Thomas DeBruine Exercises Options, Realizes $85K

On September 27, it was revealed in an SEC filing that Thomas DeBruine, Chief Operating Officer at Brady BRC executed a significant exercise of company stock options.

What Happened: The latest Form 4 filing on Friday with the U.S. Securities and Exchange Commission uncovered DeBruine, Chief Operating Officer at Brady, exercising stock options for 2,851 shares of BRC. The total transaction was valued at $85,465.

Brady shares are trading down 0.0% at $76.05 at the time of this writing on Friday morning. Since the current price is $76.05, this makes DeBruine’s 2,851 shares worth $85,465.

All You Need to Know About Brady

Brady Corp provides identification solutions and workplace safety products. The company offers identification and healthcare products that are sold under the Brady brand to maintenance, repair, and operations as well as original equipment manufacturing customers. Products include safety signs and labeling systems, material identification systems, wire identification, patient identification, and people identification. Brady also provides workplace safety and compliance products such as safety and compliance signs, asset tracking labels, and first-aid products. The company is organized and managed on a geographic basis with two reportable segments: Americas & Asia which derives maximum revenue, and Europe & Australia.

Financial Insights: Brady

Decline in Revenue: Over the 3 months period, Brady faced challenges, resulting in a decline of approximately -0.73% in revenue growth as of 31 July, 2024. This signifies a reduction in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: Achieving a high gross margin of 51.56%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 1.16, Brady showcases strong earnings per share.

Debt Management: Brady’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.12.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 18.69 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 2.75 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 12.46 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Important Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Brady’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Top Tech Stock to Buy Hand Over Fist Before TSMC's Spending Splurge Begins

Taiwan Semiconductor Manufacturing (NYSE: TSM), popularly known as TSMC, is the world’s largest semiconductor foundry that manufactures chips for fabless semiconductor companies. Its customers include popular names such as Nvidia, Apple, Advanced Micro Devices, Broadcom, Qualcomm, and others.

TSMC controls 62% of the global foundry market, enjoying a significant lead over second-place Samsung, which has a market share of just 13%. So, TSMC is in a solid position to make the most of the secular long-term growth opportunity in the semiconductor market, which is getting a nice boost thanks to a new catalyst in the form of artificial intelligence (AI) that’s positively impacting multiple end markets.

The semiconductor market’s growth potential is encouraging TSMC to boost capital spending

The global semiconductor market’s revenue is expected to cross $1.3 trillion in 2032, up from $547 billion last year. This explains why TSMC is set to spend a lot on enhancing its manufacturing footprint. The company’s board recently approved a $30 billion investment plan to install and upgrade advanced chip manufacturing facilities, construct new fabs, and also shore up its advanced packaging and specialty chip manufacturing abilities.

It is worth noting that TSMC spent a similar amount of money in 2023 on capital expenditure. However, it won’t be surprising to see TSMC gradually increasing its capex levels. The company intends to spend between $30 billion and $32 billion on capital expenditure in 2024 as compared to its earlier estimate of $28 billion to $30 billion. Analysts are expecting its capital expenses to land at the higher end of that range.

More importantly, analysts expect the higher end of TSMC’s capex to hit $37 billion in 2025. On the other hand, The Wall Street Journal recently reported that TSMC and Samsung are considering a $100 billion investment to build huge chipmaking facilities in the Middle East as a part of their global expansion strategy. So, there is a good chance that the spending on semiconductor manufacturing equipment could lead to higher capex by the likes of TSMC and Samsung.

The potential jump in TSMC’s capex suggests that the company will spend more to buy chipmaking equipment, especially high-end equipment so that it can meet the demand for chips made on advanced manufacturing processes such as 3-nanometer (nm) and 2nm nodes.

For instance, the production capacity of TSMC’s 3nm process node is currently full thanks to demand from the likes of Intel and Apple. Meanwhile, Apple is reportedly looking to secure all of TSMC’s 2nm manufacturing capacity for its 2025 iPhones. All of this bodes well for a key TSMC supplier that is vital to its production of these advanced chips — ASML Holding (NASDAQ: ASML).

ASML Holding’s growth is set to accelerate

Dutch semiconductor equipment giant ASML has a monopoly in the market for extreme ultraviolet (EUV) lithography machines that are used for making advanced chips based on small process nodes such as 5nm and 3nm. Not surprisingly, chipmakers such as Samsung, TSMC, and Intel have been lining up to buy ASML’s advanced machines so that they can manufacture faster and more power-efficient chips.

This resulted in ASML reporting a massive order backlog of 39 billion euros, which is higher than the company’s 2024 revenue forecast of 27.5 billion euros. Oddly, ASML expects its revenue to remain flat in 2024 when compared to 2023, but the recent developments concerning the semiconductor industry’s capex suggest that better times lie ahead for the company.

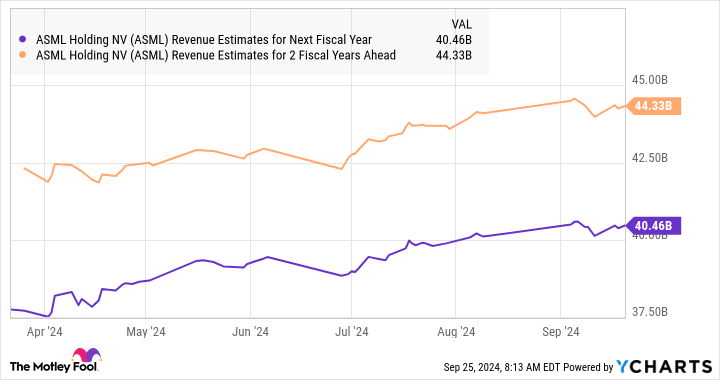

As per consensus estimates, ASML’s revenue in 2024 could rise by 5% to $30.9 billion. However, the forecasts for the next couple of years have been rising and point toward a nice acceleration in its growth.

That won’t be surprising considering the huge sums of money that TSMC and other chipmakers are planning to spend to shore up their production capacities. It is worth noting that ASML got 29% of its revenue from customers based in Taiwan last year, indicating that TSMC is most probably a big customer for the Dutch company.

Investors should also note that South Korean customers accounted for 25% of ASML’s net sales in 2023. So, Samsung’s rumored spending splurge in the Middle East, as mentioned earlier, could be a catalyst for ASML. Additionally, South Korean memory manufacturer SK Hynix is also reportedly in line to purchase ASML’s advanced chipmaking equipment.

All this explains why the market for EUV lithography machines is expected to touch $50 billion by 2039 as compared to $8 billion in 2022. ASML, therefore, could see terrific incremental revenue growth over the next five years as chipmakers pour more money into its offerings to make advanced chips.

That’s why now would be a good time for investors to buy ASML stock as it is trading at 28 times forward earnings, a discount to its five-year average forward earnings multiple of 35 and also to the U.S. technology sector’s earnings ratio of 45. The stock may have underperformed the broader market this year with gains of just 7%, but it could break out of this mediocrity thanks to a bump in capital spending by chipmakers such as TSMC and others.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

1 Top Tech Stock to Buy Hand Over Fist Before TSMC’s Spending Splurge Begins was originally published by The Motley Fool

MicroStrategy 2X Leveraged ETF Sees Massive Inflows In First Week Of Trading As MSTR Outperforms Bitcoin

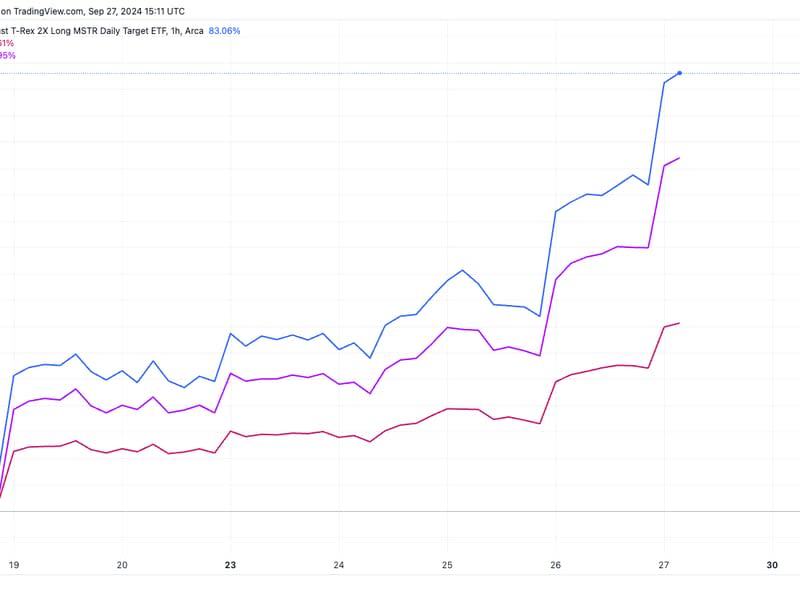

Seven days after hitting the market, the T-REX 2X Long MSTR Daily Target ETF (MSTU) has become one of the most successful new exchange-traded funds (ETFs) on the market after attracting over $72 million.

The fund, issued by REX Shares and Tuttle Capital Management, promises two times the daily performance to the stock of MicroStrategy (MSTR), the software mogul turned bitcoin strategy company, the most leverage any fund tied to MSTR gives.

A similar fund, the Defiance Daily Target 1.75X Long MicroStrategy ETF (MSTX), promises traders returns of 175% of the daily percentage change in the share price of MSTR. MSTX went live on Aug. 15 and has so far taken in roughly $857 million, according to data from Bloomberg Intelligence senior ETF analyst Eric Balchunas, putting it in the top 8% of launches this year.

“Both have robust liquidity,” Balchunas said in a post on X. “I didn’t think there was room for both (esp so quickly), it just [shows] how much ‘need for speed’ there is out there.”

MicroStrategy has been an attractive investment for traders looking to gain exposure to bitcoin {{BTC}} without directly investing in the digital asset, as shares of the company are highly correlated with the token due to MicroStrategy’s holding 252,220 BTC.

MicroStrategy outperforms bitcoin and tech in current market rally

Bitcoin’s price has just exceeded $66,000 for the first time since July 31. At that time, MicroStrategy was priced at $168; it is now trading at almost $178, $10 a share higher. As MicroStrategy is trading higher while bitcoin effectively has been flat since then, this shows that MicroStrategy is leading the current rally.

Another development can be seen with the divergence between MicroStrategy and NVIDIA (NVDA). Both assets were in lockstep for the past month, but since Sept. 19, MicroStrategy has gone on from strength to strength while NVIDIA has flatlined. This shows that tech is not the primary driver in this rally.

From Binance's Zhao To Silk Road's Ulbricht: Meet The Crypto Moguls Who Amassed 272 Years Of Prison Time

Binance co-founder Changpeng Zhao was released on Friday, after having served a four-month sentence for failing to implement Anti-Money Laundering (AML) measures between 2017 and 2022.

But Zhao’s case is just one among many that highlight the growing enforcement against crypto crimes. The crypto industry has seen intense legal scrutiny in the past decade, with authorities handing out a combined 272 years of prison time to various industry leaders.

Famous Crypto Founders That Went Behind Bars

The list of jailed crypto kingpins features some of the most prominent figures in the industry, according to Social Capital Markets.

Ross Ulbricht, founder of the Silk Road marketplace, remains the most severely punished, serving a double life imprisonment plus 40 years for charges including money laundering, computer hacking and narcotics trafficking.

His conviction in 2015 set a precedent for how severely the legal system views crypto-related crimes.

Sam Bankman-Fried, the founder of FTX, received a 25-year prison sentence earlier this year for fraud and conspiracy.

His conviction followed the collapse of FTX, an event that shook the crypto market and highlighted the vulnerabilities of centralized exchanges.

John McAfee, the software pioneer turned crypto advocate, was arrested in 2021 in Spain for tax evasion related to his cryptocurrency earnings.

He died in prison while awaiting extradition to the United States, ending a turbulent saga of legal troubles, which also involved accusations of insider trading and money laundering.

Pavel Durov, the founder of Telegram, faced a brief detention of four days in France in 2024.

His platform, known for its encryption and privacy features, became a hub for illegal activities, including illicit crypto transactions, drawing the attention of regulatory bodies.

Do Kwon, founder of Terraform Labs, was arrested in Montenegro in 2023 for his role in the collapse of Terra and its stablecoin USTC/USD in 2020, which resulted in a $40 billion market loss.

Kwon is currently out on bail and fighting extradition to South Korea, where he faces fraud charges.

Roger Thomas Clark, a senior advisor to Silk Road, was convicted in 2023 and sentenced to 20 years for his involvement in narcotics trafficking.

His case demonstrated the extensive reach of law enforcement in tackling those who facilitated dark web enterprises.

Karl Sebastian Greenwood, co-founder of OneCoin, was sentenced to 20 years in 2023 for his role in orchestrating one of the largest Ponzi schemes in cryptocurrency history, which defrauded billions from investors worldwide.

Mark Scott, a former lawyer who played a pivotal role in laundering money for the OneCoin scam, was convicted in 2024 and sentenced to 10 years in prison.

Scott used his legal expertise to create a sophisticated network of shell companies and offshore accounts to hide over $400 million in stolen funds.

How Is Crypto Crime Developing?

Between 2019 and 2024, there was a 267% increase in crypto-related convictions, with 63% of these occurring in just the past three years.

Overall, crypto crime convictions have surged by 300% from 2014 to 2024, reflecting intensified regulatory scrutiny and efforts to combat crimes like money laundering and fraud, which make up nearly 60% of offenses resulting in long prison terms.

The United States has been at the forefront of this crackdown, issuing some of the harshest penalties for crypto crimes and setting a global standard for enforcement.

The implications of these legal actions on market dynamics and regulations will be a key topic at Benzinga’s Future of Digital Assets event on November 19, where industry leaders will discuss the future of crypto in a world of increasing regulatory oversight.

Read Next:

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Polyetheretherketone (PEEK) Market Size Expected to Hit USD 1.7 Billion by 2034 with a 7.4% CAGR Increase| Exclusive Report by Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 27, 2024 (GLOBE NEWSWIRE) — The global polyetheretherketone (PEEK) market (폴리에테르에테르케톤 시장) was projected to attain US$ 776.8 million in 2023. It is anticipated to garner a 7.4% CAGR from 2024 to 2034, and by 2034, the market is likely to attain US$ 1.7 billion.

High-performance engineering thermoplastic Polyetheretherketone (PEEK) is a member of the polyketone family. Due to its remarkable mechanical, thermal, and chemical qualities may be used in various ways.

A semicrystalline performance thermoplastic is called PEEK. Some of PEEK’s most important qualities include its resistance to high temperatures, wear, chemicals, creep, and strength.

PEEK may be produced in many organic ways. Step-growth polymerization by dialkylation of bisphenolate salts is a typical procedure. A polar aprotic solvent with a high melting temperature is used for the synthesis. It is utilized in several industries, including chemical, aerospace, automotive, medical, electrical, electronics, and industrial.

Gain expert insights and supercharge your growth strategies. Request our market overview sample: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2257

Key Findings of Market Report

- PEEK is used in a variety of under-the-hood applications as a metal substitute.

- PEEK parts are employed in piston units because they can tolerate high temperatures and offer superior tribological interaction.

- In addition, it is utilized in washers, bearings, and seals to guarantee improved performance in temperature variations.

- With engine compartments getting smaller, PEEK offers a heavier metal replacement.

- The growth of the polyetheretherketone (PEEK) market is being driven by the rise of the automotive sector.

- The market for PEEK is being driven by the growth in lightweight automotive parts and noise reduction. Low carbon emissions and fuel economy are guaranteed by lightweight automobile parts.

- The need for lightweight automotive parts is being driven by the electrification of cars.

- The market value of electric cars is increasing due to their increased manufacturing worldwide.

Market Trends For Polyetheretherketone (PEEK)

- PEEK is widely utilized to create connections and insulators in electronic equipment due to its excellent temperature resilience and flame resistance. PEEK performs exceptionally well in these circumstances, as these components must endure high temperatures as well as mechanical stress.

- The need for improved materials is being driven by the development of small electrical devices. As a result, developments in the electrical and electronics industries are promoting favorable market dynamics.

- PEEK is commonly utilized because of its resistance to high processing temperatures in the semiconductor manufacturing industry. It is appropriate for crucial components in semiconductor equipment because to its superior chemical resistance and mechanical stability. In the manufacture of semiconductors, PEEK wafer carriers are employed.

- These carriers are useful for carrying fragile semiconductor wafers during processing because they have improved stiffness, chemical resistance, and low weight. The market for polyetheretherketone (PEEK) is primarily driven by the need for consumer electronics and the fast industrialization of the world.

Global Market for Polyetheretherketone (PEEK): Regional Outlook

Various reasons propel the polyetheretherketone (PEEK) market growth throughout the regions. These are:

- Asia Pacific led the worldwide market in 2023, according to regional insights from the polyetheretherketone (PEEK) sector. Throughout the projection period, the polyetheretherketone (PEEK) market share is anticipated to grow due to the fast digitization and increase in demand for 5G connection.

- The electronics industry in this region is being supported by adopting new technologies, including augmented reality, robots, virtual reality, and artificial intelligence. Furthermore, the industrial sector’s technical improvements are accelerating market growth.

Global Polyetheretherketone (PEEK) Market: Key Players

New developments in the polyetheretherketone (PEEK) sector include lightweight automobile components and advancements in electronics. In order to satisfy customer expectations across a range of sectors and expand their product line, manufacturers are introducing new items. Globalizing their brands and enhancing their overall company performance, top firms in the sector are investing in business growth.

The following companies are well-known participants in the global polyetheretherketone (PEEK) market:

- Victrex plc.

- Solvay,

- Evonik Industries,

- Pan Jin Zhongrun High Performance Polymer Co., Ltd.,

- Jilin Zhongyan High Performance Engineering Plastic Co., Ltd.

Few of key developments by the players in this market are:

- Victrex PLC, a well-known manufacturer of high-performance polymer solutions, introduced a new implantable PEEK-OPTIMA polymer, in March 2023. This polymer is specifically made to be used in medical device additive manufacturing processes like Fused Deposition Modeling (FDM) and Fused Filament Fabrication (FFF).

- A new grade of KetaSpire PEEK, KT-850 SCF 30, was developed in July 2022 by the international chemical manufacturer Solvay, based in Belgium. This grade was created specifically for the precision braking system and e-mobility pump components.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights: https://www.transparencymarketresearch.com/checkout.php?rep_id=2257<ype=S

Global Polyetheretherketone (PEEK) Market Segmentation

- Application

- Automotive

- Industrial

- Aerospace

- Electrical & Electronics

- Medical

- Others

- By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Explore TMR’s Extensive Coverage in the Chemical and Materials Domain:

- Industrial Enzymes Market – The global industrial enzymes market (산업용 효소 시장) is estimated to flourish at a CAGR of 6.2% from 2023 to 2031. According to Transparency Market Research, sales of industrial enzymes are slated to total US$ 11.0 billion by the end of the aforementioned period of assessment.

- Algae Fuel Market – The algae fuel industry (조류 연료 산업) was valued at US$ 2.7 million in 2022. A CAGR of 8.8% is projected from 2023 to 2031, and the market is expected to reach US$ 5.7 million. Algae fuel production can be increased by using cultivation, genetic engineering, and extraction technologies.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fission Uranium Awaits Court Decision on Acquisition by Paladin Energy

Fission Uranium FCUUF has completed the hearing before the Supreme Court of British Columbia regarding the approval of the final order for its acquisition by Paladin Energy Limited. The hearing began before the Court on Sept. 13, 2024, and ended on Sept. 26. Its decision on the final order is expected in the coming weeks.

Fission’s acquisition by Paladin Energy, however, remains opposed by CGN Mining Company Limited (“CGN”), which holds an 11.26% stake in Fission. CGN is a subsidiary of China General Nuclear Power Corp.

Fission’s shareholders voted in favor of the acquisition at the special meeting held on Sept. 9, 2024. The closure of the acquisition currently remains subject to receipt of the final order and clearance under the Investment Canada Act, as well as other customary conditions.

Fission Uranium-Paladin Energy Merger Overview

Fission Uranium inked the deal with the Australian miner, Paladin Energy , in June 2024. Per the agreement, Paladin Energy would acquire FCUUF’s outstanding shares for an implied total equity value of C$1.14 billion ($0.846 billion).

The acquisition, if successful, will create a company with a pro forma market capitalization of $3.5 billion. It will be placed among the largest pure-play global uranium companies with a combined mineral resource of 544 million pounds of uranium and ore reserves of 157 million. It will have a solid portfolio of exploration, development and production assets, and a substantially increased international capital markets exposure.

Fission Uranium’s shareholders will receive 0.1076 fully paid shares of Paladin Energy for each share held in FCUUF. On completion, existing Paladin Energy and Fission Uranium shareholders will own around 76% and 24% of the combined entity, respectively.

Paladin Energy has applied for the listing of its shares on the Toronto Stock Exchange concurrent with the completion of the transaction. Consequently, Fission Uranium shareholders will receive TSX-listed Paladin Energy shares.

FCUUF Buyout to Strengthen Paladin Energy’s Uranium Portfolio

Paladin Energy is an independent uranium producer with 75% ownership of the world-class long-life Langer Heinrich Mine located in Namibia. It also owns a portfolio of uranium exploration and development assets in Canada and Australia. Through its Langer Heinrich Mine, it delivers uranium to major nuclear utilities across the world. It has a 17-year estimated mine life and a nameplate annual capacity of 6 million pounds of uranium.

The acquisition of Fission Uranium will make Paladin Energy the 100% owner of the Patterson Lake South uranium property. It is a proposed high-grade uranium mine and mill in Canada’s Athabasca Basin region. The feasibility study for the property projects a 10-year mine life with an annual production of 9.1 million pounds of uranium.

This move will help Paladin Energy capitalize on the growing demand for uranium. Several factors are driving this demand, such as the need for more electricity generation and the global push to decarbonize electrical grids, among others.

Over the past few years, the global uranium market has undergone a shift from an inventory-driven to a production-driven market. Underinvestment in uranium mining operations over the past decade has been the reason for a structural deficit between global production and uranium requirements. In 2024 and 2025, the gap between production and demand is projected to be more than 66 million pounds of uranium. This gap is expected to reach more than 400 million pounds by 2034. Uranium prices will be supported by robust demand and tight supply.

Fission Uranium Stock’s Price Performance

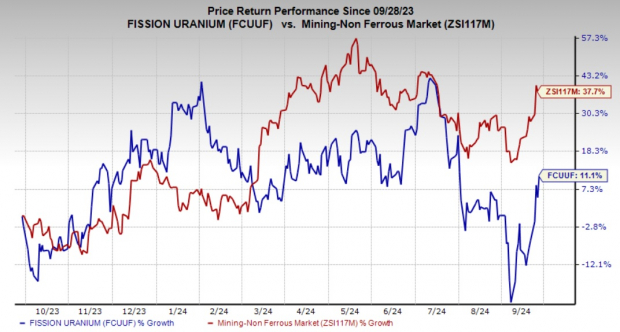

Shares of Fission Uranium have gained 11.1% in the past year compared with the industry’s 37.7% growth.

Image Source: Zacks Investment Research

FCCUF’s Zacks Rank & Stocks to Consider

Fission Uranium currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Eldorado Gold Corporation EGO and IAMGOLD Corporation IAG. Each of these stocks sports a Zacks Rank #1 (Strong Buy) at present.

The Zacks Consensus Estimate for Carpenter Technology’s fiscal 2025 earnings is pegged at $6.06 per share. The consensus estimate for earnings has moved 17% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 15.9%. CRS’ shares have gained 129% in a year.

The consensus estimate for Eldorado Gold’s 2024 earnings is pegged at $1.32 per share. The consensus estimate for earnings has moved 16% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 430%. EGO’s shares have gained 106% in a year.

The Zacks Consensus Estimate for IAMGOLD’s 2024 earnings is pegged at 39 cents per share. The consensus estimate for earnings has moved 44% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 200%. IAG’s shares have gained 160% in a year.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

USCF ANNOUNCES CHANGES TO PRODUCT LINE

WALNUT CREEK, Calif., Sept. 27, 2024 /PRNewswire/ — USCF, a leading-edge provider of exchange traded product innovation, announced today that it plans to close and liquidate one of its products as a result of a decision and vote by the Board of Trustees of USCF ETF Trust that approved the liquidation and dissolution of the following exchange-traded fund (the “Fund”):

USCF Aluminum Strategy Fund (ALUM)

After the close of business on October 11, 2024, the Fund will no longer accept creation orders. Trading in the Fund will be halted prior to market open on October 14, 2024. Beginning on October 14, the Fund will not be traded on NYSE Arca, and there will be no secondary market for the shares of the Fund. On or about October 14, 2024, the Fund will begin the process of liquidating its portfolio, and may not be managed in accordance with its investment objective. The Fund will cease operations, liquidate its assets, and distribute proceeds to shareholders on or about October 18, 2024 (the “Liquidation Date”). Any shareholders remaining in the Fund will have their shares redeemed at net asset value on or about the Liquidation Date.

For more information, please call 1-800-920-0259 or visit www.uscfinvestments.com.

About USCF

USCF operates on the leading edge of exchange-traded product (ETP) and exchange-traded fund (ETF) innovation. The firm broke new ground with the launch of the first oil ETP, the United States Oil Fund, LP (USO), in 2006. Over the next decade, USCF designed and issued fifteen more ETPs and ETFs across commodity and equity asset classes. USCF and its affiliates currently manage over $3 billion in assets from their headquarters in Walnut Creek, California.

Katie Rooney is a registered representatives of ALPS Distributors, Inc.

Funds distributed by and not affiliated with ALPS Distributors, Inc.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/uscf-announces-changes-to-product-line-302261204.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/uscf-announces-changes-to-product-line-302261204.html

SOURCE United States Commodity Funds

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

High Tide Cannabis Co. Ranks Among Top Growing Businesses In Canada In 2024

High Tide Inc. HITI, a retail-driven cannabis company, announced Friday that it placed No. 87 out of 417 companies listed on the 2024 Report on Business ranking of Canada’s Top Growing Companies.

High Tide achieved an impressive three-year revenue growth rate of 486%. This consistent growth earned the company a place in the index for the 4th year in a row.

Consistent Growth In A Competitive Market

High Tide’s ranking in 2024 follows its 2023 achievement, where it placed 38th with a remarkable growth rate of 1,040%.

This consistent upward trajectory can be attributed to the company’s strong retail strategy and operational success. CEO Raj Grover highlighted the success. “Our aggressive top-line growth is being translated into free cash flow generation.”

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

This growth allowed High Tide to expand its retail presence, capturing 12% of the market share in five Canadian provinces.

High Tide’s annualized run rate now exceeds $525 million, with net income reaching $0.8 million in the last quarter.

In addition to dominating the Canadian market, High Tide is looking to expand internationally. The company has set its sights on emerging cannabis markets in Germany and the United States.

Read Also: Canada’s Largest Cannabis Retailer High Tide Partners To Bring Marijuana Offerings To Events

About The Ranking

The full list of the 2024 winners of Canada’s Top Growing Companies is featured in the October issue of Report on Business magazine, along with detailed editorial coverage.

This ranking recognizes the achievements of 417 businesses that qualified by completing a thorough application process and meeting specific revenue requirements.

Launched in 2019, the program celebrates Canada’s most forward-thinking and fast-growing companies across various sectors.

Cover Image: Courtesy of High Tide Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Buy Gas at Costco? Watch Out for This Scam

Fueling up for less is one of the ways people save money at Costco (even if it occasionally means waiting in a line of cars to do so). On average, Costco gas is less expensive than area competitors.

What keeps this perk so exclusive, however, is that you’re required to scan your membership card at the pump. This can be your physical card or a digital card through the Costco app.

Either way, no card, no gas. This is where the scam starts.

Oh, no, I forgot my membership card!

“Darn it, my phone died and I can’t scan my membership card. Can you scan your membership for me so I can fuel up and go charge my phone?”

The request could seem innocent enough. We’ve all had our phones die at the wrong moment or forgotten our wallets without realizing it until we’re at the register. Unfortunately, extending a kind gesture could get you into a bit of hot water if the person on the receiving end is up to no good — such as trying to milk every potential dollar out of stolen credit cards.

(According to online lore, the core of this scam is that Costco doesn’t require ZIP codes to use a credit card, unlike other gas stations. It also helps muddy the waters, since the police have an easy line right to you.)

Your purchases are tied to your account

Part of scanning your card for access means that each time you fuel up at a Costco gas station, that purchase is tied to your Costco account. This includes information about the payment method you use.

Stolen credit cards get reported, and then authorities track down the purchases made. If your Costco account is tied to purchases made from a stolen credit card, you’ll likely have some serious explaining to do.

At best, you get charged for the stolen gas and the cops don’t show up. At worst, you’re having to prove you didn’t steal the credit card in the first place. But even if you wind up with the best-case scenario here, you still have to admit to Costco that you broke the terms of your membership agreement.

Costco can (and does) close accounts for breaking rules

The Costco membership rules are very clear about not letting other people use your membership card. Moreover, Costco has been very vocally cracking down on membership sharing over the last year.

If you’re caught sharing your membership — and yes, scanning your card that one time for that one person counts — Costco can, and likely will, close your account and cancel your membership.

Costco has every right to prohibit you from ever joining again, too. And then you’d never have another Costco hot dog.

How to properly share your membership

Costco’s rules are pretty strict, but there are still a few ways you can share the Costco love with your friends and family.

-

If you’re the Primary Member (or Account Manager), you can assign one free membership card to a member of your household.

-

Each cardholder can bring up to two guests to the store on a trip. However, only the member can make purchases.

-

Members can purchase Costco Shop cards, which are gift cards for Costco. A Shop card gives non-members entrance into Costco and the ability to shop, but they’ll need to use the Shop card to pay.

What to do if you’re approached at the pump

Never scan your membership card for someone else to make a purchase. Instead, you can advise the struggling person to contact the station attendant.

If the person is really a member and having an actual issue, the attendant can help them. If the person isn’t a member, they’ll likely scurry away.

It’s great to want to help our neighbors, but let’s not forget common sense, too. Fueling up at Costco is rarely life or death, so the person can head home for their card or head to another gas station. You don’t need to put your membership at risk.

Top credit card to use at Costco (and everywhere else!)

We love versatile credit cards that offer huge rewards everywhere, including Costco! This card is a standout among America’s favorite credit cards because it offers perhaps the easiest $200 cash bonus you could ever earn and an unlimited 2% cash rewards on purchases, even when you shop at Costco.

Add on the competitive 0% interest period and it’s no wonder we awarded this card Best No Annual Fee Credit Card.

Click here to read our full review for free and apply before the $200 welcome bonus offer ends!

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.Brittney Myers has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

Buy Gas at Costco? Watch Out for This Scam was originally published by The Motley Fool

Can KEYS Stock Gain From Facilitating Thunderbolt 5 Certification?

Keysight Technologies, Inc. KEYS has been designated by UL Solutions as the certification test partner for Thunderbolt 5 products. This new role reinforces UL Solutions’ position as an Intel-authorized lab for Thunderbolt 5 technologies.

Thunderbolt 5 certification mandates compliance with Thunderbolt standards and Keysight, in collaboration with UL Solutions, is committed to ensuring that the products meet these requirements. To validate Thunderbolt 5 certification, UL Solutions uses several Keysight test and measurement products, including the Infiniium UXR B Series Oscilloscopes, the M8000 Series High-Performance BERT and ENA Vector Network Analyzers.

Thunderbolt 5 brings a significant advancement in wired connectivity, boasting data transfer speeds of up to 120 Gbps — almost three times faster than Thunderbolt 4. This enhanced capability accommodates innovative display technologies and improves power delivery, enabling quicker transfers of large files like ultra-high-definition videos and intricate 3D models. The outcome is a more efficient workflow, increased productivity and an enriched user experience.

Keysight’s Testing Solutions Gain Traction

Keysight’s performance is benefiting from the strong demand for its electronic design and test solutions. As electronic devices serve as the backbone of Internet of Things services, wireless technology, data centers and 5G technologies, the swift adoption of these devices is driving an increased need for the company’s electronic testing equipment.

KEYS’ Zacks Rank & Stock Price Performance

KEYS currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 19.6% in the past year compared with the sub-industry’s growth of 16%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Seagate Technology Holdings plc STX, ANSYS, Inc. ANSS and American Software, Inc. AMSWA. STX presently sports a Zacks Rank #1 (Strong Buy), whereas ANSS & AMSWA carry a Zacks Rank #2 (Buy).

Seagate Technology delivered an earnings surprise of 80.9%, on average, in three of the trailing four quarters. In the last reported quarter, STX pulled off an earnings surprise of 40%. The Zacks Consensus Earnings Estimate for STX has increased 18% to $7.41 in the past 60 days.

ANSYS delivered an earnings surprise of 4.8%, on average, in three of the trailing four quarters. In the last reported quarter, ANSS pulled off an earnings surprise of 28.9%. It has a long-term earnings growth expectation of 6.4%.

American Software delivered an earnings surprise of 84.5%, on average, in the trailing four quarters. In the last reported quarter, AMSWA pulled off an earnings surprise of 71.4%. The Zacks Consensus Earnings Estimate for AMSWA has increased 8.6% to 38 cents in the past 60 days.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.