Sell Alert: Steven Kohlhagen Cashes Out $250K In AMETEK Stock

Making a noteworthy insider sell on September 26, Steven Kohlhagen, Director at AMETEK AME, is reported in the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Kohlhagen sold 1,460 shares of AMETEK. The total transaction amounted to $250,525.

The latest market snapshot at Friday morning reveals AMETEK shares down by 0.0%, trading at $171.97.

About AMETEK

Ametek Inc is a diversified industrial conglomerate with over $6 billion in sales. The firm operates through an electronic instruments group and an electromechanical group. EIG designs and manufactures differentiated and advanced instruments for the process, aerospace, power, and industrial end markets, and generates major revenue. EMG is a focused, niche supplier of highly engineered automation solutions, thermal management systems, specialty metals, and electrical interconnects, among other products. The majority of the firm’s sales are made in the United States. The firm’s asset-light strategy in place for nearly two decades emphasizes growth through acquisitions, new product development through research and development, driving operational efficiencies, and global and market expansion.

AMETEK: A Financial Overview

Positive Revenue Trend: Examining AMETEK’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.39% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 35.99%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, AMETEK exhibits below-average bottom-line performance with a current EPS of 1.46.

Debt Management: AMETEK’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.29.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 29.96 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 5.85 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 19.96, AMETEK demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

A Closer Look at Important Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of AMETEK’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Axonics Shares Fall Despite Australia's Approval for R20 SNM Device

Axonics, Inc. AXNX has received regulatory approval from the Therapeutic Goods Administration to market its R20 rechargeable sacral neuromodulation (SNM) system in Australia.

This cutting-edge device features a 20-year functional life and reduces recharge frequency to once every 6 to 10 months for only one hour. The implant utilizes the same small 5cc form factor as the previous generation (Axonics R15). Paired with intuitive remote control and enhanced MRI compatibility, the R20 builds on Axonics’ commitment to improving incontinence care.

The Axonics R15 is designed to treat bladder and bowel dysfunctions, such as overactive bladder and fecal incontinence. By delivering electrical stimulation to the sacral nerves, this implantable neurostimulator helps regulate control, providing patients with effective and lasting relief.

Axonics began commercial activities for its SNM systems in Australia in March 2023. By May 2024, it received TGA approval to market its F15 recharge-free SNM system. Axonics also offers Bulkamid, a hydrogel used to treat female stress urinary incontinence in Australia.

Likely Trend of AXNX Stock Following the News

Following the news release, shares of AXNX declined 0.1% to $69.53 at yesterday’s closing.

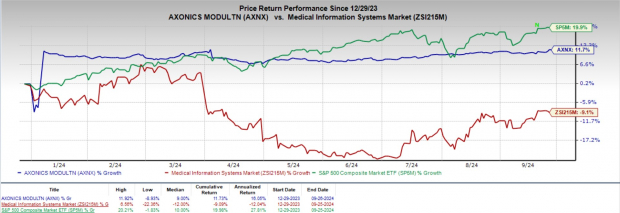

Shares of Axonics have gained 11.7% year to date against the industry’s 9.1% decline. The S&P 500 has risen 19.9% in the same time frame.

Image Source: Zacks Investment Research

Despite the recent price decline, the TGA approval for Axonics’ R20 rechargeable SNM system reflects a positive sentiment for the company, as it continues to provide long-lasting, effective therapies for adults with overactive bladder and fecal incontinence. Additionally, its Bulkamid hydrogel offers durable relief for women with stress urinary incontinence, addressing a significant global need.

Importance of Axonics’ TGA Approval for R20 Rechargeable SNM

The TGA’s approval of Axonics’ R20 marks a significant advancement in the treatment of bladder and bowel dysfunction for Australian patients. With a lifespan of 20 years and minimal recharging needs, the R20 offers durable symptom relief and enhanced convenience. This fourth-generation device reflects Axonics’ innovative approach and further strengthens the company’s position in the Australian SNM market following the approval of the F15 recharge-free system earlier this year. The launch of the R20 demonstrates Axonics’ ongoing dedication to providing best-in-class incontinence therapies.

Axonics plans to begin selling its R20 rechargeable SNM system to Australian customers in November, following the recent regulatory approval.

Market Prospects Favoring AXNX

Per a report in Grand View Research, the global neuromodulation devices market size is estimated to be worth $5.8 billion in 2024. It is anticipated to reach $10.4 billion by 2030 at a CAGR of 10.2%.

The robust growth is likely to be driven by the rise in the prevalence of lifestyle diseases such as chronic pain and depression, an increase in the number of neurological diseases and increased investment by private players in studying neurological disorders.

Zacks Rank & Key Picks

Currently, Axonics carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Universal Health Services UHS, ATI Physical Therapy ATIP and Aveanna Healthcare AVAH. While Universal Health Services sports a Zacks Rank #1 (Strong Buy), ATI Physical Therapy and Aveanna Healthcare carry a Zacks Rank #2 (Buy) each at present.

Universal Health Services has an estimated long-term growth rate of 19%. UHS’ earnings surpassed estimates in each of the trailing four quarters, with the average being 14.58%.

Universal Health Services has gained 41.1% compared with the industry’s 34.8% growth year to date.

ATI Physical Therapy’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 7.25%.

ATIP’s shares have gained 5.5% year to date compared with the industry’s 18.6% growth.

Aveanna Healthcare’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 47.5%.

AVAH’s shares have surged 104.5% year to date compared with the industry’s 15.7% growth.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Deere Recalls Its Compact Utility Tractors for Brake Failure Risk

Deere & Company DE has recalled about 147,900 compact utility tractors in the United States due to a potential brake failure risk, per reports. This voluntary recall will ensure customer safety.

The recall applies to models 1023E, 1025R and 2025R sold between November 2017 and July 2024. In Canada, the company has recalled another 16,800 of the compact utility tractor models.

The front bell crank in the brake linkage of the recalled tractors may break, endangering users in the event of a crash, according to the Consumer Product Safety Commission (“CPSC”). There have been four reports of brake linkage failure in the United States so far, with one hospitalization, two impact injuries and minor damages to the tractors.

Deere’s Commitment to Safety

The company is proactively addressing the issue in collaboration with the U.S. CPSC.

Deere instructed the impacted customers not to operate their tractors until they receive a free repair from an authorized Deere dealer. Customers have easy access to repair services due to over 2,000 dealerships in the United States and Canada. If the consumer is unable to move the tractor to a dealer’s site, the company will arrange to repair the unit at the consumer’s home.

DE’s Topline Dips Y/Y in Q3

Deere reported third-quarter fiscal 2024 earnings of $6.29 per share, which beat the Zacks Consensus Estimate of $5.80. The bottom line, however, plunged 38% from the prior-year quarter.

This was due to lower shipment volumes across all segments, reflecting weak demand, which was somewhat negated by the company’s pricing strategies and cost-saving measures.

Net sales of equipment operations (comprising Agriculture, and Turf, Construction and Forestry) were $11.39 billion, down 19.9% year over year. However, net sales topped the Zacks Consensus Estimate of $10.87 billion. Total net sales (including financial services and others) were $13.15 billion, down 16.8% year over year.

Deere’s 2024 Net Income Outlook Indicates Y/Y Dip

Deere stated that in the wake of challenging conditions in the global agricultural and construction sectors, the company will align its production with demand levels and also take steps to reduce costs. Deere maintained its guidance of net income for fiscal 2024 at $7 billion. The view suggests a 31% decline from net income of $10.2 billion reported in fiscal 2023.

Net sales for Production & Precision Agriculture are expected to decrease 20-25% year over year in fiscal 2024. Sales of Small Agriculture & Turf are expected to dip 20-25%. Deere projects sales of Construction & Forestry to be down 10-15%. The Financial Services segment’s net income is expected to be $720 million.

DE Share Price Outperforms Industry

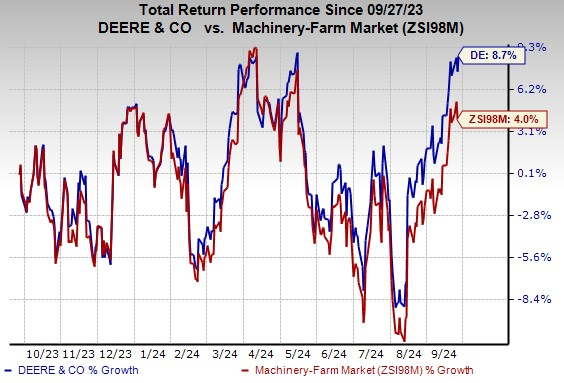

DE shares have gained 8.7% in the past year compared with the industry’s growth of 4%.

Image Source: Zacks Investment Research

Deere’s Zacks Rank & Stocks to Consider

DE currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Crane Company CR, Flowserve Corporation FLS and RBC Bearings Incorporated RBC. Each stock presently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Crane’s 2024 earnings is pegged at $5.07 per share. The consensus estimate for 2024 earnings has moved north by 6% in the past 60 days. The company has a trailing four-quarter average earnings surprise of 11.2%. CR shares have gained 75.2% in a year.

Flowserve has an average trailing four-quarter earnings surprise of 18.2%. The Zacks Consensus Estimate for FLS’ 2024 earnings is pinned at $2.76 per share, which indicates year-over-year growth of 31.6%. The consensus estimate for 2024 earnings has moved north by 4% in the past 60 days. The company’s shares have gained 27.5% in a year.

The Zacks Consensus Estimate for RBC Bearings’ fiscal 2025 earnings is pegged at $9.71 per share. The consensus estimate for 2025 earnings has moved north by 1.4% in the past 60 days. The company has a trailing four-quarter average earnings surprise of 4.7%. RBC shares have gained 27.2% in a year.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Costco's Average Hourly Wage Is Over $30. Here's How That Stacks Up

Bloomberg / Contributor / Getty Images

Key Takeaways

-

Costco now pays an average hourly wage of $30 per hour after its most recent round of raises, CEO Ron Vachris said Thursday.

-

That puts Costco roughly $5.50 above the retail average in August, according to data from the Bureau of Labor Statistics.

-

The retailer credits wages and its policy of promoting from within as reasons for high morale and low employee turnover.

Fresh data from Costco Wholesale (COST) illustrates a key reason it’s thought of as a good retail employer: Its wages are substantially above the national industry average.

On the company’s Thursday earnings conference call, CEO Ron Vachris said Costco’s average wage has reached “just north” of $30 per hour after a round of wage increases brought its minimum wage to $19.50 per hour and added 50 cents per hour to each pay tier.

Costco has long advocated the nation that higher wages lead to more productive employees, which leads to higher sales. CFO Gary Millerchip on Thursday said wages are a “critical part of delivering a better experience for our members.”

Costco Over $5 Above Retail Average

The warehouse retailer is roughly $5.50 above the retail average of $24.57 per hour as reported by the Bureau of Labor Statistics for August. Retail broadly saw the second lowest average wage in the BLS data at $24.02. That put it above only hospitality at $22.18, with an average wage over $51 for workers in the utilities sector.

Wages are one reason Costco has low employee turnover, along with its tendency to promote from within, which Vachris also highlighted in Thursday’s call. He said the company promoted 95 new warehouse managers in fiscal 2024, and 85% of those promotions were people who started as an hourly worker at Costco.

The overall average private nonfarm wage in August was just under $34, according to the BLS data.

Read the original article on Investopedia.

Pelorus Fund REIT Files Complaint to Place StateHouse Holdings into Receivership

NEWPORT BEACH, Calif., Sept. 26, 2024 /PRNewswire/ — Pelorus Fund REIT, LLC., (“Pelorus”) – a private mortgage real estate investment trust and significant owner of debt issued to StateHouse Holdings Inc. (“StateHouse” or the “Company”) STHZ STHZF, a California-focused, vertically integrated cannabis company, today filed a complaint requesting the immediate appointment of a Receivership over the Company in the Superior Court of The State of California (the “Court”).

This action follows the Company’s default on four existing loans and seeks the immediate appointment of a Receivership to assume control of all StateHouse assets and operations. Pelorus is in active communication with StateHouse management and expects that they will support the appointment of a receiver.

“As the largest lender to StateHouse, we recognize the inherent value in the Company’s operations, employees and assets,” said Dan Leimel Jr., Chief Executive Officer of Pelorus. “We believe that a court-appointed Receivership will better position StateHouse to more effectively produce and deliver high-quality product for the benefit of its key constituents. Importantly, this action is intended to protect StateHouse employees, customers, business partners and vendors, enabling the business to continue to operate across its production and distribution footprint. With those goals in mind, we are respectfully requesting the Court to move quickly in appointing a receiver so that StateHouse can be directed towards a cleaner, more efficient and appropriate structure moving forward.”

About Pelorus Capital Group and Pelorus Fund REIT, LLC

Pelorus Capital Group offers a range of innovative transactional solutions addressing the diverse needs of real estate investors and portfolio managers. Our flexible acquisition and bridge lending programs are the direct result of our involvement in more than 4,700 transactions of varying size and complexity. Since 1991, our principals have participated in more than $1 billion of real estate investment transactions using both debt and equity solutions. We draw on our extensive experience to rapidly understand an opportunity, structure a logical solution and execute a timely close. For more information, please visit https://peloruscapitalgroup.com/.

Contact Information

ASC Advisors

Taylor Ingraham / Elizabeth Amory

tingraham@ascadvisors.com / eamory@ascadvisors.com

203 992 1230

![]() View original content:https://www.prnewswire.com/news-releases/pelorus-fund-reit-files-complaint-to-place-statehouse-holdings-into-receivership-302260622.html

View original content:https://www.prnewswire.com/news-releases/pelorus-fund-reit-files-complaint-to-place-statehouse-holdings-into-receivership-302260622.html

SOURCE Pelorus Fund REIT, LLC.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Unloading: AZZURRO CAPITAL INC Sells $487K Worth Of Travelzoo Shares

On September 26, a recent SEC filing unveiled that AZZURRO CAPITAL INC, 10% Owner at Travelzoo TZOO made an insider sell.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that INC sold 37,500 shares of Travelzoo. The total transaction amounted to $487,125.

Travelzoo shares are trading up 7.21% at $13.25 at the time of this writing on Friday morning.

Discovering Travelzoo: A Closer Look

Travelzoo acts as a publisher of travel and entertainment offers. It operates in four segments. Travelzoo North America segment consists of operations in Canada and the U.S.; Travelzoo Europe segment consists of operations in France, Germany, Spain, and the U.K.; and Jack’s Flight Club segment consists of subscription revenue from premium members to access and receive flight deals from Jack’s Flight Club via email or via Android or Apple mobile applications; New Initiatives consists of Travelzoo’s licensing activities in Asia Pacific territories. It derives its revenue through advertising fees including listing fees paid by travel, entertainment, and local businesses to advertise their offers on the company’s media properties. Most of the company’s revenue is derived from North America.

Travelzoo: A Financial Overview

Revenue Growth: Travelzoo displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 0.06%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Communication Services sector.

Key Profitability Indicators:

-

Gross Margin: With a high gross margin of 88.08%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Travelzoo’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 0.23.

Debt Management: Travelzoo’s debt-to-equity ratio surpasses industry norms, standing at 9.04. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: Travelzoo’s P/E ratio of 13.29 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 2.01 is above industry norms, reflecting an elevated valuation for Travelzoo’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Travelzoo’s EV/EBITDA ratio stands at 7.92, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Understanding Crucial Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Travelzoo’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oxford Industries Recent Insider Activity

Making a noteworthy insider sell on September 26, SCOTT GRASSMYER, EVP at Oxford Industries OXM, is reported in the latest SEC filing.

What Happened: GRASSMYER opted to sell 1,495 shares of Oxford Industries, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The transaction’s total worth stands at $129,715.

As of Friday morning, Oxford Industries shares are down by 0.0%, currently priced at $86.02.

Unveiling the Story Behind Oxford Industries

Oxford Industries Inc is an apparel manufacturing company that designs, sources, markets, and distributes products under the brand name Tommy Bahama, and Lilly Pulitzer. Tommy Bahama designs, sources, markets, and distributes men’s and women’s sportswear and related products. Lilly Pulitzer designs, sources, markets, and distributes upscale collections of women’s and women’s dresses, sportswear, and related products. The company generates a majority of its revenue from the Tommy Bahama division.

Financial Insights: Oxford Industries

Negative Revenue Trend: Examining Oxford Industries’s financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -0.1% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Profitability Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 63.12%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Oxford Industries’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 2.59.

Debt Management: Oxford Industries’s debt-to-equity ratio is below the industry average. With a ratio of 0.59, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 45.51, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 0.88, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 16.22 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Navigating the World of Insider Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Oxford Industries’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SYLA Reports First-Half 2024 Financial and Operational Results

TOKYO, Sept. 27, 2024 (GLOBE NEWSWIRE) — SYLA Technologies Co., Ltd. SYT (“SYLA” or “the Company”), operator of the largest membership real estate crowd-funding platform in Japan, Rimawari-kun, reported its interim financial results for the six months ended June 30, 2024.

Operational Highlights to Date in 2024:

| ● | Entered into a capital and business alliance agreement with CUMICA CORPORATION (formerly RIBERESUTE CORPORATION) and became the largest shareholder. | |

| ● | Subscribed to a third-party allotment of new shares issued by CUMICA CORPORATION (formerly RIBERESUTE CORPORATION). | |

| ● | Announced mid-term revenue targets and a growth strategy centered on M&A. | |

| ● | Announced an interim dividend of ¥100 per share (approximately $0.68 per share at August 20, 2024 exchange rate of $1.00 = ¥146.47; 1 share = 100 ADRs). | |

| ● | Announced the development of an ultra-luxurious residence, THE SYLA SHIBUYA-TOMIGAYA. | |

| ● | Completed construction of the Company’s first office building, SYLA TOYOCHO. | |

| ● | Announced a ¥96 million gain on sale of investment securities. | |

| ● | The membership of an online AI rental brokerage service, ietty, surpassed 400,000. | |

| ● | The average occupancy rate for the SYFORME series of original brand condominiums in the first half of 2024 was 99.80%. | |

| ● | Rimawari-kun’s gross merchandise volume (total amount raised by Rimawari-kun, hereinafter “GMV”) surpassed ¥7.5 billion (approximately $46.61 million based on an exchange rate of $1.00 = ¥160.88 on June 28, 2024). | |

| ● | Subsidiary SYLA Solar announced issuance of series 1 bond of ¥50 million. | |

| ● | Subsidiary SYLA Solar announced a comprehensive business alliance with LIVE THE CREATIVE Inc. | |

| ● | Subsidiary SYLA Solar announced a business alliance with ABILITY LTD., a supplier of hydrogen cartridges. | |

| ● | Subsidiary SYLA Solar launched on-site PPA business. |

Management Commentary

“We achieved a 13% revenue increase for the first half of 2024 compared to the same period in 2023,” said Chairman, Founder, and CEO Hiroyuki Sugimoto. “Our growth strategy is delivering solid results, creating a positive impact across the entire business. We also anticipate the completion of nine new projects in the second half of 2024, which we expect will boost our gross profit.

Additionally, through the third-party allotment of new shares issued by CUMICA CORPORATION, our partnership is further strengthened, enhancing synergies with our development business in the coming fiscal year and beyond. Meanwhile, our real estate crowdfunding business continues to perform well, with steady growth in GMV (gross merchandise volume).

As part of our ongoing growth strategy, we will actively seek M&A opportunities to expand our market presence and enhance competitiveness. We remain committed to staying on track with our second-half progress, achieving diversified growth.”

First-Half 2024 Financial Results:

Results compare the six months ended June 30, 2024, to the six months ended June 30, 2023, unless otherwise indicated. Results below are for SYLA Technologies Co., Ltd. on a consolidated basis.

| ● | Total revenues for the six months ended June 30, 2024, increased to ¥10,564,041 thousand ($65.7 million based on an exchange rate of $1.00 = ¥160.88 on June 30, 2024, hereinafter the same) from ¥9,318,404 thousand ($57.9 million) for the six months ended June 30, 2023. The increase was attributable to an increase of ¥4,595,491 thousand ($28.6 million) in real estate sales, with 162 units sold during the six months ended June 30, 2024, compared to 110 units during the six months ended June 30, 2023, as well as the sales of two entire buildings. On the other hand, sales of large-scale development sites decreased by ¥3,527,071 thousand ($21.9 million). In the renewable energy sector, solar power plant sales increased by ¥303,171 thousand ($1.9 million). On July 1, 2024, SYLA Solar absorbed renewable data center company (SYLA Biotech Co., Ltd.) to further grow its business and enhance corporate value by leveraging internal resources and sales channels. | |

| ● | Gross profit decreased to ¥1,944,954 thousand ($12.1 million) for the six months ended June 30, 2024, from ¥2,340,856 thousand ($14.6 million) for the six months ended June 30, 2023. Despite an increase in the number of units and buildings sold, this was offset by a decline in large-scale development site sales that reduced our gross profit. | |

| ● | Total operating expenses decreased to ¥1,750,353 thousand ($10.9 million) for the six months ended June 30, 2024, from ¥1,906,117 thousand ($11.8 million) for the six months ended June 30, 2023. The decrease mainly consists of a ¥295,729 thousand ($1.8 million) decrease in legal and professional expenses and consulting fees including the costs for IPO to NASDAQ as well as listing maintenance costs, including audit expenses and legal fees for compliance with disclosure requirements and related matters. This decrease is offset by an increase of ¥84,648 thousand ($0.5 million) in personnel expenses due to hiring for future business expansion. | |

| ● | Net loss attributable to SYLA Technologies Co., Ltd. was ¥67,257 thousand ($0.4 million) (¥255.99 ($1.59) per basic and diluted share) for the six months ended June 30, 2024, compared to net income attributable to SYLA Technologies Co., Ltd. of ¥249,979 thousand ($1.6 million) (¥1,002.63 ($6.23) per basic share and ¥834.02 ($5.18) per diluted share) for the six months ended June 30, 2023. Despite an increase of ¥96,162 thousand ($0.6 million) in gains from the sale of investment securities classified as other income, the net income decreased due to higher interest expenses resulting from increased borrowings for real estate development expenditures and investments aimed at business expansion. | |

| ● | As of June 30, 2024, SYLA Technologies Co., Ltd. had ¥2,381,394 thousand ($14.8 million) in cash and cash equivalents. |

About SYLA Technologies Co., Ltd.

Headquartered in Tokyo, Japan, SYLA Technologies Co., Ltd. SYT (“SYLA” or “the Company”) owns and operates the largest membership real estate crowd-funding platform in Japan, Rimawari-kun, which targets individuals, corporate and institutional investors, as well as high net worth individuals. SYLA’s mission is to democratize real estate investment around the world through technology and asset management through the Rimawari-kun platform. SYLA is engaged in the overall investment condominium business, including planning, development, construction, sales, rental management, building management, repair work, and the sale of properties. Additional information about the Company’s products and services is available at https://syla-tech.jp/en.

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act and other securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements. For example, the Company is using forward-looking statements when it discusses the expected gross proceeds and the closing of the offering. Forward-looking statements are not historical facts, and are based upon management’s current expectations, beliefs and projections, many of which, by their nature, are inherently uncertain. Such expectations, beliefs and projections are expressed in good faith. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved, and actual results may differ materially from what is expressed in or indicated by the forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward-looking statements. For a more detailed description of the risks and uncertainties affecting the Company, reference is made to the Company’s reports filed from time to time with the Securities and Exchange Commission (“SEC”), including, but not limited to, the risks detailed in the Company’s annual report on Form 20-F, filed with the SEC on May 15, 2024. Forward-looking statements speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If the Company does update one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements. References and links to websites have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this press release.

Contact Information

SYLA Technologies Investor Relations Contact :

Gateway Group, Inc.

John Yi and Steven Shinmachi

SYLA@gateway-grp.com

(949) 574-3860

SYLA Technologies Company Contact :

Takeshi Fuchiwaki

Director, Chief Growth Officer

irpr@syla.jp

SYLA TECHNOLOGIES CO., LTD.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands of Japanese Yen (“JPY”), except for share data)

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | 2,381,394 | 4,017,311 | ||||||

| Restricted cash | 455,330 | 569,469 | ||||||

| Term deposits | 288,741 | 233,505 | ||||||

| Short-term investments | – | 89,482 | ||||||

| Accounts receivable, net | 141,935 | 162,690 | ||||||

| Inventories, net | 25,001,539 | 16,849,935 | ||||||

| Prepaid expenses, net | 441,241 | 357,104 | ||||||

| Other current assets, net | 182,518 | 304,271 | ||||||

| Total current assets | 28,892,698 | 22,583,767 | ||||||

| Non-current assets | ||||||||

| Restricted cash, non-current | 2,667 | 25,180 | ||||||

| Long-term deposits | 70,557 | 9,300 | ||||||

| Long-term investments, net | 2,642,748 | 490,437 | ||||||

| Property, plant and equipment, net | 11,635,956 | 11,889,701 | ||||||

| Solar power systems, net | 582,751 | 476,778 | ||||||

| Intangible assets, net | 127,325 | 133,226 | ||||||

| Goodwill | 730,776 | 730,776 | ||||||

| Operating lease right-of-use assets | 2,293,147 | 2,409,255 | ||||||

| Finance lease right-of-use assets | 11,004 | 11,980 | ||||||

| Other assets, net | 1,393,372 | 1,324,027 | ||||||

| Total non-current assets | 19,490,303 | 17,500,660 | ||||||

| TOTAL ASSETS | 48,383,001 | 40,084,427 | ||||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | 322,650 | 559,420 | ||||||

| Accrued liabilities | 163,185 | 277,425 | ||||||

| Short-term loans | 2,378,800 | 1,692,599 | ||||||

| Current portion of long-term loans | 9,443,778 | 7,243,022 | ||||||

| Current portion of long-term bonds | 88,454 | 107,601 | ||||||

| Deferred revenue | 50,427 | 165,262 | ||||||

| Income tax payables | 182,423 | 466,872 | ||||||

| Operating lease liabilities, current | 412,049 | 433,725 | ||||||

| Finance lease liabilities, current | 3,647 | 4,158 | ||||||

| Other current liabilities | 776,069 | 1,047,016 | ||||||

| Total current liabilities | 13,821,482 | 11,997,100 | ||||||

| Non-current liabilities | ||||||||

| Long-term loans | 20,579,315 | 14,308,136 | ||||||

| Long-term bonds | 113,228 | 97,549 | ||||||

| Operating lease liabilities, non-current | 1,849,266 | 1,958,689 | ||||||

| Finance lease liabilities, non-current | 7,571 | 8,040 | ||||||

| Other liabilities | 516,746 | 534,228 | ||||||

| Total non-current liabilities | 23,066,126 | 16,906,642 | ||||||

| TOTAL LIABILITIES | 36,887,608 | 28,903,742 | ||||||

| EQUITY | ||||||||

| Capital stock (900,000 shares authorized, 265,543 and 260,891 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively, with no stated value) | 114,001 | 100,000 | ||||||

| Capital surplus | 5,078,338 | 4,988,126 | ||||||

| Treasury stock, at cost (357 and 142 shares as of June 30, 2024 and December 31, 2023, respectively) | (22,828) | (13,631) | ||||||

| Retained earnings | 3,299,652 | 3,413,644 | ||||||

| Total SYLA Technologies Co., Ltd.’s equity | 8,469,163 | 8,488,139 | ||||||

| Noncontrolling interests | 3,026,230 | 2,692,546 | ||||||

| TOTAL EQUITY | 11,495,393 | 11,180,685 | ||||||

| TOTAL LIABILITIES AND EQUITY | 48,383,001 | 40,084,427 | ||||||

SYLA TECHNOLOGIES CO., LTD.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands of JPY, except for share and per share data)

| For the Six Months Ended June 30, | ||||||||

| 2024 | 2023 | |||||||

| Revenues, net | 10,564,041 | 9,318,404 | ||||||

| Cost of revenues | (8,619,087) | (6,977,548) | ||||||

| Gross profit | 1,944,954 | 2,340,856 | ||||||

| Operating expenses | ||||||||

| Selling, general and administrative expenses | (1,750,353) | (1,906,117) | ||||||

| Total operating expenses | (1,750,353) | (1,906,117) | ||||||

| Income from continuing operations | 194,601 | 434,739 | ||||||

| Other income (expenses) | ||||||||

| Other income | 242,122 | 254,350 | ||||||

| Income (loss) from equity method investments | 41,134 | (449) | ||||||

| Other expenses | (384,115) | (241,732) | ||||||

| Total other income (expenses) | (100,859) | 12,169 | ||||||

| Income from continuing operations before income taxes | 93,742 | 446,908 | ||||||

| Income tax expense | (127,573) | (149,060) | ||||||

| Net income (loss) from continuing operations | (33,831) | 297,848 | ||||||

| Loss from discontinued operations, net of income taxes | – | (6,742) | ||||||

| Net income (loss) | (33,831) | 291,106 | ||||||

| Less: net income from continuing operations attributable to noncontrolling interests | 33,426 | 41,127 | ||||||

| Net income (loss) attributable to SYLA Technologies Co., Ltd. | (67,257) | 249,979 | ||||||

| Net income (loss) from continuing operations per share: | ||||||||

| – Basic | (255.99) | 1,029.68 | ||||||

| – Diluted | (255.99) | 856.51 | ||||||

| Loss from discontinued operations per share: | ||||||||

| – Basic | – | (27.04) | ||||||

| – Diluted | – | (22.49) | ||||||

| Net income (loss) attributable to SYLA Technologies Co., Ltd. per share: | ||||||||

| – Basic | (255.99) | 1,002.63 | ||||||

| – Diluted | (255.99) | 834.02 | ||||||

| Weighted average shares used in calculating basic and diluted net income (loss) per share: | ||||||||

| – Basic | 262,736 | 249,323 | ||||||

| – Diluted | 262,736 | 299,730 | ||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cohen & Steers Closed-End Opportunity Fund, Inc. (FOF) Notification of Sources of Distribution Under Section 19(a)

NEW YORK, Sept. 27, 2024 /PRNewswire/ — This press release provides shareholders of Cohen & Steers Closed-End Opportunity Fund, Inc. FOF (the “Fund”) with information regarding the sources of the distribution to be paid on September 30, 2024 and cumulative distributions paid fiscal year-to-date.

In December 2021, the Fund implemented a managed distribution policy in accordance with exemptive relief issued by the Securities and Exchange Commission. The managed distribution policy seeks to deliver the Fund’s long-term total return potential through regular monthly distributions declared at a fixed rate per common share. The policy gives the Fund greater flexibility to realize long-term capital gains throughout the year and to distribute those gains on a regular monthly basis to shareholders. The Board of Directors of the Fund may amend, terminate or suspend the managed distribution policy at any time, which could have an adverse effect on the market price of the Fund’s shares.

The Fund’s monthly distributions may include long-term capital gains, short-term capital gains, net investment income and/or return of capital for federal income tax purposes. Return of capital includes distributions paid by the Fund in excess of its net investment income and net realized capital gains and such excess is distributed from the Fund’s assets. A return of capital is not taxable; rather, it reduces a shareholder’s tax basis in his or her shares of the Fund. The amount of monthly distributions may vary depending on a number of factors, including changes in portfolio and market conditions.

At the time of each monthly distribution, information will be posted to cohenandsteers.com and mailed to shareholders in a concurrent notice. However, this information may change at the end of the year because the final tax characteristics of the Fund’s distributions cannot be determined with certainty until after the end of the calendar year. Final tax characteristics of all of the Fund’s distributions will be provided on Form 1099-DIV, which is mailed after the close of the calendar year.

The following table sets forth the estimated amounts of the current distribution and the cumulative distributions paid this fiscal year-to-date from the sources indicated. All amounts are expressed per common share.

|

DISTRIBUTION ESTIMATES |

September 2024 |

YEAR-TO-DATE (YTD) |

||

|

Source |

Per Share |

% of Current |

Per Share |

% of 2024 |

|

Net Investment Income |

$0.0367 |

42.18 % |

$0.2822 |

36.04 % |

|

Net Realized Short-Term Capital Gains |

$0.0000 |

0.00 % |

$0.0000 |

0.00 % |

|

Net Realized Long-Term Capital Gains |

$0.0000 |

0.00 % |

$0.0000 |

0.00 % |

|

Return of Capital (or other Capital Source) |

$0.0503 |

57.82 % |

$0.5008 |

63.96 % |

|

Total Current Distribution |

$0.0870 |

100.00 % |

$0.7830 |

100.00 % |

You should not draw any conclusions about the Fund’s investment performance from the amount of this distribution or from the terms of the Fund’s managed distribution policy. The Fund estimates that it has distributed more than its income and capital gains; therefore, a portion of your distribution may be a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with ‘yield’ or ‘income’. The amounts and sources of distributions reported in this Notice are only estimates, are likely to change over time, and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for accounting and tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The amounts and sources of distributions year-to-date may be subject to additional adjustments.

*THE FUND WILL SEND YOU A FORM 1099-DIV FOR THE CALENDAR YEAR THAT WILL TELL YOU HOW TO REPORT THESE DISTRIBUTIONS FOR FEDERAL INCOME TAX PURPOSES

The Fund’s Year-to-date Cumulative Total Return for fiscal year 2024 (January 1, 2024 through August 31, 2024) is set forth below. Shareholders should take note of the relationship between the Year-to-date Cumulative Total Return with the Fund’s Cumulative Distribution Rate for 2024. In addition, the Fund’s Average Annual Total Return for the five-year period ending August 31, 2024 is set forth below. Shareholders should note the relationship between the Average Annual Total Return with the Fund’s Current Annualized Distribution Rate for 2024. The performance and distribution rate information disclosed in the table is based on the Fund’s net asset value per share (NAV). The Fund’s NAV is calculated as the total market value of all the securities and other assets held by the Fund minus the total liabilities, divided by the total number of shares outstanding. While NAV performance may be indicative of the Fund’s investment performance, it does not measure the value of a shareholder’s individual investment in the Fund. The value of a shareholder’s investment in the Fund is determined by the Fund’s market price, which is based on the supply and demand for the Fund’s shares in the open market.

Fund Performance and Distribution Rate Information:

|

Year-to-date January 1, 2024 to August 31, 2024 |

|

|

Year-to-date Cumulative Total Return1 |

18.23 % |

|

Cumulative Distribution Rate2 |

6.50 % |

|

Five-year period ending August 31, 2024 |

|

|

Average Annual Total Return3 |

7.49 % |

|

Current Annualized Distribution Rate4 |

8.67 % |

|

1. |

Year-to-date Cumulative Total Return is the percentage change in the Fund’s NAV over the year-to-date time period including distributions paid and assuming reinvestment of those distributions. |

|

2. |

Cumulative Distribution Rate for the Fund’s current fiscal period (January 1, 2024 through September 30, 2024) measured on the dollar value of distributions in the year-to-date period as a percentage of the Fund’s NAV as of August 31, 2024. |

|

3. |

Average Annual Total Return represents the compound average of the Annual NAV Total Returns of the Fund for the five-year period ending August 31, 2024. Annual NAV Total Return is the percentage change in the Fund’s NAV over a year including distributions paid and assuming reinvestment of those distributions. |

|

4. |

The Current Annualized Distribution Rate is the current fiscal period’s distribution rate annualized as a percentage of the Fund’s NAV as of August 31, 2024. |

Investors should consider the investment objectives, risks, charges and expense of the Fund carefully before investing. You can obtain the Fund’s most recent periodic reports, when available, and other regulatory filings by contacting your financial advisor or visiting cohenandsteers.com. These reports and other filings can be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing.

Shareholders should not use the information provided here in preparing their tax returns. Shareholders will receive a Form 1099-DIV for the calendar year indicating how to report Fund distributions for federal income tax purposes.

Website: https://www.cohenandsteers.com

Symbol: CNS

About Cohen & Steers. Cohen & Steers is a leading global investment manager specializing in real assets and alternative income, including listed and private real estate, preferred securities, infrastructure, resource equities, commodities, as well as multi-strategy solutions. Founded in 1986, the firm is headquartered in New York City, with offices in London, Dublin, Hong Kong, Tokyo and Singapore.

Forward-Looking Statements

This press release and other statements that Cohen & Steers may make may contain forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which reflect the company’s current views with respect to, among other things, its operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative versions of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties.

Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. The company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

![]() View original content:https://www.prnewswire.com/news-releases/cohen–steers-closed-end-opportunity-fund-inc-fof-notification-of-sources-of-distribution-under-section-19a-302261493.html

View original content:https://www.prnewswire.com/news-releases/cohen–steers-closed-end-opportunity-fund-inc-fof-notification-of-sources-of-distribution-under-section-19a-302261493.html

SOURCE Cohen & Steers, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EXCLUSIVE: Is Washington DC's 'Cannabis Gifting' Economy Coming To An End?

As Washington D.C.’s regulatory landscape around cannabis continues to evolve, the District’s “cannabis gifting” economy faces an uncertain future.

Benzinga Cannabis spoke with Grace Hyde, director of Commercial and Production Operations at District Cannabis and co-chair of the Regulated Cannabis Association of DC. Hyde shared her perspective on the recent efforts to crack down on this sui generis cannabis economy and its broader implications.

A Loophole On The Brink Of Closure

The gifting situation came about as the result of the District’s regulatory status; D.C. is not a state and therefore Congress holds oversight over its laws. As such, Congress has persistently blocked the establishment of a regulated retail market each time it came up for a vote, despite recreational cannabis having been legalized by voters in 2014 under Initiative 71. Thus the loophole in which shops began gifting cannabis as part of transactions involving other goods or services.

This workaround thrived for years, enabling hundreds of businesses to sell marijuana products without directly violating the law. Now, a wave of enforcement threatens to end it.

An earlier bill requiring owners of shops that gifted cannabis to transition into licensed medical cannabis dispensaries “opened up a lot of licenses so that all of these illegal stores could get a license and become legal. It has taken until now for the enforcement section to kick in. A lot of people have applied to become licensed, but not that many are really making their way through the application process,” Hyde explains.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

The Impact Of Enforcement

Earlier this year, the D.C. Council approved new legislation granting the Alcoholic Beverage and Cannabis Administration (ABCA) the authority to shut down unlicensed cannabis shops. After a grace period, authorities began padlocking.

So far, there have been four shop closures, said Hyde, out of an estimated 200 – many operating in plain sight. Hyde admits she was initially skeptical about whether the crackdown would succeed.

“We didn’t believe they would actually close the stores until the first closure happened because so many things have gotten in the way. We’ve been advocating for this for close to a decade, so we had a hard time believing it until it actually happened,” she told Benzinga.

Despite the slow start, Hyde remains hopeful that the closures will drive business back to the regulated market and ultimately improve the balance sheets of medical cannabis business, which she admits, are barely making ends meet. Something similar happened in New York recently.

“We haven’t seen the benefits of the crackdown yet. It’s only been three weeks, but we’ll start to see a shift in revenue from the illegal market to the legal market soon,” Hyde said.

Unregulated Products And Public Safety

One of the main concerns driving the crackdown is the lack of regulation of products sold in the gift shops. According to Hyde, many of these shops buy cannabis from other states, leading to safety and traceability risks.

“It’s not homegrown cannabis. They’re purchasing cannabis from across the country—California, Oregon, Maine, Michigan,” Hyde said. “The products being sold at these establishments are quite dangerous. They’re untested, unsafe, unregulated, and the public has no idea.”

She also stressed that these operations are actually in violation of Initiative 71, which allows gifting only homegrown cannabis, which is worst-kept secret and part of the tolerated gray zones that have characterized D.C.’s cannabis economy so far.

The Time For Licensed Operators Is Running Out

Licensed operators like District Cannabis have been pushing for stronger enforcement, not just to curb illegal competition but to protect the medical marijuana market.

Hyde says time is running out for many legal businesses.

“The public and some city officials realize that if they don’t act quickly, all the operators trying to move into the medical market will fail because there won’t be a medical market,” she said. “People have put their life savings into these licenses, and they could fail before they even open if the city doesn’t address this quickly.”

As things change in D.C., the cannabis gifting economy might soon become another chapter in the ‘How to regulate cannabis handbook.’ Probably the chapter on ‘lessons learned.’

Cover: Pixabay via Pexels

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.