Clock is ticking for US recession, return of Fed's QE, says black swan fund

By Davide Barbuscia and Carolina Mandl

NEW YORK (Reuters) – The first interest rate cut by the Federal Reserve signals a U.S. recession is imminent and a dramatic drop in financial markets could once again force the U.S. central bank to come to the rescue by buying bonds, said tail-risk hedge fund Universa.

The Fed said last week it started cutting rates to recalibrate monetary policy and to maintain strength in the labor market. With inflation declining, and the economy still on relatively solid footing, many see the beginning of the easing cycle as a precursor to a so-called economic soft landing.

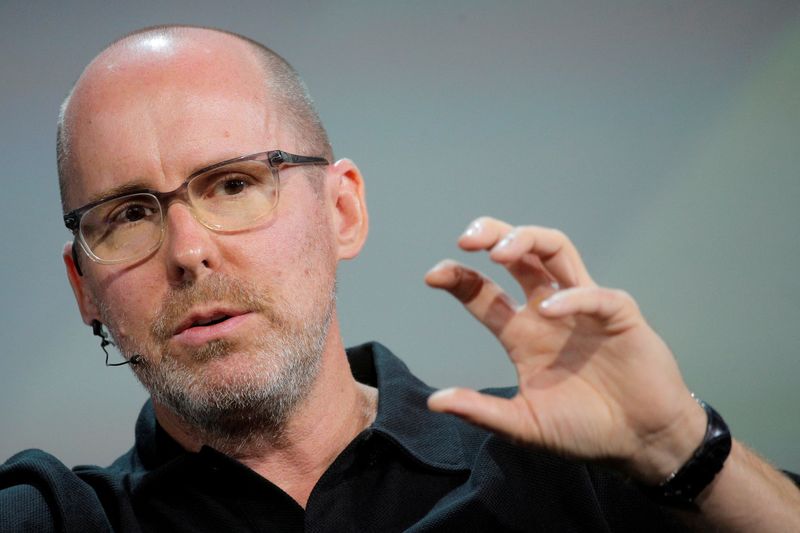

But for Mark Spitznagel, chief investment officer and founder of Universa, this was the start of an aggressive reduction in interest rates, as a highly indebted U.S. economy, which has so far defied expectations, will soon crack under the weight of interest rates still at historical highs.

“The clock is ticking and we are in black swan territory,” he told Reuters this week.

Universa is a $16 billion hedge fund specializing in risk mitigation against “black swan” events – unpredictable and high-impact drivers of market volatility. It uses credit default swaps, stock options and other derivatives to profit from severe market dislocations.

Tail-risk funds are generally cheap bets for a big, long-shot payoff that otherwise are a drag on the portfolio, similarly to monthly insurance policy payments. Universa was one of the big winners during the extreme volatility that rocked markets in the early days of the Covid-19 pandemic in 2020.

Spitznagel said the recent “disinversion” of a closely watched part of the U.S. Treasury yield curve, a key bond market indicator of an upcoming recession, signals that a sharp downturn is imminent. “The clock really starts when the curve disinverts, and we’re here now,” he said.

The curve comparing two and 10-year yields has been inverted for about two years but turned back positive in recent weeks with short-term yields dropping faster than longer-dated ones on expectations the Fed will cut interest rates to support a weakening economy. In the past four recessions – 2020, 2007-2009, 2001 and 1990-1991 – that curve had turned positive a few months before the economy started contracting.

The magnitude of the next credit crunch could be similar to the “Great Crash” of 1929 that triggered a global recession, he said. “The Fed hiked rates into such a huge, unprecedented debt complex … That’s why I say I’m looking for a crash that we haven’t seen since 1929.”

A recession could occur as soon as this year, forcing the Fed to cut rates aggressively from the current level of 4.75%-5%, and eventually pushing the central bank back to quantitative easing (QE), or bond buying – a process that generally occurs amid unsettled markets and aims to bolster monetary policy when rates are near zero.

“I do think they’ll save the day again … I feel strongly that QE is coming back and rates are going to go back to something like zero again,” said Spitznagel.

(Reporting by Davide Barbuscia and Carolina Mandl; Editing by Kirsten Donovan)

'Investor Horror Story in Florida' Warns Reventure CEO: Where Can You Actually Make Money Now?

According to Reventure CEO Nick Gerli, the Florida real estate market is teaching investors who bought at the peak harsh lessons.

In a thread posted on X (formerly Twitter) on Wednesday, Gerli pointed to a troubling, anecdotal case – an investor who purchased a home for $325,000 in 2023, hoping to rent it for $3,800 monthly. Today, that property sits vacant despite rent cuts to $2,500 per month.

Don’t Miss:

If rented, the owner would face an $8,300 annual loss after mortgage payments, according to Gerli.

That isn’t an isolated scenario. The Reventure CEO pointed to a surge in inventory across Florida, with some ZIP codes seeing listings double over the past year. It’s a red flag for the market’s health.

Florida real estate is cyclical, Gerli said. “Each boom – there’s people who think ‘this time is different,’ ‘The area is transformed,’ But in the downturn, they get reminded of the realities.”

Timing is critical in Florida’s market. The real estate executive said investors who bought between 2010 and 2020 likely have positive returns. But those who entered during the 2005-2007 or recent boom cycles struggle.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

Current market conditions are particularly challenging. Rents are stagnating or dropping while property taxes and insurance costs skyrocket. Gerli cites that the 2024 tax bill is $5,500 – nearly two months’ rent. Insurance can add another $4,000 annually in some counties.

Many investors overlook crucial details, like the loss of homestead exemptions, when converting owner-occupied homes to rentals. This can lead to dramatic tax increases. Add vacancy periods, maintenance, and management fees, and profit margins evaporate quickly.

See Also: Will the surge continue or decline on real estate prices? People are finding out about risk-free real estate investing that lets you cash out whenever you want.

“It’s getting very hard to make money in Florida real estate as an investor,” Gerli warns. “Do the math carefully before diving in.”

But where are the opportunities for real estate investors looking to build wealth over the next decade? Several experts weighed in with GOBankingRates:

Boise, Idaho: Jeff Tricoli of Keller Williams cites Boise’s 218% home appreciation over the past decade as a promising indicator. A growing job market and continued high demand make it attractive.

Fort Wayne, Indiana: With median listing prices 102% below the national average, Fort Wayne offers an affordable entry point. Recent price dips could spell opportunity for long-term investors.

Trending: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

Las Vegas, Nevada: The city’s economy and booming tourism industry create opportunities for growth. Median home prices are up 6.3% year over year and rental demand remains strong.

Seattle, Washington: Mitchell G. David of Beach Life Premier Team points to Seattle’s tech-driven economy as a catalyst for long-term growth. Housing prices have doubled in five years, outpacing national averages.

Denver, Colorado: Denver’s surging population and expanding job market make it appealing. Its proximity to other major Colorado cities adds to its appeal.

Raleigh-Durham, North Carolina: The Research Triangle’s diverse economy and prestigious universities create a stable base of high-earning renters and potential buyers.

Trending: Unlock the hidden potential of commercial real estate — This platform allows individuals to invest in commercial real estate offering a 12% target yield with a bonus 1% return boost today!

Austin, Texas: A young demographic and no state income tax make Austin attractive for residents and investors. Median listing prices are up 9.1% year-over-year.

Charlotte, North Carolina: Real estate agent Fant Camak projects potential 145% price growth over the next decade, citing strong job growth and affordability.

Phoenix, Arizona: Tech job growth and lifestyle amenities drive demand in Phoenix. Camak suggests that 130% price growth is possible in the coming years.

Nashua, New Hampshire: Shaun MacDonald of Berkshire Hathaway HomeServices Verani Realty sees an opportunity in Nashua’s relative affordability compared to nearby Boston. He projects 25% to 50% gains over the next decade.

While Florida’s cautionary tale demonstrates the risks of poorly timed investments, alternative markets offer the potential for those willing to do their due diligence and take a long-term view.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article ‘Investor Horror Story in Florida’ Warns Reventure CEO: Where Can You Actually Make Money Now? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Arqit announces leadership transition with the appointment of a new Chief Executive Officer

LONDON, Sept. 27, 2024 (GLOBE NEWSWIRE) — Arqit Quantum Inc. ARQQ ARQQW))), a leading provider of quantum-safe encryption, today announced a leadership transition. Andy Leaver, a seasoned software company executive and Operating Partner from Notion Capital, has been appointed as Chief Executive Officer and a member of the Board of Directors, effective today. Co-Founder and current CEO David Williams will step down from his role as CEO and as a member of the Board of Directors. The executive transition reflects a broader transition within the company from its early development stage to a phase of revenue and operational growth.

Mr. Williams’ entrepreneurial spirit was a driving force behind the development of Arqit’s symmetric key cryptography technology; the establishment of the company and key government, financial and partnership relationships. His contribution has been vital in bringing the company to its current stage of development.

Mr. Leaver brings a wealth of experience to the Chief Executive role having held senior executive roles at leading software companies including: Ariba, Bazaarvoice, Hortonworks, SuccessFactors and Workday as well as having been an adviser to several successful private software scale ups (e.g. OnFido). He has expertise in driving sustainable revenue growth and scaling businesses. He is an Operating Partner at Notion Capital, a leading European venture capital firm and early backer of Arqit. Mr. Leaver will act independently of Notion Capital in his role as CEO and at the direction of the Board of Directors. He has been advising Arqit on its go-to-market strategy as a consultant for the last six months so assumes his new role with understanding of the challenges and opportunities in front of the company.

David Williams, Co-founder of Arqit commented: “I take great pride in the on-going success of Arqit and see a bright future for the company. It has been a pleasure to get to know Andy over the last six months and he has already proven himself invaluable. I am confident he has the right mix of skills to lead Arqit through the next chapter of its journey.”

Andy Leaver, CEO added: “The threat to existing encryption from quantum computers is well documented and Arqit is doing something genuinely transformational in its field. It has a wealth of opportunities ahead of it and I look forward to stewarding the company at this critical juncture. On behalf of myself and the Board of Directors, I would like to thank David for his leadership and drive which has built the foundation for Arqit’s success going forward.”

Notes to Editors

About Arqit

Arqit Quantum Inc. ARQQ ARQQW))) (Arqit) supplies a unique encryption software service which makes the communications links of any networked device, cloud machine or data at rest secure against both current and future forms of attack on encryption – even from a quantum computer. Compatible with NSA CSfC Components and meeting the demands of NSA CSfC Symmetric Key Management Requirements Annexe 1.2. and RFC 8784, Arqit’s Symmetric Key Agreement Platform uses a lightweight software agent that allows end point devices to create encryption keys locally in partnership with any number of other devices. The keys are computationally secure and facilitate Zero Trust Network Access. It can create limitless volumes of keys with any group size and refresh rate and can regulate the secure entrance and exit of a device in a group. The agent is lightweight and will thus run on the smallest of end point devices. The product sits within a growing portfolio of granted patents. It also works in a standards compliant manner which does not oblige customers to make a disruptive rip and replace of their technology. Arqit is winner of two GSMA Global Mobile Awards, The Best Mobile Security Solution and The CTO Choice Award for Outstanding Mobile Technology, at Mobile World Congress 2024, recognised for groundbreaking innovation at the 2023 Institution of Engineering and Technology Awards and winner of the National Cyber Awards’ Innovation in Cyber Award and the Cyber Security Awards’ Cyber Security Software Company of the Year Award. Arqit is ISO 27001 Standard certified. www.arqit.uk

Media relations enquiries:

Arqit: pr@arqit.uk

Investor relations enquiries:

Arqit: investorrelations@arqit.uk

Caution About Forward-Looking Statements

This communication includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, may be forward-looking statements. These forward-looking statements are based on Arqit’s expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Arqit’s control. Forward-looking statements in this communication or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Arqit to predict these events or how they may affect it. Except as required by law, Arqit does not have any duty to, and does not intend to, update or revise the forward-looking statements in this communication or elsewhere after the date this communication is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this communication may not occur. Uncertainties and risk factors that could affect Arqit’s future performance and cause results to differ from the forward-looking statements in this release include, but are not limited to: (i) the outcome of any legal proceedings that may be instituted against the Arqit, (ii) the ability to maintain the listing of Arqit’s securities on a national securities exchange, (iii) changes in the competitive and regulated industries in which Arqit operates, variations in operating performance across competitors and changes in laws and regulations affecting Arqit’s business, (iv) the ability to implement business plans, forecasts, and other expectations, and identify and realise additional opportunities, (v) the potential inability of Arqit to successfully deliver its operational technology, (vi) the risk of interruption or failure of Arqit’s information technology and communications system, (vii) the enforceability of Arqit’s intellectual property, and (viii) other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Arqit’s annual report on Form 20-F (the “Form 20-F”), filed with the U.S. Securities and Exchange Commission (the “SEC”) on 21 November 2023 and in subsequent filings with the SEC. While the list of factors discussed above and in the Form 20-F and other SEC filings are considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realisation of forward-looking statements.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ALLIANCEBERNSTEIN NATIONAL MUNICIPAL INCOME FUND, INC. REPORTS THIRD QUARTER EARNINGS

NEW YORK, Sept. 27, 2024 /PRNewswire/ — AllianceBernstein National Municipal Income Fund, Inc. AFB, a registered closed‑end investment company, today announced earnings for the Fund’s third fiscal quarter ended July 31, 2024.

Total net assets of the Fund* on July 31, 2024 were $363,570,286 as compared with $350,576,798 on April 30, 2024, and $355,617,637 on July 31, 2023. On July 31, 2024, the net asset value per share of common stock was $12.65 based on 28,744,936 shares of common stock outstanding.

|

July 31, 2024 |

April 30, 2024 |

July 31, 2023 |

|

|

Total Net Assets |

$363,570,286 |

$350,576,798 |

$355,617,637 |

|

NAV Per Share |

$12.65 |

$12.20 |

$12.37 |

|

Shares Outstanding |

28,744,936 |

28,744,936 |

28,744,936 |

For the period May 1, 2024 through July 31, 2024, total net investment income was $3,056,703 or $0.11 per share of common stock. The total net realized and unrealized gain was $12,753,214 or $0.44 per share of common stock for the same period.

|

Third Quarter Ended July 31, 2024 |

Second Quarter Ended April 30, 2024 |

Third Quarter Ended July 31, 2023 |

|

|

Total Net Investment Income |

$3,056,703 |

$2,807,884 |

$2,767,045 |

|

Per Share |

$0.11 |

$0.10 |

$0.10 |

|

Total Net Realized/ Unrealized Gain (Loss) |

$12,753,214 |

($13,883,276) |

($793,105) |

|

Per Share |

$0.44 |

($0.48) |

($0.03) |

* Total net assets include assets attributable to both common and preferred shares.

AllianceBernstein National Municipal Income Fund, Inc. is managed by AllianceBernstein L.P.

![]() View original content:https://www.prnewswire.com/news-releases/alliancebernstein-national-municipal-income-fund-inc-reports-third-quarter-earnings-302261299.html

View original content:https://www.prnewswire.com/news-releases/alliancebernstein-national-municipal-income-fund-inc-reports-third-quarter-earnings-302261299.html

SOURCE AllianceBernstein National Municipal Income Fund, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Axial Bone Densitometer Market to Reach $1.0 Billion, Globally, by 2033 at 3.9% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 27, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Axial Bone Densitometer Market by Technology (Dual-Energy X-ray Absorptiometry and Quantitative Computed Tomography), Application (Osteoporosis Diagnosis, Fracture Risk Assessment and Others), and End User (Hospitals, Clinics, Diagnostic Centers and Research Institutions): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the axial bone densitometer market was valued at $0.7 billion in 2023, and is estimated to reach $1.0 billion by 2033, growing at a CAGR of 3.9% from 2024 to 2033.

Request Sample of the Report on Axial Bone Densitometer Market 2033 – https://www.alliedmarketresearch.com/request-sample/A69243

Prime determinants of growth

Rise in prevalence of osteoporosis and bone-related disorders, and growing aging population are the major factors that drive the growth of the market. However, high cost of the axial bone densitometer devices hinders the market growth. Moreover, technological advancements offer remunerative opportunities for the expansion of the global axial bone densitometer market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $0.7 billion |

| Market Size in 2033 | $1.0 billion |

| CAGR | 3.9% |

| No. of Pages in Report | 216 |

| Segments Covered | Technology, Application, End User and Region |

| Drivers |

|

| Opportunities |

|

| Restraints |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A69243

Segment Highlights

Dual-Energy X-ray Absorptiometry application

Dual-Energy X-ray Absorptiometry (DEXA) is preferred for axial bone densitometry due to its high precision, accuracy, and ability to measure bone mineral density at critical sites like the spine and hip. It provides quick, non-invasive assessments, making it the gold standard for diagnosing osteoporosis and assessing fracture risk.

Osteoporosis Diagnosis application of Axial Bone Densitometer

Axial bone densitometers are crucial for osteoporosis diagnosis by measuring bone mineral density (BMD) in the spine and hip. They help identify low bone density, assess fracture risk, and monitor response to treatment. This application aids in early detection and management of osteoporosis, reducing the risk of debilitating fractures.

Diagnostic Centers for Axial Bone Densitometer

Axial bone densitometer devices are primarily utilized by diagnostic centers due to their focused role in providing accurate bone mineral density measurements for osteoporosis screening and management. These centers specialize in bone health assessments, making them key facilities for routine bone density testing and patient management.

Regional Outlook

The Axial Bone Densitometer market shows robust growth across regions. North America and Europe lead due to high healthcare spending and aging populations. Asia-Pacific is rapidly expanding with increasing healthcare infrastructure. Latin America and the Middle East show potential growth, driven by rising awareness and improving healthcare access.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A69243

Key Players

- Swissray International, Inc.

- Eurotec Medical Systems Srl

The report provides a detailed analysis of these key players in the global axial bone densitometer market. These players have adopted different strategies such as, product launch, expansion and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Industry Development

- In April 2022, Newman Regional Health, not-for-profit 25-bed critical access hospital, expanded its health and wellness services for men and women with the addition of the Horizon DXA bone densitometry system from Hologic.

- In February 2022, Aurora Spine Corporation, a manufacturer of innovative spinal implants announced that it has entered into a joint co-marketing agreement with Echolight Medical, a manufacturer of the radiation-free EchoS portable densitometer used for patient assessment of bone mineral density (BMD) and the quality of bone microarchitecture independent of BMD.

Trending Reports in Healthcare Industry:

Drug Discovery Informatics Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Medical Batteries Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Nutrigenomics Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: This Unstoppable Stock Could Join the Trillion-Dollar Club in the Next 5 Years

Shares of Oracle (NYSE: ORCL) have been in red-hot form on the stock market in 2024, rising 56% as of this writing. Investors have been buying shares of this database software provider hand over fist thanks to its improving credentials in the artificial intelligence (AI) market.

The company’s recent results have been solid, and Oracle is set to report double-digit revenue growth in the current fiscal year. Its revenue pipeline is growing at an incredible pace thanks to the robust demand for its cloud infrastructure solutions.

It is also worth noting that Oracle recently held a financial analyst meeting on Sept. 12, and a closer look at management’s long-term predictions indicates this cloud company could be well on its way to attaining a trillion-dollar valuation within the next five years.

Here are some reasons why Oracle is likely to become a trillion-dollar company.

Oracle is going all out after the cloud AI market

Oracle currently has a market capitalization of $455 billion, which means it needs to jump another 120% to enter the trillion-dollar club. The stock could easily appreciate this much because demand for its cloud infrastructure from customers looking to train and deploy AI applications has gone through the roof.

In fiscal 2024 (which ended on May 31), Oracle’s cloud infrastructure revenue shot up 51% year over year and outpaced the 6% growth in its overall revenue. When Oracle released its fiscal Q4 results in June, the company pointed out that it is witnessing “enormous demand for training AI large language models in the Oracle Cloud.” This strong demand led to a 44% year-over-year increase in Oracle’s remaining performance obligations (RPO) in Q4 to $98 billion.

When Oracle released its Q1 results for fiscal 2025 earlier this month, it reported a stronger year-over-year increase of 53% in its RPO to a record $99 billion. RPO refers to the total value of a company’s future contracts, so the terrific growth in this metric is good news for Oracle investors, suggesting the company’s revenue pipeline is getting better.

It is also worth noting that Oracle witnessed a 162% increase in cloud AI customers in the first quarter of fiscal 2025, and the company increased its AI infrastructure capacity by a whopping 258%.

Chairman Larry Ellison remarked on the company’s latest earnings conference call:

Oracle has 162 cloud data centers, live and under construction throughout the world. The largest of these data centers is 800 megawatts, and it will contain acres of Nvidia GP clusters able to train the world’s largest AI models. That’s what’s required to stay competitive in the race to build one, just one of the most powerful artificial neural networks in the world.

The stakes are high and the race goes on. Soon Oracle will begin construction of data centers that are more than a gigawatt.

Clearly, Oracle is looking to go all out to capitalize on the fast-growing demand for AI services in the cloud. Goldman Sachs estimates generative AI could drive $200 billion to $300 billion in cloud spending by the end of the decade, which explains why Oracle is now looking to boost its capital expenditure to capture a bigger share of the end-market opportunity on offer.

The company has planned a capital expenditure of $15 billion for the current fiscal year, which would be more than double its $7 billion in capital expenditures in the previous fiscal year. Oracle says it is building cloud capacity so that it can convert its bookings into revenue and profits at a faster pace, and this probably explains why the company has set an ambitious long-term revenue and earnings growth target.

Why a trillion-dollar market cap looks like a possibility

Oracle expects its revenue to nearly double over the next five years. Specifically, the company is anticipating at least $104 billion in revenue in fiscal 2029 from $53 billion in fiscal 2024. Additionally, management is forecasting annual growth of at least 20% in its earnings per share during this period. For comparison, Oracle’s earnings per share have increased at an annual rate of just under 10% for the past five years.

Oracle ended fiscal 2024 with earnings of $5.56 per share. Based on that number, its bottom line could jump to $13.84 per share after five years. Multiplying the projected earnings with the Nasdaq-100 index’s forward earnings multiple of 29 (using the index as a proxy for tech stocks) points toward a stock price of $401 after five years. That would be a 144% jump from current levels, which would be enough to send Oracle into the trillion-dollar club.

With shares of the company currently trading at 27 times forward earnings, investors are getting a good deal on this AI stock, which they wouldn’t want to miss out on considering the substantial upside it could deliver in the long run.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group, Nvidia, and Oracle. The Motley Fool has a disclosure policy.

Prediction: This Unstoppable Stock Could Join the Trillion-Dollar Club in the Next 5 Years was originally published by The Motley Fool

Bullish Sentiment Across The Cannabis Space – Check Full Movers For September 27, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Global Microscope Camera Market: USD 191 million in 2024 to USD 278 million by 2029, CAGR 7.8% | MarketsandMarkets™

Delray Beach, FL, Sept. 27, 2024 (GLOBE NEWSWIRE) — Microscope camera market forecasted to transform from USD 191 million in 2024 to USD 278 million by 2029, driven by a CAGR of 7.8%. The increase in chronic diseases and technological advancements drive this growth, particularly in emerging regions like Asia Pacific due to high growth potential. Key challenges include high production and maintenance costs, although advancements in CMOS sensors and the demand for high-resolution cameras are notable trends. The market is segmented by type (color vs. monochrome), sensor type (CMOS vs. CCD), resolution (SD vs. HD), application (e.g., pharmaceutical research), and end-user (e.g., pharmaceutical companies). North America dominates the market, with significant players including Leica Microsystems, Nikon, and Carl Zeiss.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=155714096

Browse in-depth TOC on “ Microscope Camera Market“

259 – Tables

54 – Figures

235 – Pages

Based on the camera type, the microscope camera market is segmented into monochrome and color cameras. Color cameras can produce color images much more quickly and efficiently than monochrome cameras, which requires additional hardware and multiple images to be acquired to produce a color image. Also, molecular analysis using colored reagents or involving colored outputs needs a color microscope camera. All these factors contribuye to this segment holding the larger market share in 2023.

Based on sensor type, the microscope camera market is segmented into complementary metal oxide semiconductor (CMOS) sensors and charge-coupled device (CCD) sensors. CMOS had a larger share in 2023 owing to having advanced features such as low noise, ultra-high sensitivity with better and more reliable image quality. CMOS image sensors have several advantages over CCD sensors, such as low power consumption, ease of integration, faster frame rate, and lower manufacturing cost.

Based on resolution, the microscope camera market is segmented into standard-definition and high-definition cameras. The high-definition cameras segment dominated the market in 2023, and this trend is expected to continue during the forecast period. This segment is also expected to register a higher CAGR than the SD cameras segment in the next five years. The large share and high growth of this segment can primarily be attributed to the greater demand for HD cameras and the significant requirement for high-quality images in medical specialties.

Based on applications, the microscope camera market is segmented into live cell imaging, pathology, pharmaceutical & biopharmaceutical research, and other applications. The pharmaceutical & biopharmaceutical research segment commanded the largest share of 45% in 2023, followed by live cell imaging with a market share. The large share is due to the increased utilization of microscope cameras for mechanical characterization, biomarker research, and protein structures.

Based on end users, the microscope camera market can be categorized into pharmaceutical & biopharmaceutical companies, hospital & diagnostic laboratories, academic & research institutes, and other end users (CROs, diagnostic centers, blood banks, and forensic laboratories). Biopharmaceutical & pharmaceutical companies segment accounted for the highest share as microscope cameras are a basic requirement for Research, drug profiling, formulation, and production with the use of microscopes in stages in pharmaceutical drug development.

The global genotyping assay market is segmented into six major regions—North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa and GCC Countries. North America accounted for the largest share of the microscope camera market. The dominant position of this regional segment can be attributed to the increasing adoption of technologically advanced products, the availability of government and public funding for life science and biomedical research projects, the growing applications of cameras in diagnostic labs, increasing investments in DNA-based testing, and the presence of leading market players in the region.

Request for FREE Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=155714096

The major players in this market are Leica Microsystems, Inc. (Danaher Corporation) (US), Nikon Corporation (Japan), Carl Zeiss AG (Germany), Teledyne Technologies (US), and EVIDENT (Japan), Jenoptik AG (Germany), Hamamatsu Photonics KK (Japan), Basler AG (Germany), Excelitas Technologies Corp. (US), Thorlabs, Inc. (US), Keyence Corporation (Japan), Andor Technology (Oxford Instruments) (Ireland), Spot Imaging (US), Euromex Microscopen BV (Netherlands), Motic (China), Dino-Lite Microscope (AnMo Electronics Corporation) (Taiwan), Meiji Techno Co. (Japan), Labomed Inc. (US), DeltaPix (Denmark), Adimec Advanced Image Systems BV (Netherlands), XIMEA Gmbh (Germany), Dage-MTI (US), GT Vision Ltd. (UK), Tucsen Photonics Co. (China) and Raptor Photonics (Ireland).

Leica Microsystems (Danaher Corporation) (US)

Leica Microsystems (Danaher Corporation) (US) held the leading position in the microscope camera market in 2023, with a share of 17.8%. The firm’s leading position in this market is attributed to its wide product portfolio, including color and monochrome microscope cameras in CCD, CMOS, and sCMOS sensor types, along with HD and UHD resolution. The company has a wide geographic presence spanning North America, Latin America, Europe, Africa, the Middle East, and the Asia Pacific. The company focuses on launching new products and entering partnerships and collaborations with other players to sustain its leading position in the market.

Nikon Corporation (Japan)

Nikon Corporation (Japan) held the second position in the genotyping market, with a share of 15.3% in 2023. The company’s area of expertise is the manufacture of optics, microscopes, cameras, and image goods. It offers a wide variety of cameras, microscopes, and other optical devices used in medical imaging for support, diagnosis, research, and training. The company focuses on strengthening its position by entering into numerous agreements and partnerships with other small players and launching new products to strengthen its product portfolio in the market.

For More information, Inquire Now.

Related Reports:

Medical Cameras Market

Endoscopy Equipment Market

Medical Videoscope Market

Microscopy Market

Flow Imaging Microscopy Market

Get access to the latest updates on Microscope Camera Market Companies and Microscope Camera Market Size

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Natural Alternatives International, Inc. Announces Fiscal 2024 Q4 and YTD Results

CARLSBAD, Calif., Sept. 27, 2024 (GLOBE NEWSWIRE) — Natural Alternatives International, Inc. (“NAI”) NAII, a leading formulator, manufacturer, and marketer of customized nutritional supplements, today announced a net loss of $1.9 million, or ($0.32) per diluted share, on net sales of $29.5 million for the fourth quarter of fiscal year 2024 compared to a net income of $2.0 million, or $0.35 per diluted share, in the fourth quarter of the prior fiscal year.

Net sales during the three months ended June 30, 2024, decreased $6.4 million, or 18%, to $29.5 million as compared to $35.9 million recorded in the comparable prior year period. During the same period, private-label contract manufacturing sales decreased 14% to $27.6 million. Private-label contract manufacturing sales decreased primarily due to reduced orders from one of our larger customers associated with their efforts to reduce excess on-hand inventories, partially offset by increased shipments from other existing customers and shipments to new customers.

CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue decreased 48% to $1.85 million during the fourth quarter of fiscal year 2024, as compared to $3.57 million for the fourth quarter of fiscal year 2023. The decrease in CarnoSyn® beta-alanine royalty, licensing, and raw material sales revenue during the fourth quarter of fiscal 2024 was primarily due to decreased raw material sales and unfavorable changes in estimates for volume rebates.

Our net loss for fiscal year 2024 was $7.2 million, or ($1.23) per diluted share, compared to net income of $2.5 million, or $0.43 per diluted share, for fiscal year 2023.

Net sales during the year ended June 30, 2024, decreased $40.2 million, or 26%, to $113.8 million as compared to $154.0 million recorded in the comparable prior year period. During the year ended June 30, 2024, private-label contract manufacturing sales decreased 27% to $105.4 million, as compared to $145.3 million in the comparable prior period. CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue decreased 3% to $8.4 million during the fiscal 2024, as compared to $8.7 million for fiscal 2023.

We experienced a loss from operations during the three and twelve months ended June 30, 2024. This was primarily due to a slowdown in sales across our private-label contract manufacturing segment. Although our overall sales forecast for fiscal 2025 includes a significant increase in sales as compared to fiscal 2024, we currently anticipate we will experience a net loss in the first half of fiscal 2025, net income in the second half of fiscal 2025, and we will break-even or have a slight profit for the full fiscal 2025 year.

As of June 30, 2024, we had cash of $12.0 million and working capital of $38.1 million, compared to $13.6 million and $41.1 million respectively, as of June 30, 2023. As of June 30, 2024, we had $12.0 million of borrowing capacity on our credit facility of which we had outstanding borrowings of $3.4 million.

Mark A. Le Doux, Chairman and Chief Executive Officer of NAI stated, “As planned, our Carlsbad powder facility re-opened in the fourth quarter with on-going production to meet our customer requirements. We continue to gain traction with new business opportunities and expect these efforts to bear fruit in the coming months. Our new business opportunity pipeline remains healthy, and we are optimistic these opportunities will generate positive sales growth and pave our pathway back to profitability.”

“We recently attended the ESPEN conference in Milan, Italy where we debuted our groundbreaking new patent pending carnosine boosting ingredient called TriBsynTM to researchers, healthcare professionals, and brands within the medical foods industry. This was an exciting event for us to introduce TriBsynTM which is the world’s first paresthesia free beta-alanine to the industry, and we are encouraged by the reception it received.”

An updated investor presentation will be posted to the investor relations page on our website later today (https://www.nai-online.com/our-company/investors/).

NAI, headquartered in Carlsbad, California, is a leading formulator, manufacturer and marketer of nutritional supplements and provides strategic partnering services to its customers. Our comprehensive partnership approach offers a wide range of innovative nutritional products and services to our clients including scientific research, clinical studies, proprietary ingredients, customer-specific nutritional product formulation, product testing and evaluation, marketing management and support, packaging, and delivery system design, regulatory review, and international product registration assistance. For more information about NAI, please see our website at http://www.nai-online.com.

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 that are not historical facts and information. These statements represent our intentions, expectations and beliefs concerning future events, including, among other things, our ability to develop, maintain or increase sales to new and existing customers, our future revenue, profits and financial condition, as well as current and future economic conditions and the impact of such conditions on our business. We wish to caution readers these statements involve risks and uncertainties that could cause actual results and outcomes for future periods to differ materially from any forward-looking statement or views expressed herein. NAI’s financial performance and the forward-looking statements contained herein are further qualified by other risks, including those set forth from time to time in the documents filed by us with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K.

SOURCE – Natural Alternatives International, Inc.

CONTACT – Michael Fortin, Chief Financial Officer, Natural Alternatives International, Inc., at 760-736-7700 or investor@nai-online.com.

Web site: http://www.nai-online.com

| NATURAL ALTERNATIVES INTERNATIONAL, INC. | ||||||||||||||||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME | ||||||||||||||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||

| June 30, | June 30, | |||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||

| NET SALES | $ | 29,489 | 100.0 | % | $ | 35,894 | 100.0 | % | $ | 113,796 | 100.0 | % | $ | 154,015 | 100.0 | % | ||||||||||||

| Cost of goods sold | 28,070 | 95.2 | % | 30,697 | 85.5 | % | 106,931 | 94.0 | % | 135,857 | 88.2 | % | ||||||||||||||||

| Gross profit | 1,419 | 4.8 | % | 5,197 | 14.5 | % | 6,865 | 6.0 | % | 18,158 | 11.8 | % | ||||||||||||||||

| Selling, general & administrative expenses | 3,944 | 13.4 | % | 2,023 | 5.6 | % | 15,399 | 13.5 | % | 13,445 | 8.7 | % | ||||||||||||||||

| (LOSS) INCOME FROM OPERATIONS | (2,525 | ) | -8.6 | % | 3,174 | 8.8 | % | (8,534 | ) | -7.5 | % | 4,713 | 3.1 | % | ||||||||||||||

| Other (expense) income, net | (256 | ) | -0.9 | % | (435 | ) | -1.2 | % | (930 | ) | -0.8 | % | (1,158 | ) | -0.8 | % | ||||||||||||

| (LOSS) INCOME BEFORE TAXES | (2,781 | ) | -9.4 | % | 2,739 | 7.6 | % | (9,464 | ) | -8.3 | % | 3,555 | 2.3 | % | ||||||||||||||

| Income tax (benefit) expense | (907 | ) | 702 | (2,247 | ) | 1,033 | ||||||||||||||||||||||

| NET (LOSS) INCOME | $ | (1,874 | ) | $ | 2,037 | $ | (7,217 | ) | $ | 2,522 | ||||||||||||||||||

| NET (LOSS) INCOME PER COMMON SHARE: | ||||||||||||||||||||||||||||

| Basic: | ($0.32 | ) | $0.35 | ($1.23 | ) | $0.43 | ||||||||||||||||||||||

| Diluted: | ($0.32 | ) | $0.35 | ($1.23 | ) | $0.43 | ||||||||||||||||||||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: | ||||||||||||||||||||||||||||

| Basic | 5,916 | 5,850 | 5,871 | 5,863 | ||||||||||||||||||||||||

| Diluted | 5,916 | 5,855 | 5,871 | 5,878 | ||||||||||||||||||||||||

| NATURAL ALTERNATIVES INTERNATIONAL, INC. | ||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||

| (In thousands) | ||||||

| June 30, | June 30, | |||||

| 2024 | 2023 | |||||

| ASSETS | ||||||

| Cash and cash equivalents | $ | 11,981 | $ | 13,604 | ||

| Accounts receivable, net | 16,891 | 7,022 | ||||

| Inventories, net | 24,249 | 29,694 | ||||

| Other current assets | 8,489 | 6,690 | ||||

| Total current assets | 61,610 | 57,010 | ||||

| Property and equipment, net | 52,211 | 53,841 | ||||

| Operating lease right-of-use assets | 43,537 | 20,369 | ||||

| Other noncurrent assets, net | 4,984 | 2,932 | ||||

| Total Assets | $ | 162,342 | $ | 134,152 | ||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||

| Accounts payable and accrued liabilities | 19,456 | 14,450 | ||||

| Line of Credit | 3,400 | – | ||||

| Mortgage note payable | 9,229 | 9,517 | ||||

| Operating lease liability | 47,662 | 21,413 | ||||

| Total Liabilities | 79,747 | 45,380 | ||||

| Stockholders’ Equity | 82,595 | 88,772 | ||||

| Total Liabilities and Stockholders’ Equity | $ | 162,342 | $ | 134,152 | ||

This press release was published by a CLEAR® Verified individual.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

VersaBank To See Modest Expansion In Net Interest Margins: Analyst

Roth MKM analyst Craig Irwin initiated coverage on VersaBank VBNK with a price target of $18.

Following the August 2024 acquisition of Stearns Bank Holdings, VersaBank is now federally chartered in both the U.S. and Canada.

According to the analyst, management plans to implement VersaBank’s proven, risk-mitigated point-of-sale lending model in the U.S. to enhance leverage and deliver long-term value in this larger, more profitable market.

Irwin says VersaBank’s technology infrastructure enables it to digitally handle nearly all its lending and deposits through partners, enhancing leverage for incremental business.

Additionally, the analyst notes commercial real estate (CRE) comprises about 17% of the bank’s lending and is well-managed in their view.

Irwin anticipates modest net interest margin (NIM) expansion for VersaBank, driven by higher U.S. retail pricing power margins and the easing of headwinds from delayed interest rate resets on Canadian deposits, though this may be partially offset by lower-margin real estate loans.

For FY25, the analyst forecasts the company to report earnings per share of $1.68.

VBNK Price Action: VBNK shares closed Friday down 2.03% to $13.03.

Read Next:

This article was created with the help of artificial intelligence and has been reviewed by an editor.

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.