iHuman Inc. Announces Second Quarter 2024 Unaudited Financial Results

BEIJING, Sept. 27, 2024 /PRNewswire/ — iHuman Inc. IH (“iHuman” or the “Company”), a leading provider of tech-powered, intellectual development products in China, today announced its unaudited financial results for the second quarter ended June 30, 2024.

Second Quarter 2024 Highlights

- Revenues were RMB215.1 million (US$29.6 million), compared with RMB241.0 million in the same period last year.

- Gross profit was RMB151.7 million (US$20.9 million), compared with RMB170.8 million in the same period last year.

- Operating income was RMB18.8 million (US$2.6 million), compared with RMB40.9 million in the same period last year.

- Net income was RMB24.7 million (US$3.4 million), compared with RMB42.1 million in the same period last year.

- Average total MAUs[1] for the second quarter were 24.57 million, a year-over-year increase of 20.8%.

|

[1] “Average total MAUs” refers to the monthly average of the sum of the MAUs of each of the Company’s apps during a specific period, which is counted based on the number of unique mobile devices through which such app is accessed at least once in a given month, and duplicate access to different apps is not eliminated from the total MAUs calculation. |

Dr. Peng Dai, Director and Chief Executive Officer of iHuman, commented, “In the second quarter, we made steady progress in advancing our strategic priorities, intensifying efforts across multiple fronts to build momentum for our sustainable growth.

In the domestic market, we expanded our smart device lineup with the introduction of the iHuman Pinyin Reader, which is designed to help kids master Pinyin through high-quality content, interactive hands-on experiences, and engaging exercises. The product features catchy pinyin mnemonics to enhance memory retention and offers audio and visual challenges to make learning more engaging. The iHuman Pinyin Reader uses Pinyin as a gateway to introduce nursery rhymes and foundational Chinese classical studies. Its proprietary rating system also assigns children to different proficiency levels, keeping kids motivated while making it easy for parents to track progress.

Our international expansion continued to gain momentum as we enriched our content library with new themes that appeal to young audiences worldwide. In Aha Makeover, we launched “Mermaid Melody” and “Forest Fantasy,” two themes that combine imaginative elements like whimsical mermaids and enchanting forests with a variety of interactive features. In Gogo Mini World, the new theme “Fashion Salon” offers a dynamic platform for creative expression through beauty and styling activities, allowing children to share photos of their unique fashion designs. Furthermore, the new theme “Princess Castle” introduces a magical touch with magic wand play and customizable fireworks. These new themes are particularly engaging for children as they offer a mix of fantasy, creativity, and interactive fun, encouraging them to explore their interests and unleash their imaginations.

During the quarter, our animation studio Kunpeng also made notable headway internationally with its Cosmicrew franchise. Following a successful run on major TV networks and streaming platforms in China, the Cosmicrew animated series has now expanded into several global markets, including the United States, the United Kingdom, Australia, and Singapore. The franchise’s international reach was further extended with the Cosmicrew movie, which, after its premiere in China in 2023, has also been screened this year in several European countries. This global expansion not only boosts Kunpeng’s international visibility and brand recognition, but also supports our broader international business strategy, thereby solidifying our presence in key global markets.

The progress we achieved across markets and business lines in the second quarter underscores our effective execution and commitment to long-term growth. Moving forward, we will continue to build on core strengths and leverage our extensive product portfolio to drive market expansion and business growth,” concluded Dr. Dai.

Ms. Vivien Weiwei Wang, Director and Chief Financial Officer of iHuman, added, “In the second quarter of 2024, we recorded our tenth consecutive quarter of profitability. We also ended the quarter with RMB1.13 billion in cash, cash equivalents, and time deposits. With our healthy financial position, we have the privilege to accelerate our innovation efforts in pioneering content and technologies, ensuring that we remain at the forefront of technological developments and emerging trends to welcome and accommodate the evolving needs and preferences of users. For instance, during the quarter, we developed an experimental product specifically designed for use with Apple’s Vision Pro, establishing ourselves as an industry pioneer in exploring applications compatible with this revolutionary headset. By harnessing the Vision Pro’s immersive spatial environment, precise eye tracking, and gesture capture functions, we deliver even more interactive and captivating experiences for children. On the operational front, we calibrated our sales and marketing efforts to align with our expanded efforts on new product development and launches. Notably, we have strengthened collaborations with leading manufacturers of learning pads, smart speakers, tablets, and even smart cars to pre-install our app products. As smart devices become increasingly integral to daily life, we expect these partnerships to extend our market coverage and make our offerings more accessible to families. Looking ahead to the second half of the year, we will continue to invest strategically in product innovation and global brand recognition to build a sustainable growth engine for our business.”

Second Quarter 2024 Unaudited Financial Results

Revenues

Revenues were RMB215.1 million (US$29.6 million), a decrease of 10.7% from RMB241.0 million in the same period last year, primarily due to more conservative consumer spending.

Average total MAUs for the quarter were 24.57 million, an increase of 20.8% year-over-year from 20.33 million in the same period last year, primarily due to the effective execution of our user acquisition strategy.

Cost of Revenues

Cost of revenues was RMB63.4 million (US$8.7 million), a decrease of 9.7% from RMB70.2 million in the same period last year, primarily due to decreased channel costs.

Gross Profit and Gross Margin

Gross profit was RMB151.7 million (US$20.9 million), compared with RMB170.8 million in the same period last year. Gross margin was 70.5%, compared with 70.9% in the same period last year.

Operating Expenses

Total operating expenses were RMB132.9 million (US$18.3 million), compared to RMB130.0 million in the same period last year.

Research and development expenses were RMB57.2 million (US$7.9 million), a decrease of 9.8% from RMB63.4 million in the same period last year, primarily due to decreased payroll related expenses.

Sales and marketing expenses were RMB51.3 million (US$7.1 million), an increase of 26.4% from RMB40.6 million in the same period last year, primarily due to increased strategic spending on promotional activities, brand enhancement, and overseas expansion.

General and administrative expenses were RMB24.4 million (US$3.4 million), a decrease of 6.0% from RMB26.0 million in the same period last year, primarily due to decreases in share-based compensation expenses, as well as other administrative expenses.

Operating Income

Operating income was RMB18.8 million (US$2.6 million), compared with RMB40.9 million in the same period last year.

Net Income

Net income was RMB24.7 million (US$3.4 million), compared with RMB42.1 million in the same period last year.

Basic and diluted net income per ADS were RMB0.47 (US$0.06) and RMB0.45 (US$0.06), respectively, compared with RMB0.80 and RMB0.77 in the same period last year. Each ADS represents five Class A ordinary shares of the Company.

Deferred Revenue and Customer Advances

Deferred revenue and customer advances were RMB289.9 million (US$39.9 million) as of June 30, 2024, compared with RMB318.6 million as of December 31, 2023.

Cash, Cash Equivalents and Time Deposits

Cash, cash equivalents and time deposits were RMB1,129.4 million (US$155.4 million) as of June 30, 2024, compared with RMB1,213.8 million as of December 31, 2023. The decrease was primarily due to the payment of annual bonuses to employees in the first quarter.

Exchange Rate Information

The U.S. dollar (US$) amounts disclosed in this press release, except for those transaction amounts that were actually settled in U.S. dollars, are presented solely for the convenience of the reader. The conversion of Renminbi (RMB) into US$ in this press release is based on the exchange rate set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System as of June 28, 2024, which was RMB7.2672 to US$1.00. The percentages stated in this press release are calculated based on the RMB amounts.

Non-GAAP Financial Measures

iHuman considers and uses non-GAAP financial measures, such as adjusted operating income, adjusted net income and adjusted diluted net income per ADS, as supplemental metrics in reviewing and assessing its operating performance and formulating its business plan. The presentation of non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). iHuman defines adjusted operating income, adjusted net income and adjusted diluted net income per ADS as operating income, net income and diluted net income per ADS excluding share-based compensation expenses, respectively. Adjusted operating income, adjusted net income and adjusted diluted net income per ADS enable iHuman’s management to assess its operating results without considering the impact of share-based compensation expenses, which are non-cash charges. iHuman believes that these non-GAAP financial measures provide useful information to investors in understanding and evaluating the Company’s current operating performance and prospects in the same manner as management does, if they so choose.

Non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. Non-GAAP financial measures have limitations as analytical tools, which possibly do not reflect all items of expense that affect our operations. Share-based compensation expenses have been and may continue to be incurred in our business and are not reflected in the presentation of the non-GAAP financial measures. In addition, the non-GAAP financial measures iHuman uses may differ from the non-GAAP measures used by other companies, including peer companies, and therefore their comparability may be limited. The presentation of these non-GAAP financial measures is not intended to be considered in isolation from or as a substitute for the financial information prepared and presented in accordance with GAAP.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Statements that are not historical facts, including statements about iHuman’s beliefs and expectations, are forward-looking statements. Among other things, the description of the management’s quotations in this announcement contains forward-looking statements. iHuman may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials, and in oral statements made by its officers, directors or employees to third parties. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: iHuman’s growth strategies; its future business development, financial condition and results of operations; its ability to continue to attract and retain users, convert non-paying users into paying users and increase the spending of paying users, the trends in, and size of, the market in which iHuman operates; its expectations regarding demand for, and market acceptance of, its products and services; its expectations regarding its relationships with business partners; general economic and business conditions; regulatory environment; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in iHuman’s filings with the SEC. All information provided in this press release is as of the date of this press release, and iHuman does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

About iHuman Inc.

iHuman Inc. is a leading provider of tech-powered, intellectual development products in China that is committed to making the child-upbringing experience easier for parents and transforming intellectual development into a fun journey for children. Benefiting from a deep legacy that combines over two decades of experience in the parenthood industry, superior original content, advanced high-tech innovation DNA and research & development capabilities with cutting-edge technologies, iHuman empowers parents with tools to make the child-upbringing experience more efficient. iHuman’s unique, fun and interactive product offerings stimulate children’s natural curiosity and exploration. The Company’s comprehensive suite of innovative and high-quality products include self-directed apps, interactive content and smart devices that cover a broad variety of areas to develop children’s abilities in speaking, critical thinking, independent reading and creativity, and foster their natural interest in traditional Chinese culture. Leveraging advanced technological capabilities, including 3D engines, AI/AR functionality, and big data analysis on children’s behavior & psychology, iHuman believes it will continue to provide superior experience that is efficient and relieving for parents, and effective and fun for children, in China and all over the world, through its integrated suite of tech-powered, intellectual development products.

For more information about iHuman, please visit https://ir.ihuman.com/.

For investor and media enquiries, please contact:

iHuman Inc.

Mr. Justin Zhang

Investor Relations Director

Phone: +86 10 5780-6606

E-mail: ir@ihuman.com

Christensen

In China

Ms. Alice Li

Phone: +86-10-5900-1548

E-mail: alice.li@christensencomms.com

In the US

Ms. Linda Bergkamp

Phone: +1-480-614-3004

E-mail: linda.bergkamp@christensencomms.com

|

iHuman Inc. |

|||||

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

|||||

|

(Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“US$”) |

|||||

|

except for number of shares, ADSs, per share and per ADS data) |

|||||

|

December 31, |

June 30, |

June 30, |

|||

|

2023 |

2024 |

2024 |

|||

|

RMB |

RMB |

US$ |

|||

|

ASSETS |

|||||

|

Current assets |

|||||

|

Cash and cash equivalents |

1,213,767 |

914,474 |

125,836 |

||

|

Time deposits |

– |

214,944 |

29,577 |

||

|

Accounts receivable, net |

60,832 |

52,440 |

7,216 |

||

|

Inventories, net |

16,518 |

19,070 |

2,624 |

||

|

Amounts due from related parties |

1,810 |

1,773 |

244 |

||

|

Prepayments and other current assets |

89,511 |

93,971 |

12,931 |

||

|

Total current assets |

1,382,438 |

1,296,672 |

178,428 |

||

|

Non-current assets |

|||||

|

Property and equipment, net |

6,169 |

4,643 |

639 |

||

|

Intangible assets, net |

23,245 |

20,430 |

2,811 |

||

|

Operating lease right-of-use assets |

3,648 |

2,811 |

387 |

||

|

Long-term investment |

26,333 |

26,333 |

3,624 |

||

|

Other non-current assets |

8,662 |

7,981 |

1,098 |

||

|

Total non-current assets |

68,057 |

62,198 |

8,559 |

||

|

Total assets |

1,450,495 |

1,358,870 |

186,987 |

||

|

LIABILITIES |

|||||

|

Current liabilities |

|||||

|

Accounts payable |

22,139 |

19,925 |

2,742 |

||

|

Deferred revenue and customer advances |

318,587 |

289,927 |

39,895 |

||

|

Amounts due to related parties |

4,428 |

15,164 |

2,087 |

||

|

Accrued expenses and other current liabilities |

143,677 |

91,244 |

12,556 |

||

|

Dividend payable |

– |

30,653 |

4,218 |

||

|

Current operating lease liabilities |

1,927 |

1,788 |

246 |

||

|

Total current liabilities |

490,758 |

448,701 |

61,744 |

||

|

Non-current liabilities |

|||||

|

Non-current operating lease liabilities |

1,933 |

1,083 |

149 |

||

|

Total non-current liabilities |

1,933 |

1,083 |

149 |

||

|

Total liabilities |

492,691 |

449,784 |

61,893 |

||

|

SHAREHOLDERS’ EQUITY |

|||||

|

Ordinary shares (par value of US$0.0001 per share, |

185 |

185 |

25 |

||

|

Additional paid-in capital |

1,088,628 |

995,474 |

136,982 |

||

|

Treasury stock |

(16,665) |

(21,788) |

(2,998) |

||

|

Statutory reserves |

8,164 |

8,164 |

1,123 |

||

|

Accumulated other comprehensive income |

17,955 |

20,549 |

2,828 |

||

|

Accumulated deficit |

(140,463) |

(93,498) |

(12,866) |

||

|

Total shareholders’ equity |

957,804 |

909,086 |

125,094 |

||

|

Total liabilities and shareholders’ equity |

1,450,495 |

1,358,870 |

186,987 |

||

|

iHuman Inc. |

|||||||||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||||||||

|

(Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“US$”) |

|||||||||||||

|

except for number of shares, ADSs, per share and per ADS data) |

|||||||||||||

|

For the three months ended |

For the six months ended |

||||||||||||

|

June 30, |

March 31, |

June 30, |

June 30, |

June 30, |

June 30, |

June 30, |

|||||||

|

2023 |

2024 |

2024 |

2024 |

2023 |

2024 |

2024 |

|||||||

|

RMB |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|||||||

|

Revenues |

240,993 |

235,003 |

215,107 |

29,600 |

506,196 |

450,110 |

61,938 |

||||||

|

Cost of revenues |

(70,160) |

(66,892) |

(63,372) |

(8,720) |

(149,796) |

(130,264) |

(17,925) |

||||||

|

Gross profit |

170,833 |

168,111 |

151,735 |

20,880 |

356,400 |

319,846 |

44,013 |

||||||

|

Operating expenses |

|||||||||||||

|

Research and development expenses |

(63,412) |

(67,923) |

(57,219) |

(7,874) |

(125,085) |

(125,142) |

(17,220) |

||||||

|

Sales and marketing expenses |

(40,564) |

(54,995) |

(51,263) |

(7,054) |

(80,999) |

(106,258) |

(14,622) |

||||||

|

General and administrative expenses |

(25,982) |

(27,724) |

(24,426) |

(3,361) |

(52,717) |

(52,150) |

(7,176) |

||||||

|

Total operating expenses |

(129,958) |

(150,642) |

(132,908) |

(18,289) |

(258,801) |

(283,550) |

(39,018) |

||||||

|

Operating income |

40,875 |

17,469 |

18,827 |

2,591 |

97,599 |

36,296 |

4,995 |

||||||

|

Other income, net |

8,132 |

9,010 |

9,410 |

1,295 |

14,214 |

18,420 |

2,535 |

||||||

|

Income before income taxes |

49,007 |

26,479 |

28,237 |

3,886 |

111,813 |

54,716 |

7,530 |

||||||

|

Income tax expenses |

(6,933) |

(4,177) |

(3,574) |

(492) |

(16,093) |

(7,751) |

(1,067) |

||||||

|

Net income |

42,074 |

22,302 |

24,663 |

3,394 |

95,720 |

46,965 |

6,463 |

||||||

|

Net income per ADS: |

|||||||||||||

|

– Basic |

0.80 |

0.42 |

0.47 |

0.06 |

1.81 |

0.89 |

0.12 |

||||||

|

– Diluted |

0.77 |

0.41 |

0.45 |

0.06 |

1.75 |

0.86 |

0.12 |

||||||

|

Weighted average number of ADSs: |

|||||||||||||

|

– Basic |

52,804,594 |

52,729,148 |

52,496,541 |

52,496,541 |

52,878,535 |

52,612,845 |

52,612,845 |

||||||

|

– Diluted |

54,725,528 |

54,691,599 |

54,295,419 |

54,295,419 |

54,744,139 |

54,493,509 |

54,493,509 |

||||||

|

Total share-based compensation expenses included in: |

|||||||||||||

|

Cost of revenues |

70 |

40 |

26 |

4 |

168 |

66 |

9 |

||||||

|

Research and development expenses |

1,142 |

457 |

348 |

48 |

1,780 |

805 |

111 |

||||||

|

Sales and marketing expenses |

59 |

46 |

45 |

6 |

438 |

91 |

13 |

||||||

|

General and administrative expenses |

1,160 |

301 |

392 |

54 |

2,452 |

693 |

95 |

||||||

|

iHuman Inc. |

|||||||||||||

|

UNAUDITED RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|||||||||||||

|

(Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“US$”) |

|||||||||||||

|

except for number of shares, ADSs, per share and per ADS data) |

|||||||||||||

|

For the three months ended |

For the six months ended |

||||||||||||

|

June 30, |

March 31, |

June 30, |

June 30, |

June 30, |

June 30, |

June 30, |

|||||||

|

2023 |

2024 |

2024 |

2024 |

2023 |

2024 |

2024 |

|||||||

|

RMB |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|||||||

|

Operating income |

40,875 |

17,469 |

18,827 |

2,591 |

97,599 |

36,296 |

4,995 |

||||||

|

Share-based compensation expenses |

2,431 |

844 |

811 |

112 |

4,838 |

1,655 |

228 |

||||||

|

Adjusted operating income |

43,306 |

18,313 |

19,638 |

2,703 |

102,437 |

37,951 |

5,223 |

||||||

|

Net income |

42,074 |

22,302 |

24,663 |

3,394 |

95,720 |

46,965 |

6,463 |

||||||

|

Share-based compensation expenses |

2,431 |

844 |

811 |

112 |

4,838 |

1,655 |

228 |

||||||

|

Adjusted net income |

44,505 |

23,146 |

25,474 |

3,506 |

100,558 |

48,620 |

6,691 |

||||||

|

Diluted net income per ADS |

0.77 |

0.41 |

0.45 |

0.06 |

1.75 |

0.86 |

0.12 |

||||||

|

Impact of non-GAAP adjustments |

0.04 |

0.01 |

0.02 |

0.00 |

0.09 |

0.03 |

0.00 |

||||||

|

Adjusted diluted net income per ADS |

0.81 |

0.42 |

0.47 |

0.06 |

1.84 |

0.89 |

0.12 |

||||||

|

Weighted average number of ADSs – diluted |

54,725,528 |

54,691,599 |

54,295,419 |

54,295,419 |

54,744,139 |

54,493,509 |

54,493,509 |

||||||

|

Weighted average number of ADSs – adjusted |

54,725,528 |

54,691,599 |

54,295,419 |

54,295,419 |

54,744,139 |

54,493,509 |

54,493,509 |

||||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ihuman-inc-announces-second-quarter-2024-unaudited-financial-results-302260944.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ihuman-inc-announces-second-quarter-2024-unaudited-financial-results-302260944.html

SOURCE iHuman Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alibaba, JD.com Strike Deal To Open Ecosystems Amid Slowing Growth And China's Antitrust Pressure

Ahead of the Double Eleven shopping festival, Chinese e-commerce titans Alibaba Group BABA and JD.com Inc. JD have decided to integrate their ecosystems to combat slowing user growth and increased regulatory scrutiny.

What Happened: Chinese e-commerce giants Alibaba Group and JD.com have agreed to open their ecosystems to each other. The deal comes as both companies face slowing user growth and increased antitrust scrutiny from Beijing, Nikkei Asia reported on Friday.

The agreement will see Alibaba’s Taobao and Tmall platforms integrate JD.com’s logistics services. Meanwhile, JD.com will add Alipay, Alibaba’s fintech arm, as a payment option. This move aligns with Beijing’s antitrust directives, sources told Nikkei Asia.

Additionally, JD.com will utilize Cainiao Global Express and Cainiao Stations, which are part of Alibaba’s logistics network. The integration is set to begin in late October, just ahead of the Double Eleven shopping festival.

Currently, JD.com prioritizes JD Pay, UnionPay, and WeChat Pay for transactions. The inclusion of Alipay is expected to enhance payment flexibility for users.

In a separate initiative, Taobao Hong Kong will launch a three-month promotion starting Oct. 1. Orders over 99 yuan will have waived delivery fees, and new users will receive a 300-yuan coupon, according to David Ye, General Manager of Taobao Tmall World.

See Also: Meta Unveils Zuckerberg’s 10-Year Vision With Orion Glasses, Nvidia’s Jensen Huang Rocks Them

Why It Matters: The collaboration between Alibaba and JD.com is significant in the context of their recent competitive maneuvers and regulatory challenges. Earlier this year, both companies engaged in aggressive price cutting in the cloud computing sector, slashing prices by up to 55% on over 100 services to regain market share.

Moreover, the Chinese government has been ramping up antitrust scrutiny on major tech companies, pushing them to open their ecosystems and reduce monopolistic practices. This collaboration aligns with these regulatory directives, aiming to foster a more competitive and open market environment.

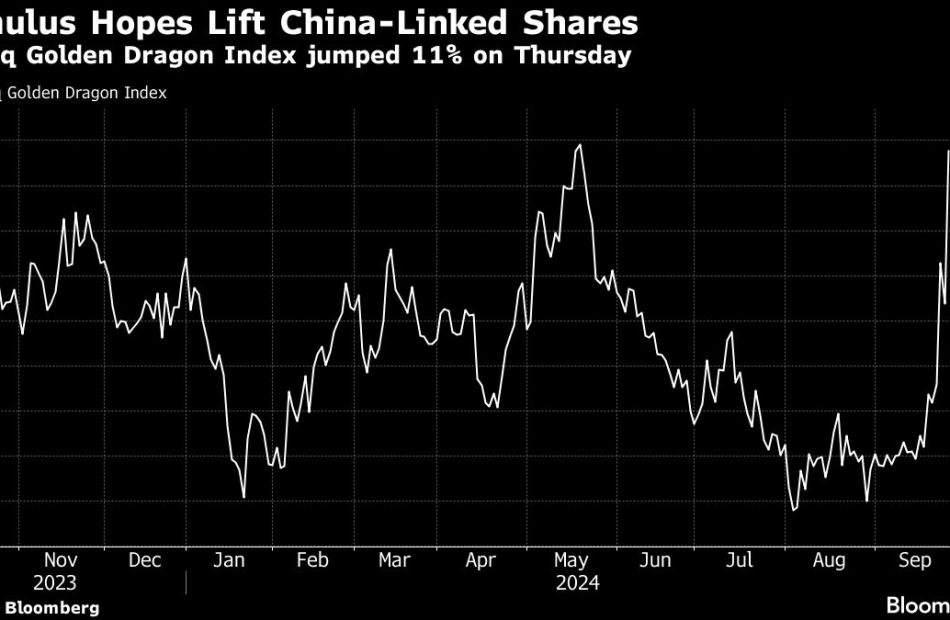

Additionally, both Alibaba and JD.com have seen positive market reactions on Friday following economic stimulus measures announced by China’s central bank. The People’s Bank of China recently reduced the amount of cash banks need to hold and outlined plans to support the struggling property market, boosting investor confidence. As a result, Alibaba’s shares rose by 2.17%, while JD.com’s shares increased by 4.90%.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Surges Over 100 Points; Costco Earnings Top Views

U.S. stocks traded higher this morning, with the Dow Jones index rising more than 100 points on Friday.

Following the market opening Friday, the Dow traded up 0.27% to 42,290.97 while the NASDAQ rose 0.16% to 18,218.51. The S&P 500 also rose, gaining, 0.17% to 5,755.11.

Check This Out: Micron To $150? Here Are 10 Top Analyst Forecasts For Friday

Leading and Lagging Sectors

Energy shares jumped by 0.8% on Friday.

In trading on Friday, consumer staples shares fell by 0.2%.

Top Headline

Costco Wholesale Corp COST reported upbeat earnings for its fourth quarter, while sales missed expectations.

The company reported quarterly revenue of $79.697 billion, missing the consensus estimate of $79.973 billion. The membership-based retailer reported quarterly earnings of $5.29 per share, beating analyst estimates of $5.08 per share, according to Benzinga Pro.

Equities Trading UP

- CN Energy Group. Inc. CNEY shares shot up 109% to $1.21.

- Shares of Onconetix, Inc. ONCO got a boost, surging 78% to $6.03. Altos Venture reported a 32.5% stake in the company as of September 24 in a 13D filing on Thursday.

- Fangdd Network Group Ltd. DUO shares were also up, gaining 38% to $1.47.

Equities Trading DOWN

- Seelos Therapeutics, Inc SEEL shares dropped 23% to $3.8725. Seelos announced postponement of its annual meeting of stockholders.

- Shares of enVVeno Medical Corporation NVNO were down 22% to $3.50 after the company announced the pricing of a $15 million public offering of 4.3 million shares at $3.50 per share.

- Acadia Healthcare Company, Inc. ACHC was down, falling 17% to $62.78 after the company issued a statement stating they are cooperating fully with the authorities regarding a government investigation.

Commodities

In commodity news, oil traded up 0.1% to $67.71 while gold traded down 0.1% at $2,694.70.

Silver traded up 0.4% to $32.480 on Friday, while copper fell 0.5% to $4.6170.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 gained 0.5%, Germany’s DAX climbed 1.2% and France’s CAC 40 jumped 0.6%. Spain’s IBEX 35 Index rose 0.3%, while London’s FTSE 100 rose 0.3%.

The industry confidence indicator in Spain climbed by 2.8 points from the prior month to a reading of -0.7 in September. Industrial producer prices in Italy declined by 0.8% year-over-year in August.

The economic sentiment indicator in the Eurozone slipped to 96.2 in September from 96.5 in August, while services sentiment indicator climbed to a four-month high level of 6.7 in September. The consumer confidence indicator in the Eurozone gained by 0.5 points to -12.9 in September.

Asia Pacific Markets

Asian markets closed mostly higher on Friday, with Japan’s Nikkei 225 jumping 2.32%, Hong Kong’s Hang Seng Index jumping 3.55%, China’s Shanghai Composite Index gaining 2.88% and India’s BSE Sensex falling 0.31%.

Hong Kong’s trade deficit widened to $33.1 billion in August versus $25.6 billion in the year-ago month. The People’s Bank of China slashed the reserve requirement ratio for banks by 50bps.

Economics

- U.S. wholesale inventories increased 0.2% month-over-month to $905.7 billion in August compared to a revised 0.2% rise in the prior month.

- The U.S. trade deficit in goods narrowed to $94.3 billion in August versus a revised $102.8 billion gap in the previous month.

- U.S. personal income rose by 0.2% from the prior month to $24.015 trillion in August compared to a 0.3% gain in the previous month.

- Personal spending rose by 0.2% month-over-month in August.

- The U.S. core PCE price index increased by 0.1% from the prior month in August compared to market estimates of a 0.2% increase and versus the 0.2% gain in the previous month.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ferrellgas Partners, L.P. Reports Full Fiscal Year and Fourth Quarter Fiscal 2024 Results

LIBERTY, Mo., Sept. 27, 2024 (GLOBE NEWSWIRE) — Ferrellgas Partners, L.P. FGPR (“Ferrellgas” or the “Company”) today reported financial results for its fiscal year (“fiscal 2024”) and the fourth fiscal quarter ended July 31, 2024.

For the fourth fiscal quarter, Adjusted EBITDA, a non-GAAP financial measure, increased by $4.6 million, or 16%, to $33.6 million, compared to $29.0 million in the prior year quarter. Gross profit was flat with an increase of $0.4 million. A $7.7 million decrease in general and administrative expense, after adjusting for a $1.8 million decrease in EBITDA adjustments, and a $3.7 million increase in operating expense, were the main drivers of the increase in Adjusted EBITDA for the fourth fiscal quarter as compared to the prior year period.

For fiscal 2024, Adjusted EBITDA decreased by $42.8 million, or 12%, to $317.4 million, compared to $360.2 million in fiscal 2023. Gross profit decreased $24.1 million, or 2%. A $24.1 million increase in operating expense and a $3.7 million decrease in general and administrative expense, after adjusting for a $16.7 million decrease in EBITDA adjustments, also contributed to the decrease in Adjusted EBITDA for fiscal 2024 as compared to fiscal 2023.

In sharing fiscal fourth quarter and fiscal 2024 year end results, Tamria Zertuche, President and Chief Executive Officer of Ferrellgas commented, “Last fall we added over 6,000 accounts to our Blue Rhino branded Tank Exchange business knowing the investment in the first half of the year would pay dividends in the high demand season of the fourth quarter. Blue Rhino EBITDA grew 26% over prior year. However, the real story is in this brand’s supply chain excellence. We are fortunate to have some of the best innovators in the industry helping to create opportunities in efficiencies that drive positive results. Removing multiple days of supply across the nationwide network resulted in material improvement in free cash flow and subsequent decreases in capital expenditures for this business over the prior year. The improvements will sustain continued cash flow advantages for the Company. Regarding our retail business, our focus has been on growing our customer base by targeting specific customer types and geographic locations. As with last quarter, we continued to see additional business closings from the effects of inflation, which contributed to a decrease in retail customers in some areas of our national footprint and these decreases were not fully offset by continued customer gains during the year. The modest increase in plant and other expenses are partially attributed to the opening of six locations in growing regions, which is the result of our focus on weather-agnostic opportunities in coastal regions. Our asset strategy is to re-deploy these reclaimed assets related to closed businesses for gallon growth occurring in future periods. Throughout the fourth quarter our highly experienced retail operations professionals have been supporting our strong commercial business while also focusing on seasonal preparedness. We are grateful to have thousands of drivers, service techs, and managers all making sure we are ready for the coming La Nina winter.”

The fourth fiscal quarter increase of $0.4 million in gross profit was driven by a decrease of $1.9 million, or 1%, in cost of product sold, which was partially offset by a decrease of $1.4 million, or 0.4%, in revenues. Gallons sold for the fourth fiscal quarter decreased 6.1 million, or 4%, as the Company continued to see some business closings and effects of inflation. We will be able to re-deploy assets related to these closed businesses for gallon growth occurring in future periods.

Margin per gallon was favorable with a 4% increase compared to the prior year period. Segment mix, our fixed cost price program for residential customers, and national account pricing improvement continue to drive the trend in margin improvement. The $7.7 million decrease in general and administrative expense noted above was primarily due to a $6.0 million reduction in incentive accruals compared to the prior year period. The $3.7 million increase in operating expense was driven by increases of $5.3 million in plant and other costs and $1.0 million in personnel expense, partially offset by a decrease of $2.6 million in vehicle costs.

The fiscal 2024 decrease of $24.1 million, or 2%, in gross profit was driven by a decrease of $189.3 million, or 9%, in revenues, which was partially offset by a decrease of $165.3 million, or 16%, in cost of product sold. This was primarily due to warmer than normal weather, the 5% decrease in retail customers partially related to the business closings noted above, and lower wholesale propane prices at our two major supply points. The 44.3 million, or 5%, year to date decrease in gallons sold correlates with weather that was 10% warmer than normal and 4% warmer than fiscal 2023. Additionally, our two major supply points had wholesale propane prices that averaged 6% and 9% less in fiscal 2024 compared to fiscal 2023, which contributed to the revenues and cost of product decreases. Margin per gallon was also favorable with an increase of 3% in fiscal 2024 compared to the prior year period due to the positive factors noted above.

The fiscal 2024 $24.1 million increase in operating expense compared to fiscal 2023 was driven by increases of $13.1 million in personnel expense, $5.6 million in vehicle expense, and $5.4 million in plant and other costs. Increases of $11.3 million in medical insurance claims paid under our self-insured benefits plan and $6.6 million in payroll costs, partially offset by a $4.7 million decrease for incentive accruals, comprised the change in personnel expense. The increase in vehicle expense was primarily due to increases of $5.7 million for repairs and maintenance and $0.6 million in telematics technology, partially offset by a decrease in fuel costs. The increase in plant and other costs was primarily due to increases of $4.5 million in miscellaneous expense, $1.5 million for property repairs and network costs, and $1.2 million related to legal and general liability costs. These increases were partially offset by a decrease in credit card fees related to a new payment platform, which charges less in processing fees. The $3.7 million decrease in general and administrative expense noted above was primarily due to a $5.4 million reduction in incentive accruals.

We recognized a net loss attributable to Ferrellgas Partners, L.P. of $20.8 million and $29.1 million in the fourth fiscal quarter of fiscal 2024 and 2023, respectively. We recognized net earnings attributable to Ferrellgas Partners, L.P. of $110.2 million and $136.9 million in fiscal 2024 and 2023, respectively. The changes relate to the factors noted above. Operating income per gallon increased $0.06, or 150%, for the fourth fiscal quarter of fiscal 2024 and decreased $0.02, or 7%, for fiscal 2024 compared to the respective prior year periods.

As noted above, the weather can impact our results. The Company continues to progress in steps to be more weather-agnostic, such as our autogas business in which school districts are fueling buses with clean energy. In July 2024, we completed the installation of an 18,000-gallon tank and autogas pumps which will be used to transport nearly 200,000 students to school this year. The school district’s 38 new autogas-fueled buses will use more than 100,000 gallons of propane a year. We also continue to expand our business in other areas of the country outside of the Midwest, such as our fiscal 2024 acquisition of Eastern Sierra Propane in California. As we seek strategic acquisitions throughout the country, this helps to mitigate the impact of weather conditions in a specific region. We also benefit from our tank exchange brand, Blue Rhino, which thrives during warmer weather as customers seek to enjoy the outdoors. As we see power outages from storms and other events, the Company, with its national distribution network, readily steps up to provide easily accessible portable fuel. Both Blue Rhino and Ferrellgas were on hand to help storm victims and support Operation BBQ Relief by providing propane and tanks to fuel meals for those impacted by the storm and first responders in response to Hurricane Beryl, a category one storm which made landfall in Texas in July 2024, in addition to providing an energy source for those without power. Additionally, Blue Rhino realized savings in both the fourth fiscal quarter and fiscal 2024 in its strategy to refurbish displays for use by its retail partners as well as the implementation of supply chain improvements which reduced our capital expenditures in fiscal 2024.

As a nationwide logistics company, we continue to invest in technology and initiatives to deliver propane to our customers efficiently. In fiscal 2024, we installed more than 10,000 tank monitors on existing residential tanks. We also reduced our skipped stops by 12.6%, which reduced our delivery costs. Our fleet team partnered with national vendors to realize savings in tires, maintenance and short-term rentals. Safety is key to the Company’s operations. Last year, we began the installation of back-up cameras in our vehicles. With over 2,400 cameras installed to date, we have realized a 28% reduction in backing incidents. These initiatives drove the decrease in vehicle costs noted above.

On Friday, September 27, 2024, the Company will conduct a live teleconference on the Internet at https://edge.media-server.com/mmc/p/ur62uncc to discuss the results of operations for the fiscal year ended July 31, 2024. The live webcast of the teleconference will begin at 8:30 a.m. Central Time (9:30 a.m. Eastern Time). Questions may be submitted via the investor relations e-mail box at InvestorRelations@ferrellgas.com or through the webcast portal to be answered during live Q&A.

About Ferrellgas

Ferrellgas Partners, L.P., through its operating partnership, Ferrellgas, L.P., and subsidiaries, serves propane customers in all 50 states, the District of Columbia, and Puerto Rico. Its Blue Rhino propane exchange brand is sold at over 68,000 locations nationwide. Ferrellgas employees indirectly own 1.1 million Class A Units of the partnership, through an employee stock ownership plan. Ferrellgas Partners, L.P. filed an Annual Report on Form 10-K for the fiscal year ended July 31, 2024, with the Securities and Exchange Commission on September 27, 2024. Investors can request a hard copy of this filing free of charge and obtain more information about the partnership online at www.ferrellgas.com.

Cautionary Note Regarding Forward-Looking Statements

Statements included in this release concerning current estimates, expectations, projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are forward-looking statements as defined under federal securities laws. These statements often use words such as “anticipate,” “believe,” “intend,” “plan,” “projection,” “forecast,” “strategy,” “position,” “continue,” “estimate,” “expect,” “may,” “will,” or the negative of those terms or other variations of them or comparable terminology. A variety of known and unknown risks, uncertainties and other factors could cause results, performance, and expectations to differ materially from anticipated results, performance, and expectations, including the effect of weather conditions on the demand for propane; the prices of wholesale propane, motor fuel and crude oil; disruptions to the supply of propane; competition from other industry participants and other energy sources; energy efficiency and technology advances; significant delays in the collection of accounts or notes receivable; customer, counterparty, supplier or vendor defaults; changes in demand for, and production of, hydrocarbon products; inherent operating and litigation risks in gathering, transporting, handling and storing propane; costs of complying with, or liabilities imposed under, environmental, health and safety laws; the impact of pending and future legal proceedings; the interruption, disruption, failure or malfunction of our information technology systems including due to cyber-attack; economic and political instability, particularly in areas of the world tied to the energy industry, including the ongoing conflicts between Russia and Ukraine and in the Middle East; disruptions in the capital and credit markets; and access to available capital to meet our operating and debt-service requirements. These risks, uncertainties, and other factors also include those discussed in the Annual Report on Form 10-K of Ferrellgas Partners, L.P., Ferrellgas, L.P., Ferrellgas Partners Finance Corp., and Ferrellgas Finance Corp. for the fiscal year ended July 31, 2024, and in other documents filed from time to time by these entities with the Securities and Exchange Commission. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this release are made only as of the date hereof. Ferrellgas disclaims any intention or obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by law.

| FERRELLGAS PARTNERS, L.P. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except unit data) |

||||||||

| (unaudited) | ||||||||

| ASSETS | July 31, 2024 | July 31, 2023 | ||||||

| Current assets: | ||||||||

| Cash and cash equivalents (including $10,678 and $11,126 of restricted cash at July 31, 2024 and 2023, respectively) | $ | 124,160 | $ | 137,347 | ||||

| Accounts and notes receivable, net | 120,627 | 159,379 | ||||||

| Inventories | 96,032 | 98,104 | ||||||

| Price risk management asset | 5,925 | 11,966 | ||||||

| Prepaid expenses and other current assets | 28,458 | 29,135 | ||||||

| Total current assets | 375,202 | 435,931 | ||||||

| Property, plant and equipment, net | 604,954 | 615,174 | ||||||

| Goodwill, net | 257,006 | 257,006 | ||||||

| Intangible assets (net of accumulated amortization of $358,895 and $349,614 at July 31, 2024 and 2023, respectively) | 112,155 | 106,615 | ||||||

| Operating lease right-of-use assets | 47,620 | 57,839 | ||||||

| Other assets, net | 61,813 | 58,838 | ||||||

| Total assets | $ | 1,458,750 | $ | 1,531,403 | ||||

| LIABILITIES, MEZZANINE AND EQUITY (DEFICIT) | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 33,829 | $ | 35,115 | ||||

| Current portion of long-term debt | 2,510 | 2,597 | ||||||

| Current operating lease liabilities | 22,448 | 24,600 | ||||||

| Other current liabilities | 184,021 | 197,030 | ||||||

| Total current liabilities | 242,808 | 259,342 | ||||||

| Long-term debt | 1,461,008 | 1,456,184 | ||||||

| Operating lease liabilities | 26,006 | 34,235 | ||||||

| Other liabilities | 27,267 | 29,084 | ||||||

| Contingencies and commitments | ||||||||

| Mezzanine equity: | ||||||||

| Senior preferred units, net of issue discount and offering costs (700,000 units outstanding at July 31, 2024 and 2023) | 651,349 | 651,349 | ||||||

| Equity (Deficit): | ||||||||

| Limited partner unitholders | ||||||||

| Class A (4,857,605 Units outstanding at July 31, 2024 and 2023) | (1,256,946 | ) | (1,205,103 | ) | ||||

| Class B (1,300,000 Units outstanding at July 31, 2024 and 2023) | 383,012 | 383,012 | ||||||

| General partner Unitholder (49,496 Units outstanding at July 31, 2024 and 2023) | (70,080 | ) | (70,566 | ) | ||||

| Accumulated other comprehensive income | 2,025 | 1,059 | ||||||

| Total Ferrellgas Partners, L.P. deficit | (941,989 | ) | (891,598 | ) | ||||

| Noncontrolling interest | (7,699 | ) | (7,193 | ) | ||||

| Total deficit | (949,688 | ) | (898,791 | ) | ||||

| Total liabilities, mezzanine and deficit | $ | 1,458,750 | $ | 1,531,403 | ||||

| FERRELLGAS PARTNERS, L.P. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

||||||||||||||||

| (in thousands, except per unit data) (unaudited) |

||||||||||||||||

| Three months ended | Year ended | |||||||||||||||

| July 31, | July 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenues: | ||||||||||||||||

| Propane and other gas liquids sales | $ | 318,239 | $ | 320,115 | $ | 1,731,439 | $ | 1,916,892 | ||||||||

| Other | 22,213 | 21,771 | 105,677 | 109,573 | ||||||||||||

| Total revenues | 340,452 | 341,886 | 1,837,116 | 2,026,465 | ||||||||||||

| Cost of sales: | ||||||||||||||||

| Propane and other gas liquids sales | 151,191 | 150,958 | 841,490 | 1,003,357 | ||||||||||||

| Other | 1,115 | 3,221 | 12,481 | 15,913 | ||||||||||||

| Gross profit | 188,146 | 187,707 | 983,145 | 1,007,195 | ||||||||||||

| Operating expense – personnel, vehicle, plant & other | 146,689 | 142,948 | 601,602 | 577,520 | ||||||||||||

| Operating expense – equipment lease expense | 5,591 | 5,781 | 21,585 | 23,252 | ||||||||||||

| Depreciation and amortization expense | 24,292 | 23,917 | 98,471 | 93,370 | ||||||||||||

| General and administrative expense | 7,018 | 16,577 | 50,339 | 70,738 | ||||||||||||

| Non-cash employee stock ownership plan compensation charge | 734 | 723 | 3,234 | 2,935 | ||||||||||||

| Loss on asset sales and disposals | 972 | 2,763 | 2,819 | 5,691 | ||||||||||||

| Operating income (loss) | 2,850 | (5,002 | ) | 205,095 | 233,689 | |||||||||||

| Interest expense | (25,018 | ) | (25,229 | ) | (98,223 | ) | (97,712 | ) | ||||||||

| Other income, net | 982 | 760 | 4,491 | 2,625 | ||||||||||||

| (Loss) earnings before income tax expense | (21,186 | ) | (29,471 | ) | 111,363 | 138,602 | ||||||||||

| Income tax (benefit) expense | (25 | ) | 93 | 686 | 981 | |||||||||||

| Net (loss) earnings | (21,161 | ) | (29,564 | ) | 110,677 | 137,621 | ||||||||||

| Net (loss) earnings attributable to noncontrolling interest (1) | (378 | ) | (463 | ) | 461 | 740 | ||||||||||

| Net (loss) earnings attributable to Ferrellgas Partners, L.P. | $ | (20,783 | ) | $ | (29,101 | ) | $ | 110,216 | $ | 136,881 | ||||||

| Class A unitholders’ interest in net (loss) earnings | $ | (36,807 | ) | $ | (45,060 | ) | $ | (55,660 | ) | $ | 10,171 | |||||

| Net (loss) earnings per unitholders’ interest | ||||||||||||||||

| Basic and diluted net (loss) earnings per Class A Unit | $ | (7.58 | ) | $ | (9.28 | ) | $ | (11.46 | ) | $ | 2.09 | |||||

| Weighted average Class A Units outstanding – basic and diluted | 4,858 | 4,858 | 4,858 | 4,858 | ||||||||||||

(1) Amounts allocated to the general partner for its 1.0101% interest (excluding the economic interest attributable to the preferred unitholders) in the operating partnership, Ferrellgas, L.P.

| Supplemental Data and Reconciliation of Non-GAAP Items: | ||||||||||||||||

| Three months ended | Year ended | |||||||||||||||

| July 31, | July 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Net (loss) earnings attributable to Ferrellgas Partners, L.P. | $ | (20,783 | ) | $ | (29,101 | ) | $ | 110,216 | $ | 136,881 | ||||||

| Income tax (benefit) expense | (25 | ) | 93 | 686 | 981 | |||||||||||

| Interest expense | 25,018 | 25,229 | 98,223 | 97,712 | ||||||||||||

| Depreciation and amortization expense | 24,292 | 23,917 | 98,471 | 93,370 | ||||||||||||

| EBITDA | 28,502 | 20,138 | 307,596 | 328,944 | ||||||||||||

| Non-cash employee stock ownership plan compensation charge | 734 | 723 | 3,234 | 2,935 | ||||||||||||

| Loss on asset sales and disposal | 972 | 2,763 | 2,819 | 5,691 | ||||||||||||

| Other income, net | (982 | ) | (760 | ) | (4,491 | ) | (2,625 | ) | ||||||||

| Severance costs | — | — | — | 644 | ||||||||||||

| Legal fees and settlements related to non-core businesses | 1,510 | 4,477 | 2,990 | 21,751 | ||||||||||||

| Acquisition and related costs (1) | 2,169 | — | 2,169 | — | ||||||||||||

| Business transformation costs (2) | 1,054 | 2,088 | 2,610 | 2,088 | ||||||||||||

| Net (loss) earnings attributable to noncontrolling interest (3) | (378 | ) | (463 | ) | 461 | 740 | ||||||||||

| Adjusted EBITDA (4) | 33,581 | 28,966 | 317,388 | 360,168 | ||||||||||||

| Net cash interest expense (5) | (21,634 | ) | (22,398 | ) | (85,045 | ) | (86,695 | ) | ||||||||

| Maintenance capital expenditures (6) | (7,737 | ) | (4,754 | ) | (21,689 | ) | (20,169 | ) | ||||||||

| Cash paid for income taxes | (204 | ) | (379 | ) | (699 | ) | (1,092 | ) | ||||||||

| Proceeds from certain asset sales | 341 | 73 | 2,310 | 2,152 | ||||||||||||

| Distributable cash flow attributable to equity investors (7) | 4,347 | 1,508 | 212,265 | 254,364 | ||||||||||||

| Less: Distributions accrued or paid to preferred unitholders | 16,232 | 16,251 | 64,778 | 64,314 | ||||||||||||

| Distributable cash flow attributable to general partner and non-controlling interest | (86 | ) | (31 | ) | (4,245 | ) | (5,087 | ) | ||||||||

| Distributable cash flow attributable to Class A and B Unitholders (8) | (11,971 | ) | (14,774 | ) | 143,242 | 184,963 | ||||||||||

| Less: Distributions paid to Class A and B Unitholders (9) | — | — | 99,996 | 49,998 | ||||||||||||

| Distributable cash flow (shortage) excess (10) | $ | (11,971 | ) | $ | (14,774 | ) | $ | 43,246 | $ | 134,965 | ||||||

| Propane gallons sales | ||||||||||||||||

| Retail – Sales to End Users | 84,109 | 87,148 | 563,885 | 602,143 | ||||||||||||

| Wholesale – Sales to Resellers | 47,025 | 50,061 | 199,870 | 205,890 | ||||||||||||

| Total propane gallons sales | 131,134 | 137,209 | 763,755 | 808,033 | ||||||||||||

(1) Non-recurring due diligence related to potential acquisition activities and restructuring costs.

(2) Non-recurring costs included in “Operating, general and administrative expense” primarily related to the implementation of an ERP system as part of our business transformation initiatives.

(3) Amounts allocated to the general partner for its 1.0101% interest (excluding the economic interest attributable to the preferred unitholders) in the operating partnership, Ferrellgas, L.P.

(4) Adjusted EBITDA is calculated as net (loss) earnings attributable to Ferrellgas Partners, L.P., plus the sum of the following: income tax (benefit) expense, interest expense, depreciation and amortization expense, non-cash employee stock ownership plan compensation charge, loss on asset sales and disposals, other income, net, severance costs, legal fees and settlements related to non-core businesses, acquisition and related costs, business transformation costs, and net (loss) earnings attributable to noncontrolling interest. Management believes the presentation of this measure is relevant and useful because it allows investors to view the partnership’s performance in a manner similar to the method management uses, adjusted for items management believes make it easier to compare its results with other companies that have different financing and capital structures. Adjusted EBITDA, as management defines it, may not be comparable to similarly titled measurements used by other companies. Items added into our calculation of Adjusted EBITDA that will not occur on a continuing basis may have associated cash payments. Adjusted EBITDA should be viewed in conjunction with measurements that are computed in accordance with GAAP.

(5) Net cash interest expense is the sum of interest expense less non-cash interest expense and other income, net.

(6) Maintenance capital expenditures include capitalized expenditures for betterment and replacement of property, plant and equipment, and may from time to time include the purchase of assets that are typically leased.

(7) Distributable cash flow attributable to equity investors is calculated as Adjusted EBITDA minus net cash interest expense, maintenance capital expenditures and cash paid for income taxes plus proceeds from certain asset sales. Management considers distributable cash flow attributable to equity investors a meaningful measure of the partnership’s ability to declare and pay quarterly distributions to equity investors, including holders of the operating partnership’s Preferred Units. Distributable cash flow attributable to equity investors, as management defines it, may not be comparable to similarly titled measurements used by other companies. Items added into our calculation of distributable cash flow attributable to equity investors that will not occur on a continuing basis may have associated cash payments. Distributable cash flow attributable to equity investors should be viewed in conjunction with measurements that are computed in accordance with GAAP.

(8) Distributable cash flow attributable to Class A and B Unitholders is calculated as Distributable cash flow attributable to equity investors minus distributions accrued or paid on the Preferred Units and distributable cash flow attributable to general partner and noncontrolling interest. Management considers distributable cash flow attributable to Class A and B Unitholders a meaningful measure of the partnership’s ability to declare and pay quarterly distributions to Class A and B Unitholders. Distributable cash flow attributable to Class A and B Unitholders, as management defines it, may not be comparable to similarly titled measurements used by other companies. Items added to our calculation of distributable cash flow attributable to Class A and B Unitholders that will not occur on a continuing basis may have associated cash payments. Distributable cash flow attributable to Class A and B Unitholders should be viewed in conjunction with measurements that are computed in accordance with GAAP.

(9) The Company did not pay any distributions to Class A Unitholders during any of the periods in fiscal 2024 or fiscal 2023.

(10) Distributable cash flow (shortage) excess is calculated as Distributable cash flow attributable to Class A and B Unitholders minus Distributions paid to Class A and B Unitholders. Distributable cash flow excess, if any, is retained to establish reserves, to reduce debt, to fund capital expenditures and for other partnership purposes, and any shortage is funded from previously established reserves, cash on hand or borrowings under our Credit Facility. Management considers Distributable cash flow (shortage) excess a meaningful measure of the partnership’s ability to effectuate those purposes. Distributable cash flow (shortage) excess, as management defines it, may not be comparable to similarly titled measurements used by other companies. Items added into our calculation of distributable cash flow excess that will not occur on a continuing basis may have associated cash payments. Distributable cash flow excess should be viewed in conjunction with measurements that are computed in accordance with GAAP.

Contacts Investor Relations – InvestorRelations@ferrellgas.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Uranium Energy Corp Files Fiscal 2024 Annual Report

NYSE American: UEC

Transformative Year with Wyoming ISR Production Restart, 100% Unhedged Uranium Exposure and Subsequent Accretive Acquisition of Rio Tinto’s Sweetwater Plant and Wyoming Uranium Assets

Highlights:

- Successful startup of uranium production at the past-producing Christensen Ranch in-situ recovery (“ISR“) operations and Irigaray Central Processing Plant (“CPP“) in Wyoming’s Powder River Basin.

- South Texas hub-and-spoke ISR production platform making strong progress with increased resources at Burke Hollow Project and development plans for the construction of a satellite facility to the Hobson CPP.

- Advancing the Roughrider Project in Canada’s Eastern Athabasca Basin with environmental baseline, technical studies and positive drill results leading to the discovery of Roughrider North, 850 meters northeast of the Roughrider deposit.

- UEC’s attributable resources now total 230.0 million pounds U3O8 in the Measured and Indicated Categories and 102.7 million pounds U3O8 in the Inferred category across all its projects(1), cementing UEC’s status as one of the largest and diversified North American focused uranium companies.

- Over 1,466,000 pounds of U3O8 inventories as of July 31, 2024 valued at $125.3 million at market price(2). Taking deliveries of an additional 700,000 pounds of U3O8 at an average cost of $38.20 per pound through December 2025.

- Approximately $331.5 million of cash, equity holdings(3) and inventory(2) at market prices, and no debt, as of July 31, 2024.

- Landmark agreement with Rio Tinto America Inc. (“Rio Tinto“) to acquire 100% of Rio Tinto’s Sweetwater Plant and a portfolio of uranium mining projects in Wyoming, creating a third U.S. hub-and-spoke ISR production platform within UEC’s pure-play uranium business.

- Achieved a Sustainalytics Rating of 23.8, placing UEC as the leading uranium mining company and in the top 5th percentile of the Diversified Metals and Mining Subindustry as rated by Morningstar Sustainalytics (as of September 2, 2024).

CORPUS CHRISTI, Texas, Sept. 27, 2024 /PRNewswire/ – Uranium Energy Corp UEC, (the “Company” or “UEC“) is pleased to report that it has filed its Annual Report on Form 10-K for the fiscal year ended July 31, 2024 with the U.S. Securities and Exchange Commission (the “SEC“). The Annual Report filing, which includes the Company’s audited consolidated financial statements, related notes thereto and management’s discussion and analysis for its fiscal year 2024, is available for viewing on the SEC’s website at www.sec.gov and on the Company’s website at www.uraniumenergy.com.

Amir Adnani, CEO and President, stated: “Fiscal 2024 proved to be a year of successful transformative growth for UEC with the restart of production at our Christensen Ranch ISR operations in Wyoming. At the same time, we continued to advance our Roughrider and Burke Hollow projects with resource expansions and development programs respectively.”

Mr. Adnani continued: “We are also thrilled with the recent acquisition from Rio Tinto of the fully-licensed Sweetwater Plant and a portfolio of uranium properties, which adds approximately 175 million pounds of historical uranium resources(4). These assets will unlock tremendous value, by establishing our third hub-and-spoke production platform, and cements UEC as the leading uranium developer in Wyoming and the U.S.”

Mr. Adnani concluded, “Global demand for nuclear energy and uranium is surging, highlighted by the proposed Three Mile Island Unit 1 restart to support Microsoft’s AI data center expansion. The U.S. and European Union Russian uranium bans and Russia’s recent signaling of future export restrictions, emphasize the need for reliable domestic supply chains to meet Western nuclear fuel supply requirements. As the demand side pressure increases, UEC remains 100% unhedged. Our balance sheet is debt free with approximately $331.5 million in cash, equity holdings and inventory at market prices on July 31, 2024, providing the financial strength to rapidly expand and develop our U.S. ISR production platforms and Canadian assets, including the Roughrider Project.”

Notes:

|

(1) |

The noted resource estimates represent the combined totals for the Company’s uranium projects. Please see the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2024 for further information regarding such estimates, including the methodologies, assumptions and other important information. |

|

(2) |

Based on spot price quoted on UxC CVD as of July 31, 2024. |

|

(3) |

Based on closing prices as of July 31, 2024. |

|

(4) |

Based upon internal studies and other historic data prepared by prior owners in regards to the projects and dated between 1984 and 2019. Such estimates are being treated by the Company as historical in nature and a qualified person has not done sufficient work to classify the historical estimates as current mineral resources. The Company is not treating them as current resource estimates and is disclosing these historic estimates for illustrative purposes and to provide readers with relevant information regarding the projects. In addition, such estimates were not prepared for disclosure under S-K 1300 standards and the results of future estimates by the Company may vary from these historic estimates. |

The technical information in this news release has been reviewed and approved by Chris Hamel, P.Geo., Vice President Exploration, Canada, for the Company, being a Qualified Person as defined by Regulation S-K 1300.

About Uranium Energy Corp

Uranium Energy Corp is the fastest growing supplier of the fuel for the green energy transition to a low carbon future. UEC is the largest, diversified North American focused uranium company, advancing the next generation of low-cost, environmentally friendly ISR mining uranium projects in the United States and high-grade conventional projects in Canada. The Company has two production-ready ISR hub and spoke platforms in South Texas and Wyoming. These two production platforms are anchored by fully operational Central Processing Plants (“CPPs”) and served by seven U.S. ISR uranium projects with all their major permits in place. In August 2024, production began at the Christensen Ranch project in Wyoming, sending uranium loaded resin to the CPP at Irigaray (Wyoming hub). Additionally, the Company has diversified uranium holdings including: (1) one of the largest physical uranium portfolios of U.S. warehoused U3O8; (2) a major equity stake in Uranium Royalty Corp., the only royalty company in the sector; and (3) a Western Hemisphere pipeline of resource stage uranium projects. The Company’s operations are managed by professionals with decades of hands-on experience in the key facets of uranium exploration, development and mining.

Stock Exchange Information:

NYSE American: UEC

WKN: AØJDRR

ISN: US916896103

Safe Harbor Statement

Except for the statements of historical fact contained herein, the information presented in this news release constitutes “forward-looking statements” as such term is used in applicable United States and Canadian securities laws. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as “forward-looking statements”. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the actual results of exploration activities, variations in the underlying assumptions associated with the estimation or realization of mineral resources, future mineral resource estimates may vary from historic estimates, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, accidents, labor disputes and other risks of the mining industry including, without limitation, those associated with the environment, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, title disputes or claims limitations on insurance coverage. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Many of these factors are beyond the Company’s ability to control or predict. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company’s filings with the Securities and Exchange Commission. For forward-looking statements in this news release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities.

![]() View original content:https://www.prnewswire.com/news-releases/uranium-energy-corp-files-fiscal-2024-annual-report-302260962.html

View original content:https://www.prnewswire.com/news-releases/uranium-energy-corp-files-fiscal-2024-annual-report-302260962.html

SOURCE Uranium Energy Corp

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

WeRide Drives Into Uber Partnership, As U.S. Listing Plan Idles

Key Takeaways:

- WeRide and Uber have launched a partnership starting in the UAE, which will see Uber app users get the option of ordering rides in WeRide’s robotaxis by year-end

- WeRide halted its $400 million U.S. listing at the 11th hour in August, but could try to relaunch it by year-end after getting new approval from China’s securities regulator

By Doug Young

Its New York IPO may be sidelined for the moment, but that doesn’t mean robotaxi operator WeRide Inc. is just sitting idly on the roadside.

The company suffered an embarrassing setback in August when its IPO, which was set to become one of the largest by a Chinese company in New York in the last three years, was suddenly derailed at the 11th hour. It’s been largely quiet on the matter since then, though it has continued to file updated materials with the U.S. securities regulator, including an updated prospectus filed on Wednesday this week.

But financials aside, the company once again showcased its position as a leader in the autonomous driving space, also on Wednesday, by announcing a new strategic partnership with leading shared ride operator Uber UBER. That partnership looks quite significant, adding not only Uber’s brand to WeRide’s worldwide fleet of robotaxis, but potential to become a major new source of business.

Such tie-ups will be important for WeRide as it tries to generate some serious revenue with the commercialization of its technology. The company generated just 150 million yuan ($21 million) in the first half of this year and 402 million yuan in 2023 – hardly impressive for a company that was worth $5.1 billion at the time of its last fundraising. By comparison, it spent 517 million yuan on R&D in the first six months of this year alone, roughly equal to its revenue for the 18 months to June.

WeRide and Uber called their alliance “a strategic partnership to bring WeRide’s autonomous vehicles onto the Uber platform, beginning in the United Arab Emirates.” They added that the service will launch by the end of this year, and that Uber users will be given the option of choosing a WeRide driverless robotaxi when requesting rides in the UAE.

WeRide currently has autonomous driving permits for its fleet of robotaxis in China, Singapore, the UAE and the U.S., and operates in 30 cities in seven countries across Asia, the Middle East and Europe. Notably, the latest announcement says that Uber and WeRide do not “contemplate any launches in the United States or China.” What’s more, WeRide’s robotaxis are still in the testing phase in the few other markets where it has permits, meaning the Uber partnership will likely be relatively limited for now.

“It’s clear that the future of mobility will be increasingly shared, electric, and autonomous, and we look forward to working with leading (autonomous vehicle) companies like WeRide to help bring the benefits of autonomous technology to cities around the world,” said Uber CEO Dara Khosrowshahi in announcing the partnership.

The announcement added some positive fuel to WeRide’s story, keeping its name in the headlines after its embarrassing last-minute decision to delay in its U.S. IPO. The company is vying for attention in an increasingly crowded field of Chinese autonomous driving concept stocks, including Hong Kong-listed iMotion (1274.HK) and U.S-listed Hesai HSAI.

In addition, Toyota-backed robotaxi startup Pony.ai and BYD-backed autonomous driving software company Momenta have both been green-lighted by the Chinese securities regulator to make U.S. IPOs. And auto chip designers Horizon Robotics and Black Sesame Technology have applied to list in Hong Kong.

Unclear Road Ahead For IPO

WeRide was green-lighted by China’s securities regulator for a U.S. listing in August last year, fulfilling a mandatory step for all Chinese companies looking to make overseas IPOs. It made its first public filing with the U.S. securities regulator in late July this year, and was set to make its trading debut the week of Aug. 19.

The listing would have raised more than $400 million, including up to $120 million from the sale of 6.5 million American depositary shares (ADS) for between $15.50 and $18.50. WeRide said that global auto parts giant Robert Bosch had indicated an interest in buying about $100 million worth of the IPO shares, equal to 90% or more of the stock being offered. The rest of the fundraising would have come through another $320 million in concurrent private placements, led by a $100 million investment from Alliance Ventures, the venture capital fund of the Renault Nissan Mitsubishi alliance.

Such major commitments were an important signal of confidence in a market where sentiment was relatively weak at the time, showing WeRide would only need to find other investors to buy a very small amount of its stock. That should have been quite easy, considering the listing’s underwriters included the A-list trio of Morgan Stanley, JPMorgan and China’s own CICC.

But then the listing date came and went without any trading debut. The company later explained that: “Updating transaction documents is currently taking longer than expected, and WeRide is working to complete the documentation necessary to move forward with the transaction.”

Unfortunately for the company, it failed to complete its listing by Aug. 25, the date its approval from China’s securities regulator expired. In its latest U.S. filing on Wednesday, WeRide acknowledged the expiration of its earlier application and said it has already resubmitted an updated application with the China Securities Regulatory Commission (CSRC).

“We would not be able to complete this offering and listing before the CSRC completes its review of our updated filing materials and issues a new filing notice,” it said, without indicating when it thought it might receive a new green light. The approval process is relatively new, launched in March last year, and appears to usually take a few months. But it’s possible WeRide’s new application could get the green light more quickly since it only includes updated information of a previously approved application.

The company was relatively cash rich, with 1.8 billion yuan in its coffers at the end of June. That seems to show it’s not in any imminent danger of running out of funds, and that the rush to list in August was tied to the expiration of its CSRC approval.

The new Uber announcement looks at least partly timed to keep the company’s name in the headlines, hinting at the potential of this future partnership as WeRide tries to sell its story to investors outside its inner circle. Given the current situation, we wouldn’t be surprised to see the CSRC give relatively speedy new approval for the listing, and for WeRide to potentially try to relaunch and complete its IPO by the end of the year.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If You Invested $1000 In Bitcoin, Dogecoin, And Shiba Inu Exactly A Year Ago, This Crypto Would Give You The Best Returns Today