European Inflation Drop Raises ECB Rate Cut Chances

European inflation reported in France and Spain slowed in September below the European Central Bank’s (ECB) target rate of 2%.

This has raised chances of an ECB interest rate cut at its meeting next month.

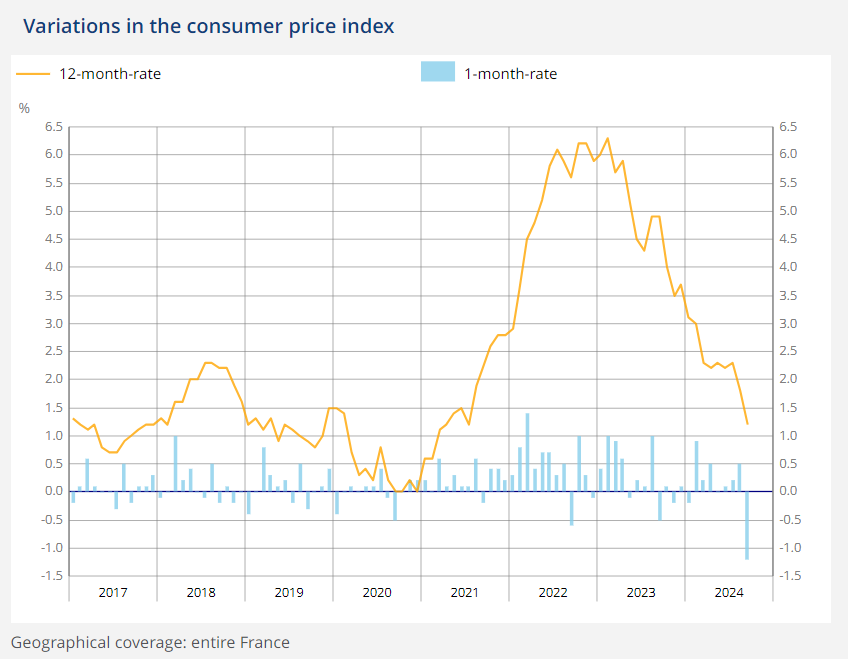

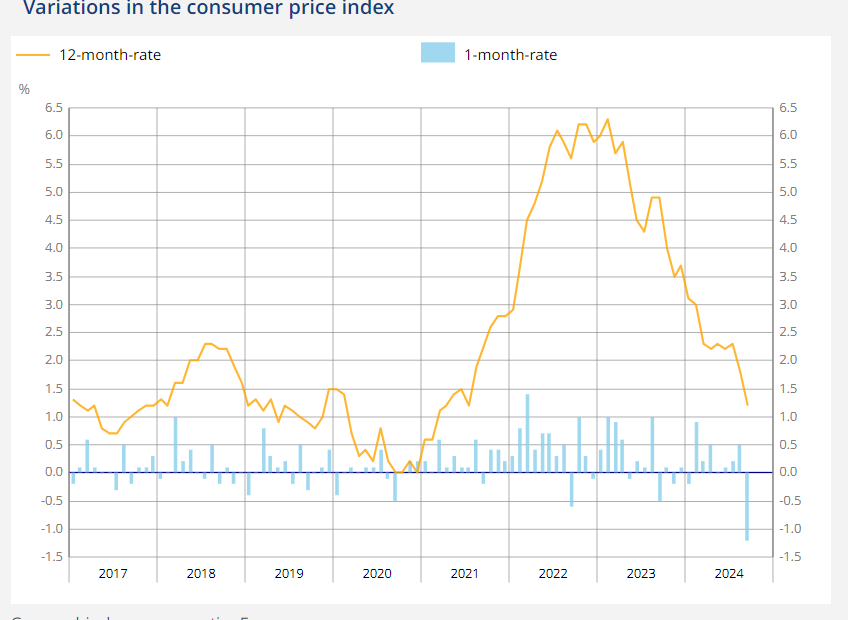

France’s Harmonized Consumer Price Index slowed to 1.5% in September, from 2.2% in August, according to INSEE data. The consensus for September was 1.9%, according to TradingView.

“The softest inflation report EVER from France almost smack-dab at our out of consensus forecast,” Andreas Steno Larsen, CEO at Steno Research posted on X. “The ECB will cut in October I think.”

French headline annual inflation slowed to 1.2% in France, from 1.8% in August.

This marked the second straight month that the rate held below the ECB’s inflation target, according to INSEE data.

Source: INSEE, France’s Consumer Price Index

There was a “big downside surprise” in French headline inflation,” Frederik Ducrozet, Head of Macroeconomic Research, Pictet Wealth Management, wrote on X.

“If we get similar surprises across euro area countries the ECB will have all it needs to cut in October.”

Spain’s annual HCPI stood at 1.7%, compared to 2.4% a month earlier, according to the country’s statistics institute. This came in below consensus of 1.9%, according to TradingView data.

European Inflation Boosts Rate Cut Probability to 79%

Money markets reacted to European inflation data from France and Spain, Europe’s second and fourth largest economies.

They now indicate that there is a 79% chance of an ECB interest rate cut next month, up from a 60% chance on Thursday and 25% a week ago, the Telegraph reported.

Analysts at BNP Paribas also shifted their call for October to a ECB interest rate cut, as did Bloomberg Economics, according to Bloomberg News.

“Our base case has now been revised to call for an ECB rate cut in October,” Jamie Rush, chief European economist at Bloomberg Economics, wrote.

“We previously expected policymakers to wait on further confirmation of disinflationary trends,” Rush wrote. “That confirmation seems to be arriving early.”

The euro fell, and Eurozone government bond yields dropped, in response to the European inflation data. Germany’s 10-year bond yield, the benchmark for the eurozone bloc, fell 3.5 basis points to 2.14%.

Lagarde Remains Cautious On European Inflation

The latest inflation data does not guarantee that the ECB will cut rates.

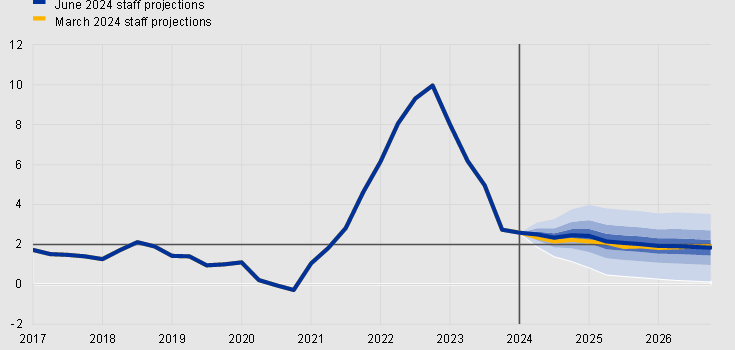

ECB President Christine Lagarde cautioned on September 12, after the central bank cut interest rates by 25 basis points, that European inflation is expected to rise again in the latter part of this year before declining towards “our target over the second half of next year.”

Euro area HICP inflation: ECB Staff Projections

She also warned on September 20 in Washington that the “uncertainty ahead is still profound.” Her comments came two days after the Federal Reserve lowered rates by 50 basis points. The ECB first cut rates by 25 basis points in June.

While Lagarde has taken a cautious approach to the ECB’s next rate decision, pressure may build on slowing growth across the 27-member bloc.

German unemployment climbed to 3.8% in August, compared to 3.2% year on year, the country’s Federal Statistical Office said on Friday.

“The eurozone is heading towards stagnation,” Cyrus de la Rubia, Hamburg Commercial Bank chief economist, said in an S&P Global press release on September 23.

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply