Philip Morris Intl Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Philip Morris Intl.

Looking at options history for Philip Morris Intl PM we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 27% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $114,711 and 8, calls, for a total amount of $500,215.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $155.0 for Philip Morris Intl over the last 3 months.

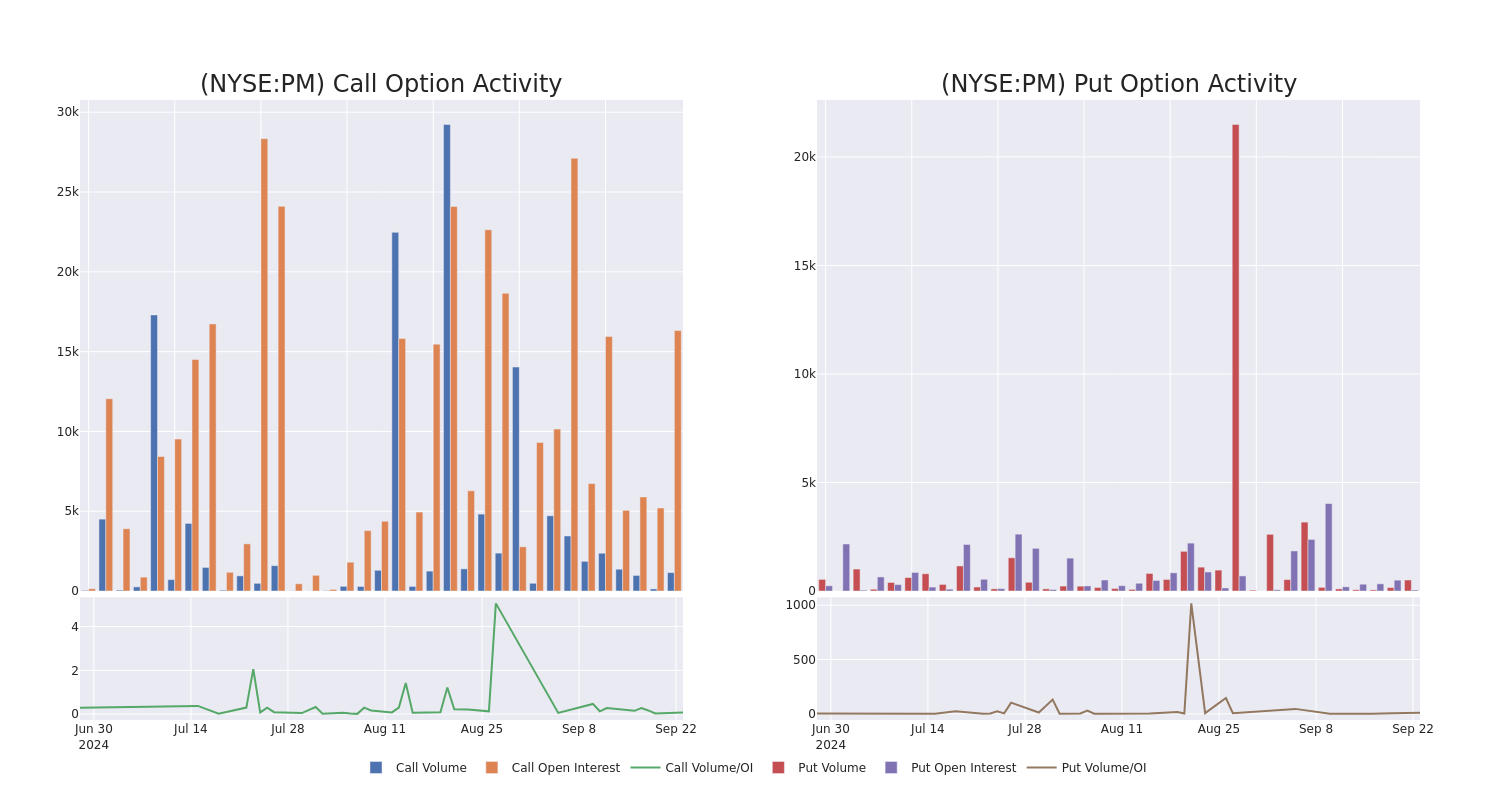

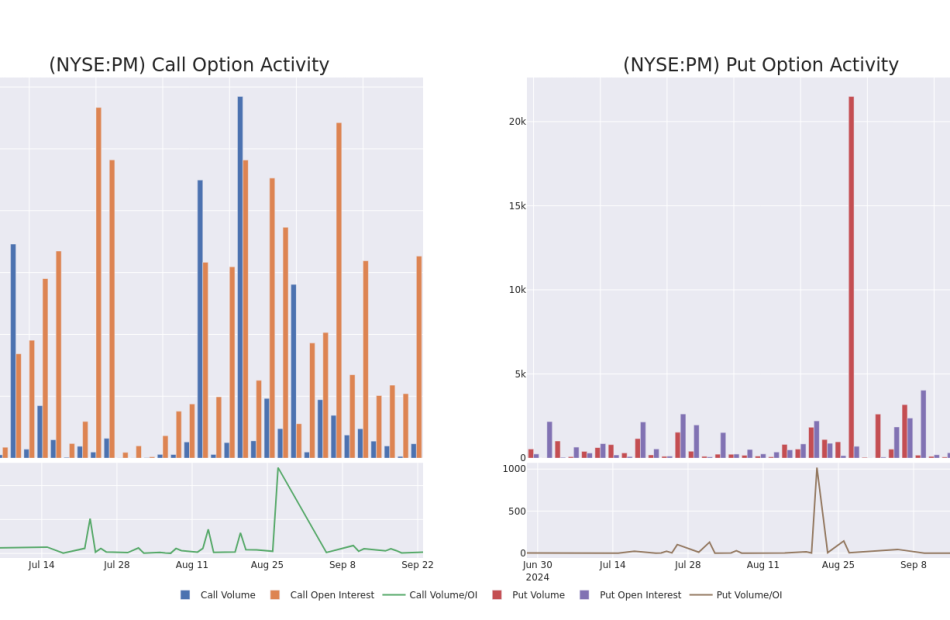

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Philip Morris Intl’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Philip Morris Intl’s whale activity within a strike price range from $70.0 to $155.0 in the last 30 days.

Philip Morris Intl 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PM | CALL | TRADE | BULLISH | 01/17/25 | $41.5 | $40.8 | $41.5 | $80.00 | $141.1K | 275 | 35 |

| PM | CALL | SWEEP | BULLISH | 12/20/24 | $5.5 | $5.2 | $5.4 | $120.00 | $81.0K | 2.7K | 290 |

| PM | CALL | TRADE | BULLISH | 12/20/24 | $21.7 | $21.4 | $21.6 | $100.00 | $75.6K | 725 | 128 |

| PM | CALL | TRADE | BULLISH | 12/20/24 | $5.5 | $5.2 | $5.4 | $120.00 | $53.4K | 2.7K | 139 |

| PM | CALL | SWEEP | BEARISH | 01/16/26 | $54.0 | $51.2 | $51.5 | $70.00 | $46.3K | 72 | 10 |

About Philip Morris Intl

Created from the international operations of Altria in 2008, Philip Morris International sells cigarettes and reduced-risk products, including heatsticks, vapes, and oral nicotine offerings primarily outside of the US. With the 2022 acquisition of Swedish Match, a leading manufacturer of traditional oral tobacco products and nicotine pouches primarily in the US and Scandinavia, PMI has not only diversified away from smokeable products but also gained a toehold into the US to sell its iQOS heatsticks.

After a thorough review of the options trading surrounding Philip Morris Intl, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Philip Morris Intl

- Currently trading with a volume of 4,557,848, the PM’s price is up by 0.61%, now at $121.95.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 27 days.

Expert Opinions on Philip Morris Intl

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $131.75.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Stifel persists with their Buy rating on Philip Morris Intl, maintaining a target price of $138.

* Maintaining their stance, an analyst from UBS continues to hold a Sell rating for Philip Morris Intl, targeting a price of $105.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Philip Morris Intl with a target price of $139.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Philip Morris Intl, targeting a price of $145.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Philip Morris Intl, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply