Personal Income And Spending Disappoint, Super Micro Computer Lesson, BOJ Supporter As Japan PM

To gain an edge, this is what you need to know today.

Spending Disappointment

Please click here for an enlarged chart of Super Micro Computer Inc SMCI.

Note the following:

- This article is about the big picture, not an individual stock. The chart of SMCI stock is being used to illustrate the point.

- A fortune is to be made in artificial intelligence, but it is not going to be in a straight line. At times, it is going to be treacherous. It is important to not make mistakes by getting carried away with the momo crowd and listening to momo gurus who have a vested interest that is not your best interest.

- The chart shows that momo crowd favorite SMCI fell yesterday on the news of a Department of Justice (DOJ) probe due to allegations of accounting irregularities. A DOJ probe is a serious matter as it is often a criminal probe.

- The chart shows that the enthusiasm was at its peak right after SMCI stock was added to S&P 500.

- The chart shows from the peak to the low, the stock lost 69% of its value.

- The chart shows that the day S&P 500 added SMCI stock, The Arora Report made a bold call. The Arora Report call was that SMCI was worth only $442 – $486 in the best case. The stock peaked at $1229. As of this writing in the premarket, SMCI stock is trading at $400.95. All Arora Report calls are 100% transparent, traceable, and auditable. Members have access to over ten years of archives, including the winners and losers – no cherry picking.

- Right now, the momo crowd is sitting on massive losses in SMCI stock. The momo crowd was not able to distinguish between NVIDIA Corp NVDA and Super Micro Computer – the prevailing belief among the momo crowd was that NVDA and SMCI were the same.

- The U.S. economy is 70% consumer based. For this reason, prudent investors pay attention to personal income and personal spending. Just released personal income and spending data is disappointing. Here are the details of the new personal income and spending data:

- Personal income came at 0.2% vs. 0.4% consensus.

- Personal spending came at 0.2% vs. 0.3% consensus.

- PCE is the Fed’s favorite inflation gauge. Here are the details:

- PCE came at 0.1% vs. 0.1% consensus.

- Core PCE came at 0.1% vs. 0.2% consensus.

- In The Arora Report analysis, the data is in line with expectations. As such, this data should have no impact on the stock market.

- Even though the stock market pays a lot of attention to PCE, in The Arora Report analysis, economists have become really good at projecting PCE. As such, investors’ expectations, in general, should be that PCE will come in line with consensus.

Japan

Bank of Japan (BOJ) actions are very important for U.S. investors. The reason is the carry trade. In carry trade, funds borrow in yen and invest in the U.S. stock market. Lately, they have been buying AI stocks. Japan’s ruling party LDP has chosen Shigeru Ishiba as its new leader. Ishiba is the next prime minister of Japan. In The Arora Report analysis, yen is rallying on the news as Ishiba is a supporter of BOJ.

In The Arora Report analysis, this development is negative for the carry trade and positive for the yen position using ETF Invesco CurrencyShares Japanese Yen Trust FXY in The Arora Report’s ZYX Allocation.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Apple Inc AAPL, Alphabet Inc Class C GOOG, Microsoft Corp MSFT, and Tesla Inc TSLA.

In the early trade, money flows are neutral in Amazon.com, Inc. AMZN, Meta Platforms Inc META, and NVDA.

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust Series 1 QQQ.

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Bitcoin BTC/USD is on track to have the best September ever.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JPMorgan Chase Just Hiked Its Payout by 9%. Is This a Great Dividend Stock?

JPMorgan Chase (NYSE: JPM), the country’s largest bank by assets, recently declared a third-quarter dividend of $1.25, a roughly 9% hike. Banks are generally known as good dividend-paying stocks, and JPMorgan Chase is one of the most profitable large banks. It has grown its payout significantly over the last decade.

Is this a great dividend stock? Let’s take a look.

A growing dividend

JPMorgan’s $1.25 quarterly dividend equates to an annual total of $5. Based on the share price as of Sept. 23, which was near all-time highs, that results in a 2.37% dividend yield.

That’s certainly not bad, but generally, I would like to see a 3% yield or higher to call it a good dividend stock. That said, JPMorgan is highly profitable and has been growing its dividend significantly, so it’s certainly possible that it could get to a 3% yield in the not too distant future.

Since JPMorgan Chase was formed in 2000, it has paid a dividend every year, although it was cut significantly in 2009 and 2010. This was common for banks following the Great Recession. Since bottoming in 2010 at $0.20, JPMorgan has grown its annual dividend to a projected $5.

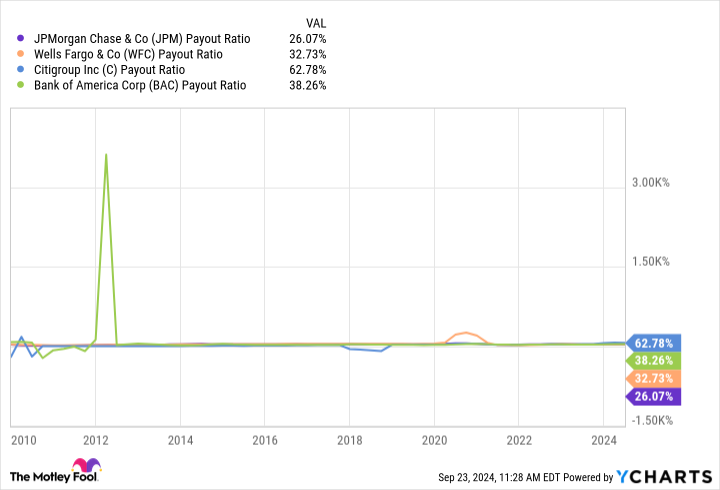

The payout ratio is a good place to start when looking at a bank’s ability to grow its dividend. As you can see below, JPMorgan has the lowest payout ratio among its peers at 26%. Banks will typically pay in the 30% to 40% range.

When evaluating a dividend, other good places to look are a bank’s earnings and excess capital, which it needs for capital distributions. When looking at analyst earning projections in Visible Alpha, a financial analysis software platform, the consensus as of Sept. 23 was that diluted operating earnings per share will come down about 8 cents next year and then move significantly higher in 2026 and 2027.

As for excess capital, JPMorgan had a common equity tier 1 (CET1) capital ratio of 15.3%. The CET1 looks at a bank’s ratio of core capital to risk-weighted assets such as loans. Banks use excess capital as a reserve for loans (so they need it to grow) and to pay dividends and make share repurchases.

Regulators set annual CET1 requirements for the largest banks in the U.S. JPMorgan’s requirement for 2025 is 12.3%. So the bank has roughly $53 billion of excess capital based on risk-weighted assets at the end of the second quarter.

With a $1.25 quarterly dividend, JPMorgan will pay out roughly $3.6 billion in dividends per quarter, or nearly $14.5 billion a year. But keep in mind this is coming out of the $45 billion to $55 billion in earnings it is going to have each year, so the bank won’t have to touch any excess capital. But even if it somehow did, it has enough to cover the annual dividend for at least four years.

It should grow into a good dividend

I suspect JPMorgan Chase will continue to grow its dividend and that it will eventually surpass a 3% yield. The bank has plenty of excess capital and strong earnings. The other thing to consider is that the stock is expensive right now, which makes share repurchases less appealing.

JPMorgan Chase will want to get its payout ratio into that 30% to 40% range to be more in line with peers, I believe. Ultimately, I think it is a good dividend stock. It’s not the highest yield you’ll find, but the company can easily pay its dividend and has plenty of room to keep growing it.

Should you invest $1,000 in JPMorgan Chase right now?

Before you buy stock in JPMorgan Chase, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and JPMorgan Chase wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and JPMorgan Chase. The Motley Fool has a disclosure policy.

JPMorgan Chase Just Hiked Its Payout by 9%. Is This a Great Dividend Stock? was originally published by The Motley Fool

Source Agriculture Corp Signs agreement with RWE Clean Energy Development LLC to Install Wind Turbines on Illinois Farm

CHICAGO, IL, Sept. 27, 2024 /PRNewswire/ – Source Agriculture Corp is pleased to announce the signing of a strategic agreement with RWE Clean Energy Development LLC, marking a significant milestone in Source Agriculture’s commitment to sustainability and increased revenue generation. Under this agreement, RWE Clean Energy will install wind turbines and wind turbine infrastructure on Source Agriculture’s 158-acre farm located in Illinois.

This collaboration is a key component of Source Agriculture’s long-term strategy to enhance the return on investment (ROI) of its agricultural holdings through the integration of clean energy projects. The installation of wind turbines aligns with Source Agriculture’s vision of blending traditional farming practices with innovative renewable energy solutions, demonstrating the company’s dedication to sustainable development and profitability.

RWE Clean Energy, a subsidiary of RWE Group/ RWE AG, brings years of expertise in the U.S. renewable energy sector. Renowned for its robust track record in developing, constructing, and operating renewable energy facilities, RWE Clean Energy is well-positioned to deliver on the ambitious goals of this partnership. As a leading renewable energy company in the United States, RWE Clean Energy’s involvement underscores the significance of this project and its potential to drive additional revenue for Source Agriculture.

“This agreement with RWE Clean Energy is a testament to Source Agriculture’s commitment to executing on our promised vision of integrating clean energy solutions into our operations,” said Vare Grewal, President CEO of Source Agriculture Corp. “We are excited to partner with such a reputable and experienced company to advance our sustainability goals and enhance the value of our farm investments.”

RWE AG, headquartered in Essen, Germany, is a multinational energy company with a global footprint in generating and trading electricity across Asia-Pacific, Europe, and the United States.

The company was founded in Essen in 1898, as Rheinisch-Westfälisches Elektrizitätswerk Aktiengesellschaft (Rhenish-Westphalian Power Plant) by Elektrizitäts-Actien-Gesellschaft vorm. W. Lahmeyer & Company (EAG) and others. The full name was used until 1990 when it was renamed to RWE AG

For more information about Source Agriculture Corp and its sustainability initiatives, please visit www.sourceagriculture.com.

About Source Agriculture Corp

Source Agriculture Corp is a leading innovator in sustainable agricultural practices, dedicated to maximizing the value of its farm investments through the integration of cutting-edge technologies, carbon credits and clean energy solutions. With a focus on long-term growth and environmental responsibility, Source Agriculture is committed to shaping the future of agriculture.

![]() View original content:https://www.prnewswire.com/news-releases/source-agriculture-corp-signs-agreement-with-rwe-clean-energy-development-llc-to-install-wind-turbines-on-illinois-farm-302261495.html

View original content:https://www.prnewswire.com/news-releases/source-agriculture-corp-signs-agreement-with-rwe-clean-energy-development-llc-to-install-wind-turbines-on-illinois-farm-302261495.html

SOURCE Source Agriculture Corp

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alair Homes Celebrates 17 Years of Growth with Expanded Senior Leadership Team

Rob Cecil named CEO of Alair; Blair McDaniel transitions to Chairman; New compliance and operating roles reflect Alair’s vision for the future

NANAIMO, BC, Sept. 27, 2024 /CNW/ – Alair Homes®, North America’s largest privately held custom home building and renovation company, is proud to announce key leadership changes as it marks its 17th anniversary. Rob Cecil, who joined Alair in 2013 and has served as President and Chief Development Officer, will assume the roles of President and Chief Executive Officer. Founder Blair McDaniel will transition from Chief Executive Officer to the role of Chairman, where he will continue to provide strategic guidance and support for Alair.

As president, Cecil’s leadership has been instrumental in the company’s expansion to over 100 locations across North America. Cecil’s transition to CEO marks another significant step in Alair’s journey toward continued growth and industry leadership.

“This is an exciting time for Alair,” said Blair McDaniel, founder and chairman of Alair Homes. “Our company has come a long way since we first opened our doors in 2007, and as we celebrate 17 years, I’m confident that Rob’s leadership will help us continue to set new standards for what it means to build custom homes in the U.S. and Canada.”

Key Highlights:

- CEO: Rob Cecil is named President and CEO. Blair McDaniel, Alair’s founder, steps into the new role of Chairman.

- Operational Excellence: Stu Hopewell transitions to Chief Compliance Officer, while Duane Johns is named Chief Operating Officer.

- Industry Leadership: This leadership transition reflects Alair’s commitment to growth, innovation, and an unparalleled client experience across over 100 locations in North America.

Founded on September 28, 2007 by McDaniel, Alair has grown from a vision to transform the custom homebuilding industry into North America’s largest network of custom homebuilding and renovation partners, each dedicated to empowering homeowners to live better.

“As the only franchise of our size in our industry, Alair is in a unique position to drive change across North America,” said Rob Cecil, president and CEO of Alair. “The momentum we’ve built is a testament to the strength of our partners and our commitment to redefining what’s possible for homeowners.”

Commitment to Process and Operational Excellence

Alair’s approach as a leader in construction management is defined by its commitment to delivering a consistent, reliable process for every project. As part of this vision, the company is also announcing changes to its senior leadership team to ensure operational consistency remains a core focus.

Stu Hopewell, who has been pivotal as Chief Operations Officer, will now transition into the newly created position of Chief Compliance Officer. In this role, Hopewell will ensure that Alair continues to maintain its high standards of excellence across all projects and locations.

“At Alair, it’s not just about delivering a great final product; it’s about doing so through a process that homeowners and our project partners can trust,” said Stu Hopewell, Chief Compliance Officer at Alair. “These leadership changes reflect our unwavering focus on consistency and quality, which sets Alair apart in the custom homebuilding industry.”

Katrina McLauchlan, who has been with Alair since its infancy in 2007, will continue to serve as Alair’s Chief Financial Officer. McLauchlan oversees all financial planning and fiscal management system-wide for Alair as well as leadership of the accounting team.

Duane Johns, a Regional Partner in North Carolina, will now move into the role of Chief Operating Officer. A partner with Alair since 2016, Johns brings extensive experience in Alair’s Client Control® methodology and a deep understanding of the company’s core values. As COO, Johns will oversee operations and implement strategic plans that align with the company’s vision for excellence in residential construction.

“I’m excited to build on the foundation we’ve established at Alair,” said Duane Johns, Chief Operating Officer at Alair. “Our goal is to give homeowners peace of mind while we build or renovate their home, and I’m looking forward to working closely with our partners to deliver best in class services that ensure efficiency, transparency, and a truly exceptional building experience.”

About Alair®

Founded in 2007, Alair Homes is North America’s largest, privately held custom home building and renovation company. With a rapidly growing network of franchises since 2012, Alair has become a trusted name in over 100 locations across North America. Our distinctive approach is cemented in partnerships with esteemed architects, proficient trade partners, and innovative designers, ensuring homeowners a distinctive construction management experience. Striving for continuous improvement through our proprietary Client Control® construction project management methodology, Alair is dedicated to delivering meticulously crafted, beautiful homes while ensuring a transparent, client-focused journey from conception to completion. Learn more at www.AlairHomes.com

SOURCE Alair Enterprises Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/27/c6067.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/27/c6067.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cardenas Ricardo Exercises Options, Realizes $4.13M

A significant insider transaction involving the exercise of company stock options was reported on September 25, by Cardenas Ricardo, President and CEO at Darden Restaurants DRI, as per the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Ricardo, President and CEO at Darden Restaurants, a company in the Consumer Discretionary sector, just exercised stock options worth 42,403 shares of DRI stock with an exercise price of $71.51.

The latest update on Thursday morning shows Darden Restaurants shares up by 0.45%, trading at $168.87. At this price, Ricardo’s 42,403 shares are worth $4,128,400.

About Darden Restaurants

Darden Restaurants is the largest restaurant operator in the us full-service space, with consolidated revenue of $11.4 billion in fiscal 2024 resulting in 3%-4% full-service market share (per NRA data and our calculations). The company maintains a portfolio of 10 restaurant brands: Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Ruth’s Chris, Yard House, The Capital Grille, Seasons 52, Eddie V’s, Bahama Breeze, and The Capital Burger. Darden generates revenue almost exclusively from company-owned restaurants, though a small network of franchised restaurants and consumer-packaged goods sales through the traditional grocery channel contribute modestly. As of the end of its fiscal 2024, the company operated 2,031 restaurants in the us.

Darden Restaurants’s Financial Performance

Revenue Challenges: Darden Restaurants’s revenue growth over 3 months faced difficulties. As of 31 August, 2024, the company experienced a decline of approximately -6.77%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Profitability Metrics:

-

Gross Margin: With a low gross margin of 20.41%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 1.75, Darden Restaurants showcases strong earnings per share.

Debt Management: Darden Restaurants’s debt-to-equity ratio is below the industry average. With a ratio of 2.48, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 19.39 is lower than the industry average, implying a discounted valuation for Darden Restaurants’s stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 1.77, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Darden Restaurants’s EV/EBITDA ratio, lower than industry averages at 13.88, indicates attractively priced shares.

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Important Transaction Codes

Digging into the details of stock transactions, investors frequently turn their attention to those taking place in the open market, as outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Darden Restaurants’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

OpenAI CFO Sarah Friar Reassures Staff Of 'Incredibly High' Investor Interest As CTO Mira Murati And Key Executives Exit Amid Major Strategic Shift

OpenAI‘s CFO Sarah Friar reportedly informed employees that investor interest in the company’s funding round was “incredibly high.”

What Happened: This announcement aimed to reassure staff following the unexpected resignations of several high-profile executives, reported Axios, citing a source familiar with the situation.

The departures began with CTO Mira Murati, who informed CEO Sam Altman of her decision on Wednesday morning.

Her resignation was publicly announced later that afternoon. Following Murati’s exit, Chief Research Officer Bob McGrew and VP of Research Barret Zoph also announced their departures.

During a half-hour staff meeting on Thursday, Altman, appearing remotely from Italy, along with Friar and Murati, addressed the company’s direction and future. Altman expressed gratitude towards Murati and acknowledged the promotion of Mark Chen to Senior VP of Research and Jakub Pachocki to Chief Scientist.

Friar highlighted the overwhelming investor interest in the funding round, describing it as “very oversubscribed and market-defining.” She noted that investors are impressed by OpenAI’s progress and potential.

A clause in the funding agreement allows investors to request their money back if OpenAI does not restructure within two years, according to the report.

Additionally, OpenAI’s board is contemplating a shift away from its nonprofit roots, potentially granting significant equity to Altman.

OpenAI did not immediately respond to Benzinga’s comment request.

Why It Matters: The recent high-profile departures at OpenAI come at a crucial time as the company undergoes significant changes. CEO Altman recently defended the executive exits, stating that such changes are natural for a rapidly growing company.

OpenAI is also transitioning to a for-profit model, a move that could significantly benefit Altman financially. The restructuring aims to attract more investors and could lead to an IPO in the future.

Furthermore, OpenAI has reportedly been engaging with President Joe Biden‘s administration to expand its data centers, highlighting the economic and national security benefits.

Lastly, OpenAI’s collaboration with Apple Inc.‘s former design legend Jony Ive on a new AI hardware project adds another layer of intrigue to the company’s future. Details about this project remain scarce.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Royal Caribbean Gr's Options: A Look at What the Big Money is Thinking

Investors with a lot of money to spend have taken a bearish stance on Royal Caribbean Gr RCL.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with RCL, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 9 options trades for Royal Caribbean Gr.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 44%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $60,750, and 8, calls, for a total amount of $383,686.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $155.0 to $185.0 for Royal Caribbean Gr over the last 3 months.

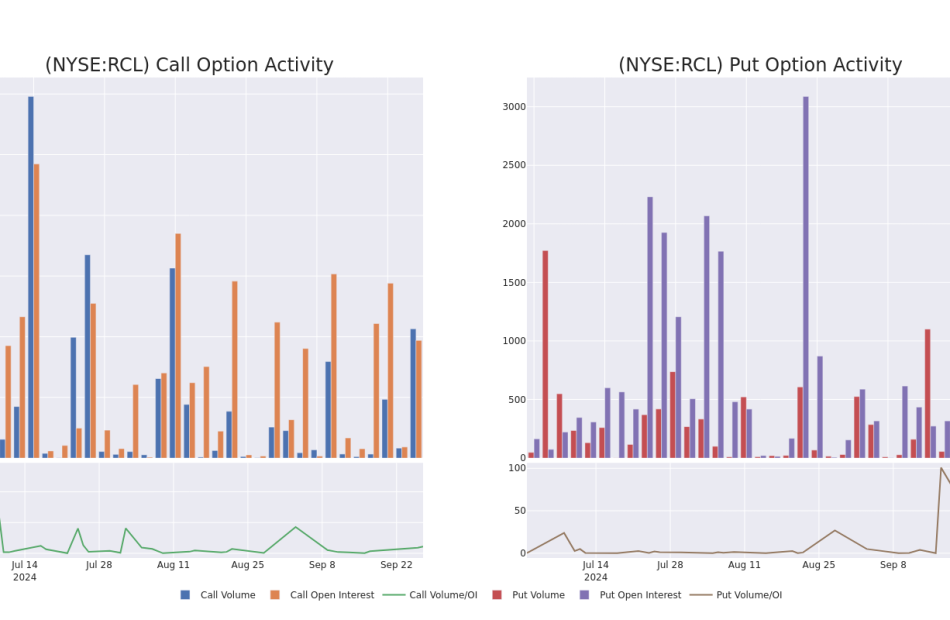

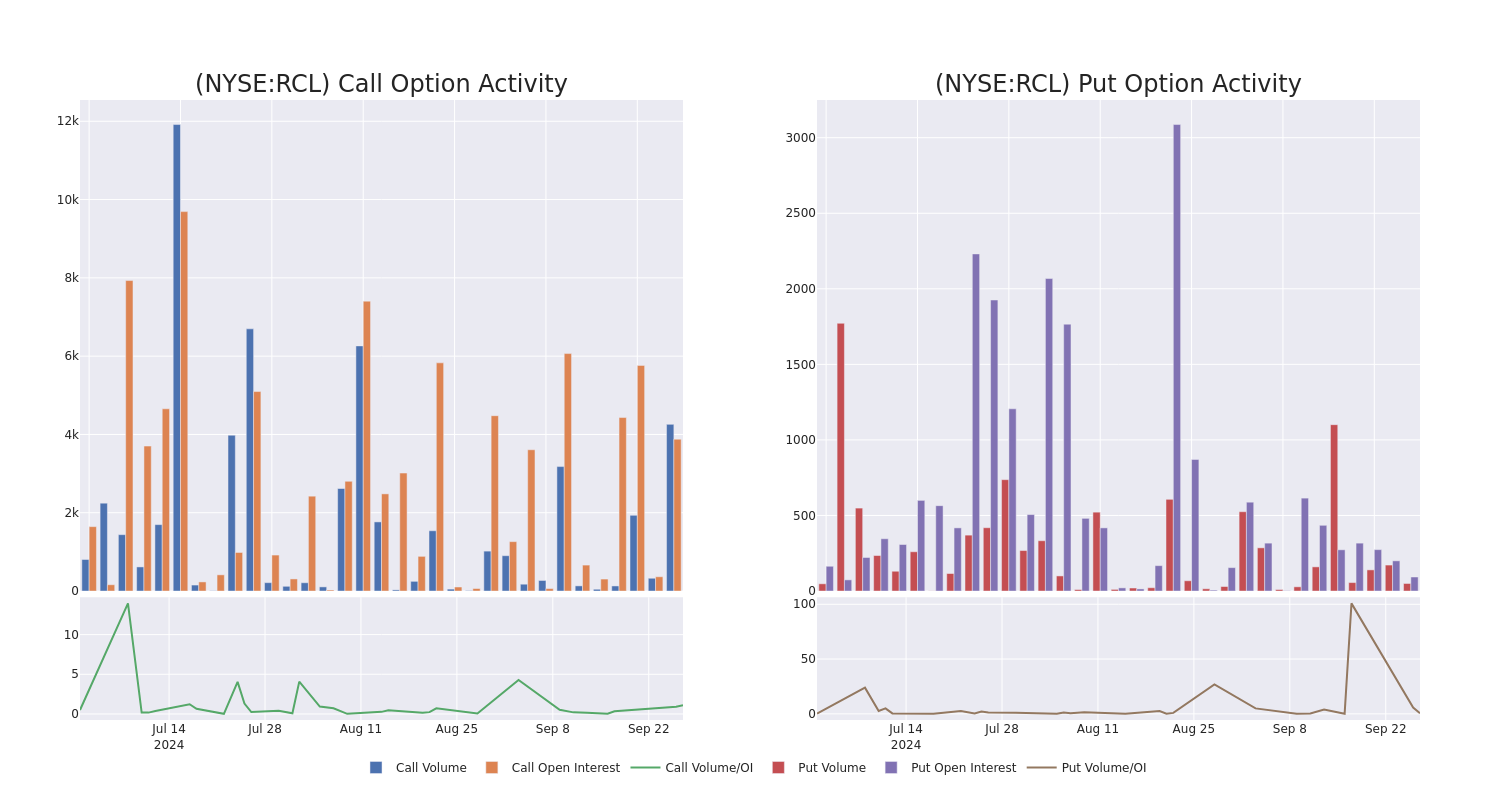

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Royal Caribbean Gr options trades today is 662.0 with a total volume of 4,308.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Royal Caribbean Gr’s big money trades within a strike price range of $155.0 to $185.0 over the last 30 days.

Royal Caribbean Gr Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RCL | CALL | TRADE | NEUTRAL | 03/21/25 | $36.5 | $34.95 | $35.68 | $155.00 | $107.0K | 45 | 60 |

| RCL | CALL | SWEEP | NEUTRAL | 10/04/24 | $7.85 | $7.25 | $7.43 | $175.00 | $73.3K | 1.5K | 980 |

| RCL | PUT | TRADE | BEARISH | 12/20/24 | $12.2 | $11.65 | $12.15 | $180.00 | $60.7K | 93 | 50 |

| RCL | CALL | SWEEP | BEARISH | 10/04/24 | $7.6 | $7.3 | $7.45 | $175.00 | $51.3K | 1.5K | 1.0K |

| RCL | CALL | SWEEP | BULLISH | 10/18/24 | $4.25 | $4.0 | $4.18 | $185.00 | $41.1K | 349 | 1.0K |

About Royal Caribbean Gr

Royal Caribbean is the world’s second-largest cruise company, operating 68 ships across five global and partner brands in the cruise vacation industry. Brands the company operates include Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. The selection of brands in the portfolio allows Royal to compete on the basis of innovation, quality of ships and service, variety of itineraries, choice of destinations, and price. The company completed the divestiture of its Azamara brand in 2021.

Following our analysis of the options activities associated with Royal Caribbean Gr, we pivot to a closer look at the company’s own performance.

Where Is Royal Caribbean Gr Standing Right Now?

- With a trading volume of 578,528, the price of RCL is down by -1.09%, reaching $180.81.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 27 days from now.

Professional Analyst Ratings for Royal Caribbean Gr

2 market experts have recently issued ratings for this stock, with a consensus target price of $208.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Royal Caribbean Gr, which currently sits at a price target of $213.

* An analyst from Truist Securities persists with their Buy rating on Royal Caribbean Gr, maintaining a target price of $204.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Royal Caribbean Gr, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P Hits New Record High Following Economic Reports: Investor Optimism Improves Further, Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed further improvement in the overall market sentiment, but the index remained in the “Greed” zone on Thursday.

U.S. stocks settled higher on Thursday, with the S&P 500 surging to a fresh record high level during the session.

Micron Technology Inc MU shares jumped around 15% on Thursday after the company reported better-than-expected fourth-quarter financial results. Accenture Plc ACN reported better-than-expected earnings for its fourth quarter.

On the economic data front, U.S. core PCE prices increased by 2.8% from the prior quarter during the second quarter compared to a 3.7% gain in the previous period. U.S. initial jobless claims fell by 4,000 from the prior week to 218,000 during the period ending September 21, compared to estimates of 225,000. The U.S. economy expanded at an annualized rate of 3% during the second quarter versus a revised 1.6% increase in the first quarter.

Most sectors on the S&P 500 closed on a positive note, with materials, information technology, and financials stocks recording the biggest gains on Thursday. However, energy and real estate stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 260 points to 42,175.11 on Thursday. The S&P 500 rose 0.40% to 5,745.37, while the Nasdaq Composite gained 0.60% at 18,190.29 during Thursday’s session.

Investors are awaiting earnings results from Moving iMage Technologies, Inc. MITQ today.

What is CNN Business Fear & Greed Index?

At a current reading of 71.8, the index remained in the “Greed” zone on Thursday, versus a prior reading of 67.1.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TAYLOR DEVICES ANNOUNCES FIRST QUARTER RESULTS

NORTH TONAWANDA, N.Y., Sept. 27, 2024 /PRNewswire/ — Taylor Devices, Inc. (NASDAQ SmallCap: “TAYD”) announced today that it had first quarter sales of $11,617,856, up from last year’s first quarter sales of $9,923,628.

Net earnings for the first quarter were $2,666,655, significantly up from last year’s first quarter earnings of $1,847,863.

“The very strong execution by our team in FY24 continued this first quarter of our FY25 as new company high Q1 records were set for both sales and net earnings with improvements of 17% and 44% year-on-year respectively,” stated Tim Sopko, CEO. He continued, “Once again, all three of our customer product groups; Aerospace/Defense, Structural and Industrial contributed to these results with the favorable momentum in our Aerospace/Defense market continuing to offset the headwinds we have been experiencing in our Structural markets due to high interest rates and unfavorable foreign exchange rates.” He further commented, “The benefit of our team’s relentlessly disciplined focus on our Profitable Growth Campaigns over the past several years can be seen in our firm order backlog at the end of this Q1 of $28.4M which is not only slightly improved over the $28.3M we had at the end of last year’s Q1 but well ahead of the average firm order backlog level over our past five fiscal year Q1’s of $21.9M.” He concluded, “As our FY25 continues, we remain focused on our growth strategies supported by our continued investments in our team, technologies (R&D) and facilities.”

Taylor Devices, Inc. is a 69-year-old company engaged in the design, development, manufacture & marketing of shock absorption, rate control and energy storage devices for use in various types of vehicles, machinery, equipment & structures. The company continues to target growth in the domestic Aerospace and Defense market as well as global Structural Construction and Industrial markets.

|

First Quarter (3 months ended 08/31/24 & 8/31/23) |

Fiscal 2025 |

Fiscal 2024 |

||

|

Sales |

$ 11,617,856 |

$ 9,923,628 |

||

|

Net Earnings |

$ 2,666,655 |

$ 1,847,863 |

||

|

Earnings per Share |

$ 0.85 |

$ 0.52 |

||

|

Shares Outstanding |

3,118,975 |

3,520,910 |

Taylor’s website can be visited at: www.taylordevices.com, with company newsletters and other pertinent information at www.taylordevices.com/investors.

|

Contact: |

Artie Regan |

|

Regan & Associates, Inc. |

|

|

212) 587-3005 (phone) |

|

|

212) 587-3006 (fax) |

|

![]() View original content:https://www.prnewswire.com/news-releases/taylor-devices-announces-first-quarter-results-302260780.html

View original content:https://www.prnewswire.com/news-releases/taylor-devices-announces-first-quarter-results-302260780.html

SOURCE Taylor Devices, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Raising the full retirement age to 69 would cut Social Security benefits — and it wouldn’t save the program

Raising Social Security’s full retirement age by two years to age 69 would decrease individuals’ lifetime benefits and overall spending by the program, but would not stave off Social Security’s expected insolvency in 2034.

Gradually raising the full retirement age to 69 years old, up from the current rule of 67 for those born in 1960 or later, would mean that individuals would get less money over their lifetime, the Congressional Budget Office said in a response to queries by Democratic Rep. Brendan Boyle released Wednesday.

Most Read from MarketWatch

Under the “specified policy” calculated by the CBO, the earliest age at which a person can claim Social Security would remain 62, but the age at which a person could get the maximum Social Security payout would increase to 72, up from 70 currently.

The analysis comes as Social Security faces insolvency in less than a decade and countries such as China have raised their retirement age.

In a letter to Boyle, who represents Pennsylvania’s 2nd District and is the ranking member of the House committee on the budget, the CBO said that for workers born in 1965, the full retirement age would be 67 years and three months, and would increase by an additional three months per birth year until it reached age 69 for workers born in 1972 or later.

The CBO gave these examples of how the higher full retirement age would affect workers’ payouts. For workers born in 1972, claiming Social Security at the earliest possible age of 62 would reduce their benefits by 40%. Under the current law, claiming early reduces benefits by 30%.

Meanwhile, for people born in the 1970s — the first 10-year birth cohort in which all beneficiaries would be affected by the increase in the full retirement age — the average retirement benefits for workers who claimed benefits at age 65 would be 13% less than under current law. The decline in benefits for those born in the 1980s would be similar to that for the 1970s cohort, the CBO said.

What does this mean for the big picture for Social Security?

The increase in the full retirement age would reduce spending for Social Security, in terms of dollars spent and as a percentage of gross domestic product (GDP). That would reduce the 75-year actuarial deficit of the program measured in relation to GDP by 24%, from 1.5.% to 1%.

However, the CBO said gradually raising the full retirement age would not change the projection that the trust funds that back Social Security would be exhausted in 2034.

Read: Opinion: Social Security will run out of money in 8 years. Is anyone paying attention?

Henry Aaron, senior fellow in the economics studies program at the Brookings Institution, said the change in the full retirement age would affect new Social Security beneficiaries, not existing beneficiaries. And new beneficiaries account for just about 5% of total spending — which is not enough to significantly help change the insolvency date for Social Security.

Also, the change in the full retirement age would be gradually phased in and the full impact of the change wouldn’t occur until the insolvency date already occurred, said Richard Johnson, senior fellow and director of the program on retirement policy at the Urban Institute.