Palantir Stock vs. Amazon Stock: Wall Street Says Buy One and Sell the Other

Artificial intelligence (AI) platforms let businesses develop and deploy machine learning models across use cases like content generation, predictive insights, and decision-making, and demand is increasing rapidly. “AI platforms will be the fastest growing technology in the years to come,” according to Andrea Minonne, research manager at the International Data Corporation (IDC).

IDC estimates AI-platform spending will compound at 51% annually through 2028. That bodes well for Palantir Technologies (NYSE: PLTR) and Amazon (NASDAQ: AMZN), but Wall Street analysts expect the stocks to move in opposite directions over the next year.

-

Palantir has a median price target of $27 per share, based on the estimates of 24 analysts. That implies a 27% downside from the current share price of $37.

-

Amazon has a median price target of $220 per share, based on the estimates of 64 analysts. That implies a 15% upside from its current share price of $191.

Here’s what investors should know about these AI stocks.

1. Palantir

Palantir specializes in data analytics software. Its primary platforms, Foundry and Gotham, let businesses integrate data, develop machine learning models, and interact with those digital assets through prebuilt and custom applications that improve decision-making. AIP (Artificial Intelligence Platform) enhances Foundry and Gotham by adding support for large language models and generative artificial intelligence.

Palantir’s introduction of AIP last year captured the attention of analysts, and the company has been praised for its technological prowess. In August, Forrest Research recognized the company’s leadership in AI and machine learning platforms. And in September, Dresner Advisory Services awarded Palantir the No. 1 spot in its AI, data science, and machine learning market study.

Palantir reported strong financial results in the second quarter. Revenue increased 27% to $678 million, and non-GAAP earnings jumped 80% to $0.09 per diluted share. Chief Executive Officer (CEO) Alex Karp attributed the strong performance to an “unrelenting wave of demand from customers for artificial intelligence systems that go beyond merely performative and academic.” In other words, businesses want products that make AI useful in real-world situations, and Palantir provides that with AIP.

The problem with Palantir is its valuation. Wall Street expects adjusted earnings to grow at 21% annually through 2026. That makes the current valuation of 115 times adjusted earnings look outrageously expensive.

Shares charged higher after the second-quarter report, and the stock continued climbing when Palantir was added the S&P 500 this month. But at the stock’s current price, investors should avoid the stock and consider trimming their positions.

2. Amazon

Amazon has a strong presence in e-commerce, digital advertising, and cloud computing, and the company is gaining share across all three markets. According to eMarketer, the company will account for 40.4% of online retail sales in the U.S. this year, up from 39.6% last year. Amazon will also capture 13.9% of domestic digital ad spending this year, up from 12.5% last year, due to its dominance in the quickly growing retail media market.

Meanwhile, Amazon Web Services (AWS) accounted for 32% of cloud infrastructure and platform services spending in the second quarter, up from 31% in the previous quarter, according to Synergy Research Group. And chief information officers (CIOs) recently surveyed by Morgan Stanley selected Microsoft Azure and AWS as the public clouds most likely to gain share in generative AI over the next three years. For AWS, that hints at strong demand for its AI platforms SageMaker and Bedrock.

Amazon reported mixed results in the second quarter. Total revenue increased 10% to $148 billion, falling short of the $148.6 billion analysts forecasted. The reason for the shortfall was light advertising revenue. But GAAP earnings still jumped 94% to $1.26 per diluted share, crushing the consensus estimate of $1.03 per diluted share. However, the stock declined sharply when management provided underwhelming guidance, but patient investors have good reason to be optimistic.

Three tailwinds should make Amazon more profitable in the next few years. First, the company is regionalizing its fulfillment network to streamline logistics and lower costs. Second, revenue is growing more quickly in the high-margin cloud and advertising segments, as compared to the low-margin retail segment. Third, cooling inflation should encourage consumer and business spending.

With that in mind, Wall Street expects Amazon’s earnings to grow at 25% annually through 2026. That makes the current valuation of 46 times earnings seem reasonable, which lends credit to the median price target of $220 per share. More importantly, I think investors who buy a position in Amazon today will be very happy with their decision in five years.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon and Palantir Technologies. The Motley Fool has positions in and recommends Amazon, Microsoft, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Palantir Stock vs. Amazon Stock: Wall Street Says Buy One and Sell the Other was originally published by The Motley Fool

Trump Claims Inflation Has Cost American Households $28,000 – Is He Right? Here's What Financial Experts And Analysts Are Saying

Former President Donald Trump has recently ramped up his criticism of President Biden and Vice President Kamala Harris, claiming inflation has caused severe financial strain for American families.

During a Sept. 13 rally in Las Vegas, Trump asserted that “the worst inflation in American history” has cost the average American household a whopping $28,000. He repeated the figure at rallies in Wisconsin, Pennsylvania and Arizona, raising eyebrows and fueling debate.

But is Trump’s claim accurate? Economists and analysts have weighed in, providing some clarity on the matter.

Don’t Miss:

It’s true that under President Biden, inflation reached its highest level in decades, peaking at 9.1% in June 2022. However, inflation has since moderated, falling to 2.5% in August 2024, the lowest rate in three years. While the rate of price increases has slowed, prices themselves haven’t come down.

See Also: Don’t miss out on the next Nvidia – you can invest in the future of AI for only $10.

As CBS News reports, the cost of household essentials remains elevated compared to pre-pandemic times.

So, where did Trump get that figure of $28,000? According to economists, the number holds some truth, but there’s more to the story. It aligns closely with an estimate from Republicans on Congress’ Joint Economic Committee. Based on data from the Bureau of Economic Analysis, their tracker follows personal consumption expenditures at the state level.

Since January 2021, the study monitored the monthly expenses of an average American household across all states. By July 2024, the cumulative increase in household costs, fueled by inflation, reached an average of $27,950 for households in all 50 states and Washington, D.C.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

These numbers reflect cumulative cost increases over three and a half years. But it’s important to note that while expenses have surged, so have incomes. Many households have seen wage growth partially offset inflation’s sting.

Economists interviewed by CBS News confirmed that the $28,000 estimate is mostly accurate, but they caution against focusing solely on price hikes without considering income growth.

There’s no denying that inflation has made life more expensive for most Americans. But how does the Biden administration compare to the Trump era in this regard? According to government data, prices rose under Trump too, though to a lesser extent.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

During his four years in office, the Consumer Price Index (CPI) for all items rose by about 8%. By contrast, consumer prices have surged by roughly 20% since Biden took office. The difference is stark, but so are the circumstances each president faced. Trump’s administration benefited from low inflation and strong job growth for much of his term.

However, the COVID-19 pandemic disrupted the economy in his final year. When Biden took office, the economy was recovering, with inflation spiking due to supply chain disruptions and surging demand.

Many countries worldwide experienced similar inflation spikes during this period, with some exceeding U.S. levels. Inflation is a normal part of a growing economy and the Federal Reserve aims to keep it around 2% annually. Deflation or falling prices, is typically viewed as harmful by economists.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Trump Claims Inflation Has Cost American Households $28,000 – Is He Right? Here’s What Financial Experts And Analysts Are Saying originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stella-Jones Announces Private Offering of C$400 Million of 7-Year Senior Unsecured Notes

MONTREAL, Sept. 26, 2024 (GLOBE NEWSWIRE) — Stella-Jones Inc. SJ (“Stella-Jones” or the “Company”) announced today that it has priced an inaugural offering of Canadian dollar denominated senior unsecured notes.

Stella-Jones will issue C$400 million aggregate principal amount of senior unsecured notes due October 1st, 2031, bearing interest at the rate of 4.312% per annum, payable semi-annually until maturity (the “Notes”). The Company intends to use the net proceeds from the offering to repay existing indebtedness under its revolving credit facilities, and any balance will be used for general corporate purposes.

The Notes are being offered in Canada through an agency syndicate consisting of TD Securities Inc., CIBC World Markets Inc. and RBC Dominion Securities Inc., as joint lead agents and bookrunners, along with Merrill Lynch Canada Inc. and Scotia Capital Inc., as co-managers. The offering is expected to close on October 1st, 2024, subject to customary closing conditions.

The Notes will be unsecured obligations of Stella-Jones, will rank equally and pari passu with the other present and future unsecured and unsubordinated obligations of Stella-Jones, and will be issued pursuant to a trust indenture, as supplemented by a first supplemental indenture, each to be dated the date of closing of the offering. Payment of the Notes will be guaranteed on an unsecured basis by certain wholly-owned subsidiaries of Stella-Jones. The Notes have been assigned a provisional rating of “BBB”, with a stable trend, by DBRS Limited.*

The Notes will be offered on a private placement basis in each of the provinces of Canada in reliance upon exemptions from the prospectus requirements of applicable securities laws. The Notes have not been, and will not be, registered under the Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy any of the Notes in the United States or any other jurisdiction where such offering or sale would be unlawful.

* Credit ratings are not recommendations to purchase, hold or sell such securities as such ratings are not a comment upon the market price of the securities or their suitability for a particular investor.

ABOUT STELLA-JONES

Stella-Jones Inc. SJ is a leading North American manufacturer of pressure-treated wood products, focused on supporting infrastructure that is essential to the delivery of electrical distribution and transmission, and the operation and maintenance of railway transportation systems. It supplies the continent’s major electrical utilities and telecommunication companies with wood utility poles and North America’s Class 1, short line and commercial railroad operators with railway ties and timbers. It also supports infrastructure with industrial products, namely wood for railway bridges and crossings, marine and foundation pilings, construction timbers and coal tar-based products. Additionally, the Company manufactures and distributes premium treated residential lumber and accessories to Canadian and American retailers for outdoor applications, with a significant portion of the business devoted to servicing Canadian customers through its national manufacturing and distribution network.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This press release contains information and statements of a forward-looking nature, including statements regarding the timing and completion of the proposed offering of Notes and the expected use of the net proceeds of the offering. These statements are based on suppositions and uncertainties as well as on management’s best possible evaluation of future events, including those referenced in the Company’s continuous disclosure filings (available on SEDAR+ at sedarplus.ca). The completion of the proposed offering of Notes is subject to general market and other conditions and there can be no assurance that the proposed offering will be completed or that the terms of the proposed offering will not be modified. As a result, readers are advised that actual results may differ from expected results. Unless required to do so under applicable securities legislation, the Company does not assume any obligation to update or revise forward-looking statements to reflect new information, future events or other changes after the date hereof.

| Head Office 3100 de la Côte-Vertu Blvd., Suite 300 Saint-Laurent, Québec H4R 2J8 Tel.: (514) 934-8666 Fax: (514) 934-5327 |

Exchange Listings The Toronto Stock Exchange Stock Symbol: SJ Transfer Agent and Registrar Computershare Investor Services Inc. |

Investor Relations Silvana Travaglini Senior Vice-President and Chief Financial Officer Tel.: (514) 934-8660 Fax: (514) 934-5327 stravaglini@stella-jones.com |

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Magnolia Oil & Gas Recent Insider Activity

EnerVest Ltd, Board Member at Magnolia Oil & Gas MGY, disclosed an insider sell on September 25, according to a recent SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Ltd sold 7,000,000 shares of Magnolia Oil & Gas. The total transaction amounted to $181,020,000.

Magnolia Oil & Gas shares are trading down 2.6% at $23.97 at the time of this writing on Thursday morning.

About Magnolia Oil & Gas

Magnolia Oil & Gas Corp is an independent oil and natural gas company engaged in the acquisition, development, exploration, and production of oil, natural gas, and natural gas liquid (NGL) reserves. The Company’s oil and natural gas properties are located in Karnes County and the Giddings area in South Texas, where the Company targets the Eagle Ford Shale and Austin Chalk formations. Its objective is to generate stock market value over the long term through consistent organic production growth, high full-cycle operating margins, and an efficient capital program with short economic paybacks. The company’s operating segment is acquisition, development, exploration, and production of oil and natural gas properties located in the United States.

Magnolia Oil & Gas: Financial Performance Dissected

Revenue Growth: Over the 3 months period, Magnolia Oil & Gas showcased positive performance, achieving a revenue growth rate of 20.13% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Energy sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 53.21%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Magnolia Oil & Gas’s EPS reflects a decline, falling below the industry average with a current EPS of 0.51.

Debt Management: Magnolia Oil & Gas’s debt-to-equity ratio is below the industry average. With a ratio of 0.22, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 12.06 is lower than the industry average, implying a discounted valuation for Magnolia Oil & Gas’s stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 3.51 is above industry norms, reflecting an elevated valuation for Magnolia Oil & Gas’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 5.12 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Magnolia Oil & Gas’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ASHFORD HOSPITALITY TRUST ANNOUNCES REVERSE STOCK SPLIT TO MAINTAIN LISTING ON THE NYSE

DALLAS, Sept. 26, 2024 /PRNewswire/ — Ashford Hospitality Trust, Inc. AHT (“Ashford Trust” or the “Company”) today announced that it was notified by the New York Stock Exchange (the “NYSE”) on September 23, 2024, that it is not in compliance with Section 802.01C of the NYSE’s Listed Company Manual, which requires listed companies to maintain an average closing share price of at least $1.00 over a consecutive 30 trading day period.

The Company plans to notify the NYSE within 10 business days of receipt of the notice that it intends to execute a 1-for-10 reverse stock split in order to regain compliance. The Company can regain compliance at any time within a six-month cure period following its receipt of the notice if, on the last trading day of any calendar month during such cure period, the Company has both: (i) a closing share price of at least $1.00 and (ii) an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of the applicable calendar month.

The Company believes the reverse stock split will benefit all shareholders by addressing several items impacting its common stock:

- It will allow the Company’s common stock to continue trading on the NYSE.

- The Company anticipates that the reverse stock split will meaningfully increase the Company’s market price per share above the $5 per share threshold required by many institutions to hold shares.

- Some brokers limit the ability or increase the cost to margin a stock under $5 per share.

By implementing a reverse stock split, the Company and its Board of Directors believes it can realize increased incremental demand for its common stock while also making the Company’s shares more attractive to a broader range of potential long-term institutional investors, individual investors, and buy-side analysts.

The Company’s common stock will continue to be listed and traded on the NYSE during this period, subject to the Company’s compliance with other NYSE continued listing standards. The Company’s common stock will continue to trade under the symbol “AHT,” but will have an added designation of “.BC” to indicate that the Company is not currently in compliance with NYSE continued listing standards.

The notice does not affect the Company’s ongoing business operations or its Securities and Exchange Commission reporting requirements, nor does it trigger a breach of the Company’s material debt obligations. The Company can provide no assurances that it will be able to satisfy any of the steps outlined above and maintain the listing of its shares on the NYSE.

* * * * *

Ashford Hospitality Trust is a real estate investment trust (REIT) focused on investing predominantly in upper upscale, full-service hotels.

Forward-Looking Statements

Certain statements and assumptions in this press release contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the federal securities regulations. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Additionally, statements regarding the following subjects are forward-looking by their nature: our business and investment strategy; anticipated or expected purchases, sales or dispositions of assets; our projected operating results; completion of any pending transactions; our plan to pay off strategic financing; our ability to restructure existing property-level indebtedness; our ability to secure additional financing to enable us to operate our business; our understanding of our competition; projected capital expenditures; the impact of technology on our operations and business; the risk that the notice and noncompliance with NYSE continued listing standards may impact the Company’s results of operations, business operations and reputation and the trading prices and volatility of the Company’s common stock; and the Company’s ability to regain compliance with the NYSE continued listing standards. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. These and other risk factors are more fully discussed in the Company’s filings with the SEC.

The forward-looking statements included in this press release are only made as of the date of this press release. Investors should not place undue reliance on these forward-looking statements. We will not publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations or otherwise except to the extent required by law.

![]() View original content:https://www.prnewswire.com/news-releases/ashford-hospitality-trust-announces-reverse-stock-split-to-maintain-listing-on-the-nyse-302260495.html

View original content:https://www.prnewswire.com/news-releases/ashford-hospitality-trust-announces-reverse-stock-split-to-maintain-listing-on-the-nyse-302260495.html

SOURCE Ashford Hospitality Trust, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Caterpillar Stock Jumped To a Record High Thursday—Here's Why

Smith Collection / Gado / Getty Images

Key Takeaways

-

Caterpillar shares hit a record high Thursday and are up more than 30% this year.

-

Reports of fresh Chinese stimulus measures drove a broad market rally.

-

Caterpillar stands to benefit from a rebound in China’s housing market, which has struggled in recent years.

Caterpillar (CAT) shares rose more than 3% to a record high Thursday as reports of fresh Chinese stimulus efforts drove a wider market rally.

The Chinese government said Thursday that it would institute “necessary fiscal expenditures” and stabilize the country’s struggling real estate sector, according to the state-run Xinhua News Agency. Bloomberg also reported that Beijing is planning to inject around $140 billion into its largest state lenders to prop up the economy.

Caterpillar shares had advanced 4% Tuesday as China laid out a massive monetary stimulus package to boost the economy.

Caterpillar Likely Would Benefit From Rebound in Chinese Housing Market

Caterpillar stands to benefit from expansion in China’s housing market. The construction equipment company is considered a bellwether stock as a proxy for domestic and global economic expansion or contraction.

Shares of Caterpillar recently were 3.2% higher at $390.49 after earlier hitting record $397.22. The stock is up about 32% year-to-date.

Last month, the company reported second lower second-quarter revenue than analysts had anticipated but slightly better-than-expected profit.

Read the original article on Investopedia.

A surfer without a degree is worth $16 billion after his biotech company's stock soared 1,100% in a year

-

A surfer who never graduated from college has made billions in the biotech industry.

-

Summit Therapeutics CEO Bob Duggan is worth about $16 billion after a 1,100% stock gain in 12 months.

-

Duggan, 80, ranks 129th on the global rich list and is the 23rd biggest wealth gainer this year.

A surfer without a college degree has gone from baking cookies to building robots, minting billions in biotech, and ranking among the world’s richest people.

Bob Duggan, 80, is the co-CEO and chairman of Summit Therapeutics, a cancer drug developer. He has tripled his net worth to $15.9 billion this year, making him the 23rd biggest wealth gainer of 2024 and the 129th richest person on the planet, per the Bloomberg Billionaires Index as of Thursday.

His net worth has soared thanks to his more than 550 million shares of Summit, a roughly 75% stake. The company’s stock price has surged by over 1,100% in the past 12 months, lifting its market value to over $16 billion.

Summit stock jumped from about $12 on September 6 to a record high of $32 on September 13, but has retreated to around $23 since then. It spiked after the company released late-stage trial data showing one of its drugs, Ivonescimab, performed better than Merck’s blockbuster Keytruda medication in some lung cancer patients.

Duggan stands out in the biotech industry, where most bosses rely on their advanced degrees to navigate complex, jargon-heavy medical research.

He spent six years taking classes at UC Santa Barbara in the 1960s, but never intended to get a degree as he was focused on finding ways to make money, he recently told The Wall Street Journal. Those included investing in Ethernet companies.

Duggan opened a bakery called Cookie Muncher’s Paradise in 1976 with the help of his then-brother-in-law. They converted it into a luxury sandwich chain, grew it to 16 locations, and then sold it for about $6 million in 1987, according to Bloomberg.

“People laugh that I was in the cookie business. But you know what? It was the bestselling chocolate-chip cookie ever,” he told WSJ. “You know why? Because we engineered it. We engineered it specifically so that it would be soft, so that when you pulled it away, it was like a pizza.”

Duggan became the CEO and chairman of Computer Motion, a robotic surgery company, in 1990. Intuitive Surgical acquired it for $67 million in stock in 2003, allowing Duggan to cash out his stake for over $150 million eventually.

Spurred on by his son’s death from brain cancer, Duggan started building a stake in Pharmacyclics, a maker of cancer drugs, in 2004. Pharmaceutical titan AbbVie bought the business for $21 billion in cash and stock in 2015, netting Duggan more than $3 billion, per Bloomberg.

He joined Summit’s board in 2019 and became CEO and chairman in 2020, making cancer drugs his principal focus. He appears to have caught lightning twice in the brutal biotech space, where many companies pour tons of money and years of work into medications that turn out to be duds.

Duggan is also a megadonor to the Church of Scientology, and has backed himself to find and bet on more winning businesses as the head of his own venture capital firm, Duggan Investments.

Read the original article on Business Insider

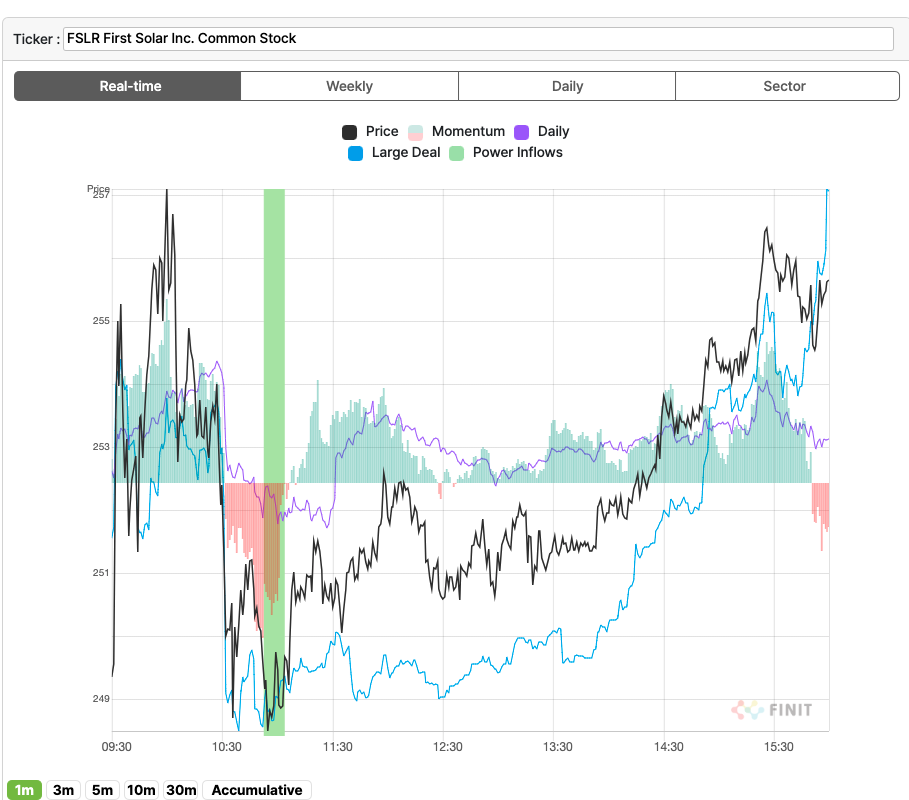

Tradepulse Power Inflow Alert: First Solar Inc. Moves Over 3% Higher After Receiving Tradepulse Alert

STOCK MOVED HIGHER THROUGHOUT THE DAY AND CLOSED NEAR THE HIGH

First Solar Inc. FSLR today experienced a Power Inflow, a significant event for those who follow where smart money goes and value order flow analytics in their trading decisions.

Today, at 11:02 AM on September 26th, a significant trading signal occurred for First Solar, Inc. as it demonstrated a Power Inflow at a price of $248.87. This indicator is crucial for traders who want to know directionally where institutions and so-called “smart money” moves in the market. They see the value of utilizing order flow analytics to guide their trading decisions. The Power Inflow points to a possible uptrend in Amazon’s stock, marking a potential entry point for traders looking to capitalize on the expected upward movement. Traders with this signal closely watch for sustained momentum in First Solar’s stock price, interpreting this event as a bullish sign.

Power Inflow Description

Order flow analytics, aka transaction or market flow analysis, separates and studies the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions. This particular indicator is interpreted by active traders as a bullish signal.

The Power Inflow occurs within the first two hours of the market open and generally signals the trend that helps gauge the stock’s overall direction, powered by institutional activity in the stock, for the remainder of the day.

By incorporating order flow analytics into their trading strategies, market participants can better interpret market conditions, identify trading opportunities, and potentially improve their trading performance. But let’s not forget that while watching smart money flow can provide valuable insights, it is crucial to incorporate effective risk management strategies to protect capital and mitigate potential losses. Employing a consistent and effective risk management plan helps traders navigate the uncertainties of the market in a more controlled and calculated manner, increasing the likelihood of long-term success

If you want to stay updated on the latest options trades for FSLR, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Market Close UPDATE:

The price at the time of the Power Inflow was $248.87. The returns on the High price ($256.48) and Close price ($255.56) after the Power Inflow were respectively 3.1% and 2.7%. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. In this case the high of the day and close were very close but that is not always the case

Past Performance is Not Indicative of Future Result

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Plunges as Prosecutor Reviews Accounting Claims

(Bloomberg) — Super Micro Computer Inc. fell the most in a month on a report that the US Justice Department is looking into an ex-employee’s claims that the server maker violated accounting rules just a few years after settling a bookkeeping case with a top financial regulator.

Most Read from Bloomberg

A prosecutor at the US attorney’s office in San Francisco recently reached out to people who may have relevant information about the allegations, according to a person familiar with the matter. The inquiry was reported earlier Thursday by the Wall Street Journal, which cited a case against Super Micro by former employee, Bob Luong.

Scrutiny has intensified on Super Micro since Luong alleged earlier this year in federal court that the company had sought to overstate its revenue. Short-seller Hindenburg Research subsequently referenced Luong’s claims in a research report about Super Micro, claiming “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

Super Micro declined to comment on the prosecutor’s inquiry as did the Justice Department.

Earlier this month, Charles Liang, Super Micro’s chief executive officer, said in a letter to customers that Hindenburg’s report contained “false or inaccurate statements about our company including misleading presentations of information that we have previously shared publicly.”

Super Micro shares fell 12% to $402.40 at the close Thursday in New York, marking the biggest decline since Aug. 28, a day after Hindenburg Research released its report. The stock has gained 42% this year.

The company sells high-powered servers for data centers and has seen an explosion of demand over recent quarters amid the growth in AI, making its shares a proxy for enthusiasm in the nascent technology.

In 2020, Super Micro resolved an investigation by the US Securities and Exchange Commission into its accounting by paying a $17.5 million penalty. Super Micro didn’t admit to or deny the regulator’s allegations as part of its settlement.

–With assistance from Chris Strohm and Ian King.

(Updates with data on inquiry in second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Newcore Gold Announces Closing of $5.5 Million Private Placement Financings

NOT FOR DISTRIBUTION TO THE UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, British Columbia, Sept. 26, 2024 (GLOBE NEWSWIRE) — Newcore Gold Ltd. (“Newcore” or the “Company”) NCAUNCAUF is pleased to announce that it has closed its previously announced non-brokered private placement financing, announced on September 5, 2024 and upsized on September 6, 2024, pursuant to which the Company issued 18,965,518 units of the Company (the “Units”) at $0.29 per Unit for aggregate gross proceeds of $5,500,000 (the “LIFE Offering”). The Units under the LIFE Offering were issued pursuant to the LIFE Exemption (as defined below).

Luke Alexander, President and CEO of Newcore stated, “We are very happy to have had such strong funding support to allow Newcore to continue to advance and de-risk the development of our Enchi Gold Project in Ghana. We would like to thank new and existing shareholders for their continued support. We are thrilled to be welcoming new institutional investors who recognize the significant upside potential at our Enchi Gold Project, as we advance the project towards a pre-feasibility study and continue to explore the district scale potential. Management and the Board of Directors also meaningfully participated in the financing, continuing to be strongly aligned with shareholders by way of an approximate 18% equity ownership post financing. With a drill rig turning at Enchi, we look forward to a busy year ahead as we continue to prove out the significant potential across the property.”

In addition to closing the LIFE Offering, the Company has also closed a concurrent non-brokered private placement financing pursuant to which the Company issued 151,638 Units at $0.29 per Unit for aggregate gross proceeds of $43,975 (the “Concurrent Offering” and together with the LIFE Offering, the “Offerings”).

Each Unit under the Offerings consisted of one common share in the capital of the Company (each, a “Common Share”) and one-half of one Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder thereof to purchase one Common Share of the Company at an exercise price of $0.40 per Common Share at any time on or before September 26, 2025.

The Company intends to use the net proceeds of the Offerings to fund exploration and development activities at the Company’s 100% owned Enchi Gold Project in Ghana, as well as for general corporate and working capital purposes.

The Units were sold under the LIFE Offering to purchasers pursuant to the listed issuer financing exemption (the “LIFE Exemption”) under Part 5A of National Instrument 45-106 – Prospectus Exemptions. The Units issued in the LIFE Offering pursuant to the LIFE Exemption are not subject to a statutory hold period pursuant to applicable Canadian securities laws. The Units issued in the Concurrent Offering are subject to a hold period of four months and a day ending on January 27, 2025.

In connection with the completion of the Offerings, the Company paid $119,110.25 to certain arm-length third parties who assisted in introducing subscribers to the Offerings.

Certain directors and officers of the Company (the “Insiders”) participated in the Offerings. Participation by the Insiders in the Offerings was considered a “related party transaction” pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”) as the Insiders are directors or senior officers of the Company. The Company was exempt from the requirements to obtain a formal valuation or minority shareholder approval in connection with the Insiders’ participation in the Offering in reliance on sections 5.5(a) and 5.7(1)(a) of MI 61-101. The Company will file a material change report in respect of closing of the Offerings.

The securities offered have not, nor will they be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any applicable securities laws of any state of the United States and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent such registration or an applicable exemption from such registration requirements. This release does not constitute an offer for sale or the solicitation of an offer to buy any of the securities in the United States or to, or for the account or benefit of, a U.S. person. “U.S. person” and “United States” are as defined in Regulation S under the U.S. Securities Act.

About Newcore Gold Ltd.

Newcore Gold is advancing its Enchi Gold Project located in Ghana, Africa’s largest gold producer (1). Newcore Gold offers investors a unique combination of top-tier leadership, who are aligned with shareholders through their 18% equity ownership, and prime district scale exploration opportunities. Enchi’s 248 km2 land package covers 40 kilometres of Ghana’s prolific Bibiani Shear Zone, a gold belt which hosts several multi-million-ounce gold deposits, including the Chirano mine 50 kilometers to the north. Newcore’s vision is to build a responsive, creative and powerful gold enterprise that maximizes returns for shareholders.

(1) Source: Production volumes for 2023 as sourced from the World Gold Council.

On Behalf of the Board of Directors of Newcore Gold Ltd.

Luke Alexander

President, CEO & Director

For further information, please contact:

Mal Karwowska | Vice President, Corporate Development and Investor Relations

+1 604 484 4399

info@newcoregold.com

www.newcoregold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release includes statements that contain “forward-looking information” within the meaning of the applicable Canadian securities legislation (“forward-looking statements”). All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: the use of proceeds from sales from the Offerings, the estimation of mineral resources; results of preliminary economic assessments; completion of a pre-feasibility study; results of our ongoing drill campaign, magnitude or quality of mineral deposits; anticipated advancement of mineral properties or programs; and future exploration prospects.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. The assumptions underlying the forward-looking statements are based on information currently available to Newcore. Although the forward-looking statements contained in this news release are based upon what management of Newcore believes, or believed at the time, to be reasonable assumptions, Newcore cannot provide any assurance that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Forward-looking information also involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Newcore to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others: risks related to the speculative nature of Newcore’s business; Newcore’s formative stage of development; Newcore’s financial position; possible variations in mineralization, grade or recovery rates; actual results of current exploration activities; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold and other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, unusual or unexpected geological formations); the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties.

Forward-looking statements contained herein are made as of the date of this news release and Newcore disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.