Ask an Advisor: Why Does an Advisor Get a 1% Fee Even if My Portfolio Doesn't Perform? It's 25% of My Return

Why does a financial advisor get a fee of 1% or more? That seems really high. If my return is only 4% (for example, in dividends), I am giving away 25% of my return, which is even worse with a bear market. How about charging 1% contingent on the increase in the value of dividend income?

-Drex

It’s completely understandable to view your investment returns as a measure of how much value your financial advisor is providing. Most people want to make sure their money is put to good use.

I’m also not going to tell you that your advisor should be charging 1% or more. There are many different types of financial advisors with many different types of fee arrangements. The right partnership for you will depend on your goals and circumstances.

That said, I would encourage you to look beyond comparing your investment returns against your fees when considering whether your financial advisor is worth the cost. (This tool can help match you with an advisor who might meet your needs.)

Recent Investment Terms Aren’t a Good Gauge of Value

A good financial advisor will work to understand your investment goals and your personal risk tolerance. He or she will help you construct a portfolio that gives you a good chance of reaching those goals, based on the best research available.

But even the best financial advisors are at the whim of the market.

Most professional investors who try to beat the market actually underperform it over a given time period. And those who do manage to outperform the market over one time period can rarely outperform it again over the subsequent time period. For an in-depth illustration of this, see S&P Global’s recent “Persistence Scorecard.”

In other words, even professionals can’t beat the market with consistency. That means that the right expectation is typically to target a portfolio that tracks the market as closely as possible with a balance between risk (stocks) and stability (bonds) that matches your goals and risk tolerance.

And even when that portfolio delivers the long-term returns you need, there will always be good years and bad years. Sometimes, your portfolio will be way up. Sometimes, it will be down. That’s just the way the market works.

Unless your financial advisor is promising to outperform the market, which might actually be a good reason to reconsider the relationship, recent investment returns are often not a good gauge of their value.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The Real Value of a Financial Advisor

Good financial advisors provide value far beyond the percent return in your investment accounts. Here are a few services a good advisor may provide:

-

Taking the time to understand your goals and values, and helping you construct a plan that allows you to reach them.

-

Determining how much you need to save and which accounts you should be contributing to in order to reach your goals.

-

Helping you understand exactly what you can afford and creating withdrawal strategies that maximize tax efficiency, so your money lasts as long as possible.

-

Making sure you have the right insurance in place.

-

Coordinating with an attorney to ensure that you have an estate plan aligned with the rest of your financial plan.

-

Guiding you if you want to buy a house, make a charitable contribution, or help your child or grandchild through college.

And yes, they are there to create, implement and maintain an investment portfolio that should provide the long-term returns you need to fund your biggest goals. But even then, there’s far more than the return to consider in terms of what your financial advisor is providing.

Quantifying the Value of a Financial Advisor

A good financial advisor can increase net returns by up to, or even exceeding, 3% per year over the long term, according to Vanguard research.

The most significant portion of that value comes from behavioral coaching, which means helping investors stay disciplined through the ups and downs of the market. That value won’t be easy to see from year to year, especially in years when the market is down. But over the long term, that consistency will do a lot for your bottom line.

Now, this doesn’t mean that you should expect your portfolio to exceed market returns by 3% every year. Instead, 3% is a long-term number. It’s a comparison to how the average investor would perform on her own, not a comparison to market returns.

But it does mean that a good financial advisor is usually providing significant value, even when your portfolio isn’t performing the way you’d like.

How to Evaluate Your Financial Advisor

Evaluating financial advisors is challenging, especially when there aren’t easy numbers you can use to measure their performance.

So what should you be looking at? Here are some key questions I would consider:

-

Do they listen well?

-

Do their recommendations align with your personal goals and values?

-

Do you understand your financial plan and how it is helping you reach your goals?

-

Are they responsive and helpful when you have questions?

-

Are they helping you with your entire financial situation and not just your investment portfolio?

-

Are your investment returns in line with market returns, given your personal balance between risk and return?

-

Are they proactive in helping you anticipate and plan for future needs?

-

Do you trust them?

-

Do you feel more secure because of their guidance?

If you have questions or concerns, I would bring them to your financial advisor. This relationship hinges on trust and communication. This is absolutely something you should be able to discuss.

What to Do Next

Remember that short-term returns are often not a good way to measure your financial advisor’s value. Those returns are almost always out of our control, and a good financial advisor is doing a lot more to help you reach your goals.

Investing and Retirement Planning Tips

-

If you have questions specific to your investing and retirement situation, a financial advisor can help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

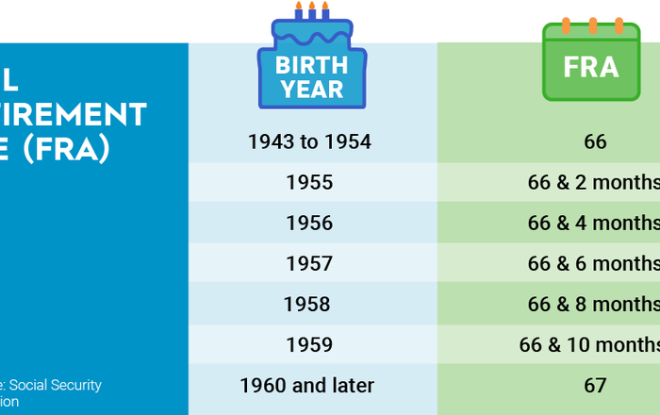

As you plan for retirement, keep an eye on Social Security. Use SmartAsset’s Social Security calculator to get an idea of what your benefits could look like in retirement.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Matt Becker, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Matt is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset, and he has been compensated for this article.

Photo credit: ©iStock.com/Natee Meepian, ©iStock.com/AndreyPopov

The post Ask an Advisor: ‘I Am Giving Away 25% of My Return.’ Why Does a Financial Advisor Earn a 1% Fee, Even in a Bear Market? appeared first on SmartAsset Blog.

Leave a Reply