Schwab Splitting Shares for Two-Thirds of ETF Lineup

Schwab Asset Management is splitting shares on two-thirds of its 33 exchange-traded funds, aiming to stimulate sales with lower share prices.

The company announced this week an effort to make 20 of its exchange-traded funds more appealing to financial advisors and retail investors by reducing the net asset values through share splits.

The impacted ETFs, ranging from a 4-for-1 split by the Schwab US Large Cap Growth ETF (SCHG) to a 2-for-1 split by the Schwab International Equity ETF (SCHF), will not change the total value of a shareholder’s investment.

Schwab ETF Split: List of Funds

The list of ETFs subject to share splits, scheduled for Oct. 9, all have current share prices ranging from $40 to $103.

Ticker

Fund

NAV/share

Split Ratio

Schwab U.S. Large-Cap Growth ETF

103.90

4-for-1

Schwab U.S. Dividend Equity ETF

85.02

3-for-1

Schwab U.S. Mid-Cap ETF

83.20

3-for-1

Schwab U.S. Large-Cap Value ETF

80.26

3-for-1

Schwab Fundamental U.S. Large Company ETF

71.55

3-for-1

Schwab Fundamental U.S. Broad Market ETF

70.18

3-for-1

Schwab U.S. Large-Cap ETF

67.74

3-for-1

Schwab U.S. Broad Market ETF

66.39

3-for-1

Schwab Fundamental U.S. Small Company ETF

59.58

2-for-1

Schwab 1000 Index® ETF

55.16

2-for-1

Schwab U.S. TIPS ETF

53.78

2-for-1

Schwab High Yield Bond ETF

53.36

2-for-1

Schwab Municipal Bond ETF

52.33

2-for-1

Schwab U.S. Small-Cap ETF

51.57

2-for-1

Schwab Intermediate-Term U.S. Treasury ETF

50.76

2-for-1

Schwab 1-5 Year Corporate Bond ETF

49.69

2-for-1

Schwab Short-Term U.S. Treasury ETF

49.06

2-for-1

Schwab U.S. Aggregate Bond ETF

47.66

2-for-1

Schwab 5-10 Year Corporate Bond ETF

46.28

2-for-1

Schwab International Equity ETF

40.76

2-for-1

ETF Share Split: What It Means

“ETF share splits are primarily about maintaining or increasing investor accessibility,” said Nate Geraci, founder of The ETF Store in Overland Park, Kans.

“The lower price handle makes it easier for advisors to deploy and manage the ETFs in portfolios, primarily for smaller dollar accounts,” he added. “It also appeals to retail investors, offering the perception of affordability.”

Ryan Jackson, senior manager research analyst at Morningstar, explained that the ETF share splits “don’t matter much for current investors.”

“They don’t affect the overall value of the ETFs or create a taxable event,” he said. “It could improve the liquidity in some instances because more investors may be able to trade them, but that’s a very small-scale benefit. It’s mostly business as usual.”

Scwhab ETF Splits May Increase Demand

Jackson added that share splits are an easy way to potentially increase demand for Schwab’s ETFs.

“Schwab, in particular, has been a hit in the individual investor community, and its lower price could entice even more retail investors to jump on board,” he added.

Schwab Asset Management is the asset management arm of Charles Schwab Corp. in Westlake, Texas.

Schwab has 31 ETFs that combine for $375 billion in assets.

Sumit Roy, etf.com senior ETF analyst, agreed that share splits are “merely cosmetic and don’t change anything for investors, especially in the day of fractional share trading.”

Tim Holsworth, president of AHP Financial in Midland, Mich., thinks most investors and financial advisors have long since seen past the stock split ploy to spark fresh investor interest.

“We know the actual value doesn’t change from splits,” he said. “As a seasoned veteran, it seems to me stock splits used to be a way to increase interest in the shares and it seemed to drive buying, but I don’t think it matters like it used to.”

Trump Seeks to Wipe Out Biggest Debt Costing $112,000 a Day

(Bloomberg) — Donald Trump’s lawyers are on a mission to wipe out his biggest financial liability — a nearly half-billion dollar civil fraud verdict in New York that’s soaring by more than $100,000 every day.

Most Read from Bloomberg

Lawyers for the Republican presidential nominee asked an appeals court Thursday to toss out a $454 million penalty levied against Trump for exaggerating his wealth in banking documents to get better terms on loans. They argue the claims were filed too late by New York authorities and that “clear disclaimers” on Trump’s documents advised banks to do their own assessments of his wealth.

“The disclaimers say what everybody already knows you do in this industry — you do your own due diligence,” Trump attorney John Sauer told a panel of five appellate judges, several of whom appeared open to his arguments.

The fight, just six weeks before Election Day, is playing out as Trump’s wealth has fluctuated wildly amid the rise and fall of his social media startup. His majority stake in Trump Media & Technology Group Corp (DJT) added billions to his net worth earlier this year and created a potential source of cash to pay the fraud penalty. But that windfall has shrunk as the stock has collapsed.

A decision by the Manhattan appellate court isn’t expected before the Nov. 5 election and could take several months. If Trump loses, he can take the case to New York’s highest court and, if necessary, to the US Supreme Court— though doing so could drag out a final decision until 2026.

The appeal is a financial gamble. The verdict, in a suit brought by New York’s attorney general, has accumulated about $23 million in interest costs during Trump’s challenge, bringing the total he owes to roughly $477 million. Further time-consuming appeals could add to that sum.

“We are confident that a fair hearing on the merits of this case will result in a total dismissal of the unconstitutional, unlawful judgment,” Trump campaign spokesman Steven Cheung said in a statement.

The verdict was the biggest liability listed on Trump’s financial disclosure form filed Aug. 13 with the US Office of Government Ethics. It far exceeds his other big debts, including a $160 million Ladder Capital Finance LLC mortgage for his 40 Wall Street skyscraper, and a pair of Axos Bank mortgages totaling $225 million for Trump Tower and Trump National Doral golf course.

The penalty was handed down after a New York judge found Trump had exaggerated his wealth by billions of dollars a year on annual financial documents for more than a decade to get better terms on loans, reaping hundreds of millions of dollars in “ill-gotten” profits. Trump, 78, denies wrongdoing.

Wealth Swings

Jennifer Rodgers, a former federal prosecutor in Manhattan who has tracked Trump’s cases closely, said she thinks Trump has a “decent chance” at getting the penalty at least partially reduced because the method used to calculate ill-gotten profit is “not a hard science.”

During Thursday’s hearing, a majority of the appellate panel focused their questions on the attorney general’s lawyer, Judith Vale. The judges repeatedly asked for explanations about the extent of the attorney general’s power under New York law and why the case had been filed when no banks or consumers lost money. One judge called the size of the penalty “troubling” and asked why the case shouldn’t be seen as “mission creep.”

Vale was also pressed about Trump’s use of disclaimers and the argument that Trump’s conduct had “little to no impact on the public marketplace.”

“There was absolutely a public impact,” Vale said. “When deceptively hidden risks are injected into the market that does hurt the counterparties — and there was harm to the counterparties here — but it also harms other market participants and the market as a whole because they are not understanding the risks.”

The appeal hearing is refocusing attention on Trump’s shifting financial fortunes. His wealth has been driven this year by the share price of Trump Media, which immediately became his biggest asset when it debuted on public markets in March. Trump’s net worth soared by more than $4 billion to $6.5 billion, placing him on the Bloomberg Billionaires Index ranking of the world’s 500 richest people for the first time.

The value of Trump’s stake jumped again when he was granted more shares that were contingent on meeting certain price targets. By early May, Trump was worth $8.8 billion, making him the 293rd-richest person on the planet.

But most of that was on paper because Trump couldn’t sell his shares until the end of a lock-up period, which ended last week. The stock is now down about 80% from it’s high in late March.

Trump is now worth $4.1 billion, according to Bloomberg’s wealth index. He’s vowed not to sell his Trump Media shares, a pledge he kept through Monday, the earliest day such a move would be disclosed.

Trump’s stake is currently worth about $1.6 billion and he still can freely sell millions of shares or use them as collateral for loans. However, experts have pointed to thin trading volumes, potential volatility and regulatory restrictions around rapidly selling shares as a deterrent to Trump using the shares as collateral.

Trump Media shares, by some measures, have been more volatile than Bitcoin and meme stock GameStop Corp. Its 30-day realized volatility sits around 97, more than double Bitcoin’s reading and well above the likes of Elon Musk’s Tesla Inc.

Meanwhile, the billionaire is eying new income sources that could generate quick cash down the road, from $100 silver coins bearing his likeness to a crypto project that he has said will take on traditional banks.

Liabilities, Income

Trump faces other financial liabilities stemming from court decisions. Those include the $83.3 million verdict against Trump in writer E. Jean Carroll’s defamation case, and a separate $5 million verdict in her sexual-abuse lawsuit. His total legal debts are close to $600 million.

The filing with US Office of Government Ethics, which covers Trump’s finances for 2023 and the first four months of 2024, also showed $513 million in income from US resort and residential properties including his Mar-a-Lago and Bedminster clubs. He also reported hundreds of thousands of dollars in revenue from licensing his name and image to promote sales of the “God Bless the USA Bible.”

Additional income streamed in from Trump-branded items including high-top sneakers and non-fungible tokens. He also got about $500,000 from a photo book of his presidency.

Paying the verdict could be complicated if his appeal eventually fails because his real estate holdings are vast but illiquid. Earlier in the case, Trump said he had $400 million to $500 million in cash, but the appeal bond was lowered to $175 million after he said he didn’t have the resources to cover the full amount.

(Updates with details from hearing starting in third paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

3 Ultra-High-Yield Dividend Stocks to Buy Now and Hold at Least a Decade

It will be over a decade before I start relying on dividend income from my stock portfolio. These days, I spend my time looking for businesses that pay juicy dividends, but it takes more than a high yield to get my attention.

I like to invest in successful businesses that offer a high yield upfront and can grow their dividend payouts over time. These three stocks stand out because they offer ultra-high yields upfront and there’s an excellent chance their payouts will continue growing steadily once I’m ready to retire.

W.P. Carey (NYSE: WPC), Pfizer (NYSE: PFE), and Verizon (NYSE: VZ) all offer dividend yields above 5% at recent prices and would do well in just about any income-seeking investor’s portfolio. Here’s how buying them now could lead to heaps of passive income for patient investors.

1. W.P. Carey

W.P. Carey is a real estate investment trust (REIT), which means it can avoid paying income taxes by distributing nearly everything it earns to shareholders as a dividend. This REIT used to lease a lot of office buildings but spun off that operation last year and lowered its dividend payout accordingly.

On Sept. 25, W.P. Carey raised its payout by 1.7% to $0.875 per share. At recent prices, it offers a juicy 5.5% yield, and its dividend program is on steadier footing than you might think.

Funds from operations (FFO) are a proxy for earnings used to evaluate REITs. During each of the past three quarters, W.P. Carey generated adjusted FFO of $1.14 per share or higher. That’s less than it reported before spinning out Net Lease Office Properties, but a lot more than it needs to meet its present dividend obligation.

Now that W.P. Carey is out of the office building business, warehouses and industrial properties are responsible for 64% of the rent it expects to receive in the year ahead. The portfolio is well diversified, with the largest tenant responsible for just 2.5% of annual base rent.

A majority of W.P. Carey’s leases don’t expire until after 2034. With annual rent increases written into those long-term leases, investors can look forward to steady gains in the decade ahead.

2. Pfizer

Shares of Pfizer have been under pressure due to rapidly contracting sales of its COVID-19 vaccine and antiviral treatment. The company has been raising its dividend every year since 2009. At recent prices, it offers a big 5.7% dividend yield.

In the first half, total revenue fell by 11% year over year, but investors can look forward to surging sales in the years ahead. If we ignore COVID-19 products and currency-exchange rates, Pfizer reported second-quarter sales that jumped 14% higher year over year.

These days, COVID-19 products are responsible for just 3% of the company’s total revenue. Without this fierce headwind, Pfizer can probably keep raising its dividend for another 15 years. More than a dozen of its products grew second-quarter sales by 10% or better.

In addition to growing sales of drugs that are already well-established, Pfizer is launching more new treatments than any of its peers. In 2023, the company received U.S. Food and Drug Administration (FDA) approval for a record nine new drugs.

3. Verizon

Recently, Verizon announced its 18th consecutive annual dividend raise. At recent prices, it offers a 6.1% yield.

Verizon is the largest American telecommunications business by revenue. Barriers to entry are so high in this industry that it’s likely to remain one of just three companies with a nationwide 5G network.

Internet and phone subscriptions are Verizon’s main business, but it also sells a lot of smartphones. Equipment sales that are responsible for about 15% of total revenue fell by 6.1% in the first half of 2024.

Despite an equipment-sales headwind, total revenue inched forward by 0.4% in the first half. In the second quarter, broadband sales rose 12.3% year over year, which helped offset declining equipment sales.

Verizon’s broadband success could get a boost soon. The company recently unveiled a plan to acquire Frontier Communications, which has about 2.2 million fiber subscribers spread throughout 25 states. Millions of new broadband subscribers making regular monthly payments are exactly what Verizon needs to keep raising its dividend payout in the decade ahead.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

3 Ultra-High-Yield Dividend Stocks to Buy Now and Hold at Least a Decade was originally published by The Motley Fool

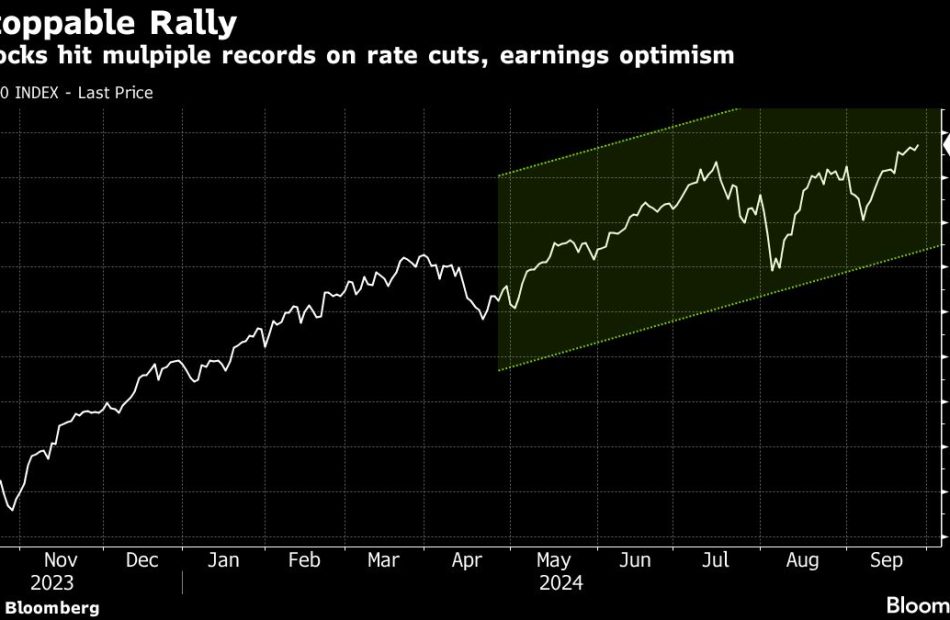

Stock Market’s ‘Goldilocks Zone’ Is in Danger of an Abrupt End

(Bloomberg) — With equities hitting all-time highs and traders growing confident of an economic soft landing, the stock market appears to be in a “Goldilocks zone,” according to Mark Spitznagel, founder and chief investment officer of Universa Investments.

Most Read from Bloomberg

But investors should be wary of second-order effects, such as an economic slowdown that could send the market crashing down abruptly, even as the Federal Reserve cuts interest rates, he said in an interview with Bloomberg Television Thursday. Spitznagel is anticipating a “crush” in global markets until the end of this year, which can be driven by a slowdown in economies.

“When the yield curve disinverts and then unverts, the clock starts ticking and that’s when you enter black swan territory,” said, Spitznagel, whose firm is advised by Black Swan author Nassim Nicholas Taleb. “Black swans always lurk, but now we’re in their territory.”

The S&P 500 Index has hit 42 record highs in 2024, boosted by resilient corporate earnings, the Fed’s rate cutting cycle and expectations that the US economy will be able to avoid a recession. But Spitznagel thinks that the Fed reducing borrowing costs should have investors worried and thinking more about is where stock prices will be next year.

“Gold is going to go down, cryptocurrencies will go down along with risk assets,” he said, adding that bonds could be a place to hide. He also sees a spike in volatility in the months ahead.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Behind the Scenes of Yum China Holdings's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Yum China Holdings YUMC.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with YUMC, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 16 options trades for Yum China Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 68% bullish and 6%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $47,430, and 15, calls, for a total amount of $2,517,328.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $32.5 to $47.5 for Yum China Holdings over the recent three months.

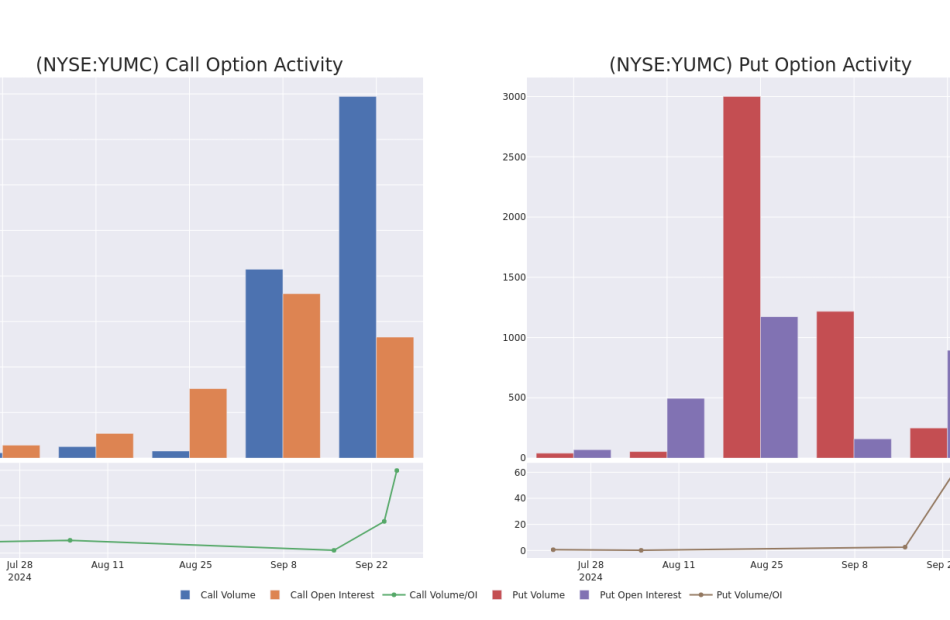

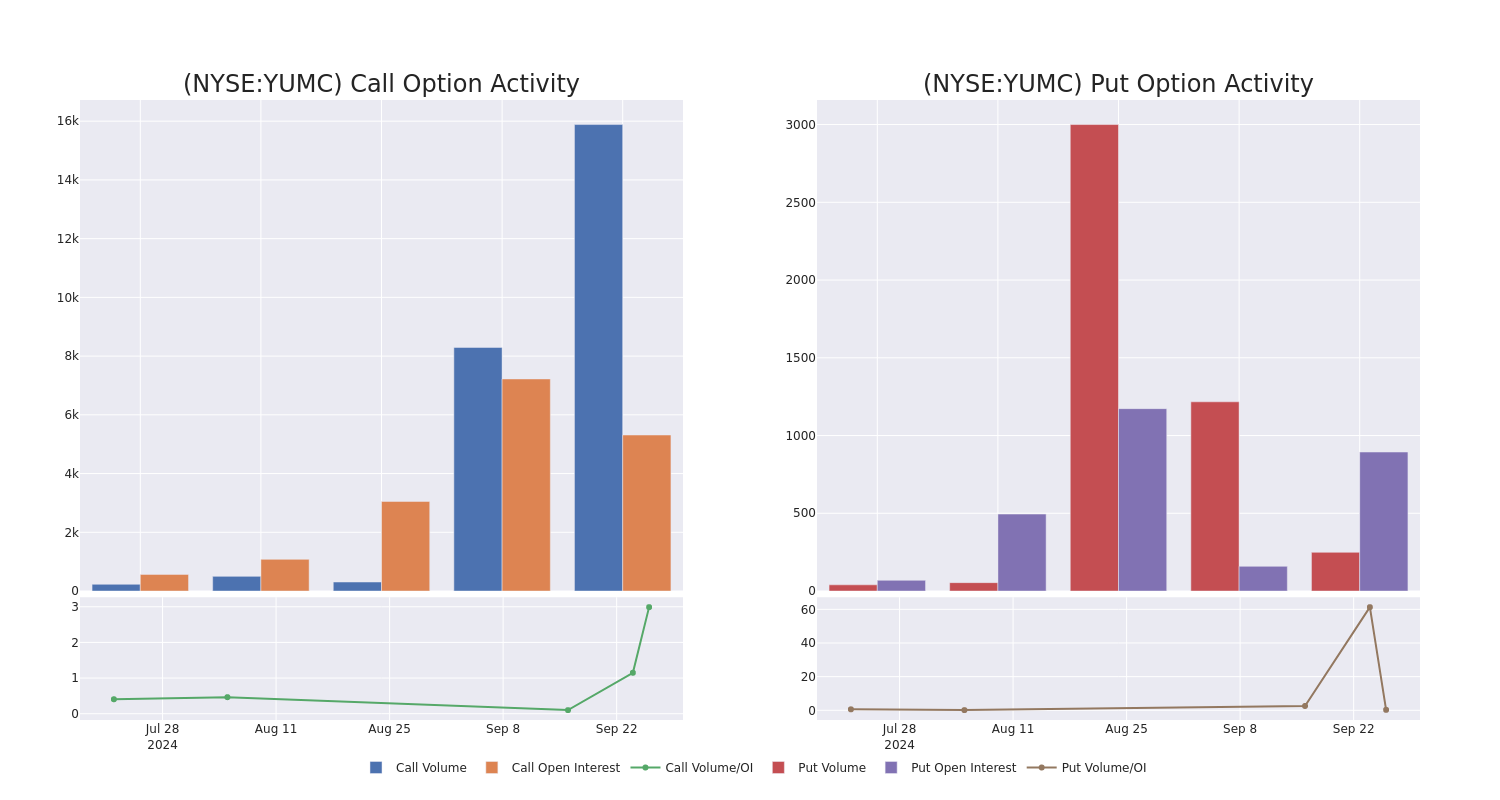

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Yum China Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Yum China Holdings’s significant trades, within a strike price range of $32.5 to $47.5, over the past month.

Yum China Holdings 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| YUMC | CALL | TRADE | BULLISH | 11/15/24 | $2.75 | $1.8 | $2.75 | $45.00 | $825.0K | 107 | 3.0K |

| YUMC | CALL | TRADE | NEUTRAL | 04/17/25 | $5.2 | $3.1 | $4.0 | $45.00 | $800.0K | 53 | 2 |

| YUMC | CALL | SWEEP | BULLISH | 10/18/24 | $5.1 | $3.6 | $5.1 | $40.00 | $279.0K | 3.2K | 620 |

| YUMC | CALL | SWEEP | BULLISH | 10/18/24 | $5.1 | $4.0 | $5.1 | $40.00 | $119.3K | 3.2K | 854 |

| YUMC | CALL | TRADE | BULLISH | 01/17/25 | $3.9 | $2.7 | $3.9 | $45.00 | $97.5K | 431 | 254 |

About Yum China Holdings

With almost 13,000 units and USD 10 billion in systemwide sales in 2022, Yum China is the largest restaurant chain in China. It generates revenue through its own restaurants and franchise fees. Key concepts include KFC (9,094 units) and Pizza Hut (2,903), but the company’s portfolio also includes other brands such as Little Sheep, East Dawning, Taco Bell, Huang Ji Huang, COFFii & Joy, and Lavazza (collectively representing about 950 units). Yum China is a trademark licensee of Yum Brands, paying 3% of total systemwide sales to the company it separated from in October 2016.

Having examined the options trading patterns of Yum China Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Yum China Holdings Standing Right Now?

- Trading volume stands at 11,803,635, with YUMC’s price up by 14.32%, positioned at $43.66.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 33 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Yum China Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

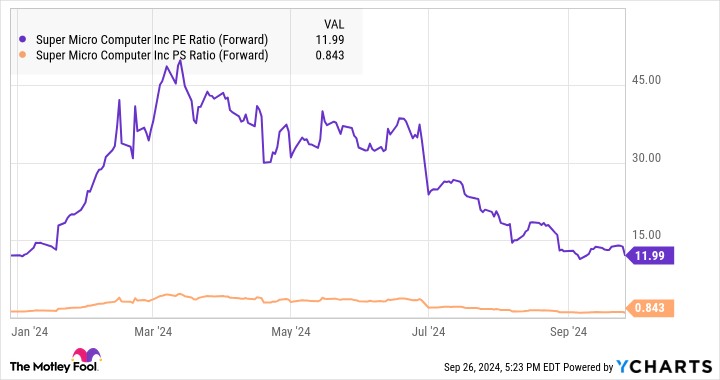

Super Micro Computer Plummeted Today — Should You Buy the AI Stock Before Its Stock Split on Oct. 1?

Super Micro Computer (NASDAQ: SMCI) stock got crushed today following a report that the company is being investigated by the Department of Justice (DoJ). The server specialist’s share price closed out the day’s trading down 12.2%, and it had been down as much as 18.6% earlier in the session.

The Wall Street Journal reported today that the DoJ is in the early stages of conducting an investigation into Supermicro. According to the report, the investigation is likely connected to allegations of bad accounting practices that were made in a short-seller note published by Hindenburg Research at the end of August.

Following today’s big sell-off, Supermicro stock is now down 66% from the high that it reached earlier this year. Despite the valuation pullback, the company is still on track to proceed with a 10-for-1 stock split that will take effect on Oct. 1.

Is Supermicro a buy ahead of its stock split?

Supermicro has been hit with some intense bearish pressures lately, but it’s possible that negative sentiment surrounding the stock has become overblown. For starters, the DoJ has not yet announced an official investigation into the company. Even if an investigation were to take place, that wouldn’t necessarily mean that any impropriety had actually occurred.

The Department of Justice has generally been applying more scrutiny to big-tech and financial companies lately, having has launched antitrust suits against companies including Apple, Alphabet, and Visa. Supermicro is unlikely to face antitrust scrutiny, but the DoJ’s recent surge of activity provides background context that’s worth keeping in mind.

If an investigation into Supermicro by the DoJ is underway, Hindenburg’s allegations that it had found evidence of new accounting violations by the tech company could have been a key catalyzing factor. But it’s important to keep in mind that Hindenburg is a short seller, and it profits when valuations for companies it has placed bets against decline.

The lack of visibility on the company’s outlook means that Super Micro Computer stock won’t be a good fit for investors without above-average risk tolerance. On the other hand, investors who are willing to embrace risk and uncertainty could wind up scoring big returns by treating recent sell-offs as a buying opportunity.

Following today’s stock pullback, Supermicro is now trading at just 12 times this year’s expected earnings and less than 85% of expected sales. Even with expectations that the business will see cyclical moderation, that’s a cheap-looking valuation for a company that has been seeing stellar sales and earnings growth thanks to artificial intelligence (AI)-driven demand. If the tech specialist scores wins with liquid-cooling technologies that help differentiate its high-performance rack servers, Supermicro stock could push through recent controversies and come roaring back.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Apple, and Visa. The Motley Fool has a disclosure policy.

Super Micro Computer Plummeted Today — Should You Buy the AI Stock Before Its Stock Split on Oct. 1? was originally published by The Motley Fool

Costco, Scholastic And 3 Stocks To Watch Heading Into Friday

With U.S. stock futures trading mixed this morning on Friday, some of the stocks that may grab investor focus today are as follows:

- Costco Wholesale Corp COST reported upbeat earnings for its fourth quarter, while sales missed expectations. The company reported quarterly revenue of $79.697 billion, missing the consensus estimate of $79.973 billion. The membership-based retailer reported quarterly earnings of $5.29 per share, beating analyst estimates of $5.08 per share, according to Benzinga Pro. Costco shares slipped 1.4% to $888.62 in after-hours trading.

- Moving iMage Technologies, Inc. MITQ will report financial and operational results for its fourth quarter. Moving iMage Technologies shares gained 5% to $0.5985 in the after-hours trading session.

- Scholastic Corporation SCHL reported better-than-expected results for its first quarter, after the closing bell on Thursday. Scholastic reported a quarterly loss of $2.13 per share compared to market estimates for a loss of $2.48 per share. The company reported quarterly sales of $237.200 million which beat the analyst consensus estimate of $233.488 million. Scholastic shares gained 6.5% to $32.13 in the after-hours trading session.

Check out our premarket coverage here

- enVVeno Medical Corporation NVNO announced a proposed public offering. enVVeno Medical shares dipped 15.6% to $3.80 in the after-hours trading session.

- Travere Therapeutics, Inc. TVTX announced a voluntary pause of enrollment in its Phase 3 HARMONY study of Pegtibatinase. Travere Therapeutics shares fell 5.3% to $14.24 in the after-hours trading session.

Check This Out:

Photo courtesy: Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Zillow introduces First Street's comprehensive climate risk data on for-sale listings across the US

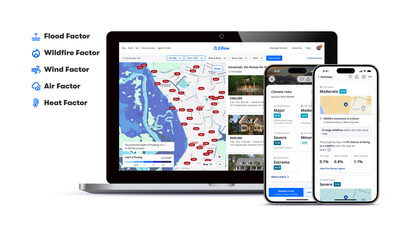

For-sale listings on Zillow will now feature detailed climate risk information for five key categories — flood, wildfire, wind, heat and air quality — along with insurance recommendations

SEATTLE, Sept. 26, 2024 /PRNewswire/ — Zillow® is introducing climate risk data, provided by First Street, the standard for climate risk financial modeling, on for-sale property listings across the U.S. Home shoppers will gain insights into five key risks—flood, wildfire, wind, heat and air quality—directly from listing pages, complete with risk scores, interactive maps and insurance requirements.

With more than 80% of buyers now considering climate risks when purchasing a home, this feature provides a clearer understanding of potential hazards, helping buyers to better assess long-term affordability and plan for the future. In assisting buyers to navigate the growing risk of climate change, Zillow is the only platform to feature tailored insurance recommendations alongside detailed historical insights, showing if or when a property has experienced past climate events, such as flooding or wildfires.

“Climate risks are now a critical factor in home-buying decisions,” said Skylar Olsen, chief economist at Zillow. “Healthy markets are ones where buyers and sellers have access to all relevant data for their decisions. As concerns about flooding, extreme temperatures and wildfires grow — and what that might mean for future insurance costs — this tool also helps agents inform their clients in discussing climate risk, insurance and long-term affordability.”

Climate risk information will be available on the Zillow app for iOS® and on the Zillow website by the end of the year, with Android™ availability expected early next year.

Navigating climate risk scores on Zillow

When using Zillow’s search map view, home shoppers can explore climate risk data through an interactive map highlighting five key risk categories: flood, wildfire, wind, heat and air quality. Each risk is color-coded and has its own color scale, helping consumers intuitively navigate their search. Informative labels give more context to climate data and link to First Street’s property-specific climate risk reports for full insights.

When viewing a for-sale property on Zillow, home shoppers will see a new climate risk section. This section includes a separate module for each risk category—flood, wildfire, wind, heat and air quality—giving detailed, property-specific data from First Street. This section not only shows how these risks might affect the home now and in the future, but also provides crucial information on wind, fire and flood insurance requirements.

Nationwide, more new listings came with major climate risk, compared to homes listed for sale five years ago, according to a Zillow analysis conducted in August. That trend holds true for all five of the climate risk categories Zillow analyzed. Across all new listings in August, 16.7% were at major risk of wildfire, while 12.8% came with a major risk of flooding.

Zillow partnership with First Street

Zillow has partnered with First Street, a trusted leader in climate risk modeling, to deliver accurate, reliable data to home shoppers. First Street’s models, developed by leading scientists and vetted through a peer-review process, are used across multiple industries, including real estate, banking, government and insurance, ensuring that the climate insights given on Zillow are both credible and actionable.

First Street’s analysis of the impact of Hurricane Debby found 78% of properties flooded by that hurricane were outside FEMA flood zones, and consequently located where flood insurance isn’t mandatory. It’s important to note that 85% of these properties would have received an insurance recommendation on Zillow, highlighting how climate risk data can guide users in assessing insurance needs and making informed decisions about their future homes.

“At First Street we are on a mission to connect climate change to financial risk,” said Matthew Eby, founder and CEO of First Street. “Partnering with Zillow helps us achieve that mission by providing the millions of everyday users on the Zillow platforms with the same property-specific climate risk data that is used by top banks, agencies and investors.”

SBTi validates Zillow’s science-based targets

Zillow is not only expanding its suite of innovative tools and data to address climate-related challenges, but is also taking steps to reduce its own environmental footprint. Earlier this week, Zillow announced that the Science Based Targets initiative (SBTi) validated Zillow’s near-term science-based targets for reducing greenhouse gas (GHG) emissions. Zillow’s validated targets are:

- To reduce Zillow’s absolute scopes 1 and 2 GHG emissions 94% by 2030 from a 2019 base year.

- For 75% of the company’s suppliers to have science-based targets for emissions reductions covering procured goods and services, capital goods and business travel by 2028.

See our blog post here for more information about SBTi’s validation of Zillow’s science-based targets. For more information about Zillow’s work on its climate and other sustainability priorities, read our 2023 Sustainability Report.

About Zillow Group:

Zillow Group, Inc. Z is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in the United States, Zillow and its affiliates help people find and get the home they want by connecting them with digital solutions, dedicated partners and agents, and easier buying, selling, financing and renting experiences.

Zillow Group’s affiliates, subsidiaries and brands include Zillow®, Zillow Premier Agent®, Zillow Home Loans℠, Zillow Rentals®, Trulia®, Out East®, StreetEasy®, HotPads®, ShowingTime+℠, Spruce® and Follow Up Boss®.

All marks herein are owned by MFTB Holdco, Inc., a Zillow affiliate. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). © 2024 MFTB Holdco, Inc., a Zillow affiliate.

About First Street:

First Street™ is the standard for climate risk financial modeling (CRFM) working to connect climate change to financial risk. First Street uses transparent, peer-reviewed methodologies to calculate the past, present, and future climate risk for properties globally and makes it available for citizens, industry and government.

(ZFIN)

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/zillow-introduces-first-streets-comprehensive-climate-risk-data-on-for-sale-listings-across-the-us-302259357.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/zillow-introduces-first-streets-comprehensive-climate-risk-data-on-for-sale-listings-across-the-us-302259357.html

SOURCE Zillow

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Costco misses revenue estimates on choppy big-ticket spend

By Juveria Tabassum

(Reuters) -Costco Wholesale missed market expectations for fourth-quarter revenue on Thursday hurt by cautious consumer spending on pricier items at its membership-only stores and lower gasoline prices.

While ultra-low prices are driving demand for groceries and kitchen staples, consumer spending on furniture, home and sporting goods has been choppy, hurting sales at Costco’s warehouses.

“There’s definitely some signs that the consumer is being very choiceful in how they’re spending their dollars,” Chief Financial Officer Gary Millerchip said on a post-earnings call.

Customers were looking for more deals, and appliances and electronics categories became more promotional over time, Millerchip added.

Online shopping is also driving sales for retailers as consumers look for the convenience of choice and delivery.

“Shoppers have not run out of steam but are redistributing their spend between various physical and online retailers,” said Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors.

While Costco has worked on drawing more sales through its website and mobile app, its ecommerce sales growth slowed to 18.9% from 20.7% in the previous quarter.

The membership warehouse retailer’s same-store sales also took a hit from lower gasoline prices. They grew 5.4% in the reported period ended Sept. 1, compared with a 6.6% rise in the third quarter.

Costco’s fourth-quarter revenue rose nearly 1% to $79.70 billion, falling short of analysts’ average estimate of $79.97 billion, as per LSEG data.

However, net income of $5.29 per share beat estimates of $5.08 apiece, as gross margins grew by 40 basis points.

In July, Costco said it would hike its annual membership fee by $5 to $65 for the “gold star” members, and to $130 from $120 for executive members, effective Sept. 1.

Costco’s shares fell 1% in extended trading and have gained about 37% so far this year.

(Reporting by Juveria Tabassum; Editing by Alan Barona)

I've More Than Quintupled My Stake in This Historically Cheap Legal Monopoly That Just Conducted a Reverse Stock Split

Although nothing has been more popular with the investing community than artificial intelligence (AI) in 2024, the euphoria surrounding stock splits can, arguably, give AI a run for its money.

A stock split is a tool publicly traded companies have at their disposal that gives them the option of adjusting their share price and outstanding share count by the same factor. Keep in mind that stock splits are purely surface scratching and have no impact on a company’s market cap or its operating performance.

Most investors tend to gravitate to companies announcing forward stock splits. A forward split is designed to reduce a company’s share price to make it more nominally affordable for retail investors and/or employees who lack access to fractional-share purchasing with their broker. This type of split is almost always announced by businesses that are out-executing and out-innovating their competition.

On the other hand, investors typically avoid companies completing reverse stock splits. A reverse split aims to increase a publicly traded company’s share price, with the goal often to ensure continued listing on a major stock exchange. The lion’s share of companies conducting reverse splits are doing so from a position of operating weakness.

In 2024, a little over a dozen industry-leading businesses have announced or completed a stock split. Only one of these premier businesses completed a reverse split — and it’s the stock I’ve more than quintupled my stake in since mid-April.

Meet Wall Street’s most-anticipated reverse stock split of 2024

Though reverse stock splits happen all the time, none was more anticipated on Wall Street in 2024 than the recent split from satellite-radio operator Sirius XM Holdings (NASDAQ: SIRI).

In mid-December, Sirius XM announced it would be merging with Liberty Media’s Sirius XM tracking stock, Liberty Sirius XM Group, to eliminate the confusion and share price variance caused by having multiple classes of common shares. Prior to their combination, which went into effect following the close of trading on Sept. 9, Liberty Sirius XM Group shares were vastly outperforming Sirius XM’s shares over the trailing year.

But in addition to this merger, Sirius XM announced and completed a 1-for-10 reverse stock split (also after the close of trading on Sept. 9), which reduced its outstanding share count from close to 3.4 billion to a little north of 339 million.

Unlike the countless businesses that conduct reverse splits each year to maintain minimum continued share price listing standards and avoid delisting, Sirius XM was a roughly $10 billion company at the time of its split and was in no danger of delisting.

Rather, the company’s board wanted to increase its share price to make it more appealing to institutional investors. Stocks that trade below $5 per share are deemed off-limits or too risky by some fund managers. Splitting the company’s stock and cosmetically lifting its share price to the mid-$20 range should make it more palatable for big-money investors.

However, it’s not just institutional investors that have been lured by Sirius XM.

I’ve increased my position in this legal monopoly by 463% since mid-April

Well before Sirius XM’s board announced plans to conduct a reverse split, I was busy adding to what began the year as a token stake in Sirius XM. Since mid-April, I’ve increased the number of shares I own by a cool 463%.

Let me preface this discussion by plainly stating that Sirius XM is far from perfect. Its total subscribers have declined in each of the last two quarters, with concerns mounting about the health of the U.S. economy and the auto market.

With regard to the latter, promotional subscriptions to Sirius XM’s services are sometimes offered to new vehicle buyers for a period of three months. The company counts on these promotional listeners to become self-pay subscribers. If fewer autos are being sold, it means less opportunity for Sirius to convert promotional users into paying subscribers.

There are also a couple of predictive metrics, such as the first notable decline in U.S. M2 money supply since the Great Depression, as well as the longest yield-curve inversion in history, which suggest economic weakness is in the U.S. economy’s not-too-distant future. Most radio operators are heavily reliant on advertising revenue to keep the lights on, and ad spending tends to be highly cyclical.

Despite these headwinds, I view Sirius XM as historically cheap and worth piling into.

One phenomenal aspect of its operating model is that it’s a genuine legal monopoly. Though it still faces competition for listeners with terrestrial and online radio providers, Sirius XM is the only legally licensed satellite-radio operator. This does afford the company some degree of pricing power with its subscriptions, and should help it stay ahead of the inflationary curve.

Another reason I’m drawn to Wall Street’s most-anticipated reverse stock split of 2024 is because of how it generates revenue. Whereas traditional radio companies rely almost exclusively on advertising to keep the lights on, Sirius XM has closer to an 80/20 revenue split from subscriptions and advertising (via Pandora Media, which it acquired in 2019).

The silver lining for the radio industry as a whole is that the U.S. economy enjoys lengthy periods of expansion. But when inevitable downturns do occur, it’s perfectly normal for ad revenue to notably taper. Since Sirius XM generates most of its sales from subscriptions, and subscribers are less likely to cancel their service than businesses are to pare back their ad spending, it puts Sirius XM on a firmer foundation than its competition.

I’ve also come to appreciate Sirius XM’s somewhat predictable cost structure over the years. Line items like equipment costs and transmission expenses aren’t going to change much, if at all, no matter how many subscribers Sirius XM signs up.

But the primary lure, at least right now, has to be Sirius XM’s historically cheap valuation. Even with sales growth stagnant at the moment, shares are valued at a forward-year earnings multiple of less than 8, which is pretty much an all-time low since the company went public in September 1994.

Furthermore, recent weakness in its shares has lifted the company’s annual yield to 4.2%. Sirius XM’s board is committed to sustaining the company’s annual payout of more than $1 per share.

Sirius XM may not be a sexy stock selection when compared to high-growth/high-flying AI stocks, but it’s a historically cheap legal monopoly that should, over time, deliver solid returns for patient investors.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Sean Williams has positions in Sirius XM. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

I’ve More Than Quintupled My Stake in This Historically Cheap Legal Monopoly That Just Conducted a Reverse Stock Split was originally published by The Motley Fool