Behind the Scenes of Yum China Holdings's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Yum China Holdings YUMC.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with YUMC, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 16 options trades for Yum China Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 68% bullish and 6%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $47,430, and 15, calls, for a total amount of $2,517,328.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $32.5 to $47.5 for Yum China Holdings over the recent three months.

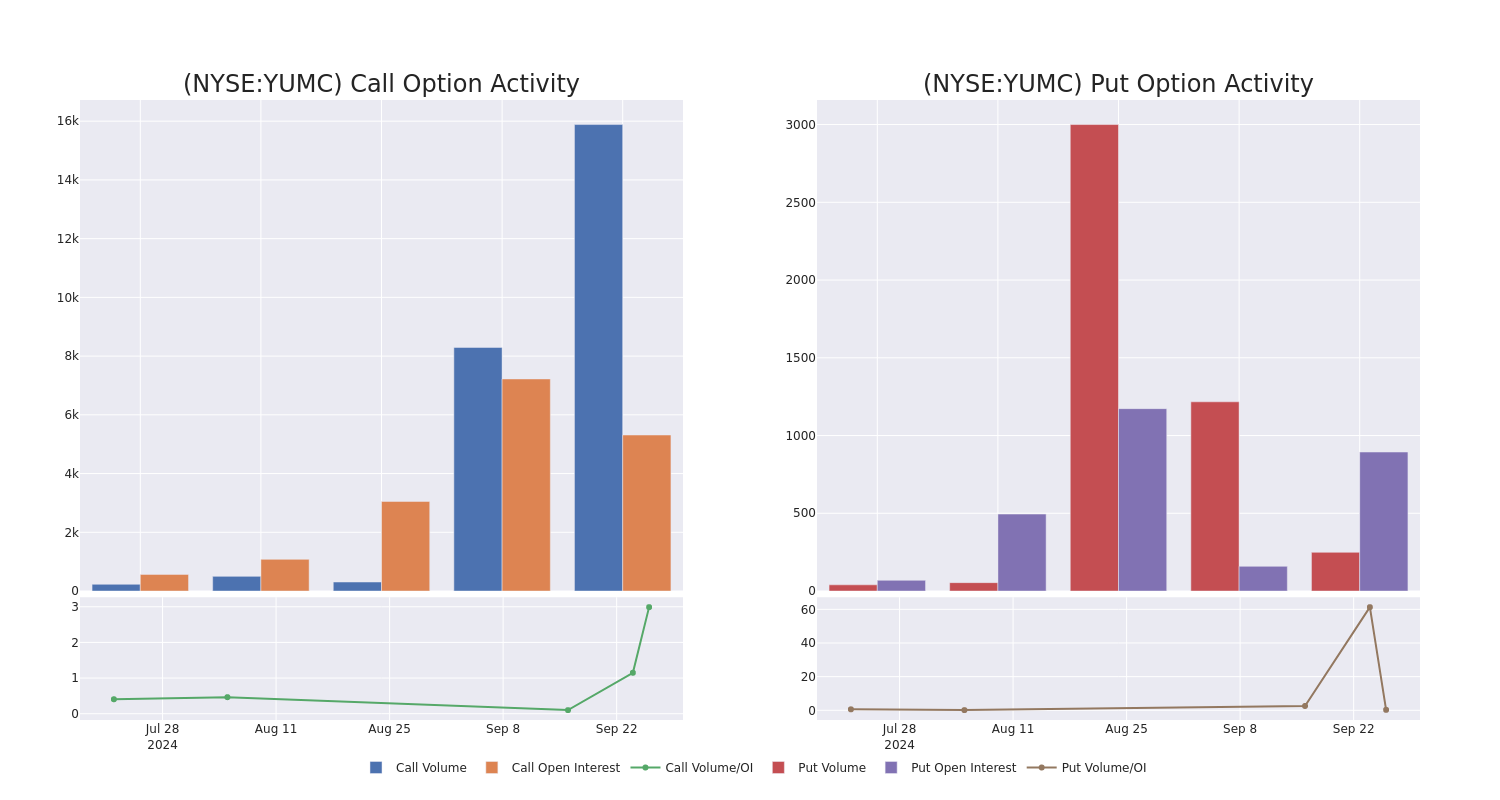

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Yum China Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Yum China Holdings’s significant trades, within a strike price range of $32.5 to $47.5, over the past month.

Yum China Holdings 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| YUMC | CALL | TRADE | BULLISH | 11/15/24 | $2.75 | $1.8 | $2.75 | $45.00 | $825.0K | 107 | 3.0K |

| YUMC | CALL | TRADE | NEUTRAL | 04/17/25 | $5.2 | $3.1 | $4.0 | $45.00 | $800.0K | 53 | 2 |

| YUMC | CALL | SWEEP | BULLISH | 10/18/24 | $5.1 | $3.6 | $5.1 | $40.00 | $279.0K | 3.2K | 620 |

| YUMC | CALL | SWEEP | BULLISH | 10/18/24 | $5.1 | $4.0 | $5.1 | $40.00 | $119.3K | 3.2K | 854 |

| YUMC | CALL | TRADE | BULLISH | 01/17/25 | $3.9 | $2.7 | $3.9 | $45.00 | $97.5K | 431 | 254 |

About Yum China Holdings

With almost 13,000 units and USD 10 billion in systemwide sales in 2022, Yum China is the largest restaurant chain in China. It generates revenue through its own restaurants and franchise fees. Key concepts include KFC (9,094 units) and Pizza Hut (2,903), but the company’s portfolio also includes other brands such as Little Sheep, East Dawning, Taco Bell, Huang Ji Huang, COFFii & Joy, and Lavazza (collectively representing about 950 units). Yum China is a trademark licensee of Yum Brands, paying 3% of total systemwide sales to the company it separated from in October 2016.

Having examined the options trading patterns of Yum China Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Yum China Holdings Standing Right Now?

- Trading volume stands at 11,803,635, with YUMC’s price up by 14.32%, positioned at $43.66.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 33 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Yum China Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply