A boomer says he's struggling to survive on Social Security after retiring early to care full time for his wife

-

Robert Papalia, 74, retired early to care for his ailing wife, Marie.

-

The couple’s $5,000 monthly pre-tax retirement income is strained by medical bills and taxes.

-

Many Americans face similar financial struggles, relying on Social Security amid high medical costs.

Robert Papalia, 74, had to retire earlier than he planned after his wife Marie, 71, started getting sicker. After working more than 30 years at a telephone company, he retired at 60 — five years before he intended — to care for her.

The couple, who live in Burlington, New Jersey, have struggled financially over the past few years. Though they bring in about $5,000 a month in retirement income before taxes, much of that goes toward medical bills, high property taxes, and costly insurance payments. They’re left with little at the end of each month, though Papalia said they weren’t in dire straits.

“Do we have money in the bank? Yes. Is it a lot of money? No,” Papalia told Business Insider.

We want to hear from you. Are you an older American with any life regrets that you would be comfortable sharing with a reporter? Please fill out this quick form.

Many Americans have told BI they’ve struggled to prepare financially for the unexpected, such as a sudden health emergency or death in the family. As Americans increasingly rely on Social Security and other retirement income to get by, high medical expenses could throw years of retirement planning out of balance.

Retiring early to be his wife’s caretaker

Papalia had a goal to retire in 2015 at age 65 so he could receive Social Security benefits and have enough saved that money wouldn’t be a huge issue. In 2010, however, he retired to care for his wife full time, taking a buyout from his company that lasted until 2014.

Marie, a lifelong diabetic, had dealt with medical issues throughout her life, including vision loss in her right eye, static hypertension, and low blood sugar. She received a prosthetic eye after she experienced retinal damage.

Marie’s medical care was expensive, and the couple also cared for two dogs, both of whom had costly medical issues.

Marie needed around-the-clock care, and Papalia felt it was worth the financial sacrifice of retiring early to spend every hour with her to ensure she’d stay as healthy as possible. She had a heart attack in 2012 that forced them to pause their plans to sell their New Jersey house to move to an area in Pennsylvania with a lower cost of living.

In 2014, Marie underwent open heart surgery after doctors discovered a 95% blockage of her heart’s main artery. Papalia said that year was when finances became much tighter — he added that Marie took eight or nine prescriptions each day. She’s struggled to walk over the past few years and has relied on a wheelchair.

“I know for a fact that when I look at my wallet at the end of the day now, it’s a difference between night and day,” Papalia said, comparing his financial situation with that in 2010.

Scraping by and making sacrifices

Papalia receives $2,132 a month in Social Security before taxes and insurance and $1,900 from his pension, while Marie gets $1,113 a month from Social Security. Papalia said that though they stayed afloat, some months were particularly tight.

Medications could cost $60 to $70 each week, and hospital bills add up to a few hundred dollars every few months, meaning well over 10% of their income goes toward Marie’s medical costs. Papalia said his health was stable, though he has acid reflux, neuropathy, and an irregular heartbeat, for which he takes some medications.

“Without insurance, I’d be living underneath a bridge,” Papalia said. “If you don’t have insurance, you’re playing with fire.”

They shifted their grocery shopping to essentials at cheaper stores, and with food inflation over the past few years, they’ve been even more methodical about purchases. Papalia estimated they were spending under $100 on groceries weekly, though they occasionally order takeout. He said pandemic-era stimulus checks helped them afford necessities.

“We’re constantly going to doctors for everything you might imagine: clogged arteries, eye surgery, a situation where she lost toes off her left foot,” Papalia said, noting that though they get Medicare, the cost of deductibles and copays adds up.

They pay more than $10,000 in property taxes each year, and they anticipate that will continue increasing. Their heating bill runs them nearly $300 monthly, while they pay upward of $40 monthly on life insurance. They also pay nearly $300 a month for car and homeowners insurance.

Papalia said it’s only a matter of time before something goes wrong with the house, driving them into the red. A few years ago, he was given an estimate of $11,000 to fix his roof, but because the original roofing wasn’t up to building codes, it became a $36,000 payment that they won’t pay off until 2030.

“It’s a struggle every day, and something’s going to pop,” Papalia said.

Finances were so tight, he said, that he took out a reverse mortgage on the house, a loan for older Americans to borrow money against their home’s equity and supplement their Social Security.

He said they rotate between 30 credit cards for various purchases to limit their budget, get rewards, and keep balances on each card low to maintain their credit.

Papalia said he’d looked into getting a part-time job, but he could rarely leave the house given Marie’s conditions. Hiring a caretaker would be too expensive, he added.

“We’re just taking it one day at a time,” Papalia said. “We’re worrying about today and letting tomorrow take care of itself.”

Are you worried about retirement? Please fill out this quick form or reach out to this reporter at nsheidlower@businessinsider.com.

Read the original article on Business Insider

Costco Posts Major Earnings Beat, But Misses On These Metrics

Costco stock slid in late trade after posting mixed results for its Q4 report after Thursday’s closing bell.

Costco Wholesale (COST) reported earnings of $5.29 per share to beat FactSet estimates of $5.08 per share. The company reported earnings of $4.86 per share for Q4 2023. Revenue increased 1% to $79.69 billion, shy of views for $79.91 billion.

↑

X

How To Buy Stocks: Ways To Profit From Earnings Reports

Membership fee revenue ticked up slightly to $1.51 billion, while analysts expected $1.55 billion. Overall comparable sales rose 5.4% for the quarter, just below forecasts for 5.7% growth. U.S. same-store sales rose 5.3%.

Costco operated 891 warehouses at the end of the quarter, up from 878 at the end of Q3. The number of locations in the U.S. increased by nine to 614.

Costco Stock

COST stock fell slightly in late trading. Shares eased 0.8% to 901.44 in Thursday’s regular session.

The stock is trading low in a buy zone for a seven-week cup base. Costco broke out above the 896.67 buy point on Aug. 27.

COST stock isn’t too far off its record high of 923.83 from Sept. 13.

Costco rallied more than 36% this year through Thursday’s close.

You can follow Harrison Miller for more stock news and updates on X/Twitter @IBD_Harrison

YOU MAY ALSO LIKE:

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

Join IBD Live And Learn Top Chart Reading And Trading Techniques From Pros

Learn How To Time The Market With IBD’s ETF Market Strategy

Market In Power Trend; AI Chip Plays Shrug Off Super Micro Dive

Scholastic Stock Climbs After Better-Than-Expected Q1 Results: Details

Scholastic Corp. SCHL reported first-quarter financial results after Thursday’s closing bell. Here’s a look at the details from the report.

The Details:

Scholastic reported quarterly GAAP losses of $2.21 per share, which beat the analyst consensus estimate for losses of $2.48. Quarterly revenue of $237.2 million beat the analyst consensus estimate of $233.5 million.

- Book Fairs revenues were $28.8 million, up 5% from the prior year period.

- Book Clubs revenues were $2.7 million, in line with the prior year period.

- Consolidated Trade revenues were $73.9 million, up 2% from the prior year period, primarily driven by higher foreign rights revenues, partly offset by lower frontlist sales compared to the prior year period.

Read Next: Expect Healthy Online Spending This Holiday Season, Says Analyst: What To Know

“During our first quarter, Scholastic prepared for another important back-to-school season, as we executed on our long-term growth initiatives. In the seasonally quiet quarter for our school-based channels, first quarter’s operating loss improved modestly versus the prior year,” said Peter Warwick, president and CEO of Scholastic.

SCHL Price Action: According to Benzinga Pro, Scholastic shares are up 7.69% after-hours at $32.50 at the time of publication Thursday.

Read Also:

Image: Courtesy of Scholastic Corporation.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spotlight on Danaher: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Danaher.

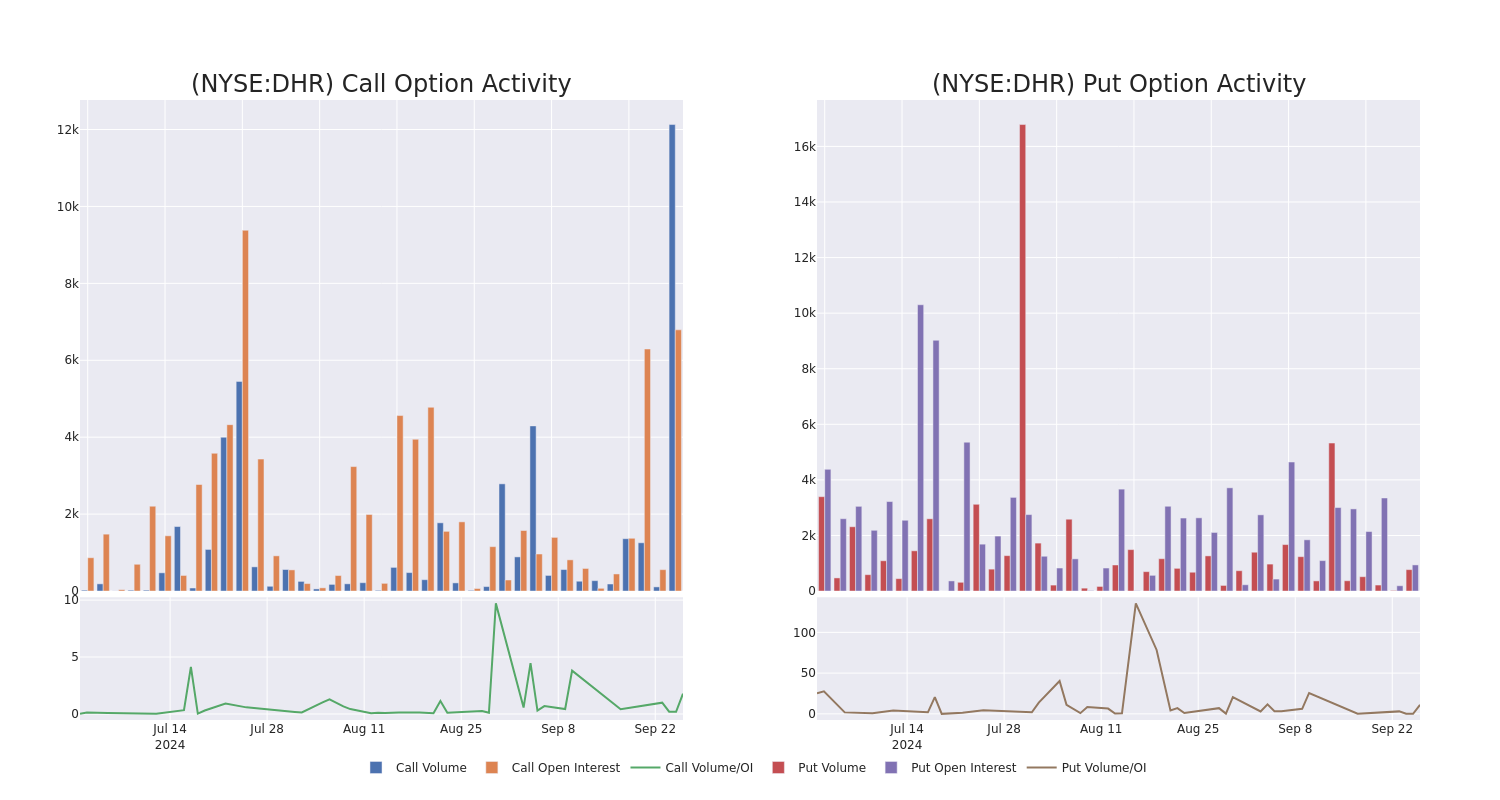

Looking at options history for Danaher DHR we detected 38 trades.

If we consider the specifics of each trade, it is accurate to state that 28% of the investors opened trades with bullish expectations and 57% with bearish.

From the overall spotted trades, 12 are puts, for a total amount of $675,331 and 26, calls, for a total amount of $1,751,865.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $340.0 for Danaher during the past quarter.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Danaher options trades today is 552.21 with a total volume of 12,900.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Danaher’s big money trades within a strike price range of $100.0 to $340.0 over the last 30 days.

Danaher Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHR | CALL | SWEEP | BULLISH | 12/20/24 | $10.5 | $10.4 | $10.4 | $280.00 | $158.0K | 1.6K | 579 |

| DHR | CALL | SWEEP | NEUTRAL | 12/20/24 | $10.4 | $10.1 | $10.4 | $280.00 | $144.5K | 1.6K | 792 |

| DHR | CALL | SWEEP | BULLISH | 12/20/24 | $10.6 | $9.2 | $10.4 | $280.00 | $132.0K | 1.6K | 993 |

| DHR | PUT | SWEEP | BEARISH | 01/16/26 | $19.3 | $18.6 | $19.3 | $260.00 | $115.8K | 617 | 60 |

| DHR | PUT | SWEEP | BULLISH | 01/16/26 | $19.0 | $18.6 | $19.0 | $260.00 | $114.0K | 617 | 120 |

About Danaher

In 1984, Danaher’s founders transformed a real estate organization into an industrial-focused manufacturing company. Through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in the life science and diagnostic industries after the late 2023 divesititure of its environmental and applied solutions group, Veralto.

Current Position of Danaher

- With a trading volume of 2,617,178, the price of DHR is up by 3.38%, reaching $276.93.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 26 days from now.

What The Experts Say On Danaher

1 market experts have recently issued ratings for this stock, with a consensus target price of $300.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from RBC Capital lowers its rating to Outperform with a new price target of $300.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Danaher with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alibaba Stock Races To New Highs After New Stimulus Shock, But Is BABA Stock A Buy Now?

After a mild downdraft Wednesday, Alibaba stock held a strong gain in afternoon trading Thursday even though major stock indexes were well off session highs. Alibaba stock vaulted 9% to another 52-week high, but is BABA stock a buy now?

Chinese stocks extended gains on reports China is considering injecting more than $100 billion into the country’s top banks. China’s Shanghai composite soared 3.6%, while Hong Kong’s Hang Seng index jumped 4.2%.

↑

X

Indexes Trade In Up-And-Down Session; Onsemi, KBR, Harmony Biosciences In Focus

The news fueled a broad rally in several other Chinese internet stocks like JD.com (JD), PDD (PDD), Baidu (BIDU) and Bilibili (BILI).

Alibaba (BABA) gapped up powerfully Tuesday after China loosened lending standards to stimulate an economy that’s been slow to recover. China stock indexes rallied sharply on the news. The Shanghai composite and the Hang Seng soared 4.1% overnight.

Alibaba stock scored a technical breakout last week after the company announced a suite of new open-source artificial intelligence (AI) models as well as text-to-video AI technology.

BABA stock also gapped up in late August after Chinese regulators said the company has successfully completed a three-year regulatory “rectification process.” Alibaba (BABA) was fined $2.6 billion in 2021 for monopolistic practices.

It hasn’t been the best of times for Alibaba stock in recent years amid waning fundamentals. Alibaba isn’t the growth engine it once was, but revenue growth should accelerate in coming quarters as China’s consumer continues a slow recovery.

Recent Earnings

In mid-August, Alibaba reported adjusted profit of $2.26 a share. Revenue growth accelerated from the prior quarter, rising 4% to $33.5 billion.

Sellers hit Alibaba stock hard on May 14 despite a slight revenue beat, although buyers pushed the stock well of lows by the close. Buyers were in control for the next three trading sessions, sending shares higher by more than 11%.

On an adjusted basis, Alibaba earned $1.40 a share, down 10% year over year. Revenue edged higher by 1% to $30.7 billion.

Alibaba also announced a two-part dividend. It includes an annual cash dividend of $1 per American depository share and a “one-time extraordinary cash dividend” of 66 cents per ADS. The total dividend will cost $4 billion, the company said.

BABA stock rallied sharply on Feb. 6 after the company reported fiscal Q3 revenue of $36.7 billion, up 2% from the year-ago quarter and slightly above the $36.16 billion consensus. But adjusted profit fell 4% to $2.67 a a share.

Investors also liked the fact that Alibaba added $25 billion to its share buyback program through March 2027.

Three months earlier, Alibaba stock plunged in mid-November despite reporting an 18% rise in quarterly profit and 6% increase in revenue.

Alibaba Stock News

BABA stock surged on Jan. 23 on reports that co-founder Jack Ma and business associate Joe Tsai have been buying shares of BABA stock in recent months.

According to an SEC filing, Tsai purchased $151 million in Alibaba stock in the fourth quarter via his Blue Pool Management family fund. Ma, meanwhile, bought $50 million worth of Alibaba stock. Ma stepped down as the company’s chairman in 2019 and remains a big shareholder.

Stock Market ETF Strategy And How To Invest

Alibaba came under selling pressure on Sept. 11 after outgoing CEO Daniel Zhang unexpectedly stepped down as head of the company’ cloud business.

The company said in June that Zhang was departing as chairman and CEO of the company to focus on Alibaba’s cloud intelligence unit. In May, Alibaba announced plans to spin off its cloud business as a separate, publicly traded company.

In December, the company said that CEO Eddie Wu would take over the company’s struggling e-commerce business.

Alibaba stock soared above its 200-day moving average in July 2023 after Chinese regulators fined Alibaba’s financial arm, Ant Group, just under $1 billion.

Chinese regulators halted Ant Group’s IPO in late 2020 for not meeting listing requirements. In April 2021, regulators hit Alibaba with $2.8 billion fine in an anti-monopoly probe. But after three years of regulatory scrutiny, optimism is building that Beijing is close to ending its crackdown on tech firms.

In March 2023, Alibaba announced plans to separate into six separate units.

The company said each business will have the ability raise outside funding and even pursue an IPO. According to report, the company would likely hold on to its cloud/artificial intelligence business and its giant e-commerce operations.

- Cloud Intelligence

- Taobao Tmall Commerce

- Local Services

- Cainiao Smart Logistics

- Global Digital Commerce

- Digital Media and Entertainment

China/U.S. Relations

Sentiment was weak around Chinese stocks in October after the Biden administration announced new restrictions on China’s access to U.S. semiconductor technology. This included tighter rules on the sale of chip equipment to China as well as restrictions on the exports of some types of chips used in supercomputing and artificial intelligence.

Alibaba stock rallied sharply in late August 2023 on reports that Beijing and U.S. regulators were close to an audit-inspection deal.

Increased regulatory scrutiny has weighed on Alibaba and other Chinese stocks for the past couple of years. Besides a strict regulatory environment, Chinese stocks have also been dealing with a slowing economy.

In April 2020, China regulators fined Alibaba $2.8 billion after an antimonopoly probe. At the time, it looked like BABA stock was ready to break out of a downtrend. But the stock got turned away at its 50-day moving average. It tried to rally above the 50-day line again in late April but sellers knocked the stock lower again.

Alibaba Stock Fundamental Analysis

The company has a five-year annualized earnings growth rate of 3%, hurt by recent earnings declines.

See Which Stocks Are In The Leaderboard Portfolio

Alibaba’s Composite Rating of 84 (on a scale of 1-99 with 99 being the best) has improved quite a bit in recent weeks. Still, the rating is weighed down by soft fundamentals.

But annual return on equity of 16% helps give Alibaba a top-notch SMR Rating (sales + margins + return on equity) of A from IBD Stock Checkup (on an A-to-E scale with A tops).

The Stock Checkup tool quickly identifies group leaders based on a combination of fundamental and technical factors.

According to Zacks, Alibaba is expected to earn $8.35 a share in its current fiscal year 2025, down 3% compared to fiscal 2024. For fiscal 2026, earnings are expected to rise 13% to $9.39 a share.

Click here to the top-rated stocks in the group.

Alibaba Stock Technical Analysis

Alibaba’s relative strength line is pointing upward again

A stock’s relative strength line, found in daily and weekly charts at Investors.com, compares the stock’s daily price performance to the S&P 500. An upward-sloping RS line means the stock is outperforming the S&P 500. A downward-sloping line means the stock is lagging the S&P 500.

Alibaba’s Accumulation/Distribution Rating is very good at A-. The rating is helped by higher-volume price gains in recent weeks. Higher-volume price declines will weigh on the rating.

BABA Stock: Is It A Buy Now?

Overhead supply issues are still an issue for Alibaba, with the stock more than 5% above the buy zone after gapping above an 85.79 entry. A low-volume pullback closer to the entry would upt Alibaba stock in an alternate buy zone.

Some might call Alibaba a turnaround story with revenue growth expected to ramp up in coming quarters.

For the September-ended quarter, revenue is expected to climb 7% to $33.7 billion, with 8% to 10% top-line growth expected over the next three quarters.

Follow Ken Shreve on Twitter at @IBD_KShreve for more market insight and analysis right now.

YOU MIGHT ALSO LIKE:

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Dermatology Diagnostics Devices Market to Reach $8.6 Billion, Globally, by 2033 at 7.6% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 26, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Dermatology Diagnostics Devices Market by Product Type (Imaging Devices, Dermatoscopes and Microscopes), Application (Skin Cancer, Psoriasis and Others), and End User (Hospitals, Clinics and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the dermatology diagnostics devices market was valued at $4.1 billion in 2023, and is estimated to reach $8.6 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033.

Prime determinants of growth

Increase in prevalence of skin diseases, surge in preference of minimally invasive procedures, and rise in awareness about skin health and the importance of early detection of skin cancers are the major factors that drive the growth of the dermatology diagnostics devices market growth. However, the shortage of skilled diagnostics devices professionals and high cost of dermatology diagnostics devices restricts the market growth. Moreover, rise in technological advancements and growth opportunities in emerging markets offer remunerative opportunities for the expansion of the global dermatology diagnostics devices market.

Request Sample of the Report on Dermatology Diagnostics Devices Market 2033 – https://www.alliedmarketresearch.com/dermatology-diagnostics-devices-market-A324405

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $4.1 billion |

| Market Size in 2033 | $8.6 billion |

| CAGR | 7.6% |

| No. of Pages in Report | 240 |

| Segments Covered | Product Type, Application, End User, and Region. |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A324405

Segment Highlights

Rise in adoption of imaging devices

By product type, the imaging devices segment is driven by advancements in technology and the increasing demand for accurate and non-invasive diagnostic solutions. High-resolution imaging devices offer detailed visualization of skin structures, enhancing the early detection of skin conditions and cancers. The growing preference for non-invasive methods among patients and healthcare providers further propels this segment growth. Additionally, the integration of artificial intelligence (AI) in imaging devices improves diagnostic accuracy and efficiency, boosting their adoption. The rising incidence of skin disorders and the need for precise, real-time assessments also contribute to the robust growth of the imaging devices segment in dermatology diagnostics.

Increase in prevalence of skin cancer

By application, the skin cancer segment plays an important role in the market. This is attributed to increasing prevalence of skin cancers and the urgent need for early and accurate detection. In addition, rising incidence of melanoma and non-melanoma skin cancers drives demand for advanced diagnostic technologies that can provide detailed imaging and precise analysis. Moreover, heightened public awareness about skin cancer and the emphasis on preventive healthcare further support the growth of this segment.

Rise in adoption of diagnostics devices in hospitals

By end user, the hospital segment held a substantial portion of the dermatology diagnostics devices market share, primarily driven by surge in need for advanced, high-resolution diagnostic tools. Hospitals often serve as the primary centers for comprehensive skin cancer screening, diagnostic imaging, and complex dermatological assessments, requiring sophisticated equipment to manage a wide range of skin conditions. In addition, hospitals are equipped with the resources for maintaining and upgrading high-cost diagnostic devices, further contributing to their significant market share.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A324405

Regional Outlook

North America Dominance by 2033

North America is poised to maintain its leadership in the dermatology diagnostics devices market owing to its advanced healthcare infrastructure, high prevalence of skin disorders, and substantial investments in medical technology. In addition, strong research and development activities, coupled with high levels of healthcare expenditure and favorable reimbursement policies, drive innovation and adoption of advanced diagnostic technologies which thereby drives the segment growth. The high awareness and proactive approach towards skin health among the population further supports market growth.

Key Players

- Michelson Diagnostics Ltd. (MDL)

- HEINE Optotechnik GmbH & Co. KG

- F. Hoffmann-La Roche Ltd

- Warner and Webster Pty Ltd

- FotoFinder Systems GmbH

- MetaOptima Technology Inc.

- KIRCHNER & WILHELM GmbH + Co. KG

The report provides a detailed analysis of these key players in the global dermatology diagnostics devices market. These players have adopted different strategies such as agreement, expansion, product launch, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Get Customized Reports with your Requirements – https://www.alliedmarketresearch.com/request-for-customization/A324405

Recent Developments in Dermatology Diagnostics Devices Industry

- In February 2021, MetaOptima announced that it has received a Breakthrough Designation Device status by the U.S. Food and Drug Administration (FDA) for DermDx, a tool that harnesses the power of artificial intelligence to provide diagnostics for medical professionals about a patient’s potential skin cancer case.

Trending Reports in Healthcare Industry:

Mechanical Ventilator Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Electrophysiology Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Contraceptives Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Capsule Endoscopy System Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Robotaxi Event Invites Are Out And This Is What Investors Need To Know Before Oct. 10

Tesla (TSLA) has a big October, with third-quarter delivery data and earnings coming next month. However, the global EV giant is also scheduled to reveal its highly anticipated robotaxi on Oct. 10 at an event in Los Angeles. Investors appear to be waiting until then before making any big Tesla stock bets.

Robotaxi event invitations were officially sent to Tesla investors on Wednesday and while most of the details are still under wraps, Chief Executive Elon Musk is setting sky-high expectations for the event.

“This will be one for the history books,” Musk posted to X on Wednesday, along with a photo of the event announcement. “We, Robot,” the banner reads. “10.10 Los Angeles.”

↑

X

Tesla’s Robotaxi Is Delayed. Will It Make A Difference For Tesla Stock?

On Sept. 11, Musk wrote on X that in his opinion the robotaxi reveal will be the most significant moment for Tesla since the EV company unveiled the Model 3 nearly nine years ago.

Tesla Stock Rebounds As The Robotaxi Approaches; But What About Waymo

Tesla stock fell 1% to 254.22, hitting an intraday high of 261.75, during market action on Thursday after gaining more than 1% to 257.02 on Wednesday — climbing further above its 50-day moving average to within around 5% of its July high.

With several weeks remaining until Oct. 10, this is what investors need to know heading into the event.

Tesla Stock: Location And Viewing

Tesla has confirmed the robotaxi reveal will take place in Los Angeles, but have not officially announced a venue location. Bloomberg reported that Tesla will hold the event at the Warner Bros. studio in Burbank. However, that has not yet been confirmed.

On Sept. 10, Tesla announced retail investors could sign up for a chance to attend the event in person. Entries for the draw must have been made by Sept. 17.

Those invitations went out to Tesla investors Wednesday with only a select few investors receiving the nod to attend in person.

“Join us for We, Robot — our official unveiling of the future of autonomy,” the invite proclaims.

Investors must RSVP before Oct. 6 to be able go to the robotaxi reveal, according to screenshots of the invitation. Tickets are non-transferrable and guests must be at least 21 years of age. The invite states “next steps” will be sent out after tickets are confirmed.

Remarks will begin at 7 p.m. on Oct. 10. The event is expected to be broadcast across Tesla’s different social media channels, including X and YouTube.

The Robotaxi And Maybe Something Else?

Musk previously planned to unveil the robotaxi on Aug. 8, but pushed the event out to “make some important changes.” Musk also hinted on the Q2 earnings call that there could also potentially be other product announcements on Oct. 10.

“Moving it back a few months, allowed us to improve the robotaxi, as well as add in a couple other things for the product unveil,” Musk said on the July 23 earnings call.

Adam Jonas, Morgan Stanley’s high-profile auto analyst and a TSLA bull, wrote on Sept. 5 he expects the Oct. 10 robotaxi event will include a demonstration of the latest iteration of full self-driving, or FSD, which would be version 12.5 or later, as well as a demonstration of a fully-autonomous robotaxi, or “cyber-cab” driving on a “a closed/semi-closed course.”

Jonas stressed that Tesla currently has a permit for autonomous vehicle testing “with a driver” but does not possess a permit for autonomous vehicle testing or deployment without a driver.

On Musk’s hints at other products, Jonas wrote: “Could we see an electric plane? A boat? The latest gen Optimus robot flipping burgers at a Tesla Diner? We’re not really sure.”

“We remind investors that such events aim to achieve multiple purposes including recruiting, marketing and consumer education,” the analyst added.

On Thursday, Deutsche Bank wrote it expects the Oct. 10 event to include an unveiling of the “CyberCab,” some sort of robotaxi demonstration along with updates on operating parameters such as cost per mile, scale and timeline.

Tesla should also unveil the new lower cost vehicle slated for next year, according to Deutsche Bank.

Tesla Stock Performance

TSLA shares rose 3.5% to 238.25 last week, clearing an aggressive entry of 235. TSLA stock has an official 271 buy point from a cup base, according to MarketSurge.

On Sept. 5, shares popped above their 50-day moving average, buoyed by robust China sales and the EV giant’s full self-driving rollout plans.

TSLA shares are up 20% in September after declining 7.7% in August. Tesla stock has battled back in 2024 and is now up 3% on the year, after rebounding more than 80% from a late-April low.

Tesla’s Massive October Starts Next Week With Third-Quarter Deliveries

Tesla has a busy October ahead. The EV giant has third-quarter deliveries next week, followed up with the robotaxi event on Oct. 10 and then Q3 earnings.

Tesla stock ranks third in the 35-member IBD Auto Manufacturers industry group. The stock has a 72 Composite Rating out of a best-possible 99. Shares also have an 85 Relative Strength Rating and a 57 EPS Rating.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

The Tesla Robotaxi Event Approaches; But What About Waymo

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

Costco Wholesale Corporation Reports Fourth Quarter and Fiscal Year 2024 Operating Results

ISSAQUAH, Wash., Sept. 26, 2024 (GLOBE NEWSWIRE) — Costco Wholesale Corporation (“Costco” or the “Company”) COST today announced its operating results for the 16-week fourth quarter and the 52-week fiscal year ended September 1, 2024.

For the 16-week fourth quarter, the Company reported net sales of $78.2 billion, an increase of 1.0 percent compared to net sales of $77.4 billion in the 17-week fourth quarter of fiscal year 2023. For the 52-week fiscal year, the Company reported net sales of $249.6 billion, an increase of 5.0 percent from $237.7 billion reported in the 53-week fiscal year 2023.

The following comparable sales data reflect comparable locations year-over-year and comparable retail weeks.

Comparable sales were as follows:

| 16 Weeks | 16 Weeks | 52 Weeks | 52 Weeks | ||||

| Adjusted* | Adjusted* | ||||||

| U.S. | 5.3% | 6.3% | 4.5% | 5.0% | |||

| Canada | 5.5% | 7.9% | 7.0% | 8.1% | |||

| Other International | 5.7% | 9.3% | 8.1% | 8.4% | |||

| Total Company | 5.4% | 6.9% | 5.3% | 5.9% | |||

| E-commerce | 18.9% | 19.5% | 16.1% | 16.2% |

*Excluding the impacts from changes in gasoline prices and foreign exchange.

Net income for the 16-week fourth quarter was $2.354 billion, $5.29 per diluted share, compared to $2.160 billion, $4.86 per diluted share, in the 17-week fourth quarter last year. This year’s results included a net non-recurring tax benefit of $63 million, $0.14 per diluted share, related to a transfer pricing settlement, and true-ups of tax reserves.

Net income for the 52-week fiscal year was $7.367 billion, $16.56 per diluted share, compared to $6.292 billion, $14.16 per diluted share, in the 53-week prior year.

Costco currently operates 891 warehouses, including 614 in the United States and Puerto Rico, 108 in Canada, 40 in Mexico, 35 in Japan, 29 in the United Kingdom, 19 in Korea, 15 in Australia, 14 in Taiwan, seven in China, five in Spain, two in France, and one each in Iceland, New Zealand and Sweden. Costco also operates e-commerce sites in the U.S., Canada, the U.K., Mexico, Korea, Taiwan, Japan and Australia.

A conference call to discuss these results is scheduled for 2:00 p.m. (PT) today, September 26, 2024, and will be available via a webcast on investor.costco.com (click “Events & Presentations”).

Certain statements contained in this document and the pre-recorded message constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For these purposes, forward-looking statements are statements that address activities, events, conditions or developments that the Company expects or anticipates may occur in the future. In some cases forward-looking statements can be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. These risks and uncertainties include, but are not limited to, domestic and international economic conditions, including exchange rates, inflation or deflation, the effects of competition and regulation, uncertainties in the financial markets, consumer and small business spending patterns and debt levels, breaches of security or privacy of member or business information, conditions affecting the acquisition, development, ownership or use of real estate, capital spending, actions of vendors, rising costs associated with employees (generally including health-care costs and wages), energy and certain commodities, geopolitical conditions (including tariffs), the ability to maintain effective internal control over financial reporting, regulatory and other impacts related to climate change, public-health related factors, and other risks identified from time to time in the Company’s public statements and reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and the Company does not undertake to update these statements, except as required by law. Comparable sales and comparable sales excluding impacts from changes in gasoline prices and foreign exchange are intended as supplemental information and are not a substitute for net sales presented in accordance with U.S. GAAP.

| CONTACTS: | Costco Wholesale Corporation |

| David Sherwood, 425/313-8239 | |

| Josh Dahmen, 425/313-8254 | |

| Andrew Yoon, 425/313-6305 | |

COST-Earn

COSTCO WHOLESALE CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(dollars in millions, except per share data) (unaudited)

| 16 Weeks Ended | 17 Weeks Ended | 52 Weeks Ended | 53 Weeks Ended | ||||||||||||

| September 1, 2024 | September 3, 2023 | September 1, 2024 | September 3, 2023 | ||||||||||||

| REVENUE | |||||||||||||||

| Net sales | $ | 78,185 | $ | 77,430 | $ | 249,625 | $ | 237,710 | |||||||

| Membership fees | 1,512 | 1,509 | 4,828 | 4,580 | |||||||||||

| Total revenue | 79,697 | 78,939 | 254,453 | 242,290 | |||||||||||

| OPERATING EXPENSES | |||||||||||||||

| Merchandise costs | 69,588 | 69,219 | 222,358 | 212,586 | |||||||||||

| Selling, general and administrative | 7,067 | 6,939 | 22,810 | 21,590 | |||||||||||

| Operating income | 3,042 | 2,781 | 9,285 | 8,114 | |||||||||||

| OTHER INCOME (EXPENSE) | |||||||||||||||

| Interest expense | (49 | ) | (56 | ) | (169 | ) | (160 | ) | |||||||

| Interest income and other, net | 120 | 238 | 624 | 533 | |||||||||||

| INCOME BEFORE INCOME TAXES | 3,113 | 2,963 | 9,740 | 8,487 | |||||||||||

| Provision for income taxes | 759 | 803 | 2,373 | 2,195 | |||||||||||

| NET INCOME | $ | 2,354 | $ | 2,160 | $ | 7,367 | $ | 6,292 | |||||||

| NET INCOME PER COMMON SHARE: | |||||||||||||||

| Basic | $ | 5.30 | $ | 4.87 | $ | 16.59 | $ | 14.18 | |||||||

| Diluted | $ | 5.29 | $ | 4.86 | $ | 16.56 | $ | 14.16 | |||||||

| Shares used in calculation (000’s): | |||||||||||||||

| Basic | 444,013 | 443,876 | 443,914 | 443,854 | |||||||||||

| Diluted | 444,977 | 444,445 | 444,759 | 444,452 | |||||||||||

COSTCO WHOLESALE CORPORATION

CONSOLIDATED BALANCE SHEETS

(amounts in millions, except par value and share data) (unaudited)

Subject to Reclassification

| September 1, 2024 |

September 3, 2023 |

||||||||

| ASSETS | |||||||||

| CURRENT ASSETS | |||||||||

| Cash and cash equivalents | $ | 9,906 | $ | 13,700 | |||||

| Short-term investments | 1,238 | 1,534 | |||||||

| Receivables, net | 2,721 | 2,285 | |||||||

| Merchandise inventories | 18,647 | 16,651 | |||||||

| Other current assets | 1,734 | 1,709 | |||||||

| Total current assets | 34,246 | 35,879 | |||||||

| OTHER ASSETS | |||||||||

| Property and equipment, net | 29,032 | 26,684 | |||||||

| Operating lease right-of-use assets | 2,617 | 2,713 | |||||||

| Other long-term assets | 3,936 | 3,718 | |||||||

| TOTAL ASSETS | $ | 69,831 | $ | 68,994 | |||||

| LIABILITIES AND EQUITY | |||||||||

| CURRENT LIABILITIES | |||||||||

| Accounts payable | $ | 19,421 | $ | 17,483 | |||||

| Accrued salaries and benefits | 4,794 | 4,278 | |||||||

| Accrued member rewards | 2,435 | 2,150 | |||||||

| Deferred membership fees | 2,501 | 2,337 | |||||||

| Current portion of long-term debt | 103 | 1,081 | |||||||

| Other current liabilities | 6,210 | 6,254 | |||||||

| Total current liabilities | 35,464 | 33,583 | |||||||

| OTHER LIABILITIES | |||||||||

| Long-term debt, excluding current portion | 5,794 | 5,377 | |||||||

| Long-term operating lease liabilities | 2,375 | 2,426 | |||||||

| Other long-term liabilities | 2,576 | 2,550 | |||||||

| TOTAL LIABILITIES | 46,209 | 43,936 | |||||||

| COMMITMENTS AND CONTINGENCIES | |||||||||

| EQUITY | |||||||||

| Preferred stock $0.005 par value; 100,000,000 shares authorized; no shares issued and outstanding | — | — | |||||||

| Common stock $0.005 par value; 900,000,000 shares authorized; 443,126,000 and 442,793,000 shares issued and outstanding | 2 | 2 | |||||||

| Additional paid-in capital | 7,829 | 7,340 | |||||||

| Accumulated other comprehensive loss | (1,828 | ) | (1,805 | ) | |||||

| Retained earnings | 17,619 | 19,521 | |||||||

| TOTAL EQUITY | 23,622 | 25,058 | |||||||

| TOTAL LIABILITIES AND EQUITY | $ | 69,831 | $ | 68,994 | |||||

COSTCO WHOLESALE CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(amounts in millions) (unaudited)

Subject to Reclassification

| 52 Weeks Ended | 53 Weeks Ended | ||||||

| September 1, 2024 |

September 3, 2023 |

||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||

| Net income | $ | 7,367 | $ | 6,292 | |||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

| Depreciation and amortization | 2,237 | 2,077 | |||||

| Non-cash lease expense | 315 | 412 | |||||

| Stock-based compensation | 818 | 774 | |||||

| Impairment of assets and other non-cash operating activities, net | (9 | ) | 495 | ||||

| Changes in working capital | 611 | 1,018 | |||||

| Net cash provided by operating activities | 11,339 | 11,068 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||

| Purchases of short-term investments | (1,470 | ) | (1,622 | ) | |||

| Maturities and sales of short-term investments | 1,790 | 937 | |||||

| Additions to property and equipment | (4,710 | ) | (4,323 | ) | |||

| Other investing activities, net | (19 | ) | 36 | ||||

| Net cash used in investing activities | (4,409 | ) | (4,972 | ) | |||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||

| Repayments of short-term borrowings | (920 | ) | (935 | ) | |||

| Proceeds from short-term borrowings | 928 | 917 | |||||

| Repayments of long-term debt | (1,077 | ) | (75 | ) | |||

| Proceeds from issuance of long-term debt | 498 | — | |||||

| Tax withholdings on stock-based awards | (315 | ) | (303 | ) | |||

| Repurchases of common stock | (700 | ) | (676 | ) | |||

| Cash dividend payments | (9,041 | ) | (1,251 | ) | |||

| Financing lease payments | (136 | ) | (291 | ) | |||

| Other financing activities, net | (1 | ) | — | ||||

| Net cash used in financing activities | (10,764 | ) | (2,614 | ) | |||

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | 40 | 15 | |||||

| Net change in cash and cash equivalents | (3,794 | ) | 3,497 | ||||

| CASH AND CASH EQUIVALENTS BEGINNING OF YEAR | 13,700 | 10,203 | |||||

| CASH AND CASH EQUIVALENTS END OF YEAR | $ | 9,906 | $ | 13,700 | |||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Supermicro Stock Crashes On Report Of Justice Department Probe

Supermicro (SMCI) crashed Thursday on a report that the Justice Department is investigating the server maker for alleged accounting irregularities. SMCI stock was down well more than 10% in early afternoon trading.

The DOJ is probing Super Micro Computer after an activist short-selling firm published a report critical of the company, The Wall Street Journal reported, citing unnamed sources.

↑

X

Blue Chips, Small Caps Lag In Mixed Session; META, KBH, ARM In Focus

Supermicro stock fell after a Hindenburg Research report in August accusing Supermicro of accounting manipulation, export control failures, customer issues and other problems.

Shares dropped again after the AI server maker delayed the filing of its annual report with the Securities and Exchange Commission.

Supermicro said it needed more time “to complete its assessment of the design and operating effectiveness of its internal controls over financial reporting” for the fiscal year ended June 30.

Supermicro stock fell 14.4% to 392.18 on Thursday, hitting an eight-month low intraday. The stock has shed more than 30% since late August.

Supermicro stock’s Relative Strength Rating has taken a heavy beating. The RS Rating tumbled from a perfect 99 three months ago to 27, according to MarketSurge.

YOU MAY ALSO LIKE:

Microsoft Azure Sales Estimate Lowered As Copilots Slow To Take Off

Pfizer Tanked A $5.4 Billion Takeover. Why Crispr, Agios, Beam Could Benefit.

Market In Power Trend; AI Chip Plays Shrug Off Super Micro Dive