McCormick Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

McCormick & Company, Incorporated MKC will release earnings results for its third quarter, before the opening bell on Tuesday, Oct. 1.

Analysts expect the Hunt Valley, Maryland-based company to report quarterly earnings at 67 cents per share, up from 65 cents per share in the year-ago period. McCormick is projected to post quarterly revenue of $1.67 billion, according to data from Benzinga Pro.

On Sept. 24, the company’s board declared a quarterly dividend of 42 cents per share.

McCormick shares fell 0.2% to close at $83.25 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

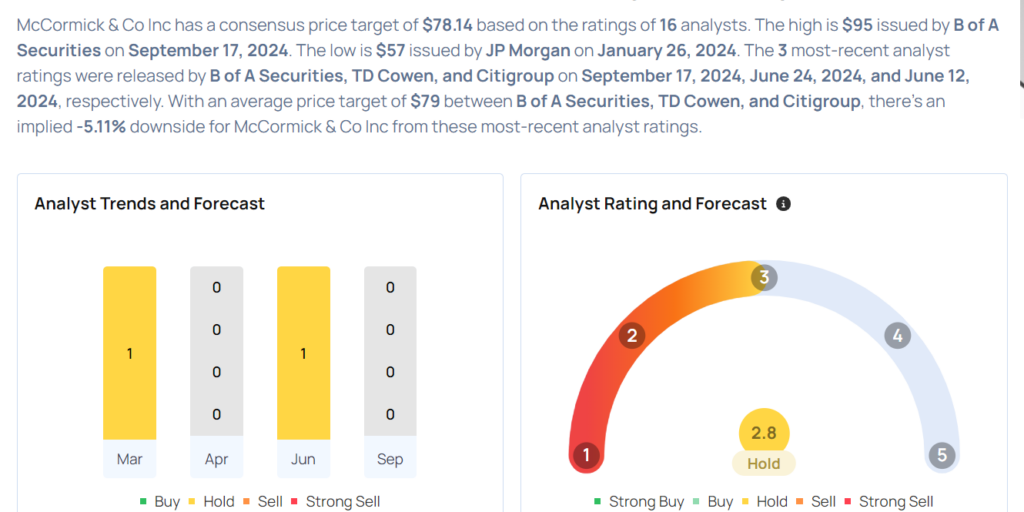

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- TD Cowen analyst Robert Moskow maintained a Hold rating and cut the price target from $75 to $73 on June 24. This analyst has an accuracy rate of 68%.

- Argus Research analyst John Staszak upgraded the stock from Hold to Buy with a price target of $88 on April 2. This analyst has an accuracy rate of 68%.

- Stifel analyst Matthew Smith maintained a Hold rating and boosted the price target from $70 to $75 on March 27. This analyst has an accuracy rate of 70%.

- JP Morgan analyst Ken Goldman maintained an Underweight rating and cut the price target from $59 to $57 on Jan. 26. This analyst has an accuracy rate of 83%.

- Consumer Edge Research analyst Connor Rattigan downgraded the stock from Overweight to Equal-Weight on Jan. 22. This analyst has an accuracy rate of 70%.

Considering buying MKC stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply