US Justice Department probes Super Micro Computer, WSJ reports

(Reuters) -The U.S. Department of Justice is investigating Super Micro Computer, the Wall Street Journal reported on Thursday, nearly a month after short-seller Hindenburg Research alleged “accounting manipulation” at the AI server maker.

Super Micro’s shares fell about 12% following the report.

The WSJ report, which cited people familiar with the matter, said the probe was at an early stage and that a prosecutor at a U.S. attorney’s office recently contacted people who may be holding relevant information.

The prosecutor has asked for information that appeared to be connected to a former employee who accused the company of accounting violations, the report added.

Super Micro had late last month delayed filing its annual report, citing a need to assess “its internal controls over financial reporting,” a day after Hindenburg disclosed a short position and made claims of “accounting manipulation”.

The short-seller had cited a three-month investigation that included interviews with former senior employees of Super Micro and litigation records.

Hindenburg’s allegations included evidence of undisclosed related-party transactions, failure to abide by export controls, among other issues.

The company had denied Hindenburg’s claims.

Super Micro on Thursday declined to comment on the report, while the DOJ said it cannot confirm or deny the existence of such a probe.

A Reuters review of tender documents earlier this year showed Chinese entities acquired high-end Nvidia chips embedded in server products made by several companies, including Super Micro, through resellers.

The U.S. government has been cracking down on the sale of such technology to China.

Super Micro has been a big winner in the generative AI boom, as businesses bet on the technology needed to power applications such as ChatGPT, sending its market value to $67 billion in March from roughly $4.4 billion.

The rally in AI stocks has since cooled, as investors realized the payoff on companies’ heavy investments would be slower than expected.

(Reporting by Akash Sriram and Aditya Soni in Bengaluru; Editing by Shreya Biswas)

Costco Q4 Earnings: Revenue Miss, EPS Beat, Comps Climb 5.4%, Shares Slide

Costco Wholesale Corp COST reported fourth-quarter financial results after the market close on Thursday. Here’s a look at the key numbers from the quarter.

Q4 Earnings: Costco reported fourth-quarter revenue of $79.697 billion, missing the consensus estimate of $79.973 billion. The membership-based retailer reported quarterly earnings of $5.29 per share, beating analyst estimates of $5.08 per share, according to Benzinga Pro.

Comparable sales in the fourth quarter were up 5.3% in the U.S., up 5.5% in Canada and up 5.7% in the Other International segment. Total comps climbed 5.4% year-over-year, and total e-commerce sales jumped 18.9%. The reported figures were adjusted to account for the total weeks in the quarter.

Costco’s fourth quarter this year was a 16-week period versus 17 weeks in the fourth quarter of 2023.

Membership fees came in at $1.512 billion, up from $1.509 billion in the prior year’s quarter. Costco announced it was raising the price of its annual store membership by $5 in July. The membership fee increase went into effect on Sept. 1.

Costco noted it now operates 891 warehouses. The company said it ended the quarter with $9.906 billion in cash and cash equivalents.

Management will hold a conference call with investors and analysts to discuss these results at 5 p.m. ET.

Related Link: Top 10 Stock Picks For The Holiday Boom: Adobe Forecasts Unprecedented E-Commerce Sales This Season

COST Price Action: Costco shares were down 1.10% in after hours, trading around $891.50 at the time of publication Thursday, per Benzinga Pro.

Photo: Wikimedia Commons.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AppFolio to Unveil Powerful New Real Estate Industry Insights and Innovations at 2024 FUTURE Conference

SAN DIEGO, Sept. 26, 2024 (GLOBE NEWSWIRE) — AppFolio APPF, the technology leader powering the future of the real estate industry, today announced the speaker line-up for FUTURE: The Real Estate Conference by AppFolio. The event will convene real estate professionals, speakers, technologists, and industry leaders for three days of innovation from October 28-30, 2024 in San Diego, CA.

New York Times #1 Best-Selling Author Daniel Pink and Three-Time Olympic Gold Medalist Kerri Walsh Jennings will deliver inspiring keynotes on the mainstage, which will also include talks from AppFolio CEO Shane Trigg, SVP of Product Kyle Triplett, and Industry Principal Stacy Holden. FUTURE will feature a musical performance from legendary R&B vocal group Boyz II Men at the Rady Shell.

As the premier conference for real estate professionals, attendees will be able to explore more than 45 sessions led by over 60 industry speakers, including:

- Stephanie Anderson, Senior Director of Communication and Social Media, Grace Hill

- Dom Beveridge, Principal, 20for20

- Mike Brewer, Co-Founder, Multifamily Media Network

- Jordan Brooks, Senior Market Analyst, ALN Apartment Data

- Daniel Craig, Chief Strategy Officer, ProfitCoach

- Kristi Fickert, Vice President of Enterprise Growth, Realync

- Sharon Wilson Géno, President, National Multifamily Housing Council

- Ray Hespen, CEO and Co-Founder, Property Meld

- Moses Kagan, Co-Founder and Partner, Adaptive Realty; Founder, Re-convene

- Robert Pinnegar, President and CEO, National Apartment Association

- Taimur Rashid, Managing Director, Generative AI Innovation & Delivery, Amazon Web Services

At this year’s conference, attendees will experience:

- Innovation that will transform the results of their business: Come away with a deeper perspective on the evolving landscape and the strategies that will define the future, including AI, affordable housing, transformation of the resident experience, and more.

- New solutions and partners to elevate business: Discover the latest proptech solutions and platform innovations through demos from product experts and the growing network of AppFolio Stack™ partners.

- Connections with the industry’s best and brightest: Foster relationships with other real estate professionals, speakers, technologists, and industry leaders through curated networking events.

- Hands-on training opportunities: Master AppFolio workflows to reach goals through pre-event training and certification sessions; available to current AppFolio customers for an additional fee.

“For more than a decade, our conference has sparked insights and connections AppFolio customers can use to more effectively operate and grow their businesses. This year, we’re elevating the experience by expanding into a premier real estate industry event,” said Lisa Horner, Senior Vice President of Marketing at AppFolio. “We’re thrilled to invite the real estate community to join us at FUTURE 2024, which will converge thought leadership, pioneering vision, and technology innovation to champion the future of real estate.”

FUTURE 2024 Sponsors:

- Platinum Sponsors: AvidXchange, Balanced Asset Solutions, REA.co

- Gold Sponsors: Amazon Hub Apartment Locker, Banyan, Eng Flanders Group, Hunter Warfield, Pay Ready, Possession Partner, Proper AI, Property Meld, RentCheck, SafeRent, ShowMojo, Tenant Turner, zInspector

- Silver Sponsors: Aldous & Associates, APM Help, Birdeye, Breezeway, ButterflyMX, Engrain, HappyCo, Hott Solutions, The KSC Group, LeadSimple, Livable, Livly, Lula, NetVendor, OJO Bookkeeping, One11 Advisors, Opiniion, Page Per Page, PetScreening, Quext, RemoteLock, REdirect Consulting, Zego

- Experience Sponsor: Best Egg

The FUTURE conference will take place from October 28-30, 2024 at the Marriott Marquis San Diego Marina. To learn more or register, visit futureconference.com.

About AppFolio

AppFolio is the technology leader powering the future of the real estate industry. Our innovative platform and trusted partnership enable our customers to connect communities, increase operational efficiency, and grow their business. For more information about AppFolio, visit appfolio.com.

For more information, please contact:

Mission North for AppFolio

appfolio@missionnorth.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/8b9cdce4-672e-4497-a427-b42b582cc5ae

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BlackBerry Q2 Earnings: Revenue, EPS Beat Estimates Driven By Strength In IoT, Cybersecurity

BlackBerry Ltd BB reported second-quarter financial results Thursday after the bell. Here’s a rundown of the report.

Q2 Earnings: BlackBerry reported second-quarter revenue of $145 million, beating analyst estimates of $141.42 million. The company reported breakeven second-quarter earnings on an adjusted basis, beating analyst estimates for a loss of 3 cents per share, per Benzinga Pro.

IoT revenue was $55 million, up 12% year-over-year. Cybersecurity revenue totaled $87 million in the quarter, up 10% year-over-year. Licensing revenue came in at $3 million.

BlackBerry ended the quarter with $265 million in cash, cash equivalents and short- and long-term investments.

“BlackBerry reached a significant milestone on our path to profitability by recording breakeven adjusted EBITDA and non-GAAP EPS. This result was achieved through a combination of stronger-than-expected, double-digit revenue growth for both IoT and Cybersecurity, as well as tremendous ongoing progress in rationalizing our cost structure. Operating expenses for the quarter were 24% lower than the baseline for the prior year,” said John Giamatteo, CEO of BlackBerry.

“QNX delivered strong royalty revenue again this quarter, and there was year-over-year revenue growth for the secure communications products in our Cybersecurity division.”

What’s Next: BlackBerry expects third-quarter revenue of $146 million to $154 million. BlackBerry sees third-quarter IoT revenue of $56 million to $60 million, cybersecurity revenue of $86 million to $90 million and licensing and other revenue of approximately $4 million.

The company also guided for breakeven third-quarter earnings, plus or minus one cent per share.

BlackBerry anticipates full-year revenue of $591 million to $616 million. The company anticipates a full-year adjusted earnings loss of 2 cents to 5 cents per share.

Management will hold a conference call to discuss these results at 5:30 p.m. ET.

BB Price Action: BlackBerry shares were up 0.79% in after-hours, trading at $2.56 at the time of publication Thursday, according to Benzinga Pro.

Photo: Courtesy of BlackBerry.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Federated Hermes, Inc. launches MDT Mid Cap Growth Collective Investment Fund

- Newest MDT product aims to meet growing demand for retirement products

PITTSBURGH, Sept. 26, 2024 /PRNewswire/ — Federated Hermes, Inc. FHI, a global leader in active investment management, today announced the launch of the Federated Hermes MDT Mid Cap Growth Collective Investment Fund, a strategy for qualified retirement plan investors. The fund pursues capital appreciation by investing in a diversified portfolio of US mid-cap growth companies.

The Federated Hermes MDT stock-selection process utilizes cutting-edge research, technology and daily data from multiple market cycles—conferring the advantages of discipline, testability and repeatability. Through a bottom-up, systematic approach, it seeks to remove subjective and emotional influences from the stock-selection process.

The fund is trusteed by Great Gray Trust Company, LLC (Great Gray), a leading provider of collective investment trusts (CITs) to the retirement plan market. Through the new CIT, Great Gray will offer retirement plan investors Federated Hermes MDT’s experience in seeking alpha from multiple sources—differentiating the fund from many other growth strategies.

“Our MDT strategies have seen continued interest in the retirement market, and we are pleased to offer another vehicle in which clients can access our investment team’s capabilities,” said Paul Uhlman, President of Federated Securities Corp. “The new mid-cap growth CIT builds upon our relationship with Great Gray and is another step in growing Federated Hermes’ global investment platform capabilities and bringing our diverse range of investment solutions to institutional investors.”

The fund is managed by a veteran portfolio management team: Daniel Mahr, CFA, who serves as Head of the MDT Group and has 22 years of experience; Damien Zhang, CFA, who is Head of MDT Research and has 15 years of experience; Frederick Konopka, CFA, who is Portfolio and Trading Manager and has 27 years of experience; and John Paul Lewicke, who serves as Research Manager and has 17 years of experience. The investment team behind the collective investment fund also manages more than $10 billion in several Federated Hermes MDT mutual funds, ETFs, institutional separate accounts and separately managed accounts (SMAs).

The new fund is Federated Hermes’ first equity CIT, complementing four fixed-income CITs with Great Gray: Federated Hermes Total Return Bond Collective Investment Fund, Federated Hermes High Yield Bond Collective Investment Fund, Federated Hermes Prime Cash Collective Investment Fund and Federated Hermes Unconstrained Credit Collective Investment Fund. Since 1986, Federated Hermes also has offered a stable value CIT—the Federated Hermes Capital Preservation Fund—which is trusteed by Federated Investors Trust Company.

Federated Hermes, Inc. is a global leader in active, responsible investment management, with $782.7 billion in assets under management, as of June 30, 2024. We deliver investment solutions that help investors target a broad range of outcomes and provide equity, fixed-income, alternative/private markets, multi-asset and liquidity management strategies to more than 10,000 institutions and intermediaries worldwide. Our clients include corporations, government entities, insurance companies, foundations and endowments, banks and broker/dealers. Headquartered in Pittsburgh, Federated Hermes has more than 2,000 employees in London, New York, Boston and offices worldwide. For more information, visit FederatedHermes.com/us.

###

Collective funds are subject to risks and fluctuate in value.

The quantitative models and analysis used by MDT may perform differently than expected and may affect fund performance.

Diversification does not assure a profit nor protect against loss.

Past performance is no guarantee of future results.

Alpha is a measure of how much or how little return is generated, given the risk a portfolio takes.

![]() View original content:https://www.prnewswire.com/news-releases/federated-hermes-inc-launches-mdt-mid-cap-growth-collective-investment-fund-302260464.html

View original content:https://www.prnewswire.com/news-releases/federated-hermes-inc-launches-mdt-mid-cap-growth-collective-investment-fund-302260464.html

SOURCE Federated Hermes, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Very Few Investments Achieve Dividend Aristocrat Status: Only Three Of Them Are REITs – Can You Guess Which?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

It’s common knowledge that dividend stocks can help investors build wealth and generate passive income. However, not all dividend stocks are created equally and only 68 have earned dividend aristocrat status. Despite the REIT sector’s solid performance history, only three REITs are certified dividend aristocrats. Keep reading to find out which ones.

Don’t Miss:

How Do Stocks Achieve Dividend Aristocrat Status?

Achieving Dividend aristocrat status requires stocks to hit several key metrics in terms of longevity, performance and name recognition. First, the company issuing the stock must have a market cap of $3 billion and an average daily trading activity of $5 million. Second, the company must be a member of the S&P 500. Finally, it must have increased its paid shareholder dividend for at least 25 consecutive years.

Federal Realty Investment Trust (NYSE: FRT)

Federal Realty Investment Trust is a large operator of shopping centers and retail hubs in America’s largest metropolitan areas. This REIT owns and operates over 26 million square feet of retail space but has also diversified into the residential sector, where it has 3,100 multifamily units under management.

Federal Realty Investment’s market cap is an impressive $9.46 billion and its shares are trading in the $113 range. The stock’s price has been surging for much of 2024 and it’s paying a dividend of 3.85%.

That’s $4.35/share and Federal Realty Trust has been increasing its dividend for 50 consecutive years. That means this REIT is one of the very rare stocks that has attained both dividend king and dividend aristocrat status. Federal Realty Investment Trust’s performance history makes it an offering worthy of strong consideration from dividend investors.

Essex Property Trust (NYSE: ESS)

Essex Property Trust is one of America’s largest multifamily residential REITs. It owns and operates 254 separate assets that total 62,000 units. More importantly for Essex investors, most of its portfolio assets are in America’s most expensive West Coast rental markets. The high home prices create an ideal scenario for Essex investors because most residents in these markets have no choice but to rent.

That helps explain Essex’s impressive performance history and its estimated $19.66 billion market cap. Essex shares are currently trading at $312.51 and paying a dividend of 3.14%, which is $9.81/share. Essex’s long-term future looks solid as long as the average home price in California is in the high six figures.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Realty Income (NYSE: O)

Realty Income has transcended Dividend Aristocrat status and entered the rarified air of dividend king. This REIT specializes in triple-net-leased retail properties in free-standing buildings suited for big-box retailers, who usually make reliable tenants and sign long-term leases. The Realty Income portfolio includes 15,000 properties in 49 states and it has recently diversified into the gaming, industrial and distribution sectors.

Realty Income’s current market cap is $53.67 billion and its shares are trading at $61.63. Lately, Realty Income’s share price has been moving steadily upward on the strength of solid Q2 2024 earnings. The estimated current dividend is a very investor-friendly 5.21%, which is $3.21/share.

That alone is enough to make Realty Income very popular with investors. However, that’s not the only reason they love this stock. Unlike many other REITs or dividend stocks, which pay dividends every quarter, Realty Income pays them on a monthly basis. Additionally, this dividend aristocrat REIT has also achieved dividend king status by increasing its shareholder dividend for 50 consecutive years!

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Very Few Investments Achieve Dividend Aristocrat Status: Only Three Of Them Are REITs – Can You Guess Which? originally appeared on Benzinga.com

Shiba Inu Soars 29% On SHI Stablecoin Update: Lead Developer Shytoshi Kusama Teases Breakout With Dragon Ball Meme — Burn Rate Soars 33818%

Shytoshi Kusama, the mysterious lead developer of the Shiba Inu SHIB/USD, shared a GIF, purportedly celebrating the breakout rally of the ecosystem’s top cryptocurrencies.

What happened: On Thursday, the pseudonymous lead posted a meme on X, showing Vegeta, a character in the popular anime series Dragon Ball, smirking after looking at a device.

The media possibly reflected Kusama’s own sentiment after watching tokens like SHIB and Bone ShibaSwap BONE/USD rally sharply over the day.

SHIB, the ecosystem’s biggest cryptocurrency by market capitalization, soared nearly 29% in the last 24 hours, rising to levels not seen since mid-June.

The coin’s trading volume more than tripled to $1.2 billion in the 24-hour period,

See Also: Maxine Waters Says ‘Crypto Is Inevitable,’ Other Countries Are ‘Way Ahead’ Of The United States

Additionally, BONE, the token widely used in decentralized exchange, ShibaSwap, and Layer-2 blockchain Shibarium, also bounced nearly 15%.

Why It Matters: The rally came after Shiba Inu’s marketing lead, Lucie, teased details about the ecosystem’s own stablecoin SHI, which was in the works.

First introduced by the project’s founder, Ryoshi, in 2021, Lucie informed that SHI is a “crucial development” and its introduction was aimed at enhancing the features of Shibarium.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

2 High-Yield Dividend Stocks That Can Deliver a Lifetime of Passive Income

Passive income is a powerful tool for building long-term wealth and securing financial freedom. High-yield dividend stocks offer investors an effective way to generate steady cash flow without active management or daily involvement.

Success in dividend investing hinges on identifying companies that offer attractive yields and possess the financial strength to maintain and potentially grow their payouts over time. These rare finds can become cornerstone investments, providing reliable income streams for decades.

Two stocks currently shine in the high-yield landscape, each offering yields above 5% with intriguing long-term prospects. Let’s examine why these dividend powerhouses merit closer attention from income-focused investors.

Verizon: A telecom titan with a juicy yield

Verizon Communications (NYSE: VZ) presents a compelling case for income-focused investors in light of its hefty 6.07% dividend yield. The telecom giant boasts an 18-year streak of consecutive-dividend increases, recently raising its quarterly payout to 67.75 cents per share despite its 100% payout ratio.

Verizon’s strength stems from its dominant U.S. wireless market position, controlling approximately 40% of the postpaid phone market share. This scale allows Verizon to generate industry-leading margins and returns on capital, underpinning its generous dividend payments.

The company’s stock has climbed over 18% year to date, likely benefiting from investor rotation into select high-yield dividend stocks ahead of anticipated interest rate cuts. While Verizon faces stiff competition and challenges in its fixed-line business, its extensive fiber-network assets and 5G technology offer growth potential.

Verizon’s focus on wireless service-revenue growth, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) expansion, and free-cash-flow generation reinforces its commitment to maintaining an attractive dividend. With shares trading at just 9.5 times forward earnings, the stock also offers a substantial margin of safety in the event of a marketwide pullback.

This blend of high-yield, growth potential, and attractive valuation makes Verizon an attractive passive-income play.

Pfizer: A pharmaceutical giant with an attractive yield

Pfizer (NYSE: PFE) offers passive income investors a substantial 5.69% dividend yield. The pharmaceutical powerhouse also sports a vast portfolio of over 350 marketed medicines and 113 clinical-trial candidates, with a global footprint spanning more than 200 countries.

Still, recent challenges, primarily stemming from declining COVID-19 franchise sales, have hit Pfizer’s stock hard. The drugmaker’s share price has plummeted by over 50% from its three-year peak, potentially creating an attractive value opportunity. Currently, Pfizer trades at just 9.6 times projected 2026 earnings.

While Pfizer’s 15-year streak of consecutive-dividend increases is impressive, the current 436% payout ratio raises eyebrows regarding sustainability. Management has tackled this concern head-on, reaffirming its commitment to a top-tier dividend and implementing a $4 billion cost-saving initiative to shore up its balance sheet during the post-COVID transition.

Looking ahead, Pfizer’s future largely depends on the fate of its clinical pipeline, especially its slate of potential blockbuster cancer treatments. Success in this high-growth market segment could significantly boost the company’s financial outlook and help bring the payout ratio closer to its historical 50% average.

Pfizer’s status as an economically insensitive stock, coupled with its high yield and promising pipeline, makes it an intriguing option for those seeking steady income and long-term portfolio stability. Moreover, the drugmaker’s rock-bottom valuation should provide a significant margin of safety in the event of a marketwide correction.

All told, Pfizer screens as a top candidate for a long-term-oriented passive income portfolio.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

George Budwell has positions in Pfizer. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

2 High-Yield Dividend Stocks That Can Deliver a Lifetime of Passive Income was originally published by The Motley Fool

Invesco Mortgage Capital Laps the Stock Market: Here's Why

The latest trading session saw Invesco Mortgage Capital IVR ending at $9.01, denoting a +1.46% adjustment from its last day’s close. The stock’s performance was ahead of the S&P 500’s daily gain of 0.25%. At the same time, the Dow added 0.2%, and the tech-heavy Nasdaq gained 0.56%.

The real estate investment trust’s shares have seen an increase of 1.95% over the last month, surpassing the Finance sector’s gain of 1.86% and the S&P 500’s gain of 1.65%.

The investment community will be paying close attention to the earnings performance of Invesco Mortgage Capital in its upcoming release. The company is expected to report EPS of $0.78, down 48.34% from the prior-year quarter. Alongside, our most recent consensus estimate is anticipating revenue of $8.94 million, indicating a 5.2% downward movement from the same quarter last year.

In terms of the entire fiscal year, the Zacks Consensus Estimates predict earnings of $3.23 per share and a revenue of $34.21 million, indicating changes of -39.63% and -31.17%, respectively, from the former year.

It’s also important for investors to be aware of any recent modifications to analyst estimates for Invesco Mortgage Capital. These revisions typically reflect the latest short-term business trends, which can change frequently. Consequently, upward revisions in estimates express analysts’ positivity towards the company’s business operations and its ability to generate profits.

Our research reveals that these estimate alterations are directly linked with the stock price performance in the near future. To utilize this, we have created the Zacks Rank, a proprietary model that integrates these estimate changes and provides a functional rating system.

Ranging from #1 (Strong Buy) to #5 (Strong Sell), the Zacks Rank system has a proven, outside-audited track record of outperformance, with #1 stocks returning an average of +25% annually since 1988. Within the past 30 days, our consensus EPS projection remained stagnant. Currently, Invesco Mortgage Capital is carrying a Zacks Rank of #3 (Hold).

From a valuation perspective, Invesco Mortgage Capital is currently exchanging hands at a Forward P/E ratio of 2.75. This valuation marks a discount compared to its industry’s average Forward P/E of 8.99.

The REIT and Equity Trust industry is part of the Finance sector. With its current Zacks Industry Rank of 146, this industry ranks in the bottom 43% of all industries, numbering over 250.

The strength of our individual industry groups is measured by the Zacks Industry Rank, which is calculated based on the average Zacks Rank of the individual stocks within these groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cisco Systems Options Trading: A Deep Dive into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bearish stance on Cisco Systems.

Looking at options history for Cisco Systems CSCO we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 10% of the investors opened trades with bullish expectations and 80% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $253,853 and 7, calls, for a total amount of $605,961.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $45.0 to $57.5 for Cisco Systems over the recent three months.

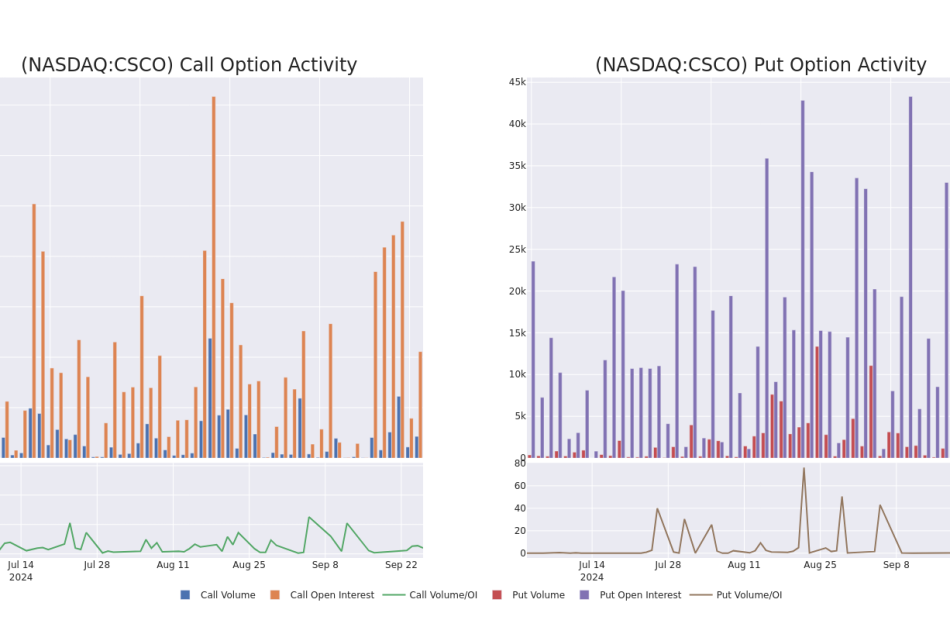

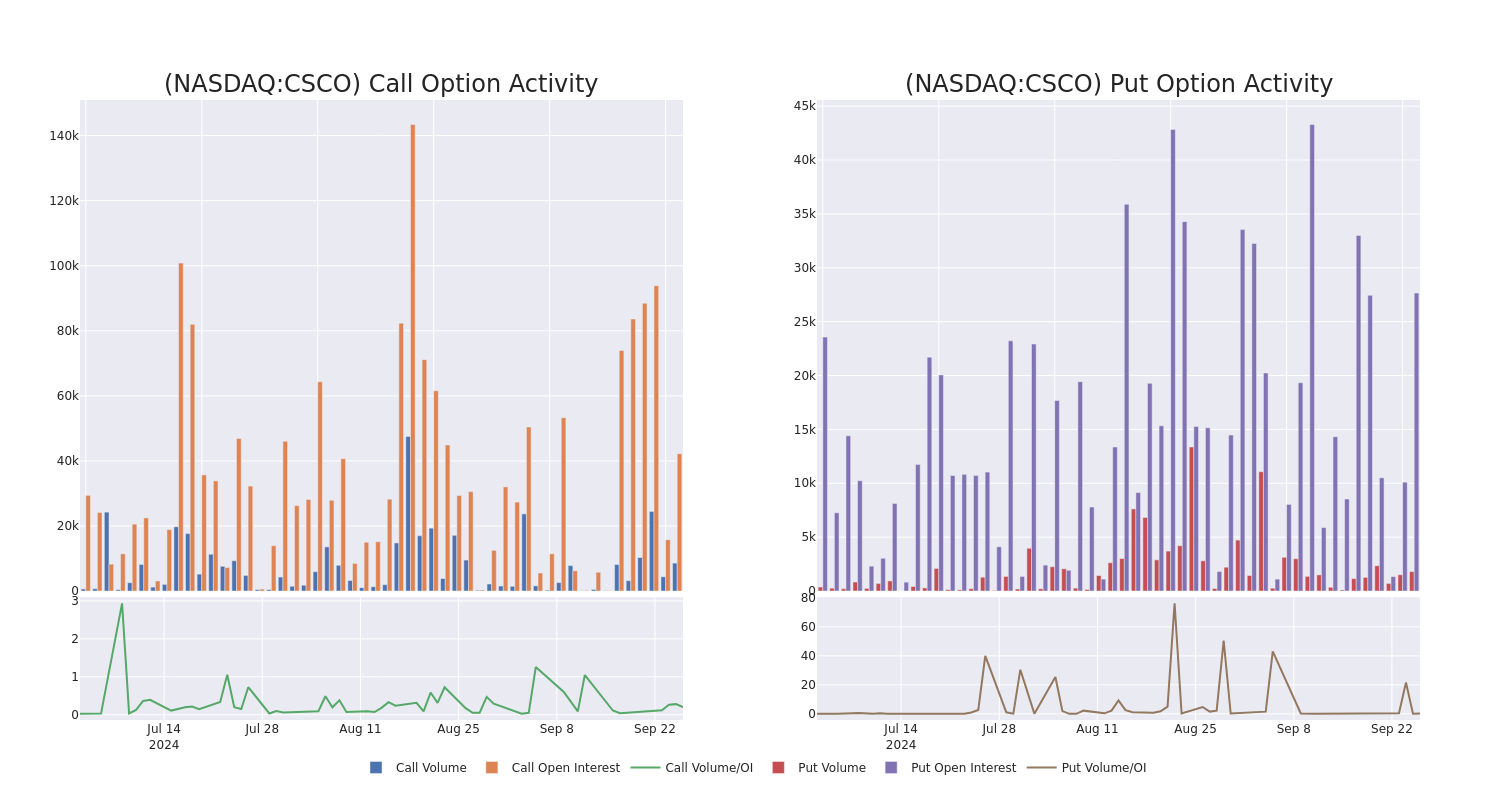

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Cisco Systems’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Cisco Systems’s whale trades within a strike price range from $45.0 to $57.5 in the last 30 days.

Cisco Systems 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CSCO | PUT | SWEEP | BEARISH | 01/17/25 | $1.2 | $1.17 | $1.2 | $50.00 | $172.3K | 26.0K | 1.5K |

| CSCO | CALL | TRADE | BEARISH | 10/18/24 | $1.08 | $1.05 | $1.06 | $52.50 | $155.3K | 28.5K | 2.5K |

| CSCO | CALL | SWEEP | BEARISH | 01/16/26 | $7.2 | $7.0 | $7.0 | $50.00 | $140.0K | 4.3K | 5 |

| CSCO | CALL | SWEEP | BEARISH | 10/18/24 | $1.11 | $1.06 | $1.06 | $52.50 | $105.4K | 28.5K | 4.0K |

| CSCO | CALL | TRADE | BULLISH | 12/20/24 | $0.65 | $0.64 | $0.65 | $57.50 | $66.1K | 2.8K | 1.5K |

About Cisco Systems

Cisco Systems is the largest provider of networking equipment in the world and one of the largest software companies in the world. Its largest businesses are selling networking hardware and software (where it has leading market shares) and cybersecurity software such as firewalls. It also has collaboration products, like its Webex suite, and observability tools. It primarily outsources its manufacturing to third parties and has a large sales and marketing staff—25,000 strong across 90 countries. Overall, Cisco employs 80,000 people and sells its products globally.

Following our analysis of the options activities associated with Cisco Systems, we pivot to a closer look at the company’s own performance.

Where Is Cisco Systems Standing Right Now?

- Trading volume stands at 16,463,200, with CSCO’s price up by 0.7%, positioned at $53.02.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 48 days.

Professional Analyst Ratings for Cisco Systems

In the last month, 1 experts released ratings on this stock with an average target price of $60.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Cisco Systems with a target price of $60.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cisco Systems with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.