Cathie Wood's Ark Invest Dumps Palantir Shares Amidst S&P 500 Inclusion And Extended AI Alliance

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

On Wednesday, the Cathie Wood-led Ark Invest made a notable move by selling a significant portion of its stake in Palantir Technologies Inc (NYSE:PLTR).

The Palantir Trade: The ARK Innovation ETF (NYSE:ARKK) offloaded 62,809 shares of Palantir. The sale came just days after Palantir’s inclusion in the S&P 500 index, replacing American Airlines Group, Inc. This inclusion could potentially boost Palantir’s stock as it gains wider exposure to investors and as shares are accumulated to be included in index funds that mirror the S&P 500. Despite the positive news, Ark Invest decided to reduce its exposure to the company.

Don’t Miss:

Moreover, the sale occurred on the same day Palantir announced a multi-million-dollar extension of its deal with APA Corporation. The deal, which builds on three years of collaboration, introduces new AI capabilities through Palantir’s Artificial Intelligence Platform (AIP) software. Despite these developments, Ark Invest’s move suggests a strategic shift in its investment approach towards Palantir.

The value of the trade, based on Palantir’s closing price of $37.12 on the same day, is approximately $2.33 million.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Other Key Trades:

-

Ark Invest’s ARK Genomic Revolution ETF (ARKG) sold shares of Veeva Systems Inc (VEEV) and shares of Butterfly Network Inc (BFLY).

-

The ARK Autonomous Technology & Robotics ETF (ARKQ) sold shares of Materialise NV (MTLS) and also shares of Vuzix Corp (VUZI).

-

The ARK Next Generation Internet ETF (ARKW) sold shares of Roku Inc (ROKU). The ARK Space Exploration & Innovation ETF (ARKX) bought shares of Blade Air Mobility Inc (BLDE) and sold shares of Mynaric AG (MYNA).

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

-

Fractional real estate is the next big opportunity for building passive income — get started for just $100.

-

With returns as high as 300%, it’s no wonder this asset is the investment choice of many billionaires. Uncover the secret.

This article Cathie Wood’s Ark Invest Dumps Palantir Shares Amidst S&P 500 Inclusion And Extended AI Alliance originally appeared on Benzinga.com

Morris Goldfarb Takes Money Off The Table, Sells $5.19M In G-III Apparel Group Stock

Revealing a significant insider sell on September 26, Morris Goldfarb, CEO at G-III Apparel Group GIII, as per the latest SEC filing.

What Happened: Goldfarb’s recent move involves selling 167,014 shares of G-III Apparel Group. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value is $5,189,524.

The latest update on Friday morning shows G-III Apparel Group shares down by 0.89%, trading at $30.0.

Unveiling the Story Behind G-III Apparel Group

G-III Apparel Group Ltd is a textile company. It makes a wide range of apparel, footwear, and accessories that it sells under its own brands, licensed brands, and private-label brands. G-III has a substantial portfolio for licensed and proprietary brands, anchored by five global power brands: DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger, and Karl Lagerfeld. The company has two reportable operations: Wholesale Operations and Retail Operations. The Wholesale operations segment includes sales of products under brands licensed by from third parties, as well as sales of products under its own brands and private label brands. The retail operations segment consists primarily of Wilsons Leather, G.H. Bass, and DKNY retail stores. It derives most of its revenues from Wholesale operations.

G-III Apparel Group: Delving into Financials

Negative Revenue Trend: Examining G-III Apparel Group’s financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -2.27% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Analyzing Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 42.79%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): G-III Apparel Group’s EPS reflects a decline, falling below the industry average with a current EPS of 0.54.

Debt Management: With a below-average debt-to-equity ratio of 0.42, G-III Apparel Group adopts a prudent financial strategy, indicating a balanced approach to debt management.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: G-III Apparel Group’s P/E ratio of 7.6 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.46 is lower than the industry average, implying a discounted valuation for G-III Apparel Group’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 4.94, G-III Apparel Group could be considered undervalued.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Cracking Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of G-III Apparel Group’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Barbituric Acid Market to Reach $0.3 Billion, Globally, by 2033 at 4% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 27, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Bariatric surgery devices Market by Device Type (Assisting Devices, Implantable Devices, and Others), Procedure (Sleeve Gastrectomy, Gastric Bypass, and Others), and End User (Hospitals, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the barbituric acid market was valued at $0.2 billion in 2023, and is estimated to reach $0.3 billion by 2033, growing at a CAGR of 4% from 2024 to 2033.

Request Sample of the Report on Barbituric Acid Market 2033 – https://www.alliedmarketresearch.com/request-sample/A324375

Prime determinants of growth

Rising demand in the pharmaceutical industry and growing research and development activities are the major factors that drive the growth of the market. However, adverse health effects hinder the market growth. Moreover, technological advancements in manufacturing offer remunerative opportunities for the expansion of the global barbituric acid market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $0.2 billion |

| Market Size in 2033 | $0.3 billion |

| CAGR | 4.0% |

| No. of Pages in Report | 216 |

| Segments Covered | Grade, Application, End User and Region |

| Drivers |

|

| Opportunities |

|

| Restraints |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A324375

Segment Highlights

More Preference for High Pure Grade Barbituric Acid

High pure grade barbituric acid is more utilized than regular grade due to its superior quality and consistency, essential for sensitive applications in pharmaceuticals and analytical chemistry. Its higher purity ensures minimal impurities, leading to better performance, safety, and reliability in drug synthesis and laboratory experiments, thereby meeting stringent regulatory and industry standards.

Pharmaceutical Application of Barbituric Acid

Pharmaceutical applications of barbituric acid, including sedatives, anesthetics, and anticonvulsants, are more widely used due to their effectiveness in managing conditions like anxiety, epilepsy, and for inducing anesthesia. These drugs leverage barbituric acid’s properties to exert significant central nervous system effects, making them crucial in medical treatments

Regional Outlook

The market outlook for barbituric acid varies regionally. North America and Europe lead due to advanced pharmaceutical sectors and stringent healthcare regulations. Asia-Pacific shows promising growth with increasing healthcare investments and expanding pharmaceutical industries. Latin America, Middle East, and Africa also demonstrate potential with rising healthcare awareness and improving infrastructure.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A324375

Key Players

- Zhengzhou Lifeng Chemical Co., Ltd.

- Explicit chemicals pvt. Ltd.

- Hebei Chengxin Co., Ltd.

- Danopharm Chemicals Pvt. Ltd.

- CDH Druh House (P) Ltd.

- Hunan HongQiang Chem Technology Development Co., Ltd.

The report provides a detailed analysis of these key players in the global barbituric acid market. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Healthcare Industry:

Immune Checkpoint Inhibitor Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Track and Trace Solutions Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Near Infrared Imaging Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hampton University Fuels Half-Billion-Dollar Economic Boost to Hampton Roads

Hampton, VA, Sept. 27, 2024 (GLOBE NEWSWIRE) — As Hampton Roads faces new economic challenges, institutions of higher education are stepping up to drive regional prosperity. Hampton University, with a legacy spanning more than 155 years, continues to be a key economic engine, contributing an impressive $530 million in economic impact to the Hampton Roads community. New preliminary findings reveal that the HBCU’s influence extends far beyond the classroom, transforming the local economy and supporting thousands of jobs in the region.

According to a recent UNCF report, Hampton University ranks #1 in economic impact in the Commonwealth of Virginia, while standing among the top historically Black colleges and universities (HBCUs) in the nation for economic contributions. This significant impact is fueled by Hampton’s operational spending, wages, and institutional purchases, which support local businesses and stimulate the regional economy. Additionally, the indirect effects—from student spending to the influx of visitors to campus—create a ripple effect that generates millions more in sustained economic activity.

“Hampton University plays a pivotal role in the economic fabric of Hampton Roads,” said Hampton University President Darrell K. Williams. “Our findings affirm and underscore our commitment to not only educating future leaders but also investing in the vitality of the region. Our community impact, especially during these times, speaks to the power of partnership and progress.”

The University’s role as an economic powerhouse is further reinforced by its recent recognition in Virginia Coastal magazine as the 2023 Best Private College, an accolade that not only highlights Hampton’s academic excellence but also its unparalleled economic contributions to the Commonwealth.

Hampton University’s contributions are visible across several sectors. The university supports approximately 2,200 jobs in the local and regional economies, including over 800 on-campus positions and additional roles created through university-related spending.

Economic Impact Breakdown

Jobs and Salaries:

Hampton University is a major employer in Hampton Roads, providing thousands of jobs for faculty, staff, and support personnel. These jobs contribute to the local workforce and bolster the economic stability of surrounding communities. In addition, wages earned by employees are spent locally, supporting industries like healthcare, retail, dining, and hospitality, thus creating a multiplier effect. In Hampton Roads, where the unemployment rate hovers around 3.7%, the job opportunities provided by the university are crucial for maintaining economic momentum.

Housing:

The presence of Hampton University generates significant demand for housing in Hampton Roads, particularly in Hampton, Newport News, and surrounding cities. Faculty, staff, and students live both on and off-campus, which bolsters the local real estate market. This demand supports property values and contributes to new housing developments, particularly in rental housing, where occupancy rates remain high. In 2023, Hampton’s residential rental market saw an average occupancy rate of 96.4%, a rate bolstered by the continuous demand from the university’s student body and employees.

Purchases of Retail Goods and Services:

The spending power of Hampton University’s employees, students, and visitors results in substantial purchases of retail goods and services in the local community. From daily essentials such as groceries and transportation to leisure activities like dining and entertainment, this spending fuels local businesses. In 2023, retail sales in Hampton Roads exceeded $26 billion, with Hampton University’s community contributing a significant share of that revenue. Additionally, the university itself spends millions on operational needs, contracting with local vendors and suppliers, further supporting the Hampton Roads business ecosystem.

Visitors to Campus:

Hampton University attracts a significant number of visitors each year, including alumni, parents, and guests attending athletic events, Homecoming, Commencement, the Ministers’ Conference, and the Hampton Jazz and Music Festival. These visitors contribute to the local economy by spending on accommodations, dining, transportation, and shopping. In Hampton Roads, tourism-related spending contributes over $5.2 billion annually, and Hampton University’s events play a key role in generating this economic activity.

Year-round Athletic Events:

Hampton University’s athletics program, particularly in sports like football and basketball, brings in fans from across the region, generating revenue for local businesses. Spectators spend on tickets, merchandise, and local services, with popular games such as Homecoming and Community Day contributing significantly to the local economy. During the 2023-2024 season, Hampton’s home football games alone brought over 25,000 spectators, injecting much-needed revenue into hotels, restaurants, and retail outlets.

Annual Events:

Signature events like Commencement, the Ministers’ Conference, Homecoming, and the Hampton Jazz and Music Festival attract large crowds from around the country, contributing millions of dollars to the local economy. The annual three-day Hampton Jazz and Music Festival draws approximately 20,000 attendees, delivering an estimated $3 million economic impact. These events not only bring revenue to local businesses but also enhance the region’s reputation as a cultural and tourist destination.

Elevating Engagement, Embracing Innovation

As Hampton University moves forward under President Williams’ leadership, the institution’s 10-year strategic plan, Elevating Hampton Excellence, charts a bold path for expanding stakeholder engagement and driving economic development. The plan focuses on strengthening partnerships with local businesses, fostering innovation through research, and creating new avenues for growth that benefit the community.

President Williams envisions untapped opportunities for universities to further enhance local economies—such as technology transfer, entrepreneurship programs, and workforce development tailored to meet the region’s evolving needs. By leveraging its intellectual capital, resources, and collaborative spirit, Hampton University is poised to become an even greater force for economic progress in Hampton Roads, ensuring a future of shared prosperity and collaboration.

About Hampton University

Hampton University, a dynamic historically Black institution in southeastern Virginia with a legacy of excellence in education, research, and community service, provides a nurturing and empowering environment for students to thrive academically and personally. Founded in 1868, Hampton emphasizes a scientific and professional curriculum with a strong liberal arts undergirding, offering a broad range of technical, liberal arts and graduate degree programs. With a commitment to inclusion and innovation, Hampton continues to be a beacon of educational leadership in the Commonwealth of Virginia. Named to Money Magazine’s “Best Colleges in America” and “Best Private College” in Virginia by Virginia Coastal magazine, HU is a tightly-knit community of learners and educators representing 44 states and 32 territories and nations. With a commitment to fostering intellectual curiosity, critical thinking, and global citizenship, Hampton University prepares students to thrive in an ever-changing world. Visit www.hamptonu.edu.

Richelle Payne Hampton University 757.727.5253 Richelle.Payne@Hamptonu.edu

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

European Inflation Drop Raises ECB Rate Cut Chances

European inflation reported in France and Spain slowed in September below the European Central Bank’s (ECB) target rate of 2%.

This has raised chances of an ECB interest rate cut at its meeting next month.

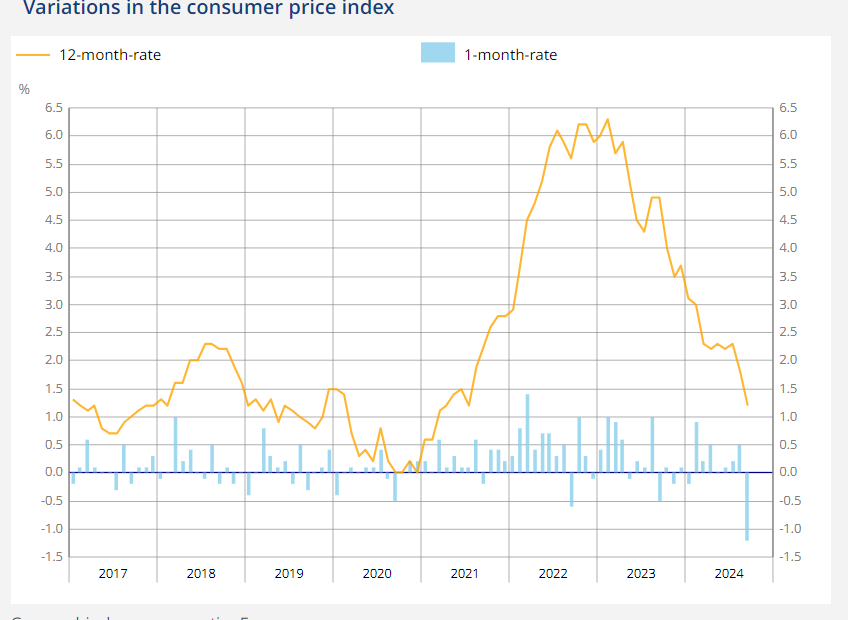

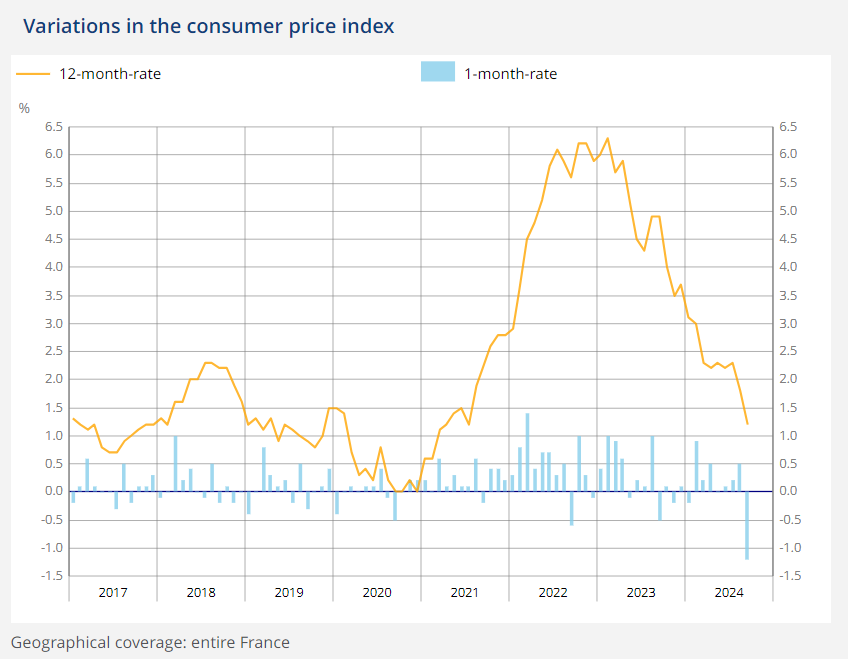

France’s Harmonized Consumer Price Index slowed to 1.5% in September, from 2.2% in August, according to INSEE data. The consensus for September was 1.9%, according to TradingView.

“The softest inflation report EVER from France almost smack-dab at our out of consensus forecast,” Andreas Steno Larsen, CEO at Steno Research posted on X. “The ECB will cut in October I think.”

French headline annual inflation slowed to 1.2% in France, from 1.8% in August.

This marked the second straight month that the rate held below the ECB’s inflation target, according to INSEE data.

Source: INSEE, France’s Consumer Price Index

There was a “big downside surprise” in French headline inflation,” Frederik Ducrozet, Head of Macroeconomic Research, Pictet Wealth Management, wrote on X.

“If we get similar surprises across euro area countries the ECB will have all it needs to cut in October.”

Spain’s annual HCPI stood at 1.7%, compared to 2.4% a month earlier, according to the country’s statistics institute. This came in below consensus of 1.9%, according to TradingView data.

European Inflation Boosts Rate Cut Probability to 79%

Money markets reacted to European inflation data from France and Spain, Europe’s second and fourth largest economies.

They now indicate that there is a 79% chance of an ECB interest rate cut next month, up from a 60% chance on Thursday and 25% a week ago, the Telegraph reported.

Analysts at BNP Paribas also shifted their call for October to a ECB interest rate cut, as did Bloomberg Economics, according to Bloomberg News.

“Our base case has now been revised to call for an ECB rate cut in October,” Jamie Rush, chief European economist at Bloomberg Economics, wrote.

“We previously expected policymakers to wait on further confirmation of disinflationary trends,” Rush wrote. “That confirmation seems to be arriving early.”

The euro fell, and Eurozone government bond yields dropped, in response to the European inflation data. Germany’s 10-year bond yield, the benchmark for the eurozone bloc, fell 3.5 basis points to 2.14%.

Lagarde Remains Cautious On European Inflation

The latest inflation data does not guarantee that the ECB will cut rates.

ECB President Christine Lagarde cautioned on September 12, after the central bank cut interest rates by 25 basis points, that European inflation is expected to rise again in the latter part of this year before declining towards “our target over the second half of next year.”

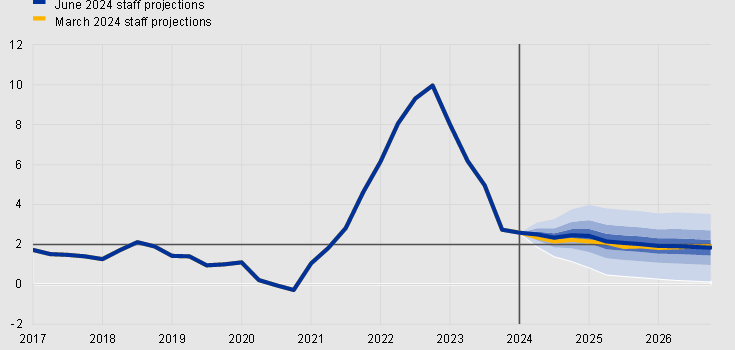

Euro area HICP inflation: ECB Staff Projections

She also warned on September 20 in Washington that the “uncertainty ahead is still profound.” Her comments came two days after the Federal Reserve lowered rates by 50 basis points. The ECB first cut rates by 25 basis points in June.

While Lagarde has taken a cautious approach to the ECB’s next rate decision, pressure may build on slowing growth across the 27-member bloc.

German unemployment climbed to 3.8% in August, compared to 3.2% year on year, the country’s Federal Statistical Office said on Friday.

“The eurozone is heading towards stagnation,” Cyrus de la Rubia, Hamburg Commercial Bank chief economist, said in an S&P Global press release on September 23.

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

At 65 and Taking Social Security-Can I Still Do a Roth Conversion with $750k?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

If you’re 65 years old and collecting Social Security, you may wonder if it’s too late to convert your $750,000 traditional IRA into a Roth IRA. The short answer is no – there are no legal restrictions to Roth conversion based on age or income. Practically, however, the decision involves carefully weighing tax implications, healthcare costs, estate planning and more. Spreading conversions over multiple years often makes the most financial sense for larger IRAs. Guidance from a financial advisor can help you weigh the costs of a Roth conversion in your circumstances.

Roth Conversion Basics

A Roth IRA conversion involves moving funds from a traditional, pre-tax IRA into an after-tax Roth IRA account. You pay income tax on the money that gets converted now, but future withdrawals in retirement come out tax-free.

Plus, traditional IRAs are subject to required minimum distributions (RMDs) starting at age 73. This can lead to higher taxes in retirement as RMD income, which is treated as ordinary taxable income, can push retirees into higher tax brackets. But RMD rules don’t apply to Roth IRAs and Roth 401(k)s, so you can leave the money in the account or withdraw it any time you need it without owing any taxes on your contributions (you may owe income taxes on investment earnings if you withdraw them less than five years after making your initial contribution).

If you need additional help navigating the rules surrounding Roth IRAs, consider speaking with a financial advisor.

Why Timing Your Roth Conversion Matters

The sooner you convert funds from your traditional pre-tax IRA to a Roth account, the more years of tax-free growth you’ll enjoy in your Roth account. And you’ll be able to withdraw those Roth funds without owing any taxes.

But you will have to pay taxes on the conversion, which is no small consideration when it comes to timing. Converting a large IRA can require you to pay the top marginal tax rate of 37% on most or even all of the entire conversion amount, depending on your other income, deductions and additional factors.

If you convert it gradually, however, you can spread the income bump out over several years and avoid subjecting it to the top marginal tax rate. This can help reduce the tax owed each year and overall.

It’s also important to consider when you’ll need to withdraw funds from your Roth IRA. Funds can’t be withdrawn without penalty within five years of the conversion. And, if you convert your IRA to a Roth gradually over time, those conversions each retrigger the five-year rule for that portion of the money.

Meeting with a financial advisor can provide clarity on complex moves like Roth conversions.

Converting a $750k IRA

A major concern in converting a $750,000 IRA balance at once would be the significant tax bill that would accompany such a transaction. Completely a Roth conversion of that size would push the person into the 37% marginal tax bracket.

If you’re a single filer and your Social Security income isn’t high enough to be taxed, adding $750,000 to your current income could trigger about $238,000 in extra taxes, using the 2023 tax brackets. Going slowly with $75,000 converted per year over 10 years reduces the tax hit each year by keeping your taxable income in the 22% bracket.

Here’s how those scenarios might play out, assuming you are a single filer and your Social Security income is less than $25,000 so escapes taxation:

Scenario 1: Converting $750,000 All at Once

-

Size of Roth conversion: $750,000

-

Tax bracket: 37%

-

Total Federal income tax owed: $237,831

This option leaves you with a massive tax bill but around $512,000 in your new Roth IRA, which you’ll eventually be able to withdraw tax-free.

Scenario 2: Annual $75,000 Conversions Over 10 Years

-

Size of Roth conversion: $75,000 (x10)

-

Tax bracket: 22%

-

Total Federal income tax owed: $88,000 over 10 years

Keep in mind that funds left in your IRA will continue to grow while you’re executing these annual conversions, so the IRA likely won’t be empty by the time you have to start taking RMDs. However, the RMDs you’ll have to take by then will be much smaller so won’t incur nearly as much taxation compared to leaving the money in a traditional IRA.

A third option is to leave the money unconverted in your IRA and start taking RMDs once you turn 73, paying taxes on them as you go. However, this could leave you paying higher taxes in retirement until your death. But if you need more help taking stock of your different options, this free matching tool can pair you with a fiduciary advisor.

Making the Call

You may not find that one course of action is clearly superior. Factors to consider when deciding if and how much Roth conversion makes sense:

-

Compare current vs. future income tax rates

-

Account for RMDs and estate plans

-

Weigh healthcare and other senior costs

-

Assess tax impact on heirs

-

Model multi-year scenarios

Strategic partial Roth conversions tailored to your situation may provide the most tax advantages for people with large IRA balances.

One major limitation to Roth conversions is that they cannot be reversed. If tax rates decline later or you need converted funds sooner, you could regret having locked in taxes now at a higher rate. Inheritance plans may also change. Do a thorough multi-year analysis before committing to convert.

Run your own Roth conversion scenarios first or enlist the help of a financial advisor to help you make these important calculations.

Bottom Line

At 65 or any age, while parts of your retirement finances remain unsettled, limiting Roth conversions to small chunks spread over years offers flexibility. This balances immediate tax costs against future tax savings for you and your heirs. As with most money moves in retirement, prudently assessing your multi-year tax picture first is key.

Retirement Planning Tips

-

Instead of guessing if converting your IRA makes sense, talk to a financial advisor who can crunch the numbers. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep in mind that there are income limitations for contributing to a Roth IRA. In 2024, the IRS doesn’t permit single filers with an adjusted gross income (AGI) above $87,000 and married couples who file jointly with an AGI above $240,000. However, backdoor Roth IRAs can help high earners legally circumvent these income limits.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/zimmytws, ©iStock.com/Panupong Piewkleng, ©iStock.com/kate_sept2004

The post I’m 65 Years Old With $750k in an IRA. I’m Taking Social Security – Is It Too Late for a Roth Conversion? appeared first on SmartReads by SmartAsset.

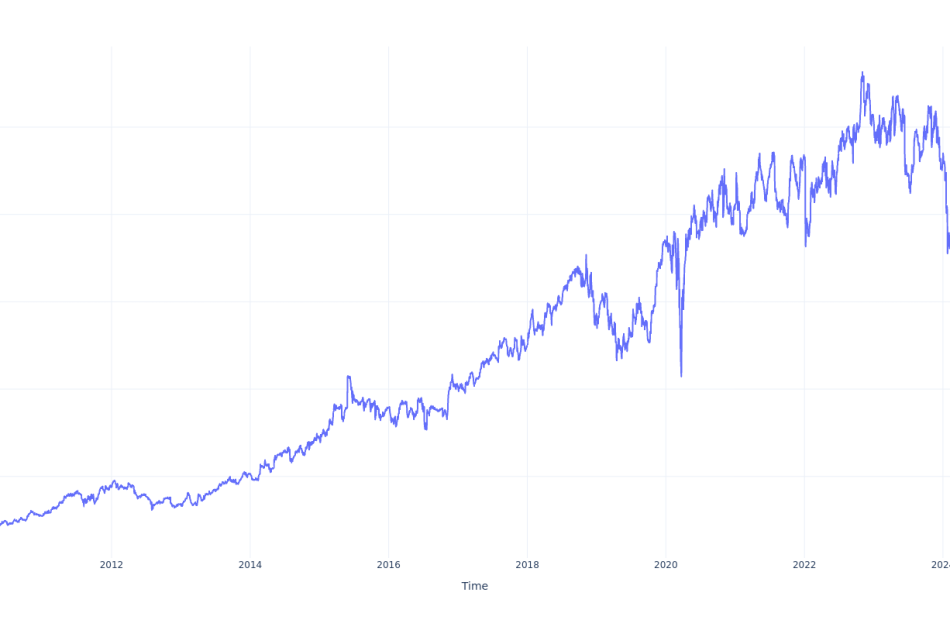

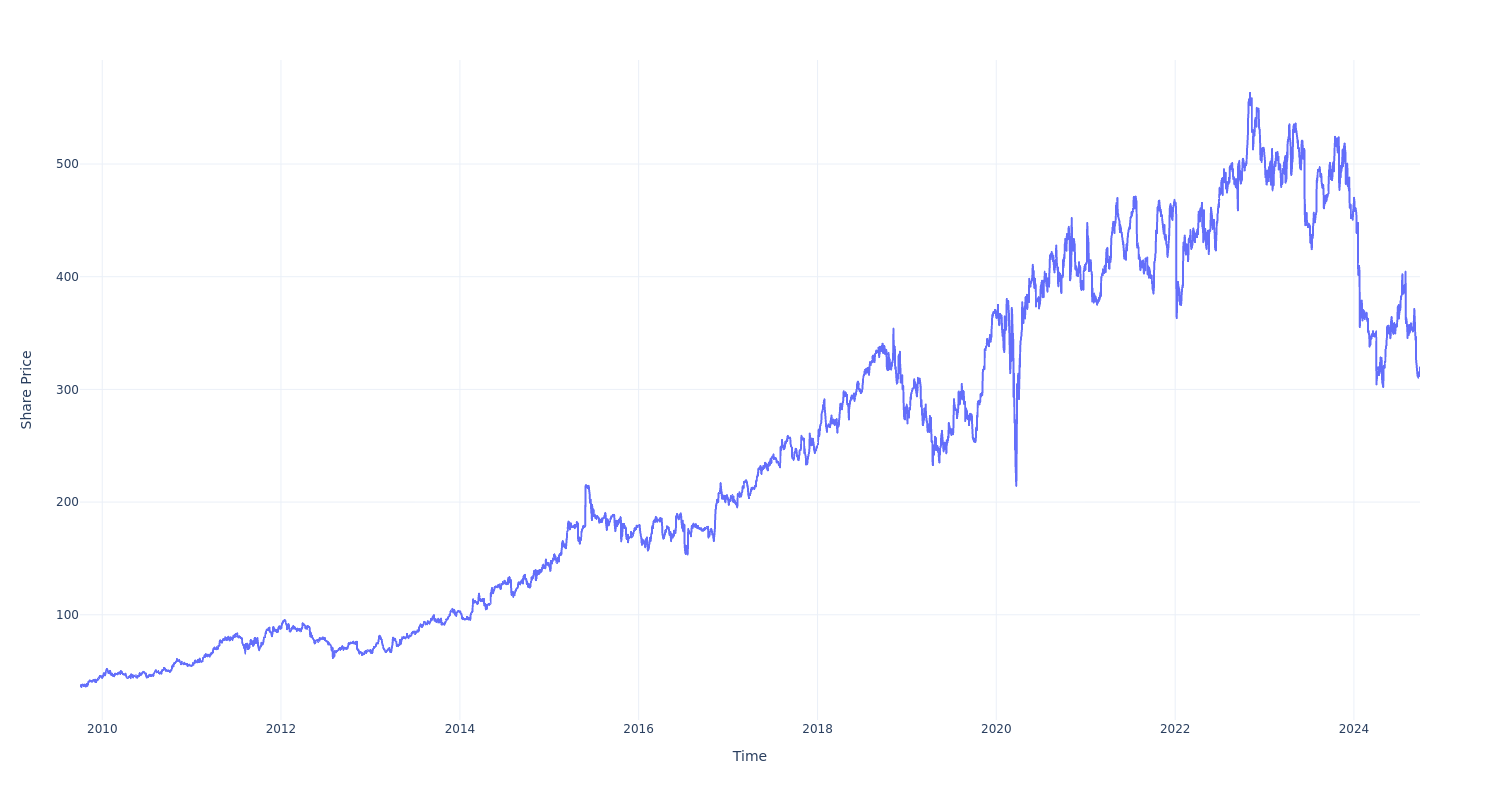

$1000 Invested In This Stock 15 Years Ago Would Be Worth $8,700 Today

Humana HUM has outperformed the market over the past 15 years by 3.4% on an annualized basis producing an average annual return of 15.43%. Currently, Humana has a market capitalization of $38.48 billion.

Buying $1000 In HUM: If an investor had bought $1000 of HUM stock 15 years ago, it would be worth $8,712.38 today based on a price of $319.57 for HUM at the time of writing.

Humana’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Neighbor.com Reveals 2024 Ranking of the Most Neighborly Cities in America

Colorado Springs, CO claims the overall top spot as the most neighborly city

LEHI, Utah, Sept. 27, 2024 /PRNewswire/ — In celebration of National Neighbor Day (September 28), Neighbor.com—the leading peer-to-peer storage and parking marketplace—unveils the results of its fifth annual “Most Neighborly Cities in America” ranking. To establish the grading criteria, Neighbor surveyed 1,000 individuals on how they define neighborliness. The most common factors included charitable contributions, volunteer participation, and community engagement.

In addition to an overall winner, Neighbor added subcategories by population. After all, community engagement and spirit thrive across cities of all sizes. Claiming the top spots as the “Most Neighborly City in America” by metro area are:

- Seattle, WA (Large City). Seattle’s high charitable giving, voter turnout, and innovative community programs propelled it to the top of the large cities category. Despite recent narratives, Seattle’s violent crime rate is middle of the pack for large cities which led to only a small impact on its overall ranking.

- Colorado Springs, CO (Medium City). Taking the top overall winner and medium-sized metro for 2024. Colorado Springs stands out for its packed community event calendar as well as its high rankings in both volunteerism and voter turnout.

- Provo, UT (Small City). The winner for small cities. Provo’s strong commitment to the community is clear from its emphatic support of local businesses and volunteer programs.

“In a time where social media often amplifies our differences, real-world neighborliness is making a surprising comeback,” said Joseph Woodbury, CEO of Neighbor. “Our data shows that despite the divisive narratives we often hear, Americans are actually craving and creating stronger local communities. This is especially crucial during this polarizing election season when loneliness and division seem to be on the rise. At Neighbor, we’re all about building a network of community thinkers who are willing to help their neighbors in small and meaningful ways.”

Top 5 Most Neighborly Large Cities:

- Seattle, WA

- Phoenix, AZ

- Tampa, FL

- El Paso, TX

- Portland, OR

Top 5 Most Neighborly Medium Cities:

- Colorado Springs, CO

- Madison, WI

- Virginia Beach, VA

- Des Moines, IA

- Richmond, VA

Top 5 Most Neighborly Small Cities:

- Provo, UT

- Ogden, UT

- Rochester, NY

- Harrisburg, PA

- Augusta, GA

2024’s Overall Most Neighborly Cities in America

- Colorado Springs, CO

- Madison, WI

- Virginia Beach, VA

- Des Moines, IA

- Provo, UT

- Ogden, UT

- Rochester, NY

- Seattle, WA

- Richmond, VA

- Minneapolis, MN

Mayor Yemi of Colorado Springs said, “I’m incredibly proud and honored that Colorado Springs has been ranked the most neighborly city in the United States. Strong communities are built on the foundation of connectedness, where neighbors get to know, uplift, and support each other. One way we’ve promoted the spirit of neighborliness is our 1,000 Neighborhood Gatherings initiative, where we challenged residents to connect in meaningful ways—whether through lively block parties or casual hangouts. This initiative is about connecting and activating our community, all in the spirit of addressing loneliness. We are on a mission to build a city of great neighbors.”

Neighbor also surveyed 1,000 Americans on what they consider “neighborly”—turns out people have stronger connections with their neighbors than you might think:

- Importance of Community: 60% of Americans rated living in a neighborly community as either “very high” or “high” priority when choosing where to live, emphasizing that people still highly value close-knit connections.

- Supportive Networks: Nearly 65% of people feel they can rely on their neighbors for help when needed.

About Neighbor

Founded in 2017, Neighbor is a community marketplace based in Silicon Slopes, Utah. The company connects people with unused space in their garages, basements, and driveways to renters looking for closer and more affordable self-storage or parking. One neighbor saves money, while the other is able to earn thousands of dollars per year from their unused space. Neighbor is the first storage provider in history to serve renters in all 50 states, with availability across cities, suburbs and rural areas. Neighbor’s investors include leaders in real estate and marketplaces, including Andreessen Horowitz, Fifth Wall, and the CEOs of marketplace businesses DoorDash, Uber, Overstock and StockX.

Contact:

Casey Schow

8017538114

383463@email4pr.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/neighborcom-reveals-2024-ranking-of-the-most-neighborly-cities-in-america-302259971.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/neighborcom-reveals-2024-ranking-of-the-most-neighborly-cities-in-america-302259971.html

SOURCE Neighbor.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Powell Industries 10% Owner Trades Company's Stock

Making a noteworthy insider sell on September 26, Thomas W Powell, 10% Owner at Powell Industries POWL, is reported in the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Powell sold 25,000 shares of Powell Industries. The total transaction amounted to $5,338,998.

As of Friday morning, Powell Industries shares are up by 0.41%, currently priced at $216.64.

All You Need to Know About Powell Industries

Powell Industries Inc is a United States-based company that develops, designs, manufactures, and services custom-engineered equipment and systems for electrical energy distribution, control, and monitoring. The company’s principal products comprise integrated power control room substations, custom-engineered modules, electrical houses, traditional and arc-resistant distribution switchgear and control gear, and so on. These products are applied in oil and gas refining, offshore oil and gas production, petrochemical, pipeline, terminal, mining and metals, light-rail traction power, electric utility, pulp and paper, and other heavy industrial markets. The company generates the majority of its sales from the United States.

Powell Industries: A Financial Overview

Positive Revenue Trend: Examining Powell Industries’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 49.8% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Evaluating Earnings Performance:

-

Gross Margin: The company shows a low gross margin of 28.37%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Powell Industries’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 3.85.

Debt Management: Powell Industries’s debt-to-equity ratio is below the industry average. With a ratio of 0.0, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 20.2, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 2.78 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 13.89, Powell Industries presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Understanding Crucial Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Powell Industries’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the Newest Stock in the S&P 500. It Soared 880% Over the Past Decade, and It's Still a Buy Right Now, According to Wall Street.

The S&P 500 is the most widely followed benchmark of the stock market in the U.S., comprised of the 500 largest companies in the country. Given the breadth of its component companies, it is considered to be the most reliable gauge of overall stock market performance. To be considered for membership in the S&P 500, companies must meet the following requirements:

-

Be a U.S.-based company.

-

Have a market cap of at least $8.2 billion.

-

Must be highly liquid.

-

Must have a minimum of 50% of its outstanding shares available for trading.

-

Must be profitable according to GAAP in the most recent quarter.

-

Must be profitable over the preceding four quarters in aggregate,

Dell Technologies (NYSE: DELL) just became one of the latest additions to the S&P 500, joining its ranks on Sept. 23, one of only 11 companies added to the index so far this year. Since the beginning of 2023, Dell stock has surged 193% as the rapid adoption of generative AI has caused investors to take a fresh look at the company’s hardware and IT services solutions. Its performance is even more pronounced over the past decade, as Dell’s revenue has grown 104%, net income has soared 1,440%, and the stock price has surged 879% (as of this writing).

Despite its incredible run, some on Wall Street believe there’s much more to come. Let’s look at the opportunity ahead and why Dell stock is a buy.

Stepping into the fray

Dell is something of a household name and has been supplying computers and IT solutions for more than four decades — and was quick to recognize the opportunity represented by AI. Earlier this year, Dell unveiled the Dell AI Factory — powered by Nvidia‘s gold standard AI chips. The AI factory is a suite of products, services, and solutions optimized and tailored to handle AI workloads. Dell not only has hardware designed to meet the rigors of AI but can also help businesses of all sizes accelerate their adoption of AI.

Dell has also partnered with Microsoft and introduced a comprehensive portfolio of Copilot+ AI-powered PCs, workstations, laptops, and notebooks. This gives the company yet another way to profit from the ongoing adoption of AI.

The evidence is clear

The impact of the AI revolution has begun to show up in Dell’s results. During the company’s fiscal 2025 second quarter, ended Aug. 2, net revenue accelerated 9% year over year to $25 billion, while diluted earnings per share (EPS) of $1.17 surged 86%.

Dell’s infrastructure solutions group — which includes servers and networking equipment — delivered record revenue that grew 38% to $11.6 billion, driven by surging demand for servers with the computational horsepower to handle AI. This was partially offset by tepid results from the company’s client solutions group — which includes consumer PCs and commercial workstations — which was down 4% year over year to $12.4 billion due to weak demand for PCs.

Management boosted its full-year outlook and is now forecasting revenue of $97 billion at the midpoint of its guidance, representing year-over-year growth of about 10%.

Furthermore, Dell’s future looks bright. Many PCs that were purchased during the pandemic are coming to the end of their useful lives. The resulting pent-up demand, combined with the release of AI-enabled PCs, is expected to boost growth over the next couple of years.

Indeed, global PC shipments finally turned positive this year, up roughly 2% year over year in the first quarter and 3% in the second quarter, according to data compiled by market intelligence firm International Data Corporation. This comes after eight consecutive quarters of year-over-year contraction. The PC market is expected to grow by 5% in 2024 and 8% in 2025, according to research firm Canalys. As one of the largest suppliers of PCs in the world, Dell will no doubt benefit from this recovery.

Furthermore, the AI revolution is only beginning to take shape, and the opportunity ahead is enormous. The worldwide AI market was estimated at $2.4 trillion in 2023 and is expected to surge to $30.1 trillion by 2032, a compound annual growth rate of 32%, according to Expert Market Research.

Given the magnitude of this opportunity and Dell’s location at the crossroads of consumer and business computing, the company is well-positioned to profit from the accelerating adoption of AI.

The future is bright

Don’t take my word for it. Of the 21 Wall Street analysts that covered Dell stock in August, 81% rated it a buy or strong buy and none recommended selling. Furthermore, on the eve of its admission into the S&P 500, TD Cowen analyst Krish Sankar boosted his price target to a Street-high $218. That represents potential upside of 85%, compared with Monday’s closing price.

While the analyst acknowledges that server demand for the current quarter could be flat — which would likely weigh on investor sentiment — the long-term picture is bright, as evidenced by Dell’s increased full-year outlook.

For investors looking to cash in on the AI revolution without betting the farm, you’ve come to the right place. Dell stock is currently selling for 21 times earnings, a significant discount to a price-to-earnings ratio of 30 for the S&P 500.

Given the recent run-up in its stock price, Dell will no doubt be a bit volatile from here. That said, the company is well-positioned to benefit from the accelerating adoption of AI, which would profit its shareholders along the way.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Danny Vena has positions in Microsoft and Nvidia. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Newest Stock in the S&P 500. It Soared 880% Over the Past Decade, and It’s Still a Buy Right Now, According to Wall Street. was originally published by The Motley Fool