American Express Stock Sinks As Market Gains: Here's Why

American Express AXP ended the recent trading session at $266.21, demonstrating a -0.41% swing from the preceding day’s closing price. This change lagged the S&P 500’s 0.25% gain on the day. On the other hand, the Dow registered a gain of 0.2%, and the technology-centric Nasdaq increased by 0.56%.

Prior to today’s trading, shares of the credit card issuer and global payments company had gained 5.29% over the past month. This has outpaced the Finance sector’s gain of 1.86% and the S&P 500’s gain of 1.65% in that time.

The investment community will be paying close attention to the earnings performance of American Express in its upcoming release. The company is slated to reveal its earnings on October 18, 2024. It is anticipated that the company will report an EPS of $3.26, marking a 1.21% fall compared to the same quarter of the previous year. At the same time, our most recent consensus estimate is projecting a revenue of $16.66 billion, reflecting an 8.28% rise from the equivalent quarter last year.

For the annual period, the Zacks Consensus Estimates anticipate earnings of $13.13 per share and a revenue of $65.99 billion, signifying shifts of +17.13% and +9.04%, respectively, from the last year.

Investors should also pay attention to any latest changes in analyst estimates for American Express. Recent revisions tend to reflect the latest near-term business trends. Therefore, positive revisions in estimates convey analysts’ confidence in the company’s business performance and profit potential.

Based on our research, we believe these estimate revisions are directly related to near-team stock moves. We developed the Zacks Rank to capitalize on this phenomenon. Our system takes these estimate changes into account and delivers a clear, actionable rating model.

Ranging from #1 (Strong Buy) to #5 (Strong Sell), the Zacks Rank system has a proven, outside-audited track record of outperformance, with #1 stocks returning an average of +25% annually since 1988. Over the past month, the Zacks Consensus EPS estimate has moved 0.04% higher. American Express is currently a Zacks Rank #2 (Buy).

Looking at its valuation, American Express is holding a Forward P/E ratio of 20.36. Its industry sports an average Forward P/E of 11.23, so one might conclude that American Express is trading at a premium comparatively.

Investors should also note that AXP has a PEG ratio of 1.48 right now. The PEG ratio is similar to the widely-used P/E ratio, but this metric also takes the company’s expected earnings growth rate into account. AXP’s industry had an average PEG ratio of 1.1 as of yesterday’s close.

The Financial – Miscellaneous Services industry is part of the Finance sector. Currently, this industry holds a Zacks Industry Rank of 54, positioning it in the top 22% of all 250+ industries.

The Zacks Industry Rank is ordered from best to worst in terms of the average Zacks Rank of the individual companies within each of these sectors. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bosses are firing Gen Z grads just months after hiring them—here’s what they say needs to change

After complaining that Gen Z grads are difficult to work with for the best part of two years, bosses are no longer all talk, no action—now they’re rapidly firing young workers who aren’t up to scratch just months after hiring them.

According to a new report, six in 10 employers say they have already sacked some of the Gen Z workers they hired fresh out of college earlier this year.

Intelligent.com, a platform dedicated to helping young professionals navigate the future of work, surveyed nearly 1,000 U.S. leaders. It found that the class of 2024’s shortcomings will impact future grads.

After experiencing a raft of problems with young new hires, one in six bosses say they’re hesitant to hire college grads again.

Meanwhile, one in seven bosses have admitted that they may avoid hiring them altogether next year.

Three-quarters of the companies surveyed said some or all of their recent graduate hires were unsatisfactory in some way.

Gen Z grads “unprepared and unprofessional”

So, where is it going wrong for fresh-faced graduates?

Employers’ gripe with young people today is their lack of motivation or initiative—50% of the leaders surveyed cited that as the reason why things didn’t work out with their new hire.

Bosses also pointed to Gen Z being unprofessional, unorganized and having poor communication skills as their top reasons for having to sack grads.

Leaders say they have struggled with the latest generation’s tangible challenges, including being late to work and meetings often, not wearing office-appropriate clothing, and using language appropriate for the workspace.

Now, more than half of hiring managers have come to the conclusion that college grads are unprepared for the world of work. Meanwhile, over 20% say they can’t handle the workload.

In reality, colleges know that their students are wholly unprepared for the workforce—and some have started stepping up to fill the gap.

For example, Michigan State University is teaching students how to handle a networking conversation, including how to look for signs that the other party is starting to get bored and that it’s time to move on.

Meanwhile, a high school in London is trialing a 12-hour school day to prepare pupils for adult life.

Want to be more hirable? Attitude is everything

When asked what would make college grads more hirable, bosses responded: A positive attitude and more initiative.

Intelligent’s chief education and career development advisor, Huy Nguyen, advises Gen Z grads to observe how other workers interact to understand the company culture at any new firm they may join. From there, it’s easier to gauge what’s an appropriate way of engaging with others.

“Take the initiative to ask thoughtful questions, seek feedback, and apply it to show your motivation for personal growth,” Nguyen adds. “Build a reputation for dependability by maintaining a positive attitude, meeting deadlines, and volunteering for projects, even those outside your immediate responsibilities,” says Nguyen.”

Amazon CEO Andy Jassy recently echoed that an “embarrassing” amount of your success in your twenties depends on your attitude—and the reason why is simple: Managers would rather work with positive people.

Some leaders have even insisted that a can-do attitude at work will advance young workers’ careers more than a college degree.

Richard Branson, the billionaire founder of Virgin, has repeatedly urged young people to ditch university in favor of the “school of life”.

Meta CEO Mark Zuckerberg recently claimed that raw talent and personality trump credentials.

To that end, Cisco’s top executive in the U.K., David Meads, dropped out of school at 16 years old. He told Fortune that “attitude and aptitude are more important than whatever letters you have after your name, or whatever qualifications you’ve got on a sheet.”

Have you had to let go of a Gen Z employee? Or perhaps, you are the Gen Zer who’s just been fired. Fortune wants to hear from you. Email: orianna.royle@fortune.com

This story was originally featured on Fortune.com

4 Stocks Set to Benefit from Recent Interest Rate Cuts

The stock market is about to make a major shift, this time driven by the shift in monetary policy set on by the Federal Reserve (the Fed). After the most recent meeting to decide the new path of interest rates for the United States, Jerome Powell (the Fed chairman) cut interest rates by the most aggressive pace in 16 years.

That means a few things for the stock market, but investors must understand that not all industries will be affected equally. The ones that deserve a second – or deeper – look are those that depend on consumer and financial trends, sectors like consumer discretionary and real estate. There’s even a historical tendency for oil prices to do well on lower interest rates. Hence, the energy sector deserves a spot on this list as well.

Within these spaces, names like Nike Inc. NKE, Chesapeake Energy Co. CHK, and even SoFi Technologies Inc. SOFI carry enough reasons to potentially become relative winners in the coming quarters, especially as money and investors begin to shift their preferences to match this new business cycle.

Consumer Stocks Like Nike Poised for a Comeback with Rate Cuts on the Horizon

Nike shares have been volatile recently, particularly after the company reported a less-than-spectacular quarter. Leaning on China slowdowns and weakening U.S. consumer sentiment, bears raided Nike stock after the results came out.

However, some on Wall Street saw far ahead enough to pick up this stock at its lows, such as billionaire hedge fund manager Bill Ackman. More than that, analysts at Sanford C. Bernstein see the stock as worth up to $109 a share, calling for up to 32.4% upside from where it trades today.

Reacting to the recent Wall Street bullishness and institutional buying, bears retreated from further selling this stock, as Nike stock’s short interest declined by 14.5% in the past month alone. The stock still trades at only 67% of its 52-week high, leaving enough room for investors to catch a further recovery rally.

Energy Stocks Are Strong, But Chesapeake Stock Stands Out as the Better Pick

Over the past month, shares of Chesapeake have gone on a bit of a tear, rallying by as much as 7.5% as front-run expectations for Fed interest rate cuts started to influence the energy sector positively. One big investor who saw this trend coming is Warren Buffett.

Based on this belief, Buffett bought up to 29% of Occidental Petroleum Co. OXY, but retail investors have an advantage over mega investors like Buffett. They can choose smaller companies, especially those placed higher in the industry’s value chain and paid first.

Chesapeake Energy stock is one example, and Wall Street knows this. Those at Stephens see a potential bull case in which this stock reaches a valuation of $118 a share, daring it to rally by as much as 53.6% from where it trades today. Considering Chesapeake is still only 83% of its 52-week high, investors have a new reason to call for new highs.

That reason is interest rate cuts, which typically help boost business activity and demand, which rely on oil for manufacturing and transport. As oil prices recover based on these trends, Chesapeake stock might be at the center of the bullish price action, given its place in the value chain for exploration and production.

Lower Mortgage Rates Could Propel SoFi Stock to New Heights

Many would-be home buyers are sitting on the sidelines, waiting for more affordable financing rates through more accessible mortgages. Investors should remember that when interest rates come down, so do mortgage rates, enabling new home buyers to enter the market.

This is where SoFi stock comes into play and why Wall Street holds it in such high regard. Now that the stock is down to 80% of its 52-week high, there are a few more tailwinds in place to let investors assume this name could make its way back and even make a new high.

Wall Street analysts forecast up to $0.07 in earnings per share (EPS) in SoFi stock for the next 12 months, up from today’s EPS of $0.01. This is a seven-fold jump in profits, meaning some of the current price targets and valuations might have to be adjusted upward in face of this potential spike.

Those at Dimensional Fund Advisors saw enough reason to boost their holdings in SoFi stock by up to 263.3% as of August 2024, bringing their net investment to $86.5 million today, or 1.2% ownership in the company.

Wall Street’s Latest Top Pick Comes from a Different Market

Stanley Druckenmiller (responsible for George Soros’ returns) decided to sell out of the U.S. technology sector and sought to relocate his winnings into the bond market. Remember how mortgage rates come down during Fed cuts? So do bond yields.

Just like any other fixed-income product, prices are inversely related to yield, so as bond yields come down, their prices will go up. Investors can copy Druckenmiller’s playbook and check out the iShares 20+ Year Bond ETF TLT for potential exposure.

The ETF has recently declined by roughly 3% from its highs. However, momentum is still bullish enough to suggest further upside from this level, especially as the Fed might keep cutting rates for the next 12 months, bringing the price of bonds higher and higher.

The article “4 Stocks Set to Benefit from Recent Interest Rate Cuts” first appeared on MarketBeat.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About DexCom

Investors with a lot of money to spend have taken a bullish stance on DexCom DXCM.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DXCM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for DexCom.

This isn’t normal.

The overall sentiment of these big-money traders is split between 44% bullish and 44%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $346,714, and 3 are calls, for a total amount of $110,992.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $50.0 and $100.0 for DexCom, spanning the last three months.

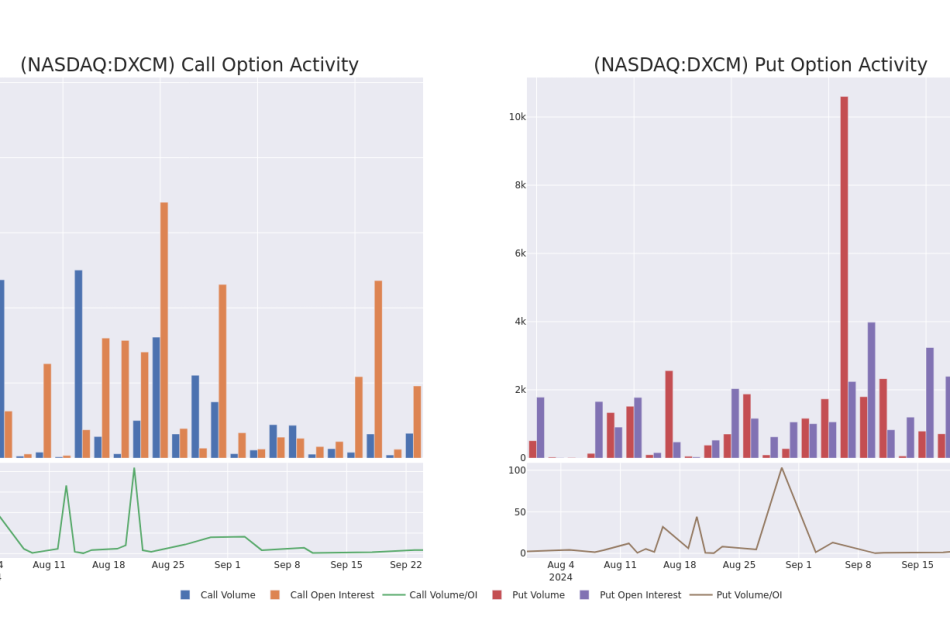

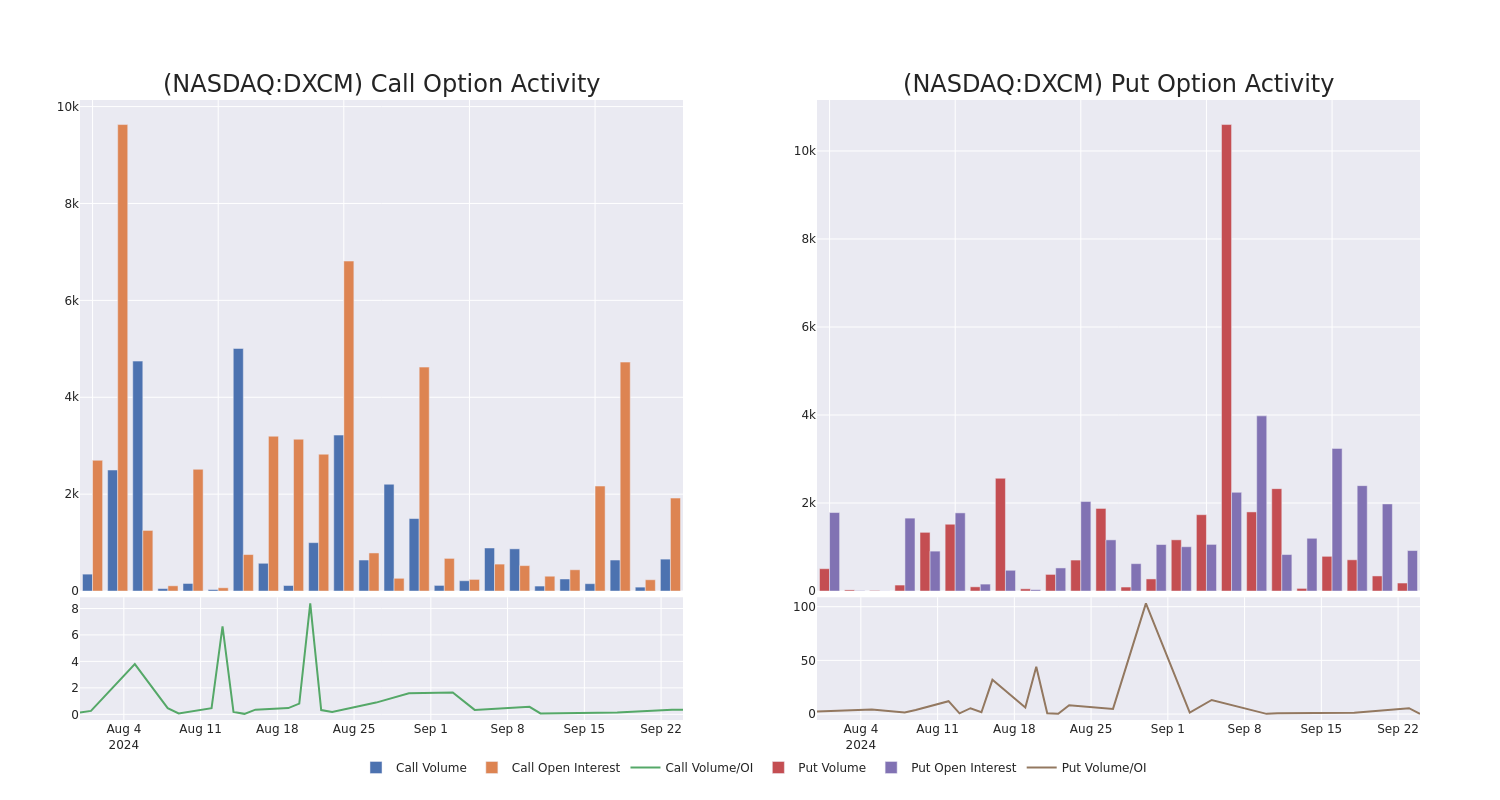

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for DexCom options trades today is 476.12 with a total volume of 901.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for DexCom’s big money trades within a strike price range of $50.0 to $100.0 over the last 30 days.

DexCom 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DXCM | PUT | TRADE | BULLISH | 09/19/25 | $6.8 | $6.5 | $6.6 | $55.00 | $165.0K | 0 | 250 |

| DXCM | PUT | SWEEP | BEARISH | 06/20/25 | $12.3 | $12.1 | $12.3 | $70.00 | $71.3K | 471 | 58 |

| DXCM | CALL | SWEEP | BULLISH | 12/20/24 | $4.2 | $4.1 | $4.2 | $75.00 | $50.4K | 645 | 0 |

| DXCM | CALL | SWEEP | BULLISH | 01/16/26 | $15.6 | $15.2 | $15.44 | $70.00 | $30.8K | 73 | 21 |

| DXCM | PUT | SWEEP | NEUTRAL | 11/15/24 | $2.75 | $2.7 | $2.72 | $60.00 | $29.9K | 1.0K | 146 |

About DexCom

Dexcom designs and commercializes continuous glucose monitoring systems for diabetic patients. CGM systems serve as an alternative to the traditional blood glucose meter process, and the company is evolving its CGM systems to provide integration with insulin pumps from Insulet and Tandem for automatic insulin delivery.

After a thorough review of the options trading surrounding DexCom, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of DexCom

- With a volume of 3,204,425, the price of DXCM is up 1.2% at $67.53.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 28 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest DexCom options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood Says Software Is the Next Big AI Opportunity — 1 Spectacular Stock You'll Regret Not Buying if She's Right

Cathie Wood is the head of Ark Investment Management, which operates a family of exchange-traded funds (ETFs) focused on innovative technology stocks. Last year, Wood said software companies could be the next big opportunity in the artificial intelligence (AI) industry. She predicts they will eventually generate $8 in revenue for every $1 they spend on AI data center chips from suppliers like Nvidia.

And Wood has put her money where her mouth is. Since making that call, she has piled into AI software companies like xAI, Anthropic, and OpenAI through the private Ark Venture Fund. Plus, Ark’s ETFs hold several AI software stocks, including Tesla, Palantir, Meta Platforms, and Microsoft.

If Wood is ultimately right about AI software companies, here’s why Google parent Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL) could be among the biggest winners.

Alphabet is transforming Google Search using AI

Alphabet is a tech conglomerate that is home to Google, YouTube, self-driving vehicle company Waymo, and a host of other businesses. Google Search accounted for more than half of Alphabet’s $84.7 billion in revenue during the second quarter of 2024, driven by its 90% market share in the internet search industry. But that dominance faces its greatest-ever test because of AI.

AI chatbots, like OpenAI’s ChatGPT, provide direct responses to users’ queries, giving them rapid access to information on almost any topic. Google, on the other hand, requires users to sift through web pages to find the information they need and generates revenue by charging businesses money to promote their websites in the search results. As a result, the traditional search model is very important for Alphabet.

But rather than defend what could eventually become obsolete, Alphabet decided to make drastic changes. In many cases, users who run Google Search queries will now receive AI-generated, text-based responses above the web search results to give them faster access to information. Google also launched AI Overviews earlier this year, taking that concept a step further.

Overviews incorporate text, images, and links to third-party websites to provide more complete answers to prompts within Search. Plus, with the click of a button, the user can simplify or break down responses to gain a better understanding of the content. Alphabet has already discovered that links within Overviews receive more clicks compared to the same links in the traditional search format, so this new feature could be a big driver of advertising revenue in the future.

On top of that, Alphabet now offers its own family of AI models called Gemini (and a chatbot with the same name), which can answer complex questions and generate content like text and images. For an additional fee, Gemini is already available as an add-on in Google Workspace, which is home to productivity apps such as Gmail, Docs, Sheets, and more. As a result, it could become a powerful driver of subscription-based revenue over time.

Google Cloud is Alphabet’s fastest-growing business

Search might be Alphabet’s largest business, but Google Cloud is growing at twice the pace. It generated a record $10.3 billion in revenue during the 2024 second quarter, a 29% increase from the year-ago period — compared to 13.7% growth in Search.

Google Cloud provides a portfolio of services to help businesses succeed in the digital age, such as data storage, web hosting, and software development tools, among others. However, the platform has also become a leading provider of AI services.

Developers can access the computing power they need to create AI software through Google Cloud’s data centers. To accelerate their progress, they can even use the latest ready-made large language models (LLMs). That includes Gemini and over 130 others from leading start-ups and third-party developers.

Google Cloud is also designing its own data center chips to give AI software developers more choices, which helps differentiate the platform from other cloud providers that rely primarily on suppliers like Nvidia. Google recently launched its sixth-generation tensor processing unit (TPU) called Trillium, which achieves almost five times the peak computing performance of the previous generation.

Most AI developers pay for computing capacity by the minute, so faster chips can substantially reduce costs. Plus, circling back to Wood’s forecast, if Google makes its own chips at scale, the payoff could be significantly larger when it uses them to create software — or leases them to other developers — because it won’t have to send billions of dollars to suppliers like Nvidia.

Alphabet stock is cheap, but there is one big caveat

Alphabet generated $6.97 in earnings per share during the past four quarters, and based on its stock price of $161.85 as of this writing, it trades at a price-to-earnings (P/E) ratio of 23.2. That makes Alphabet the cheapest of all the U.S. technology companies valued at $1 trillion or more:

But there is one glaring problem, and it has nothing to do with the company’s growth or its position as an AI powerhouse.

The U.S. Department of Justice (DOJ) filed an antitrust lawsuit against Alphabet in 2020, alleging the company engaged in monopolistic practices by paying Apple as much as $20 billion a year to make Google the default search engine on its devices. Unfortunately for Alphabet, the judge in the case handed down a decision last month and sided with the DOJ.

It’s unclear what the consequences will be. Alphabet might have to pay a financial penalty, or the government could force a breakup of the entire company. The latter would create significant uncertainty for investors because Alphabet would likely have to sell certain parts of its business to satisfy the DOJ that it won’t engage in anti-competitive behavior in the future.

Many Wall Street analysts say a breakup would be an extreme and unlikely outcome. Technology analyst Dan Ives of Wedbush Securities thinks Alphabet will reach a settlement with the DOJ within the next 18 months to bring the matter to a close. That could involve a financial penalty and some changes to how Alphabet structures deals with its partners.

Absent a settlement, it could take years to reach a final resolution while Alphabet appeals the judge’s decision, so the status-quo should prevail for now. Therefore, Alphabet stock looks like a great value at the current price, and if the company does emerge from this regulatory situation intact, it could look like an absolute bargain, considering Cathie Wood’s AI software forecast.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Cathie Wood Says Software Is the Next Big AI Opportunity — 1 Spectacular Stock You’ll Regret Not Buying if She’s Right was originally published by The Motley Fool

Trump Media Co-Founders Moved Quickly to Cash In Their Stake

(Bloomberg) — The former contestants on Donald Trump’s TV show The Apprentice who co-founded his media startup wasted no time offloading millions of shares in the company after restrictions that prevented selling were lifted.

Most Read from Bloomberg

Andy Litinsky and Wes Moss’s United Atlantic Ventures sold more than 7.5 million Trump Media & Technology Group Corp. shares within a week after a lock-up agreement expired last week, according to a regulatory filing on Thursday. The stake would have been worth at least $88 million, based on the lowest price where shares have traded during regular hours since the restrictions were lifted.

The sales likely made a nice payout for the pair who helped co-found Trump Media, which owns the X-lookalike social media platform Truth Social, even though the restrictions preventing them from cashing in the stock for nearly six months theoretically cost them hundreds of millions of dollars.

The former president and current Republican nominee has insisted he has no plans on selling shares and has apparently kept that pledge through Tuesday, the earliest day such a move would have been disclosed. His current stake of nearly 115 million shares is worth $1.6 billion, though the rules around him turning the position into cash limit how quickly any sale could happen.

Investors anticipated that Litinsky and Moss would offload stock, and are also braced for a flurry of sales from Patrick Orlando, whose fund, ARC Global Investments II LLC, sponsored the special-purpose acquisition company that merged with Trump Media to take it public. There have been no filings indicating Orlando has sold shares.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Notable Insider Move: Owen Catherine Adams Takes Part In Options Exercise At ACADIA Pharmaceuticals

A large exercise of company stock options by Owen Catherine Adams, Chief Executive Officer at ACADIA Pharmaceuticals ACAD was disclosed in a new SEC filing on September 25, as part of an insider exercise.

What Happened: The latest Form 4 filing on Wednesday with the U.S. Securities and Exchange Commission uncovered Adams, Chief Executive Officer at ACADIA Pharmaceuticals, exercising stock options for 0 shares of ACAD. The total transaction was valued at $0.

The Thursday morning market activity shows ACADIA Pharmaceuticals shares up by 1.24%, trading at $15.51. This implies a total value of $0 for Adams’s 0 shares.

Unveiling the Story Behind ACADIA Pharmaceuticals

Acadia Pharmaceuticals Inc is a biotechnology company that develops and commercializes biopharmaceutical products to address central nervous system disorders. The company aims to discover small molecules drugs that address disorders such as Parkinson’s, Alzheimer’s, and schizophrenia. Acadia also seeks to in-license or acquire complementary products and candidates. The company’s patent applications claim proprietary technology, including novel methods of screening and chemical synthetic methods, novel drug targets, and novel compounds identified using its technology.

A Deep Dive into ACADIA Pharmaceuticals’s Financials

Revenue Growth: Over the 3 months period, ACADIA Pharmaceuticals showcased positive performance, achieving a revenue growth rate of 46.44% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 92.47%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): ACADIA Pharmaceuticals’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 0.2.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.11.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 80.63 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 2.85, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): ACADIA Pharmaceuticals’s EV/EBITDA ratio at 61.21 suggests potential undervaluation, falling below industry averages.

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes Worth Your Attention

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of ACADIA Pharmaceuticals’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lucas GC Limited Announces 1H 2024 Financial Results: Revenue at US$83.32 million with Increases in Both Gross Margin and Net Income Margin

NEW YORK, Sept. 26, 2024 (GLOBE NEWSWIRE) — Lucas GC Limited LGCL (“Lucas” or the “Company”), an artificial intelligence (the “AI”) technology-driven Platform-as-a-Service (the “PaaS”) company whose technologies have been applied to the human resources, insurance and wealth management industry verticals, today announced its financial results for 1H fiscal year of 2024.

1H 2024 Financial Highlights

- Our revenue was RMB605.52 million (US$83.32 million) for the six months ended June 30, 2024, compared with RMB820.07 million for the six months ended June 30, 2023, representing a decrease of 26.16%.

- We recorded a gross margin of 33.54% for the six months ended June 30, 2024, representing an increase of 516 bps compared with that of the six months ended June 30, 2023.

- We recorded net income of RMB53.93 million (US$7.42 million) for the six months ended June 30, 2024, compared with RMB53.69 million for the six months ended June 30, 2023.

- Our net income margin increased to 8.91% for the six months ended June 30, 2024, compared with 6.55% for the six months ended June 30, 2023.

1H 2024 Operational Highlights

- Increased active registered users by 10% to 702,060 in 1H 2024 as compared to Dec 2023.

- Obtained two patents related to core Artificial Intelligence (AI) technology, bringing the total number of granted patents to 18.

- Signed two strategic agreements with publicly traded financial institutions, i.e. Bank of Ningbo and Industrial Securities Co., Limited., to port the AI LLM technology into wealth management vertical.

- Signed a strategic agreement with Beijing Fourth Paradigm Technology Co., Limited to develop Artificial Intelligence training programs.

- Won The 2024 Cberi Prize in The Most Valuable Brand for Investment during the Asian Brand Economy Conference (ABEC).

Management Commentary

Howard Lee, Chief Executive Officer of Lucas, said “We adopted a change of strategy in 1H 2024. We decided to position ourselves as a technology company rather than a service company. As a result, we started selling our technology to peers and let them deliver the assignments themselves, rather than compete with them. We tried to reduce our activities in delivering the recruitment assignments directly ourselves, and instead we focused on selling the technology and information to our peers and clients with products that have higher margins than those of assignment delivery services. That’s why we had significant gross margin improvement in 1H 2024 compared to 1H 2023. The revenue decrease was due to our change of strategy to focus on higher-margin products, as well as the effect of one-time post COVID recovery spike in China, making 1H 2023 a higher-than-normal-business-run-rate comparison.”

“In order to sustain our technological leads as a technology company, we have continued to invest significantly in research and development. R&D expenses increased by 2.45% compared to 1H 2023 due to continuous investments in AI-enabled technologies including Generative Pre-trained Transformer (GPT) and related artificial intelligence generated content (AIGC) technologies. R&D as a percentage of revenue was 13.31% in 1H 2024 compared with 9.59% in 1H 2023.”

“We had a strong growth of our user base: our active registered users reached 702,060 by June 2024, representing 10% growth in 1H 2024, compared to Dec 2023, setting the stage for strong revenue growth for the future, not only within human resource services, but in the areas such as IT outsourcing and information services. I also expect to execute acquisitions or form partnerships outside China that are accretive and will drive value for shareholders in the coming months.”

About Lucas GC Limited

With 18 granted U.S. and Chinese patents and over 74 registered software copyrights in the AI, data analytics and blockchain technologies, Lucas GC Limited is an AI technology-driven Platform as a Service (PaaS) company with over 702,060 agents working on its platform. Lucas’ technologies have been applied to the human resources, insurance and wealth management industry verticals. For more information, please visit: https://www.lucasgc.com/.

Forward-Looking Statements

Statements in this press release about future expectations, plans, and prospects, as well as any other statements regarding matters that are not historical facts, may constitute “forward-looking statements.” The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including the uncertainties related to market conditions. Any forward-looking statements contained in this press release speak only as of the date hereof, and Lucas GC Limited specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

For Investor Inquiries and Media Contact:

https://www.lucasgc.com/

ir@lucasgc.com

T: 818-741-0923

| LUCAS GC LIMITED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (All amounts in thousands, except for share and per share data, or otherwise noted) |

|||||||||

| As of December 31, | As of June 30, | ||||||||

| 2023 | 2024 | ||||||||

| RMB | RMB | US$ | |||||||

| (Unaudited) | |||||||||

| ASSETS | |||||||||

| Current assets | |||||||||

| Cash and cash equivalents | 30,123 | 51,513 | 7,088 | ||||||

| Restricted cash | 100 | – | – | ||||||

| Accounts receivable, net | 28,144 | 46,448 | 6,391 | ||||||

| Advance to suppliers, net | 164,802 | 223,004 | 30,686 | ||||||

| Deferred offering costs | 6,541 | 706 | 97 | ||||||

| Prepaid expenses and other current assets | 1,626 | 1,616 | 222 | ||||||

| Total current assets | 231,336 | 323,287 | 44,484 | ||||||

| Non-current assets | |||||||||

| Software and equipment, net | 48,299 | 76,388 | 10,511 | ||||||

| Operating lease right-of-use assets, net | 84 | 797 | 110 | ||||||

| Deferred tax assets | 12,103 | 12,897 | 1,775 | ||||||

| Total non-current assets | 60,486 | 90,082 | 12,396 | ||||||

| TOTAL ASSETS | 291,822 | 413,369 | 56,880 | ||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||

| Current liabilities | |||||||||

| Short-term borrowings | 39,381 | 57,829 | 7,958 | ||||||

| Accounts payable | 35,217 | 51,997 | 7,155 | ||||||

| Contract liabilities | 13,552 | 17,203 | 2,367 | ||||||

| Income tax payable | 131 | 131 | 18 | ||||||

| Amounts due to related parties | 3,097 | 2,120 | 292 | ||||||

| Operating lease liabilities, current | 86 | 449 | 62 | ||||||

| Accrued expenses and other current liabilities | 3,766 | 3,580 | 490 | ||||||

| Total current liabilities | 95,230 | 133,309 | 18,342 | ||||||

| Operating lease liabilities, non-current | – | 401 | 55 | ||||||

| Total non-current liability | – | 401 | 55 | ||||||

| TOTAL LIABILITIES | 95,230 | 133,710 | 18,397 | ||||||

| Shareholders’ equity | |||||||||

| Ordinary shares (US$0.000005 par value; 10,000,000,000 and 10,000,000,000 shares authorized as of December 31, 2023 and June 30, 2024; 78,063,300 and 78,063,300 shares issued and outstanding as of December 31, 2023 and June 30, 2024, respectively) |

3 | 3 | – | ||||||

| Subscription receivables | (3 | ) | (3 | ) | – | ||||

| Additional paid-in capital | 113,554 | 142,255 | 19,575 | ||||||

| Statutory reserve | 19,559 | 23,758 | 3,269 | ||||||

| Retained earnings | 61,041 | 110,372 | 15,188 | ||||||

| Accumulated other comprehensive (loss)/income | (11 | ) | 427 | 59 | |||||

| Total Lucas GC Limited shareholders’ equity | 194,143 | 276,812 | 38,091 | ||||||

| Non-controlling interests | 2,449 | 2,847 | 392 | ||||||

| Total shareholders’ equity | 196,592 | 279,659 | 38,483 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 291,822 | 413,369 | 56,880 | ||||||

| LUCAS GC LIMITED UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (All amounts in thousands, except for share and per share data, or otherwise noted) |

|||||||||

| For the six months ended June 30, | |||||||||

| 2023 | 2024 | ||||||||

| RMB | RMB | US$ | |||||||

| (Unaudited) | (Unaudited) | ||||||||

| Revenues | |||||||||

| Recruitment service | 395,360 | 155,812 | 21,440 | ||||||

| Outsourcing service | 366,550 | 418,456 | 57,581 | ||||||

| Others | 58,162 | 31,250 | 4,300 | ||||||

| Total revenues | 820,072 | 605,518 | 83,321 | ||||||

| Cost of revenues | (587,382 | ) | (402,438 | ) | (55,377 | ) | |||

| Gross profit | 232,690 | 203,080 | 27,944 | ||||||

| Operating expenses | |||||||||

| Selling and marketing expenses | (41,678 | ) | (39,000 | ) | (5,367 | ) | |||

| General and administrative expenses | (61,389 | ) | (30,298 | ) | (4,169 | ) | |||

| Research and development expenses | (78,675 | ) | (80,612 | ) | (11,093 | ) | |||

| Total operating expenses | (181,742 | ) | (149,910 | ) | (20,629 | ) | |||

| Income from operations | 50,948 | 53,170 | 7,315 | ||||||

| Other/(expenses) income | |||||||||

| Financial expenses, net | (273 | ) | (754 | ) | (104 | ) | |||

| Other income, net | 2,535 | 718 | 99 | ||||||

| Total other income/(expenses), net | 2,262 | (36 | ) | (5 | ) | ||||

| Income before income tax benefit | 53,210 | 53,134 | 7,310 | ||||||

| Income tax benefit | 482 | 794 | 109 | ||||||

| Net income | 53,692 | 53,928 | 7,419 | ||||||

| Less: net income attributable to non-controlling interests | (397 | ) | (398 | ) | (55 | ) | |||

| Net income attributable to Lucas GC Limited | 53,295 | 53,530 | 7,364 | ||||||

| Net income | 53,692 | 53,928 | 7,419 | ||||||

| Other comprehensive income: | |||||||||

| Foreign currency translation difference, net of tax of nil | 6 | 438 | 60 | ||||||

| Total comprehensive income | 53,698 | 54,366 | 7,479 | ||||||

| Less: total comprehensive income attributable to non-controlling interests | (397 | ) | (398 | ) | (55 | ) | |||

| Comprehensive income attributable to Lucas GC Limited | 53,301 | 53,968 | 7,424 | ||||||

| Net income per share: | |||||||||

| Basic | 0.68 | 0.69 | 0.09 | ||||||

| Diluted | 0.68 | 0.69 | 0.09 | ||||||

| Weighted average shares outstanding used in calculating basic and diluted loss per share: | |||||||||

| Basic | 78,063,300 | 78,063,300 | 78,063,300 | ||||||

| Diluted | 78,063,300 | 78,063,300 | 78,063,300 | ||||||

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Li Auto's Options: A Look at What the Big Money is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on Li Auto.

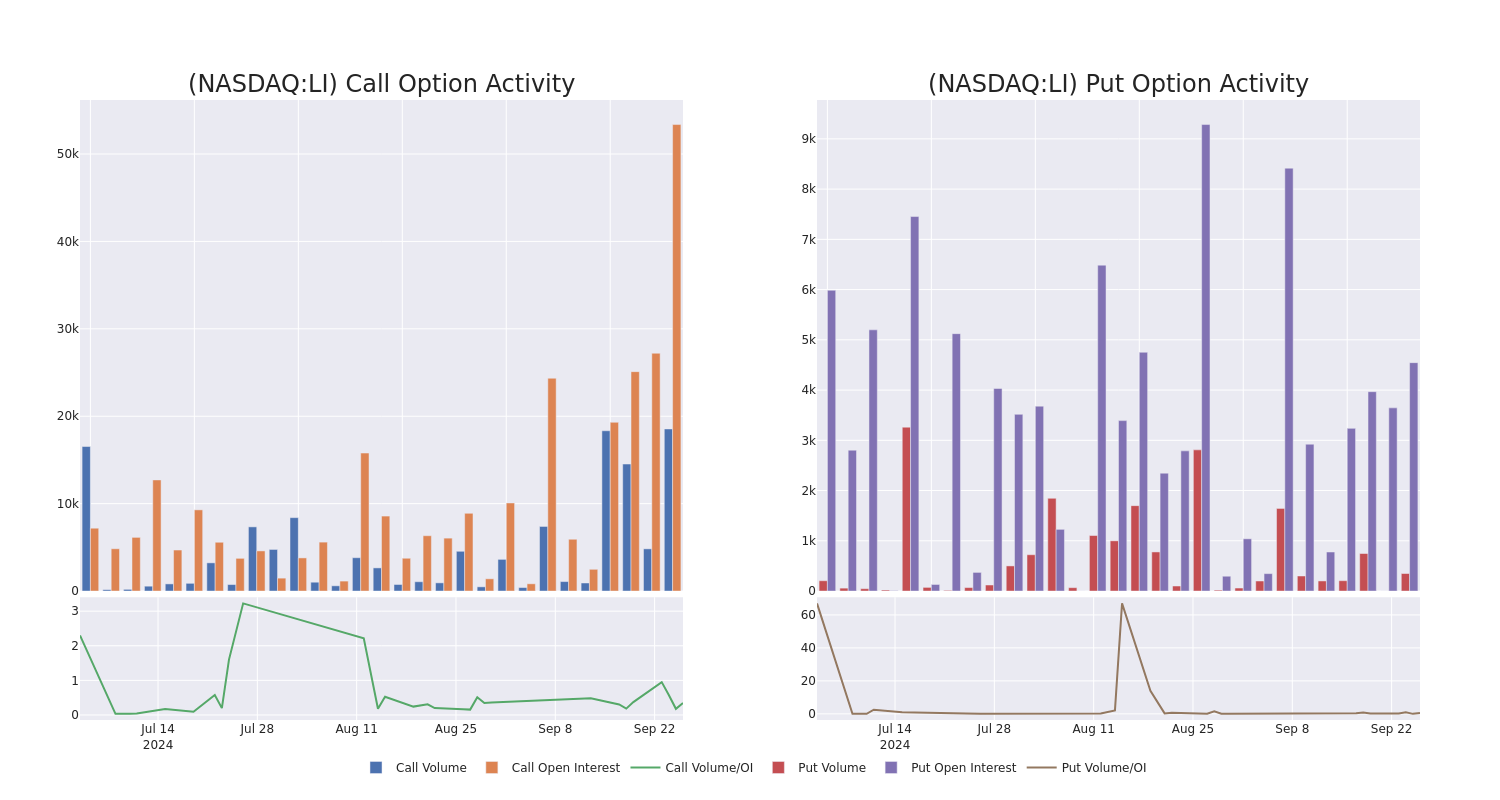

Looking at options history for Li Auto LI we detected 47 trades.

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 31% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $170,482 and 44, calls, for a total amount of $4,376,920.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $40.0 for Li Auto during the past quarter.

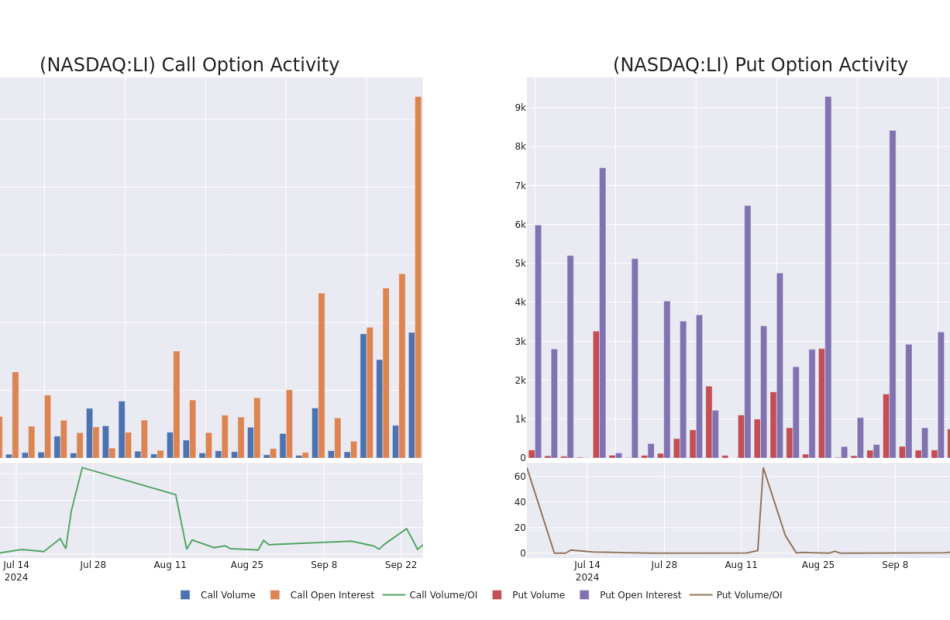

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Li Auto’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Li Auto’s substantial trades, within a strike price spectrum from $20.0 to $40.0 over the preceding 30 days.

Li Auto Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LI | CALL | SWEEP | BEARISH | 12/20/24 | $3.7 | $3.65 | $3.7 | $25.00 | $427.5K | 5.1K | 149 |

| LI | CALL | TRADE | BEARISH | 11/15/24 | $5.85 | $5.7 | $5.71 | $21.00 | $411.1K | 4.0K | 1.3K |

| LI | CALL | TRADE | BULLISH | 10/04/24 | $5.4 | $5.4 | $5.4 | $21.00 | $356.4K | 841 | 660 |

| LI | CALL | SWEEP | BEARISH | 11/15/24 | $5.8 | $5.65 | $5.66 | $21.00 | $282.4K | 4.0K | 1.3K |

| LI | CALL | TRADE | BULLISH | 10/18/24 | $3.0 | $2.86 | $3.0 | $24.00 | $264.6K | 2.0K | 892 |

About Li Auto

Li Auto is a leading Chinese NEV manufacturer that designs, develops, manufactures, and sells premium smart NEVs. The company started volume production of its first model Li One in November 2019. The model is a six-seater, large, premium plug-in electric SUV equipped with a range extension system and advanced smart vehicle solutions. It sold over 376,000 NEVs in 2023, accounting for about 4% of China’s passenger new energy vehicle market. Beyond Li One, the company expands its product line, including both BEVs and PHEVs, to target a broader consumer base.

In light of the recent options history for Li Auto, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Li Auto

- Currently trading with a volume of 16,448,202, the LI’s price is up by 6.48%, now at $25.31.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 42 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Li Auto, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Semiconductor Stocks That Could Go Parabolic

Semiconductors are essential to modern technology, and the pandemic helped to accelerate its adoption by pushing many individuals and corporations to digitize. This surge in demand for microchips has continued post-pandemic.

The introduction of generative artificial intelligence (AI), along with the Internet of Things (IoT), 5G, and autonomous vehicles, have all contributed to the continued progress of the semiconductor industry.

The good news is that you can share in the spoils of this rapid growth. The semiconductor sector includes solid growth companies that are seeing their revenue and profits soar. By parking some of your money in these stocks, your portfolio can enjoy stellar capital gains over time. These businesses should have a dominant market share and a business model that can help them capture sustainable growth.

Here are two attractive semiconductor stocks whose share prices could soar in the coming years.

1. Synopsys

Synopsys (NASDAQ: SNPS) is the market leader in designing and testing complex chips, as well as the models and processes for companies to manufacture these chips. With silicon chips becoming more advanced due to the progress of IoT, AI, and 5G, Synopsys’ services are in great demand. Foundries need guidance on the complexities of these designs to effectively produce these chips.

The company has demonstrated steady growth, with revenue rising from $4.2 billion in fiscal 2021 (ended Oct. 31) to $5.8 billion in fiscal 2023. Net income climbed from $757.5 million to $1.2 billion over the same period. The business also generated an average positive free cash flow of $1.5 billion over these three fiscal years.

This strong performance has continued into the first nine months of fiscal 2024. Revenue rose 16.6% year over year to $4.5 billion, and operating income climbed 23% to $1 billion. Net income was 30% higher than the prior year at $1.1 billion, and the company had positive free cash flow of $725.4 million.

Management is predicting strong momentum and expects full fiscal 2024 revenue to increase by 15% year over year to a new record. The company’s long-term objectives include double-digit revenue growth, free cash flow margins in the mid-30% range, and earnings per share in the mid-teens.

Sassine Ghazi, who was named CEO in January this year, said that design cycles are shortening while chip complexity is increasing, both of which are positive signs for Synopsys. AI is driving demand for high-performance computing in data centers, smartphones, and personal computers. The innovation that comes with evolving AI needs will require more-complex chipsets, which should drive higher business volumes for the company.

Synopsys acquired Ansys in January for around $35 billion to help increase its portfolio of products and technologies, making it complementary to its business.

With this purchase, Synopsys expects to see its total addressable market increasing by 50% to around $28 billion, which will grow at roughly 11% per annum, creating significant business opportunities for the combined company.

2. Nvidia

Nvidia (NASDAQ: NVDA) is a market leader in graphics processing units (GPUs) with a market share of around 88% in 2024. GPUs are ideal for powering AI, machine learning, and other uses.

Nvidia has grown at breakneck speed over the last three fiscal years, and management believes this is just the tip of the iceberg. Revenue more than doubled from $26.9 billion in fiscal 2022 (ending Jan. 31) to $60.9 billion in fiscal 2024. Net income tripled over the period to $29.8 billion from $9.8 billion.

Free cash flow rose from $8.1 billion in fiscal 2022 to $27 billion in fiscal 2024.

In the first six months of fiscal 2025, this strong momentum continued. Revenue more than doubled year over year to $56.1 billion while net income leaped from $8.2 billion in the previous year to $31.5 billion. Free cash flow for the first half of fiscal 2025 was $28.5 billion, already exceeding the total for the whole of fiscal 2024. The company also pays a quarterly cash dividend of $0.01 per share.

CEO Jensen Huang said that demand remains very strong as data centers seek to upgrade for accelerated computing and generative AI.

Nvidia’s next-generation GPU, the Blackwell, failed to ship in the second quarter of calendar 2024 because of a manufacturing defect, causing widespread grief for many customers, which were relying on the new GPU to power their AI requirements.

But Huang assured buyers that Blackwell chips are now in full production and will start being shipped in the fourth quarter of this calendar year.

A bright outlook for semiconductor sales

Semiconductor sales experienced a cyclical year-over-year decline in 2023 because of the surge in pent-up demand for electronic products during the pandemic. The Semiconductor Industry Association announced that global sales fell by 8.2% year over year to $526.8 billion after falling from their 2022 peak.

However, there are strong indicators that 2024 and 2025 will see a sharp rebound and continued growth for the industry. World Semiconductor Trade Statistics, a group that tracks the industry, forecasts that global semiconductor sales will grow 16% year over year for 2024, followed by a 12.5% year-over-year rise in 2025 to hit $687 billion.

SEMI, representing more than 300 businesses in the industry, predicts 3.4% year-over-year growth for global sales of semiconductor manufacturing equipment to $109 billion for this year, followed by 17% year-over-year expansion to $128 billion for 2025.

These projections bode well for Synopsys and Nvidia, and both companies should see firm demand for their products and services.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Royston Yang has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Synopsys. The Motley Fool has a disclosure policy.

2 Semiconductor Stocks That Could Go Parabolic was originally published by The Motley Fool