Meet the Stock Doubling Warren Buffett's Initial Investment From Dividend Income Alone Every 21 Months

Few investors command Wall Street’s attention quite like the aptly dubbed “Oracle of Omaha,” Warren Buffett. Since taking over as the CEO of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) in the mid-1960s, he’s practically doubled up the annualized total return of the benchmark S&P 500, and generated an aggregate return of more than 5,500,000% in his company’s Class A shares (BRK.A). Returns of this magnitude are going to create quite the following on Wall Street.

For decades, Buffett has been, with few exceptions, an open book. At Berkshire Hathaway’s annual shareholder meetings, he willingly shares his opinions and wisdom on the U.S. economy, the stock market, and occasionally some of Berkshire Hathaway’s individual holdings. Mirroring what the Oracle of Omaha does from a trading standpoint has been a profitable investment strategy for decades.

But among the multitude of factors that have made Warren Buffett such a successful investor, the one that consistently fails to get enough credit is his love of dividend stocks. Adding income stocks to Berkshire’s roughly 43-stock, $316 billion investment portfolio has been vital to the company’s success.

Dividend stocks have a rich history of outperformance

On the surface, it’s easy to understand why dividend stocks have been, collectively, unstoppable over the long run. Companies that willingly share a percentage of their earnings with investors on a regular basis tend to be recurringly profitable, time-tested, and can almost always provide transparent long-term growth outlooks. In other words, they’re the types of businesses we’d expect to increase in value over time and rarely cost investors a night’s sleep.

But aside from being predictable, dividend stocks have vastly outperformed non-payers over long periods.

In The Power of Dividends: Past, Present, and Future, the investment advisors at Hartford Funds, in collaboration with Ned Davis Research, examined the numerous ways income stocks have outpaced non-paying public companies over the long run. In particular, researchers found that dividend payers averaged a 9.17% annual return over 50 years, which was more than double the 4.27% average annual return for non-payers from 1973 through 2023.

Additionally, researchers showed that dividend stocks crushed the non-payers while being considerably less volatile. Whereas income stocks were 6% less volatile than the benchmark S&P 500 over the last half-century, non-payers were 18% more volatile.

Perhaps it’s no surprise that a majority of Berkshire Hathaway’s holdings pay a dividend. Even after Buffett sold a significant percentage of Berkshire’s stake in Apple and Bank of America in 2024, his company is on track to collect in the neighborhood of $5 billion in dividend income over the next 12 months.

Although energy stock Occidental Petroleum has worked its way into the top spot in terms of annual income generation for Berkshire Hathaway, it’s far from being Buffett’s highest-yielding company, relative to cost.

Warren Buffett doubles his money on this stock from the dividend income alone every seven quarters

Thanks to the long-term ethos instilled by the late Charlie Munger, Berkshire’s portfolio is home to a number of stocks that have been held for 10 or more years. However, no company has been a fixture in Warren Buffett’s portfolio quite like “forever” holding Coca-Cola (NYSE: KO).

Coca-Cola has been a continuous holding by Berkshire since 1988, with Buffett’s company enjoying an enviable cost basis of roughly $3.2475 per share.

What’s noteworthy about Coca-Cola is that it’s raised its base annual payout for 62 consecutive years. Even though its current base annual dividend of $1.94 per share equates to a 2.7% yield for today’s buyers, Buffett’s company is absolutely rolling in the dough thanks to its low cost basis. The approximately 60% annual yield Berkshire Hathaway is generating on its stake in Coca-Cola, relative to its cost basis, ensures that the dividend income alone doubles Buffett’s initial investment in the beverage giant (about $1.3 billion) every seven quarters (21 months).

One of the reasons Coca-Cola has been able to deliver such consistent dividend growth for more than six decades is because it’s a consumer staples stock. Consumer staples, such as food and beverages, are going to be purchased no matter how well or poorly the U.S. or global economy are performing. This leads to predictable operating cash flow in any climate.

Another sustained growth catalyst for Coca-Cola is its virtually unparalleled geographic sales diversity. Aside from Cuba, North Korea, and Russia — the latter has to do with its invasion of Ukraine — Coca-Cola has operations in every other country. This means it can lean on higher-growth emerging markets to move its organic growth needle, and also generates highly predictable cash flow from its core developed markets.

Branding is the other key puzzle piece to Coca-Cola’s ongoing success and rock-solid dividend. The annual “Brand Footprint” report from Kantar finds that Coca-Cola’s brand has been the most-purchased by consumers for an astounding 12 consecutive years.

The company’s branding is also buoyed by a stellar marketing team, which relies on artificial intelligence (AI) and digital media to connect with younger consumers, and leans into Coca-Cola’s rich history and well-known brand ambassadors to engage with its more mature audience.

With Warren Buffett overseeing the collection of $776 million in dividend income each year from Berkshire’s stake in Coca-Cola, there’s simply no reason for this supercharged-yielding position to ever be sold.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Meet the Stock Doubling Warren Buffett’s Initial Investment From Dividend Income Alone Every 21 Months was originally published by The Motley Fool

SpaceX's Starlink Now Connects 4M Customers With More Than 6K Operational Satellites, Adds A Million Users In 4 Months

Elon Musk‘s SpaceX said on Thursday that its Starlink satellite internet service is providing connectivity to over 4 million people around the globe.

What Happened: The company made the announcement via a post on social media platform X, adding that the 4 million Starlink customers are spread across over 100 countries, territories, and other markets.

Starlink announced that it is connecting over 3 million customers merely a few months back on May 20, implying that the segment added a million customers in just 4 months.

Starlink first hit a million subscribers in December 2022 after starting limited beta internet service in 2020.

Why It Matters: Starlink uses a constellation of satellites in low-Earth orbit to provide connectivity to customers including airlines. Earlier this month, SpaceX launched its 7000th Starlink satellite into space. Of these, over 6000 are working, according to data kept by astronomer Jonathan McDowell.

Earlier on Thursday, Air France said that it will start rolling out onboard Wi-Fi service in all its aircraft with Starlink from 2025.

“During the flight, customers will be able to easily stay in touch with friends and family, follow all the world’s news live, play video games online, and of course stream TV, films, and series,” the airline company said. “The service will be accessible from smartphones, digital tablets, and laptops, and each customer will be able to connect several devices simultaneously.”

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read More:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Declaring Los Angeles as the Leading Design Hotspot, Dwell Launches New Home Tours

The LA event offers attendees in-person tours of three architecturally outstanding private residences and Frank Lloyd Wright’s Hollyhock House

LOS ANGELES, Sept. 26, 2024 /PRNewswire/ — This fall, Dwell will relaunch its exclusive and highly popular home tours of some of the most innovative residences in America. The first event will be held on Saturday, October 19th, from 9 a.m. to 3:30 p.m. PDT, and up to 300 guests will have the opportunity to tour three remarkable structures that represent the future of home design on the Eastside of Los Angeles.

The ticketed three-hour event also includes a one-year subscription or renewal to Dwell.com and Dwell magazine, an exclusive gift bag, a coffee meetup from Canyon Coffee to kick off the tour and meet fellow attendees, and first access to future Home tours. Additional stops on the tour include Frank Lloyd Wright’s Hollyhock House, where guests will check in and explore the grounds before the event starts. A portion of proceeds from ticket sales will be made to the Barnsdall Art Park Foundation to support the continued preservation of the Hollyhock House.

“It’s no secret that Los Angeles currently has one of the most dynamic design scenes in the country,” says William Hanley, Dwell’s Editor-in-Chief. “The three very different homes we’ve chosen for the tour each demonstrate why what people are building in LA is so exciting right now. Our editorial team has specifically chosen them because of the architects and designers’ commitment to the city’s famed spirit of experimentation.”

The three private residences featured on the tour represent new thinking about residential design, and provide attendees with a diverse range of themes, styles, and architectural challenges:

- Atwater House, Atwater Village: One half of the daring and playfully irreverent architecture firm Design, Bitches, Rebecca Rudolph, and her husband Collin Thompson of Gensler, just completed their own home. Since the project began nearly 25 years ago it has served as a testing ground for new ideas.

- Renovated Craftsman, Los Feliz: Architect Chet Callahan renovated his own historic home, a craftsman dating from somewhere between 1895 and 1905, preserving its original detail while adding a bold, contemporary addition.

- Abbott Hill House, Highland Park: Designer Isaac Resnikoff and Lizz Wasserman built the perfect perch in Highland Park on a steep site with sustainability in mind. It’s a casually artistic home designed by Lizz’s architect father and landscape architect mother. It’s a beautiful blend of aesthetics and ecology.

Tickets are sold at specified time slots offered between 9 AM and 3:30 PM, check-in will take place outside of the entrance of Hollyhock House at Barnsdall Park, beginning at 9:00am PDT. Attendees will have opportunities to hear from Dwell’s editorial team and the homeowners throughout the day. Tickets and more information can be found here.

ABOUT DWELL

Dwell’s mission is simple: We champion home design that improves people’s lives. From daily content on Dwell.com to our social media channels to our celebrated 24-year-old print magazine, we feature new ideas about what a home can and should be, offer expert advice for making your own space a better place to live, and provide a marketplace for the best-designed products available. Dwell is part of Recurrent, a digital media company with over 15 enthusiast brands.

![]() View original content:https://www.prnewswire.com/news-releases/declaring-los-angeles-as-the-leading-design-hotspot-dwell-launches-new-home-tours-302260292.html

View original content:https://www.prnewswire.com/news-releases/declaring-los-angeles-as-the-leading-design-hotspot-dwell-launches-new-home-tours-302260292.html

SOURCE Dwell

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Peter Thiel has now sold $1 billion of Palantir stock this year

(Bloomberg) — Peter Thiel sold almost $600 million of Palantir Technologies Inc. stock this week, bringing his total disposals this year to more than $1 billion.

Most Read from Bloomberg

He sold more than 16 million shares over three days this week, according to a regulatory filing, adding to the 20 million shares he sold in March and May.

Palantir in December disclosed that entities owned by Thiel had adopted the kind of trading plan that public-company executives commonly use to schedule sales. The billionaire planned to sell as many as 20 million shares. In May, the entity adopted a second trading plan encompassing as many as 28.6 million shares, a filing shows.

Filings didn’t disclose why Thiel sold the stock or what he plans to do with the money. He didn’t respond to a request for comment. The 56-year-old co-founded Palantir and has a $12.4 billion fortune, according to the Bloomberg Billionaires Index.

Thiel only sold common equity, not units from the share classes with special voting rights that give him and co-founders Alex Karp and Stephen Cohen control of the board.

Palantir this week was added to the S&P 500. Its shares have more than doubled so far this year.

–With assistance from Biz Carson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

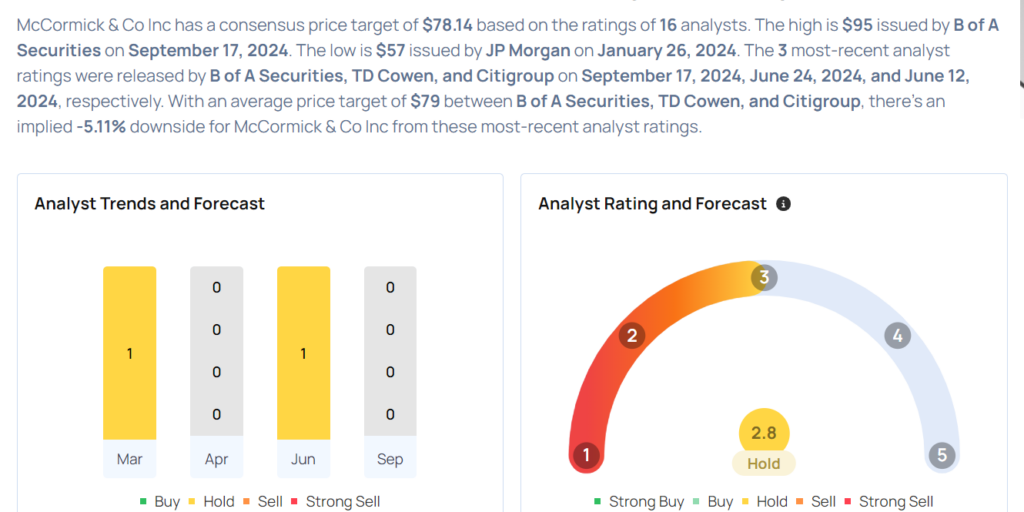

McCormick Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

McCormick & Company, Incorporated MKC will release earnings results for its third quarter, before the opening bell on Tuesday, Oct. 1.

Analysts expect the Hunt Valley, Maryland-based company to report quarterly earnings at 67 cents per share, up from 65 cents per share in the year-ago period. McCormick is projected to post quarterly revenue of $1.67 billion, according to data from Benzinga Pro.

On Sept. 24, the company’s board declared a quarterly dividend of 42 cents per share.

McCormick shares fell 0.2% to close at $83.25 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- TD Cowen analyst Robert Moskow maintained a Hold rating and cut the price target from $75 to $73 on June 24. This analyst has an accuracy rate of 68%.

- Argus Research analyst John Staszak upgraded the stock from Hold to Buy with a price target of $88 on April 2. This analyst has an accuracy rate of 68%.

- Stifel analyst Matthew Smith maintained a Hold rating and boosted the price target from $70 to $75 on March 27. This analyst has an accuracy rate of 70%.

- JP Morgan analyst Ken Goldman maintained an Underweight rating and cut the price target from $59 to $57 on Jan. 26. This analyst has an accuracy rate of 83%.

- Consumer Edge Research analyst Connor Rattigan downgraded the stock from Overweight to Equal-Weight on Jan. 22. This analyst has an accuracy rate of 70%.

Considering buying MKC stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed's Preferred Inflation Gauge Comes In Below Expectations For August, Easing Concerns About Rising Prices

The Federal Reserve’s preferred measure of inflation in August came in below expectations, showing a decline from July’s inflation rate.

According to government data released Friday, the Personal Consumption Expenditures (PCE) Price Index increased by 2.2% in August compared to the same period last year. The reading was below the 2.3% analysts were expecting and a drop from July’s 2.5%.

The core PCE, which excludes volatile food and energy prices, was 2.7% year-over-year in August, matching analyst expectations and 0.1% higher than July’s number.

Personal Income And Outlays For August: Key Highlights

- Personal income increased by $50.5 billion (0.2%) in August, with disposable personal income up $34.2 billion (0.2%) and personal consumption expenditures up $47.2 billion (0.2%).

- The PCE price index rose 0.1% in August, with a 0.1% increase in core inflation excluding food and energy. Real DPI and real PCE both increased by 0.1%.

- Goods spending decreased by $7.6 billion, while services spending surged by $54.8 billion, primarily in housing and financial services. Motor vehicle purchases saw the largest decline in goods.

- The PCE price index is up 2.2% year-over-year, with a 2.7% increase excluding food and energy. Energy prices fell by 5%, while food prices rose by 1.1%.

- Personal saving rate stood at 4.8%, with personal saving totaling $1.05 trillion in August. Personal outlays increased by $48.3 billion.

Market Reactions

The U.S dollar index, as tracked by the Invesco DB USD Index Bullish Fund ETF UUP, rose 0.2% after the release.

Futures on major U.S. equity indices soared in premarket trading Friday. Contracts on the S&P 500, as tracked by the SPDR S&P 500 ETF Trust SPY, were 0.22% higher. Futures on the tech-heavy Nasdaq 100 rose 0.3%, while futures for the Dow Jones Industrial Average, tracked by the SPDR Dow Jones Industrial Average ETF DIA, were 0.17% higher premarket.

Services Drive Inflation Upward

In August, the key drivers of inflation primarily stemmed from an increase in the cost of services, particularly in the housing, financial services, and insurance sectors. These categories saw the most significant price growth, contributing to the overall PCE index rise. Spending on services continued to rise, reflecting both higher demand and increasing service costs. On the other hand, goods experienced a slight decline in prices, which somewhat balanced out the overall inflationary pressure.

Energy prices, particularly for gasoline and other energy-related goods, continued their downward trend in August, moderating overall inflation. Energy prices fell significantly compared to the same time last year, which helped to temper the impact of rising prices in other categories. This was in stark contrast to earlier periods when energy costs had been a more substantial inflationary driver.

Food prices saw a modest increase in August, though their contribution to inflation was relatively mild compared to other categories. The food sector’s price rise was driven mainly by off-premises consumption, such as groceries, while restaurant and dining prices remained more stable. These food price increases, while noticeable, did not have as large of an impact on overall inflation as the service sector did.

Core inflation, which excludes the volatile categories of food and energy, remained steady. This was largely due to persistent price increases in durable goods, like automobiles, and ongoing inflation in service categories. Even though goods prices decreased slightly, the overall inflationary trend was influenced by steady price pressures in essential service sectors, contributing to the sustained core inflation rate in August.

Read Next:

Photo: Shutterstock.

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

IonQ, Biomea Fusion, Rocket Lab USA And Other Big Stocks Moving Higher On Friday

U.S. stocks were higher, with the Dow Jones index gaining around 100 points on Friday.

Shares of IonQ, Inc. IONQ rose sharply during Friday’s session after the company announced it signed a $54.5 million contract with the United States Air Force Research Lab.

IonQ shares surged 20% to $9.67 on Friday.

Here are some other big stocks recording gains in today’s session.

- Biomea Fusion, Inc. BMEA shares jumped 15.5% to $11.05. Biomea Fusion disclosed that the FDA lifted its clinical hold on BMF-219 in Type 2 and Type 1 diabetes trials. Rodman & Renshaw analyst Tony Butler upgraded Biomea Fusion from Neutral to Buy.

- Uxin Limited UXIN surged 14.1% to $3.23.

- AMTD Digital Inc. HKD rose 11.5% to $3.67.

- Rocket Lab USA, Inc. RKLB jumped 11.5% to $9.69. Keybanc analyst Michael Leshock maintained Rocket Lab USA with an Overweight and raised the price target from $8 to $11.

- NANO Nuclear Energy Inc. NNE gained 11.3% to $16.79.

- Certara, Inc. CERT shares jumped 10.5% to $11.82.

- Empire State Realty OP, L.P. ESBA gained 8.4% to $11.50.

- MINISO Group Holding Limited MNSO gained 8.4% to $16.79.

- Dada Nexus Limited DADA climbed 7% to $1.71.

- NIO Inc. NIO gained 6.6% to $6.16.

- Walgreens Boots Alliance, Inc. WBA gained 5.7% to $9.01.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Betting On China As It Brings Out The Big Guns

China Brings Out The Big Guns

As ZeroHedge reported on Thursday, “China’s Bazooka Moment” has arrived. China’s expanded stimulus measures include:

- A September politburo meeting focused on economic measures. According to Goldman strategist Lu Sun, economics is rarely the focus of a September meeting, so this is extraordinary.

- China issuing ¥2 trillion in government bonds (equivalent to 1.7% of its GDP), with half of those proceeds earmarked for consumption-related subsidies.

- China injecting ¥1 trillion into state-owned backs to boost their Tier-1 capital.

In light of that, here are four bets on China we’ve placed in the Portfolio Armor trading Substack, starting with a brief update on the one I mentioned here earlier this week.

Four Trades That Could Benefit From China’s Bazooka Moment

Qifu Technology, Inc. QFIN. This is essentially the Chinese version of Lending Club LC. Our trade here was buying the $25 strike calls on QFIN expiring on January 17th for $2. Those were trading for $4.70 as of Thursday’s close, so you might want to go a little further out of the money if you are buying now.

X Financial XYF. Like QFIN, X offers a peer-to-peer lending platform in China, but X also offers other consumer financial products such as insurance. We bought the underlying shares on this one at $3.95 earlier this year. It closed at $5.45 on Thursday, but probably still has more room to run with the stimulus tailwind.

Hello Group Inc. MOMO. This is a profitable Chinese social media company, which includes a dating app similar to those of America’s Match Group, Inc. MTCH. It also has non-dating apps related to karaoke, etc. This might be the deepest value of the names mentioned here so far, as it currently trades at 0.83x tangible book. Our trade here was buying the $7 strike calls expiring on January 17th for $0.70. Those were trading at $0.85 as of Thursday’s close.

PDD Holdings Inc. PDD. This Chinese company combines elements of America’s Amazon.com, Inc. AMZN and Groupon, Inc. GRPN. Our trade here was buying a $140-$145 call spread expiring on December 20th for $1.60. As of Thursday’s close, the midpoint on that spread was $1.10. To be honest, I had mentally written off this trade after the company’s weak guidance last quarter, but it spiked 13.57% on Thursday. Despite that, it still looks cheap, with a valuation rating of 9 (out of 10) according to Chartmill.

What Happens When The Effects Of China’s Stimulus End?

Each of those names should benefit at least as long as the tailwind from China’s stimulus measures lasts.

If you think ZeroHedge’s prediction below is correct, consider exiting after PDD’s earnings in two months.

If you’d like a heads up when we place our next trade, feel free to subscribe to my trading Substack/occasional email list below.

If you’d like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we’re using that for our occasional emails now).

And you can hedge your long positions using our optimal hedging app.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

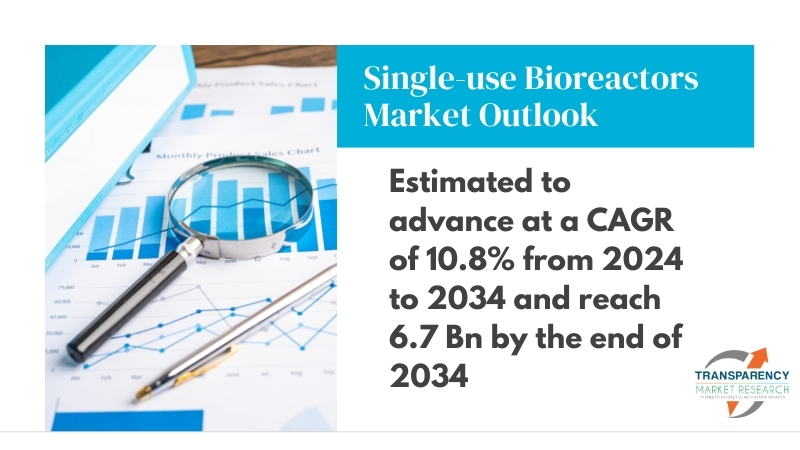

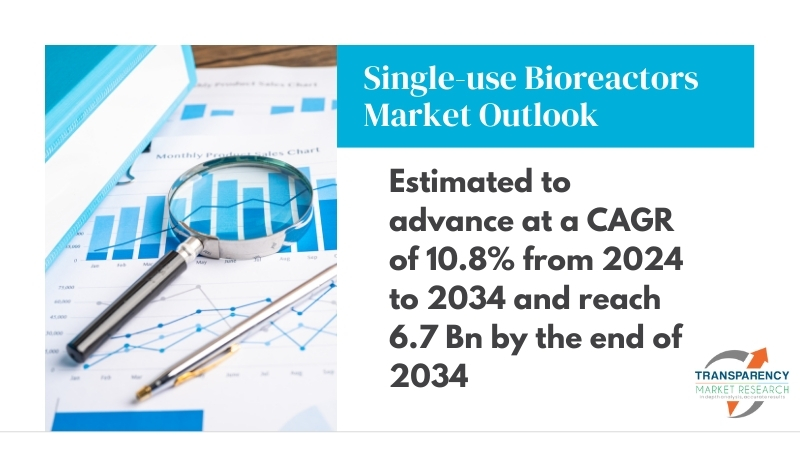

Single-use Bioreactors Market Size is Set to Grow to USD 6.7 Billion by 2034 with a CAGR of 10.8% , Driven by Demand in Food and Industrial Biotechnology | Exclusive Report by Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 26, 2024 (GLOBE NEWSWIRE) — The single-use bioreactors industry (일회용 생물반응기 산업) generated a value of US$ 2.1 billion in 2023. Over the next ten years, the market is expected to expand at a CAGR of 10.8%, reaching 6.7 billion by 2034. Single-use bioreactor operations will be transformed by incorporating digital technologies like IoT, AI, and machine learning into bioprocessing, also known as Bioprocessing 4.0.

Predictive maintenance, process optimization, and quicker decision-making will be made possible by real-time data monitoring and analytics, increasing productivity and cutting expenses.

Single-use bioreactors are expected to find utility in fields other than typical biopharmaceutical manufacturing, like food and beverage production, industrial biotechnology, and agricultural biotechnology. A greater range of companies may be able to afford single-use systems as technology advances and costs come down.

Single-use bioreactor systems that are modular and adjustable will become more in demand as businesses look for ways to be flexible to meet a range of production requirements. Due to their modular architecture, platforms for single-use bioprocessing will be able to easily incorporate extra unit activities, like filtration and purification.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/single-use-bioreactors-market.html

Key Findings of the Market Report

- North America held a majority of the market share in 2023.

- Single-use bioreactor systems are predicted to power market growth.

- Based on cell type, bacterial cells are expected to drive the demand for single-use bioreactors.

- In terms of molecule type, monoclonal antibodies (MABs) will present opportunities in the future.

- As biotechnology companies expand, the market for single-use bioreactors is expected to grow.

Global Single-Use Bioreactors Market: Growth Drivers

- Sterilization and cleaning are expensive with stainless-steel bioreactors but unnecessary with single-use ones. Biopharmaceutical businesses can also save a great deal of money by reducing the possibility of cross-contamination.

- Single-use bioreactors’ flexibility and scalability are higher than conventional bioreactors. They are scaled up or down to satisfy production demands and adjusted to various process requirements. Biopharmaceutical businesses can experience huge changes in product demand, which makes this flexibility particularly useful.

- Continuous improvements in single-use bioreactor technology have increased output, dependability, and quality. Advances like disposable mixing systems, sophisticated control systems, and real-time monitoring sensors have increased the versatility of single-use bioreactors and accelerated their acceptance in various applications.

- The growing need for biologics, biosimilars, and gene and cell therapies is fueling the biopharmaceutical industry’s continued rapid growth. The widespread usage of single-use bioreactors can be attributed to their cost-effective and efficient solution for generating complicated biopharmaceutical products.

- The FDA and EMA have acknowledged Single-use technology as a major advantage in biopharmaceutical production. As a result of their assistance and guidance in installing single-use solutions, they have further accelerated industry acceptance.

Global Single-Use Bioreactors Market: Regional Landscape

- The biopharmaceutical sector is thriving in North America, which has various biologics, biosimilars, and gene therapy markets. As the biotechnology industry expands and manufacturers seek more flexible and affordable ways to produce their products, single-use bioreactors will become increasingly popular.

- Bioprocessing infrastructure, including manufacturing facilities and research institutions, will improve if single-use bioreactors are implemented. Market expansion will be aided by public and private measures to support the biopharmaceutical industry.

- Health Canada and the FDA in the United States are two regulatory bodies in North America that have backed single-use bioprocessing technologies. The region will adopt single-use bioreactors more easily if there are clear regulatory rules and measures to expedite the clearance process for biologics and innovative medicines.

- Technological innovation and biopharmaceutical research are centered in North America. Prominent educational establishments, research hubs, and biotech hubs to propel advancements in single-use bioreactor technology, promoting cooperation and information sharing among industry participants.

- The increasing focus on personalized medicines and precision medicine in North America will increase the need for biomanufacturing systems that are adaptable and scalable, such as single-use bioreactors. These tools provide the quick and economical creation of personalized treatments according to each patient’s requirements.

Global Single-use Bioreactors Market: Key Players

Major market players offer process-optimized products. Microbial bioprocessing requires products well-suited to this process’s nuanced demands. Bioprocess control is made more accessible and dependable with budget-friendly single-use bioreactors from key players in the global market.

- Danaher Corporation

- General Electric Company

- Merck KGaA

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Eppendorf AG

- Parker Hannifin Corporation

- PBS Biotech Inc.

- Distek Inc.

- Getinge

Key Developments

- In January 2023, PBS Biotech (“PBS”), a bioreactor manufacturer with single-use technology and process development services, closed a deal valued at $22 million backed by Avego Management, LLC (“Avego”) and BroadOak Capital Partners (“BroadOak”). In addition to improving the company’s product portfolio, expanding process development capabilities, and increasing customer support for global cell therapy clients, this funding supported the company’s expansion and enhancement of its technical support services.

- In August 2023, Sartorius and Repligen merged their technologies to enhance Sartorius’ Biostat STR® bioreactor via Repligen’s XCell® ATF technology. Both companies believe intensified seed trains and N perfusion are intended to simplify biopharmaceutical manufacturer implementation.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=2108<ype=S

Global Single-use Bioreactors Market: Segmentation

By Product Type

- Single-use Bioreactor Systems

- Media Bags

- Filtration Assemblies

- Others

By Cell Type

- Mammalian Cells

- Bacterial Cells

- Yeast Cells

- Others

By Molecule Type

- Monoclonal Antibodies (MABs)

- Vaccines

- Stem Cells

- Gene-modified Cells

- Others

By End User

- Biopharmaceutical Companies

- Biotechnology Companies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

More Trending Reports by Transparency Market Research –

- Tumor Ablation Market – The global tumor ablation market (종양 절제 시장) was projected to attain US$ 1.3 billion in 2022. It is anticipated to garner a 6.9% CAGR from 2023 to 2031 and by 2031, the market is likely to attain US$ 2.3 billion by 2031.

- Bioprocess Containers Market – The global market for bioprocess containers (바이오프로세스 용기 시장) was estimated to have garnered a global market valuation of around US$ 2.9 billion in 2022. The market is anticipated to grow with a booming 11.1% CAGR from 2022 to 2031 and by 2031, the market is likely to gain US$ 9.3 billion.

- Asia Pacific Single-use Bioprocessing Systems Market – The Asia Pacific single-use bioprocessing systems market (일회용 생물공정 시스템 시장) is expected to increase at a CAGR of 12.50% by 2024.

- ELISA Analyzers Market – The global ELISA analyzers market (ELISA 분석기 시장) is projected to advance at a CAGR of 5.9% from 2023 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why XPeng Stock Spiked Higher Today

Chinese companies have been a focus for investors in recent days. Shares of companies that do business in China have soared after the government announced fresh economic stimulus measures.

Electric vehicle (EV) maker XPeng (NYSE: XPEV) is one likely beneficiary of those support measures. But there are other reasons that investors are becoming more bullish on XPeng. That helped the stock surge as much as 14% Friday morning. As of 1:30 p.m. ET, XPeng shares had pared some of that rise, but held onto a gain of 10%.

Tailwinds for the EV maker

One new bullish take on XPeng’s business just came from Citigroup analysts. The firm boosted its price target on the EV manufacturer as it sees increasing sales on the horizon. That should lead to better financial performance in the medium to long term.

Citi sees sales volumes nearly doubling by 2026, to over 400,000 units. Interest is strong in Xpeng’s soon-to-be-released updated P7 sedan and its Tesla Model 3 rival Mona M03, according to Citi. The EV maker also plans to build a lineup of Extended Range Electric Vehicles (EREVs) in 2025. Those new vehicles include fossil fuel generators to boost the electric battery range.

The timing for those new offerings seems to be ideal. This week, China’s central bank made several moves to boost business investment and aid the real estate market. That included cutting interest rates on existing mortgages as well as cutting the reserve requirement ratio for banks by 50 basis points.

Leadership in China followed that news by promising “necessary fiscal spending” to help meet its economic growth target of about 5%. That news gave investors further confidence that stronger economic growth will resume. That should benefit XPeng at an ideal time as its lineup gains interest. If that sales growth comes to fruition, better financial results will follow. That has investors boosting the stock today.

Should you invest $1,000 in XPeng right now?

Before you buy stock in XPeng, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XPeng wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Howard Smith has positions in Tesla and XPeng. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

Why XPeng Stock Spiked Higher Today was originally published by The Motley Fool