Axonics Shares Fall Despite Australia's Approval for R20 SNM Device

Axonics, Inc. AXNX has received regulatory approval from the Therapeutic Goods Administration to market its R20 rechargeable sacral neuromodulation (SNM) system in Australia.

This cutting-edge device features a 20-year functional life and reduces recharge frequency to once every 6 to 10 months for only one hour. The implant utilizes the same small 5cc form factor as the previous generation (Axonics R15). Paired with intuitive remote control and enhanced MRI compatibility, the R20 builds on Axonics’ commitment to improving incontinence care.

The Axonics R15 is designed to treat bladder and bowel dysfunctions, such as overactive bladder and fecal incontinence. By delivering electrical stimulation to the sacral nerves, this implantable neurostimulator helps regulate control, providing patients with effective and lasting relief.

Axonics began commercial activities for its SNM systems in Australia in March 2023. By May 2024, it received TGA approval to market its F15 recharge-free SNM system. Axonics also offers Bulkamid, a hydrogel used to treat female stress urinary incontinence in Australia.

Likely Trend of AXNX Stock Following the News

Following the news release, shares of AXNX declined 0.1% to $69.53 at yesterday’s closing.

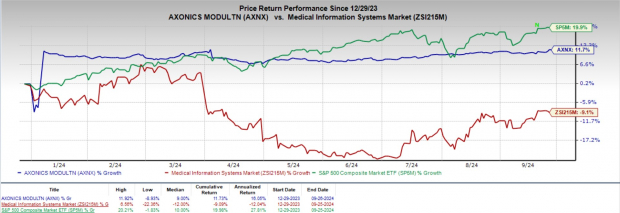

Shares of Axonics have gained 11.7% year to date against the industry’s 9.1% decline. The S&P 500 has risen 19.9% in the same time frame.

Image Source: Zacks Investment Research

Despite the recent price decline, the TGA approval for Axonics’ R20 rechargeable SNM system reflects a positive sentiment for the company, as it continues to provide long-lasting, effective therapies for adults with overactive bladder and fecal incontinence. Additionally, its Bulkamid hydrogel offers durable relief for women with stress urinary incontinence, addressing a significant global need.

Importance of Axonics’ TGA Approval for R20 Rechargeable SNM

The TGA’s approval of Axonics’ R20 marks a significant advancement in the treatment of bladder and bowel dysfunction for Australian patients. With a lifespan of 20 years and minimal recharging needs, the R20 offers durable symptom relief and enhanced convenience. This fourth-generation device reflects Axonics’ innovative approach and further strengthens the company’s position in the Australian SNM market following the approval of the F15 recharge-free system earlier this year. The launch of the R20 demonstrates Axonics’ ongoing dedication to providing best-in-class incontinence therapies.

Axonics plans to begin selling its R20 rechargeable SNM system to Australian customers in November, following the recent regulatory approval.

Market Prospects Favoring AXNX

Per a report in Grand View Research, the global neuromodulation devices market size is estimated to be worth $5.8 billion in 2024. It is anticipated to reach $10.4 billion by 2030 at a CAGR of 10.2%.

The robust growth is likely to be driven by the rise in the prevalence of lifestyle diseases such as chronic pain and depression, an increase in the number of neurological diseases and increased investment by private players in studying neurological disorders.

Zacks Rank & Key Picks

Currently, Axonics carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Universal Health Services UHS, ATI Physical Therapy ATIP and Aveanna Healthcare AVAH. While Universal Health Services sports a Zacks Rank #1 (Strong Buy), ATI Physical Therapy and Aveanna Healthcare carry a Zacks Rank #2 (Buy) each at present.

Universal Health Services has an estimated long-term growth rate of 19%. UHS’ earnings surpassed estimates in each of the trailing four quarters, with the average being 14.58%.

Universal Health Services has gained 41.1% compared with the industry’s 34.8% growth year to date.

ATI Physical Therapy’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 7.25%.

ATIP’s shares have gained 5.5% year to date compared with the industry’s 18.6% growth.

Aveanna Healthcare’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 47.5%.

AVAH’s shares have surged 104.5% year to date compared with the industry’s 15.7% growth.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply