This Is What Whales Are Betting On Cleveland-Cliffs

Investors with a lot of money to spend have taken a bearish stance on Cleveland-Cliffs CLF.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CLF, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 10 options trades for Cleveland-Cliffs.

This isn’t normal.

The overall sentiment of these big-money traders is split between 10% bullish and 80%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $31,900, and 9, calls, for a total amount of $507,213.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $8.0 to $20.0 for Cleveland-Cliffs over the recent three months.

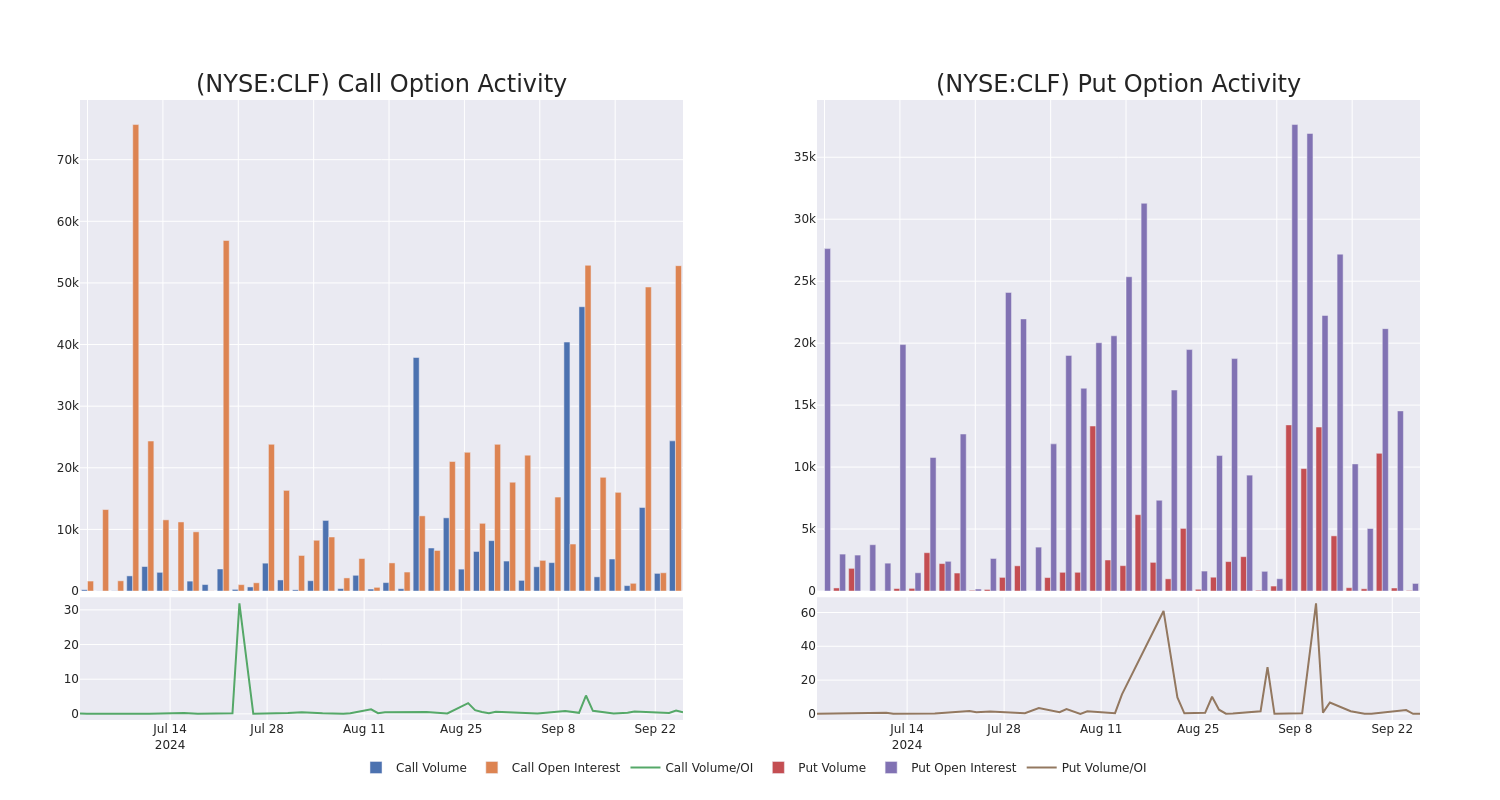

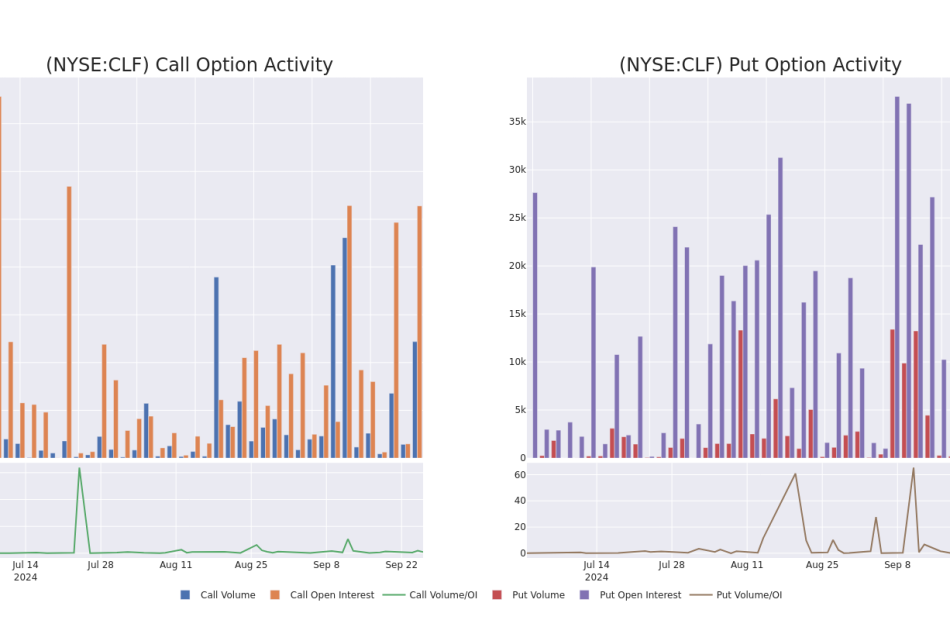

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cleveland-Cliffs’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cleveland-Cliffs’s substantial trades, within a strike price spectrum from $8.0 to $20.0 over the preceding 30 days.

Cleveland-Cliffs Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CLF | CALL | SWEEP | BEARISH | 01/16/26 | $6.25 | $6.2 | $6.2 | $8.00 | $139.5K | 1.2K | 226 |

| CLF | CALL | SWEEP | BEARISH | 10/18/24 | $0.72 | $0.7 | $0.7 | $13.00 | $80.7K | 14.9K | 3.6K |

| CLF | CALL | SWEEP | BULLISH | 10/18/24 | $0.15 | $0.13 | $0.15 | $15.00 | $62.3K | 12.7K | 5.9K |

| CLF | CALL | SWEEP | BEARISH | 09/27/24 | $0.31 | $0.27 | $0.27 | $13.00 | $54.4K | 9.6K | 2.9K |

| CLF | CALL | SWEEP | BEARISH | 10/18/24 | $0.71 | $0.69 | $0.7 | $13.00 | $52.3K | 14.9K | 7.5K |

About Cleveland-Cliffs

Cleveland-Cliffs Inc is a flat-rolled steel producer and manufacturer of iron ore pellets in North America. It is organized into four operating segments based on differentiated products, Steelmaking, Tubular, Tooling and Stamping and European Operations, but operates through one reportable segment -Steelmaking. It is vertically integrated from mined raw materials, direct reduced iron, and ferrous scrap to primary steelmaking and downstream finishing, stamping, tooling and tubing. It serves a diverse range of other markets due to its comprehensive offering of flat-rolled steel products. Geographically, it operates in the United States, Canada and other countries. The majority of revenue is from the United States. It is a supplier of steel to the automotive industry in North America.

Following our analysis of the options activities associated with Cleveland-Cliffs, we pivot to a closer look at the company’s own performance.

Current Position of Cleveland-Cliffs

- With a volume of 13,492,521, the price of CLF is up 4.0% at $12.74.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 25 days.

Professional Analyst Ratings for Cleveland-Cliffs

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $13.666666666666666.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Citigroup has decided to maintain their Neutral rating on Cleveland-Cliffs, which currently sits at a price target of $12.

* An analyst from Morgan Stanley persists with their Equal-Weight rating on Cleveland-Cliffs, maintaining a target price of $15.

* An analyst from Morgan Stanley persists with their Equal-Weight rating on Cleveland-Cliffs, maintaining a target price of $13.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cleveland-Cliffs options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply