Stock Market’s ‘Goldilocks Zone’ Is in Danger of an Abrupt End

(Bloomberg) — With equities hitting all-time highs and traders growing confident of an economic soft landing, the stock market appears to be in a “Goldilocks zone,” according to Mark Spitznagel, founder and chief investment officer of Universa Investments.

Most Read from Bloomberg

But investors should be wary of second-order effects, such as an economic slowdown that could send the market crashing down abruptly, even as the Federal Reserve cuts interest rates, he said in an interview with Bloomberg Television Thursday. Spitznagel is anticipating a “crush” in global markets until the end of this year, which can be driven by a slowdown in economies.

“When the yield curve disinverts and then unverts, the clock starts ticking and that’s when you enter black swan territory,” said, Spitznagel, whose firm is advised by Black Swan author Nassim Nicholas Taleb. “Black swans always lurk, but now we’re in their territory.”

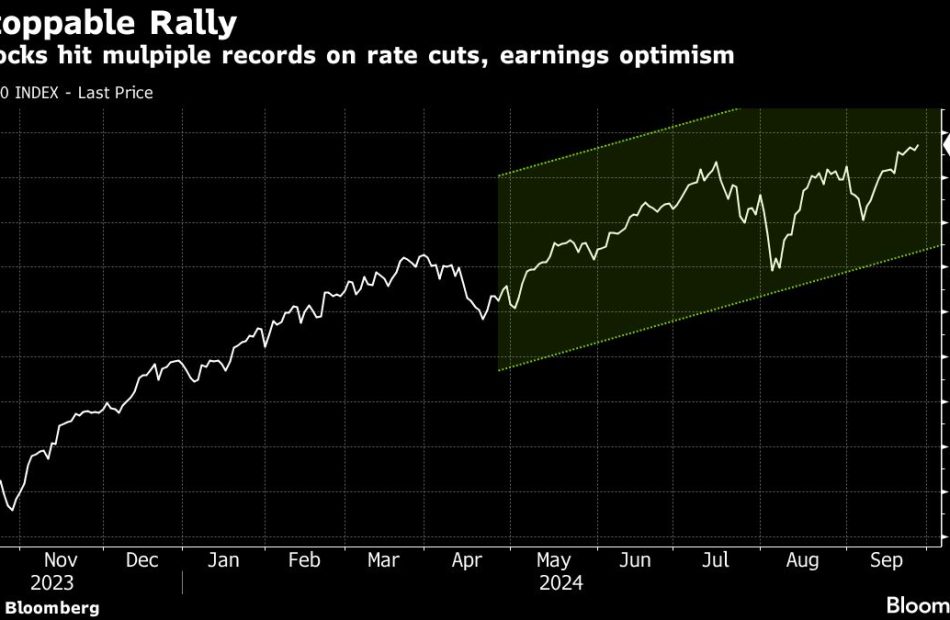

The S&P 500 Index has hit 42 record highs in 2024, boosted by resilient corporate earnings, the Fed’s rate cutting cycle and expectations that the US economy will be able to avoid a recession. But Spitznagel thinks that the Fed reducing borrowing costs should have investors worried and thinking more about is where stock prices will be next year.

“Gold is going to go down, cryptocurrencies will go down along with risk assets,” he said, adding that bonds could be a place to hide. He also sees a spike in volatility in the months ahead.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Leave a Reply