Top 3 Materials Stocks You'll Regret Missing This Quarter

The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

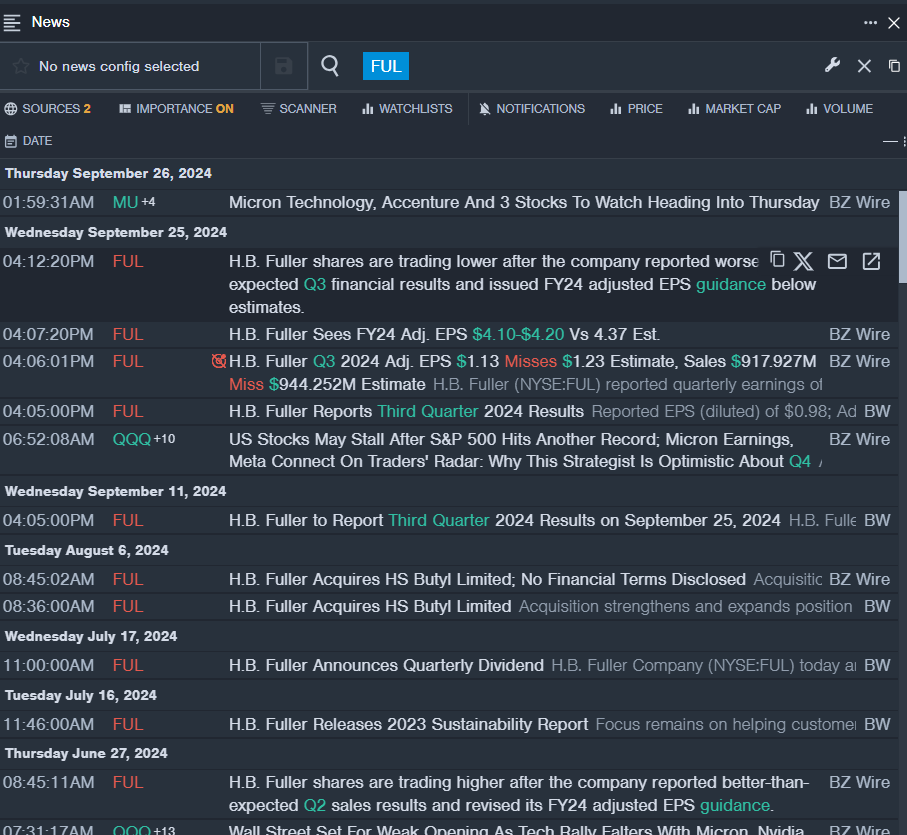

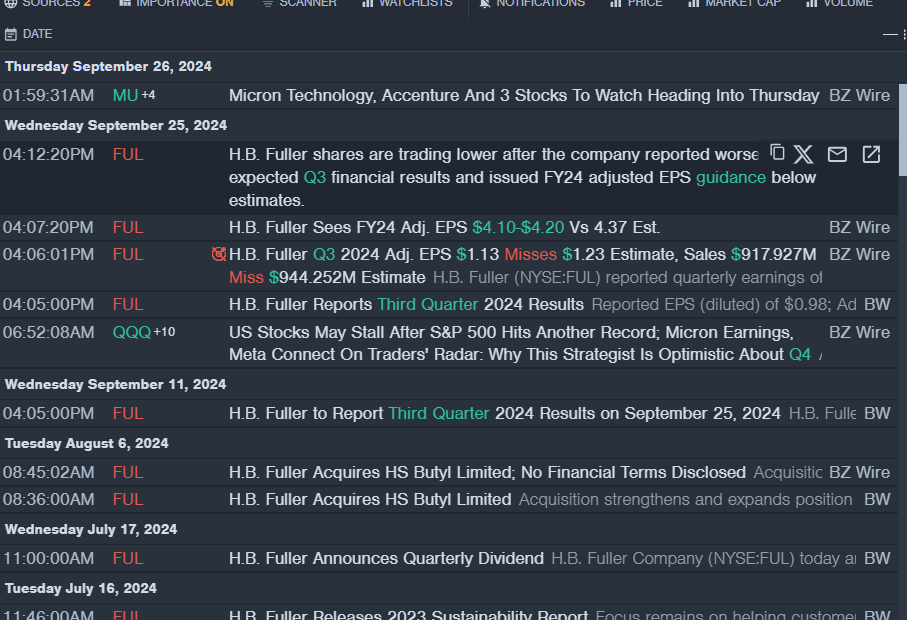

H.B. Fuller Company FUL

- On Sept. 25, H.B. Fuller reported worse-than-expected third-quarter financial results and issued FY24 adjusted EPS guidance below estimates. H.B. Fuller President and CEO Celeste Mastin said, “In the third quarter, we continued to advance our strategy and expand EBITDA margins through volume growth, restructuring actions, and the acquisition of highly profitable, fast-growing businesses.” The company’s stock fell around 3% over the past five days and has a 52-week low of $64.64.

- RSI Value: 28.45

- FUL Price Action: Shares of H.B. Fuller fell 1.8% to close at $80.63 on Wednesday.

- Benzinga Pro’s real-time newsfeed alerted to latest FUL news.

Clearwater Paper Corp CLW

- On Aug. 6, Clearwater Paper reported quarterly losses of $1.55 per share. “We completed the acquisition of the Augusta facility in May and our integration is on track. We are pleased with the quality of the assets and are committed to achieving our targeted synergies by the end of 2026,” said Arsen Kitch, president and chief executive officer. “Our tissue business continues to deliver outstanding performance, and we are expecting a gradual recovery in paperboard market demand in the coming quarters.” The company’s stock fell around 15% over the past month. It has a 52-week low of $27.69.

- RSI Value: 28.90

- CLW Price Action: Shares of Clearwater Paper fell 4.7% to close at $28.40 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in CLW stock.

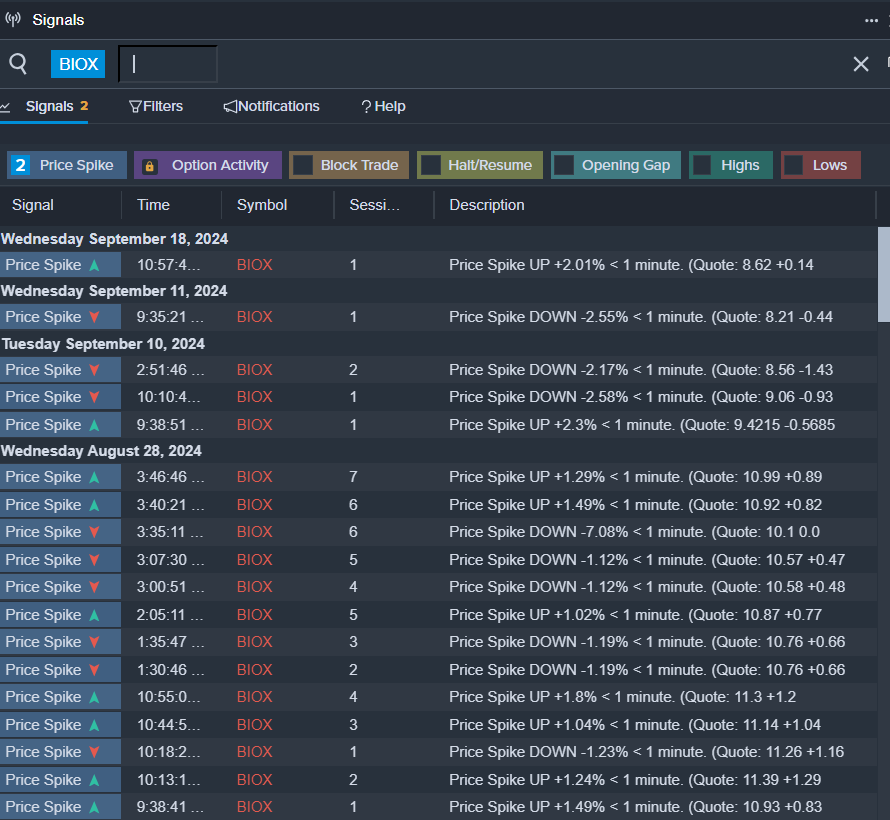

Bioceres Crop Solutions Corp BIOX

- On Sept. 9, Bioceres reported worse-than-expected fourth-quarter sales results. Mr. Federico Trucco, Bioceres´ Chief Executive Officer, commented, “In fiscal year 2024 we consolidated Bioceres’ financial performance at record-high revenue and adjusted EBITDA levels, despite it having been another challenging year for agriculture, with on-farm economics declining in key crops and geographies.” The company’s shares fell around 22% over the past month and has a 52-week low of $7.74

- RSI Value: 21.88

- BIOX Price Action: Shares of Bioceres Crop Solutions fell 3.3% to close at $7.85 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in BIOX shares.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Previous Post

Oil Extends Sharp Drop on Prospect for More Saudi, Libyan Supply

Next Post

Leave a Reply