Stocks Rally Pauses Before PCE Data; Yen Jumps: Markets Wrap

(Bloomberg) — US Treasuries rallied after fresh economic data reinforced bets for further rate cuts by the Federal Reserve. Stocks wavered, briefly pushing higher after an indicator highlighted optimism about the US economy.

Most Read from Bloomberg

Yields fell across the curve, with the 10-year rate declining to around 3.76%. The dollar stayed lower. The S&P 500 and the Nasdaq 100 fluctuated.

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen.

The Fed’s preferred gauge of underlying US inflation rose mildly in August. The core metric, which excludes volatile food and energy prices, was up 0.1% from July and ticked 2.7% higher from a year ago. Inflation-adjusted consumer spending climbed 0.1%.

After the data, the market is still pricing in a split chance between a quarter point and half point cut at the Fed’s next meeting. Economists now see inflation reaching the US central bank’s 2% target next year.

“Add today’s PCE price index to the list of economic data landing in a sweet spot,” said Chris Larkin, managing director, trading and investing at E*Trade. “Inflation continues to keep its head down, and while economic growth may be slowing, there’s no indication it’s falling off a cliff.”

Traders also got a read on US consumer sentiment on Friday, with the index reaching a five-month high in the wake of the Fed lowering borrowing costs.

Damian McIntyre, a portfolio manager at Federated Hermes, said while a soft landing for the economy is never guaranteed, investors should find solace in the strength of recent economic data.

“Today’s inflation print confirms what Jerome Powell told us last week: inflation is falling, the consumer is strong, and the labor market remains resilient,” he said.

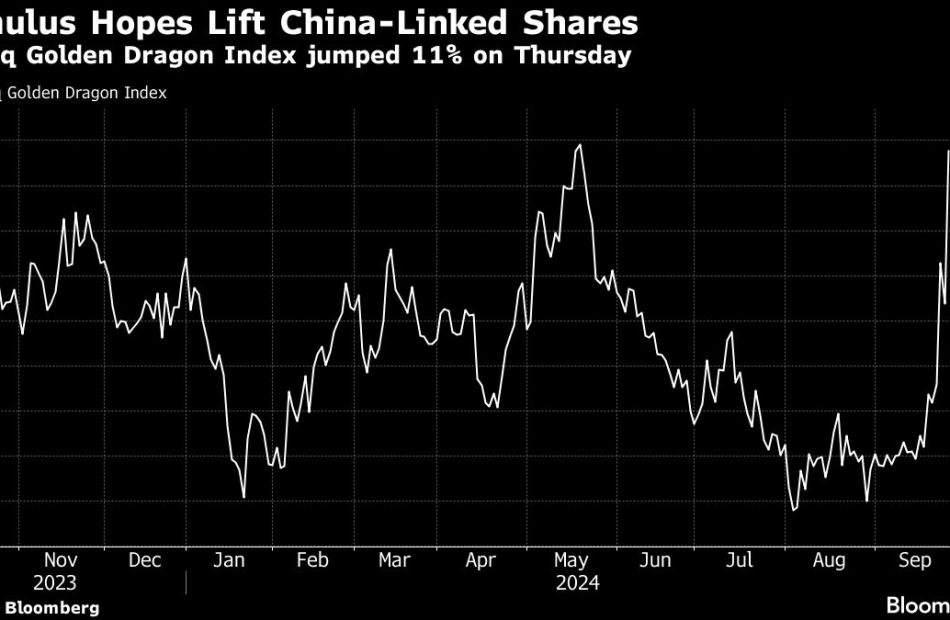

China’s daily stimulus announcements have also stoked risk appetite across markets this week.

“The data’s saying soft landing — you have to respect the data — but the forward-looking indicators are flagging warning signs,” said Andrew Pease, global head of investment strategy at Russell Investments Ltd. “The descent into a soft landing will always look the same as the start of a recession. And you won’t know till after you’ve got there.”

Japan’s yen rebounded as Shigeru Ishiba won the vote for leadership of the nation’s ruling party. Ishiba, a party veteran who has served in several senior roles including defense minister, is seen as supportive of the Bank of Japan’s plan to gradually hike rates.

Europe’s Stoxx 600 index climbed, on track for its best weekly performance since May after the pledges of support by China’s leaders drove up luxury and mining stocks exposed to the nation’s economy.

German bond yields and the euro fell as inflation figures in both Spain and France came in lower than anticipated, fueling expectations of more decisive rate cuts by the ECB.

European Bond Rally Builds Momentum as Bets on October Cut Grow

In China, the CSI 300 Index wrapped up its best week since 2008. The People’s Bank of China unleashed one of the country’s most daring policy campaigns in decades, with Beijing rolling out a strong stimulus package in a push to shore up the slowing economy and investor confidence.

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.2% as of 10:05 a.m. New York time

-

The Nasdaq 100 was little changed

-

The Dow Jones Industrial Average rose 0.5%

-

The Stoxx Europe 600 rose 0.3%

-

The MSCI World Index rose 0.4%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.3%

-

The euro was little changed at $1.1182

-

The British pound was little changed at $1.3405

-

The Japanese yen rose 1.6% to 142.51 per dollar

Cryptocurrencies

-

Bitcoin rose 1.8% to $65,840.3

-

Ether rose 1.1% to $2,660.17

Bonds

-

The yield on 10-year Treasuries declined four basis points to 3.76%

-

Germany’s 10-year yield declined six basis points to 2.12%

-

Britain’s 10-year yield declined four basis points to 3.97%

Commodities

-

West Texas Intermediate crude fell 0.4% to $67.37 a barrel

-

Spot gold fell 0.3% to $2,664.41 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu, Divya Patil, Alex Nicholson, Sujata Rao, Margaryta Kirakosian and Edward Bolingbroke.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Leave a Reply