Adjusted earnings per share of $1.18 also exceeded both the top range of Micron’s guidance and the $1.11 forecast by Wall Street.

Micron’s memory chip business has undergone a resurgence over the past year as Big Tech companies pour billions into the semiconductor sector for hardware to power AI data centers.

Micron distinguishes itself by partnering with, rather than competing against, industry superpower Nvidia (NVDA). Micron supplies memory chips for Nvidia’s hotly demanded GPUs.

Investors have staggeringly high and ever-increasing standards for AI chipmakers, which have left them often disappointed in recent months. Micron’s third quarter earnings beat did little to sway investors in late June, and shares plummeted due to its fourth quarter outlook, which came right in line with (rather than beating) Wall Street’s expectations.

Nvidia stock also sank after reporting quarterly earnings at the end of August. Despite more than doubling profits and beating sales forecasts, investors wanted more from the semiconductor superpower.

Nvidia stock has since rebounded, and Micron’s fourth quarter results lifted its stock after an otherwise disappointing few months, which have seen shares plummet from highs in the $150 range in mid-June.

The PHLX Semiconductor Sector Index (^SOX) has begun to recover from a dip at the beginning of the month as tech stocks rallied following the US Federal Reserve’s jumbo interest rate cut and the Chinese central bank’s broad stimulus package. The index is up nearly 6% over the past week.

Laura Bratton is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Forget Nvidia: Putting $300 to Work in These 3 Unstoppable Stocks Right Now Would Be a Smarter Move

One of the best aspects of putting your money to work on Wall Street is that most online brokers have eliminated barriers that had previously kept retail investors on the sideline. Minimum deposit requirements and commission fees for common stock trades on major U.S. exchanges are predominantly a thing of the past.

For everyday investors, it means virtually any amount of money — even $300 — can be the perfect amount to put to work in the stock market.

While it might sound tempting to invest $300 in the hottest stock on Wall Street, artificial intelligence (AI) kingpin Nvidia (NASDAQ: NVDA), there are three unstoppable stocks that make for much smarter buys right now.

Four reasons investors can safely pass on Nvidia

Despite Nvidia’s AI-graphics processing units (GPUs) absolutely dominating in high-compute data centers, there are a number of reasons to believe the company’s stock has peaked and will underperform in the years to come.

For example, there hasn’t been a next-big-thing innovation for at least three decades that’s avoided an early innings bubble-bursting event. Without fail, investors consistently overestimate the adoption and utility of new technologies and innovations, which eventually leads to real-world results falling short of otherworldly expectations. If artificial intelligence follows this path, no company is going to be hurt more than Nvidia.

Another expected headwind for Nvidia is an increase in competition. While it’s well-documented that other chipmakers are ramping up production and/or debuting AI-GPUs for AI-accelerated data centers, investors are likely overlooking the prospect of internal competition. All four of Nvidia’s top customers by net sales are developing AI-GPUs of their own, which will undoubtedly limit future orders for the company’s hardware.

Insiders aren’t giving investors a reason to buy, either. Nvidia’s recently unveiled $50 billion buyback program, or as I refer to it, the “smoke-and-mirrors campaign,” doesn’t hide the fact that it’s been 45 months since a single share was purchased by an insider on the open market.

Lastly, Nvidia’s valuation isn’t nearly as enticing as it might appear. Shares of the company are valued at an unsightly 30 times trailing-12-month (TTM) sales, and briefly topped a TTM price-to-sales ratio of 40 in June.

Forget about Nvidia and consider putting $300 to work right now in the following three unstoppable stocks.

Visa

The first sensational stock that can be bought with $300 right now, and has all the tools needed to deliver superior returns to Nvidia in the coming years, is leading payment processor Visa (NYSE: V).

Despite recessionary red flags cropping up, Visa benefits immensely from the non-linearity of the economic cycle. While recessions are both normal and inevitable, they’re historically short-lived. Just three of the 12 U.S. recessions since the end of World War II endured for a full year.

By comparison, most periods of growth stick around for many years, if not a decade. Visa enjoys the spoils of lengthy growth periods and the long-term expansion of consumer and enterprise spending.

At the same time, Visa is well-protected from downturns thanks to its purposeful avoidance of lending. Although some of its peers act as lenders and payment processors, Visa solely focuses on payment facilitation. Since it doesn’t lend, it’s not required to set aside capital for those inevitable periods where the U.S. economy weakens. This gives Visa more financial flexibility than its peers and helps it bounce back from recessions very quickly.

Visa has an incredible opportunity in overseas markets, too. Cross-border payment volume grew 14% on a constant-currency basis in Visa’s latest quarter, which follows a consistent theme of sustained double-digit growth in cross-border payment volume. Many of the world’s fastest-growing emerging markets are chronically underbanked, which provides Visa with a no-brainer opportunity to sustain double-digit annual earnings growth through the remainder of this decade, if not well beyond.

Walt Disney

A second unstoppable stock that can outpace Nvidia in the return column and makes for a stellar buy right now with $300 is media goliath Walt Disney (NYSE: DIS).

Few companies were clobbered more directly by the COVID-19 pandemic than Disney. The closing of theme parks, coupled with limited studio output and select movie theater closures, severely hampered its bottom line. But with China’s economy reopened and studio output ramping up, Disney is shining, once more.

Perhaps the best aspect of Disney’s operating model is that it can’t be duplicated. Even though there are no shortage of movies and shows to watch and theme parks to visit, no other company offers the history, depth of engagement, characters, or storytelling capacity that Disney brings to the table. This alone ensures that Walt Disney will continue to generate predictable cash flow from its multiple operating segments.

Something else for investors to be excited about is Disney’s progress with its direct-to-consumer (DTC) segment. After years of sizable losses, Disney delivered its first operating profit from its DTC segment. Being an irreplaceable media company has allowed it to increase subscription prices for all of its tiers and move its DTC segment to profitability a full quarter ahead of schedule.

The “House of Mouse” is also historically inexpensive. Its forward price-to-earnings ratio of 18 marks a 31% discount to its average forward-year earnings multiple over the prior half-decade. Further, Disney should be able to deliver sustained double-digit earnings growth as its DTC segment and studio begin to stretch their proverbial legs.

PubMatic

The third unstoppable stock that makes for a smarter buy than Nvidia with $300 right now is small-cap adtech company PubMatic (NASDAQ: PUBM).

PubMatic finds itself perfectly positioned to take advantage of the rise of digital advertising. Even though advertising is highly cyclical, and businesses aren’t shy about paring back their marketing budget at the first sign(s) of trouble, the aforementioned non-linearity of economic cycles works in favor of ad-driven businesses. Investors with a long-term mindset should benefit from owning stakes in companies that see ad spending climb over time.

One of the key reasons PubMatic is set for success is the decision by its management team to design and develop its own cloud-based programmatic ad platform. While it would have been easy for PubMatic to rely on a third-party provider, the decision to build its own cloud-based infrastructure should result in a decisively higher operating margin as it scales its revenue.

As noted, PubMatic has honed in on the fastest-growing aspects of the advertising arena. Specifically, it’s a sell-side platform aiming to sell digital display space for advertisers in mobile, video, and connected TV (CTV). All three of these segments can sustain double-digit annual ad spending growth for the foreseeable future, with CTV ad spend growing the fastest.

Lastly, PubMatic is sitting on a cash-rich balance sheet that gives it ample financial flexibility. The company ended June with $165.6 million in cash and cash equivalents, and no debt, and has repurchased roughly $100 million worth of its common stock. Additionally, it’s working on its 10th consecutive year of generating positive operating cash flow.

Should you invest $1,000 in Visa right now?

Before you buy stock in Visa, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Sean Williams has positions in PubMatic and Visa. The Motley Fool has positions in and recommends Nvidia, PubMatic, Visa, and Walt Disney. The Motley Fool has a disclosure policy.

Forget Nvidia: Putting $300 to Work in These 3 Unstoppable Stocks Right Now Would Be a Smarter Move was originally published by The Motley Fool

A Closer Look at JPMorgan Chase's Options Market Dynamics

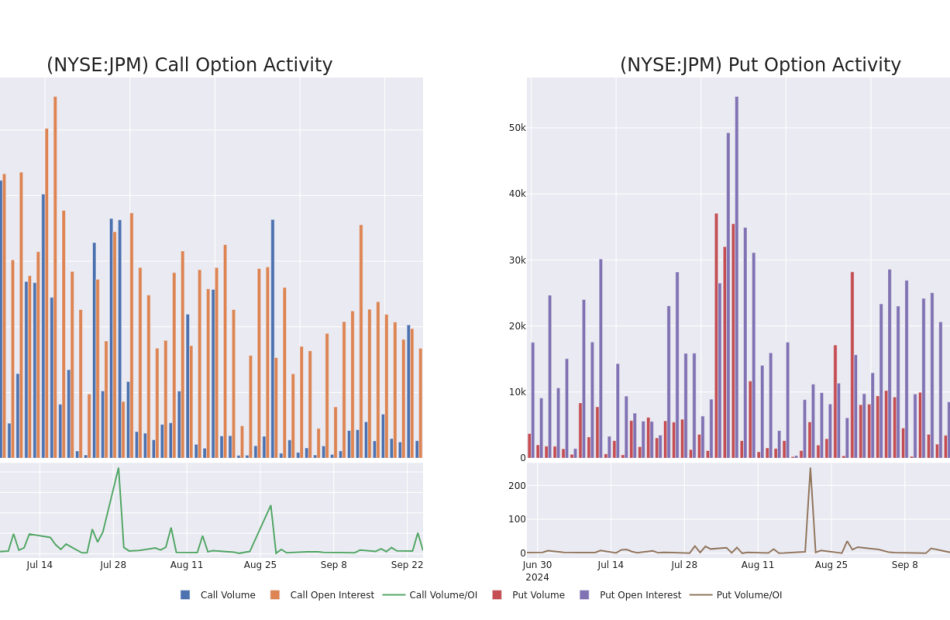

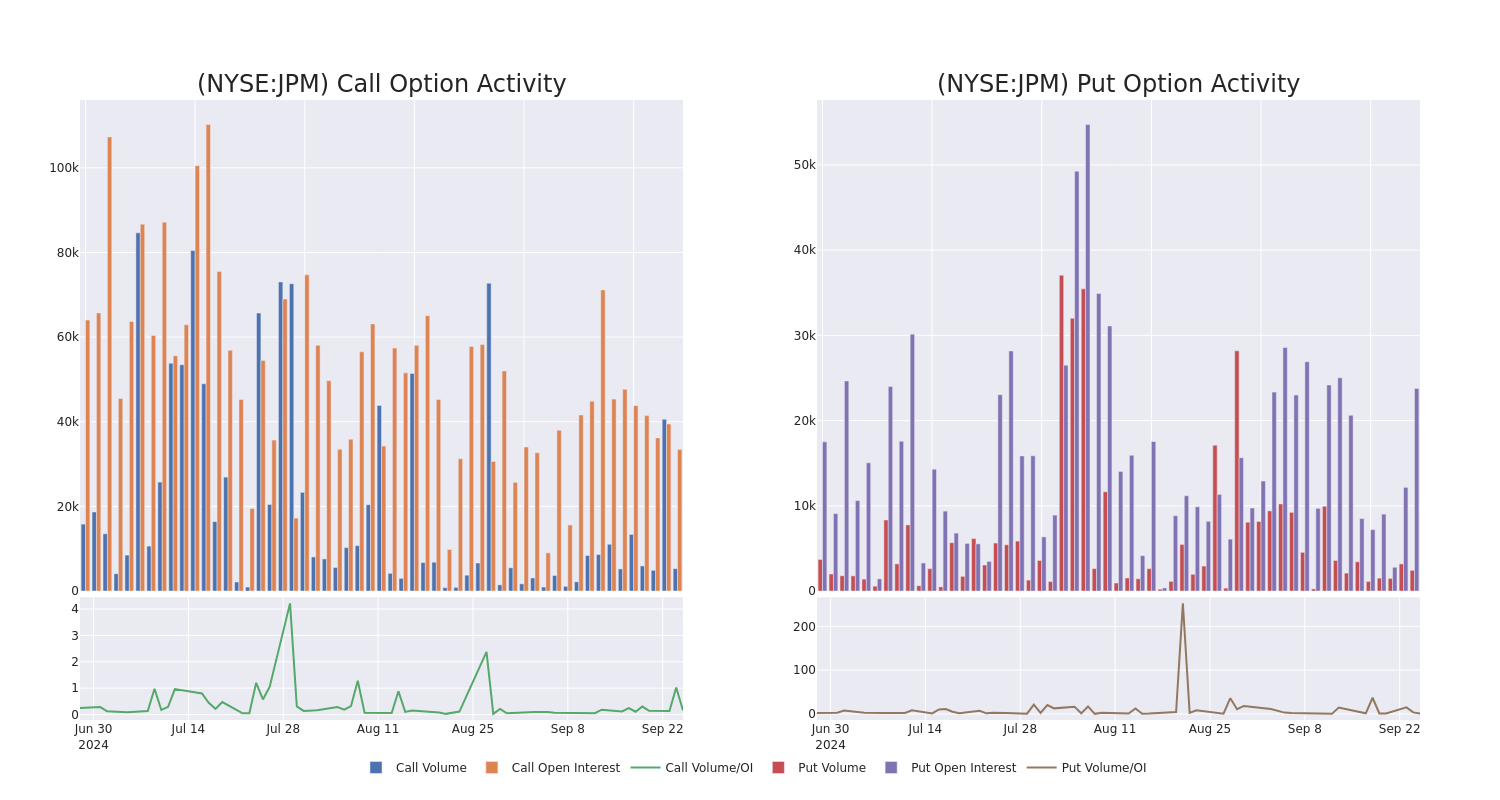

Financial giants have made a conspicuous bullish move on JPMorgan Chase. Our analysis of options history for JPMorgan Chase JPM revealed 31 unusual trades.

Delving into the details, we found 48% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $429,963, and 20 were calls, valued at $1,022,321.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $160.0 to $225.0 for JPMorgan Chase over the recent three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for JPMorgan Chase options trades today is 2599.95 with a total volume of 7,714.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for JPMorgan Chase’s big money trades within a strike price range of $160.0 to $225.0 over the last 30 days.

JPMorgan Chase Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | CALL | SWEEP | NEUTRAL | 10/18/24 | $3.95 | $3.9 | $3.9 | $212.50 | $78.0K | 537 | 442 |

| JPM | CALL | SWEEP | BULLISH | 10/18/24 | $3.65 | $3.6 | $3.65 | $212.50 | $73.0K | 537 | 660 |

| JPM | CALL | SWEEP | NEUTRAL | 01/17/25 | $20.7 | $20.65 | $20.7 | $195.00 | $72.4K | 3.5K | 60 |

| JPM | CALL | TRADE | BEARISH | 10/18/24 | $3.6 | $3.5 | $3.54 | $212.50 | $70.8K | 537 | 1.1K |

| JPM | CALL | TRADE | BULLISH | 01/16/26 | $42.6 | $42.2 | $42.6 | $180.00 | $68.1K | 716 | 21 |

About JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4.1 trillion in assets. It is organized into four major segments–consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

Following our analysis of the options activities associated with JPMorgan Chase, we pivot to a closer look at the company’s own performance.

Current Position of JPMorgan Chase

- With a volume of 8,218,659, the price of JPM is down -0.66% at $210.19.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 16 days.

What The Experts Say On JPMorgan Chase

2 market experts have recently issued ratings for this stock, with a consensus target price of $227.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Morgan Stanley persists with their Overweight rating on JPMorgan Chase, maintaining a target price of $220.

* An analyst from Deutsche Bank has revised its rating downward to Hold, adjusting the price target to $235.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JPMorgan Chase with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Steven Cohen Just Sold Amazon Stock and Scooped Up This Other "Magnificent Seven" Member

Investment firms managing over $100 million in stocks are required to file a form 13F with the Securities and Exchange Commission (SEC) once quarterly. These filings can be helpful as they provide a glimpse into what the companies’ sophisticated investors, such as hedge fund managers, are buying and selling.

One investor I enjoy following is Steven Cohen of Point72 Asset Management. Last quarter, Point72 sold about 600,000 shares of Amazon (NASDAQ: AMZN) stock — reducing its stake by 16%. At the same time, the hedge fund initiated a position in another “Magnificent Seven” stock, Apple (NASDAQ: AAPL), buying almost 1.6 million shares.

Let’s dig into what may have driven these moves and assess whether Apple deserves a spot in your portfolio as well.

Why sell Amazon stock right now?

Although Amazon is known for its e-commerce marketplace and cloud computing enterprise, its ecosystem also spans advertising, streaming and entertainment, subscription services, and so much more. Considering generative artificial intelligence (AI) applications have the potential to upend so many different end markets, it’s not surprising to see that Amazon is emerging at the forefront of the AI conversation.

Simply put, the technology has a chance to ignite all sorts of new growth opportunities for one of the world’s largest and most diversified businesses — and Amazon is making a lot of moves. For example, it invested $4 billion in a start-up called Anthropic. A cornerstone of this relationship is that Anthropic will train future versions of its large language models (LLM) on Amazon’s in-house Trainium and Inferentia semiconductor chips.

On top of that, Amazon recently announced an $11 billion infrastructure investment to build its own data centers in Indiana. This investment comes on the heels of Amazon’s acquisition of a nuclear-powered data center back in March.

All told, Amazon is spending a lot of money on various AI initiatives. While I can’t say for certain what drove Cohen and his team’s calculus to trim the position in Amazon, it could be that the company’s aggressive spending across the AI realm has inspired some questions regarding the return on these investments.

Why buy Apple stock right now?

For more than a year, Apple has struggled to demonstrate consistent revenue growth across both its line-up of products and in different geographic markets. While this dynamic has caused some to doubt Apple’s growth prospects, I’d say the company’s financial trends make some sense from a macro standpoint.

High levels of inflation and a rising interest rate environment have caused consumers in the U.S. to scale back on spending over the last couple of years. Moreover, a sluggish economy in China — one of Apple’s largest markets — has been a theme from a global perspective that’s impacted the company.

However, all hope is not lost for Apple. In fact, the company could be looking at a couple of different catalysts right now.

For starters, the iPhone 16 launch is currently underway. Recent cuts to interest rates from the Federal Reserve could spark some newfound spending from rejuvenated consumers. In turn, Apple users may choose to upgrade their old iPhones — leading to a so-called “supercycle” event for the company.

Moreover, as Apple continues integrating more features leveraging OpenAI and AI technology into its products, demand for the company’s newer hardware could witness a surge.

Should you follow Cohen’s moves?

Here’s the most important thing to note from Cohen’s recent moves: Point72 still owns a lot of Amazon stock. In fact, even after trimming its position, Amazon remains Point72’s largest position, comprising about 2% of the total portfolio.

I think Cohen’s purchase of Apple stock is a savvy move for a couple of reasons. First, adding Apple to the Point72 portfolio provides additional exposure and diversification among mega cap AI players.

While companies such as Amazon have been making moves in the AI realm for some time now, Apple’s initiatives have followed a slower pace. For this reason, there’s an argument to be made that the AI narrative is less baked into Apple’s stock price compared to Amazon’s valuation.

Moreover, the iPhone 16 launch and new AI integrations throughout the iOS ecosystem could spark some near-term sales growth, leading to longer-term tailwinds for Apple over time. This could make the timing of Cohen’s Apple purchase a particularly smart move.

At the end of the day, I think Cohen is merely hedging his various positions and diversifying his exposure to AI more broadly. Personally, I see both Amazon and Apple as rock-solid choices in a crowded AI landscape. I think Cohen’s diversification strategy is a good one to replicate, especially for investors with a long-run time horizon.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon and Apple. The Motley Fool has positions in and recommends Amazon and Apple. The Motley Fool has a disclosure policy.

Billionaire Steven Cohen Just Sold Amazon Stock and Scooped Up This Other “Magnificent Seven” Member was originally published by The Motley Fool

Why Trump Media Stock Is Soaring Today

Trump Media (NASDAQ: DJT) stock is posting big gains in Wednesday’s trading following the expiration of its lockup period. The company’s share price was up 9.3% as of 11:30 a.m. ET. Shares had been up as much as 13.2% earlier in the daily session.

Trump Media went public through a merger with a special purpose acquisition company (SPAC) in March, and insiders at the social media company had been prevented from selling shares for six months. The lockup period expired on Friday, and the additional two-day window requiring insiders to disclose stock sales concluded yesterday.

Trump Media stock passes lockup expiration test

Thus far, Trump Media hasn’t seen a wave of insider selling — and that’s good news for the stock. Investors had been worried that the expiration of the lockup period would be followed by a large amount of stock being sold on the market.

If insiders moved to sell large blocks of stock, the company’s share price would have faced intense pressure. Potential selling by one shareholder, in particular, has been under the microscope.

Donald Trump is Trump Media’s majority shareholder and owns roughly 60% of the company. Earlier this month, the former president and current presidential candidate said he didn’t plan to sell Trump Media stock. With early signs that the lockup expiration won’t be followed by a wave of shares hitting the market, the stock is seeing big gains today.

What comes next for Trump Media stock?

In the second quarter, Trump Media recorded a net loss of $16.4 million on revenue of only $828,000. The company ended Q2 with approximately $344 million in cash and zero debt, so the loss it posted in the period isn’t a dire signal. However, there’s plenty of uncertainty about what comes next for the business.

Right now, the cornerstone of Trump Media’s business is Truth Social — a social media platform that’s similar to X, the platform formerly known as Twitter. Compared to major social media platforms, Truth Social has a small user base and is posting uninspiring levels of monetization. Despite some positive catalysts related to the presidential election, it’s not clear that the service is gaining meaningful traction.

With the stock still down roughly 79% from its high, it’s possible that Trump Media stock will continue to enjoy a rebound rally in the short term following easing insider-selling fears. But the company still hasn’t given investors a clear road map for what its expansion plans look like, and the stock remains a risky speculative bet.

Should you invest $1,000 in Trump Media & Technology Group right now?

Before you buy stock in Trump Media & Technology Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Trump Media & Technology Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Trump Media Stock Is Soaring Today was originally published by The Motley Fool

Jefferies Financial Stock Dips After Q3 Results: Here's Why

Jefferies Financial Group Inc. JEF reported its third-quarter financial results after Wednesday’s closing bell. Here’s a look at the details from the report.

The Details: Jefferies Financial reported quarterly sales of $1.68 billion, which missed the analyst consensus estimate of $1.71 billion by 1.52%.

- Investment Banking net revenues were $949 million, including record quarterly advisory revenues of $592 million.

- Capital Markets net revenues were $671 million.

- Asset Management net revenues (before allocated net interest) were $75 million.

“Our third-quarter net revenues of $1.68 billion reflect strong performance and continued momentum in Investment Banking, with particularly strong performance in Advisory and demonstrating the successful ongoing execution of our strategy to drive the growth of our business,” said Richard Handler, CEO of Jefferies Financial.

Read Next: What’s Going On With Snowflake Stock?

Outlook: Jefferies Financial said it was optimistic about the balance of the year and outlook for 2025.

JEF Price Action: According to Benzinga Pro, Jefferies Financial Group shares are down 1.57% after-hours at $61 at the time of publication Wednesday.

Read Also: What’s Going On With Intel Stock?

Photo: Courtesy of Jefferies Finanicial Group, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

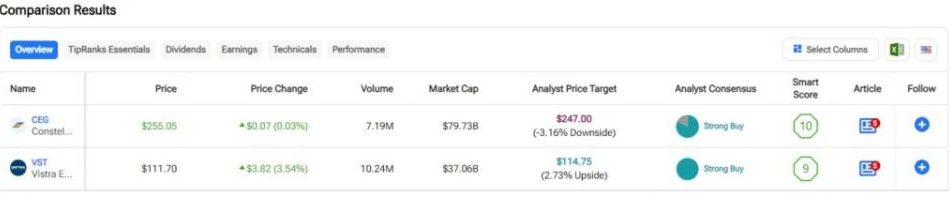

CEG vs. VST: Which Clean Energy Stock Is Better?

In this piece, I’m evaluating two electric utility stocks: Constellation Energy (CEG) and Vistra Energy (VST). A closer look supports a neutral view for Constellation Energy and a bearish view for Vistra Energy.

Constellation Energy is the largest U.S. producer of carbon-free energy and provides sustainable solutions to homes, businesses, and public-sector customers in the continental U.S. On the other hand, Vistra Energy produces electricity via natural gas and coal in addition to its nuclear and solar facilities. Vistra serves commercial, residential, municipal, and industrial customers in the U.S.

Shares of Constellation Energy have soared 119% year to date, including an 18% gain over the last three months. Meanwhile, Vistra Energy stock has skyrocketed 182% year to date. Both these stocks have delivered excellent performance for shareholders lately.

After Vistra’s much-larger one-year rally, it has opened up a sizable valuation gap versus Constellation Energy. I’ll compare these two companies in examining their valuations and their risk profiles.

The valuation of the energy industry as a whole is much lower than the P/Es we’re seeing for CEG and VST. An industry comparison is less helpful in this case.

A Closer Look At Constellation Energy (CEG)

Constellation Energy shares soared 25% to a record high on September 20 after it announced plans to reopen its Unit 1 nuclear plant on Three Mile Island. The nuclear plant will provide electricity for Microsoft’s data centers, and this should translate into big bucks for Constellation. The reopening is part of a 20-year deal that should help the software giant slash its carbon footprint. In a presentation, Constellation told investors it expects the Microsoft contract to boost its annual base earnings per share growth rate from 10% to 13% from 2024 to 2030. That seems like small compensation for the 25% higher share price, suggesting to me that CEG stock looks too pricey for new investors right now.

A potential risk is that Constellation hasn’t yet applied for any of the permits to reopen the facility, which was closed back in 2019 due to economic reasons. Furthermore, Constellation doesn’t even expect the permitting process to be finished until 2027 — if it receives the necessary reopening permits at all. According to Reuters, no U.S. nuclear power plant has ever been reopened after being shut down, so the whole venture seems unprecedented.

While the Microsoft deal was a shot in the arm, Constellation Energy stock is now in overbought territory with a Relative Strength Indicator of about 80. Thus, a downside correction could be right around the corner, which might then present opportunistic investors with a buy-the-dip opportunity, mitigate some of the risk of the project.

At a P/E of 34x, Constellation Energy is trading at a sizable discount to Vistra Energy, however. I still believe that a neutral view is appropriate at this time given the run-up in shares, along with the implementation risks for rebooting the old nuclear plant. Constellation Energy already operates the largest fleet of nuclear plants in the United States.

What is the Price Target for CEG stock?

Constellation Energy has a Strong Buy consensus rating based on 10 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $261.75, the average Constellation Energy stock price target approximates the most recent trading value for CEG stock.

A Closer Look At Vistra Energy (VST)

At a P/E of 87x, Vistra Energy is trading at a sizable premium to Constellation Energy despite its involvement in natural gas and coal. The company’s transition from coal to cleaner energy sources is a huge positive, and the stock has soared thus far in 2024. In my view, however, it’s simply overvalued at current levels, opening the prospect for a bearish view.

Just like Constellation, Vistra stock jumped to a new record high this past week and is now in overbought territory with a Relative Strength Index of 81. Here too a correction certainly seems quite possible, especially considering how expensive the stock is. Vistra Energy’s valuation has been quite volatile over the past five years. The company wasn’t even profitable in 2022 or 2021 and has now generated net income of $648 million in the last 12 months on ~$14 billion in revenue. That’s a fairly slim net income margin of 4.6%.

Vista’s uneven quarterly results may be excusable due to the company’s ongoing transition from coal to clean energy sources. According to its 2023 sustainability report, Vistra is making progress on that transition, having achieved a 9% reduction in Scope 1 greenhouse gas emissions year over year. The company also states that it has a clear path to hitting its reduction target for 2030. However, this transition also means Vistra Energy faces more broad-based risks than Constellation Energy, which doesn’t burn any coal, although it does burn oil according to its 2024 ESG factsheet.

Nuclear energy is far more reliable than solar power, and Vistra seems focused on adding nuclear capacity through acquisitions of nuclear plants. In 2023, Vistra acquired three nuclear facilities. Of course, such acquisitions require a significant amount of capital investment.

What is the Price Target for VST stock?

Vistra Energy has a Strong Buy consensus rating based on six Buys, zero Holds, and zero Sell ratings assigned over the last three months. However, the recent jump in the share price has vaulted the stock above the average VST stock price target of $108.17. Investors may wish to monitor any price target changes from analysts who cover VST.

Conclusion: Neutral on CEG, Bearish on VST

A quick glance at TipRanks’ News page for Constellation Energy reveals multiple price target increases, verses a smaller number for Vistra.

Both companies face their share of risks, although Vistra’s risks are arguably more broad-based due to its transition away from coal and expansion of solar energy. On the other hand, Constellation faces a unique risk in attempting to recommission the Three Mile Island nuclear plant.

Constellation looks like the better stock holding at this point, although I have a neutral rating. CEG stock looks like the better buy than VST on any pullback.

Acushnet Hldgs President and CEO Makes $155K Stock Purchase

Eugene David Maher, President and CEO at Acushnet Hldgs GOLF, reported an insider buy on September 24, according to a new SEC filing.

What Happened: In a recent Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, Maher increased their investment in Acushnet Hldgs by purchasing 2,453 shares through open-market transactions, signaling confidence in the company’s potential. The total transaction value is $155,446.

Monitoring the market, Acushnet Hldgs‘s shares down by 0.09% at $63.74 during Wednesday’s morning.

Unveiling the Story Behind Acushnet Hldgs

Acushnet Holdings Corp is engaged in the design, development, manufacture, and distribution of golf products. Its product category includes golf balls, golf shoes, golf clubs, wedges, putters, golf gloves, golf gear and golf wear, of which key revenue is derived from the sales of golf balls and golf gloves. The operating segments of the company are Titleist golf balls, Titleist golf clubs, Titleist golf gear and FootJoy golf wear. Geographically, the company operates in the United States, EMEA, Japan, Korea and other countries, of which a majority of the revenue is generated from the operations in the United States.

Financial Milestones: Acushnet Hldgs’s Journey

Negative Revenue Trend: Examining Acushnet Hldgs’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -0.8% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 54.36%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Acushnet Hldgs’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 1.12.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.87, caution is advised due to increased financial risk.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 21.55 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.74 is above industry norms, reflecting an elevated valuation for Acushnet Hldgs’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 13.77, the company’s market valuation exceeds industry averages.

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Exploring Key Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Acushnet Hldgs’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia stock edges up as industry report predicts 'unprecedented levels' of investment in AI data centers

Nvidia stock (NVDA) rose more than 2% on Wednesday after an industry report projected “unprecedented” levels of investments in artificial intelligence, a bullish sign for the AI chipmaker.

Consulting firm Bain’s annual technology report published on Wednesday projects that companies will need to make “unprecedented levels of investment” in technology infrastructure to stay on top of the artificial intelligence boom.

“If large data centers currently cost between $1 billion and $4 billion, costs for data centers five years from now could be between $10 billion and $25 billion,” the report said.

The firm’s research also states data center operators and hardware suppliers will enjoy a short-term windfall as companies and governments splurge on computing capacity.

“Nvidia, for example, projected $10 billion in revenue from governments’ sovereign AI investments in 2024, up from zero last year,” the report said.

Over the past few months, Wall Street has been searching for clues about how long massive infrastructure spending will last and what the return on investments for AI chip buyers will look like.

On Wednesday, Nvidia stock extended prior session gains after CEO Jensen Huang appeared to have finished selling shares for the time being.

Over the past few months, Huang cashed in on roughly $713 million worth of shares as part of a plan to sell 6 million shares by March 2025 — a goal he reached earlier than expected.

Despite his stock sale, Huang continues to hold his position as the company’s biggest shareholder.

Nvidia shares are up roughly 20% since Sept. 6. The stock has gained more than 150% year to date.

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Correction: A previous version of this article contained an incorrect spelling of Jensen Huang’s name. We regret the error.