Anbogen Announces Drug Supply Collaboration with BeiGene to Evaluate Combination Therapy in Colorectal Cancer

TAIPEI, Sept. 27, 2024 /PRNewswire/ — Anbogen, a clinical-stage biotech company, today announced a drug supply collaboration to evaluate the combination of Anbogen’s HDAC inhibitor, ABT-301, with BeiGene’s anti-PD-1 antibody tislelizumab, in patients with mismatch repair–proficient (pMMR) or microsatellite stable (MSS) metastatic colorectal cancer (mCRC) in a global Phase II trial. Under the terms of the agreement, BeiGene will supply tislelizumab to Anbogen for the study.

In 2020, over 1.9 million new cases of colorectal cancer were diagnosed globally. Immune checkpoint inhibitors (ICIs) have emerged as a primary treatment for metastatic colorectal cancer (mCRC) with mismatch repair deficiency (dMMR) or high microsatellite instability (MSI-H). However, this innovative therapy benefits only a small fraction of patients, as less than 5% of mCRC cases exhibit dMMR/MSI-H. Consequently, there remains a significant unmet need for the 95% of patients with pMMR/MSS tumors, who do not respond to ICIs.

ABT-301, a novel HDAC inhibitor, has shown promising safety and pharmacokinetic profiles in a prior Phase 1 study as a single agent. Preclinical studies indicate that ABT-301 enhances the effectiveness of anti-PD-1/anti-PD-L1 therapies by increasing CD8+ cytotoxic T cells and decreasing monocytic myeloid-derived suppressor cells within both the tumor and circulation, and inhibiting angiogenesis. These immune response enhancements may broaden the efficacy of ICIs in colorectal cancer patients. The upcoming Phase II study will investigate the effectiveness of treatment regimens combining ABT-301 and tislelizumab, with and without Bevacizumab, in pMMR/MSS mCRC patients with significant unmet needs.

“We are excited to partner with BeiGene to investigate this promising combination therapy,” said John Hsu, CEO of Anbogen. “ABT-301 has shown potential in preclinical studies, and we believe that combining it with tislelizumab could provide a new therapeutic option for patients with colorectal cancer.”

The clinical trial will be conducted in multiple centers and will evaluate the safety, tolerability, and preliminary efficacy of the combination therapy in patients with advanced MSS CRC. The study is expected to begin enrollment in the first quarter of 2025.

About Anbogen

Anbogen is a clinical-stage biotech company that completed a US$20M Series A in 2024. We are dedicated to developing precision anti-cancer drugs and are committed to R&D innovations to improve the lives of cancer patients around the world. The company was founded by Dr. Joe Shih in response to national science and technology policy. The team has years of experience in new drug development while working at the National Health Research Institutes and in the biopharma industry.

Currently, there are two clinical-stage assets being developed. ABT-101 is being investigated in non-small cell lung cancer (NSCLC) patients who harbor HER2 exon20 insertion mutations, and ABT-301 and being investigated in pMMR/MSS mCRC patients in combination with anti-PD-1. For more information, please visit www.anbogen.com.

![]() View original content:https://www.prnewswire.com/news-releases/anbogen-announces-drug-supply-collaboration-with-beigene-to-evaluate-combination-therapy-in-colorectal-cancer-302258403.html

View original content:https://www.prnewswire.com/news-releases/anbogen-announces-drug-supply-collaboration-with-beigene-to-evaluate-combination-therapy-in-colorectal-cancer-302258403.html

SOURCE Anbogen Therapeutics

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

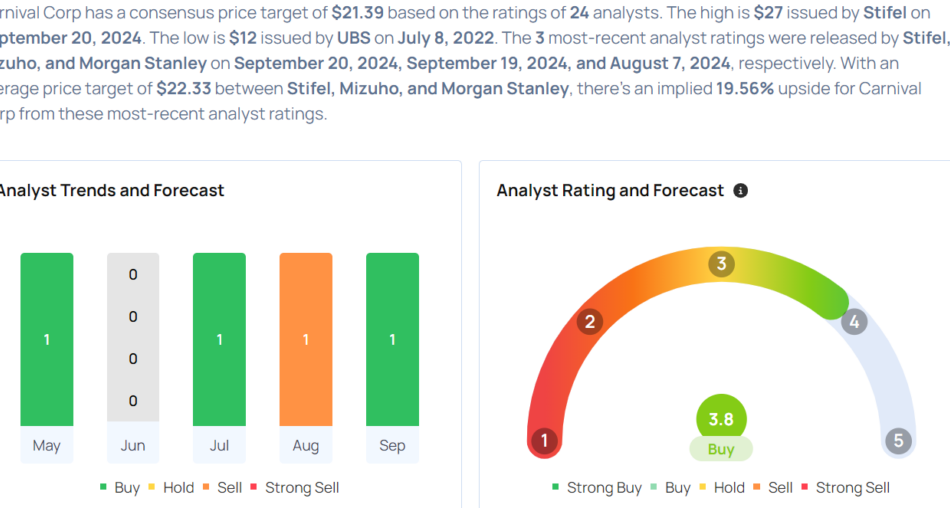

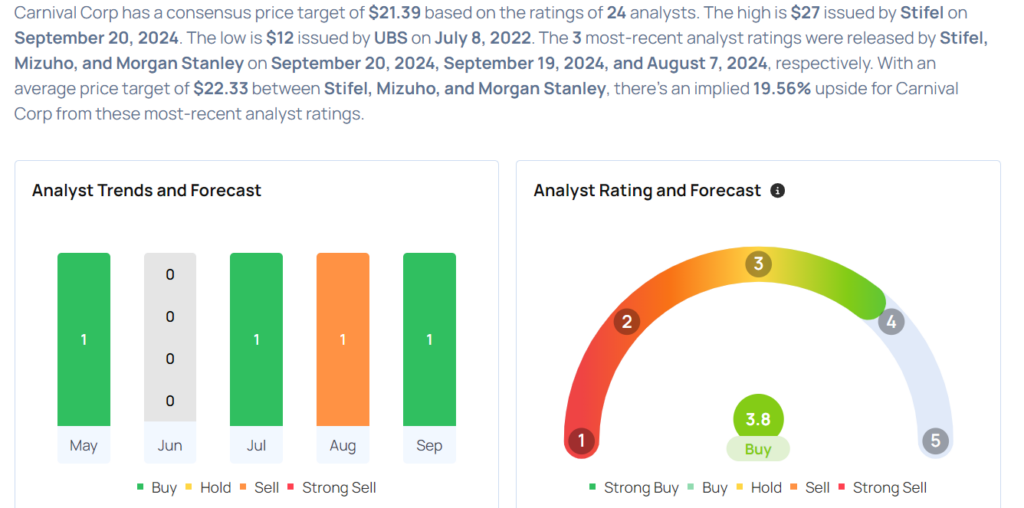

Carnival Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Carnival Corporation CCL will release earnings results for its third quarter, before the opening bell on Monday, Sept. 30.

Analysts expect the Miami, Florida-based company to report quarterly earnings at $1.16 per share, up from 86 cents per share in the year-ago period. Carnival projects to report revenue of $7.83 billion for the quarter, according to data from Benzinga Pro.

Carnival, last month, unveiled new itineraries for seven ships sailing in 2026 and 2027 from Miami, Port Canaveral, Galveston, and Baltimore. The new itineraries include Half Moon Cay, which will expand with a larger beach, enhanced dining, and a new pier for Carnival’s Excel class ships, including Mardi Gras and Carnival Celebration.

Carnival shares gained 3.6% to close at $18.68 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Matthew Boss maintained an Overweight rating and raised the price target from $23 to $25 on July 24. This analyst has an accuracy rate of 67%.

- Truist Securities analyst Patrick Scholes maintained a Hold rating and boosted the price target from $17 to $20 on July 23. This analyst has an accuracy rate of 68%.

- B of A Securities analyst Nicholas Thomas maintained a Buy rating and raised the price target from $23 to $24 on June 27. This analyst has an accuracy rate of 67%.

- Argus Research analyst John Eade maintained a Buy rating and boosted the price target from $20 to $25 on June 27. This analyst has an accuracy rate of 74%.

- Citigroup analyst James Hardiman maintained a Buy rating and raised the price target from $18 to $22 on June 26. This analyst has an accuracy rate of 67%.

Considering buying CCL stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin ETF Demand Grows Among U.S. Investors as China Considers Massive $142B Capital Injection

-

Bitcoin traded above $63,000, experiencing a slight daily decline but a weekly gain, with BTC ETFs seeing significant positive net inflows, indicating a trend towards accumulation.

-

China is reportedly considering a substantial 1 trillion yuan capital injection into its major state banks to bolster the economy, following the People’s Bank of China’s decision to cut the reserve requirement ratio and lower the repo rate.

-

Ether traded above $2,500 with a weekly increase, despite a small daily drop, with its ETFs also showing positive inflows. Meanwhile, WorldCoin’s WLD tokens surged by 14% following expansion announcements and developments at OpenAI.

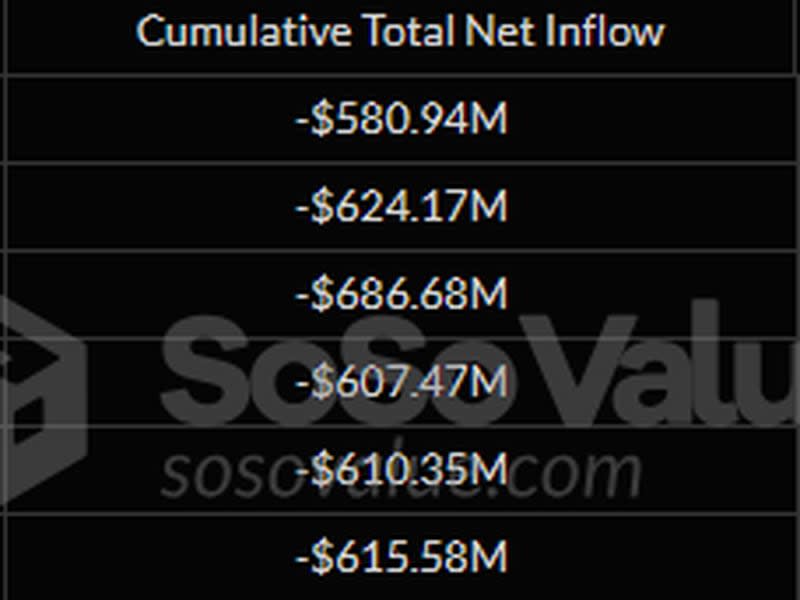

Bitcoin {{BTC}} traded above $63,000 for the first half of the Asian trading hours on Thursday, down 1.4%, but up 2% on-week as inflows into BTC exchange-traded funds (ETFs) remain positive.

Asian stocks surged higher amid reports that China is considering injecting up to 1 trillion yuan ($142 billion) of capital into its biggest state banks to increase their capacity to support the struggling economy.

This follows an easing decision from earlier in the week that saw The People’s Bank of China (PBOC) cutting the reserve requirement ratio for mainland banks by 50 basis points (bps) while also lowering the seven-day reverse repo rate – the interest rate at which a central bank borrows funds from commercial banks – by 20 bps to 1.5%.

Data from SoSoValue shows that the total daily net inflow cracked $100 million for the second day in a row for the BTC ETFs. This marks a five-day streak of positive net inflow for the funds.

That has flipped an indicator tracking 30-day net holdings among ETFs to positive for the first time in September, data from CryptoQuant shows, suggesting a rising trend of accumulation as opposed to sales.

Meanwhile, ether {{ETH}} is trading above $2,500, down 1.3% on-day and up 8% for the week. Data shows that spot ETH ETFs had daily net inflow of $43 million, marking a second day of positive net inflow.

In a recent note, Presto Research wrote that rising Ethereum gas fees, driven by an increase in network transactions, have coincided with ETH outperforming BTC following the Fed’s 50 basis points rate cut.

While on-chain yields remain below the three-month treasury bill, some investors are positioning for a potential recovery in total value locked (TVL), Presto Write. However, a broader capital migration may not happen until 2025.

Sam Altman-backed WorldCoin’s WLD jumped 14% in the past 24 hours to become one of the only gainers in the broader crypto market. The company on Wednesday said it had begun its verification services in Poland, Malaysia and Guatemala over the past week – onboarding more users and boosting the project’s fundamentals.

The rise came amid an executive shuffle at OpenAI – another Altman company – and a switch in the company’s status from a nonprofit to a for-profit benefit corporation. WLD tokens have historically tended to move on development at OpenAI as crypto traders may consider the two closely related.

Jianzhi Education Technology Group Company Limited Reports Half Year 2024 Financial Results

BEIJING, Sept. 27, 2024 (GLOBE NEWSWIRE) — Jianzhi Education Technology Group Company Limited (the “Company” or “Jianzhi”) JZ, a leading provider of digital educational content in China, today announced its financial results for six months ended June 30, 2024.

- Revenue decreased by 25.4% from RMB280.6 million for the six months ended June 30, 2023 to RMB 209.3 million (US$28.8 million) for the six months ended June 30, 2024.

- Gross profit was RMB 41.7 million (US$5.7 million) and RMB 23.9 million for the six months ended June 30, 2024 and 2023.

- Gross profit margin rose to 19.9% for the six months ended June 30, 2024 from 8.5% for the six months ended June 30, 2023.

- Net income was RMB27.6 million (US$3.8 million) for the six months ended June 30, 2024, a turnaround from net loss of RMB93.6 million for the same period in 2023.

- The following table sets forth a summary of the consolidated results of operations for the years indicated:

| For the Six Months Ended June 30, | |||||||||||||||

| 2023 | 2024 | ||||||||||||||

| RMB | RMB | % Change | |||||||||||||

| (in million, except for percentages) | |||||||||||||||

| Revenue | 280.6 | 209.3 | (25.4 | %) | |||||||||||

| Gross profit | 23.9 | 41.7 | 74.5 | % | |||||||||||

| Gross margin | 8.5 | % | 19.9 | % | 11.4 percentage points |

||||||||||

| Total operating expenses | (115.3 | ) | (16.1 | ) | (86.0 | %) | |||||||||

| (Loss) income from operations | (91.3 | ) | 25.6 | 128.0 | % | ||||||||||

| (loss) income before income tax | (91.3 | ) | 25.3 | 127.7 | % | ||||||||||

| Net (loss) income | (93.6 | ) | 27.6 | 129.5 | % | ||||||||||

Mr. Yong Hu, CEO of the Company, commented: “In the first half of 2024, we faced a 25.4% decline in net revenues, which was primarily driven by lower demand for IT-related solutions and educational content services. However, we view this as a strategic opportunity for improvement.”

“Notably, we successfully reduced our cost of revenue by 34.7%, bringing it down to RMB167.6 million (US$23.1 million). This cost management initiative allowed us to achieve a gross profit of RMB41.7 million (US$5.7 million), resulting in a positive gross profit margin of 19.9%, a significant growth from 8.5% of the previous year.”

“Our focus on operational efficiency is reflected in the reduction of operating expenses, which has contributed to our impressive transition from a net loss of RMB93.6 million in first half of 2023 to a net income of RMB27.6 million (US$3.8 million) during same period in 2024. This shift underscores our commitment to enhancing profitability and positioning the Company for sustainable growth moving forward.”

“Looking ahead, we are rolling out several key initiatives including a partnership with China’s top telecom operator to boost our B2B operations across multiple provinces, as we target to acquire massive paying users within the next three years. The partnership will offer various subscription plans, which we believe projects strong revenue and profit margins. Moreover, we are also expanding the partnership into AI applications that will initially target the education sector before expanding to other applications such as research institutions, public libraries to further enhance user engagement with our services.”

“We remain optimistic about our future strategies and are dedicated to leveraging our strengths to navigate the challenges ahead.”

Half Year 2024 Financial Results:

Net revenues

Revenues decreased by 25.4% from RMB280.6 million for the six months ended June 30, 2023 to RMB 209.3 million (US$28.8 million) for the six months ended June 30, 2024. This decrease was primarily driven by the net effects of a decrease of RMB53.4 million in net revenues from the provision of IT related solution services, and a decrease of RMB17.9 million in revenue generated from educational content services and other services.

- Net revenue from the educational content service and other services decreased by RMB17.9 million from RMB28.5 million for the six months ended June 30, 2023 to RMB10.6 million (US$1.5 million) for the six months ended June 30, 2024 primarily caused by a decrease of revenue by RMB16.5 million (US$2.3 million) in Fish Learning. Such decrease in revenues were primarily because we did not provide new and attractive contents on the platform leading to decreased subscriptions from end customers.

- Net revenue from IT related solution services decreased by RMB53.4 million (US$7.3 million), or 21.2% from RMB 252.1 million for the six months ended June 30, 2023 to RMB 198.7 million (US$27.3 million) for the six months ended June 30, 2024. The decrease was primarily caused by a decrease in customer orders for design and development of customized IT system, and procurement and assembling of equipment.

Cost of Revenues

Cost of revenue decreased by 34.7% from RMB256.7 million for the six months ended June 30, 2023, to RMB 167.6 million (US$23.1 million) for the six months ended June 30, 2024. The decrease was primarily attributable to the decrease of RMB27.4 million in amortization of educational and decrease of RMB57.7 million in purchase of IT equipment for IT related solution services, partially offset by an increase of RMB14.7 million in material costs used for educational content service and other services with decreased subscriptions from end customers and decreased orders from high schools.

Compared with the decrease in revenues growth, the higher percentage of decrease in cost of revenues was mainly attributable to the higher gross profit we earned from IT solution services in the first half of 2024 as compared with the same period of 2023.

Gross Profit

Gross profit was RMB 23.9 million and RMB 41.7 million (US$5.7 million) for the six months ended June 30, 2023 and 2024, respectively. The Company’s gross profit margin changed from 8.5% for the six months ended June 30, 2023 to 19.9% for the six months ended June 30, 2024.

The change was mainly due to an increase in the gross profits margin for IT related solution services for the first half 2024, because the Company was primarily engaged in IT design and development services for customers in the first half of 2024, as compared with procurement and assembling equipment projects in the same period of 2023. The profit margin was higher in IT design and development services than procurement and assembling equipment projects.

Operating expenses

The Company’s total operating expenses changed from RMB115.3 million for the six months ended June 30, 2023 to RMB16.1 million (US$2.2 million) for the six months ended June 30, 2024.

- Sales and marketing expenses decreased from RMB3.9 million for the six months ended June 30, 2023 to RMB2.5 million (US$0.3 million) for the six months ended June 30, 2024.

- General and administrative expenses increased from RMB9.6 million for the six months ended June 30, 2023 to RMB10.5 million (US$1.4 million) for the six months ended June 30, 2024.

- Research and development expenses decreased from RMB4.4 million for the six months ended June 30, 2023 to RMB3.1 million (US$0.4 million) for the six months ended June 30, 2024.

- The Company provided impairment of educational contents of RMB97.3 million for the six months ended June 2023, and nil during the same period in 2024.

Net income (loss)

As a result of the foregoing, the Company reported net loss of RMB93.6 million and net income of RMB27.6 million (US$3.8 million) for the six months ended June 30, 2023 and 2024, respectively.

About Jianzhi Education Technology Group Company Limited

Headquartered in Beijing and established in 2011, Jianzhi is a leading provider of digital educational content in China and has been committed to developing educational content to fulfill the massive demand for high-quality, professional development training resources in China. Jianzhi started operations by providing educational content products and IT services to higher education institutions. Jianzhi also provides products to individual customers. Leveraging its strong capabilities in developing proprietary professional development training content and success in consolidating educational content resources within the industry, Jianzhi has successfully built up a comprehensive, multi-dimensional digital educational content database which offers a wide range of professional development products. Jianzhi embeds proprietary digital education content into the self-developed online learning platforms, which are provided to a wide range of customers through its omni-channel sales system. Jianzhi is also fully committed to the digitalization and informatization of the education sector in China. For more information, please visit: www.jianzhi-jiaoyu.com

Safe Harbor Statement

This press release contains statements that may constitute “forward-looking” statements pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “likely to,” and similar statements. Statements that are not historical facts, including statements about the Company’s beliefs, plans, and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. Further information regarding these and other risks is included in the Company’s filings with the SEC. All information provided in this press release is as of the date of this press release, and the Company does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

Janice Wang

Wealth Financial Services LLC

Phone: +86 13811768559

+1 628 283 9214

Email: services@wealthfsllc.com

| JIANZHI EDUCATION TECHNOLOGY GROUP COMPANY LIMITED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts in Renminbi (“RMB”) and U.S. dollars (“US$”), except for number of shares and per share data) |

||||||||||||

| December 31, 2023 |

June 30, 2024 |

June 30, 2024 |

||||||||||

| RMB | RMB | US$ | ||||||||||

| (unaudited) | (unaudited) | |||||||||||

| Assets | ||||||||||||

| Current assets: | ||||||||||||

| Cash | 18,175,959 | 13,115,287 | 1,804,724 | |||||||||

| Accounts receivable, net | 4,912,020 | 76,240,194 | 10,491,000 | |||||||||

| Amount due from related parties | 2,172,565 | 1,115,565 | 153,507 | |||||||||

| Short-term prepayments | 77,950,037 | 1,965,969 | 270,526 | |||||||||

| Short-term investments | 4,223,894 | 7,648,722 | 1,052,499 | |||||||||

| Prepaid expenses and other current assets | 14,914,484 | 10,534,089 | 1,449,538 | |||||||||

| Total current assets | 122,348,959 | 110,619,826 | 15,221,794 | |||||||||

| Non-current assets: | ||||||||||||

| Right-of-use assets, net | 7,604,933 | 5,903,758 | 812,384 | |||||||||

| Deferred tax assets, net | 11,226,164 | 13,518,156 | 1,860,160 | |||||||||

| Property and equipment, net | 213,369 | 183,032 | 25,186 | |||||||||

| Intangible assets, net | 1,257,860 | 1,106,916 | 152,317 | |||||||||

| Other non-current assets | 219,416 | 176,949 | 24,349 | |||||||||

| Long-term prepayments | 8,815,919 | 18,059,668 | 2,485,093 | |||||||||

| Total non-current assets | 29,337,661 | 38,948,479 | 5,359,489 | |||||||||

| Total assets | 151,686,620 | 149,568,305 | 20,581,283 | |||||||||

| Liabilities | ||||||||||||

| Current liabilities: | ||||||||||||

| Accounts payable | 11,524,904 | 66,456,088 | 9,144,662 | |||||||||

| Contract liabilities | 86,731,977 | 13,108,638 | 1,803,809 | |||||||||

| Salary and welfare payable | 3,170,255 | 1,962,572 | 270,059 | |||||||||

| Income taxes payable | 4,474,575 | 2,603,097 | 358,198 | |||||||||

| Value added tax (“VAT”) and other tax payable | 2,198,217 | 4,315,792 | 593,873 | |||||||||

| Other payables | 3,506,282 | 1,873,102 | 257,747 | |||||||||

| Lease liabilities, current | 3,482,876 | 3,027,011 | 416,531 | |||||||||

| Amount due to related parties | 47,505,624 | 480,902 | 66,174 | |||||||||

| Total current liabilities | 162,594,710 | 93,827,202 | 12,911,053 | |||||||||

| Non-current liabilities: | ||||||||||||

| Deferred tax liabilities | 2,274,256 | 2,336,341 | 321,491 | |||||||||

| Lease liabilities, non-current | 4,035,598 | 2,790,522 | 383,989 | |||||||||

| Total non-current liabilities | 6,309,854 | 5,126,863 | 705,480 | |||||||||

| Total liabilities | 168,904,564 | 98,954,065 | 13,616,533 | |||||||||

| JIANZHI EDUCATION TECHNOLOGY GROUP COMPANY LIMITED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS — (Continued) (Amounts in Renminbi (“RMB”) and U.S. dollars (“US$”), except for number of shares and per share data) |

||||||||||||

| December 31, 2023 |

June 30, 2024 |

June 30, 2024 |

||||||||||

| RMB | RMB | US$ | ||||||||||

| (unaudited) | (unaudited) | |||||||||||

| Commitments and contingencies | ||||||||||||

| Shareholders’ (deficit) equity | ||||||||||||

| Ordinary shares (US$0.0001 par value; 500,000,000 shares authorized, 121,110,000 and 121,110,000 issued and outstanding as of December 31, 2023 and June 30, 2024) | 77,747 | 77,747 | 12,111 | |||||||||

| Additional paid-in capital | 238,567,906 | 278,748,454 | 39,129,453 | |||||||||

| Statutory reserves | 23,557,710 | 23,557,710 | 3,318,034 | |||||||||

| Accumulated deficit | (291,805,140) | (264,741,760) | (37,375,863) | |||||||||

| Accumulated other comprehensive income | 6,096,465 | 6,124,383 | 938,739 | |||||||||

| Total Jianzhi Education Technology Group Company Limited’s shareholders’ (deficit) equity | (23,505,312) | 43,766,534 | 6,022,474 | |||||||||

| Noncontrolling interests | 6,287,368 | 6,847,706 | 942,276 | |||||||||

| Total shareholders’ (deficit) equity | (17,217,944) | 50,614,240 | 6,964,750 | |||||||||

| Total liabilities and shareholders’ (deficit) equity | 151,686,620 | 149,568,305 | 20,581,283 | |||||||||

| JIANZHI EDUCATION TECHNOLOGY GROUP COMPANY LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME (Amounts in Renminbi (“RMB”) and U.S. dollars (“US$”) except for number of shares and per share data) |

||||||||||||

| For the Six Months Ended June 30, | ||||||||||||

| 2023 | 2024 | 2024 | ||||||||||

| RMB | RMB | US$ | ||||||||||

| Net revenues | 280,606,379 | 209,303,030 | 28,801,055 | |||||||||

| Cost of revenues | (256,660,584) | (167,646,023) | (23,068,861) | |||||||||

| Gross profit | 23,945,795 | 41,657,007 | 5,732,194 | |||||||||

| Operating expenses: | ||||||||||||

| Sales and marketing expenses | (3,943,550) | (2,459,869) | (338,489) | |||||||||

| General and administrative expenses | (9,581,756) | (10,513,568) | (1,446,722) | |||||||||

| Research and development expenses | (4,412,218) | (3,121,624) | (429,550) | |||||||||

| Impairment of intangible assets | (97,332,087) | — | — | |||||||||

| Total operating expenses | (115,269,611) | (16,095,061) | (2,214,761) | |||||||||

| (Loss) income from operations | (91,323,816) | 25,561,946 | 3,517,433 | |||||||||

| Other income (expenses): | ||||||||||||

| Investment income | 60,649 | 13,739 | 1,891 | |||||||||

| Interest expenses, net | (701,899) | (467,320) | (64,305) | |||||||||

| Other (expenses) income, net | (16,781) | 22,641 | 3,116 | |||||||||

| Government grants | 643,646 | 139,236 | 19,160 | |||||||||

| Total other expenses, net | (14,385) | (291,704) | (40,138) | |||||||||

| (Loss) income before income tax | (91,338,201) | 25,270,242 | 3,477,295 | |||||||||

| Income tax (expense) benefits | (2,238,882) | 2,353,476 | 323,849 | |||||||||

| Net (loss) income | (93,577,083) | 27,623,718 | 3,801,144 | |||||||||

| Net (loss) income attributable to noncontrolling interests | (2,885,241) | 560,338 | 77,105 | |||||||||

| Net (loss) income attributable to the Jianzhi Education Technology Group Company Limited’s shareholders | (90,691,842) | 27,063,380 | 3,724,039 | |||||||||

| Net (loss) income | (93,577,083) | 27,623,718 | 3,801,144 | |||||||||

| Other comprehensive (loss) income: | ||||||||||||

| Foreign currency translation adjustments | 830,133 | 27,918 | 3,842 | |||||||||

| Total comprehensive (loss) income | (92,746,950) | 27,651,636 | 3,804,986 | |||||||||

| Net comprehensive (loss) income attributable to noncontrolling interests | (2,885,241) | 560,338 | 77,105 | |||||||||

| Comprehensive (loss) income attributable to the Jianzhi Education Technology Group Company Limited’s shareholders | (89,861,709) | 27,091,298 | 3,727,881 | |||||||||

| (Loss) earnings per share – Basic and diluted | (0.75) | 0.22 | 0.03 | |||||||||

| Weighted average number of shares – Basic and diluted | 121,100,000 | 121,110,000 | 121,110,000 | |||||||||

| JIANZHI EDUCATION TECHNOLOGY GROUP COMPANY LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Renminbi (“RMB”) and U.S. dollars (“US$”) |

||||||||||||

| For the Six Months Ended June 30, | ||||||||||||

| 2023 | 2024 | 2024 | ||||||||||

| RMB | RMB | US$ | ||||||||||

| Net cash (used in) provided by operating activities | (7,630,383) | 10,944,793 | 1,506,046 | |||||||||

| Cash flows from investing activities: | ||||||||||||

| Purchase of short-term investments | (20,000,000) | (5,800,000) | (798,107) | |||||||||

| Proceeds from redemption of short-term investment | 20,000,000 | 2,375,172 | 326,835 | |||||||||

| Purchase of property and equipment | (319,309) | — | — | |||||||||

| Return of deposits for property and equipment | — | 1,803,140 | 248,120 | |||||||||

| Repayment of loans from a related party | — | — | ||||||||||

| Purchase of educational contents | (19,184,980) | (13,445,345) | (1,493,918) | |||||||||

| Loans made to a third party | (13,851,828) | — | — | |||||||||

| Repayment of loans from a third party | 3,100,833 | — | — | |||||||||

| Repayment of loans from a related party | 137,814 | 200,998 | 27,658 | |||||||||

| Net cash used in investing activities | (30,117,470) | (14,866,035) | (2,045,635) | |||||||||

| Cash flows from financing activities: | ||||||||||||

| Repayment to related parties | (13,257) | (499,842) | (68,781) | |||||||||

| Net cash used in financing activities | (13,257) | (499,842) | (68,781) | |||||||||

| Effect of exchange rate changes on cash held in foreign currencies | 1,332,362 | (639,588) | (88,001) | |||||||||

| Net decrease in cash | (36,428,748) | (5,060,672) | (696,371) | |||||||||

| Cash at beginning of the period | 65,055,278 | 18,175,959 | 2,501,095 | |||||||||

| Cash at end of the period | 28,626,530 | 13,115,287 | 1,804,724 | |||||||||

| Supplemental disclosures of cash flows information: | ||||||||||||

| Cash paid for income taxes | — | 130,244 | 17,922 | |||||||||

| Cash paid for interest expenses | — | — | — | |||||||||

| Non-cash Investing and Financing activities: | ||||||||||||

| Waive of liabilities due by shareholders | — | 40,180,548 | 5,529,027 | |||||||||

| Right-of-use assets obtained in exchange for operating lease liabilities | 8,943,892 | 5,817,299 | 800,487 | |||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top 4 Materials Stocks That May Implode In Q3

As of Sept. 27, 2024, four stocks in the materials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

Freeport-McMoRan Inc FCX

- On Sept. 25, Freeport said its Board of Directors declared cash dividends of 15 cents per share on FCX’s common stock payable on Nov. 1, to shareholders of record as of Oct. 15. The company’s stock gained around 17% over the past five days and has a 52-week high of $55.24.

- RSI Value: 76.95

- FCX Price Action: Shares of Freeport-McMoRan gained 7.5% to close at $51.91 on Thursday.

Mp Materials Corp MP

- On Sept. 3, MP Materials approved a $300 million increase to the company’s existing share repurchase program, bringing the total authorized amount to $600 million. “We remain very confident in the long-term value of our assets and the MP platform,” said James Litinsky, Founder, Chairman, and CEO of MP Materials. “As we have consistently stated, subject to continuing to maintain a fortress balance sheet, we expect to be opportunistic in our approach to capital allocation to create value for shareholders.”The company’s stock gained around 20% over the past five days and has a 52-week high of $20.85.

- RSI Value: 78.23

- MP Price Action: Shares of Mp Materials rose 4.6% to close at $16.90 on Thursday.

ArcelorMittal SA MT

- On Aug. 28, Deutsche Bank analyst Bastian Synagowitz upgraded ArcelorMittal from Hold to Buy and raised the price target from $29 to $31. The company’s stock gained around 10% over the past month and has a 52-week high of $29.01.

- RSI Value: 72.57

- MT Price Action: Shares of ArcelorMittal gained 5.1% to close at $25.93 on Thursday.

Southern Copper Corp SCCO

- On Sept. 19, Morgan Stanley analyst Carlos De Alba maintained Southern Copper with an Underweight and raised the price target from $97 to $100. The company’s stock jumped around 15% over the past five days and has a 52-week high is $129.07.

- RSI Value: 73.34

- SCCO Price Action: Shares of Southern Copper gained 8.2% to close at $120.43 on Wednesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street On Wait-And-Watch Mode Ahead Of Inflation Data, Bitcoin Holds Above 65.5K: Analyst Says Volatility Ahead Providing Better Entry Point Into Long-term Bull Market

Sentiment has soured ahead of the key inflation data that is due ahead of the market open on Friday, with the index futures pointing to a modestly lower opening. A fairly benign data could keep the upward trajectory intact ahead of next week’s key labor market data. Stocks are on track to finish September, a seasonally weaker month, on a positive note, and election uncertainty could weigh down on the market in the upcoming month. The focus would shift to the third-quarter reporting season in the latter half of October.

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.18% |

| S&P 500 | -0.07% |

| Dow | -0.03% |

| R2K | +0.31% |

In premarket trading on Friday, the SPDR S&P 500 ETF Trust SPY edged up 0.03% to $572.46 and the Invesco QQQ ETF QQQ fell 0.08% to $489.09, according to Benzinga Pro data.

Cues From Last Session:

U.S. stocks advanced on Thursday as traders digested a slew of economic data, Chinese stimulus that set the Asian markets on fire and Micron Technology, Inc.’s MU earnings. A sharp drawdown in the shares of Super Micro Computer, Inc. SMCI on the back of the news of a Department of Justice probe tempered optimism toward the tech stocks.

The major indices opened sharply higher after separate reports showed jobless claims fell in the recent reporting week, durable goods orders remained flat, belying expectations for a decline, and the second-quarter GDP data was left unrevised at 3%.

The indices squandered the early gains but remained mostly above the unchanged line for the rest of the session before closing higher for the day.

The S&P 500 scored another record intraday and closing highs, with nine of the 11 S&P 500 sector classes closing higher. Material stocks advanced notably, while energy stocks came under significant selling pressure.

| Index | Performance (+/) | Value |

| Nasdaq Composite | +0.60% | 18,190.29 |

| S&P 500 Index | +0.40% | 5,745.37 |

| Dow Industrials | +0.62% | 42,175.11 |

| Russell 2000 | +0.57% | 2,209.87 |

Insights From Analysts:

LPL Chief Economist Jeffrey Roach said in a note he anticipates a period of higher volatility among both bonds and equities during the present period of global uncertainty and softer growth outlook. “We expect volatility to remain elevated over the next few months, and believe a better entry point back into the longer-term bull market is likely,” he said.

The economist said the long and variable lag of monetary policy is not perfectly symmetrical, and it could take time for the monetary stimulus to filter down from Wall Street to Main Street. “Portfolio allocators should consider keeping a domestic bias during these periods of flux,” he added.

With just two sessions to go for September, the S&P 500 is up about 17.2% for the month-to-date period. Carson Group Chief Investment Strategist Ryan Detrick underlined a positive aspect of it. If the index finishes September in the green, it would mark gains for eight of the nine months of 2024. Going back into history, this has occurred nine other times and in those years, the index posted gains for the fourth quarter all nine times. The average gain is a decent 6.7%.

See also: Best Futures Trading Software

Upcoming Economic Data:

- The Bureau of Economic Analysis is due to release a personal income and spending report for August at 8:30 a.m. EDT. Economists, on average, expect personal income and spending to have increased by 0.4% and 0.3% month-over-month, respectively, in August. This compares to the July rates of 0.3% and 0.5%, respectively. The price consumption expenditure index may have edged up 0.1% compared to July’s 0.2% increase. Annually, the rate of increase in the PCEI is expected to have slowed from 2.5% in July to 2.3% in August. The monthly and annual rates of the core PCEI are estimated at 0.2% and 2.7%, respectively, for August, compared to July’s 0.2% and 2.6% rates.

- The advanced trade balance report for August will be released by the Commerce Department at 8:30 a.m. EDT. The consensus estimate calls for a deficit of $100.60 billion for August compared to a deficit of $102.84 billion in July. The Commerce Department will also release advance wholesale and retail inventory data at 8:30 a.m. EDT.

- The University of Michigan’s final consumer sentiment index for September is scheduled to be released at 10 a.m. EDT. The headline consumer sentiment index is expected to be revised from the flash reading of 69 to 69.3, marking an increase from 67.9 in August. The one-year and five-year inflation expectations readings will likely come in at 2.7% and 3.1%, respectively,

- Atlanta Fed GDPNow for the third quarter, due at 10:30 a.m. EDT, is expected to show 2.9% growth.

- Federal Reserve Governor Michelle Bowman is scheduled to speak at 1:15 p.m. EDT.

Stocks In Focus:

- BlackBerry Limited BB fell over 1.50% in premarket trading following the company’s earnings announcement, and Costco Wholesale Corporation COST was down about 1.30% on earnings.

- Bristol Myers Squibb Co. BMY shares rose over 6% after the FDA approved Cobenfy, an oral medication for the treatment of schizophrenia in adults.

Commodities, Bonds And Global Equity Markets:

Crude oil futures are weaker yet again, although more modestly than in the previous two sessions, and gold futures retreated modestly and traded just shy of the record. Bitcoin BTC/USD rallied over 3% over the past 24 hours and is fast approaching the next psychological resistance of $66K.

The yield on the 10-year Treasury note remained almost flattish with a slight negative bias at 3.785%.

In Asia, stocks in Hong Kong, Japan and China rose strongly and the Australian averages gained modestly, but major indices elsewhere settled mostly lower. China’s optimism continued to buoy sentiment in the mainland markets.

The European markets advanced in early trading as traders digested inflation data from some key countries in the region and other data.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palo Alto, Delta Air, PayPal And More On CNBC's 'Final Trades'

On CNBC’s “Halftime Report Final Trades,” Brenda Vingiello of Sand Hill Global Advisors said Palo Alto Networks, Inc. PANW continues to gain market share in the cybersecurity space.

On Aug. 19, Palo Alto Networks reported better-than-expected results for its fourth quarter and issued strong guidance. Palo Alto’s board authorized an additional $500 million for share repurchases, bringing the company’s remaining buyback authorization up to $1 billion.

Jim Lebenthal of Cerity Partners named Delta Air Lines, Inc. DAL as his final trade.

Southwest Airlines Co LUV recently introduced a new $2.5 billion share repurchase program. Southwest’s repurchase plan, alongside its enhanced growth projections and cost-saving initiatives, signals broader optimism for the airline industry’s recovery and profitability. Delta, as one of the leading carriers in the U.S., could see increased investor interest as competitors like Southwest aim for financial efficiency and stronger earnings growth. Delta Air Lines is scheduled to hold a live conference call and webcast to discuss its September quarter financial results on Thursday, Oct. 10.

Don’t forget to check out our premarket coverage here

Liz Young Thomas of SoFi picked The Health Care Select Sector SPDR Fund XLV.

Joshua Brown of Ritholtz Wealth Management said PayPal Holdings, Inc. PYPL continues to break out.

PayPal Holdings recently unveiled its plan to extend cryptocurrency services to U.S. business account holders, with the exception of New York State. As per a press release issued on Tuesday, the latest move would enable U.S. merchants to buy, sell, and hold cryptocurrency directly from their business accounts.

Price Action:

- Palo Alto fell 0.5% to close at $338.73 during Thursday’s session.

- Delta Air shares gained 6.3% to settle at $51.81 on Thursday.

- The Health Care Select Sector SPDR Fund gained 0.3% during Thursday’s session.

- PayPal shares gained 3.5% to close at $80.08 on Thursday.

Check This Out:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AIRAmed and Memory Treatment Centers (Bonita Springs and Jacksonville, Florida) have launched a research partnership aimed at studying Alzheimer's disease in cognitively impaired individuals undergoing anti-amyloid therapy

As the global Alzheimer’s community enters a new era of drug treatments, we at MTC are excited to announce our collaboration with AIRAmed. This partnership will provide enhanced tools for the diagnosis and treatment of Alzheimer’s patients. AIRAmed’s cutting-edge technology allows patients to monitor their brain health through serial MRIs, which are conducted regularly during anti-amyloid therapy.

BONITA SPRINGS, Fla., Sept. 27, 2024 /PRNewswire/ — AIRAmed, a software company dedicated to the earlier detection of neurodegenerative diseases, more precise diagnoses, personalized treatments, and improving the quality of life for affected patients, is pleased to announce a research collaboration with Memory Treatment Centers. In partnership with Dr. Donald McCarren (DO, FAAN, FAANEM), Dr. Samuel Giles (MD), Dr. Robert Mannel (MD) and Dr. Jamie Plante (MD), the study will focus on quantitative brain volume measurements in cognitively impaired individuals receiving anti-amyloid treatment.

AIRAmed and Memory Treatment Centers have launched a research partnership studying Alzheimer’s disease.

Dr Tobias Lindig, Managing Director, AIRAmed said, “AIRAmed’s vision and mission is to continuously improve patient care with cutting edge technology – especially in the field of neurodegenerative diseases. We dedicate ourselves to early detection of disease. We developed our FDA-cleared AI-software AIRAscore – allowing to track changes in regional brain volume not visible to the eye. We are convinced that the partnership with MTC in this new era of treatments for Alzheimer´s disease offers a game-changing quality-of-life change for patients undergoing these new therapies.”

Dr. Donald McCarren, Memory Treatment Centers, said, “we at MTC are eager to partner with AIRAmed and drive forward innovation in patient care. Through this collaboration, we will share HIPAA-compliant, real-world data with the global Neurologic community, helping to enhance our understanding of the disease, improve treatment strategies, and augment patient outcomes. AIRAmed will provide exact volumetric data – enabling us at MTC to get a better understanding for Alzheimer disease; exact quantification of MR imaging data at the same time will allow us to monitor disease under therapy with precision.”

About AIRAmed – Our mission at AIRAmed is to bring the latest findings and possibilities from clinical research to the patient as quickly as possible. In many years as doctors and researchers at the University Hospital of Tuebingen, we have often seen valuable research results disappear into a drawer. With AIRAmed’s innovative software solutions, we want to prevent exactly that, instead bringing innovation into medicine – pushing boundaries of modern radiology.

For more information, visit https://www.airamed.de/en/home

About Memory Treatment Centers – At Memory Treatment Centers, we are leaders in innovative treatments and advancing the level and effectiveness of memory diagnosing, treatment, and monitoring. Committed to providing hope and relief to individuals struggling with various forms of cognitive impairment, including Alzheimer’s Disease, our goal is to help patients achieve better health and a higher quality of life. We actively pursue new treatment opportunities and partnerships to enhance memory care and expand patient access to treatment. Additionally, we strive to help and educate individuals and caregivers, ensuring they have the support and knowledge needed on their journey to improved well-being.

For more information, visit https://memorytreatmentcenters.com/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/airamed-and-memory-treatment-centers-bonita-springs-and-jacksonville-florida-have-launched-a-research-partnership-aimed-at-studying-alzheimers-disease-in-cognitively-impaired-individuals-undergoing-anti-amyloid-therapy-302260210.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/airamed-and-memory-treatment-centers-bonita-springs-and-jacksonville-florida-have-launched-a-research-partnership-aimed-at-studying-alzheimers-disease-in-cognitively-impaired-individuals-undergoing-anti-amyloid-therapy-302260210.html

SOURCE Memory Treatment Centers

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Witnessing An Insider Decision, Williamson Laura B Exercises Options Valued At $97K At Darden Restaurants

A substantial insider activity was disclosed on September 25, as B, President at Darden Restaurants DRI, reported the exercise of a large sell of company stock options.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday revealed that B, President at Darden Restaurants in the Consumer Discretionary sector, exercised stock options for 1,086 shares of DRI stock. The exercise price of the options was $78.84 per share.

The latest update on Thursday morning shows Darden Restaurants shares up by 0.45%, trading at $168.87. At this price, B’s 1,086 shares are worth $97,772.

All You Need to Know About Darden Restaurants

Darden Restaurants is the largest restaurant operator in the us full-service space, with consolidated revenue of $11.4 billion in fiscal 2024 resulting in 3%-4% full-service market share (per NRA data and our calculations). The company maintains a portfolio of 10 restaurant brands: Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Ruth’s Chris, Yard House, The Capital Grille, Seasons 52, Eddie V’s, Bahama Breeze, and The Capital Burger. Darden generates revenue almost exclusively from company-owned restaurants, though a small network of franchised restaurants and consumer-packaged goods sales through the traditional grocery channel contribute modestly. As of the end of its fiscal 2024, the company operated 2,031 restaurants in the us.

Financial Insights: Darden Restaurants

Negative Revenue Trend: Examining Darden Restaurants’s financials over 3 months reveals challenges. As of 31 August, 2024, the company experienced a decline of approximately -6.77% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Navigating Financial Profits:

-

Gross Margin: The company shows a low gross margin of 20.41%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Darden Restaurants’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 1.75.

Debt Management: Darden Restaurants’s debt-to-equity ratio is below the industry average at 2.48, reflecting a lower dependency on debt financing and a more conservative financial approach.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 19.39, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.77 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 13.88 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Breaking Down the Significance of Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Darden Restaurants’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.