Super Micro Computer update: Wild week for SMCI as stock split date approaches amid reported DOJ probe

Super Micro Computer, better known as Supermicro, is going through one of the most contentious periods in its 30-plus year history this week thanks to two major events. The first is news that the Department of Justice (DOJ) is reportedly investigating the AI server company’s accounting practices. The second is an upcoming stock split.

Most Read from Fast Company

And speaking of that stock, shares of Supermicro (Nasdaq:SMCI) plunged over 12% yesterday after news of the alleged DOJ investigation broke. Here’s what you need to know.

DOJ investigation

The most troubling news for Supermicro this week came after the Wall Street Journal reported that the company was under investigation by the Department of Justice over alleged accounting irregularities. Neither the DOJ nor Supermicro have confirmed the investigation, which the WSJ says is in its early days.

We’ve reached out to Supermicro for comment.

As for why the DOJ has allegedly launched an investigation, it likely has to do with a Hindenburg Research report on Supermicro from late August. Hindenburg Research is an activist investment short-selling firm. In its report, the firm alleged that throughout the course of its three-month investigation, it found “glaring accounting red flags,” as well as sanctions and export control failures, and evidence of undisclosed related party transactions.

After Hindenburg’s report was published in late August, SMCI shares plummeted from a high of $557 on August 27 to close at just above $443 on August 28—a drop of around 20%.

And with yesterday’s news of a possible DOJ probe, SMCI shares dropped another 12%. As of the time of this writing, SMCI shares are currently trading about 1.6% lower in premarket at around $396 per share.

SMCI stock split

While all this is happening, Supermicro’s shares are due to split next week. The company announced the stock split back in early August—nearly three weeks before Hindenburg’s report came out.

It is a 10-for-1 split, which means that after the split, there will be 10 times the number of SMCI shares as there were before the split, but each share will be worth just one-tenth of what it was presplit.

The split is due to take place after the closing bell on Monday, September 30. On Tuesday, October 1, SMCI shares will begin trading at their post-split price.

Usually, when a stock is just a few days away from splitting, it’s pretty easy to estimate at what rough price the split shares may begin trading around. But with the news of the possible DOJ probe, SMCI stock could be volatile between now and then.

But let’s assume that SMCI shares are trading around their current price of around $400 on Monday; that would mean that on Tuesday morning, the split-adjusted price of SMCI shares would be around $40 each.

Supermicro’s AI server solutions are used at companies in industries as diverse as healthcare, retail, and manufacturing.

This post originally appeared at fastcompany.com

Subscribe to get the Fast Company newsletter: http://fastcompany.com/newsletters

Tim Cook-Led Apple Reportedly Abandons OpenAI Funding Round Discussions, But Nvidia And Microsoft Could Still Invest In ChatGPT-Parent

Apple Inc. AAPL has reportedly decided to withdraw from negotiations to invest in OpenAI’s funding round, which is projected to raise between $6.5 billion and $7 billion.

What Happened: Apple’s decision to pull out of the talks was made at the last minute. The funding round, spearheaded by venture capital firm Thrive Capital, is due to close next week, reported The Wall Street Journal, citing a person with knowledge of the matter.

Microsoft Corp. MSFT and Nvidia Corp. NVDA are still in talks to join the round, with the former expected to contribute around $1 billion, adding to its existing $13 billion investment in the company.

See Also: OpenAI CTO Mira Murati Steps Down: ‘I Want To Create The Time And Space To Do My Own Exploration…’

Investment firm Tiger Global Management and UAE state-backed company MGX are also reportedly considering participation.

Earlier this month, it was reported that OpenAI is in the process of transitioning from a nonprofit to a for-profit entity, a move encouraged by many investors in the round.

This transition is expected to be a complex process for the startup. If the transition is not completed within two years, investors in the current round will have the right to request their money back.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: OpenAI’s transition to a for-profit model has also been a contentious issue. Tesla and SpaceX CEO Elon Musk, who co-founded OpenAI in 2015 and left in 2018, has previously questioned the legality of this shift.

Earlier this year, Musk also criticized Apple’s partnership with OpenAI due to concerns about data security and privacy.

Apple had announced its collaboration with OpenAI to incorporate ChatGPT into its operating systems, which led to Musk threatening to ban the Tim Cook-led company’s devices from his ventures including Tesla.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Apple

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk Gets Labelled As An 'Outspoken' Trump Supporter After Journalist Gets Banned On X For Publishing Leaked JD Vance Docs: 'This Is Political'

Independent American journalist Ken Klippenstein has been indefinitely barred from using Elon Musk’s social media platform X, formerly Twitter.

What Happened: This action was taken after Klippenstein on Thursday published leaked documents allegedly associated with Sen. JD Vance (R-Ohio.), the running mate of Republican candidate Donald Trump.

In his newsletter, Klippenstein disclosed a 271-page opposition research file on Vance, which is suspected to be part of an Iranian scheme to influence the U.S. election.

Following the publication of these files, Klippenstein was banned from X, where he had posted a link to his report and the dossier. Now, the independent journalist has asserted that his ban from X is permanent.

“Elon Musk is an outspoken supporter of Donald Trump and J.D. Vance’s political campaign,” he said.

Adding, “X clearly doesn’t want to give the appearance that my ban was politically motivated. But a careful look at the pretext X cites for my suspension makes it obvious that this is political.”

Klippenstein also said that his article discloses less private information than the Hunter Biden laptop story, which Musk had previously criticized Twitter for blocking.

He also points out that any user who posts a link to his article on X gets their account locked, mirroring Twitter’s handling of the Hunter Biden laptop story.

The journalist went on to add that X usually offers users the chance to remove posts violating its policies to reinstate their accounts.

However, he claims he received no such offer. As a test, he and his editor redacted all “private” information from the Vance Dossier on Substack and filed an appeal, yet his ban remains.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: In December 2022, after Musk acquired Twitter for $44 billion, several high-profile journalists’ accounts were suspended over the platform’s new “doxxing” policy.

Musk has repeatedly said that his acquisition of the social media site was primarily motivated by his commitment to free speech. However, the recent ban on Klippenstein raises questions about the platform’s commitment to these principles.

The tech mogul has previously also criticized Twitter for banning Trump and reinstated the former President’s account on X.

Meanwhile, Musk’s involvement with the Hunter Biden story was marked by his release of internal Twitter communications that detail how the platform handled a controversial article from the New York Post in October 2020.

This article alleged corruption involving Hunter Biden, particularly focusing on emails from a laptop purportedly belonging to him.

At the time, Musk said that revealing these documents was “necessary to restore public trust.”

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photos courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kevin Clark Named President of Del-Air Residential New Construction Division

ORLANDO, Fla., Sept. 27, 2024 /PRNewswire/ — Del-Air Plumbing, Air Conditioning and Electric, Florida’s foremost indoor comfort provider, announced today that veteran construction industry executive Kevin E. Clark will serve as the president of Del-Air’s residential new construction division. Clark originally joined the Del-Air leadership team in July as the executive vice president of the division.

“Del-Air is proud to name Kevin as president of our residential new construction division. Kevin has made a name for himself as an excellent leader in the construction industry, and we know that he can deliver excellent results as Del-Air continues expanding its family of homebuilder clients,” said Rick Rogers, CEO of Del-Air. “Providing excellent service to our partners is one of our main goals as we continue expanding, and Kevin is the perfect person to lead those efforts.”

An established name in the construction industry, Clark has led several national homebuilders including MI Homes, Richmond American Homes, Beazer Homes, Ashton Woods Homes, Ryland Homes and Buffington Homes.

“Joining the Del-Air family is truly a great opportunity, and I am extremely honored to be leading such a dedicated group of individuals,” Clark said. “From builders to homeowners, Del-Air has been highly respected and supported for over 40 years. I look forward to being a part of that history and being an asset to the Del-Air legacy. Through the use of innovative technology and increased service efficiency, there is a great opportunity to continue building on the great foundation Del-Air has created over the past four decades.”

Established in 1983, Del-Air rose to prominence by working with many homebuilders throughout Florida to install their air conditioning systems. Having built a reputation as a home-grown Florida success story, Del-Air continues to work with homebuilders across the state, with their mission to provide every Florida family with the American dream of a cool and comfortable home. Del-Air is majority owned by Astara Capital Partners.

For more information, visit http://delair.com or call (888) 831-2665.

About Del-Air Plumbing, Air Conditioning and Electric

Since 1983, Del-Air has served Florida residents, businesses and homebuilders with quality air conditioning, heating, plumbing and electrical products and services. Del-Air’s warranty programs and flagship Precise Comfort Plan includes regular professional maintenance for all household plumbing, air conditioning and electrical systems where applicable. Visit https://www.delair.com/ or call 888-831-2665 to contact Del-Air.

MEDIA CONTACT:

Heather Ripley

Ripley PR

(865) 977-1973

hripley@ripleypr.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/kevin-clark-named-president-of-del-air-residential-new-construction-division-302260400.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/kevin-clark-named-president-of-del-air-residential-new-construction-division-302260400.html

SOURCE Del-Air Plumbing, Air Conditioning and Electric

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fannie Mae Releases August 2024 Monthly Summary

WASHINGTON, Sept. 27, 2024 /PRNewswire/ — Fannie Mae’s FNMA August 2024 Monthly Summary is now available. The monthly summary report contains information about Fannie Mae’s monthly and year-to-date activities for our gross mortgage portfolio, mortgage-backed securities and other guarantees, interest rate risk measures, and serious delinquency rates.

About Fannie Mae

Fannie Mae advances equitable and sustainable access to homeownership and quality, affordable rental housing for millions of people across America. We enable the 30-year fixed-rate mortgage and drive responsible innovation to make homebuying and renting easier, fairer, and more accessible. To learn more, visit:

fanniemae.com | X (formerly Twitter) | Facebook | LinkedIn | Instagram | YouTube | Blog

Fannie Mae Newsroom

https://www.fanniemae.com/newsroom

Photo of Fannie Mae

https://www.fanniemae.com/resources/img/about-fm/fm-building.tif

Fannie Mae Resource Center

1-800-2FANNIE

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fannie-mae-releases-august-2024-monthly-summary-302261328.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fannie-mae-releases-august-2024-monthly-summary-302261328.html

SOURCE Fannie Mae

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Want to Collect Passive Income? This High-Yielding ETF Gives You 100 Top Dividend Stocks for 1 Low Price.

Buying dividend stocks is an excellent way to make passive income. However, with so many companies paying dividends, it can be hard to know where to start.

The Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) makes it easy. The exchange-traded fund (ETF) lets you invest in 100 of the top dividend stocks through one easy-to-buy package. And it charges an ultra-low expense ratio, which lets investors keep more of the dividend income these stocks produce without giving too much back in fees.

A who’s who of dividend stocks

The Schwab U.S. Dividend Equity ETF aims to track the Dow Jones U.S. Dividend 100 Index. That index measures the performance of higher-yielding dividend stocks with a record of consistency and strong financial metrics compared to their peers. These features enable the companies to steadily increase their above-average payouts.

That’s clear from looking at a couple of the fund’s top holdings. Home Depot (NYSE: HD) currently sits at the top of the list with a 4.3% allocation. The home improvement retail giant has a dividend yield above 2% at Friday’s prices, comfortably higher than the S&P 500 (less than 1.5%). Home Depot has an excellent record of paying dividends. It has increased its payout for 15 straight years, including by 7.7% in February. The company backs its payout up with a strong financial profile. It generated nearly $11 billion in net cash from operating activities in the first half of this year, easily covering its roughly $4.5 billion dividend outlay. With its cash flow, balance sheet, and long-term fundamentals strong, Home Depot should have no trouble continuing to pay dividends.

Verizon (NYSE: VZ) is the fund’s second-largest holding, at 4.25% of its assets. The telecom titan currently offers a dividend yield above 6%. It recently delivered its 18th consecutive annual dividend increase, the longest current streak in the U.S. telecom sector. Verizon produces lots of cash ($16.6 billion of cash flow from operations in the first half of this year), which covered its capital expenditures ($8.1 billion) and dividend payments ($5.6 billion) with room to spare. Verizon uses its excess free cash to strengthen its already solid balance sheet, which is giving it the financial fortitude to buy Frontier Communications in a $20 billion all-cash deal to drive future growth.

A high yield for a low price

Home Depot and Verizon are two of the 100 dividend stocks held by the fund. Most of its holdings offer high dividend yields. Because of that, the fund itself has a high yield. Over the past year, the fund’s yield is 3.3% based on its distribution payments.

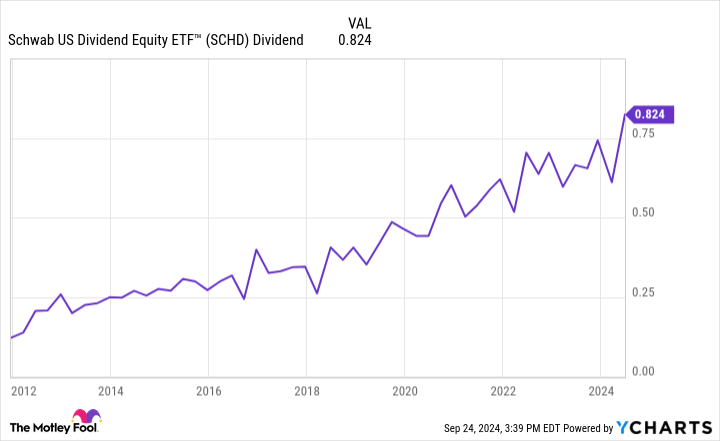

Those payments ebb and flow each quarter based on the dividend payments received by the fund. However, they’ve trended higher over the years:

Driving that growth is the fund’s focus on holding stocks that regularly increase their dividends. Many of its top holdings have delivered a decade or more of annual dividend increases. Given the fund’s preference for companies with leading financial profiles, these companies should be able to continue increasing their payouts.

Fund investors get that rising income stream for a very low price. The ETF has a 0.06% expense ratio. For comparison, some other top dividend ETFs have expense ratios between 0.28% and 0.35%. Put another way, a $1,000 investment in Schwab U.S. Dividend Equity ETF would cost a mere $0.60 each year in fees, while higher-cost funds would incur $2.80 to $3.50 in annual management fees for every $1,000 invested.

A great way to collect dividend income

Investing in dividend stocks is an excellent way to make passive income. You could hand-select a portfolio of top dividend stocks or go the easy route and get 100 of them in one single fund through the Schwab U.S. Dividend Equity ETF. The ETF charges a low rate, which enables investors to keep more of the high-yielding dividend income its holdings generate. These features make it a top option for those seeking to collect dividend income.

Should you invest $1,000 in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Matt DiLallo has positions in Home Depot and Verizon Communications. The Motley Fool has positions in and recommends Home Depot. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Want to Collect Passive Income? This High-Yielding ETF Gives You 100 Top Dividend Stocks for 1 Low Price. was originally published by The Motley Fool

Billionaire Mark Cuban Admits To Being A Trump Supporter In 2016, Credits 'Long Conversation' With Former President's Running Mate JD Vance For His Political Shift

Billionaire entrepreneur and investor Mark Cuban admitted to supporting Donald Trump in 2016 and credited a conversation with JD Vance for his subsequent change of heart.

What Happened: On Friday, Cuban shared a video compilation of him spanning from 2015 to 2017, in which the “Shark Tank” star could be heard expressing favorable views about Trump.

The part-owner of the Dallas Mavericks, reposted the video on X, formerly Twitter, saying, “I did support Trump for a bit back in 2016. Then I had a long conversation with JD Vance.”

See Also: iOS 18 Includes Apple’s New Passwords App with End-to-End Encryption: Here’s How You Use It

Why It Matters: Cuban’s relationship with Trump has been a rollercoaster ride. He previously saw Trump as a disruptor who could shake up the status quo, a trait he admired.

“I actually started off supporting Donald and then I got to know him better. I was like, ‘He’s great, he’s not a typical Stepford candidate.’ I thought that was a positive, and then I got to know him,” Cuban said in an interview with Vivek Ramaswamy last month.

The billionaire investor’s political stance has since evolved. He has been publicly endorsing Vice President Kamala Harris, the Democratic presidential nominee for the 2024 election.

Cuban has previously also labeled Trump as a “lousy president” and stated his preference for President Joe Biden over Trump. “I truly don’t hate him at all. I just think he was and would be a lousy president.”

Earlier this month, Cuban also publicly questioned Trump’s track record of investing in startups outside his family businesses.

Cuban’s question went beyond finances, pointing to Trump’s character. When another user challenged the basis of his claim, Cuban highlighted that Trump, as a presidential candidate, must file financial disclosures with the FEC.

He added that he couldn’t find any evidence of Trump investing in businesses outside his family.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photos courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cohen & Steers Infrastructure Fund, Inc. (UTF) Notification of Sources of Distribution Under Section 19(a)

NEW YORK, Sept. 27, 2024 /PRNewswire/ — This press release provides shareholders of Cohen & Steers Infrastructure Fund, Inc. UTF (the “Fund”) with information regarding the sources of the distribution to be paid on September 30, 2024 and cumulative distributions paid fiscal year-to-date.

In March 2015, the Fund implemented a managed distribution policy in accordance with exemptive relief issued by the Securities and Exchange Commission. The managed distribution policy seeks to deliver the Fund’s long-term total return potential through regular monthly distributions declared at a fixed rate per common share. This policy gives the Fund greater flexibility to realize long-term capital gains throughout the year and to distribute those gains on a regular monthly basis to shareholders. The Board of Directors of the Fund may amend, terminate or suspend the managed distribution policy at any time, which could have an adverse effect on the market price of the Fund’s shares.

The Fund’s monthly distributions may include long-term capital gains, short-term capital gains, net investment income and/or return of capital for federal income tax purposes. Return of capital includes distributions paid by the Fund in excess of its net investment income and net realized capital gains and such excess is distributed from the Fund’s assets. A return of capital is not taxable; rather, it reduces a shareholder’s tax basis in his or her shares of the Fund. In addition, distributions from the Fund’s investments in MLPs are attributed to various sources, including net investment income and return of capital. The amount of monthly distributions may vary depending on a number of factors, including changes in portfolio and market conditions.

At the time of each monthly distribution, information will be posted to cohenandsteers.com and mailed to shareholders in a concurrent notice. However, this information may change at the end of the year because the final tax characteristics of the Fund’s distributions cannot be determined with certainty until after the end of the calendar year. Final tax characteristics of all of the Fund’s distributions will be provided on Form 1099-DIV, which is mailed after the close of the calendar year.

The following table sets forth the estimated amounts of the current distribution and the cumulative distributions paid this fiscal year-to-date from the sources indicated. All amounts are expressed per common share.

|

DISTRIBUTION ESTIMATES |

September 2024 |

YEAR-TO-DATE (YTD) September 30, 2024* |

||

|

Source |

Per Share |

% of Current |

Per Share |

% of 2024 |

|

Net Investment Income |

$0.0740 |

47.74 % |

$0.6177 |

44.28 % |

|

Net Realized Short-Term Capital Gains |

$0.0040 |

2.58 % |

$0.0040 |

0.29 % |

|

Net Realized Long-Term Capital Gains |

$0.0770 |

49.68 % |

$0.7733 |

55.43 % |

|

Return of Capital (or other Capital Source) |

$0.0000 |

0.00 % |

$0.0000 |

0.00 % |

|

Total Current Distribution |

$0.1550 |

100.00 % |

$1.3950 |

100.00 % |

You should not draw any conclusions about the Fund’s investment performance from the amount of this distribution or from the terms of the Fund’s managed distribution policy. The amounts and sources of distributions reported in this Notice are only estimates, are likely to change over time, and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for accounting and tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The amounts and sources of distributions year-to-date may be subject to additional adjustments.

*THE FUND WILL SEND YOU A FORM 1099-DIV FOR THE CALENDAR YEAR THAT WILL TELL YOU HOW TO REPORT THESE DISTRIBUTIONS FOR FEDERAL INCOME TAX PURPOSES.

The Fund’s Year-to-date Cumulative Total Return for fiscal year 2024 (January 1, 2024 through August 31, 2024) is set forth below. Shareholders should take note of the relationship between the Year-to-date Cumulative Total Return with the Fund’s Cumulative Distribution Rate for 2024. In addition, the Fund’s Average Annual Total Return for the five-year period ending August 31, 2024 is set forth below. Shareholders should note the relationship between the Average Annual Total Return with the Fund’s Current Annualized Distribution Rate for 2024. The performance and distribution rate information disclosed in the table is based on the Fund’s net asset value per share (NAV). The Fund’s NAV is calculated as the total market value of all the securities and other assets held by the Fund minus the total liabilities, divided by the total number of shares outstanding. While NAV performance may be indicative of the Fund’s investment performance, it does not measure the value of a shareholder’s individual investment in the Fund. The value of a shareholder’s investment in the Fund is determined by the Fund’s market price, which is based on the supply and demand for the Fund’s shares in the open market.

Fund Performance and Distribution Rate Information:

|

Year-to-date January 1, 2024 to August 31, 2024 |

|

|

Year-to-date Cumulative Total Return1 |

16.33 % |

|

Cumulative Distribution Rate2 |

5.53 % |

|

Five-year period ending August 31, 2024 |

|

|

Average Annual Total Return3 |

6.53 % |

|

Current Annualized Distribution Rate4 |

7.37 % |

|

1. |

Year-to-date Cumulative Total Return is the percentage change in the Fund’s NAV over the year-to-date time period including distributions paid and assuming reinvestment of those distributions. |

|

2. |

Cumulative Distribution Rate for the Fund’s current fiscal period (January 1, 2024 through September 30, 2024) measured on the dollar value of distributions in the year-to-date period as a percentage of the Fund’s NAV as of August 31, 2024. |

|

3. |

Average Annual Total Return represents the compound average of the Annual NAV Total Returns of the Fund for the five-year period ending August 31, 2024. Annual NAV Total Return is the percentage change in the Fund’s NAV over a year including distributions paid and assuming reinvestment of those distributions. |

|

4. |

The Current Annualized Distribution Rate is the current fiscal period’s distribution rate annualized as a percentage of the Fund’s NAV as of August 31, 2024. |

Investors should consider the investment objectives, risks, charges and expense of the Fund carefully before investing. You can obtain the Fund’s most recent periodic reports, when available, and other regulatory filings by contacting your financial advisor or visiting cohenandsteers.com. These reports and other filings can be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing.

Shareholders should not use the information provided here in preparing their tax returns. Shareholders will receive a Form 1099-DIV for the calendar year indicating how to report Fund distributions for federal income tax purposes.

Website: https://www.cohenandsteers.com

Symbol: CNS

About Cohen & Steers. Cohen & Steers is a leading global investment manager specializing in real assets and alternative income, including listed and private real estate, preferred securities, infrastructure, resource equities, commodities, as well as multi-strategy solutions. Founded in 1986, the firm is headquartered in New York City, with offices in London, Dublin, Hong Kong, Tokyo and Singapore.

Forward-Looking Statements

This press release and other statements that Cohen & Steers may make may contain forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which reflect the company’s current views with respect to, among other things, its operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative versions of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties.

Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. The company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

![]() View original content:https://www.prnewswire.com/news-releases/cohen–steers-infrastructure-fund-inc-utf-notification-of-sources-of-distribution-under-section-19a-302261491.html

View original content:https://www.prnewswire.com/news-releases/cohen–steers-infrastructure-fund-inc-utf-notification-of-sources-of-distribution-under-section-19a-302261491.html

SOURCE Cohen & Steers, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What Is The Dividend Payout for Chevron?

Chevron (NYSE: CVX) is recognized for its high-quality fundamentals as the only energy sector constituent of the Dow Jones Industrial Average. Part of the attraction of this integrated oil and gas giant is the stock’s compelling 4.4% dividend yield with an impressive 37-year history of annually increasing the payout amount.

Let’s explore how Chevron’s dividend has evolved and what investors can expect ahead.

Chevron’s dividend rate

Chevron’s current quarterly dividend payout is $1.63 per share, with the latest distribution on Sept. 10, 2024. If you owned 100 shares of Chevron stock, you’d have received a $163 dividend payment.

Earlier this year, the company increased the dividend by 8% from the prior quarterly rate of $1.52, and this follows a 6% increase in both 2023 and 2022. Since 2008, Chevron’s dividend payout has climbed by a compound annual growth rate of 6%.

Steady energy production growth with key investments in deepwater assets, including a strategic diversification into natural gas exposure, has supported the capital-return policy. Financial results have been impressive in recent years. Between 2021 and 2023, total revenue climbed by 27%, while earnings per share increased by an even stronger 40% over the period.

Room for future dividend hikes

Beyond any near-term volatility in energy market prices, Chevron’s strong balance sheet and approximately $18.1 billion in free cash flow generated in the trailing 12 months more than covers the annualized $11.6 billion cash dividend distribution. It’s expected that Chevron will continue increasing its dividend rate annually as part of its long-standing stated financial priority, balancing the flexibility to invest toward future growth.

While an announcement hasn’t yet been made, the fourth-quarter dividend payout from Chevron will likely be made in December for shareholders on record by mid-November. There’s also a good chance Chevron will declare a new dividend hike in January 2025, following a pattern from recent years.

To sum it up, Chevron’s stock maintains its blue chip status and can work for income-focused investors within a diversified portfolio over the long run.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

What Is The Dividend Payout for Chevron? was originally published by The Motley Fool

Vice President Harris Promises Tougher Border Security And Immigration Reform In Arizona

Vice President Kamala Harris committed to signing a new version of a bipartisan Senate border security bill during a campaign event in Douglas, Arizona, on Friday.

What Happened: In her first visit to the U.S.-Mexico border in three years, Harris emphasized her intention to reinforce asylum restrictions that have helped reduce border crossings since May.

She stated, “It was the strongest border security bill we have seen in decades,” and blamed Trump for halting its progress, reported The Hill.

Harris also proposed a five-year re-entry ban for individuals crossing the border illegally and stricter penalties for repeat offenders. She pledged to enhance the asylum system and create a pathway to citizenship for long-term undocumented residents.

Senator Mark Kelly (D-Ariz.) and Arizona Attorney General Kris Mayes also spoke at the event, highlighting the importance of border security and the economic benefits of cross-border trade.

Why It Matters: Harris’s commitment to tougher border security and immigration reform comes at a crucial time.

In her first major interview as the Democratic nominee for president, Harris vowed to enforce stricter border policies and criticized her Republican rival, Donald Trump, for derailing a bipartisan bill aimed at addressing the U.S.-Mexico border.

Additionally, Harris has been defending her policy shifts on critical issues such as immigration, maintaining that her core values remain intact. In a recent interview, she dismissed Trump’s claims about her racial identity as the “same old, tired playbook.”

Meanwhile, concerns are growing among Republicans about Trump’s campaign strategy against Harris. GOP donors and strategists are increasingly worried that his attacks on Harris have been ineffective and that his alignment with fringe politicians could hurt his chances in the 2024 presidential election.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.