What the Options Market Tells Us About DexCom

Investors with a lot of money to spend have taken a bullish stance on DexCom DXCM.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DXCM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for DexCom.

This isn’t normal.

The overall sentiment of these big-money traders is split between 44% bullish and 44%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $346,714, and 3 are calls, for a total amount of $110,992.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $50.0 and $100.0 for DexCom, spanning the last three months.

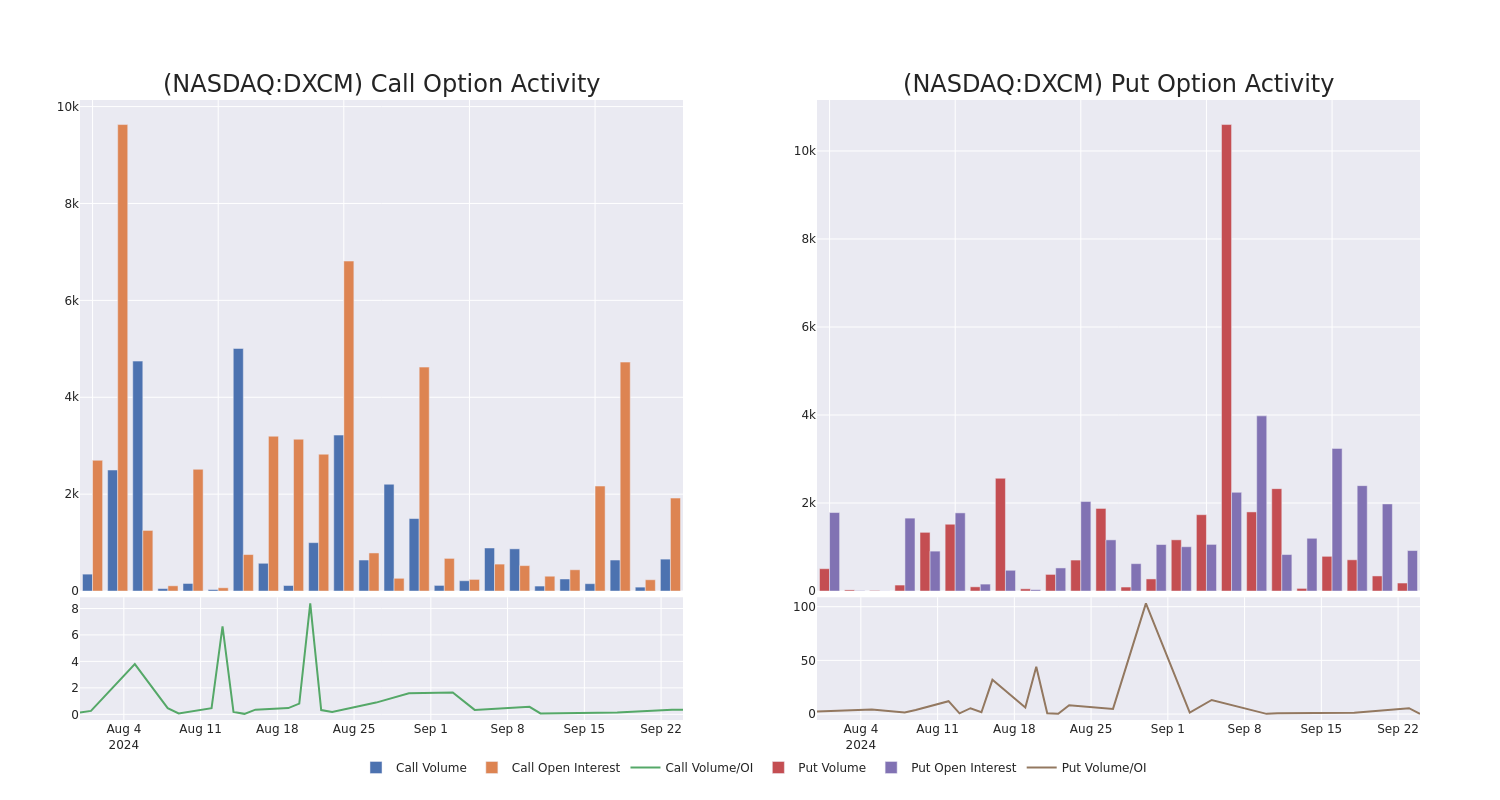

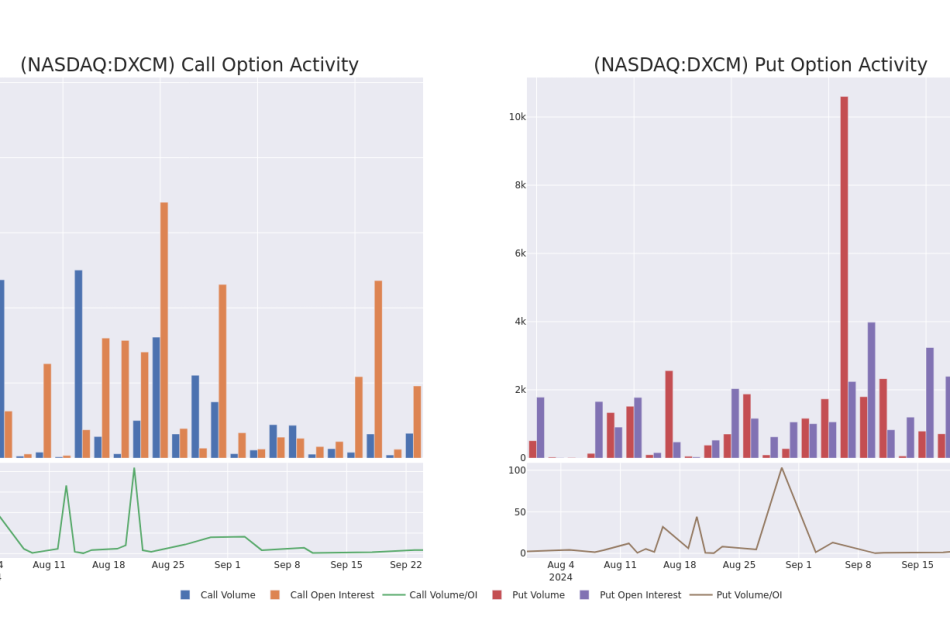

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for DexCom options trades today is 476.12 with a total volume of 901.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for DexCom’s big money trades within a strike price range of $50.0 to $100.0 over the last 30 days.

DexCom 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DXCM | PUT | TRADE | BULLISH | 09/19/25 | $6.8 | $6.5 | $6.6 | $55.00 | $165.0K | 0 | 250 |

| DXCM | PUT | SWEEP | BEARISH | 06/20/25 | $12.3 | $12.1 | $12.3 | $70.00 | $71.3K | 471 | 58 |

| DXCM | CALL | SWEEP | BULLISH | 12/20/24 | $4.2 | $4.1 | $4.2 | $75.00 | $50.4K | 645 | 0 |

| DXCM | CALL | SWEEP | BULLISH | 01/16/26 | $15.6 | $15.2 | $15.44 | $70.00 | $30.8K | 73 | 21 |

| DXCM | PUT | SWEEP | NEUTRAL | 11/15/24 | $2.75 | $2.7 | $2.72 | $60.00 | $29.9K | 1.0K | 146 |

About DexCom

Dexcom designs and commercializes continuous glucose monitoring systems for diabetic patients. CGM systems serve as an alternative to the traditional blood glucose meter process, and the company is evolving its CGM systems to provide integration with insulin pumps from Insulet and Tandem for automatic insulin delivery.

After a thorough review of the options trading surrounding DexCom, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of DexCom

- With a volume of 3,204,425, the price of DXCM is up 1.2% at $67.53.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 28 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest DexCom options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply